Global HVAC Equipment Market Size, Share, Trends & Growth Forecast Report – Segmented By Product (Heating, Ventilation and Cooling), Application (Residential, Commercial and Industrial), Type (Central and Decentralized) & Region - Industry Forecast From 2024 to 2032

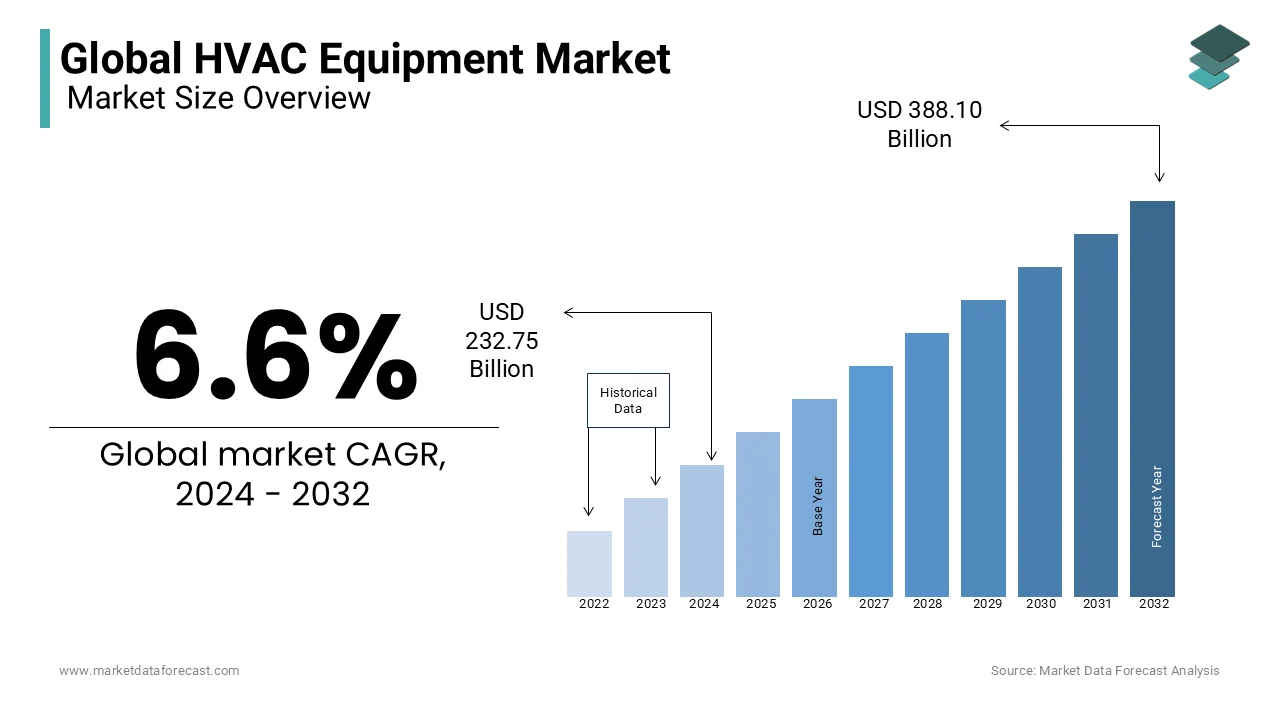

Global HVAC Equipment Market Size (2024 to 2032)

The global HVAC equipment market was worth USD 218.34 billion in 2023 and is anticipated to reach a valuation of USD 388.10 billion by 2032 from USD 232.75 billion in 2024, registering a CAGR of 6.6% from 2024 to 2032.

MARKET DRIVERS

With global temperatures on the rise due to climate change, the market growth for HVAC (Heating, Ventilation, and Air Conditioning) equipment is increasing.

People and businesses require efficient cooling systems to stay comfortable in hot weather. Also, heating systems are necessary for keeping indoor spaces warm during colder seasons. HVAC equipment is essential for maintaining comfortable living and working environments in an increasingly warming world. As a result, it drives the market growth of HVAC Equipment and maintains comfortable living and working environments during the hot weather.

The ongoing trend of urbanization and construction activities in cities and urban areas is another factor propelling the growth of HVAC equipment in the market. As cities expand and more buildings are constructed, there's a growing market demand for HVAC systems to ensure comfortable indoor environments. Therefore, these systems help regulate temperatures and air quality in residential, commercial, and industrial spaces, making them essential for urban living and workspaces. As a result, the increasing construction activities in urban areas contribute to the rising share of the HVAC equipment market.

MARKET RESTRAINTS

The HVAC equipment market faces a notable restraint in the form of high initial costs.

Purchasing and installing HVAC systems require a substantial upfront investment, encompassing equipment expenses, installation fees, and any needed structural modifications. This financial barrier can pose challenges, particularly for smaller businesses and homeowners, hindering the adoption of HVAC systems. While these systems offer long-term benefits, the significant initial cost can deter potential users and impact their affordability and accessibility.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

6.6% |

|

Segments Covered |

By Product, Type, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Carrier, Daikin Industries, Trane Technologies, Lennox International, Johnson Controls, Mitsubishi Electric, Fujitsu General, Ingersoll Rand, Rheem, Goodman Manufacturing, and Others. |

SEGMENTAL ANALYSIS

Global HVAC Equipment Market Analysis By Product

The cooling equipment segment captured the highest revenue share of 55% of the worldwide market in 2023. It includes various types of air conditioning systems, which are essential for ensuring comfortable indoor temperatures, particularly in regions with hot climates. This equipment encompasses central air conditioning systems, split-system units, window air conditioners, and portable AC units. It is crucial for maintaining comfort and productivity, both in residential and commercial settings. In areas like the Middle East, the southern United States, and parts of Asia, cooling equipment represents a dominant and high-demand segment, especially during the sweltering summer months.

The ventilation equipment segment is expected to rise at a notable CAGR during the forecast period. It plays a crucial role in maintaining indoor air quality by facilitating proper air circulation. This category includes various products such as air handlers, air filters, and fans. While ventilation is important year-round, its significance is amplified in densely populated areas and buildings with limited natural ventilation. The growing emphasis on indoor air quality and the need to mitigate pollutants, odors, and pathogens have substantially increased the importance of ventilation equipment in various applications, including residential, commercial, and industrial settings.

Global HVAC Equipment Market Analysis By Type

The decentralized HVAC systems segment holds the highest market share during the forecast period. They consist of localized units that offer heating and cooling to specific zones or areas within a building. This category includes units like window air conditioners, split systems, and heat pumps. Decentralized systems are frequently used in residential buildings, small commercial spaces, and locations where individual climate control is essential. They provide flexibility, easy installation, and reduced energy consumption, making them suitable for areas with diverse climate requirements. In recent years, decentralized systems have gained popularity due to their energy efficiency and the capability to provide zoned climate control.

Central HVAC systems are estimated to showcase a notable CAGR during the forecast period. The centralization of equipment ensures precise control over temperature and air quality, promoting energy efficiency and consistent climate maintenance. These systems typically feature components such as chillers, cooling towers, substantial air handling units, and extensive ductwork. In commercial and industrial settings, central HVAC systems are paramount for efficient and accurate climate control.

Global HVAC Equipment Market Analysis By Application

The residential HVAC equipment segment had the largest revenue share of 38% of the global market in 2023. It is primarily used for homes and apartments, encompassing a range of heating, cooling, and ventilation solutions. Its prominence results from the sheer number of individual households and apartments, coupled with the essential requirement for climate control. Both homeowners and tenants prioritize comfort, indoor air quality, and energy efficiency, propelling the demand for residential HVAC systems.

Commercial HVAC equipment holds the second biggest market share and is expected to grow with a CAGR of 6.6% during the forecast period. This segment encompasses a diverse array of systems, including rooftop units, chillers, variable refrigerant flow (VRF) systems, and packaged units. Commercial HVAC systems prevail due to the size and intricacy of commercial structures, necessitating advanced and scalable HVAC solutions. These spaces demand features like zone control, air quality management, and compliance with building codes, emphasizing the significance of commercial HVAC systems in achieving effective climate control, energy efficiency, and adaptability to diverse occupancy patterns.

REGIONAL ANALYSIS

The Asia-Pacific region led the market in 2023 and accounted for 45% of the global market share in 2023.

Rapid urbanization and economic expansion, spurring construction projects across residential, commercial, and industrial sectors, are some factors attributed to fuel the demand of the market in Asia Pacific. The HVAC market's dominance in this region is a consequence of its immense population, translating to a high demand for HVAC systems. In nations like India and China, growing disposable incomes and an expanding middle class have led to higher ownership of residential air conditioning units.

North America is the second leading market, with a CAGR of 5.8% during the forecast period. Its climate diversity, ranging from extreme cold in parts of Canada to hot and humid summers in the U.S., fuels demand for heating and cooling solutions. A mature construction sector with numerous residential, commercial, and industrial buildings further contributes to its dominance. Central air conditioning systems in homes and the push for energy-efficient HVAC technologies also bolster North America's prominent position in the market.

Europe holds a prominent position in the HVAC equipment market, driven by a combination of factors. The region's climate variability, characterized by cold winters and warm summers, demands efficient heating and cooling solutions in both residential and commercial structures. Europe's commitment to energy efficiency and environmental sustainability has driven the uptake of innovative HVAC technologies and the enforcement of rigorous energy performance standards. Consequently, Europe stands as a substantial market for cutting-edge HVAC solutions, such as heat pumps, energy recovery systems, and intelligent controls.

Latin America, the Middle East, and Africa are likely to experience significant growth during the forecast period due to ongoing construction and infrastructure development projects.

KEY PLAYERS IN THE GLOBAL HVAC EQUIPMENT MARKET

Companies playing a prominent role in the global HVAC equipment market include Carrier, Daikin Industries, Trane Technologies, Lennox International, Johnson Controls, Mitsubishi Electric, Fujitsu General, Ingersoll Rand, Rheem, Goodman Manufacturing, and Others.

RECENT HAPPENINGS IN THE GLOBAL HVAC EQUIPMENT MARKET

- In 2022, Daikin expanded its portfolio of energy-efficient and eco-friendly HVAC systems, addressing the growing demand for sustainable solutions.

- In 2023, Carrier launched new smart HVAC systems equipped with IoT technology for remote monitoring and control, enhancing user convenience and energy savings.

- In 2022, Trane introduced variable refrigerant flow (VRF) systems with enhanced zoning capabilities, providing more precise and efficient temperature control.

- In 2023, Johnson Controls focused on developing advanced building automation systems that integrate HVAC, lighting, and security, promoting energy efficiency and cost savings.

DETAILED SEGMENTATION OF HVAC EQUIPMENT MARKET INCLUDED IN THIS REPORT

This research report on the global HVAC equipment market has been segmented and sub-segmented based on product, type, application, and region.

By Product

- Heating

- Ventilation

- Cooling

By Type

- Central

- Decentralized

By Application

- Residential

- Commercial

- Industrial

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the CAGR of the HVAC Equipment Market from 2024-2032?

The HVAC Equipment Market is expected to grow with a CAGR of 6.6% during the forecast period.

Which is the dominating region for the HVAC Equipment Market share?

Asia-Pacific is currently dominating the HVAC Equipment Market share by region.

Which application type dominates the HVAC Equipment Market?

The "Residential" segment dominates the HVAC Equipment Market by Application type.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]