Global HVAC Market Size, Share, Trends, & Growth Forecast Report By Product Type (Heating Equipment, Ventilation Equipment, Air Conditioning Equipment, Chillers, and Cooling Towers), End Use, Installation, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global HVAC Market Size

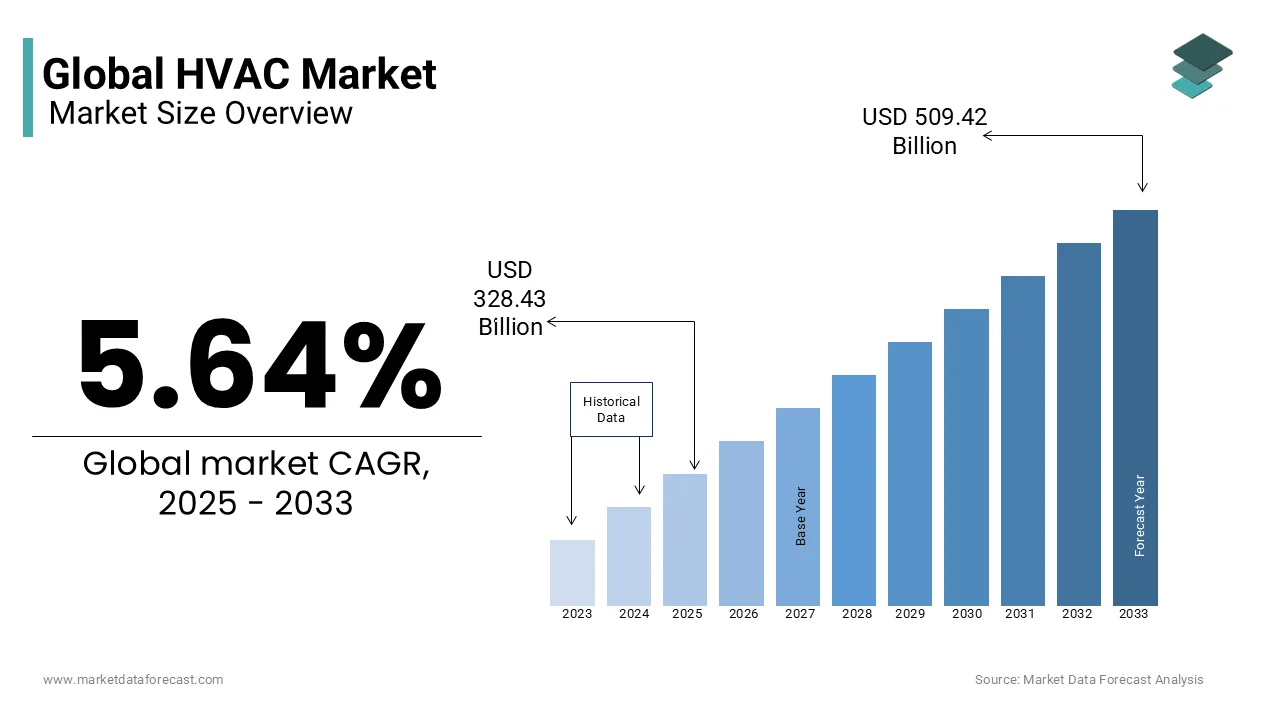

The global HVAC market was worth USD 310.90 billion in 2024. The global market is projected to reach USD 509.42 billion by 2033 from USD 328.43 billion in 2025, growing at a CAGR of 5.64% from 2025 to 2033.

The Heating, Ventilation, and Air Conditioning (HVAC) market plays a pivotal role in modern infrastructure by providing systems that regulate indoor environments for comfort, health, and energy efficiency. the global HVAC market have expectations of steady growth driven by urbanization, industrial expansion, and increasing adoption of energy-efficient technologies. This growth is particularly pronounced in emerging economies like India and China, where rapid urban development and rising disposable incomes are fueling demand in both residential and commercial sectors.

HVAC systems are essential across various industries, including healthcare, hospitality, and manufacturing, ensuring optimal temperature control, air quality, and humidity management. The push for sustainability has spurred innovations such as IoT-enabled smart HVAC systems and energy-efficient heat pumps. The U.S. Energy Information Administration notes that HVAC systems account for approximately 40% of total energy consumption in commercial buildings, underscoring their significant impact on energy usage. Regulatory frameworks promoting green building standards, such as LEED certification and the Paris Agreement's climate goals, are further influencing industry trends. With advancements in renewable energy integration and growing consumer demand for eco-friendly solutions, the HVAC market continues to evolve, balancing environmental responsibility with technological innovation to meet the needs of a rapidly changing world.

MARKET DRIVERS

Energy Efficiency and Sustainability: A Catalyst for HVAC Market Growth

The increasing emphasis on energy efficiency and sustainability in building design is one of the major drivers of the HVAC market. Governments and organizations worldwide are enacting stringent regulations to curb energy consumption and carbon emissions. The International Energy Agency states that buildings account for approximately 30% of global energy demand, with HVAC systems being a primary contributor. To address this, technologies such as heat pumps and smart thermostats, which can reduce energy use by up to 20-30%, are gaining traction. According to the U.S. Department of Energy, the adoption of energy-efficient HVAC systems could save up to USD 11 billion annually in energy costs while reducing emissions by 825 million metric tons. These advancements align with global initiatives like the European Green Deal, which mandates a 55% reduction in greenhouse gas emissions by 2030, further propelling demand for sustainable HVAC solutions.

Urbanization and Infrastructure Development: Driving HVAC Demand

Urbanization and the subsequent rise in construction activities, particularly in emerging economies is another significant driver of the market. The United Nations projects that by 2050, nearly 68% of the global population will reside in urban areas when compared to 56% in 2020. This rapid urban migration is driving demand for residential, commercial, and industrial spaces equipped with modern HVAC systems. In China, the National Bureau of Statistics reports that urbanization rates reached 65% in 2022, fueling investments in infrastructure development. Additionally, McKinsey Global Institute estimates that India’s real estate sector will grow at an impressive pace in the coming years, creating substantial opportunities for HVAC installations.

MARKET RESTRAINTS

High Initial Costs and Economic Constraints: A Barrier to HVAC Adoption

The substantial upfront costs of advanced HVAC systems pose a significant barrier, especially in price-sensitive markets. The U.S. Department of Energy confirms that energy-efficient HVAC systems can cost 20-30% more than traditional models, making them less accessible for small businesses and low-income households. In developing regions, economic instability exacerbates this issue. The World Bank reports that nearly 600 million people in Sub-Saharan Africa lack access to reliable electricity and is rendering HVAC adoption impractical. Additionally, inflationary pressures have driven up raw material costs, with the International Copper Study Group documenting a 25% increase in copper prices in 2022. These rising costs strain manufacturers and consumers, limiting market penetration in affordability-focused regions.

Stringent Environmental Regulations: A Complex Compliance Challenge

The HVAC industry faces mounting pressure to comply with environmental regulations aimed at reducing refrigerant emissions. The Kigali Amendment to the Montreal Protocol mandates an 85% reduction in hydrofluorocarbon (HFC) use by 2036 which is compelling manufacturers to adopt alternative refrigerants. However, transitioning to low-global warming potential (GWP) alternatives often requires costly system redesigns. The Environmental Protection Agency estimates that compliance could increase production costs by up to 15%. Furthermore, regional disparities in regulations, such as the European Union’s F-Gas Regulation, create additional complexity for global manufacturers. These regulatory hurdles not only slow innovation but also raise barriers for smaller players unable to absorb the financial and technical burdens of compliance.

MARKET OPPORTUNITIES

Smart HVAC Systems

The integration of smart technologies into HVAC systems presents a transformative opportunity for the industry. IoT-enabled solutions, such as predictive maintenance and AI-driven climate control, can reduce energy consumption by up to 20%, according to the American Council for an Energy-Efficient Economy. The rollout of 5G networks further enhances these capabilities, enabling real-time data analysis and remote system optimization. Ericsson forecasts that 5G will cover 60% of the global population by 2026, accelerating the adoption of connected HVAC systems. This technological evolution aligns with consumer demand for convenience and sustainability, positioning smart HVAC systems as a key growth driver.

Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and Africa represent a vast untapped market for HVAC systems. The International Monetary Fund predicts that emerging economies will contribute over 60% of global GDP growth by 2025, fueled by urbanization and industrialization. In India, the Ministry of Housing and Urban Affairs estimates that urban housing demand will grow by 7-10% annually, creating a surge in HVAC installations. Similarly, the African Development Bank highlights that infrastructure investments in Africa are expected to exceed USD 170 billion annually by 2025. Rising disposable incomes and government initiatives to improve living standards further fuel demand. China’s Belt and Road Initiative is also driving large-scale infrastructure projects across Asia and Africa, indirectly boosting HVAC adoption in these regions.

MARKET CHALLENGES

Supply Chain Disruptions: A Persistent Operational Hurdle

Supply chain disruptions have emerged as a critical challenge for the HVAC industry, exacerbated by geopolitical tensions and global events like the COVID-19 pandemic. The Federal Reserve Bank of St. Louis notes that supply chain pressures remain elevated, impacting the availability of essential components such as compressors and electronic controls. Deloitte reports that 75% of HVAC manufacturers faced delays in raw material procurement during 2022, leading to increased lead times and higher costs. Transportation bottlenecks have further compounded the issue, with the Port of Los Angeles reporting a 20% decline in container throughput during peak congestion periods. These disruptions not only disrupt production schedules but also erode profit margins, making it difficult for companies to meet growing demand efficiently.

Skilled Labor Shortages: A Growing Workforce Crisis

A shortage of skilled labor is increasingly challenging the HVAC industry, particularly in installation, maintenance, and repair services. The U.S. Bureau of Labor Statistics projects a 5% growth in HVAC employment from 2022 to 2032, yet the workforce remains insufficient to meet demand. The Air Conditioning Contractors of America (ACCA) reports that nearly 40% of HVAC technicians in the U.S. are aged 55 or older, signaling an impending wave of retirements. In Europe, Eurostat said that only 30% of young workers are entering skilled trades, leaving the industry vulnerable. Training programs and certifications are often inadequate to bridge this gap, resulting in inefficiencies and higher operational costs. As the industry adopts advanced technologies like AI and IoT, the demand for specialized skills intensifies, further complicating workforce development efforts.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.64% |

|

Segments Covered |

By Product Type, End Use, Installation, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bosch, Carrier Group, Daikin Industries Inc., Danfoss, GREE Electric Appliances, inc., Haier Group, Hisense HVAC equipment Co., Ltd., Johnson Controls Plc, Lennox International, LG Electronics, Midea Group, Mitsubishi Electric Group, Panasonic Corporation, Rheem Manufacturing Company, and Trane Technologies. |

SEGMENT ANALYSIS

By Product Type Insights

The Air conditioning equipment segment held the largest market share at 40.3% in 2024 and was driven by rising global temperatures and urbanization. The U.S. Energy Information Administration states that air conditioning accounts for about 12% of total energy consumption in U.S. homes which is spotlighting its widespread use. In regions like Asia-Pacific, where summer temperatures often exceed 35°C, demand is even higher. Additionally, the International Energy Agency reports that the number of air conditioners in use globally could triple by 2050, reaching 5.6 billion units. This segment’s dominance due to its critical role in residential and commercial comfort, making it indispensable in modern infrastructure.

The Heat pumps segment is the fastest-growing segment, with a CAGR of 8.5% due to their energy efficiency and versatility. The U.S. Department of Energy notes that heat pumps can reduce electricity use for heating by up to 50% compared to traditional furnaces. Governments worldwide are promoting heat pumps as part of green initiatives; for example, the European Commission aims to install 60 million heat pumps by 2030. Rising awareness about sustainability and incentives like tax rebates further boost adoption. With urbanization driving HVAC demand, heat pumps are gaining traction for their ability to provide both heating and cooling, making them a key growth driver.

By End Use Insights

The residential segment dominated with a 50.7% market share in 2024 because of the increasing homeownership and urbanization. The U.S. Census Bureau reports that single-family home construction grew by 15% in 2022, boosting HVAC installations. Rising disposable incomes in emerging economies also contribute to this trend. According to the International Energy Agency, households account for 29% of global energy use, with HVAC systems being a major component. Comfort and convenience remain top priorities for homeowners, ensuring sustained demand for residential HVAC solutions.

The commercial segment is growing fastest, with a CAGR of 7.2%, fueled by urbanization and expanding office spaces. The World Bank estimates that urban areas will house 68% of the global population by 2050 and is driving demand for climate-controlled environments. Smart building technologies are also propelling growth. Commercial buildings prioritize energy efficiency, with systems like VRF (Variable Refrigerant Flow) gaining popularity. Government mandates for green buildings further accelerate adoption, making this segment a key focus for manufacturers.

By Installation Insights

The Replacement/retrofit segment captured the biggest share of 60.5% in 2024 as aging HVAC systems require frequent upgrades. The U.S. Department of Energy states that nearly 70% of U.S. homes have HVAC systems over 10 years old, creating a strong replacement market. Energy-efficient retrofits are also incentivized; for example, the IRS offers tax credits for upgrading to ENERGY STAR-certified systems. With sustainability becoming a priority, retrofitting older systems with modern, eco-friendly alternatives ensures this segment remains dominant.

The New construction segment is the rapidly growing category with a CAGR of 6.8% owing to the urbanization and infrastructure development. The National Association of Home Builders reports that housing starts in the U.S. increased by 10% in 2022. In emerging markets, China’s Belt and Road Initiative funds large-scale projects, indirectly boosting HVAC demand. The United Nations predicts that urban areas will house 68% of the global population by 2050, fueling new construction. Modern HVAC systems are integral to sustainable building designs, making this segment crucial for future growth.

By Distribution Channel Insights

The Indirect distribution segment had a substantial market share in 2024 as most HVAC products are sold through dealers, contractors, and retailers. The U.S. Census Bureau reports that indirect channels account for over 80% of HVAC sales in residential applications. This model benefits consumers by providing expert installation and maintenance services. Additionally, government programs often partner with local distributors to promote energy-efficient systems, further strengthening this channel’s dominance.

The Direct distribution is expanding quickly, with a CAGR of 9.1% due to e-commerce expansion and direct-to-consumer models. Statista reports that online sales of HVAC components grew by 25% in 2022. Companies like Tesla are adopting direct sales for innovative HVAC solutions, such as solar-powered systems. The rise of smart HVAC systems also favors direct channels, as manufacturers offer subscription-based monitoring services. With digital platforms simplifying purchases, direct distribution is set to gain significant traction in the coming years.

REGIONAL ANALYSIS

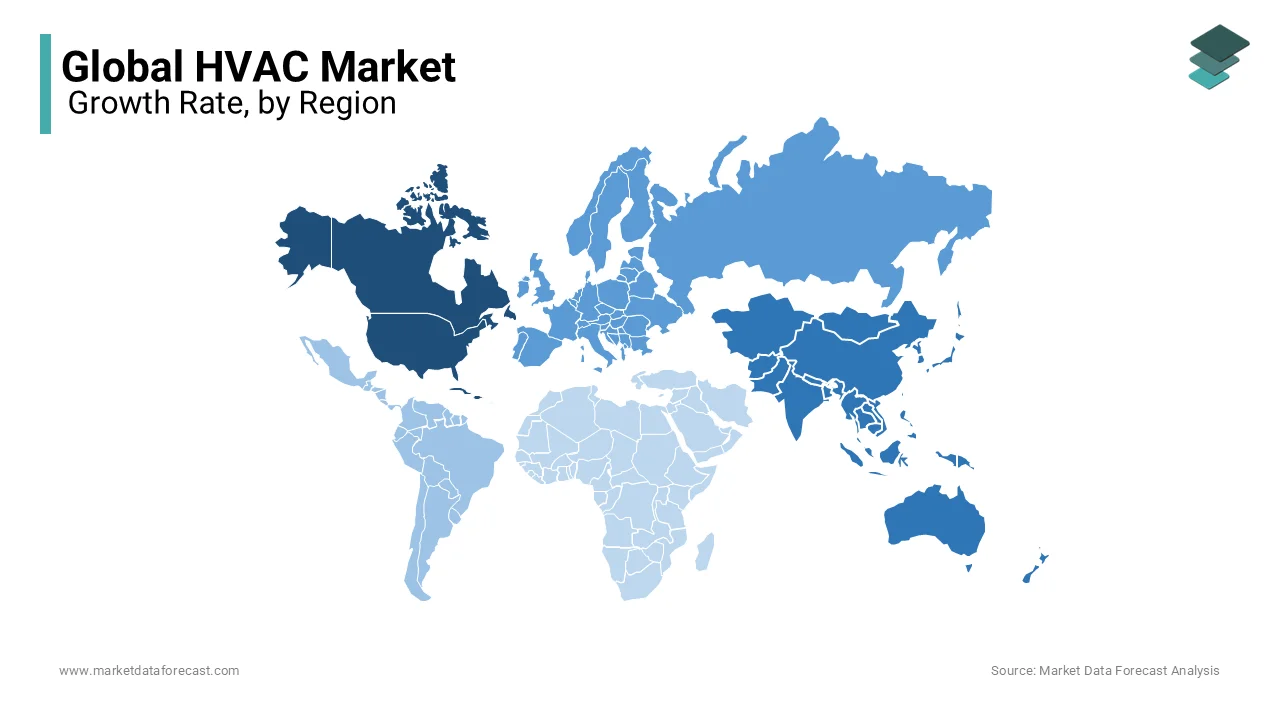

North America dominated the HVAC market by holding a 35.1% share in 2024 and was driven by advanced infrastructure and high energy consumption. The U.S. Energy Information Administration reports that HVAC systems account for 48% of energy use in American homes, underscoring their importance. Stringent energy efficiency regulations, such as California’s Title 24, further propel adoption of sustainable HVAC technologies. The region’s focus on smart homes and IoT-enabled systems boosts demand. With rising urbanization and a strong emphasis on green building standards, North America remains a leader in HVAC innovation and implementation.

Asia-Pacific is the fastest-growing HVAC market with a CAGR of 7.5% which is fueled by rapid urbanization and industrialization. The United Nations estimates that 60% of the region’s population will live in urban areas by 2030, driving demand for climate-controlled environments. China and India lead this growth, with the Indian Ministry of Housing reporting a 10% annual rise in urban housing projects. Rising disposable incomes and government initiatives like China’s Green Building Action Plan further boost adoption. The International Energy Agency stresses that Asia-Pacific accounts for over 50% of global HVAC energy consumption, making it a critical market for manufacturers and innovators.

Europe holds a significant position in the HVAC market due to its stringent environmental regulations and commitment to sustainability. The European Commission mandates a 55% reduction in greenhouse gas emissions by 2030, driving adoption of energy-efficient HVAC systems. Heat pumps are particularly popular, with the European Heat Pump Association reporting a 34% increase in installations in 2022. Germany leads the region, contributing over 25% of Europe’s HVAC revenue. The region’s focus on retrofitting old buildings with eco-friendly systems also fuels growth. With policies promoting renewable energy integration, Europe remains a pioneer in sustainable HVAC solutions.

Latin America is an emerging HVAC market, driven by urbanization and rising middle-class incomes. The World Bank predicts that urban populations in the region will grow by 10% by 2030, increasing demand for residential and commercial HVAC systems. Brazil and Mexico are key contributors, with Brazil’s HVAC market projected to grow at a CAGR of 6.2%. Government incentives for energy-efficient systems further boost adoption. The International Energy Agency notes that cooling demand in Latin America could rise by 40% by 2030 due to rising temperatures. This region’s growing infrastructure and economic development make it a promising market for HVAC manufacturers.

The Middle East & Africa region is experiencing rising HVAC demand due to extreme temperatures and rapid urbanization. The International Energy Agency states that cooling accounts for 70% of peak electricity demand in Gulf countries, showcasing the critical role of HVAC systems. Saudi Arabia and the UAE lead the market, with investments in smart cities like NEOM boosting demand. In Africa, the African Development Bank reports that infrastructure spending exceeds USD 100 billion annually, indirectly supporting HVAC adoption. Rising disposable incomes and government initiatives to improve living standards further drive growth. Despite challenges like energy access, this region’s harsh climate ensures sustained HVAC demand.

TOP 3 PLAYERS IN THE MARKET

Daikin Industries

Daikin Industries, a Japan-based multinational, holds a strong position in the global HVAC market. The company is known for its extensive range of air conditioning solutions, from residential units to large-scale commercial HVAC systems. Daikin has been a pioneer in energy-efficient and eco-friendly technologies, including inverter-driven compressors and refrigerants with lower environmental impact. By investing heavily in R&D, Daikin continues to expand its global footprint, particularly in North America, Europe, and Asia, where demand for high-performance HVAC solutions is rising.

Midea Group

Midea Group, a China-based conglomerate, has grown into one of the most competitive players in the HVAC sector. The company produces a diverse portfolio of residential and commercial air conditioning systems, leveraging automation and AI-driven smart controls to enhance energy efficiency. Midea’s focus on affordability and large-scale production allows it to maintain a significant market share, especially in emerging markets. The company has expanded its presence in global markets through strategic partnerships and acquisitions, strengthening its position in the HVAC industry.

Gree Electric Appliances

Gree Electric Appliances, also headquartered in China, is a leading manufacturer of air conditioning units, with a strong presence in residential and commercial sectors. The company is recognized for its focus on technological advancements, including variable-speed compressors and smart climate control solutions. Gree’s emphasis on sustainability aligns with global energy efficiency regulations, making it a key contributor to the HVAC market's shift towards environmentally friendly solutions.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Technological Innovation and Smart HVAC Solutions

One of the most crucial strategies is continuous investment in research and development (R&D) to introduce innovative and energy-efficient HVAC solutions. Companies like Daikin and Gree focus on inverter technology, AI-driven climate control, and IoT-enabled smart HVAC systems that offer remote monitoring and automation. These innovations improve energy efficiency, reduce operational costs, and enhance user convenience, catering to the rising demand for smart homes and buildings.

Sustainability and Green Initiatives

Environmental concerns and stringent government regulations have led major HVAC players to prioritize eco-friendly solutions. Daikin has pioneered the use of low-global-warming-potential (GWP) refrigerants, while Midea and Gree focus on solar-powered and energy-efficient air conditioning systems. These companies actively invest in reducing carbon footprints and complying with green building standards, making sustainability a key differentiator in the competitive landscape.

Strategic Mergers, Acquisitions, and Partnerships

To expand their market share, leading HVAC manufacturers engage in strategic mergers and acquisitions. For instance, Daikin acquired Goodman Manufacturing to strengthen its presence in the North American residential HVAC market. Midea has formed partnerships with global brands to enhance its product offerings and distribution channels. These acquisitions and collaborations allow companies to expand their technological capabilities, enter new markets, and leverage existing distribution networks.

COMPETITIVE LANDSCAPE

The HVAC market is very competitive because many companies are trying to sell their products in different parts of the world. Big companies like Daikin, Midea, and Gree lead the market. They make advanced and energy-saving HVAC systems. Many smaller companies also compete by offering lower prices or special features.

Technology is an important part of the competition. Companies work hard to create smart HVAC systems that save energy and are easy to control. Many businesses now use artificial intelligence and the Internet of Things to make better products. Customers want HVAC systems that are good for the environment so companies focus on eco-friendly solutions.

Another big factor in competition is expansion into new markets. Many companies try to sell their products in growing countries where more people are buying air conditioning and heating systems. They build factories in different regions to make products cheaper and deliver them faster.

Good customer service is also important. Companies with strong service networks gain more trust from customers. They offer quick repairs and better warranties to keep people happy.

KEY MARKET PLAYERS

The major players in the global HVAC market include Bosch, Carrier Group, Daikin Industries Inc., Danfoss, GREE Electric Appliances, inc., Haier Group, Hisense HVAC equipment Co., Ltd., Johnson Controls Plc, Lennox International, LG Electronics, Midea Group, Mitsubishi Electric Group, Panasonic Corporation, Rheem Manufacturing Company, and Trane Technologies.

RECENT MARKET DEVELOPMENTS

- In December 2024, the UK Department for Energy Security and Net Zero initiated a consultation to enhance product standards by updating ecodesign and energy labeling legislation for space and combination heaters. The proposals aim to improve the efficiency of space heaters, reduce carbon emissions, and lower consumer bills.

- In January 2025, ASHRAE released its public policy priorities for the 2024-2025 society year, emphasizing support for sustainable building practices, including building decarbonization, to mitigate climate change. The organization highlighted the significant role of HVAC&R systems in contributing to greenhouse gas emissions and the need for sustainable practices.

- In September 2024, Ofgem announced the implementation of energy code reforms, introducing new functions to set the direction for electricity and gas industry codes. The reforms aim to ensure that codes can adapt more quickly to changes in the energy market, supporting the UK's ambition to achieve net-zero emissions.

- In June 2024, the European Parliament signed the final act revising the internal electricity market design. This legislative reform aims to boost renewable energy integration, better protect consumers, and enhance industrial competitiveness. The act entered into force on July 16, 2024.

- In December 2024, the UK government launched a consultation seeking views on proposed reforms to enhance the Energy Performance of Buildings regime. The consultation aims to provide homeowners and tenants with accurate information about the energy performance of their homes, supporting informed investment and purchase decisions.

MARKET SEGMENTATION

This research report on the global HVAC market is segmented and sub-segmented into the following categories.

By Product Type

- Heating Equipment

- Furnaces

- Boiler

- Heat Pumps

- Ventilation Equipment

- Air Handlers

- Ductwork

- Fans

- Air Conditioning Equipment

- Chillers

- Cooling Towers

By End Use

- Residential

- Commercial

- Industrials

By Installation

- New Construction

- Replacement/Retrofit

By Distribution Channel

- Direct

- Indirect

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the key factors driving HVAC market growth?

Increasing urbanization, climate change, rising disposable incomes, and government regulations on energy efficiency are major growth drivers.

What are the latest trends in the HVAC industry?

Smart HVAC systems, IoT integration, energy-efficient technologies, and eco-friendly refrigerants are shaping the future of the industry.

What role does IoT play in modern HVAC systems?

IoT enhances HVAC efficiency through smart sensors, remote monitoring, and predictive maintenance, reducing energy consumption and operational costs.

What is the future outlook for the HVAC industry?

The industry is expected to grow steadily, driven by sustainability initiatives, advanced automation, and increasing demand for climate control solutions worldwide.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]