Global HVAC Systems Market Size, Share, Trends, & Growth Forecast Report Segmented By Cooling (Unitary Air Conditioner and VRF), Heating, Ventilation, Service Type, Implementation Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global HVAC Systems Market Size

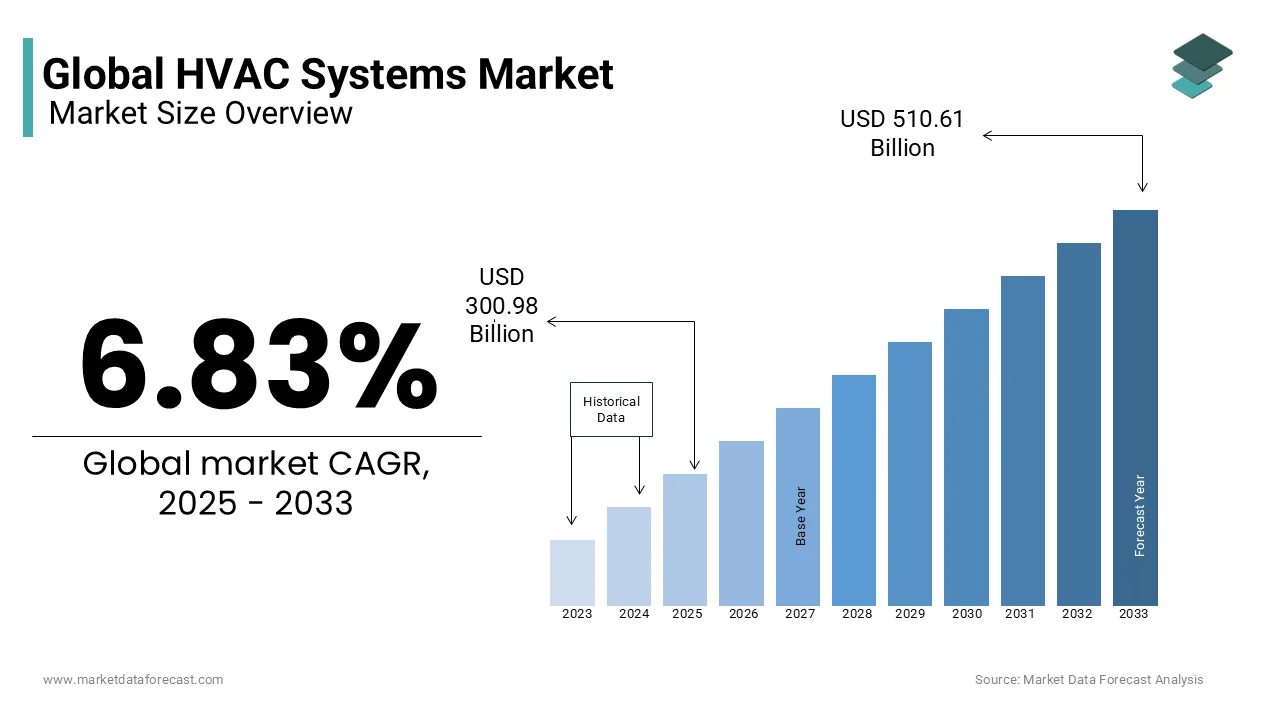

The global HVAC systems market was worth USD 281.74 billion in 2024. The global market is projected to reach USD 510.61 billion by 2033 from USD 300.98 billion in 2025, rising at a CAGR of 6.83% from 2025 to 2033.

The HVAC systems are integral to maintaining optimal indoor environmental conditions in residential, commercial, and industrial spaces by ensuring thermal comfort and air quality. In 2023, the importance of HVAC systems has been increasing by their role in energy efficiency and sustainability, as buildings account for nearly 40% of global energy consumption, according to the International Energy Agency. HVAC systems have become pivotal in reducing carbon footprints and enhancing energy performance with growing urbanization and an increasing emphasis on green building practices.

The trend is the integration of smart technologies into HVAC systems that is driven by the proliferation of Internet of Things (IoT) devices. According to the U.S. Department of Energy, smart thermostats can reduce energy usage by up to 10% is reflecting a shift toward intelligent climate control solutions. As per the World Health Organization, proper ventilation in mitigating airborne diseases in light of recent global health challenges. This has spurred demand for advanced air filtration and purification systems within HVAC frameworks. Over 68% of the global population will reside in urban areas by 2050, as per the United Nations that is escalating the need for efficient HVAC systems is expected to grow exponentially, reinforcing their centrality in modern infrastructure development.

MARKET DRIVERS

Growing Emphasis on Energy Efficiency Regulations

Stringent energy efficiency regulations imposed by governments worldwide are a significant driver of the HVAC systems market. The U.S. Environmental Protection Agency (EPA) states that heating and cooling account for nearly 48% of the energy use in a typical American home, making HVAC systems a focal point for energy conservation efforts. Policies such as the European Union’s Energy Performance of Buildings Directive mandate the integration of energy-efficient HVAC technologies to reduce greenhouse gas emissions. Additionally, the International Energy Agency reports that improving energy efficiency in buildings could deliver over 40% of the reductions in global energy-related carbon emissions needed to meet climate goals. This regulatory push is compelling manufacturers to innovate and produce systems with higher Seasonal Energy Efficiency Ratios (SEER), fostering market growth while aligning with sustainability objectives.

Increasing Urbanization and Infrastructure Development

The rapid urbanization is propelling the growth of HVAC systems market to the extent. According to the United Nations Department of Economic and Social Affairs, urban areas are expected to house approximately 68% of the global population by 2050 by creating a surge in demand for residential and commercial spaces equipped with HVAC systems. ThAccording to the U.S. Census Bureau, multifamily housing starts in the United States reached a peak of over 427,000 units annually in recent years, further amplifying HVAC system installations. According to the World Bank, urban infrastructure investments in emerging economies are accelerating, with cities in Asia and Africa witnessing unprecedented construction activity. These developments necessitate robust HVAC solutions to ensure occupant comfort and indoor air quality, which is driving market expansion as urban centers continue to evolve into hubs of economic and social activity.

MARKET RESTRAINTS

High Initial Costs and Economic Constraints

The high upfront costs associated with purchasing and installing advanced HVAC systems act as a significant restraint in the market. According to the U.S. Energy Information Administration (EIA), the average cost of HVAC system installation in commercial buildings can range from $15,000 to $50,000 by depending on the complexity and size of the system. For many small and medium-sized enterprises, these costs are prohibitive, especially during periods of economic uncertainty. According to the National Bureau of Economic Research, inflationary pressures and rising interest rates have further strained budgets by making it challenging for businesses and homeowners to invest in energy-efficient HVAC technologies. These financial barriers are particularly pronounced in developing regions, where limited access to affordable financing options hinders widespread adoption by slowing the overall growth trajectory of the HVAC systems market.

Environmental Concerns Related to Refrigerants

Environmental concerns surrounding the use of refrigerants in HVAC systems present another major restraint. According to the Environmental Protection Agency (EPA), hydrofluorocarbons (HFCs), commonly used in air conditioning systems, are potent greenhouse gases with global warming potentials thousands of times higher than carbon dioxide. To combat this, international agreements like the Kigali Amendment to the Montreal Protocol aim to phase down HFC production and consumption by over 80% by 2047. However, transitioning to alternative refrigerants such as hydrofluoroolefins (HFOs) or natural refrigerants involves significant technological and cost challenges. The Intergovernmental Panel on Climate Change (IPCC) studies have shown that the improper disposal of refrigerants contributes to approximately 2.5% of global greenhouse gas emissions annually. This environmental scrutiny is compelling stricter regulations is increasing compliance costs, and creating hesitancy among manufacturers and consumers alike.

MARKET OPPORTUNITIES

Integration of Smart Building Technologies

The growing adoption of smart building technologies presents a significant opportunity for the HVAC systems market. According to the U.S. Department of Energy, smart HVAC systems, when integrated with building automation, can reduce energy consumption by up to 30% through real-time monitoring and optimization. According to the National Institute of Standards and Technology, IoT-enabled HVAC systems enhance predictive maintenance capabilities by reducing downtime by 50% and extending equipment lifespan. HVAC systems equipped with advanced sensors and AI-driven analytics will play a pivotal role in creating sustainable, energy-efficient buildings by unlocking new revenue streams for industry players.

Expansion into Emerging Markets

Emerging markets offer a lucrative growth avenue for the HVAC systems market, which is driven by rapid industrialization and infrastructure development. According to the World Bank, infrastructure investments in developing economies are expected to exceed $1 trillion annually over the next decade, with a significant portion allocated to commercial and residential construction. According to the Ministry of Statistics and Programme Implementation, ongoing smart city projects encompass over 5,000 initiatives is creating substantial demand for HVAC solutions in India alone. As per the African Development Bank, urbanization rates in sub-Saharan Africa are among the highest globally, with cities like Lagos and Nairobi experiencing population growth exceeding 4% annually. These regions are prioritizing modern HVAC systems to address extreme climate conditions and improve indoor air quality, providing manufacturers with an opportunity to expand their footprint and cater to underserved markets while fostering local economic development.

MARKET CHALLENGES

Supply Chain Disruptions and Material Shortages

Supply chain disruptions and material shortages have emerged as significant challenges for the HVAC systems market. According to the U.S. Department of Commerce, the global semiconductor shortage, exacerbated by the COVID-19 pandemic, has impacted the production of smart HVAC systems reliant on advanced electronic components. According to the Bureau of Labor Statistics, rising costs of raw materials, such as copper and aluminum, have increased manufacturing expenses by nearly 20% in recent years. These material price fluctuations are further compounded by geopolitical tensions and trade restrictions, which hinder the seamless flow of critical components. According to the International Monetary Fund, supply chain bottlenecks could reduce global economic growth by up to 1% annually if unresolved. For HVAC manufacturers, these disruptions delay project timelines, inflate operational costs, and strain relationships with customers seeking timely installations.

Stringent Environmental Regulations on System Disposal

The increasing complexity of environmental regulations governing HVAC system disposal poses another major challenge. As per the Environmental Protection Agency, improper disposal of HVAC units contributes to over 90 million metric tons of waste annually, primarily due to non-recyclable components and refrigerants. The European Environment Agency states that new directives, such as the EU’s Waste Electrical and Electronic Equipment (WEEE) Regulation, mandate manufacturers to adopt extended producer responsibility, requiring them to manage end-of-life recycling processes. Compliance with these regulations often involves significant logistical and financial investments, particularly for smaller firms. Furthermore, the United Nations Industrial Development Organization studies revealed that only 20% of e-waste, including discarded HVAC systems, is currently recycled globally. This regulatory burden forces manufacturers to rethink product design and lifecycle management is adding layers of complexity to their operations while striving to meet sustainability goals.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.83% |

|

Segments Covered |

By Cooling, Heating, Ventilation, Service Type, Implementation Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Daikin Industries (Japan), Johnson Controls (Ireland), LG Electronics (Korea), Midea (China), Carrier (US), Trane Technologies plc (Ireland), Honeywell International Inc. (US), Mitsubishi Electric Corporation (Japan), Samsung Electronics Co., Ltd. (South Korea), Madison Air (US), Danfoss (Denmark), FUJITSU General Group (Japan), and Gree, Electric Appliances, Inc. of Zhuhai (China). |

SEGMENTAL ANALYSIS

By Cooling Insights

The unitary air conditioners segment was the largest and held 45.3% of the HVAC systems market share in 2024 owing to the adoption in residential and small commercial spaces due to ease of installation and cost-effectiveness. According to the U.S. Department of Energy, unitary systems account for over 60% of cooling energy consumption in U.S. households. Their importance lies in providing efficient climate control in regions with extreme temperatures, such as the Middle East and South Asia, where cooling demands are rising. Unitary air conditioners remain pivotal in addressing global comfort and energy efficiency needs.

The variable Refrigerant Flow (VRF) systems segment is expected to register a fastest CAGR of 9.5% from 2025 to 2033.

This rapid growth is fueled by their superior energy efficiency and ability to provide simultaneous heating and cooling by making them ideal for large commercial buildings and mixed-use developments. According to the U.S. Environmental Protection Agency, VRF systems can reduce energy consumption by up to 30% compared to traditional HVAC systems. As per the World Green Building Council, VRF systems align with global sustainability goals, as they utilize advanced refrigerants with lower global warming potential. Their modular design and scalability further enhance their appeal in urbanized regions like Asia-Pacific, where smart city projects are proliferating is driving demand for innovative HVAC solutions.

By Heating Insights

Furnaces segment dominated the market and held 45.1% of the HVAC systems market share in 2024. Their prevalence is driven by widespread use in residential and commercial spaces, particularly in colder regions like North America, where furnaces are the primary heating solution. According to the Department of Energy, modern furnaces achieve efficiency ratings of up to 98.5% Annual Fuel Utilization Efficiency (AFUE) by making them a reliable choice for energy-conscious consumers. Their affordability, coupled with established infrastructure for installation and maintenance, ensures their dominance. Furnaces remain critical for meeting heating demands in areas with harsh winters due to their importance in the HVAC systems market.

The heat pumps segment is anticipated to exhibit a fastest CAGR of 12.1% during the forecast period. This growth is fueled by increasing demand for energy-efficient and eco-friendly heating solutions. According to the U.S. Environmental Protection Agency, heat pumps can reduce electricity usage for heating by up to 50% compared to traditional systems. As per the European Heat Pump Association, over 20 million heat pumps were installed across Europe in 2022, driven by government incentives promoting renewable energy adoption. The heat pumps are pivotal in decarbonizing heating systems by offering versatility for both heating and cooling needs while aligning with net-zero emission goals.

By Ventilation Insights

The Air Handling Units (AHU) segment was the largest by occupying 43.4% of the HVAC systems market share in 2024. This dominance is attributed to their versatility and role in maintaining optimal indoor environmental conditions across diverse applications, including commercial buildings, healthcare facilities, data centers, and industrial complexes. AHUs are designed to regulate temperature, humidity, and air quality, making them indispensable for large-scale projects where centralized climate control is essential. According to the International Energy Agency, buildings equipped with AHUs consume up to 30% less energy compared to decentralized HVAC systems due to their importance in achieving sustainability goals. Furthermore, advancements in AHU technology, such as integration with IoT-enabled sensors and variable air volume (VAV) systems, enhance operational efficiency and reduce energy wastage. Their ability to seamlessly incorporate advanced filtration and humidity control systems also addresses growing concerns about indoor air quality.

The air filter segment is projected to grow with a projected CAGR of 8.5% from 2025 to 2033. This rapid expansion is fueled by increasing global awareness of the health implications associated with poor indoor air quality. According to the Environmental Protection Agency, indoor air can be two to five times more polluted than outdoor air, primarily due to contaminants like dust, allergens, and volatile organic compounds (VOCs). This has led to a surge in demand for high-efficiency particulate air (HEPA) filters and other advanced filtration technologies. According to the World Health Organization, improved air filtration systems can reduce the transmission of airborne diseases, which has become a critical priority in the wake of global health crises. According to the International Labour Organization, enhancing indoor air quality through effective filtration can decrease respiratory illnesses by up to 20%, thereby improving workplace productivity and reducing healthcare costs. Governments worldwide are also implementing stringent regulations mandating better air quality standards in public spaces, schools, and healthcare facilities, further propelling the adoption of advanced air filters. As urbanization accelerates and pollution levels rise, particularly in developing regions, the air filter segment is poised to remain the fastest-growing category within the HVAC systems market by addressing both health and regulatory imperatives.

By Service Type Insights

The Maintenance & Repair segment dominated the HVAC systems market with significant share in 2024 owing to the consistent demand for servicing aging HVAC systems, with over 60% of installed systems in developed nations being more than a decade old. Regular maintenance is critical to ensure energy efficiency, as poorly maintained systems can increase energy consumption by up to 20%. According to the Environmental Protection Agency, proactive repairs reduce refrigerant leaks, which contribute significantly to greenhouse gas emissions. This segment remains pivotal for both residential and commercial users with the growing emphasis on sustainability and operational cost savings.

The Installation segment is estimated to register a CAGR of 7.8% from 2025 to 2033. This rapid growth is driven by urbanization and new construction projects in emerging economies. According to the United Nations, the global urban infrastructure investments are expected to exceed $3.7 trillion annually by 2030 by creating immense demand for HVAC installations. Additionally, stringent energy efficiency regulations, such as those outlined by the European Commission, mandate the integration of modern HVAC systems in new buildings. Smart HVAC installations are gaining traction, with the National Renewable Energy Laboratory stating that they can reduce energy costs by up to 35%. This segment’s importance lies in its role in shaping sustainable, future-ready infrastructure while addressing the rising need for climate control solutions in expanding urban areas.

By Implementation Type Insights

The new construction was the largest and held 55.4% of the HVAC systems market share in 2024. This dominance is driven by rapid urbanization and infrastructure development, particularly in emerging economies. According to the Bureau of Economic Analysis, global construction output is projected to grow by 3.5% annually, with HVAC systems being integral to new residential, commercial, and industrial projects. The new constructions prioritize energy-efficient HVAC solutions to comply with green building standards, such as LEED certification, making this segment critical for achieving sustainability goals.

The retrofit segment is the fastest-growing in the HVAC systems market, with a compound annual growth rate (CAGR) of 8.5%, according to the International Energy Agency. This growth is fueled by aging infrastructure and stringent energy efficiency regulations, which necessitate system upgrades. According to the U.S. Department of Energy, retrofitting existing buildings with modern HVAC systems can reduce energy consumption by up to 20%. Additionally, the Environmental Protection Agency emphasizes that over 70% of commercial buildings in the U.S. are more than 20 years old, creating a vast opportunity for retrofits. As governments worldwide push for carbon neutrality, retrofitting plays a pivotal role in reducing emissions, driving its rapid expansion and underscoring its importance in the transition to sustainable practices.

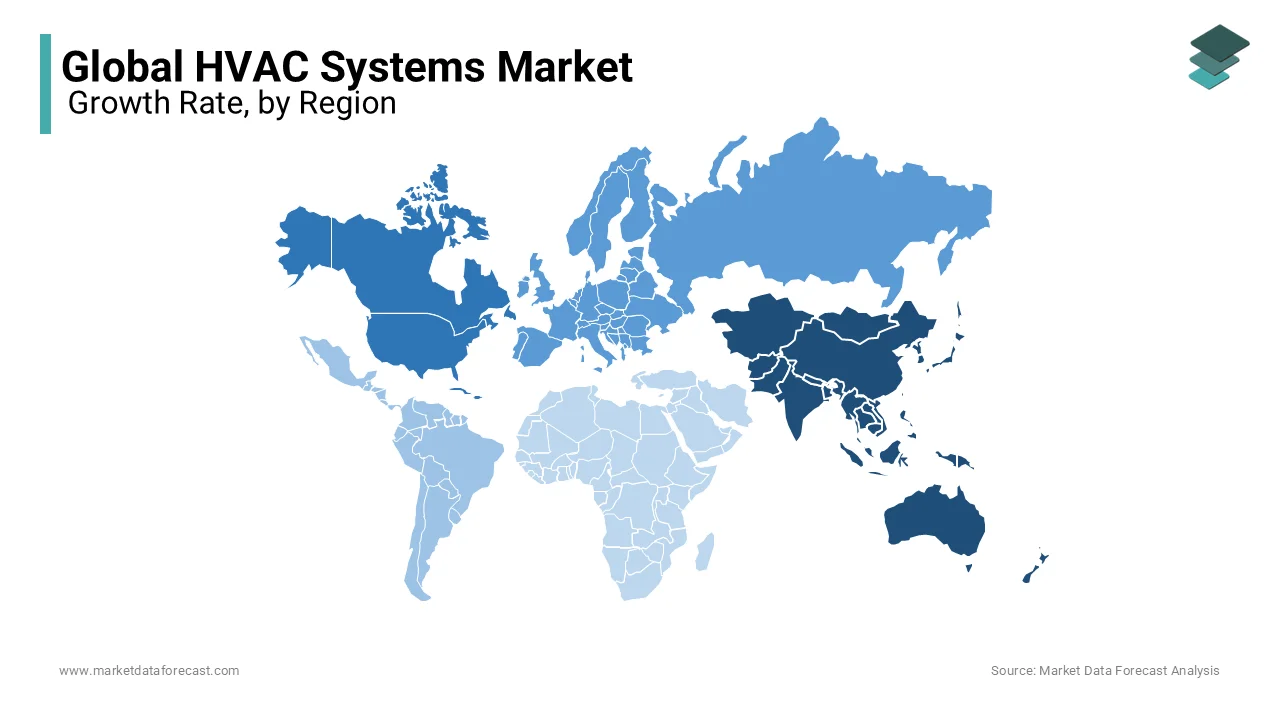

REGIONAL ANALYSIS

The Asia-Pacific region held the largest share of the HVAC systems market with 40.1% of the global market in 2024. This dominance is driven by rapid urbanization, with the United Nations projecting that the region will host 60% of the world’s urban population by 2030. According to the Indian Ministry of Statistics and Programme Implementation, large-scale smart city projects and industrialization in countries like India and China are fueling demand for HVAC systems. As per the Asian Development Bank, rising disposable incomes and extreme climate conditions are accelerating adoption, making the region a critical hub for HVAC innovation and sustainability initiatives.

North America HVAC systems market is projected to experience a CAGR of 8.7% during the forecast period. This growth is fueled by stringent energy efficiency regulations, such as the Clean Energy Standard, and the increasing need to retrofit aging infrastructure. According to the Environmental Protection Agency, HVAC systems account for nearly 40% of residential energy use in the U.S., driving demand for advanced, energy-efficient solutions. As per the Energy Information Administration, North America’s focus on sustainability and technological advancements with over 70% of American homes equipped with air conditioning is gearing up to promote new opportunities for the market in the next coming years.

Europe is expected to witness steady growth due to green building initiatives, with the European Environment Agency targeting a 60% reduction in building emissions by 2030. Latin America will likely experience moderate expansion, supported by urbanization and construction activities, as per the World Bank. In the Middle East and Africa, investments in infrastructure, particularly in Gulf nations, will drive gradual growth, with the International Renewable Energy Agency predicting a 30% rise in energy-efficient HVAC installations by 2030. These regions collectively reflect diverse opportunities amid varying economic and environmental priorities.

KEY MARKET PLAYERS

The major players in the global HVAC systems market include Daikin Industries (Japan), Johnson Controls (Ireland), LG Electronics (Korea), Midea (China), Carrier (US), Trane Technologies plc (Ireland), Honeywell International Inc. (US), Mitsubishi Electric Corporation (Japan), Samsung Electronics Co., Ltd. (South Korea), Madison Air (US), Danfoss (Denmark), FUJITSU General Group (Japan), and Gree, Electric Appliances, Inc. of Zhuhai (China).

Top 3 Players in the Market

Daikin Industries (Japan)

Daikin Industries is a global leader in the HVAC systems market, renowned for its innovative air conditioning and refrigeration solutions. The company holds approximately 23% of the global market share, as per the International Energy Agency, driven by its cutting-edge inverter technology and commitment to sustainability. Daikin’s VRV (Variable Refrigerant Volume) systems have set benchmarks in energy efficiency, reducing energy consumption by up to 30%. The company’s strong presence in Asia-Pacific, coupled with strategic acquisitions like ABC Air India. Daikin’s contribution extends beyond products; it actively promotes green initiatives, such as phasing out high-global-warming-potential refrigerants, aligning with international climate goals.

Johnson Controls (Ireland)

Johnson Controls is a key player in the HVAC market, particularly in building automation and smart HVAC solutions. According to the U.S. Department of Energy, Johnson Controls’ Metasys® building management system integrates HVAC controls with IoT, enhancing energy efficiency by up to 40%. The company commands a significant share of the commercial HVAC segment, leveraging its expertise in smart building technologies. With over 135 years of experience, Johnson Controls has expanded its footprint globally through partnerships and innovations in sustainable heating and cooling solutions. Its OpenBlue platform exemplifies its dominance in creating connected, energy-efficient buildings, making it a pivotal contributor to the global market.

LG Electronics (Korea)

LG Electronics is a prominent player in the HVAC systems market, particularly known for its advanced residential and commercial air conditioning solutions. The Korean Ministry of Trade, Industry and Energy reports that LG’s Multi V™ series of VRF systems has gained widespread adoption, contributing to its 12% global market share. LG’s focus on eco-friendly refrigerants and AI-driven climate control technologies has positioned it as a leader in innovation. The company’s global expansion strategy, including manufacturing hubs in Europe and North America, has strengthened its market position. LG’s contributions extend to promoting energy-efficient HVAC systems, which align with global sustainability targets, making it a vital player in shaping the future of the industry.

Top Strategies Used by The Key Market Participants

Strategic Acquisitions and Partnerships

Leading companies like Johnson Controls and Trane Technologies have leveraged acquisitions and partnerships to broaden their product portfolios and geographic reach. For instance, Johnson Controls acquired Silent-Aire, a leader in data center cooling solutions, to strengthen its presence in the rapidly growing hyperscale data center segment. Similarly, Trane Technologies partnered with sustainable energy firms to develop low-carbon HVAC solutions, aligning with global decarbonization goals. According to the U.S. Department of Commerce, such collaborations enable companies to tap into niche markets and integrate cutting-edge technologies, enhancing their competitive edge.

Investment in Research and Development (R&D)

Innovation is a cornerstone of success in the HVAC market. Companies like Daikin Industries and LG Electronics invest heavily in R&D to pioneer energy-efficient and eco-friendly technologies. As per the International Energy Agency, Daikin’s development of next-generation refrigerants with low global warming potential (GWP) has set industry benchmarks. LG Electronics focuses on AI-driven climate control systems, integrating IoT for predictive maintenance and energy optimization. These investments not only improve product performance but also ensure compliance with stringent environmental regulations.

Expansion into Emerging Markets

To capitalize on growth opportunities, key players like Midea and Carrier are expanding their operations in emerging markets such as India, Southeast Asia, and Africa. The Asian Development Bank notes that Midea has established manufacturing hubs in India and Vietnam to cater to regional demand, while Carrier has launched affordable HVAC solutions tailored to these markets. This strategy enables companies to capture untapped potential in regions experiencing rapid urbanization and infrastructure development.

Focus on Sustainability and Green Initiatives

Sustainability is a major focus area for HVAC manufacturers. Honeywell International and Mitsubishi Electric have introduced energy-efficient products and committed to net-zero carbon emissions. Honeywell’s Solstice® line of low-GWP refrigerants and Mitsubishi’s heat pump technologies exemplify efforts to reduce environmental impact. The Environmental Protection Agency emphasizes that companies adopting green practices gain regulatory advantages and appeal to environmentally conscious consumers.

Digital Transformation and Smart Solutions

The integration of smart technologies is another critical strategy. Samsung Electronics and Madison Air are investing in IoT-enabled HVAC systems and building automation platforms. Samsung’s SmartThings ecosystem and Madison Air’s cloud-based monitoring solutions enhance user convenience and operational efficiency. The International Data Corporation states that smart HVAC systems are expected to grow at a CAGR of 15%, underscoring the importance of digital transformation in maintaining market’s growth.

COMPETITIVE LANDSCAPE

The HVAC systems market is characterized by intense competition, driven by the presence of established global players and emerging regional firms striving to capture market share. Key companies such as Daikin Industries, Johnson Controls, and Carrier dominate the landscape, leveraging their extensive R&D capabilities, robust distribution networks, and strong brand recognition. These leaders focus on innovation, particularly in energy-efficient and smart HVAC solutions, to differentiate themselves. For instance, Daikin’s advancements in low-GWP refrigerants and Johnson Controls’ integration of IoT in building automation systems exemplify how technological dominance reinforces competitive positioning.

Regional players like Midea and Gree Electric Appliances are also gaining traction, especially in Asia-Pacific, by offering cost-effective and localized solutions tailored to emerging markets. According to the Asian Development Bank, these companies benefit from rapid urbanization and infrastructure development in regions like India and Southeast Asia, intensifying competition with global giants. Meanwhile, smaller firms emphasize niche markets, such as eco-friendly or portable HVAC systems, to carve out specialized segments.

The competitive dynamics are further shaped by regulatory pressures and sustainability mandates. Companies that align with environmental goals, such as reducing carbon footprints and adopting circular economy practices, gain a strategic edge. The International Energy Agency studies have shown that firms investing in green technologies often secure larger contracts in government-led sustainable infrastructure projects. Additionally, partnerships, mergers, and acquisitions are common strategies to consolidate market presence. This highly fragmented yet innovative ecosystem ensures continuous evolution, fostering both collaboration and rivalry as companies vie for dominance in an increasingly interconnected and sustainability-focused global market.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Daikin Industries, a Japanese multinational air conditioning leader, acquired two U.S.-based air conditioning companies as part of its strategy to expand its data center cooling business. This acquisition is anticipated to allow Daikin to capture a larger share of the growing data center market, which demands advanced and energy-efficient cooling solutions. By integrating these companies' expertise, Daikin aims to strengthen its technological capabilities and reinforce its position as a global leader in HVAC systems tailored for high-performance applications.

- In September 2022, LG Electronics introduced the MULTI V S Series, an advanced Variable Refrigerant Flow (VRF) system designed for commercial applications. This launch is anticipated to strengthen LG's position in the global HVAC market by offering a highly energy-efficient and eco-conscious solution. The MULTI V S Series incorporates AI-driven diagnostics and compact design, making it ideal for modern urban environments where space optimization and sustainability are critical. By focusing on reducing energy consumption and enhancing operational efficiency, LG aims to cater to the growing demand for smart and green HVAC systems in commercial buildings.

- In October 2022, Carrier introduced its latest Intelisense™ technology-enabled products, marking a significant advancement in smarter home servicing solutions. This launch is anticipated to enhance Carrier's presence in the residential HVAC market by offering homeowners advanced predictive maintenance and real-time system diagnostics. The Intelisense™ technology leverages data analytics and IoT connectivity to optimize HVAC performance, reduce energy consumption, and minimize downtime. By integrating this innovation into its product lineup, Carrier aims to address the growing demand for intelligent and reliable climate control systems.

- In May 2021, Johnson Controls completed the acquisition of Silent-Aire, a leader in hyperscale data center cooling solutions. This acquisition is anticipated to strengthen Johnson Controls' position in the rapidly growing data center market by expanding its portfolio of advanced cooling technologies. Silent-Aire's expertise in modular data center solutions and precision air conditioning complements Johnson Controls' existing capabilities, enabling the company to deliver more comprehensive and energy-efficient HVAC systems for hyperscale facilities. By integrating Silent-Aire's innovations, Johnson Controls aims to address the increasing demand for sustainable and high-performance cooling solutions in the data center industry.

- In May 2022, Mitsubishi Electric Corporation announced the expansion of its heat pump production capacity in Europe to meet the rising demand for renewable heating solutions. This strategic move is anticipated to strengthen Mitsubishi Electric's market presence in the region by aligning with Europe's green energy transition goals. The company aims to enhance its ability to provide energy-efficient HVAC systems that support decarbonization efforts and comply with stringent environmental regulations. By increasing production capacity, Mitsubishi Electric seeks to address the growing need for sustainable heating and cooling technologies in both residential and commercial sectors. This expansion elevates the company's commitment to driving innovation in eco-friendly HVAC solutions while reinforcing its dominance in the global market.

MARKET SEGMENTATION

This research report on the global HVAC systems market is segmented and sub-segmented into the following categories.

By Cooling

- Unitary Air Conditioner

- VRF

By Heating

- Heat Pump

- Furnace

By Ventilation

- AHU

- Air Filter

By Service Type

- Installation

- Maintenance & Repair

By Implementation Type

- New Construction

- Retrofit

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the primary factors driving growth in the HVAC market?

The market's expansion is driven by increasing demand for energy-efficient systems, rapid urbanization, and technological advancements like IoT-enabled smart HVAC solutions.

What role does government regulation play in the HVAC market?

Governments worldwide are implementing stringent regulations to promote energy efficiency, fostering innovation in HVAC technologies.

How is the integration of smart technology influencing HVAC systems?

The integration of IoT technology in HVAC systems allows for real-time monitoring and control, enhancing energy efficiency and user convenience.

How are environmental concerns shaping HVAC innovations?

Increasing awareness of environmental sustainability is driving the development of eco-friendly HVAC solutions, such as energy-efficient heat pumps.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]