Global HPLC Market Size, Share, Trends & Growth Forecast Report By Product (Instruments, Consumables and Accessories), Application (Clinical Research, Diagnostics and Forensics) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033.

Global HPLC Market Size

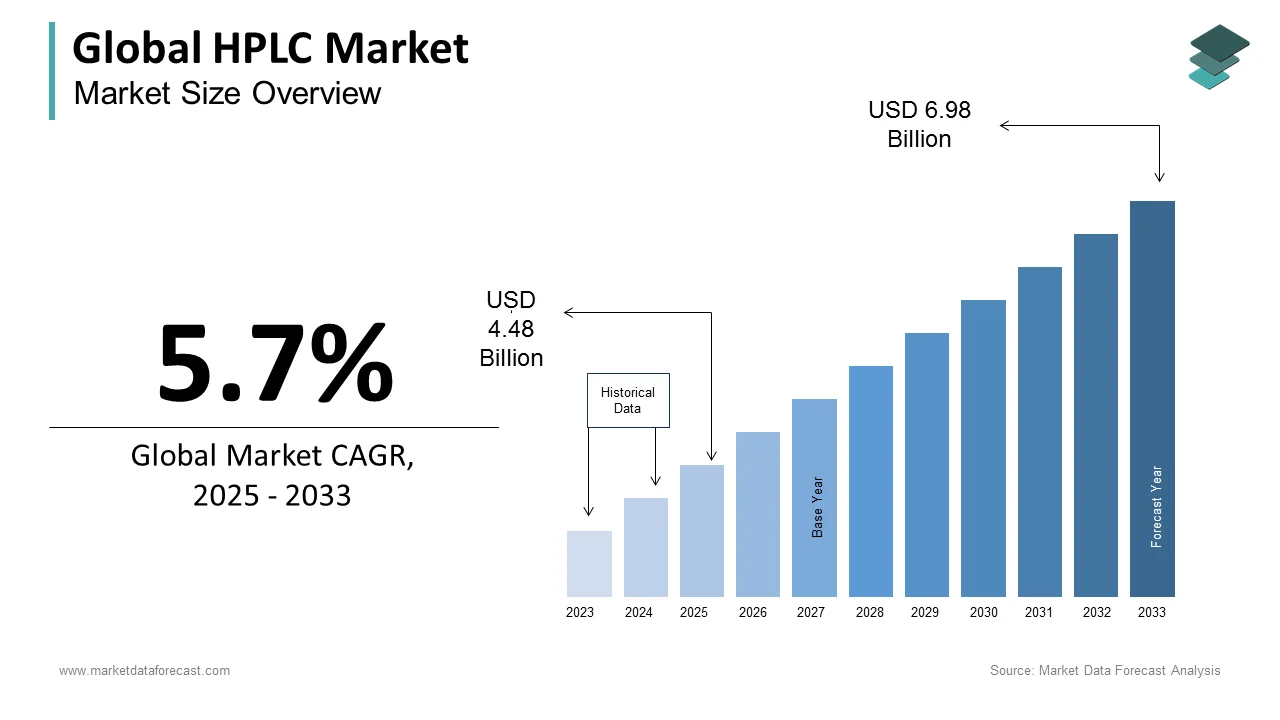

The size of the global HPLC (high-performance liquid chromatography) market was worth USD 4.24 billion in 2024. The global market is anticipated to grow at a CAGR of 5.7% from 2025 to 2033 and be worth USD 6.98 billion by 2033 from USD 4.48 billion in 2025.

The field of High-performance liquid chromatography has undergone remarkable progress in recent years, positioning it as a top choice for analytical procedures.

Today, the most frequently used type of this is reversed phase HPLC. The common application of organic solvents in RPLC leads to a lot of waste that needs proper disposal. This raises concerns about safety for analysts and the environment. As a result, green HPLC methods are on the rise. One promising approach is to replace conventional solvents like acetonitrile and methanol with more eco-friendly options. The market players and researchers also explored alternative water-miscible organic solvents for example acetone, 2-propanol, 2,2,2-trifluoroethanol, dimethyl carbonate, tetrahydrofuran, and ethanol for developing RPLC methods. However, these options are still not as commonly used as the more established solvents like methanol and acetonitrile. Moreover, in the last few years, it has gained significant attention as it focuses on creating analytical techniques that are kinder to the environment.

In the realm of liquid chromatography (LC), cognitive breakthroughs in the technology of column remain persistent. The research and development projects have increased considerably in the past few years. For instance, a study to delve into and identify the impacts of counterion concentration and mobile phase pH on withholding in hydrophilic interaction liquid chromatography (HILIC) was performed by the Department if Chemistry within the Lomonosov Moscow State University which discovered that the Diol phase, a natural ligand, functions as a cation exchanger at a pH of 5.76 because of some residual dissociated silanols. At lower pH levels (2.85), it has minimal charge. This behaviour plays a crucial role in the separation efficiency and asymmetry factors for ionised compounds, helping researchers understand how to optimise pH and counterion concentration to enhance separation conditions for complicated analyte mixtures. Such developments continue to shape the market.

Currently, the urgency for greener laboratory practices is on the rise, and Avantor, Inc. offers compelling reasons to integrate sustainability into liquid chromatography (LC). With climate change pushing us to adopt greener methods, the authors highlight the considerable environmental toll of traditional chromatography, especially the staggering amount of acetonitrile and methanol used, i.e., over 15,000 tons each year.

MARKET DRIVERS

The growing demand for HPLC in pharmaceutical analysis is primarily driving the global market growth.

HPLC is a high-sensitivity technique and offers greater accuracy, due to which the adoption is growing significantly in the pharmaceutical industry. The essential role that HPLC plays in drug development, quality control, regulatory compliance, stability testing, and pharmacokinetic studies majorly drives the adoption of HPLC in the pharmaceutical industry. The growing usage of HPLC in life sciences and biotechnology for applications such as protein analysis, metabolomics, genomics, and drug discovery further boosts the growth rate of the HPLC market.

The ability of high-performance liquid chromatography to identify the drug, monitor diseases, and adopt hyphenated techniques further accelerates the market's growth rate. The growing R&D investments, increasing number of global contract research organizers and pharmaceutical industries contribute to the market growth. The growing importance of ensuring food safety and quality drives the adoption of HPLC in food analysis to detect contaminants, pesticide residues, and other quality parameters and propel market growth.

The growing usage of HPLC in environmental testing and monitoring including the analysis of pollutants, organic compounds, and water quality, stringent regulatory requirements and quality control standards in industries such as pharmaceuticals, food, and environmental testing and rapid adoption of HPLC in forensic science fuels the growth rate of the HPLC market. The growing number of improvements in the healthcare infrastructure in developing and developed countries is fuelling the demand for HPLC systems and services for clinical analysis and research and driving market growth. The growing number of investments in healthcare, pharmaceuticals, and research infrastructure in emerging markets, such as Asia Pacific and Latin America and the rising trend towards precision medicine and personalized therapies requires robust analytical techniques like HPLC for biomarker analysis, therapeutic drug monitoring, and pharmacokinetic studies support the growth of the HPLC market.

MARKET RESTRAINTS

High costs associated with HPLC systems and associated accessories are one of the major factors hampering the market growth.

The shortage of trained professionals who can effectively utilize and troubleshoot HPLC instruments, the availability of alternative analytical techniques, such as gas chromatography (GC), mass spectrometry (MS), and capillary electrophoresis (CE) and stringent regulatory requirements further limit the growth rate of the HPLC market. The lack of appropriate infrastructure, such as a stable power supply, clean laboratory environment, and adequate space and slower adoption rates of HPLC due to various factors such as limited awareness, infrastructure challenges, and budget constraints further inhibit the growth rate of the HPLC market.

MARKET OPPORTUNITIES

Green Chromatography has already started getting attention in the HPLC market. This trend is set to take off presenting potential opportunities for market expansion. From a green

chromatography standpoint, solvents like acetone, dimethyl carbonate, and ethanol are recognised as environmentally friendly options for RPLC organic phase modifiers. Ethanol has been the most popular alternative solvent up to now. Recently, there’s been increasing interest in other innovative approaches, including ionic liquids and entirely aqueous mobile levels for reverse phase HPLC method development. These techniques have secured a lot of attention lately.

Further, the future of this market looks even more brighter as experts and scientists continue to extend the boundaries of this field, maintaining that HPLC remains at the leading end of the analytical chemistry in the coming years. As labs embrace robotics and automation, the possibilities for this market are growing rapidly. Additionally, the biotechnology and pharmaceutical industries are its key users for quality control, discovery and development of drugs believed to broaden the expansion of this market. Prominent HPLC producers who are widening their product portfolio for niche markets, like clinical diagnostics, method development, amino acid analysis, two-dimensional liquid chromatography, and preparative purification, are also expected to benefit this field in future.

Apart from these, the landscape of the HPLC market is likely to witness notable change with the introduction of new products and solutions.

- For instance, at the Pittcon 2023, companies and organisations took the opportunity to display them face-to-face the new mass spectrometry (MS) and HPLC products from 2022 to 2023 before thousands of audiences. The category of HPLC systems covers a range of instruments, comprising capillary electrophoresis (CE), LC-MS, and ion chromatography (IC). This includes Agilent 1290 Infinity II Bio 2D-LC System, Bruker Scientific NanoElute 2, Knauer Azura Size-Exclusion Chromatography (SEC), PDR-Separations AutoPREP, PDR-Separations AutoMDS, etc.

Region-wise, Asia Pacific is the fastest growing market, especially India. The country has witnessed a 12.8 per cent rise in value and a 13.8 per cent surge in quantity as compared to 2022. It is a close competition between Shimadzu and Waters, with Thermo Fisher Scientific right behind them. However, Agilent has been experiencing a drop in its market share in certain areas.

MARKET CHALLENGES

Selecting the correct column is one of the primary challenges derailing the growth trajectory of the HPLC market. When it comes to HPCL-based techniques, the main issue is selecting columns with the appropriate pore size and surface chemistry, along with preparing samples effectively. So, this is especially tough because virus-like particles (VLPs) are not quite steady and can easily fragment during processing, particularly given their low concentration, affecting the market growth rate.

Moreover, there are various problems companies face with this method, hampering the progress of the market. Multimeric state through SEC challenges the characterisation of VLPs. When you compare them to other biotherapeutic proteins, VLPs are fairly large. The

majority of HPLC columns are customised for analysing therapeutic proteins such as monoclonal antibodies. It means that when you use them for their characterization, the particles often get lost in the void volumes of these columns. There are very few commercially available columns with bigger pore sizes for effective identification and quantification of intact VLPs. Additionally, VLPs can exist in multiple molecular states within in-process samples.

- For example, human papillomavirus (HPV) of VLPs can be found in three distinct forms, comprising fully assembled (19 megadaltons), pentameric (capsomeres), and monomeric (55KD). This variety makes it impossible to accurately detect and measure all 3 forms in a single HPLC analysis.

Therefore, these challenges are impeding the expansion of this market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Waters Corporation, Agilent Technologies, Shimadzu Corporation, Thermo Fisher Scientific Inc., GE Healthcare, PerkinElmer Inc., Bio-Rad Laboratories Inc., Gilson Inc., Phenomenex Inc., and JASCO Inc. |

SEGMENTAL ANALYSIS

By Product Insights

The instruments segment had the largest share in the global HPLC market in 2024 and is predicted to grow at a healthy CAGR during the forecast period. The growing demand for accurate and efficient analytical instruments for research, quality control, and drug development purposes primarily drives the growth of the instruments segment in the global market. The advancements in HPLC technology, such as improved detector sensitivity, higher resolution, faster analysis times, and enhanced automation boost the adoption of HPLC instruments and promote segmental growth. The growing applications of HPLC in various industries, including pharmaceuticals, biotechnology, food and beverages, environmental analysis, and forensic sciences contribute to the growth of the instruments segment in the global market.

The consumables segment is predicted to witness a promising CAGR during the forecast period owing to the growing demand for HPLC consumables, including columns, vials, filters, syringes, and solvents, among others. The growing number of HPLC tests conducted in laboratories, the increasing need for routine replacement of consumables and the rapid adoption of HPLC in various industries fuel the growth of the consumables segment in the worldwide market. An increasing number of advancements in consumable materials and designs, such as the development of high-performance stationary phases and column technologies supports the growth rate of the consumables segment.

By Application Insights

The clinical research segment is predicted to account for the leading share of the global market during the forecast period. Factors such as the growing number of clinical trials, rising need for accurate and sensitive analysis of drugs and biomarkers in biological samples and increasing demand for reliable analytical methods to ensure drug safety and efficacy majorly drive the growth of the clinical research segment. The continuous advancements in HPLC technology, such as the development of new columns, detectors, and software contribute to the growth of the clinical research segment in the global HPLC market.

The diagnostics segment is expected to register a healthy CAGR during the forecast period owing to the growing prevalence of chronic diseases, increasing need for accurate and reliable diagnostic tests, and rising demand for personalized medicine. Technological advancements in HPLC, such as the integration of mass spectrometry and the development of high-throughput systems, contribute to the growth of the diagnostics segment in the worldwide market.

REGIONAL ANALYSIS

The North American market had the largest share of the global market in 2024, and the domination of the North American region is expected to continue throughout the forecast period.

The presence of advanced healthcare infrastructure, well-established pharmaceutical and biotechnology industries and a high emphasis on research and development in North America propels the growth of the North American HPLC market. The growing demand for high-quality and reliable analytical techniques in drug discovery and development, stringent regulatory requirements for quality control in pharmaceutical manufacturing and a strong focus on precision medicine and personalized healthcare further fuel the growth rate of the North American market. The U.S. held the major share of the North American market in 2024 and the lead of the U.S. is expected to continue throughout the forecast period owing to the presence of major players. The growing number of R&D investments in the U.S. majorly drives the U.S. market growth. The booming pharmaceutical industry in Canada is filling the market. The US Food and Drug Administration's recommendations on chromatographic techniques to ensure proper identity, purity, and concentration of pharmaceuticals increase the use of high-performance liquid chromatography techniques. The government's policies and funding are boosting the market growth.

The European market had the second-largest share of the global market in 2024 and is expected to grow at a healthy CAGR during the forecast period. The growing investments by the key market participants in the pharmaceutical and biotechnology industry, and increasing demand for the LC-MS technique drive the European market growth. The strong pharmaceutical and biotechnology sectors, well-developed healthcare infrastructure and increasing demand for advanced analytical techniques fuel the growth rate of the European market. The growing investments in research and development activities, rising emphasis on quality control and regulatory compliance in pharmaceutical manufacturing, and the presence of leading pharmaceutical companies and academic institutions further favor the growth rate of the European market. The United Kingdom, Germany, and Russia are projected to occupy the major share of the European market during the forecast period.

The market in Asia-Pacific is expected to showcase the highest CAGR among all the regions in the worldwide market during the forecast period. Factors such as the rising emphasis on R&D and growing awareness about HPLC techniques boost the APAC market growth. The growing pharmaceutical and biotechnology industries, increasing research and development activities and rising healthcare expenditure propel the APAC market growth. The rising demand for advanced healthcare services, increasing focus on quality control and regulatory compliance in pharmaceutical manufacturing and the presence of a large patient pool requiring advanced diagnostic and therapeutic solutions further drive the HPLC market growth in the Asia-Pacific region. China led the market in the Asia-Pacific region in 2024, followed by India.

The Latin America market is anticipated to grow steadily during the forecast period owing to the presence of emerging economies and the growing R&D efforts by the market participants. The growing number of improvements in the healthcare infrastructure across the Latin American region, increasing investments in pharmaceutical research and development and rapid adoption of advanced analytical techniques propel the Latin American market growth. The growing prevalence of chronic diseases, increasing demand for quality pharmaceutical products, and government initiatives to enhance healthcare infrastructure and promote research and development drive the HPLC market in the Latin American region. Brazil followed by Mexico are estimated to hold the major share of the Latin American market in the coming years.

The market in MEA is projected to grow at a moderate CAGR during the forecast period. The growing number of initiatives from the governments of the Middle East and Africa to enhance healthcare services, rising healthcare expenditure and the increasing demand for advanced diagnostic and research tools in the region drive the growth of the HPLC market in MEA.

KEY MARKET PLAYERS

A few of the noteworthy leading the global high-performance liquid chromatography market profiled in this report are Waters Corporation, Agilent Technologies, Shimadzu Corporation, Thermo Fisher Scientific Inc., GE Healthcare, PerkinElmer Inc., Bio-Rad Laboratories Inc., Gilson Inc., Phenomenex Inc., and JASCO Inc.

RECENT HAPPENINGS IN THE MARKET

- In May 2024, Testa Analytical via press release reported that its high-precision HPLC flowmeter received approval from the prestigious Chinese Metrology Institute in Beijing. This represents a major step forward in metrology innovation. Moreover, it is a well-known national authority that rigorously tested this flowmeter to assess the viability as a contemporary alternative to conventional flow calibration methods for HPLC pumps. In particular, the Testa Analytical’s HPLC flowmeter demonstrated its ability to provide accurate flow rate measurements in just one second, significantly reducing the time compared to the traditional 60 minutes calibration process.

- In April 2024, Waters Corporations announced the introduction of the Alliance iSBio HPLC System with fresh abilities that resolve the functional and analytical issues of biopharma quality control (QC) laboratories. The latest HPLC adds modern bio-separation technology and integral instrument intelligence characteristics. In addition, it was devised to assist biopharma QC analysts improve productivity and remove a maximum of 40 per cent of frequent errors. This saves the time lost by examining the source of unsuccessful runs and out of specification outcomes.

MARKET SEGMENTATION

This research report on the global high-performance liquid chromatography market has been segmented and sub-segmented based on the product, application, and region.

By Product

- Instruments

- Consumables

- Accessories

By Application

- Clinical Research

- Diagnostics

- Forensics

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

How much was the global HPLC market worth in 2024?

The global high-performance liquid chromatography market size was worth USD 4.24 billion in 2024.

Which segment by product held the major share of the global HPLC market in 2024?

Based on product, the instruments segment captured the most significant share of the global HPLC market in 2024.

Who are the promising players in the HPLC market?

Waters Corporation, Agilent Technologies, Shimadzu Corporation, Thermo Fisher Scientific Inc., GE Healthcare, PerkinElmer Inc., Bio-Rad Laboratories Inc., Gilson Inc., Phenomenex Inc., and JASCO Inc. are a few of the companies playing a notable role in the HPLC market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]