Global Heavy Equipment Market Size, Share, Trends and Growth Forecast Report By Type (Earth Moving, Material Handling, Heavy Construction Vehicles) End-User Industry (Mining, Construction, Oil & Gas) And By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2025 to 2033

Global Heavy Equipment Market Size

The global heavy equipment market was valued at USD 220.99 billion in 2024 and is anticipated to reach USD 232 billion in 2025 from USD 346 billion by 2033, growing at a CAGR of 5.11% during the forecast period from 2025 to 2033.

The heavy equipment are ranging from excavators and bulldozers to cranes and loaders those are pivotal in executing large-scale infrastructure projects, resource extraction, and land development. As of 2023, the global demand for heavy equipment has been shaped by urbanization trends, technological advancements, and sustainability imperatives. For instance, according to the United Nations Department of Economic and Social Affairs, approximately 56% of the world's population resides in urban areas, a figure projected to rise to 68% by 2050. This demographic shift leverages the growing necessity for robust infrastructure, thereby driving the need for advanced heavy machinery.

In tandem with urban growth, environmental concerns have also influenced the heavy equipment landscape. As per the International Energy Agency, the construction sector accounts for nearly 39% of global energy-related carbon emissions by prompting manufacturers to innovate eco-friendly solutions such as electric and hybrid models. Labor dynamics play a pivotal role in construction occupations that is reflecting an increasing reliance on skilled operators and modernized equipment.

Market Drivers

Infrastructure Development and Urbanization Trends

The rapid pace of infrastructure development, fueled by urbanization, serves as a primary driver for the heavy equipment market. According to the United Nations Department of Economic and Social Affairs, urban areas are expected to absorb 2.5 billion additional people globally by 2050, with nearly 90% of this growth occurring in Asia and Africa. This unprecedented urban expansion necessitates significant investments in housing, transportation networks, and utilities, all of which rely heavily on machinery like excavators, bulldozers, and cranes. According to the World Bank, developing countries alone require approximately $1 trillion annually to bridge their infrastructure gaps. Such demands amplify the need for durable and efficient heavy equipment. Furthermore, governments worldwide are prioritizing large-scale projects. According to the U.S. Federal Highway Administration, over $180 billion is spent annually on highway and road construction in the United States.

Technological Advancements and Automation Adoption

Technological advancements and automation adoption are anticipated to fuel the heavy equipment market growth with growing productivity and safety across industries. According to the workplace injuries in construction have declined by 44% over the past two decades, largely due to automated machinery and improved operator interfaces. Innovations such as GPS-enabled equipment, telematics, and autonomous vehicles are gaining traction, with markets like mining seeing a 20-30% increase in operational efficiency, according to the International Labour Organization. Additionally, the National Science Foundation survey revealed that investments in smart technologies for industrial applications reached $265 billion globally in 2022 with the growing emphasis on tech-driven solutions. Electric and hybrid models are also emerging, supported by government incentives for reducing carbon footprints. For example, According to the European Environment Agency, electrified machinery could reduce emissions from construction activities by up to 90%. These advancements not only address labor shortages but also align with global sustainability goals, that is driving market evolution.

Market Restraints

High Initial Costs and Capital Constraints

The high initial costs associated with purchasing machinery, which often limits accessibility for small and medium enterprises is restraining the growth rate of the heavy equipment market. According to the U.S. Census Bureau, construction machinery prices have risen by an average of 3.5% annually over the past decade, outpacing inflation rates. This financial burden is exacerbated by the need for additional investments in operator training, maintenance, and spare parts. According to the Federal Reserve, interest rates on business loans have fluctuated between 5-8% in recent years by making financing more challenging for companies with limited capital. According to the World Bank, inadequate access to credit restricts infrastructure spending, with only 20% of small firms able to secure loans for equipment procurement. These financial barriers hinder market growth, particularly among smaller players who struggle to compete with larger corporations capable of absorbing such costs.

Regulatory Compliance and Environmental Standards

The stringent regulatory frameworks and environmental standards pose another major restraint for the heavy equipment market. The Environmental Protection Agency mandates emissions reductions under its Tier 4 regulations, requiring manufacturers to invest heavily in retrofitting machinery or developing compliant models. These compliance costs can increase production expenses by up to 15%, according to the International Labour Organization. Additionally, the European Environment Agency enforces strict carbon neutrality targets, compelling manufacturers to adopt cleaner technologies despite higher upfront costs. According to the United Nations Framework Convention on Climate Change, non-compliance with global environmental agreements could result in penalties or restricted market access. Such regulations, while necessary for sustainability, create operational challenges for manufacturers and operators alike. Smaller firms, in particular, face difficulties adapting to these evolving standards by constraining market expansion amid rising regulatory pressures.

Market Opportunities

Sustainability Initiatives and Green Equipment Demand

The global trend toward sustainability presents a significant opportunity for the heavy equipment market, particularly through the development of eco-friendly machinery. As per International Energy Agency, the construction sector could reduce its carbon emissions by 40% through energy-efficient practices and low-emission equipment adoption. According to the U.S. Environmental Protection Agency offers grants under the Diesel Emissions Reduction Act, which has funded over $1 billion in projects to replace or retrofit high-emission machines. Furthermore, the European Commission’s Green Deal aims to achieve a 55% reduction in greenhouse gas emissions by 2030 encouraging manufacturers to innovate hybrid and electric models. According to the United Nations Industrial Development Organization, the market for electric construction equipment is projected to grow at a compound annual growth rate of 12% through 2030. This shift not only aligns with environmental goals but also opens new revenue streams for manufacturers embracing sustainable technologies.

Emerging Markets and Infrastructure Expansion in Developing Regions

The developing regions offer immense opportunities for the heavy equipment market due to ongoing infrastructure expansion and industrialization. According to the African Development Bank, Africa requires $130-170 billion annually to address its infrastructure deficit, with projects spanning roads, railways, and energy systems. According to the Asian Development Bank, Asia needs $1.7 trillion per year until 2030 to sustain its economic growth and urbanization trends. These investments create a robust demand for heavy machinery, particularly in countries like India and Indonesia, where urban populations are rising rapidly. According to the United Nations Conference on Trade and Development, foreign direct investment in developing economies reached $870 billion in 2022, much of it directed toward large-scale infrastructure projects. Additionally, initiatives like China’s Belt and Road Initiative have mobilized over $1 trillion in infrastructure funding across Asia, Africa, and Europe.

Market Challenges

Fluctuating Demand Due to Infrastructure Spending

One major challenge in the heavy equipment market is the unpredictable demand driven by infrastructure spending. According to the U.S. Census Bureau, public construction spending in the United States declined by 1.5% in 2022 compared to the previous year, directly impacting the sales of heavy machinery. This inconsistency creates uncertainty for manufacturers and suppliers, who must balance production with fluctuating market needs. For instance, Caterpillar reported a decline in equipment orders during periods of reduced government investment in infrastructure. According to the World Bank, global infrastructure investment needs to increase by $1 trillion annually until 2030 to meet developmental goals, yet funding gaps persist. Such volatility forces businesses to adopt costly inventory management strategies by affecting profitability and long-term planning.

Skilled Labor Shortages

Another pressing issue is the shortage of skilled labor, which hampers the production and maintenance of heavy equipment. According to the U.S. Bureau of Labor Statistics, the construction and manufacturing sectors face a deficit of over 400,000 skilled workers annually, a gap expected to widen as older workers retire. This shortage affects not only equipment operators but also technicians responsible for maintaining advanced machinery. As per the National Association of Manufacturers, 80% of manufacturers struggle to find qualified workers is leading to project delays and increased operational costs. Training programs and apprenticeships are essential to address this issue, but they require significant investment.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.11% |

|

Segments Covered |

By Type, End-User Industry and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Deere & Company, JCB, SANY Group, Teleo, XCMG Group, Volvo CE, Hitachi Construction Machinery Co Ltd, Komatsu Ltd, Leibherr. |

SEGMENT ANALYSIS

By Type

The earth moving equipment segment dominated the market and held 45.3% of heavy equipment market share in 2024. This segment includes excavators, bulldozers, and graders, which are indispensable for large-scale infrastructure and mining projects. According to the U.S. Department of Transportation, over $120 billion is spent annually on highway construction alone in the United States, which is driving demand for earth moving machinery. Furthermore, the World Bank studies have shown that developing nations require extensive land preparation for urbanization by amplifying the need for such equipment.

The material handling equipment segment is anticipated to witness a fastest CAGR of 7.8% from 2025 to 2033. This growth is fueled by the rise in e-commerce and warehouse automation, with the U.S. Census Bureau reporting a 40% increase in online retail sales since 2019. According to the National Institute of Standards and Technology, automated guided vehicles and forklifts are integral to modern supply chains by reducing operationcosts by up to 25%. According to the European Material Handling Federation, investments in smart warehouses have surged by 60% in the past five years, further propelling demand.

By End User Industry

The construction industry dominated the heavy equipment market with 45.2% of share in 2024. The rising global urbanization trends, with the United Nations projecting a $10 trillion annual spend on infrastructure by 2030 is ascribed to boost the growth of the market. The construction sector’s reliance on machinery like excavators, bulldozers, and cranes features its importance in shaping urban landscapes. According to the International Labour Organization, construction employs over 7% of the global workforce by amplifying equipment demand. Governments worldwide allocate significant budgets to infrastructure, such as the European Union’s €1.8 trillion recovery fund.

The mining segment is likely to experience a CAGR of 6.8% during the forecast period. This rapid expansion is fueled by rising demand for minerals critical to renewable energy technologies, such as lithium and cobalt. According to the U.S. Geological Survey, the global lithium production surged by 21% in 2022 alone with increased mining activities. As per the World Bank, mineral extraction will need to increase by nearly 500% by 2050 to meet clean energy requirements. Technological advancements, including autonomous haul trucks and IoT-enabled machinery, are enhancing operational efficiency by driving investments in modern equipment.

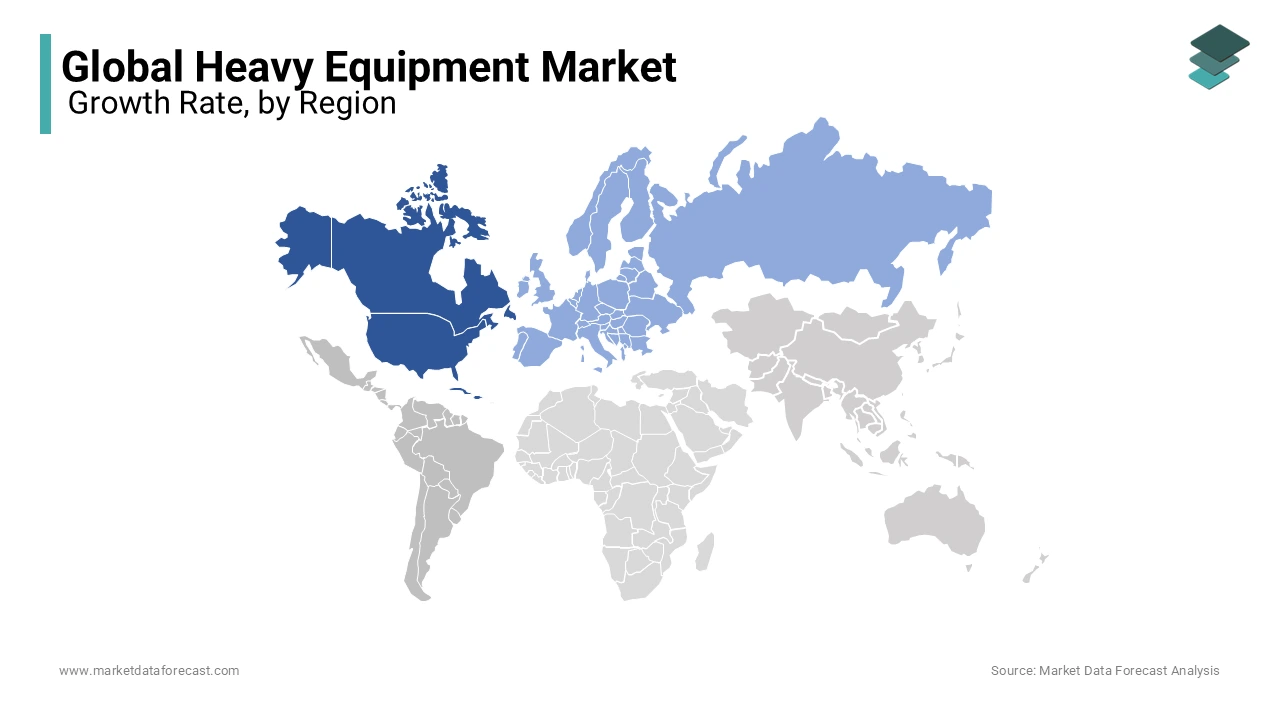

REGIONAL ANALYSIS

The Asia-Pacific region was the largest by occupying 44.9% of the heavy equipment market share in 2024 due to rapid urbanization, industrialization, and large-scale infrastructure projects. According to the United Nations, urban populations in Asia will grow by 1.2 billion by 2050 that is driving demand for construction machinery like excavators and bulldozers. Additionally, China’s Belt and Road Initiative has mobilized over $1 trillion in infrastructure investments across Asia that further amplify equipment requirements. India is also investing heavily, with the government allocating $1.4 trillion to infrastructure development under its National Infrastructure Pipeline.

North America is experiencing a fastest CAGR of 6.3% during the forecast period. This growth is propelled by significant investments in infrastructure renewal and technological advancements. The Infrastructure Investment and Jobs Act allocates $1.2 trillion to modernize roads, bridges, and energy systems by creating robust demand for advanced machinery. Furthermore, the U.S. Energy Information Administration renewable energy projects, such as wind and solar farms, are expanding rapidly, requiring specialized equipment. Automation and IoT-enabled machinery are also gaining traction, supported by incentives for sustainable practices. These developments drives the North America’s pivotal role in driving innovation and growth within the heavy equipment market.

Europe is expected to maintain steady growth, supported by the European Commission’s Green Deal, which allocates €1.8 trillion to sustainability initiatives, including eco-friendly machinery adoption. However, slower economic recovery post-pandemic limits rapid expansion. Latin America shows moderate growth, with a focus on mining and agriculture. According to the Inter-American Development Bank, $700 billion in infrastructure needs by 2030, though economic instability remains a challenge. The Middle East and Africa are poised for gradual growth, driven by energy projects and urbanization, particularly in Saudi Arabia’s Vision 2030 and African urban development programs. Collectively, these regions contribute to global stability but face unique challenges like funding gaps and political uncertainties, impacting their overall market performance.

KEY MARKET PLAYERS

Deere & Company, JCB, SANY Group, Teleo, XCMG Group, Volvo CE, Hitachi Construction Machinery Co Ltd, Komatsu Ltd, Leibherr, Other Key Players

Top 3 Players in the market

Deere & Company

Deere & Company is a global leader in the heavy equipment market, renowned for its innovative machinery and commitment to sustainability. The company specializes in advanced construction and agricultural equipment, such as excavators, loaders, and tractors, integrating technologies like GPS, automation, and telematics to enhance productivity. Deere has pioneered the development of electric and hybrid models, aligning with global emission reduction goals. Its strong global dealer network ensures widespread accessibility and customer support, while its focus on precision agriculture and smart construction solutions sets it apart. According to the U.S. Department of Agriculture, Deere’s innovations have significantly improved efficiency in both agriculture and construction sectors, solidifying its reputation as a market leader.

SANY Group

SANY Group, headquartered in China, has emerged as a dominant player in the heavy equipment market, known for its cost-effective yet technologically advanced machinery. The company specializes in excavators, cranes, and concrete equipment, catering to diverse industries such as construction, mining, and infrastructure development. SANY has aggressively expanded its global presence, particularly in emerging markets like Africa and Southeast Asia, supported by China’s Belt and Road Initiative. As per the Chinese Ministry of Industry and Information Technology, SANY’s role in promoting digital transformation through IoT-enabled equipment, which enhances operational efficiency. Its focus on research and development has enabled the company to introduce innovative solutions that meet the demands of modern construction projects worldwide.

Komatsu Ltd

Komatsu Ltd, based in Japan, is a trusted name in the heavy equipment market, recognized for its durable and high-performance machinery. The company excels in producing mining equipment, bulldozers, and hydraulic excavators, which are widely used in large-scale infrastructure and resource extraction projects. Komatsu has been at the forefront of technological advancements, introducing autonomous haul trucks and remote monitoring systems to improve safety and productivity. Additionally, Komatsu’s emphasis on sustainability is evident in its development of energy-efficient models, contributing to reduced environmental impact while maintaining high performance standards.

Top strategies used by the key market participants

Technological Innovation and Automation

Key players in the heavy equipment market, such as Komatsu Ltd and Deere & Company, are heavily investing in technological advancements to strengthen their market position. Automation and smart technologies, including autonomous machinery and IoT-enabled systems, have become central to their strategies. For instance, Komatsu has developed autonomous haul trucks that enhance safety and productivity in mining operations, while Deere integrates GPS and AI-driven solutions for precision agriculture and construction. According to the International Labour Organization, automation reduces operational costs by up to 20%, making these innovations attractive to customers. By adopting cutting-edge technologies, these companies not only improve efficiency but also differentiate themselves in a competitive market.

Sustainability and Eco-Friendly Solutions

Sustainability is a cornerstone strategy for industry leaders like SANY Group and Volvo CE. These companies are developing electric, hybrid, and energy-efficient machinery to align with global environmental regulations and customer demands for greener solutions. According to the European Environment Agency, eco-friendly equipment can reduce carbon emissions by up to 90% compared to traditional models. Volvo CE, for example, has committed to producing zero-emission construction equipment by 2040, while SANY focuses on integrating renewable energy technologies into its product lines. This shift toward sustainability not only enhances brand reputation but also opens new revenue streams in markets prioritizing green infrastructure.

Global Expansion and Strategic Partnerships

To strengthen their global footprint, key players are expanding into emerging markets and forming strategic alliances. SANY Group has capitalized on China’s Belt and Road Initiative to establish a strong presence in Africa and Southeast Asia, while Caterpillar collaborates with local distributors to penetrate untapped regions. According to the United Nations Conference on Trade and Development, emerging markets account for over 60% of global infrastructure investments, making them critical growth areas. Additionally, partnerships with tech firms, such as Komatsu’s collaboration with NVIDIA for AI integration, enable companies to enhance product capabilities and stay ahead of competitors. These strategies ensure broader market access and long-term resilience.

After-Sales Services and Digital Platforms

Enhancing customer experience through after-sales services and digital platforms is another major strategy. Companies like Deere & Company and Hitachi Construction Machinery Co Ltd offer predictive maintenance, remote diagnostics, and performance analytics via IoT-enabled systems. The U.S. Department of Commerce notes that businesses leveraging digital platforms for equipment management report a 30% reduction in downtime. These companies foster customer loyalty and increase lifecycle revenue by providing value-added services,.

Competitive Landscape

The heavy equipment market is characterized by intense competition, driven by the presence of established global players and emerging regional manufacturers. Leading companies such as Caterpillar, Komatsu Ltd, and Deere & Company dominate the market through their extensive product portfolios, technological innovations, and robust distribution networks. These firms leverage advanced technologies like automation, IoT, and AI to enhance equipment efficiency, safety, and sustainability, setting high benchmarks for competitors. For instance, autonomous machinery and predictive maintenance systems have become key differentiators in attracting customers seeking operational optimization.

Emerging players from Asia, such as SANY Group and XCMG, are challenging traditional leaders by offering cost-effective solutions without compromising on quality. Their aggressive expansion into developing regions, supported by government initiatives like China’s Belt and Road Initiative, has intensified competition. Additionally, these companies focus on eco-friendly innovations, aligning with global sustainability goals to capture environmentally conscious markets.

The competitive landscape is further shaped by collaborations, mergers, and acquisitions aimed at expanding market share and technological capabilities. For example, partnerships with tech firms enable integration of AI and data analytics into equipment. Regional players in Europe and North America emphasize premium products and after-sales services, fostering customer loyalty. According to the International Labour Organization, such strategies help companies maintain a competitive edge amid fluctuating demand and economic uncertainties. Overall, the heavy equipment market remains highly dynamic, with innovation, sustainability, and strategic expansion being pivotal to sustaining its dominance and addressing diverse customer needs globally.

Recent Happenings In This Market

In June 2022, Komatsu Ltd, a global leader in construction and mining equipment, announced the expansion of its Autonomous Haulage System (AHS) for mining trucks. This development is anticipated to enhance safety and productivity in large-scale mining operations by enabling fully autonomous hauling. According to the announcement on Komatsu’s official newsroom, the AHS technology reflects the company’s commitment to innovation and operational efficiency.

In September 2022, SANY Group, a leading Chinese heavy equipment manufacturer, announced its strategic expansion into Africa by establishing new manufacturing hubs in Kenya and Nigeria. This move is part of China’s Belt and Road Initiative and is anticipated to strengthen SANY’s presence in emerging markets while addressing the growing demand for construction and mining equipment in Africa.

In November 2021, Volvo CE, a prominent construction equipment provider, committed to achieving net-zero emissions by 2040 by transitioning to electric and hybrid machinery. This initiative is anticipated to align with global sustainability goals and attract environmentally conscious customers.

In March 2024, Hitachi Construction Machinery Co., Ltd. announced a strategic collaboration with NVIDIA to integrate artificial intelligence (AI) and machine learning technologies into its equipment. This partnership is anticipated to enhance operational efficiency by enabling predictive maintenance and real-time analytics for machinery performance. According to the announcement on Hitachi’s official newsroom, this move leverages the company’s commitment to digital transformation and innovation, aiming to provide advanced solutions that meet the evolving needs of customers in the construction and mining industries.

In April 2023, XCMG Group formally launched the XDR80TE, its new autonomous electric mining truck, as part of its push toward sustainable and innovative mining solutions. This development is anticipated to strengthen XCMG’s position in the global mining equipment market by addressing the growing demand for eco-friendly and technologically advanced machinery.

In February 2025, JCB’s hydrogen combustion engine received regulatory approval for commercial use, marking a significant milestone in the development of alternative fuel technologies. This approval is anticipated to position JCB as a pioneer in sustainable heavy equipment solutions, addressing the growing demand for low-emission machinery in the construction and agricultural sectors. According to Envirotec Magazine , the hydrogen-powered engine offers a viable alternative to traditional diesel engines, reducing carbon emissions while maintaining high performance.

In October 2022, Liebherr, a Swiss multinational equipment company, invested in a digital platform offering real-time equipment monitoring and analytics. This platform is anticipated to enhance customer experience by providing actionable insights and improving after-sales services.

In May 2023, Teleo, a technology innovator specializing in automation solutions for heavy equipment, teamed up with Position Partners, a leading provider of positioning and machine control technologies in Australia. This collaboration is anticipated to enhance the retrofitting of existing mining and construction equipment with advanced automation capabilities, improving operational efficiency and reducing costs.

MARKET SEGMENTATION

This research report on the global heavy equipment market is segmented and sub-segmented int the following categories.

By Type

- Earth Moving

- Material Handling

- Heavy Construction Vehicles

By End-User Industry

- Mining

- Construction

- Oil & Gas

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current market size of the global heavy equipment market?

The current market size of the global heavy equipment market was valued at USD 232 billion in 2025.

What are the market drivers that are driving the global heavy equipment market?

The infrastructure development and urbanization trends and technological advancements and automation adoption are the market drivers that are driving the global heavy equipment market.

What are the market opportunities that in the global heavy equipment market?

The sustainability initiatives and green equipment demand and emerging markets and infrastructure expansion in developing regions are the market oppurtinities in this market

Who are the market players that are dominating the global heavy equipment market?

Deere & Company, JCB, SANY Group, Teleo, XCMG Group, Volvo CE, Hitachi Construction Machinery Co Ltd, Komatsu Ltd, Leibherr. These are the market players that are dominating the global heavy equipment market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]