Higher Education Market Size, Share, Trends & Growth Forecast Report By Component (Hardware, Solution and Service), Course Type (Arts, Economics, Engineering, Law, Science and others), User Type (State Universities, Community Colleges and Private Schools) & Region, Industry Forecast From 2024 to 2033

Global Higher Education Market Size

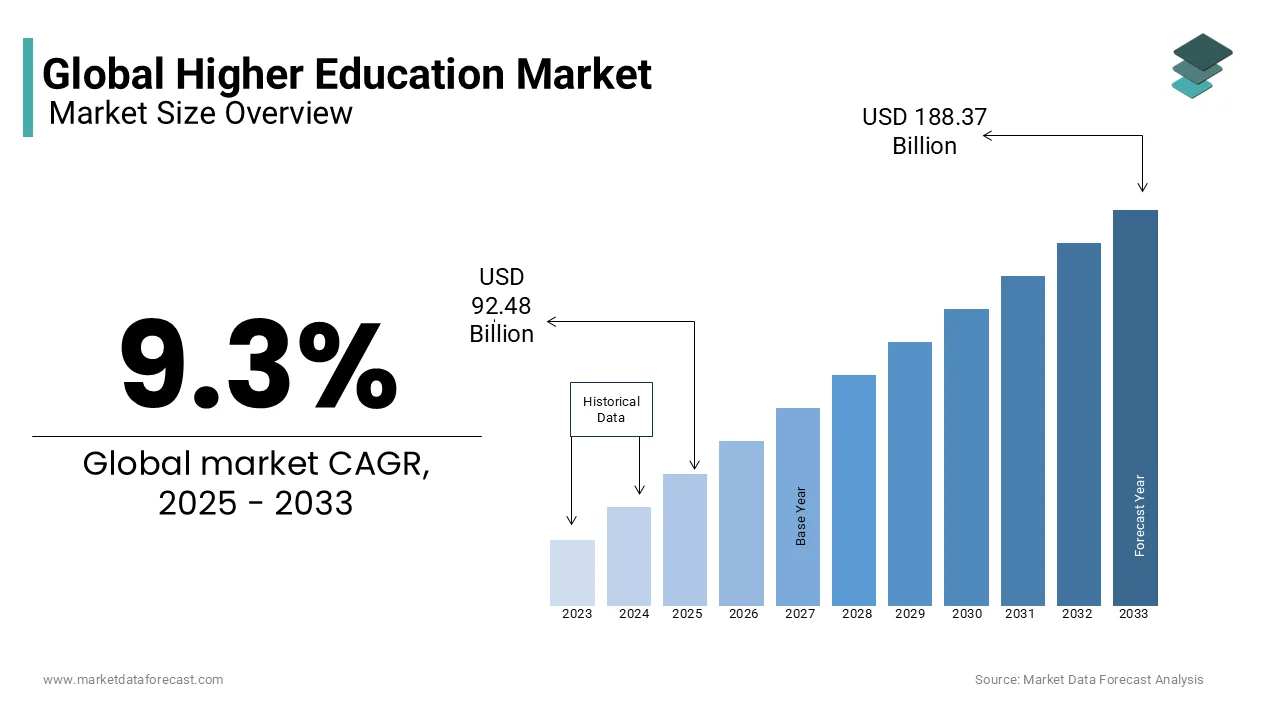

The global higher education market was valued at USD 84.61 billion in 2024. The global market size is predicted to be worth USD 92.48 billion in 2025 and USD 188.37 billion by 2033, growing at a CAGR of 9.3% from 2025 to 2033.

Higher education or post-secondary education is the final stage of formal learning that may take place after the finishing of secondary education. It includes all postsecondary education, training and research orientation in educational institutions authorized as institutions of higher education by state authorities. Higher education is provided at various educational institutions, such as universities, academies, colleges, seminars, and institutes of technology, as well as through some university-level institutions, including vocational schools, business schools, and other professional degree-granting universities.

Presently, the higher education market is in a transition stage where COVID-19, technological evolution, and hiring patterns are the key disruptors. Digital transformation and the advent of artificial intelligence, LLM-based platforms, or services are currently influencing educational institutions to integrate these into their curriculum, and some have even done it. This will help the establishments address the requirement of skilled or proficient employees. As per the report by Intelligent.com, 70 percent of companies stated they removed the requirement of a bachelor’s degree to build a more varied staff or manpower, and four in five directors or business owners place experience above education when accessing job candidates.

Further, funding is another important aspect of the market with some countries witnessing a reduction. However, the overall funding by state and local authorities remained high in 2023. According to the State Higher Education Executive Officers Association, in the FY 2023, the local and state funding for public higher education surged by 3.7 percent after considering inflation. This is the 11th consecutive year of rise.

MARKET DRIVERS

The growing demand for skilled workforce and rapid adoption of technological advancements in education delivery are propelling the higher education market growth.

There are several new trends that give institutions the ability to communicate about education in a more interactive and effective way. Higher education institutions are more aware of recent developments in the international market, structuring effective strategies for long-term partnerships and establishing a higher level in the global student market. Universities around the world strive to include unique strategies and activities, promoting their programmers to a wide audience and providing tailored services for international students. Higher education providers not only provide software and hardware solutions but are also focused on increasing technology deployments within existing and new user accounts. Therefore, it is estimated that more than 70% of the learning platforms would be software as a service or based on the cloud.

The increase in connectivity and hardware, the privacy of various cloud-based resources, the emergence of online and collaborative learning, and the personalization of technology are the major factors contributing to the growth of the market for higher education. Increased competition between various institutions over the long term would result in the rapid deployment of cloud-based resources. Therefore, new technological developments and strategic alliances and partnerships are opportunities for this market.

MARKET RESTRAINTS

Rising costs, difficulty adopting server-based computing, and declining government funding are some of the challenges in this market. Today, higher education institutions are not spending more and more on technology due to budget constraints.

MARKET OPPORTUNITIES

One of the things expected to redefine the future of the higher education market is quality contact time. After COVID-19, teachers and students both have shown some unwillingness to fully resume in-person instructions. This originates from student and academic viewpoints to different degrees and connects to transforming learner's needs and wanting to maximize contact time. Today, universities can deliver lectures or courses digitally to a significantly larger number of students than they can physically hold. It escalates competition among universities which deteriorates the teaching quality while there’s minimal or no value upgradation in in-person time. So, educational establishments must deliver higher value even in a limited amount of time. With the increasing costs and questing the economic value of university learning by students, there will be greater emphasis on teaching quality as well as face-to-face education and its ability to impact upcoming job opportunities and create transferable skills. According to a survey conducted by the Gallup and the Lumina Foundation, students engaged in full-time in-person education are most probably to measure their education quality high at 81 per cent and those learning largely in-person have the same appreciation, i.e. 78 per cent, for the program quality. Hence, quality contact time will be the basis for any technological innovation and other developments in the higher education market.

Another factor providing potential prospects for market growth is the integration of artificial intelligence. As of now, students have greater ability at their fingers than previously. This not only includes access to information but also the complete availability of generative AI technologies like offerings based on large language models (LLMs) and ChatGPT. This will require establishments to develop critical thinking skills in students, consisting of working learners, graduates, and traditional undergraduates. Also, the market is projected to witness a surge in corporate-led training programs and recruitment in the coming years.

MARKET CHALLENGES

Enrollment management and student retention is one of the main challenges to the growth of the higher education market. Traditional methods of enrollment have already slowed down significantly and become a resource-heavy process for employees and for students sometimes. Even if they get on board a good number of qualified students the next problem is to retain those and manage their enrollments. The market growth is hindered by the students dropping out.

The shifting focus to experience from degrees has also impeded the expansion of the market. The established beliefs about career stability and job security is going through a serious transformation. The emergence of AI, automation and globalisation is reforming industries and reconceiving the skills needed to be successful in the workforce. This is a major change in the understanding of the achievement and professional value for companies and individuals. As per intelligent.com, 45 percent of organizations are in the planning stage to fully remove the requirement of a bachelor’s degree for certain job positions this year, and 55 percent of companies in 2023 excluded this requisite.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.3% |

|

Segments Covered |

By Offering, User Type, Course and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Xerox Corporation, Smart Technologies, Inc., Panasonic Corporation, EduComp Solutions, Oracle Corporation, Dell, Inc., Three River Systems, Cisco Systems Inc., IBM, Adobe Corporation and Blackboard Inc, Xerox Corporation, Smart Technologies, Inc., Panasonic Corporation, EduComp Solutions, Oracle Corporation, Dell, Inc., Three River Systems, Cisco Systems Inc., IBM, Adobe and Corporation and Blackboard Inc.. |

SEGMENTAL ANALYSIS

By Offering Insights

The solutions segment includes IT applications made for universities and colleges, giving environments for developing, deploying, and executing applications that are customized to meet the demands of particular institutions.

By User Type Insights

The state universities segment is expected to be the largest segment in the worldwide market during the forecast period. The affordability of public universities makes them one of the cheapest ways to get a student degree after higher education. However, the private university market is expected to show the highest CAGR of the global market during the forecast period.

By Course Insights

The art market segment is expected to be the largest segment in the global market during the forecast period. A bachelor's degree in art offers students a broad training in their specialties. Students can choose from various subjects like humanities, social sciences, literature, history, communications, and a foreign language. It helps students to dynamically shape their education according to their interests.

REGIONAL ANALYSIS

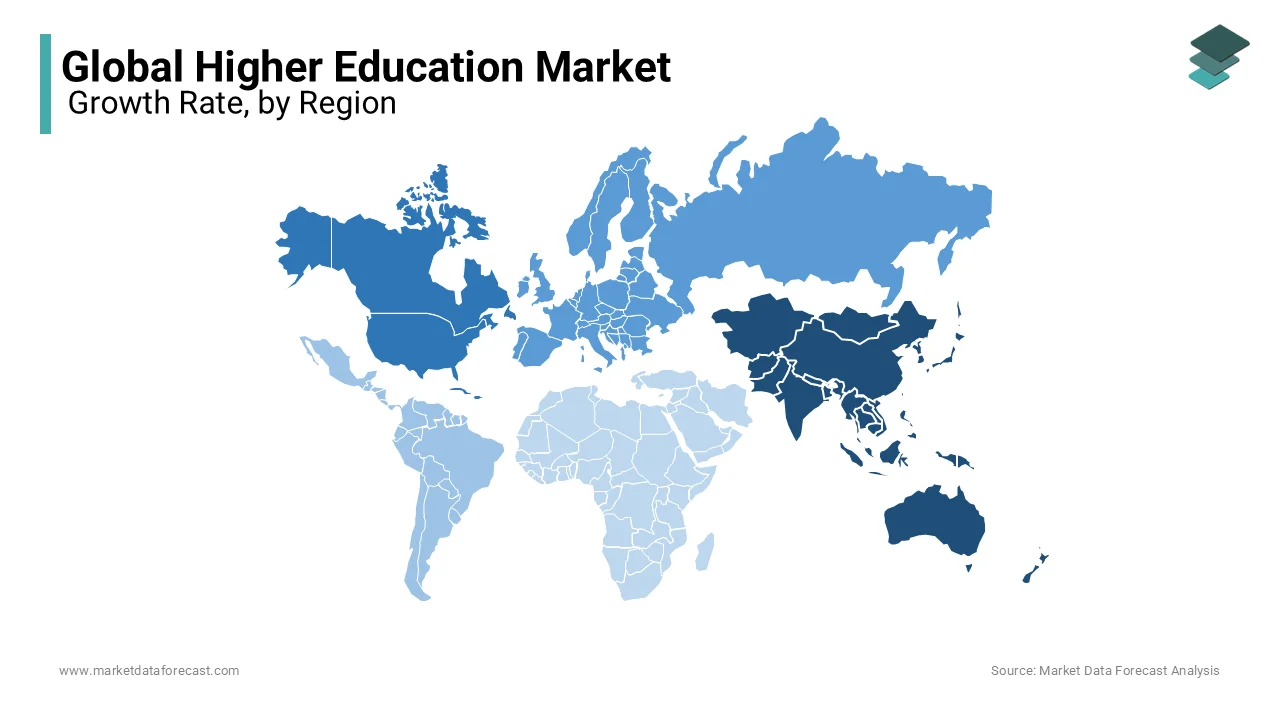

Asia-Pacific held the leading portion of the global higher education market in 2024. The Chinese market accounted for the majority of the market in this region in 2024, which is expected to continue during the forecast period. Asia-Pacific is also expected to have the highest CAGR. China is now a major producer, exporter and investor in the higher education market. The region's growth is driven by a combination of population and economic growth, bilateral business models and changes in the flow of incoming and outgoing students, increasing global competition and a rapid expansion in the capacity of the 'Higher Education.

North America is estimated to have the highest rate of adoption of higher education, and regions such as Latin America, as well as the Middle East and Africa, offer many opportunities for students. Providers in most countries like the UAE and Saudi Arabia adopt these solutions massively.

KEY PLAYERS IN THE MARKET

Some of the major players in the global higher education market are Xerox Corporation, Smart Technologies, Inc., Panasonic Corporation, EduComp Solutions, Oracle Corporation, Dell, Inc., Three River Systems, Cisco Systems Inc., IBM, Adobe Corporation and Blackboard Inc. The global higher education market is expanding with increasing mergers and acquisitions, for instance, Cisco Systems merger with Metacloud, Verizon with AOL, Inc., IBM with StoredIQ, and Blackboard with Schoolwires. In addition, various solution providers, including IBM Corporation and Ellucian, are developing new advanced learning techniques as well as management features in their solution offerings.

RECENT HAPPENINGS IN THE MARKET

- In September 2024, Accra Institute of Technology (AIT) announced at the 20th graduation ceremony that it has completely incorporated artificial intelligence (AI) throughout all aspects of the university including the 12 important stages of the student life cycle. This innovative initiative fixes its position as a prominent technological university and establishes new criteria for advancement in higher education.

- In June 2024, Ellucian and International Services Inc. (ISI) press released the signing of a 5-year partnership agreement with Atlanta Canada. The aim is to provide improved value to institutional members and support their transition to Software as a Service (SaaS). Together, Ellucian and ISI will propel technology development.

- In May 2024, a new website was introduced by the International Association of Jesuit Universities. The Secretariat for Higher Education is promoting the website, which offers a space for institutions, programs, and news that are part of the association and can be communicated to both who come under the field of international higher education.

MARKET SEGMENTATION

This research report on the global higher education market has been segmented and sub-segmented based on offering, user type, course and region.

By Offering

- Hardware

- Solutions

- Services

By User Type

- State Universities

- Community Colleges

- Private Schools

By Course Type

- Arts

- Economics

- Engineering

- Law

- Science

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the current size of the global higher education market?

The global higher education market size was valued at USD 92.48 billion in 2025.

Which regions contribute the most to the global higher education market share?

North America, Europe, and Asia-Pacific are the leading contributors to the global higher education market share, reflecting the concentration of renowned institutions and diverse educational offerings.

What is the impact of the COVID-19 pandemic on the global higher education market?

The COVID-19 pandemic has significantly impacted the higher education market, leading to the rapid adoption of online learning, changes in enrollment patterns, and financial challenges for institutions.

Who are the key players in the higher education market?

Xerox Corporation, Smart Technologies, Inc., Panasonic Corporation, EduComp Solutions, Oracle Corporation, Dell, Inc., Three River Systems, Cisco Systems Inc., IBM, Adobe Corporation and Blackboard Inc,Xerox Corporation, Smart Technologies, Inc., Panasonic Corporation, EduComp Solutions, Oracle Corporation, Dell, Inc., Three River Systems, Cisco Systems Inc., IBM, Adobe Corporation and Blackboard Inc. are some of the major companies in the global higher education market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]