Global Hospital Furniture Market Size, Share, Trends & Growth Forecast Report By Type (Bedside Tables, OT Table, Instrument Stands, Stretchers, Hospital Beds, Chairs, Scrub Sinks, Waste Container, Trolley and Others), Material (Wood, Metal and Plastic), End-user (Hospitals and Clinics, Surgical Centers, Diagnostic Centers and Others) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Hospital Furniture Market Size

The size of the global hospital furniture market was worth USD 10.28 billion in 2024. The global market is anticipated to grow at a CAGR of 6.9% from 2025 to 2033 and be worth USD 18.74 billion by 2033 from USD 11 billion in 2025.

Hospital infrastructure plays an essential role in uplifting the mood of patients, which can be attained through hospital furniture like recliner beds, cabinets, recovery couches, massage chairs, operation tables, and bedside tables. The hospital furniture is used in nursing homes, private clinics, hospitals, healthcare facilities, and diagnostic centers. The well-designed and latest hospital furniture help in enhancing the mood of patients and ultimately helps in their speedy recovery. Hospital furniture equipped with modern technology provides essential care in treating patients' illnesses. Also, the adequate infrastructure in the various medical facilities provides a comfortable working environment for doctors, nurses, and other medical staff. Besides the furniture used for medical staff and patients, they are also used for other hospital facilities like waiting rooms, receptions, and hospital canteens. Furthermore, the constant developments in the healthcare sector have resulted in the opening of more hospitals and private clinics, which boosted the demand for hospital furniture.

MARKET DRIVERS

Hospital furniture significantly impacts various medical facilities in providing better healthcare infrastructure and services. The various governments continuously invest in the healthcare sector of developing and developed nations, which results in more private clinics and hospitals. Thus, more demand for hospital furniture. Moreover, the increasing prevalence of chronic diseases worldwide leads to a rise in the number of hospital admissions. Hence, boosting the demand for hospital beds, chairs, and trolleys. In addition, the ever-increasing number of physically challenged patients has also increased the demand for hospital furniture like wheelchairs and unique beds.

Amid the Covid19, there was a massive demand for hospital beds in many developing countries, making it a potential market for investments. The continuous rise in the opening of hospitals, clinics, and diagnostic centers raises the need for more hospital furniture. This helps the manufacturers capitalize on the demand for hospital beds. The rising concern about safety and hygiene also leads to demand for virus-free products like COVID-19 quarantine beds, virus guard partitions, isolation beds, etc. Furthermore, manufacturers increasing research and development investments and the entry of local and regional players are added factors to the overall market's growth.

MARKET RESTRAINS

The high cost and maintenance of this hospital furniture impose a considerable obstacle to the market's growth. Any fatal and chronic disease requires surgery and other medical procedures that often lengthen the patient's stay in the hospital, which becomes very costly for the patient to bear and hamper the market growth. Moreover, furniture like operation tables, diagnostic machines, etc., requires more maintenance than hospital beds, chairs, and side tables. In addition, the high investment in hospital furniture also affects its growth because it restricts the entry of small and middle-size companies into the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.9% |

|

Segments Covered |

By Type, Material, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Stryker Corporation, Hill-Rom Holdings Inc., Invacare Corporation, ARJO AB, Steris Plc., Drive DeVilbiss Healthcare, GF Health Products, Inc., Medline Industries, Inc., NAUSICAA Medical, and Sunrise Medical (US) LLC, and Others. |

SEGMENTAL ANALYSIS

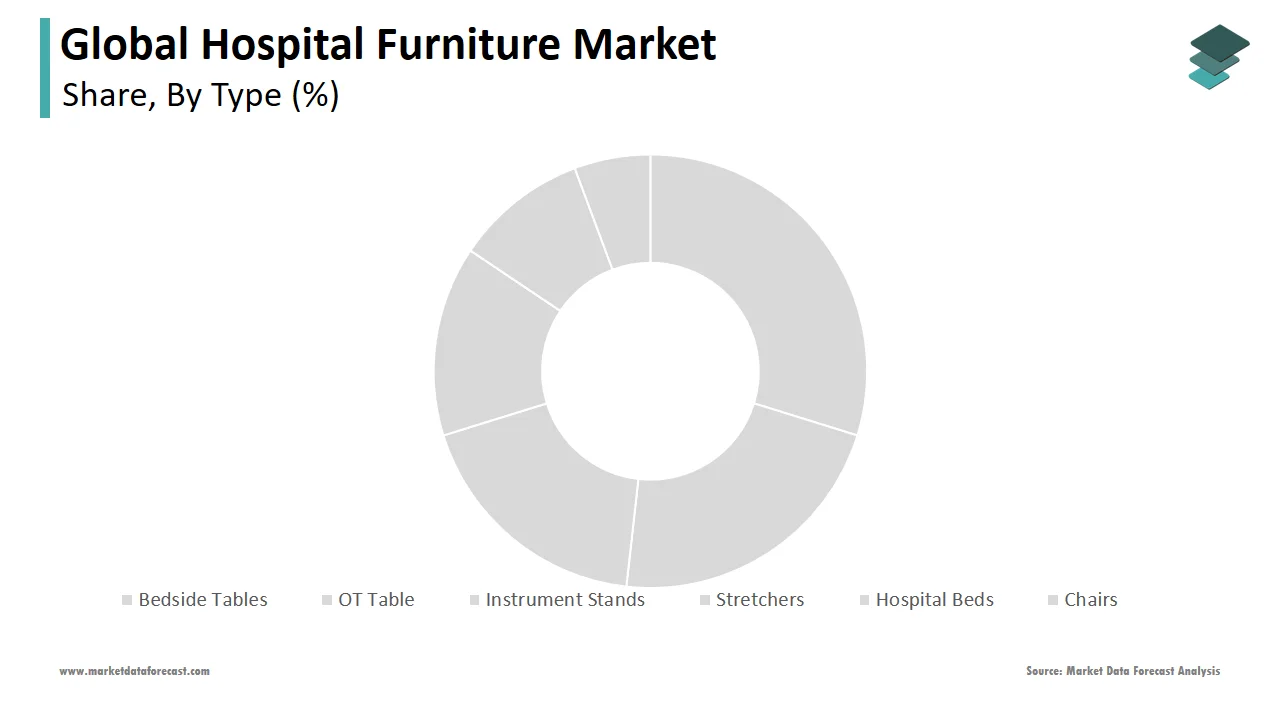

By Type Insights

The hospital beds segment had the largest share of the global hospital furniture market in 2024. The factors like an increased number of patients admitted to hospitals for surgical procedures and longer patient stays due to reduced injury healing rates have increased the demand for beds in hospitals and other medical facilities during the forecast period. In addition, many manufacturers' production of affordable beds contributed to the market's overall growth.

By Material Insights

Based on material, the wood segment held the largest share of the global hospital furniture market, more than 65% in 2022. Due to the limited capital available with public hospitals, hardwood furniture is preferred, boosting the market growth. Wooden chairs improve patient comfort and flexibility and allow them to be more relaxed; as a result, the demand for the same increases. However, the metals segment has also showcased significant growth in the market share and reached 50% in 2020. Metal-based hospital furniture is easy to maintain and durable, enhancing the material's position on the market.

By End-user Insights

In 2020, the hospital and clinic segment earned USD 11.4 billion. This segment is expected to be driven by the increased number of hospitals, increased procedures time for various chronic diseases, and increased access to health care in developing and developing countries. In addition, the market growth for this segment is also attributed to the availability of improved treatment facilities in hospitals.

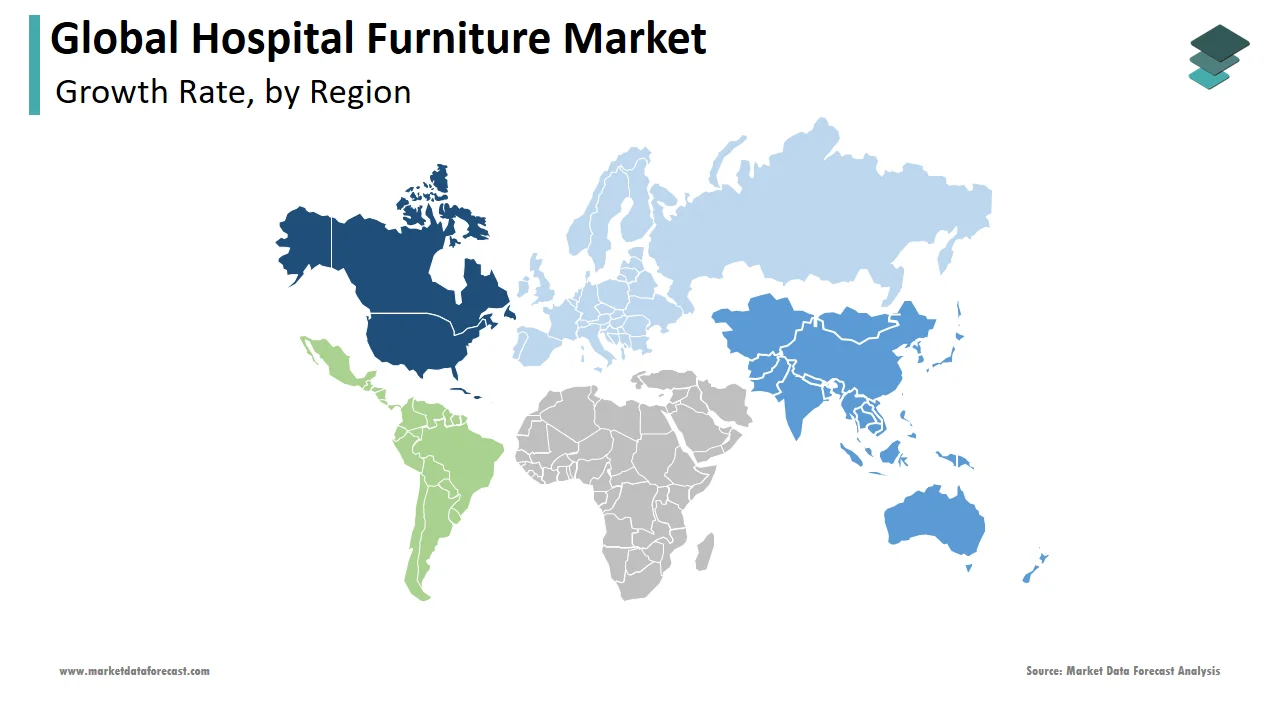

REGIONAL ANALYSIS

In 2022, North America stood at the top in the hospital furniture market, with more than 37% of the share. The increasing prevalence of road accidents, diabetes, obesity, and other chronic illnesses in the region leads to more admissions to the hospital and increases the demand for hospital furniture. In addition, various government-sponsored initiatives like refund facilities for hospital furniture and other equipment boosted the growth in the region. As the number of hospitals, clinics, and further medical facilities increases in the United States and Canada, the demand for hospital furniture increases.

The growth in the Asia Pacific is due to many patients with cancer, cardiovascular disease, and infectious diseases in India, China, Australia, and New Zealand. The increasing per capita health care costs and access to health care are added factors increasing the demand for hospital furniture in the region. As a result, markets in Latin America, the Middle East, and Africa are expected to grow modestly during the forecast period.

KEY MARKET PLAYERS

Stryker Corporation, Hill-Rom Holdings Inc., Invacare Corporation, ARJO AB, Steris Plc., Drive DeVilbiss Healthcare, GF Health Products, Inc., Medline Industries, Inc., NAUSICAA Medical, and Sunrise Medical (US) LLC are a few of the noteworthy players in the global hospital furniture market.

MARKET SEGMENTATION

This global hospital furniture market research report is segmented and sub-segmented into the following categories.

By Type

- Bedside Tables

- OT Table

- Instrument Stands

- Stretchers

- Hospital Beds

- Chairs

- Scrub Sinks

- Waste Container

- Trolley

- Others

By Material

- Wood

- Metal

- Plastic

By End-user

- Hospitals and Clinics

- Surgical Centers

- Diagnostic Centers

- Others

Frequently Asked Questions

How big is the global hospital furniture market?

As per our research report, the global hospital furniture market size is predicted to grow to USD 18.74 billion by 2033.

Which are the significant players operating in the hospital furniture market?

Based on type, the hospital beds segment led the market in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]