Global Hindered Amine Light Stabilizers (HALS) Market Size, Share, Trends, & Growth Forecast Report Segmented By Type (Monomeric, Oligomeric, Polymeric), End-use, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Hindered Amine Light Stabilizers (HALS) Market Size

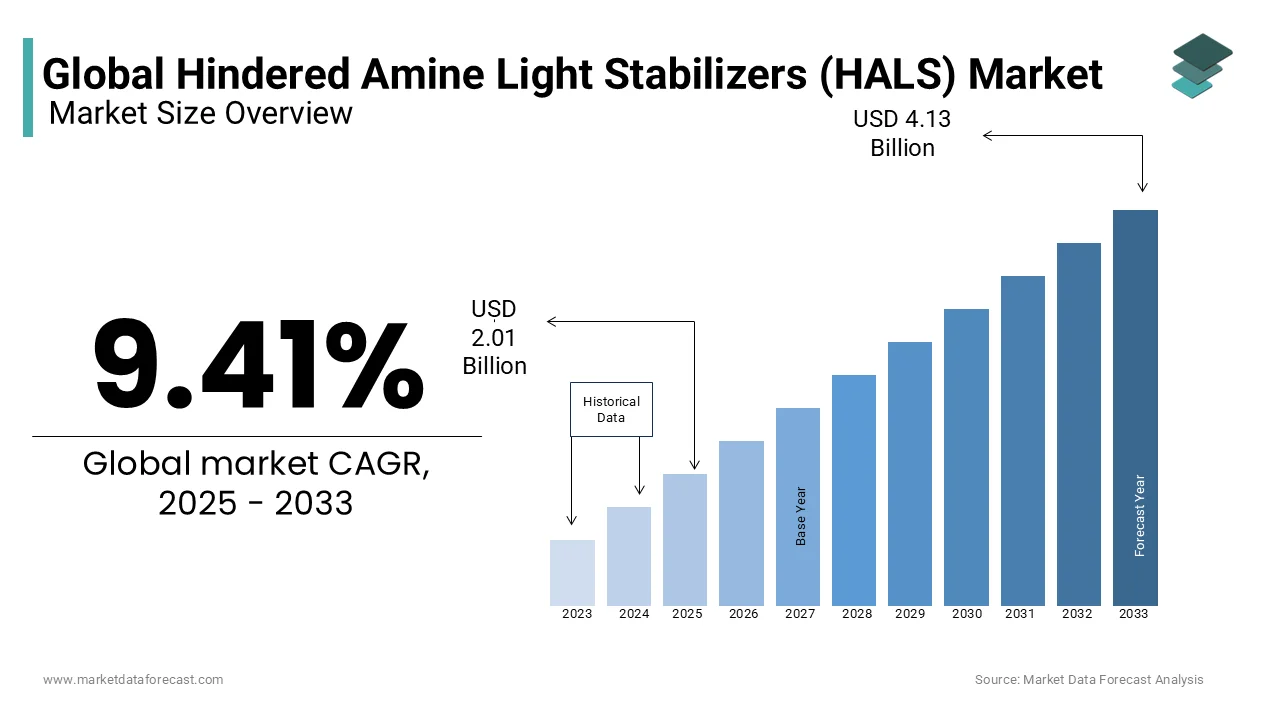

The global Hindered Amine Light Stabilizers (HALS) market size was valued at USD 1.84 billion in 2024 and is expected to reach USD 4.13 billion by 2033 from USD 2.01 billion in 2025. The market is projected to grow at a CAGR of 9.41%.

Hindered Amine Light Stabilizers (HALS) are highly effective chemical additives used to protect polymers and plastics from ultraviolet (UV) degradation. Unlike traditional UV absorbers, HALS do not absorb UV light but instead act as radical scavengers and is continuously regenerating themselves to offer long-lasting protection. According to the International Energy Agency (IEA), global plastic production consumes 8% of the world’s oil output which is showing the reliance on synthetic polymers across various industries. Furthermore, studies from the World Economic Forum indicate that approximately 40% of plastic materials are used in packaging which is a sector highly susceptible to UV exposure and is making HALS essential for maintaining product integrity and shelf life.

In the automotive sector, where plastic components account for up to 50% of a vehicle’s total volume but only 10% of its weight, as per the European Automobile Manufacturers Association) and HALS are crucial in preventing material degradation due to prolonged sun exposure. Similarly, in agriculture, HALS-stabilized polyethylene greenhouse films which account for 20% of global plastic film consumption plays a vital role in optimizing crop yields by maintaining optimal light transmission while resisting photodegradation.

With increasing environmental concerns, research has also focused on biodegradable and recyclable HALS formulations to reduce microplastic pollution. Regulatory frameworks, such as the European Union’s REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) directive which continue to influence the development of environmentally friendly stabilizers and is ensuring their compliance with global safety standards.

MARKET DRIVERS

Stringent Environmental Regulations

The implementation of stringent environmental regulations has greatly influenced the adoption of Hindered Amine Light Stabilizers (HALS) in various industries. Regulatory bodies such as the European Chemicals Agency (ECHA) have identified certain UV stabilizers as substances of very high concern due to their persistence and bioaccumulation potential. For instance, ECHA has classified specific benzotriazole UV stabilizers under stringent regulatory frameworks to mitigate environmental risks. Consequently, industries are increasingly turning to HALS as safer alternatives to comply with these regulations and minimize ecological impact. This shift not only ensures adherence to environmental standards but also promotes the development and use of more sustainable polymer stabilization solutions.

Advancements in Polymer Applications

Advancements in polymer applications have necessitated the use of effective stabilizers like HALS to enhance material performance and longevity. Research by the National Institute of Standards and Technology (NIST) has demonstrated that polymers, when exposed to environmental factors such as UV radiation, undergo degradation leading to loss of mechanical properties and discoloration. For example, studies have shown that certain polymers can experience significant degradation under UV exposure, affecting their structural integrity. The incorporation of HALS has been proven to mitigate these effects, thereby extending the service life of polymer-based products. This is particularly crucial in applications where material durability is paramount such as in automotive components, construction materials, and outdoor equipment.

MARKET RESTRAINTS

High Production Costs

The manufacturing of Hindered Amine Light Stabilizers (HALS) involves complex chemical processes that contribute to elevated production costs. These costs can be a major barrier for manufacturers and particularly when operating under tight budget constraints. The intricate synthesis procedures and stringent quality control measures required for HALS production necessitate substantial financial investment. This financial burden can deter new entrants into the market and limit the expansion capabilities of existing players and thereby restraining the overall growth of the HALS market.

Potential Environmental and Health Concerns

Despite their benefits in enhancing polymer durability, certain HALS compounds have raised environmental and health concerns. Some studies suggest that specific HALS may persist in the environment and could potentially bioaccumulate which is leading to ecological imbalances. Additionally, there are concerns regarding the potential human health impacts of prolonged exposure to these chemicals including skin and respiratory irritation. These apprehensions have led to increased scrutiny by regulatory bodies and is resulting in stricter guidelines and usage limitations. Consequently, manufacturers may face challenges in reformulating products to comply with evolving regulations which can impede market growth.

MARKET OPPORTUNITIES

Advancements in Sustainable Polymer Technologies

The increasing emphasis on environmental sustainability has led to potential advancements in polymer technologies. The U.S. National Science Foundation (NSF) in collaboration with industry partners has launched a $9.5 million research initiative aimed at accelerating the discovery and manufacturing of sustainable polymers. This program is known as Sustainable Polymers Enabled by Emerging Data Analytics (SPEED) seeks to address global challenges such as plastic waste by developing eco-friendly polymer solutions. These efforts not only contribute to environmental conservation but also open new avenues for the application of Hindered Amine Light Stabilizers (HALS) in sustainable materials.

Emerging Applications in Medical Devices

Polymers are increasingly utilized in the medical device industry due to their versatility and biocompatibility. According to the U.S. Food and Drug Administration (FDA), numerous types of materials including polymers are commonly used in medical devices and can be in contact with parts of the body for extended periods. The FDA emphasizes the importance of understanding the safety and performance of these materials in medical applications. This growing reliance on polymers in medical devices presents opportunities for the application of HALS to enhance the durability and longevity of these critical healthcare products.

MARKET CHALLENGES

Regulatory Compliance Challenges

Navigating the complex landscape of international regulations poses a grave challenge for the Hindered Amine Light Stabilizers (HALS) market. Regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) enforce stringent guidelines on chemical additives to ensure environmental and human health safety. For instance, the EPA's Toxic Substances Control Act (TSCA) mandates rigorous testing and reporting requirements for chemical substances including stabilizers used in plastics. Compliance with these regulations necessitates substantial investment in research, testing, and documentation which can be resource-intensive for manufacturers. Additionally, variations in regulatory standards across different regions complicate global distribution strategies are requiring companies to adapt formulations and processes to meet diverse compliance criteria. This regulatory complexity can impede market expansion and innovation within the HALS industry.

Technical Limitations in Specific Applications

While HALS are effective in enhancing the UV stability of many polymers, their performance can be limited in certain applications due to technical constraints. Research conducted by the National Renewable Energy Laboratory (NREL) indicates that the efficacy of HALS can diminish under high-temperature conditions or in the presence of specific chemical environments such as those found in photovoltaic (PV) modules. In these scenarios, HALS may not provide adequate long-term stabilization which is leading to polymer degradation and reduced material lifespan. Furthermore, the interaction of HALS with other additives or components within complex polymer systems can result in unforeseen compatibility issues is affecting the overall performance of the final product. Addressing these technical challenges requires ongoing research and development efforts to optimize HALS formulations and expand their applicability across a broader range of industrial applications.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.41% |

|

Segments Covered |

By Type, End-use, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

ADEKA Corporation, Arkema, BASF SE, CLARIANT, Chitec Technology Co., Ltd., Double Bond Chemical Ind., Co., Ltd., Everlight Chemical Industrial Co., Greenchemicals S.r.l., Mayzo, Inc., MPI Chemie BV, and others |

SEGMENTAL ANALYSIS

By Type Insights

The polymeric HALS segment dominated the market by accounting for 50.3% of the global market share in 2024 due to the superior performance of polymer HALS in enhancing the durability and longevity of polymers exposed to ultraviolet radiation. According to the U.S. Environmental Protection Agency (EPA), the use of advanced stabilizers like polymeric HALS has been instrumental in improving the lifespan of outdoor plastics and thereby reducing environmental waste. Their high molecular weight contributes to better compatibility with various polymers, making them indispensable in applications such as automotive parts and construction materials.

The oligomeric HALS segment is predicted to register a CAGR of 7.5% over the forecast period due to their balanced molecular weight which offers an optimal combination of volatility and compatibility with different polymer matrices. The National Institute of Standards and Technology (NIST) revealed that oligomeric HALS provide effective stabilization in packaging materials which is enhancing resistance to UV degradation and thereby extending shelf life. Their adaptability makes them increasingly popular in the packaging industry where maintaining material integrity under various environmental conditions is crucial.

By End-use Insights

The construction segment was the biggest end-use segment in the HALS market and accounted for over 36.1% of the market share in 2024. The increasing demand for high-performance materials that can withstand harsh outdoor conditions is manly the reason behind this growth. HALS are extensively used in construction materials to prevent degradation caused by UV radiation and thereby enhancing the durability and longevity of structures. The growing infrastructure development and urbanization globally have further propelled the adoption of HALS in this sector.

The packaging segment is witnessing rapid advancement in the adoption of HALS and is likely to witness a CAGR of 9.3% over the forecast period due to the increasing use of plastic packaging materials that require protection from UV-induced degradation to maintain product integrity and extend shelf life. HALS play a crucial role in preserving the mechanical properties and appearance of packaging materials exposed to sunlight during storage and transportation. The rising demand for packaged goods and especially in emerging economies which underscores the importance of HALS in ensuring packaging durability and performance.

REGIONAL ANALYSIS

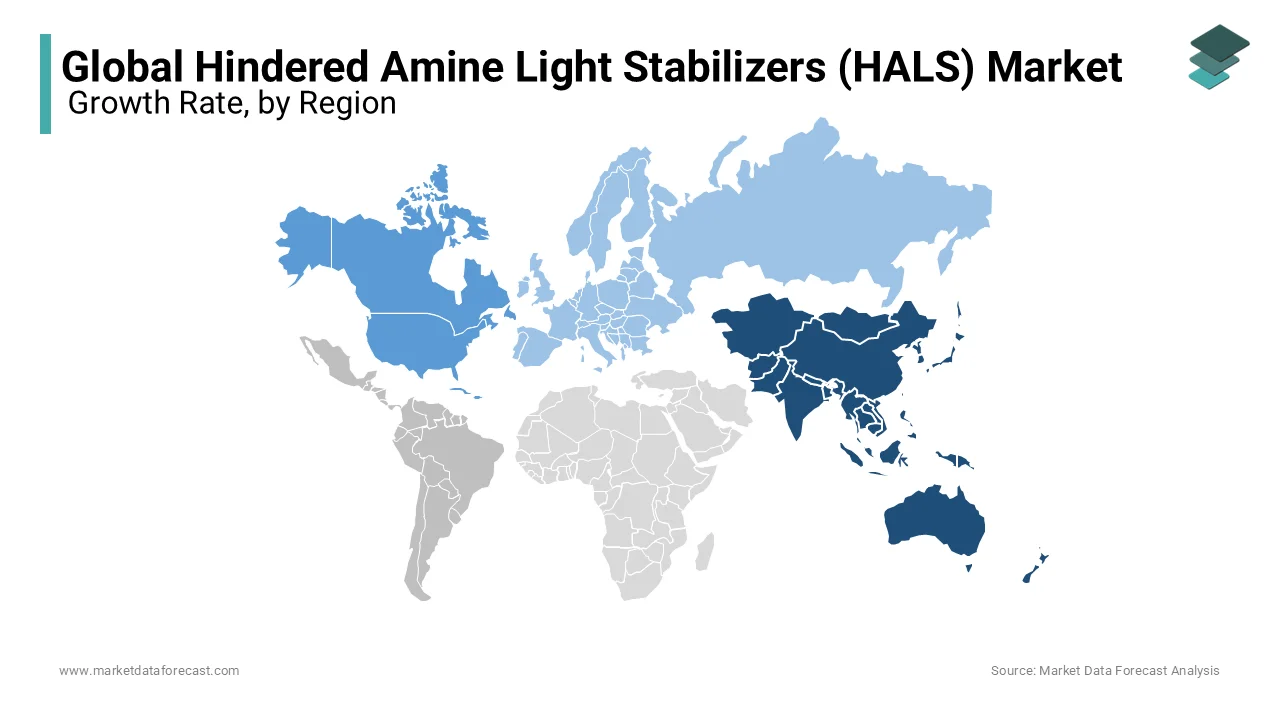

Asia-Pacific led the Hindered Amine Light Stabilizers (HALS) market by accounting for 45.3% of global revenue in 2024. This rise is fueled by rapid industrialization and increasing demand for durable polymers in automotive and construction sectors. China which is the world’s largest producer of plastics has manufactured over 100 million metric tons of plastic products in 2022. The region's focus on sustainable packaging solutions further amplifies HALS adoption. With urbanization rates exceeding 60% in countries like China and India, the need for UV-resistant materials remains critical which is solidifying Asia-Pacific's leadership role.

Latin America is predicted to grow at the CAGR of 7.1% over the forecast period. As per CONAB (National Supply Company), Brazil is a major contributor and produced 270 million tons of grains in 2022 which is increasing demand for stabilized polyethylene films in agriculture. Additionally, renewable energy investments such as Brazil’s plan to double solar capacity by 2025 further propel growth. These factors highlight the segment's importance in sustainability and economic progress.

North America is a key player in the HALS market. It is supported by its advanced automotive and packaging industries. The U.S. which is a major contributor produced approximately 65 million metric tons of plastics in 2022, as reported by the U.S. Environmental Protection Agency (EPA). Rising adoption of electric vehicles (EVs) and its sales increasing substantially in 2022 is driving demand for durable and UV-resistant components. Additionally, California’s mandate for 50% recycled content in plastic bottles by 2030 underscores the focus on sustainable polymer solutions which is boosting HALS applications.

Europe represents a mature and innovation-driven market for HALS. The EU Green Deal targets recycling 50% of plastic waste by 2025 which is creating demand for advanced stabilizers, as stated by the European Commission. Germany, Europe’s largest automotive producer manufactured 3.7 million vehicles in 2022 which is fueling demand for weather-resistant materials. Moreover, the EU allocated €10 billion under the Common Agricultural Policy (CAP) for eco-schemes and is driving the use of stabilized agricultural films. These sustainability initiatives position Europe as a leader in adopting environmentally friendly polymer technologies.

The Middle East & Africa region is expected to grow staedily. The Middle East benefits from its strong petrochemical industry which is producing a notable portion of global polymers. Saudi Arabia’s Vision 2030 initiative emphasizes chemical diversification, boosting demand for HALS in downstream applications. In Africa, rapid population growth is projected to reach 2.5 billion by 2050 (UN DESA) which increases the need for durable goods and packaging materials. Infrastructure investments such as Nigeria’s $1.5 trillion infrastructure plan by 2050 (African Development Bank) further support regional growth, making it a promising market for HALS.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

ADEKA Corporation, Arkema, BASF SE, CLARIANT, Chitec Technology Co., Ltd., Double Bond Chemical Ind., Co., Ltd., Everlight Chemical Industrial Co., Greenchemicals S.r.l., Mayzo, Inc., MPI Chemie BV are playing a dominating the hindered amine light stabilizers (HALS) market.

The Hindered Amine Light Stabilizers (HALS) market is highly competitive, with key players focusing on innovation, geographical expansion, and sustainability to gain a competitive edge. Major companies such as BASF SE, ADEKA Corporation, and SABO S.p.A. dominate the market due to their extensive product portfolios, strong R&D investments, and global distribution networks. These players compete by offering high-performance HALS formulations tailored to meet industry-specific requirements, such as improved UV resistance, long-term durability, and compatibility with various polymers.

The competition is further intensified by the rising demand for advanced polymer stabilization solutions across industries such as automotive, packaging, agriculture, and construction. Manufacturers are investing in new production facilities and strategic partnerships to expand their market presence, particularly in high-growth regions like Asia-Pacific and North America.

Additionally, sustainability trends are shaping competition, with companies focusing on eco-friendly HALS solutions that comply with global regulatory standards like REACH and EPA guidelines. Start-ups and regional players also pose competition by offering cost-effective alternatives.

STRATEGIES USED BY THE MARKET PLAYERS

Product Innovation and Development

Key players in the HALS market focus heavily on research and development to create advanced formulations that provide superior UV stabilization. Innovation in HALS technology allows companies to cater to the growing demand for enhanced weatherability, extended polymer lifespan, and improved efficiency in various applications such as automotive, packaging, and construction. By continuously improving their product offerings, companies can differentiate themselves from competitors and align with evolving industry trends. New HALS developments often focus on increased polymer compatibility, reduced toxicity, and enhanced performance in extreme environmental conditions, making them more attractive to end-users and regulatory bodies.

Strategic Collaborations and Partnerships

Leading HALS manufacturers form strategic alliances through mergers, acquisitions, and joint ventures to strengthen their market position. These collaborations enable companies to access new technologies, expand their distribution networks, and enhance production capabilities. By partnering with polymer manufacturers, resin producers, and research institutions, HALS companies can co-develop solutions tailored to industry needs. Such partnerships also help in knowledge exchange, reducing development costs, and accelerating product commercialization. For example, major industry players collaborate with automotive and construction companies to develop HALS solutions that provide long-lasting protection in harsh environmental conditions, enhancing product reliability and market reach.

Geographical Expansion

To address increasing demand and optimize supply chain efficiency, HALS manufacturers invest in expanding their production facilities and distribution networks across different regions. With Asia-Pacific and North America witnessing significant industrial growth, companies establish regional manufacturing hubs to cater to the demand from industries such as plastics, agriculture, and coatings. This strategy allows firms to mitigate risks associated with trade regulations, logistical constraints, and currency fluctuations. Additionally, by establishing local production units, companies can reduce lead times, ensure regulatory compliance, and offer tailored solutions to meet region-specific industry standards, further solidifying their market dominance.

TOP 3 PLAYERS IN THE MARKET

BASF SE

BASF SE, headquartered in Ludwigshafen, Germany, is one of the world's largest chemical producers and a key player in the Hindered Amine Light Stabilizers (HALS) market. The company provides a wide range of HALS solutions that help extend the lifespan of polymers exposed to UV radiation, making them essential for applications in automotive, construction, agriculture, and packaging industries. BASF is committed to innovation and sustainability, continuously improving its HALS formulations to enhance polymer durability. The company has also invested in expanding its production capacities and optimizing its supply chain to meet the growing global demand for light stabilizers.

ADEKA Corporation

ADEKA Corporation, based in Tokyo, Japan, is a leading specialty chemical company with a strong presence in the HALS market. ADEKA’s HALS products are known for their high efficiency in protecting plastics from UV-induced degradation, ensuring long-term stability and color retention. The company serves various industries, including automotive, packaging, and electronics, by providing tailored solutions that enhance the durability and performance of polymer-based materials. ADEKA’s continuous investment in research and development has helped it maintain a competitive edge, introducing new HALS formulations with improved stabilization properties.

SABO S.p.A.

SABO S.p.A., headquartered in Levate, Italy, is a globally recognized manufacturer of specialty chemicals, including HALS. The company is renowned for its high-performance HALS products, which provide superior protection against UV radiation, ensuring the long-term stability of plastics used in agricultural films, automotive parts, and coatings. SABO focuses on sustainability by developing environmentally friendly stabilizers and optimizing its production processes to reduce environmental impact. Through continuous technological advancements, SABO remains a key contributor to the global HALS market, meeting the growing demand for high-quality light stabilizers.

RECENT HAPPENINGS IN THE MARKET

- On March 6, 2024, BASF announced a global price increase of up to 10% for its Standard Antioxidants and Hindered Amine Light Stabilizers (HALS) used in plastics applications. This adjustment was attributed to prevailing inflationary pressures and significant rises in manufacturing and logistics costs.

MARKET SEGMENTATION

This research report on the global Hindered Amine Light Stabilizers (HALS) market has been segmented and sub-segmented based on type, end-use, and region.

By Type

- Monomeric

- Oligomeric

- Polymeric

By End-use

- Agriculture Film

- Automobile

- Construction

- Packaging

- Other End-use

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the expected growth of the HALS market?

The market is projected to grow at a CAGR of 9.41%, reaching USD 4.13 billion by 2033.

2. Which HALS segment dominated the market in 2024?

The polymeric HALS segment led the market with a 50.3% share in 2024 due to its superior UV stabilization, enhancing the durability of polymers in automotive and construction applications.

3. Which region led the Hindered Amine Light Stabilizers (HALS) market in 2024?

Asia-Pacific dominated the HALS market with a 45.3% share in 2024, driven by rapid industrialization and high demand for durable polymers in automotive and construction.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]