Global Hemp Seeds Market Size, Share, Trends, And Growth Forecasts Report – Segmented By Form (Whole Hemp Seed, Shelled Hemp Seed, Hemp Seed Protein, Hemp Seed Oil), Application (Tea And Hemp Juice, Food, Hemp Sacks, Hemp Fibre, Biofuel, Paper, Canvas, Ropes, Others), Distribution Channels (Retailers, Online, Convenience Stores, Others), And Region (North America, Latin America, Asia Pacific, Europe, Middle East and Africa) - Industry Analysis From 2025 to 2033

Global Hemp Seeds Market Size

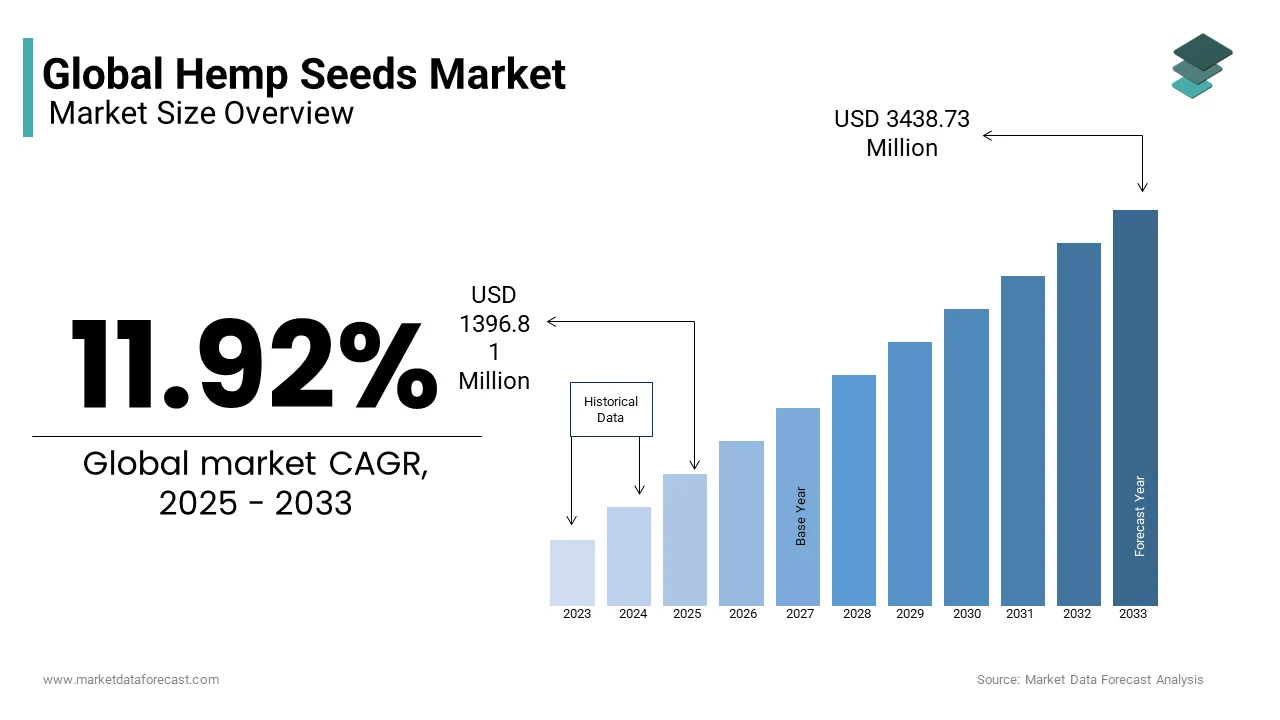

The global hemp seeds market was valued at USD 1248.04 million in 2024 and is anticipated to reach USD 1396.81 million in 2025 from USD 3438.73 million by 2033, growing at a CAGR of 11.92% from 2025 to 2033.

Hemp seeds is derived from the Cannabis sativa plant and are rich in essential fatty acids, proteins, vitamins, and minerals, which is making them a versatile ingredient in various applications, including food, beverages, and industrial products. The demand for hemp seeds is growing significantly in all parts of the worldwide due to factors such as shifting consumer preferences towards plant-based diets and sustainable agricultural practices. The European Food Safety Authority (EFSA) notes that hemp seeds contain an ideal omega-6 to omega-3 fatty acid ratio, which has bolstered their adoption in health-conscious demographics.

According to the World Health Organization (WHO), the legalization of hemp cultivation in numerous countries, including Canada, the United States, and members of the European Union, has significantly expanded production capacities. Additionally, advancements in extraction technologies have enhanced the availability of hemp seed derivatives such as oil and protein powders, further diversifying its applications. With rising awareness about the environmental benefits of hemp cultivation, the market is poised for sustained expansion.

MARKET DRIVERS

Increasing Consumer Awareness of Nutritional Benefits

The growing consumer awareness of the nutritional benefits of hemp seeds serves as a pivotal driver propelling the hemp seeds market. According to the World Health Organization (WHO), hemp seeds are recognized as a complete protein source, containing all nine essential amino acids, and are rich in omega-3 and omega-6 fatty acids, which are crucial for cardiovascular health. The USDA reports that the demand for hemp seeds in North America and Europe has surged by over 20% annually, driven by their inclusion in health-conscious diets and plant-based lifestyles. Countries like Germany and Canada have witnessed a 25% increase in hemp seed consumption over the past five years, supported by government campaigns promoting their nutritional advantages. Furthermore, the rise of veganism and flexitarian diets has amplified demand, particularly among millennials and Gen Z consumers. The EFSA highlights that nearly 40% of new product launches in the health food sector feature hemp seeds or their derivatives, underscoring their critical role in shaping dietary trends and driving market growth.

Legalization and Expansion of Hemp Cultivation

The legalization and expansion of hemp cultivation have emerged as another significant driver shaping the hemp seeds market. According to the United Nations Office on Drugs and Crime (UNODC), over 40 countries have legalized the cultivation of industrial hemp, provided it contains less than 0.3% THC, the psychoactive compound in cannabis. This regulatory shift has unlocked vast opportunities for farmers and manufacturers, enabling large-scale production of hemp seeds and their derivatives. The USDA highlights that the global acreage dedicated to hemp cultivation increased by 30% in 2022 alone, with the United States and Canada leading the charge. Additionally, government subsidies and incentives aimed at promoting sustainable agriculture have further accelerated adoption. The European Commission reports that hemp cultivation in the EU grew by 15% annually, driven by its low environmental impact and versatility in applications. This regulatory and agricultural evolution not only attracts investment but also positions hemp seeds as a cornerstone of modern agribusiness.

MARKET RESTRAINTS

Stringent Regulatory Frameworks

One of the primary restraints impeding the growth of the hemp seeds market is the stringent regulatory frameworks governing cultivation, processing, and labeling. According to the United Nations Office on Drugs and Crime (UNODC), despite the legalization of hemp in many regions, inconsistencies in THC content thresholds and licensing requirements create barriers for producers and distributors. As per the European Food Safety Authority (EFSA), regulatory ambiguities have led to delays in product approvals and market entry, particularly in emerging economies where enforcement mechanisms are still nascent. Additionally, the absence of harmonized standards for labeling and advertising hemp seed products leads to confusion among consumers and stakeholders. The USDA reports that nearly 35% of companies in the hemp seeds industry face regulatory hurdles, stifling innovation and market expansion. Addressing these challenges requires collaborative efforts between regulatory bodies, industry players, and research institutions to streamline processes and foster a conducive environment for growth.

High Production Costs and Pricing Challenges

Another significant restraint facing the hemp seeds market is the high production costs associated with cultivating and processing hemp. According to the Food and Agriculture Organization (FAO), hemp cultivation requires specialized equipment, labor-intensive harvesting techniques, and precise soil management, leading to elevated operational expenses. These costs are subsequently passed on to consumers, making hemp seeds and their derivatives less affordable compared to conventional alternatives. The Organisation for Economic Co-operation and Development (OECD) reports that the average retail price of hemp seeds is approximately 30% higher than other protein-rich seeds like chia and flax, limiting their accessibility, particularly in low-income households. Additionally, fluctuations in raw material availability, such as variations in crop yields due to climate conditions, further exacerbate pricing volatility. This economic barrier not only restricts market penetration but also challenges manufacturers in achieving economies of scale, thereby hindering widespread adoption.

MARKET OPPORTUNITIES

Expansion into Plant-Based Protein Products

The growing demand for plant-based protein products presents a substantial opportunity for the hemp seeds market. The increasing consumer preference for sustainable and ethical dietary choices have significantly fuelled the demand for plant-based protein products. Hemp seeds, with their high protein content and balanced amino acid profile, are ideally positioned to capitalize on this trend. The European Food Safety Authority (EFSA) highlights that hemp seed protein powders and isolates are increasingly being incorporated into sports nutrition supplements, meal replacements, and vegan protein bars. Countries like the Netherlands and the United Kingdom have witnessed a 25% annual increase in the adoption of hemp-based protein products, supported by their clean-label appeal and allergen-free properties. Furthermore, innovations in extraction technologies have improved the taste and solubility of hemp protein, which is addressing earlier consumer concerns and enhancing marketability. The USDA estimates that hemp-based protein products will account for 20% of the plant-based protein market by 2028, underscoring their immense potential for future growth.

Rising Adoption in Biofuel and Industrial Applications

The increasing adoption of hemp seeds in biofuel and industrial applications offers another lucrative opportunity for the market. According to the International Energy Agency (IEA), hemp seeds and their derivatives are gaining traction as sustainable alternatives to fossil fuels and synthetic materials. The USDA highlights that hemp seed oil, when processed, can be converted into biodiesel, offering a renewable energy source with minimal environmental impact. Additionally, hemp fibers derived from the plant's stalks are increasingly used in manufacturing textiles, paper, and bioplastics, further amplifying demand for hemp cultivation. The European Commission reports that the demand for hemp-based biofuels has grown by 18% annually, driven by stringent carbon emission regulations and the push for circular economy models. Furthermore, the versatility of hemp seeds in producing eco-friendly products aligns with global sustainability goals, positioning this segment as a key driver of future market expansion.

MARKET CHALLENGES

Limited Awareness and Misconceptions Among Consumers

A significant challenge confronting the hemp seeds market is the limited awareness and misconceptions surrounding their safety and legality. According to the United Nations Office on Drugs and Crime (UNODC), nearly 50% of consumers remain uncertain about the differences between hemp and marijuana, often associating hemp products with psychoactive effects. As per the European Consumer Organisation, misinformation campaigns and conflicting scientific studies have created confusion, which is deterring potential users from adopting hemp seeds and their derivatives. For instance, some consumers perceive hemp seed oil as unsafe due to its association with cannabis, despite evidence suggesting that it contains negligible levels of THC. Furthermore, the lack of standardized educational initiatives across regions complicates efforts to dispel myths and enhance consumer confidence. According to the USDA, only 30% of surveyed individuals actively seek out hemp-based products, which is further underscoring the need for targeted marketing and awareness campaigns to address knowledge gaps and build trust.

Supply Chain Vulnerabilities and Raw Material Scarcity

Another pressing challenge facing the hemp seeds market is the vulnerability of supply chains and the scarcity of raw materials essential for production. According to the Food and Agriculture Organization (FAO), disruptions caused by geopolitical tensions, climate change, and logistical bottlenecks have led to shortages of key inputs, such as high-quality hemp seeds and processing equipment. The European Environment Agency reports that extreme weather events, including droughts and floods, have adversely impacted hemp yields by up to 20% in certain regions. These supply chain constraints have resulted in increased production costs and prolonged lead times, adversely affecting market dynamics. Furthermore, the reliance on imports for certain raw materials exposes manufacturers to currency fluctuations and trade uncertainties. The Organisation for Economic Co-operation and Development (OECD) notes that over 30% of companies in the hemp seeds industry reported supply chain-related challenges in 2022, underscoring the urgent need for diversification and localization strategies to mitigate risks and ensure business continuity.

MARKET DRIVERS

Factors driving the growth of the hemp seeds market are growing health awareness and many health advantages and benefits of hemp seeds, it is used to reduce toxic substances and heal immune deficiency diseases, are a rich source of vitamins and nutrients, increase disposable income, rise in population, growth in textile and fiber industry, product innovations and technology advancements. However, a lack of awareness, a limited number of skilled professionals, and stringent regulations for product use are hampering the growth of the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

11.92% |

|

Segments Covered |

By Form, Application, Distribution Channel and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Navitas Naturals, North American Hemp and Grain Co., Harvest Hemp Foods, Hemp Oil Canada, Green source organics, CHII Naturally Pure Hemp, Kenny Delights, Manitoba and GFR Ingredients Inc., and Others. |

SEGMENT ANALYSIS

By Form

The shelled hemp seeds segment was the major segment in the global market in 2024 and accounted for 46.4% of the global market share. The versatility and ease of incorporation of these shelled hemp seeds into various food and beverage applications, including smoothies, salads, and baked goods is primarily driving the growth of the shelled hemp seeds segment in the global market. According to the European Food Safety Authority (EFSA), shelled hemp seeds are favored for their mild nutty flavor and high nutritional value, making them a popular choice among health-conscious consumers. The USDA reports that the demand for shelled hemp seeds has grown by 22% annually, supported by their use in plant-based diets and clean-label products. Additionally, advancements in de-shelling technologies have improved yield and affordability, further solidifying their dominance in the market. Their compatibility with diverse culinary traditions enhances their importance in addressing global dietary trends and driving market growth.

The hemp seed protein segment is anticipated to grow at the fastest CAGR of 18.5% over the forecast period due to the increasing demand for plant-based protein sources, particularly among athletes, vegans, and environmentally conscious consumers. According to the USDA, hemp seed protein powders and isolates are increasingly being incorporated into sports nutrition supplements, meal replacements, and vegan protein bars. The EFSA highlights that innovations in extraction technologies have improved the taste and solubility of hemp protein, addressing earlier consumer concerns and enhancing marketability. Furthermore, the rise of health-conscious millennials and Gen Z consumers has further propelled adoption, particularly in developed regions like North America and Europe. The USDA estimates that hemp seed protein will account for 25% of the market by 2028, driven by its dual benefits of nutritional superiority and environmental sustainability.

By Application

The food segment was the largest segment in the global market by application and held 51.8% of the global market share in 2024. The growth of the food segment is majorly attributed to the increasing integration of hemp seeds and their derivatives into a wide range of food products, including snacks, cereals, and beverages. According to the European Food Safety Authority (EFSA), hemp seeds are valued for their high nutritional content, including essential fatty acids, proteins, and vitamins, making them a preferred ingredient in health-conscious diets. The USDA reports that the demand for hemp-based food products has grown by 25% annually, supported by their clean-label appeal and allergen-free properties. Additionally, the rise of plant-based diets and veganism has amplified demand, particularly among millennials and Gen Z consumers. The EFSA highlights that nearly 60% of new product launches in the health food sector feature hemp seeds or their derivatives, underscoring their critical role in shaping dietary trends and driving market growth.

The biofuel segment is predicted to showcase the fastest CAGR of 21.2% over the forecast period owing to the increasing demand for sustainable and renewable energy sources to combat climate change and reduce reliance on fossil fuels. According to the USDA, hemp seed oil, when processed, can be converted into biodiesel, offering a renewable energy source with minimal environmental impact. The European Commission highlights that the demand for hemp-based biofuels has surged by 18% annually, driven by stringent carbon emission regulations and the push for circular economy models. Additionally, the versatility of hemp seeds in producing eco-friendly products aligns with global sustainability goals, positioning this segment as a key driver of future market expansion. The IEA estimates that hemp-based biofuels will account for 15% of the renewable energy market by 2028, driven by their dual benefits of energy efficiency and environmental sustainability.

By Distribution Channels

The retailer's segment accounted for 41.4% of the global market share in 2024. The domination of the retailers segment is attributed to their extensive reach, diverse product offerings, and ability to cater to a broad consumer base. According to the European Food Safety Authority (EFSA), retailers benefit from strategic partnerships with manufacturers, enabling them to stock a wide variety of hemp seed products, from mainstream brands to niche formulations. The convenience of one-stop shopping and promotional discounts further enhances consumer engagement. The USDA reports that retailers have witnessed a 22% increase in hemp seed sales over the past three years, driven by rising health consciousness and the growing availability of clean-label products. Their established infrastructure and trusted brand presence solidify their position as the leading distribution channel in the market.

The online segment is the fastest-growing distribution channel in the hemp seeds market and is likely to witness a CAGR of 25.3% over the forecast period. The growing penetration of e-commerce platforms and shifting consumer preferences towards digital shopping are boosting the expansion of the online segment in the global market. According to Eurostat, online sales of hemp seed products have surged by over 30% annually, driven by the convenience of home delivery and access to detailed product information. The rise of subscription-based models and personalized recommendations has further enhanced customer engagement. The European Consumer Organisation highlights that nearly 50% of millennials prefer purchasing hemp seed products online due to competitive pricing and exclusive deals. Additionally, the proliferation of mobile apps and social media marketing has expanded the reach of online retailers, positioning them as a key driver of future market growth.

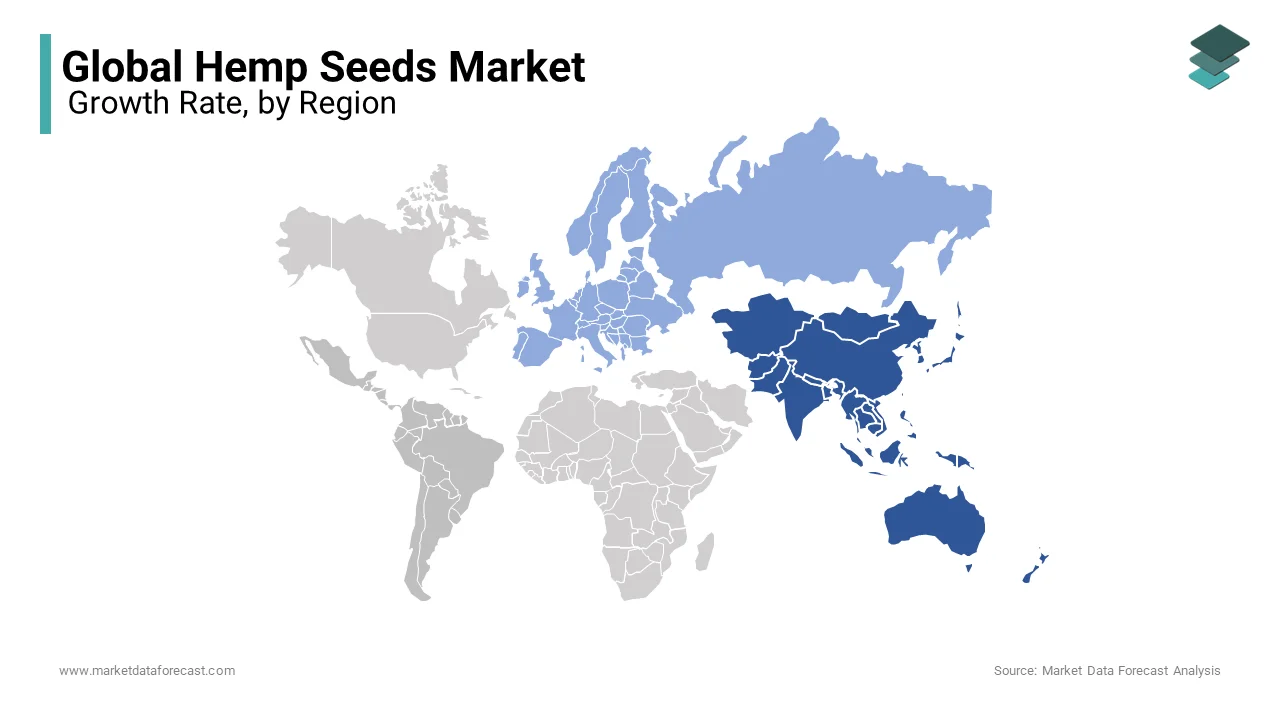

REGIONAL ANALYSIS

North America was the top performing region in the global market in 2024 and accounted for 36.3% of the global market share in 2024. The domination of North America in the global market can be credited to the region's advanced agricultural infrastructure, favorable regulatory environment, and high consumer awareness of hemp's nutritional benefits. According to the USDA, the United States accounts for over 60% of North America's hemp cultivation, supported by the 2018 Farm Bill, which legalized hemp farming nationwide. The Canadian government has also played a pivotal role by promoting hemp as a sustainable crop, resulting in a 20% annual increase in production. The EFSA highlights that the demand for hemp seeds in North America has grown by 25% annually, driven by their inclusion in health-conscious diets and plant-based lifestyles. Additionally, the region's focus on innovation and quality ensures its continued relevance in the global hemp seeds market.

Europe is another promising regional market for hemp seeds worldwide. The growth of the European market is primarily driven by the stringent environmental regulations, a strong emphasis on sustainable agriculture, and rising consumer demand for clean-label products. According to the European Commission, countries like France, Germany, and the Netherlands have witnessed a 15% annual increase in hemp cultivation, driven by government-led initiatives to promote eco-friendly farming practices. The EFSA reports that the demand for hemp seeds in Europe has surged by 22% annually, supported by their use in plant-based diets and vegan lifestyles. Additionally, the region's robust food and beverage industry has amplified demand, creating a fertile ground for market expansion.

Asia-Pacific is estimated to register the highest CAGR in the global market over the forecast period. The rapid urbanization, population growth, and increasing awareness of health and wellness trends are propelling the hemp seeds market growth in the Asia-Pacific region. According to the Asian Development Bank, countries like China and India have witnessed a 25% annual increase in hemp cultivation, supported by government-led programs to promote sustainable agriculture. The USDA highlights that the demand for hemp seeds has surged by 18% annually, driven by their inclusion in traditional recipes and modern formulations. Additionally, the region's focus on export-oriented agriculture has increased the adoption of hemp seeds, enhancing their importance in the regional market.

Latin America is predicted to grow at a healthy CAGR during the forecast period. The tropical climate and agricultural expertise of Latin America have facilitated the adoption of hemp cultivation to enhance crop diversity and economic resilience. According to the FAO, countries like Brazil and Argentina have witnessed a 20% annual increase in hemp cultivation, driven by government-led initiatives to promote sustainable farming practices. The USDA highlights that the demand for hemp seeds has surged by 15% annually, supported by their use in food, beverages, and industrial applications. Additionally, the region's focus on export-oriented agriculture has increased the adoption of hemp seeds, enhancing their importance in the regional market.

The Middle East and Africa is projected to register a steady CAGR during the forecast period. The region's growth is driven by the increasing adoption of hemp cultivation to combat food insecurity and improve livelihoods. According to the FAO, countries like Egypt and South Africa have witnessed a 10% annual increase in hemp cultivation, driven by government-led initiatives to promote sustainable agriculture. The USDA highlights that the demand for hemp seeds has surged by 12% annually, supported by their use in food, beverages, and industrial applications. Additionally, the region's focus on agricultural modernization and sustainable practices positions it as a key driver of future market growth.

KEY MARKET PLAYERS

Key companies dominating the global hemp seeds market are Navitas Naturals, North American Hemp and Grain Co., Harvest Hemp Foods, Hemp Oil Canada, Green Source Organics, CHII Naturally Pure Hemp, Kenny Delights, Manitoba, and GFR Ingredients Inc.

MARKET SEGMENTATION

This research report on the global hemp seeds market is segmented and sub-segmented based on Form, Application, Distribution Channel, and Region.

By Form

- Whole hemp seed

- Shelled hemp seed

- Hemp seed protein

- Hemp seed oil

By Application

- Tea and hemp juice

- Food containing hemp milk

- Hemp fibre

- Hemp sacks

- Biofuel

- Canvas

- Paper

By Distribution Channel

- Retailers

- Online

- Convenience stores

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle-East & Africa

Frequently Asked Questions

The current market size of the global hemp seeds market?

The current market size of the global hemp seeds market was valued at USD 1396.81 million in 2025

What type of segments are added in the global hemp seeds market?

Segments that are added to the global hemp seeds market are form, application, and distribution channels.

who are the market players that are dominating the global hemp seeds market?

Key companies dominating the global hemp seeds market are Navitas Naturals, North American Hemp and Grain Co., Harvest Hemp Foods, Hemp Oil Canada, Green Source Organics, CHII Naturally Pure Hemp, Kenny Delights, Manitoba, and GFR Ingredients Inc.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]