Global HVAC Motors Market Size, Share, Trends, & Growth Forecast Report By Type (Chiller/Cooling Tower Motors, Fan and Blower Motors, Condenser Fan Motors, Shaft Grounding Motors), Application (Unitary, Furnace, WSHP, Air Conditioner, Heat Pump, Ventilator, Air Handler, Fan Powered Terminal Unit) & Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global HVAC Motors Market Size

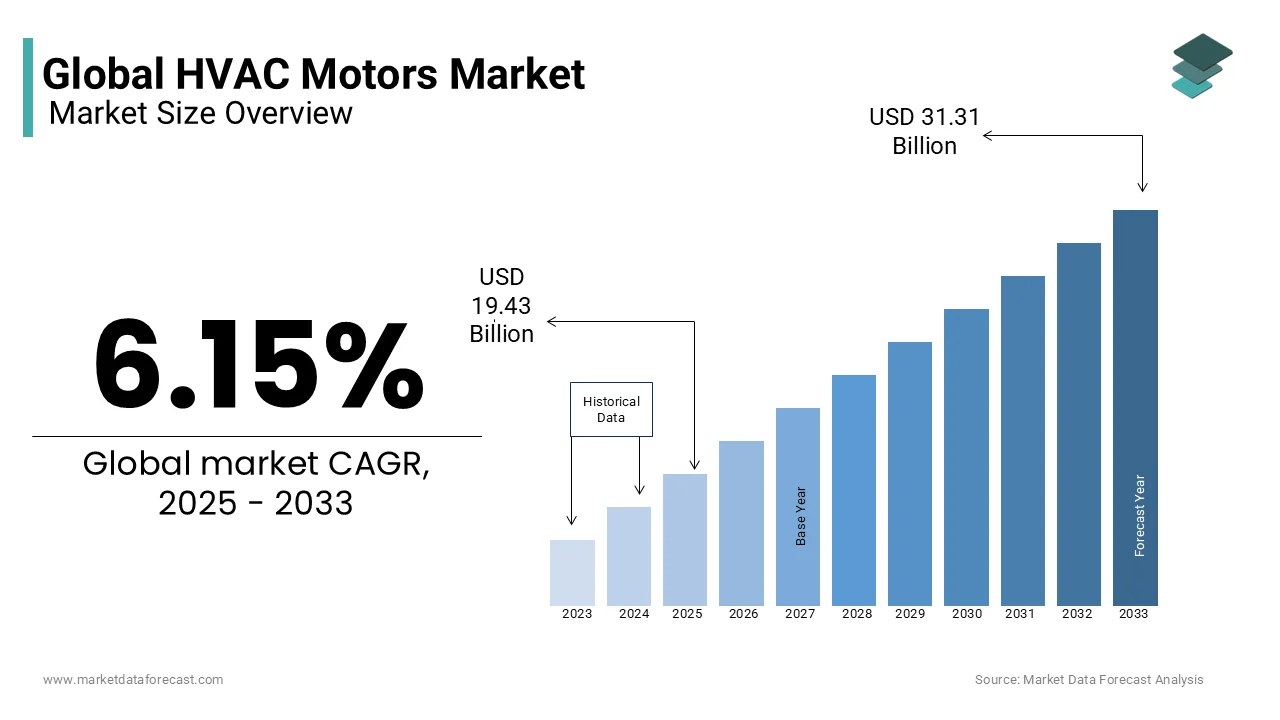

The global HVAC motors market was estimated at USD 18.3 billion in 2024 and is predicted to reach USD 31.31 billion by 2033 from USD 19.43 billion in 2025, growing at a CAGR of 6.15% from 2025 to 2033. As companies want to revolutionize the weight and size of HVAC motors, trained professionals are needed in the highly competitive automotive, petrochemical, and agricultural industries. For this reason, companies are launching online course catalogs to increase the availability of qualified professionals.

Manufacturers introduce the printed circuit board stator in HVAC motors for motors to provide superior durability and performance, improved performance in IoT deployments, and R&D to transform the size and weight of HVAC motors is escalating, With the automotive industry predicted to dominate the HVAC motor market, in terms of value and volume, start-ups are gaining experience in reducing the complexity and size of electric powertrains. HVAC (heating, ventilation, and air conditioning) is the technology for controlling and monitoring indoor environments and vehicles. Sometimes, HVAC is employed to characterize the additional field of refrigeration. HVAC systems are needed in offices and industrial buildings to manage cooling and heating costs, especially when the complex is large and requires different temperature zones throughout the building. Electric motors employed in industries such as automotive, rail, and aerospace are predicted to see a strong expansion in the coming years due to continued investment in product development. The strict standards in the transportation sector around the world that support the improvement of air quality, clean energy, and the limitation of dependence on oil, resulting in a reduction of greenhouse gas emissions, are stimulating the market call. In addition, subsidies and incentives are offered to OEMs and other customers to stimulate the sale of electric vehicles, which is likely to increase the call for electric motors in electric vehicle manufacturing. The escalating adoption of these vehicles due to their advantages, such as low maintenance over internal combustion vehicles and emission-free mobility, will positively drive the expansion of the electric motor market in the transport sector.

MARKET DRIVERS

The increase in the call for efficient machine control in the automotive industry due to the mass adoption of efficient HVAC motors is one of the important factors accelerating the call for HVAC motors worldwide. HVAC motors are also widely employed in cars to support related systems in a vehicle, such as window defrosting, internal temperature regulation, and engine cooling, which are the main components of cars. In addition, escalating progress and production of passenger cars around the world are driving the call for HVAC motors as these are employed in cars in some common applications, such as air conditioning fans and fan motors. Escalating the production of automobiles also supported this business growth. HVAC motors are primarily designed for high humidity and humid environments, which can meet the needs of common applications, i.e., drive shaft or belt cooling towers/coolers, further minimizing friction during operation and escalating efficiency. HVAC motors are employed in these applications to generate significant stress, vibration, and heating during operation, which could have a significant influence on electronic components.

MARKET RESTRAINTS

The high initial cost of energy-efficient HVAC motors is a major limitation in the global market.

MARKET OPPORTUNITIES

The rising use of HVAC motors is seen in a wide range of applications, such as motor vehicles, industrial machinery, heating, ventilation, and refrigeration (HVAC) equipment, aerospace and transportation, home appliances, and other commercial applications, to ensure ideal atmospheric conditions in industrial facilities or operations where fluctuations in temperature can cause significant performance losses.

MARKET CHALLENGES

The effect of the coronavirus pandemic on economies is also wreaking havoc in the world of manufacturing and technology. The pandemic has severely affected supply chains around the world, with manufacturing entities severely affected. Players involved in component manufacturing, especially in the Asia Pacific (APAC) region, are struggling to keep going as they are running out of stock. Also, the call at the end-user level has decreased due to restrictions on the movement of people for non-essential products. All these factors are responsible for the moderate expansion of the electric motor market in 2023.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.15% |

|

Segments Covered |

By Type, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

ABB, Siemens, Nidec Corporation, Toshiba, Robert Bosch, and WEG. Other key players include Regal Beloit, Allied Motion Technologies, Hyosung, Shandong, General Electric, Bulher Motor GmbH, and Others. |

SEGMENTAL ANALYSIS

By Type Insight

The Chiller/Cooling Tower Motors segment dominated the global HVAC motors market in 2024.

REGIONAL ANALYSIS

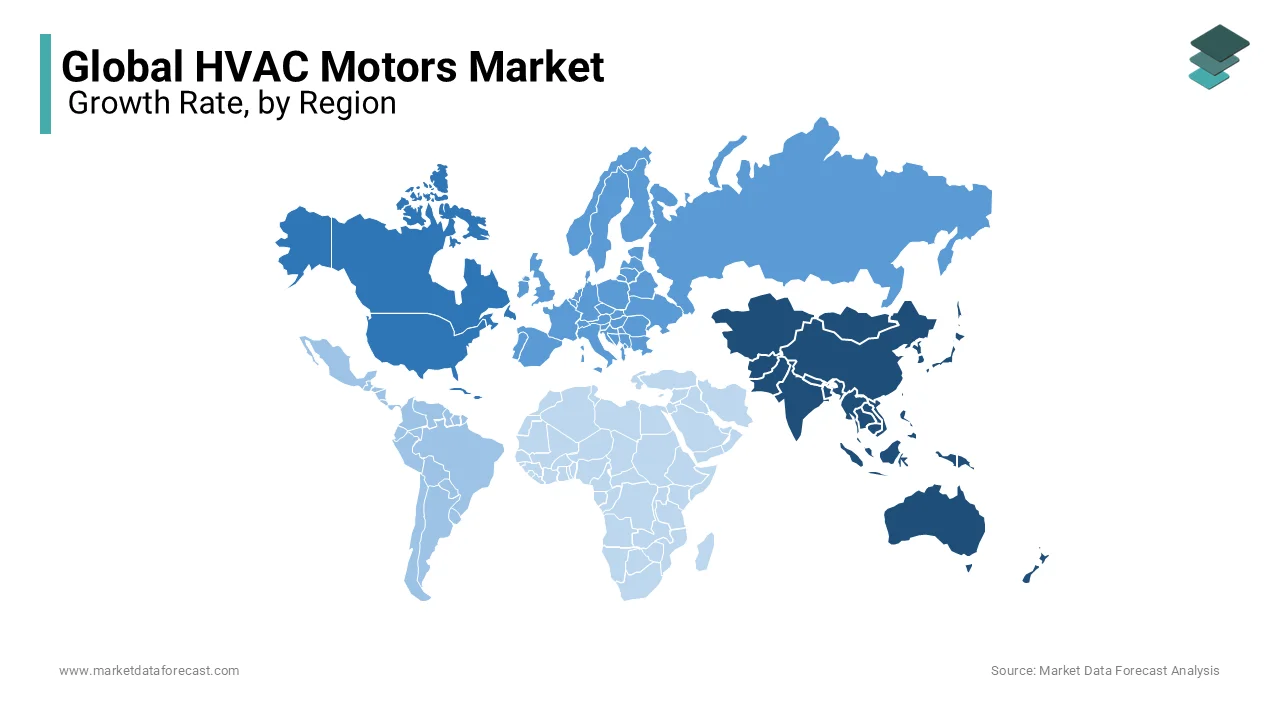

The global HVAC motors market is predicted to expand significantly in Asia-Pacific during the foreseen period. This is due to a growing awareness of saving energy, improving industrial infrastructure, and the growing acceptance of electric vehicles, which are escalating the call for HVAC motors in the Asia Pacific region. Also, the HVAC motor market is predicted to grow significantly due to the expansion of the HVAC industry and the stringent regulations on power and electricity consumption in the APAC area.

North America is a developed region, and innovation and new technologies are predicted to be the trends observed in the region in the coming years. North America had a significant share of the worldwide HVAC motor market in 2021. For the same reason, North America is predicted to experience the most opportunities in the worldwide market,

The Asia Pacific has dominated the worldwide market for electric motors in the transportation sector, accounting for a share of more than 50% in 2019 due to strong FDI policies and escalated automobile production in the region. Shifting consumer preference for vehicles that offer superior comfort and escalating electrical parts will drive call for products. Manufacturers are focused on offering products with operational excellence.

China is a major automotive hub that manufactured more than 28 million vehicles in 2019. Escalating consumer disposable income, which drives overall sales, will further fuel market expansion. Stabilizing the economic situation, particularly in emerging countries, will stimulate product sales. Industry players develop competitively priced products that provide an affordable price that stimulates sales.

KEY MARKET PLAYERS

Companies playing a prominent role in the global HVAC motors market include ABB, Siemens, Nidec Corporation, Toshiba, Robert Bosch, WEG, Regal Beloit, Allied Motion Technologies, Hyosung, Shandong, General Electric, Bulher Motor GmbH, and Others.

RECENT HAPPENINGS IN THE MARKET

- Mahindra is currently the only car manufacturer in India that retails electric cars - the E2O Plus and the e-Verito. However, that scenario is about to change as, like Hyundai, Nissan plans to launch new electric vehicles this year.

-

Hero Electric and EV Motors India have teamed up to launch fast-charging electric bikes. EV Motors will provide developed battery solutions for Hero electric vehicles.

MARKET SEGMENTATION

This global HVAC motors market research report has been segmented and sub-segmented based on type, application, and region.

By Type

- Chiller/Cooling Tower Motors

- Fan and Blower Motors

- Condenser Fan Motors

- Shaft Grounding Motors

By Application

- Unitary

- Furnace

- WSHP

- Air Conditioner

- Heat Pump

- Ventilator

- Air Handler

- Fan-Powered Terminal Unit

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the HVAC motors market growth rate during the projection period?

The Global HVAC motors market is expected to grow with a CAGR of 6.15% between 2025-2033.

What can be the total HVAC motors market value?

The Global HVAC motors market size is expected to reach a revised size of USD 31.31 billion by 2033.

Name any three HVAC motors market key players?

Toshiba, Robert Bosch, and WEG are the three HVAC motors market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]