Global Heavy Construction Equipment Market Size, Share, Trends, & Growth Forecast Report – Segmented By Machinery, Application, Propulsion, Power Output, Engine Capacity, End-Use And By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) - Industry Analysis From 2025 to 2033

Global Heavy Construction Equipment Market Size

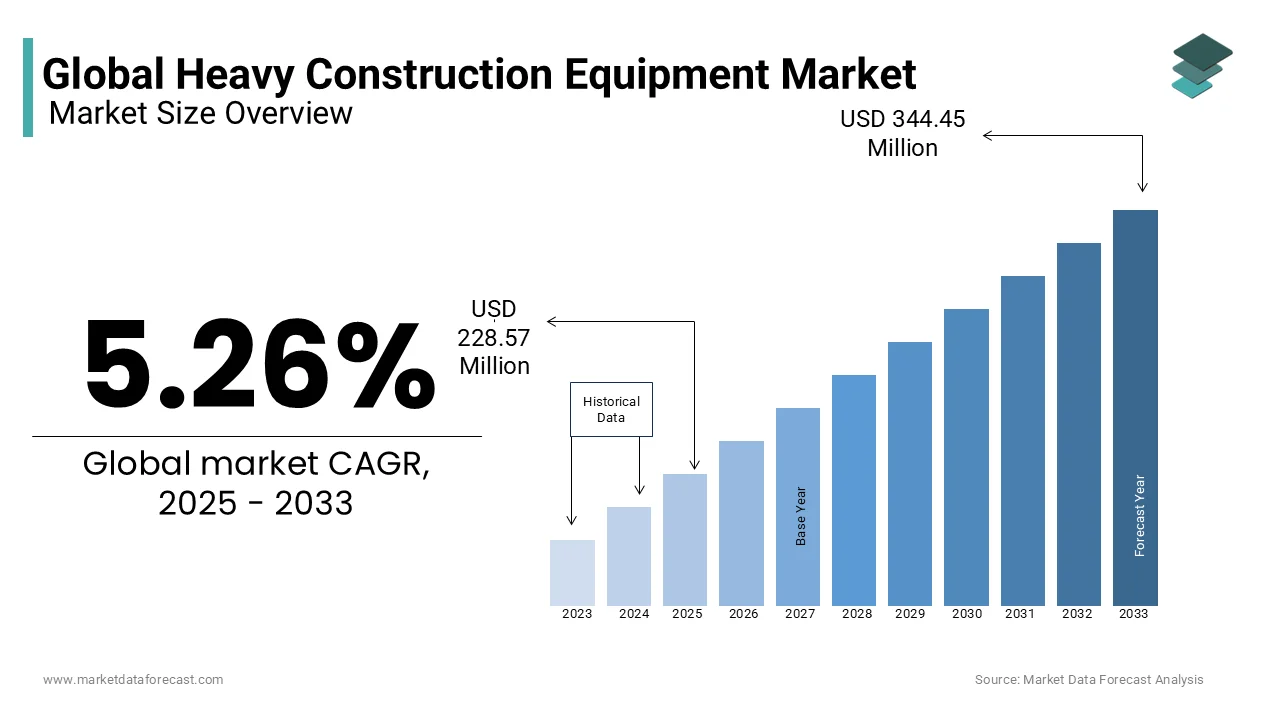

The global heavy construction equipment size was valued at USD 217.15 billion in 2024 and is anticipated to reach USD 228.57 billion in 2025 from USD 344.45 billion by 2033, growing at a CAGR of 5.26% during the forecast period from 2025 to 2033.

Current Scenario of The Heavy Construction Equipment

The Heavy Construction Equipment Market includes a variety of machines that are used in construction work, such as digging, lifting, and moving materials. This market is very important because it helps build essential infrastructure like roads, bridges, and buildings, which are necessary for economic growth and urban development. The types of equipment found in this market include excavators, bulldozers, cranes, and loaders, each designed for specific tasks in construction projects.

Right now, this market is growing quickly due to increased spending on infrastructure in developing countries and the recovery of construction activities after the pandemic. The World Bank has estimated that global infrastructure investment needs could reach around USD 94 trillion by 2040, showing a strong demand for heavy construction equipment. Additionally, the construction industry uses a lot of energy, accounting for about 36% of global energy consumption. This shows the need for efficient machines that can help reduce energy use and environmental impact.

Furthermore, there is a growing interest in sustainable construction practices, which is encouraging manufacturers to create more eco-friendly equipment. The construction sector is also a significant source of employment, providing jobs for over 200 million people around the world. This shows how important the industry is for economic development. As more people move to cities, the heavy construction equipment market is expected to continue growing, reflecting its vital role in building modern infrastructure.

Market Drivers

Urbanization Trends

Rapid urbanization is a significant driver of the Heavy Construction Equipment Market. As more people migrate to urban areas, the demand for housing, transportation, and public services increases dramatically. According to the United Nations, by 2050, approximately 68% of the world’s population is expected to live in urban areas, up from 55% in 2018. This shift necessitates extensive construction projects, including residential buildings, roads, and public transport systems, all of which require heavy construction equipment. The need to accommodate growing urban populations drives the demand for machinery that can efficiently handle large-scale construction tasks, thereby propelling market growth.

Market Sustainability Initiatives

Another key driver is the growing emphasis on sustainability within the construction industry. As environmental concerns become more pressing, there is an increasing demand for equipment that minimizes environmental impact. Many construction companies are now seeking machinery that is energy-efficient and produces lower emissions. For instance, the adoption of electric and hybrid construction equipment is on the rise, with manufacturers like Volvo and Caterpillar investing in greener technologies. According to a report by the International Energy Agency, the construction sector could reduce its carbon emissions by 30% by adopting sustainable practices and technologies. This shift towards sustainability not only meets regulatory requirements but also appeals to environmentally conscious consumers, further driving demand for advanced heavy construction equipment.

Market Restraints

Skilled Labor Shortages

A significant restraint on the Heavy Construction Equipment Market is the shortage of skilled labor. As construction projects become more complex and technologically advanced, the need for skilled operators who can effectively use heavy machinery is increasing. However, many regions are facing a shortage of qualified workers. The Associated General Contractors of America reported that 80% of construction firms are having difficulty finding qualified workers, which can lead to project delays and increased costs. This labor shortage can hinder the effective utilization of heavy construction equipment, limiting the overall productivity and efficiency of construction projects.

Economic Volatility

Economic volatility is another critical restraint affecting the Heavy Construction Equipment Market. Fluctuations in economic conditions, such as recessions or changes in government spending, can significantly impact construction activities. For example, during economic downturns, public and private investments in infrastructure projects may be reduced, leading to decreased demand for heavy construction equipment. The uncertainty surrounding economic conditions can also affect financing options for construction companies, making it challenging for them to invest in new machinery. As per the World Bank, global economic growth is projected to slow down, which could further exacerbate these challenges and restrain market growth in the heavy construction equipment sector.

Market Opportunities

Adoption of Electric and Hybrid Equipment

The shift towards electric and hybrid construction equipment presents a significant opportunity for the Heavy Construction Equipment Market. As environmental concerns grow, many construction companies are seeking to reduce their carbon footprints. Electric and hybrid machinery not only meets regulatory requirements but also offers lower operating costs due to reduced fuel consumption. This transition allows manufacturers to innovate and develop new products that cater to the increasing demand for sustainable solutions, positioning themselves favorably in a competitive market.

Increased Focus on Automation and Robotics

The increasing focus on automation and robotics in construction is another promising opportunity for the Heavy Construction Equipment Market. As labor shortages persist, construction companies are turning to automated solutions to enhance productivity and efficiency. Technologies such as autonomous vehicles and robotic arms can perform tasks with precision and reduce the need for manual labor. A study by the World Economic Forum indicates that automation could increase productivity in the construction sector by up to 30%. This trend encourages manufacturers to invest in research and development to create advanced machinery that incorporates automation, thereby meeting the evolving needs of the industry.

Market Challenges

Fluctuating Raw Material Prices

Fluctuating raw material prices pose a significant challenge for the Heavy Construction Equipment Market. The costs of steel, aluminum, and other essential materials can vary widely due to market conditions, geopolitical tensions, and supply chain issues. For instance, the price of steel has seen dramatic increases, with the World Steel Association reporting a rise of over 50% in 2021 alone. These fluctuations can lead to unpredictable production costs for manufacturers, making it difficult to maintain profit margins.

Technological Integration Costs

While technological advancements present opportunities, the costs associated with integrating new technologies into existing operations can be a significant challenge. Many construction companies may struggle with the financial burden of upgrading their equipment to incorporate advanced features such as telematics, automation, and IoT capabilities. According to a survey by the Construction Industry Institute, nearly 60% of construction firms cite high implementation costs as a barrier to adopting new technologies. This reluctance to invest in modernization can hinder the overall growth of the Heavy Construction Equipment Market, as companies may miss out on the efficiency gains and competitive advantages that come with technological integration.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.26% |

|

Segments Covered |

By Machinery, Application, Propulsion, Power Output, Engine capacity, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Caterpillar, Komatsu Ltd., AB Volvo, Hitachi Construction Machinery Co., Ltd.Deere & Company., CNH, Industrial N.V., LIEBHERR, Kobelco Construction Machinery Co., Ltd., SANY, XCMG GROUP. |

SEGMENT ANALYSIS

Heavy Construction Equipment Market Analysis By Machinery

The Earthmoving Equipment segment gained the top position and held a market share of 40.4% in 2024 which is primarily due to the high demand for machinery like excavators and bulldozers, essential for construction and excavation projects. As per the U.S. Bureau of Labor Statistics, the construction industry is expected to grow by 11%, increasing the need for earthmoving equipment. This equipment is crucial for tasks such as site preparation and land grading, making it a vital component of construction projects.

The Material Handling Equipment segment is the fastest emerging category, with a projected CAGR of 8.5% from 2025 to 2033. The increasing need for efficient transportation and storage of materials on construction sites is propelling the segment forward. The U.S. Department of Commerce reports that the construction sector is expected to invest over USD 1 trillion in infrastructure by 2025 and is further boosting demand for material handling equipment. As construction projects become more complex, the need for advanced machinery to manage materials efficiently is becoming increasingly important, making this segment a key area of growth.

Heavy Construction Equipment Market Analysis By Application

The Excavation & Demolition segment was the most popular category which captured a market share of 35.8% in 2024. The high volume of construction and demolition projects worldwide is mainly pushing the segment forward. According to the National Association of Home Builders, the U.S. alone is expected to see 1.5 million new housing starts by 2025, driving demand for excavation equipment. Excavation and demolition are critical for site preparation, making this segment essential for the overall construction process.

The Recycling & Waste Management segment is the fastest growing, with a CAGR of 9.3% from 2025 to 2033. This expansion is influenced by growing environmental regulations and the need for sustainable construction practices. The U.S. Environmental Protection Agency reports that construction and demolition debris accounts for about 25% of the total waste generated in the country. As more construction companies focus on recycling materials and reducing waste, the demand for specialized equipment in this segment is expected to rise significantly.

Heavy Construction Equipment Market Analysis By Propulsion

The Internal Combustion Engine (ICE) segment led the market by occupying a substantial share in 2024 owing to the widespread use of diesel-powered machinery in construction. The U.S. Energy Information Administration states that diesel fuel accounts for about 80% of the fuel used in the construction industry. ICE equipment is known for its power and efficiency, making it the preferred choice for heavy-duty construction tasks.

The Electric propulsion segment is the quickly moving forward, with a CAGR of 12% because of the increasing environmental concerns and the push for sustainable practices in construction. The International Energy Agency reports that electric vehicles could reduce greenhouse gas emissions by up to 70% compared to traditional diesel engines. As construction companies seek to lower their carbon footprints, the demand for electric construction equipment is expected to rise rapidly, making this segment a key area of innovation.

Heavy Construction Equipment Market Analysis By Power Output

The largest segment in the Heavy Construction Equipment Market by power output is the 201 - 400 HP segment which held a market share of 45.3% owing to the equipment in this range is versatile and suitable for various construction tasks. According to the U.S. Bureau of Labor Statistics, the construction industry is projected to grow by 11% from 2020 to 2030, increasing the demand for powerful machinery. The 201 - 400 HP range is ideal for heavy lifting and earthmoving, making it essential for many construction projects.

The >400 HP segment is the rising quickly category, with a CAGR of 7.5% from 2025 to 2033. This growth is driven by the increasing demand for high-capacity machinery in large-scale construction projects. The World Bank estimates that global infrastructure investment needs will reach USD 94 trillion by 2040, necessitating powerful equipment for major projects. As construction companies tackle larger and more complex projects, the demand for equipment with higher power output is expected to rise significantly.

Heavy Construction Equipment Market Analysis By Engine Capacity

The <5L engine capacity segment held the controlling market share at 45.3% in 2024. This segment prevailed because it is widely used in compact equipment like mini excavators and loaders, which are essential for urban construction projects. The United Nations reports that urbanization will increase by 2.5% annually, driving demand for such equipment. Additionally, the U.S. Environmental Protection Agency shows that smaller engines comply better with emissions regulations, making them more attractive. Their affordability and versatility also contribute to their dominance.

The >10L engine capacity segment is growing rapidly, with a CAGR of 8.5%. This growth is fueled by large-scale infrastructure projects like highways and dams, with the World Bank estimating $1.4 trillion in global infrastructure investments annually. The International Energy Agency notes that mining activities have increased by 6% yearly, requiring heavy machinery with high-capacity engines. These engines are crucial for efficiency in energy-intensive industries. Governments like India’s Ministry of Road Transport report rising road expansions, further boosting demand. The segment's importance lies in its role in supporting industrial and economic development.

Heavy Construction Equipment Market Analysis By End Use

The infrastructure segment dominated the market with a 35.3% share in 2024. This position in the market is caused by the massive government investments in roads, bridges, and railways. For instance, the Asian Development Bank states that Asia alone needs $1.7 trillion annually for infrastructure development. The U.S. Department of Transportation highlights that over $1 trillion is allocated for U.S. infrastructure by 2025. Infrastructure projects require versatile equipment like bulldozers and cranes, making this segment critical. With urbanization rates rising globally, infrastructure remains vital for economic progress and connectivity.

The mining segment is the fastest growing, with a CAGR of 9.2% from 2025 to 2033. Rising global mineral demands drive this growth, with the International Monetary Fund reporting a 5% annual increase in mining activities. Australia’s Department of Industry forecasts a 10% rise in iron ore production by 2025, requiring advanced equipment. Additionally, the World Mining Congress states that mining contributes 6.9% to global GDP, showcasing its economic importance. Heavy machinery like dump trucks and drills is essential for efficiency. As renewable energy projects expand, demand for mined materials like lithium grows, further propelling this segment.

REGIONAL ANALYSIS

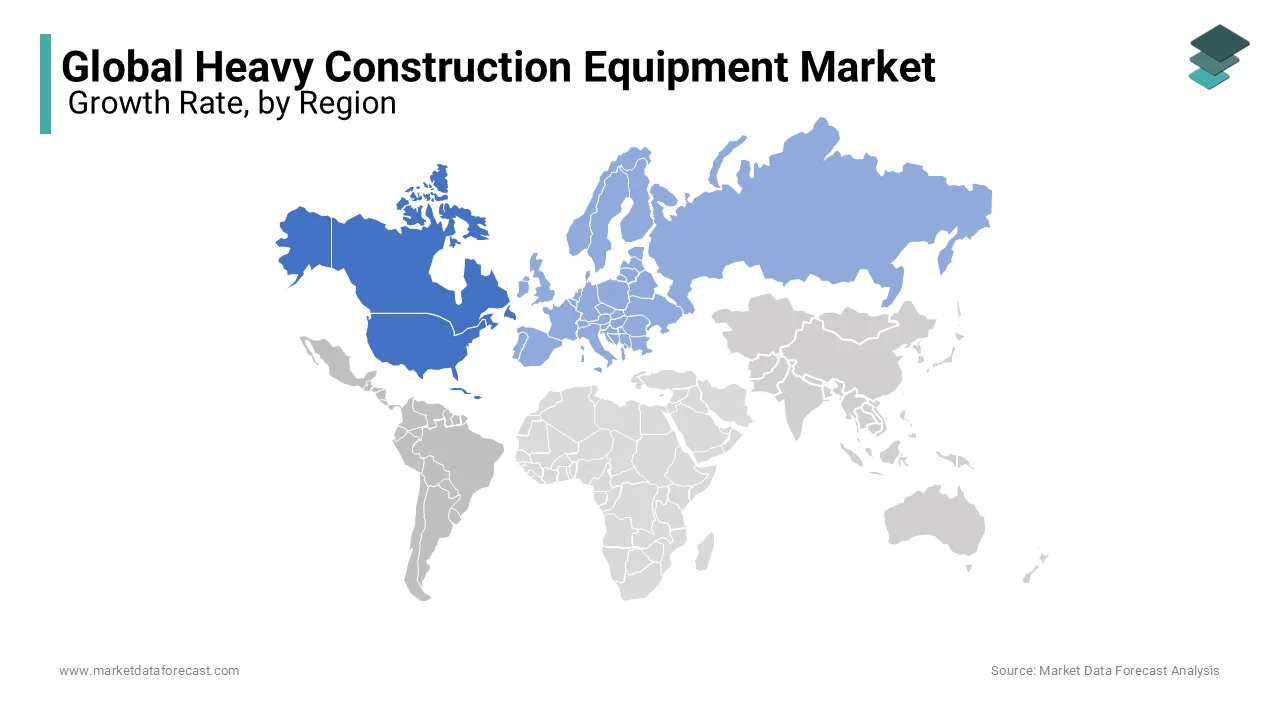

North America is projected to hold a market share of 22.5% of the global heavy construction equipment market. It is a leading region in the Heavy Construction Equipment Market, primarily driven by significant investments in infrastructure and a robust construction sector. The U.S. construction industry alone is projected to reach USD 1.8 trillion by 2025, according to the U.S. Census Bureau. The region's focus on modernizing aging infrastructure, coupled with the adoption of advanced technologies, has further propelled market growth. Additionally, the presence of major equipment manufacturers, such as Caterpillar and John Deere, enhances North America's competitive edge. The region's emphasis on sustainability and regulatory compliance also drives demand for innovative construction machinery.

Europe holds a prominent position in the Heavy Construction Equipment Market, supported by stringent environmental regulations and a strong emphasis on sustainable construction practices. Countries like Germany and the UK are leading the way in infrastructure development, with Germany investing approximately EUR 10 billion in road and rail projects in 2021. The region's commitment to reducing carbon emissions has spurred demand for electric and hybrid construction equipment, positioning Europe as a leader in eco-friendly machinery.

The Asia Pacific region is the fastest-growing market for heavy construction equipment and is expected to grow at a CAGR of 9.2% from 2025 onwards which is driven by rapid urbanization and significant infrastructure projects. As per the Asian Development Bank, Asia needs to invest USD 26 trillion in infrastructure by 2030 to maintain growth. Countries like China and India are at the forefront, with China alone investing over USD 1 trillion in infrastructure development in 2020. The region's increasing population and urban migration are fueling demand for housing, transportation, and public services, making it a critical market for heavy construction equipment manufacturers looking to expand their presence.

Latin America is emerging as a significant player in the Heavy Construction Equipment Market and is primarily due to ongoing infrastructure development initiatives. The region is predicted to invest approximately USD 1.5 trillion in infrastructure projects by 2025, according to the Inter-American Development Bank. Countries like Brazil and Mexico are leading the charge, focusing on improving transportation networks and public facilities. The growing demand for construction machinery is also driven by government programs aimed at enhancing economic growth and job creation.

The Middle East & Africa region is witnessing substantial growth in the Heavy Construction Equipment Market which is fueled by ambitious infrastructure projects and urban development initiatives. The Gulf Cooperation Council (GCC) countries are forecasted to invest over USD 1 trillion in infrastructure by 2025, according to the Gulf Cooperation Council's Economic Outlook. Major events, such as the FIFA World Cup 2022 in Qatar and Expo 2020 in Dubai, have accelerated construction activities. Additionally, the region's focus on diversifying economies away from oil dependency has led to increased investments in infrastructure, making it a vital market for heavy construction equipment manufacturers.

Top 3 Players in the Market

Caterpillar Inc. is the largest player in the global Heavy Construction Equipment Market, holding a market share of approximately 16.3%. In 2022, the company generated around $59.4 billion in revenue, showcasing its dominance in the industry. Caterpillar offers an extensive range of products, including excavators, loaders, and dozers, which are essential for various construction projects worldwide. Their commitment to innovation and technology has positioned them as a key driver of efficiency and productivity in the construction sector, making them a vital contributor to infrastructure development globally.

Komatsu Ltd., founded in Japan, is another major player in the Heavy Construction Equipment Market, with a market share of about 10.7%. The company reported revenues of approximately $25 billion in 2022. Known for its advanced excavator technology and reliable machinery, Komatsu has established a strong presence in Asia and beyond. Their focus on sustainability and the development of eco-friendly equipment has enhanced their reputation, allowing them to meet the growing demand for efficient construction solutions while significantly contributing to the global market.

XCMG Group, based in China, holds a market share of around 5.8% in the Heavy Construction Equipment Market. With revenues exceeding $13 billion in 2022, XCMG has rapidly grown to become a leading manufacturer in Asia. The company specializes in a wide range of construction equipment, including cranes and road construction machinery. XCMG's commitment to research and development has led to innovative products that meet the evolving needs of the construction industry, making them a significant contributor to the global market landscape.

Top Strategies Used By The Key Market Participants

Advanced Technology Integration

Key players in the Heavy Construction Equipment Market are increasingly leveraging advanced technologies such as automation, artificial intelligence (AI), and the Internet of Things (IoT) to enhance operational efficiency. For instance, companies like Caterpillar and Komatsu are developing smart machinery equipped with sensors that provide real-time data on equipment performance and maintenance needs. This technology allows for predictive maintenance, reducing downtime and operational costs. Additionally, automation in equipment operation can improve precision and safety on construction sites. By investing in these technologies, companies can not only improve productivity but also differentiate themselves in a competitive market, appealing to customers seeking innovative solutions.

Focus on Sustainability

Sustainability has become a critical focus for heavy construction equipment manufacturers as environmental regulations tighten and public awareness of climate change grows. Companies are investing in the development of eco-friendly machinery, such as electric and hybrid equipment, to reduce emissions and fuel consumption. For example, Komatsu has introduced electric excavators that significantly lower carbon footprints. Additionally, manufacturers are adopting sustainable practices in their operations, such as using recycled materials and reducing waste. By prioritizing sustainability, these companies not only comply with regulations but also attract environmentally conscious customers, enhancing their brand reputation and market position in an increasingly eco-aware industry.

Strategic Partnerships and Collaborations

To strengthen their market position, key players are forming strategic partnerships and collaborations with technology firms, research institutions, and other industry stakeholders. These alliances enable companies to share resources, knowledge, and expertise, leading to the development of innovative products and solutions. For instance, partnerships with tech companies can facilitate the integration of advanced technologies like AI and machine learning into construction equipment. Additionally, collaborating with local firms in emerging markets can help established companies navigate regulatory environments and understand customer needs better. By leveraging these partnerships, companies can enhance their competitive edge and expand their market reach more effectively.

COMPETITIVE LANDSCAPE

The Heavy Construction Equipment Market is highly competitive, driven by technological advancements and changing customer demands. Companies are increasingly adopting automation and smart technologies to improve efficiency and reduce costs. For instance, manufacturers are integrating sensors and AI into their equipment, allowing for real-time monitoring and predictive maintenance. This not only enhances productivity but also appeals to customers looking for innovative solutions.

Sustainability is another key factor influencing competition. As environmental concerns rise, companies are investing in eco-friendly machinery, such as electric and hybrid models, to meet regulatory standards and attract environmentally conscious buyers. Strategic partnerships are also becoming common, enabling firms to share resources and develop cutting-edge products.

Geographic expansion plays a crucial role as well, with manufacturers targeting emerging markets in Asia-Pacific and Africa, where infrastructure development is booming. A customer-centric approach is essential for building loyalty, with companies focusing on tailored solutions and excellent after-sales support. Lastly, diversification of product offerings helps companies mitigate risks and cater to various market segments. Overall, the competition in this market is intense, with companies striving to innovate and adapt to meet evolving industry needs. The Heavy Construction Equipment Market is a dynamic and competitive landscape where companies constantly strive to outdo each other. One emerging trend is the focus on digital transformation. Firms are investing in software solutions that enhance project management and equipment tracking, allowing for better resource allocation and efficiency. This shift towards digital tools not only streamlines operations but also provides valuable data analytics that can inform future business decisions.

Another perspective is the growing importance of customer experience. Companies are realizing that providing exceptional service can set them apart from competitors. This includes offering personalized consultations, flexible financing options, and comprehensive training for operators. By prioritizing customer satisfaction, businesses can build long-term relationships and foster brand loyalty.

Additionally, the rise of modular construction techniques is reshaping the market. Manufacturers are adapting their equipment to support these methods, which emphasize speed and efficiency in building projects. This adaptability can give companies a competitive edge as they align their products with industry trends.

KEY MARKET PLAYERS

Caterpillar, Komatsu Ltd., AB Volvo, Hitachi Construction Machinery Co., Ltd.Deere & Company., CNH, Industrial N.V., LIEBHERR, Kobelco Construction Machinery Co., Ltd., SANY, XCMG GROUP. These are the market players that are dominating the global heavy construction equipment market.

RECENT HAPPENINGS IN THIS MARKET

- In March 2025, Komatsu introduced its new electric excavator in the European market to reduce carbon emissions and meet the growing demand for sustainable construction equipment.

- In February 2025, Caterpillar announced a $500 million investment to expand its line of autonomous mining trucks, enhancing safety and efficiency in mining operations.

- In February 2025, Volvo Construction Equipment received European Union approval for its hydrogen fuel cell-powered wheel loader, marking a significant step toward zero-emission construction machinery.

- In January 2025, Hitachi Construction Machinery launched its next generation of hydraulic excavators, featuring advanced technologies to improve fuel efficiency and operator comfort.

- In January 2025, John Deere acquired a leading autonomous equipment startup to accelerate the integration of automation technologies into its construction equipment lineup.

MARKET SEGMENTATION

This research report on the global heavy construction market is segmented and sub-segmented into the following categories.

By Machinery

- Earthmoving Equipment

- Material Handling Equipment

- Heavy Construction Equipment

- Others

By Application

- Excavation & Demolition

- Heavy Lifting

- Material Handling

- Tunneling

- Transportation

- Recycling & Waste Management

By Propulsion

- ICE

- Electric

By Power Output

- <100HP

- 101-200 HP

- 201 - 400 HP

- >400 HP

By Engine Capacity

- <5L

- 5-10L

- >10L

By End Use

- Building & Construction

- Forestry & Agriculture

- Infrastructure

- Mining

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the current market size and growth rate?

The global heavy construction equipment market is valued at hundreds of billions and is expected to grow at a CAGR of 5.26% from 2025 to 2033.

What are the key drivers of market growth?

Increasing urbanization, infrastructure development, rising government investments, and advancements in automation & electrification.

Which regions dominate the market?

Asia-Pacific leads the market, with China and India driving demand due to large-scale construction projects. North America and Europe also hold significant shares.

What are the major types of heavy construction equipment?

Excavators, loaders, bulldozers, dump trucks, cranes, graders, and compactors are among the most commonly used.

Who are the key players in the industry?

Leading companies include Caterpillar, Komatsu, Volvo Construction Equipment, Hitachi, Liebherr, and John Deere.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]