Global HPAPI Market Size, Share, Trends & Growth Analysis Report – Segmented By Type (Innovative HPAPI’s & Generic HPAPI’s), Synthesis (Biotech HPAPI’s & Synthetic HPAPI’s), Therapeutic Application & Region – Industry Forecast (2025 to 2033)

Global HPAPI Market Size

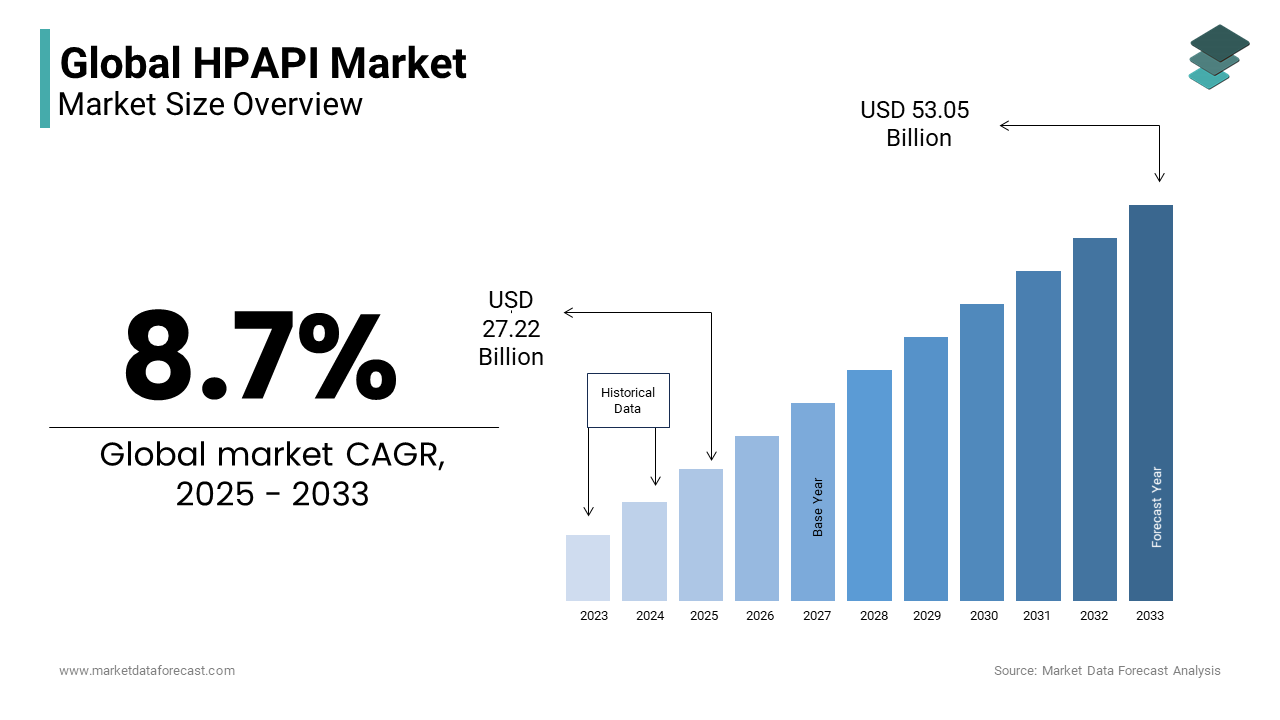

In 2024,the global HPAPI market was valued at USD 25.04 billion and it is expected to reach USD 53.05 billion by 2033 from USD 27.22 billion in 2025, growing at a CAGR of 8.7% during the forecast period.

High-potency active pharmaceutical ingredients (HPAPI) can be defined as pharmacological intermediates or substances active at concentrations of 150 micrograms per kilogram of body weight or below. They are usually highly selective and can bind to specific receptors or specific enzymes, which can cause cancer, developmental disorders, and reproductive problems at low doses. Many new drugs have these high-potency active pharmaceutical ingredients; hence the growth of this market is high. These high potency active pharmaceutical ingredients (HPAPI) have new cures for many diseases, especially cancer. After the human genome was mapped, cancer drugs were made for different cancers and other patients. However, producing these drugs is challenging since they are active at low concentrations. They can pose health hazards to workers if they leak during production, and monitoring must be done mainly against the contamination of drugs with foreign substances. Hence it requires specialized equipment for handling HPAPIs and managing air quality.

MARKET DRIVERS

The growth of the global HPAPI market is driven by factors such as their low price, a growing number of pharmaceutical manufacturers and patients, rising healthcare prices, and government initiatives to expand generic drugs' usage to cut healthcare costs.

The global high-potency active pharmaceutical ingredients market is further growing due to a growing number of new entrants in developing countries generating quick relief therapeutics. Additionally, favorable government regulations for commercializing, researching, and producing novel drug molecules are expected to drive market expansion. Other factors driving market growth include the demand for oncology drugs, antibody-drug conjugates, and advances in HPAPI manufacturing technologies.

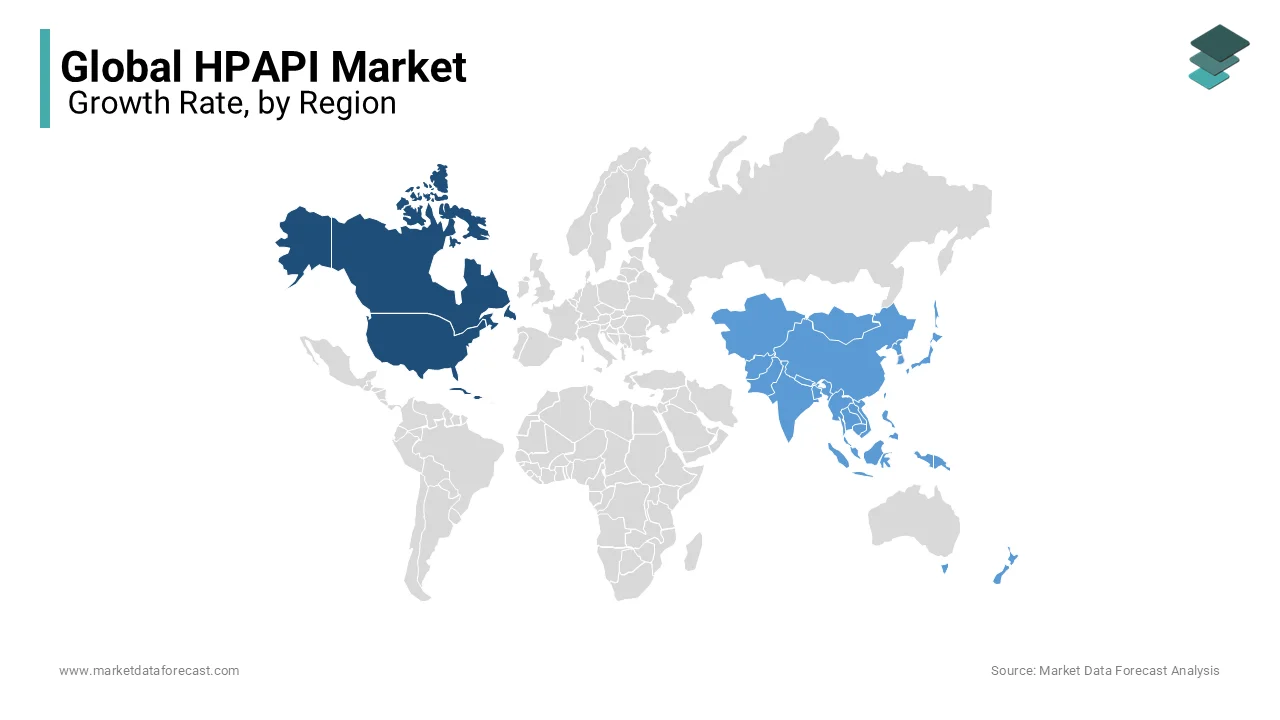

Companies in the HPAPIs market should leverage emerging economies such as India, China, and the Middle East for high-growth opportunities. Due to their large population, growing stability, and improving longevity, the demand in most of these geographies is expected to expand rapidly in the coming years. In addition, diseases such as musculoskeletal disorders, glaucoma, and cancer significantly affect people's health worldwide, with developed countries experiencing faster growth rates. For instance, according to the WHO, developing countries accounted for approximately 66% of all cancer-related deaths in 2014. Furthermore, according to GLOBOCAN 2012, 6.8 million new cancer cases were registered in Asia in 2012; this figure is projected to grow to 8.4 million cases by 2023, suggesting a 24% increase. Furthermore, emerging areas have more lenient and flexible laws, making these markets highly profitable for providers unable to meet the federal government's stringent requirements. Besides that, developing countries such as India and China deliver extremely low manufacturing and labor costs and highly skilled labor, enticing players from developed regions to enter the market.

MARKET RESTRAINTS

High equipment costs, a scarcity of skilled workers, and stringent regulatory criteria are all stumbling blocks for the HPAPI market.

Manufacturers will also be expected to invest in advanced HPAPI-antibody conjugation facilities, including potent compound handling and biologics processing. For instance, ADC Biotechnology (UK) invested USD 10 million in October 2015 to construct a manufacturing facility for advanced anti-cancer drugs. However, the need for significant investments likely hinders this market's growth. Even though the demand for high-potency APIs is new and increasing, pharmaceutical companies face significant challenges in updating their current facilities, which can only accommodate low- or medium-potency APIs. A significant portion of the budget is allocated to specialized containment to shield workers and their surroundings from exposure. Apart from the normal GMP production facilities, contract manufacturers are expected to invest extensively in constructing new facilities built explicitly for HPAPI manufacturing; these expenditures can often amount to millions of dollars.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Analysed |

By Type, Synthesis, Therapeutic Application, and Region. |

|

Various analyses covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Analysed |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Market Leaders Profiled |

Pfizer, Inc. (U.S.), Novartis International AG (Switzerland), Sanofi (France), F. Hoffmann-La Roche Ltd. (Switzerland), Eli Lilly and Company (U.S.), Bristol-Myers Squibb (U.S.), |

SEGMENTAL ANALYSIS

By Type Insights

The innovative HPAPI segment had the largest share of the global market in 2023 and is expected to grow at a prominent CAGR during the forecast period due to many patented numbers, higher prices compared to generics, pharmaceutical manufacturers focusing on producing new drugs, and demand for novel anti-cancer medicines.

By Synthesis Insights

The synthetic HPAPIs accounted for the leading share of the HPAPI market in 2023 and the segmental lead is estimated to continue throughout the forecast period owing to the rise of new drugs, ease of production, technological improvements in synthesis, and approval for new drugs.

By Therapeutic Application Insights

The oncology segment occupied the major share of the global market in 2023 and is predicted to witness a promising CAGR during the forecast period. Factors such as the rising incidence of cancer and the launch of new target therapies propel this segment's growth.

REGIONAL ANALYSIS

North America had the largest share of the world market in 2023, followed by Europe. However, Asia-Pacific is the fastest-growing market in the world. Factors like the rising incidence of cancer, increased cancer research funding, and growing demand for cancer HPAPIs are the essential factors that are likely to propel this market's growth in the future.

KEY MARKET PLAYERS

Some of the most promising companies in the Global HPAPI market are Pfizer, Inc. (U.S.), Novartis International AG (Switzerland), Sanofi (France), F. Hoffmann-La Roche Ltd. (Switzerland), Eli Lilly and Company (U.S.), Bristol-Myers Squibb (U.S.), Boehringer Ingelheim (Germany), Teva Pharmaceutical Industries Ltd. (Israel), Merck & Co., Inc. (U.S.), AbbVie Inc. (U.S.) and Mylan Inc. (U.S.).

RECENT HAPPENINGS IN THIS MARKET

- In April 2019, Cambrex Corporation, a drug material supplier, revealed that they had completed the construction of a $24 million highly potent API (HPAPI) manufacturing facility in Charles City, Iowa, which will add flexibility to the manufacturing network and accelerate the project development.

- In June 2019, Lonza constructed new facilities at its Visp, CH site to meet customer demand for highly potent API (HPAPI), especially in the oncology sector.

- In August 2019, Permira Funds, a multinational investment company headquartered in the United Kingdom, purchased Cambrex Corporation for USD 2.4 million. Due to the acquisition, Permira Funds will provide financial support to Cambrex Corporation to expand its commodity manufacturing and analytical testing services.

MARKET SEGMENTATION

This research report on the global HPAPI market has been segmented and sub-segmented based on type, synthesis, therapeutic application, and region.

By Type

- Innovative HPAPI's

- Generic HPAPI's

By Synthesis

- Biotech HPAPI's

- Synthetic HPAPI's

By Therapeutic Application

- Oncology

- Glaucoma

- Hormonal Balance

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How big is the HPAPI market?

As per our research report, the global high potency active pharmaceutical ingredients market size was valued at USD 25.04 billion in 2024 and is estimated to grow by USD 53.05 billion by 2033.

Which segment by type led the HPAPI market in 2025?

Based on type, the innovative HPAPI segment accounted for the largest share of the global HPAPI market in 2025.

Who are the leading players in the HPAPI market?

Pfizer, Inc. (U.S.), Novartis International AG (Switzerland), Sanofi (France), F. Hoffmann-La Roche Ltd. (Switzerland), Eli Lilly and Company (U.S.), Bristol-Myers Squibb (U.S.), Boehringer Ingelheim (Germany), Teva Pharmaceutical Industries Ltd. (Israel), Merck & Co., Inc. (U.S.), AbbVie Inc. (U.S.) and Mylan Inc. (U.S.) are some of the companies in the HPAPI market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]