Global Heat Exchanger Market Size, Share, Trends, & Growth Forecast Report Segmented By Type (Shell & Tube, Plate & Frame, and Air Cooled), Material, End-Use Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Heat Exchanger Market Size

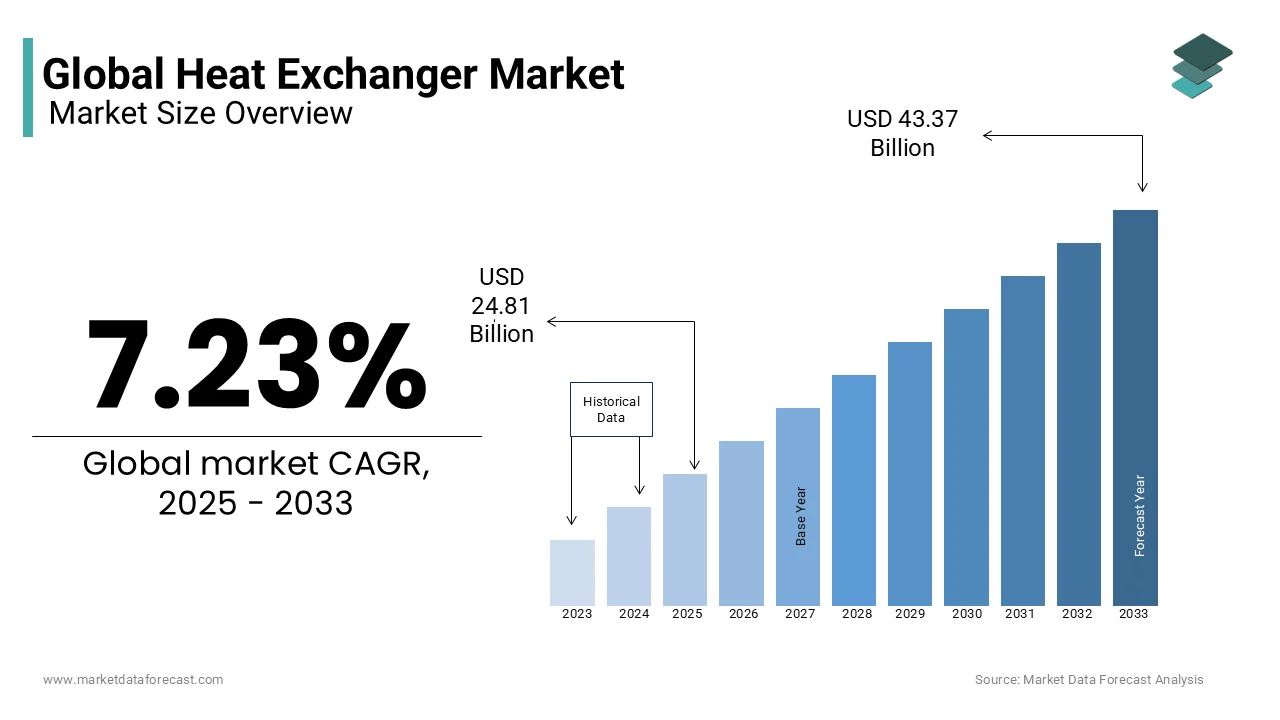

The global heat exchanger market was worth USD 23.14 billion in 2024. The global market is projected to reach USD 43.37 billion by 2033 from USD 24.81 billion in 2025, growing at a CAGR of 7.23% from 2025 to 2033.

A heat exchanger is a device designed to efficiently transfer heat between two or more fluids like liquid or gas without direct contact by ensuring optimal temperature regulation in processes ranging from HVAC systems to power generation and chemical processing. The role of heat exchangers has become pivotal in reducing carbon footprints and enhancing operational efficacy as global industries increasingly prioritize energy efficiency and sustainability. According to the International Energy Agency, industrial energy consumption accounts for approximately 37% of global final energy use with the growing need for advanced heat exchange technologies that minimize waste and improve energy utilization.

In recent years, innovations in materials and design have propelled the evolution of compact and high-efficiency heat exchangers by aligning with growing demands for smaller yet more powerful solutions. As per a report by the World Green Building Council, buildings consume around 36% of global energy with heating and cooling systems being significant contributors. This scenario elevates the importance of integrating cutting-edge heat exchangers into HVAC systems to achieve net-zero emissions targets. According to the U.S. Department of Energy, industrial facilities could save up to 20% of their energy costs through improved heat recovery systems by reinforcing the indispensable role of heat exchangers in driving both economic and environmental progress.

MARKET DRIVERS

Growing Demand for Energy Efficiency in Industrial Processes

The escalating need for energy efficiency in industrial operations serves as a significant driver for the heat exchanger market. Industries account for nearly 54% of global electricity consumption, as per the International Energy Agency. Heat exchangers play a vital role in recovering waste heat and repurposing it within processes that eventually reduces overall energy demands. According to the U.S. Department of Energy, implementing advanced heat recovery technologies could save industries up to $60 billion annually in energy costs. Industries are compelled to adopt energy-efficient solutions like heat exchangers with stricter regulatory frameworks such as the Paris Agreement pushing for lower emissions. These devices not only enhance operational sustainability but also align with global decarbonization goals by making them indispensable in modern industrial ecosystems.

Expansion of Renewable Energy Infrastructure

The rapid expansion of renewable energy infrastructure is another key driver propelling the heat exchanger market forward. According to the International Renewable Energy Agency, renewable energy capacity has grown by over 80% in the past decade is necessitating robust thermal management systems. Heat exchangers are integral to applications such as solar thermal power plants and geothermal energy systems, where they ensure efficient heat transfer to generate electricity. According to the U.S. Energy Information Administration, renewables accounted for 20% of total U.S. electricity generation in 2021, a figure expected to rise significantly in the coming years. This growth is due to increasing reliance on heat exchangers to optimize performance in renewable energy systems. The demand for durable and high-performance heat exchangers will continue to surge both technological advancements and environmental objectives.

MARKET RESTRAINTS

High Initial Costs and Capital Investment Requirements

The substantial initial costs associated with advanced heat exchangers pose a significant restraint to market growth. According to the U.S. Department of Energy, the installation of high-efficiency heat exchangers can require capital investments that are up to 30% higher than conventional systems by deterring small and medium-sized enterprises from adopting these technologies. For instance, industries operating on tight budgets often prioritize short-term cost savings over long-term energy efficiency gains. Additionally, the complexity of integrating heat exchangers into existing infrastructure further escalates costs, according to the International Energy Agency. Retrofitting older industrial facilities with modern heat exchange systems can lead to extended downtime and additional expenses by making it less appealing for businesses. These financial barriers hinder widespread adoption in developing regions where access to affordable financing remains limited, thereby slowing the overall market expansion.

Stringent Regulatory Compliance and Material Challenges

Stringent regulatory standards and material limitations present another major restraint for the heat exchanger market. According to the Environmental Protection Agency, compliance with environmental regulations, such as restrictions on refrigerants and materials used in heat exchangers will solely increase manufacturing complexities and costs. For example, the phase-out of hydrofluorocarbons (HFCs) under the Kigali Amendment has forced manufacturers to explore alternative materials, which often lack the same performance efficiency. As per the National Institute of Standards and Technology, corrosion and material fatigue remain persistent challenges shall reduce the lifespan of heat exchangers in harsh industrial environments. These issues necessitate frequent maintenance and replacements by adding to operational expenses. The balance between innovation and compliance becomes increasingly difficult to achieve as industries face mounting pressure to adhere to evolving standards while ensuring durability.

MARKET OPPORTUNITIES

Advancements in Material Science and Nanotechnology

The integration of advanced materials and nanotechnology presents a transformative opportunity for the heat exchanger market. According to the National Science Foundation, nanomaterials, such as graphene and carbon nanotubes, exhibit thermal conductivity up to 5,000 watts per meter-kelvin, significantly surpassing traditional materials like copper or aluminum. These innovations enable the development of compact and highly efficient heat exchangers, which are ideal for applications in aerospace and electronics cooling. According to the U.S. Department of Energy, adopting advanced materials can reduce the weight and size of heat exchangers by up to 40% by making them more cost-effective and environmentally sustainable. The incorporation of cutting-edge materials offers a competitive edge as industries increasingly prioritize lightweight and durable solutions. This shift not only enhances performance but also aligns with global trends toward miniaturization and energy efficiency by creating vast growth potential for manufacturers.

Rising Demand for District Heating and Cooling Systems

The growing adoption of district heating and cooling systems is another promising opportunity driving the heat exchanger market. According to the International Energy Agency, district heating currently supplies approximately 9% of Europe’s total heat demand, with projections indicating a steady rise due to urbanization and decarbonization goals. Heat exchangers are critical components in these systems by enabling efficient heat distribution from centralized sources to residential and commercial buildings. As per the U.S. Environmental Protection Agency, district energy systems can achieve energy savings of up to 30% compared to individual heating and cooling units. Governments worldwide investing in sustainable urban infrastructure, such as China’s commitment to expand district heating networks by 10% annually is amplifying the demand for robust and scalable heat exchangers is set to surge. This trend positions the market to capitalize on the transition toward smarter and greener cities.

MARKET CHALLENGES

Increasing Complexity in Design and Customization

The growing complexity in designing and customizing heat exchangers to meet diverse industrial requirements presents a significant challenge. As per U.S. Department of Energy, industries often demand highly specialized heat exchangers tailored to unique operational conditions, such as extreme temperatures or corrosive environments. This customization process can extend lead times by up to 50%, as manufacturers must conduct extensive testing and prototyping to ensure compliance with specific standards. According to the National Institute of Standards and Technology, the lack of standardized design protocols for emerging applications, such as hydrogen processing or carbon capture systems, adds to the technical challenges. These factors increase production costs and create bottlenecks in scaling innovations. Balancing customization with cost-effectiveness remains a persistent hurdle for market players as industries seek more adaptable solutions.

Vulnerability to Supply Chain Disruptions

Supply chain vulnerabilities pose another critical challenge to the heat exchanger market, particularly due to reliance on specialized raw materials. According to the International Energy Agency, key materials like stainless steel and titanium are essential for manufacturing high-performance heat exchangers, which have experienced price volatility of up to 25% in recent years due to geopolitical tensions and logistical constraints. Additionally, the U.S. Department of Commerce studies have shown that disruptions caused by global events, such as pandemics or trade restrictions, have led to delays in material procurement, impacting production schedules. For instance, during the COVID-19 pandemic, lead times for certain components increased by over 30%, affecting project timelines across industries. These supply chain uncertainties not only inflate operational costs but also hinder the ability of manufacturers to meet rising market demands, creating a pressing need for more resilient sourcing strategies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.23% |

|

Segments Covered |

By Type, Material, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

ALFA LAVAL (Sweden), Kelvion Holding GmbH (Germany), Danfoss (Denmark), Exchanger Industries Limited (Canada), Mersen (France), API Heat Transfer (US), Boyd (US), H. Güntner (UK) Limited (Germany), Johnson Controls (Ireland), Xylem (US), Wabtec Corporation (US), SPX FLOW (US), LU-VE S.p.A. (Italy), Lennox International Inc. (US), and Modine Manufacturing Company (US). |

SEGMENTAL ANALYSIS

By Type Insights

The shell & Tube heat exchangers dominated the market and held 40.2% of the global heat exchanger market share in 2024. Their widespread adoption stems from their robust design, versatility, and ability to handle high-pressure and high-temperature applications is making them indispensable in industries like oil and gas, petrochemicals, and power generation. As per the International Energy Agency, these systems are critical for processes such as steam generation, where they achieve thermal efficiencies of up to 90%. The demand for Shell & Tube heat exchangers remains pivotal in ensuring energy-efficient operations.

The plate & Frame heat exchangers segment is expected to register a CAGR of 7.5% during the forecast period. This growth is driven by their compact design, superior heat transfer efficiency, and adaptability to renewable energy applications like solar thermal and geothermal systems. According to the U.S. Environmental Protection Agency, these exchangers reduce energy losses by up to 30% compared to traditional systems. Additionally, their modular nature allows for easy scalability is catering to urban district heating projects, which are expanding at a rate of 10% annually in Europe. Plate & Frame heat exchangers are set to play a transformative role in modern thermal management systems.

By Material Insights

The metals segment was the largest by occupying the heat exchanger market share of 60.1% in 2024. Stainless steel and copper are the most widely used metals due to their superior thermal conductivity and corrosion resistance. According to the U.S. Department of Commerce, stainless steel alone contributes to nearly 40% of material usage in industrial heat exchangers. Metals’ widespread adoption ensures consistent performance in high-pressure and high-temperature environments are making them indispensable for energy-efficient systems.

The alloys segment is likely to exhibit a fastets CAGR of 7.8% from 2025 to 2033. The demand for advanced alloys, such as nickel-based superalloys, is driven by their ability to withstand extreme conditions in aerospace and power generation. According to the U.S. Department of Energy, these materials exhibit thermal efficiency improvements of up to 25% compared to traditional metals. Rising investments in renewable energy infrastructure like solar thermal plants will further propel alloy adoption. Additionally, stringent environmental regulations encourage industries to adopt durable, high-performance materials are boosting alloy demand.

By End-Use Industry insights

The chemical industry was accounted to be the dominant segment by capturing 25.1% of the heat exchanger market share in 2024. The industry's extensive reliance on heat exchangers for processes like distillation, evaporation, and chemical reactions, where precise temperature control is highly important. According to the International Energy Agency, chemical production consumes about 30% of industrial energy globally with the rising need for efficient heat transfer solutions. Heat exchangers not only optimize energy use but also ensure safety and compliance with stringent environmental regulations.

The HVACR (Heating, Ventilation, Air Conditioning, and Refrigeration) industry is expected to witness a fastest CAGR of 7.5% in next coming years. This growth is driven by urbanization and increasing demand for energy-efficient climate control systems in emerging economies. According to the U.S. Environmental Protection Agency, buildings account for nearly 40% of global energy consumption, with HVACR systems being a major contributor. The adoption of advanced heat exchangers in HVACR systems is accelerating as governments enforce stricter energy efficiency standards, such as the European Union’s EcoDesign Directive. These devices play a pivotal role in reducing energy losses and carbon emissions by aligning with global sustainability goals while addressing the rising need for thermal comfort in residential and commercial spaces.

REGIONAL ANALYSIS

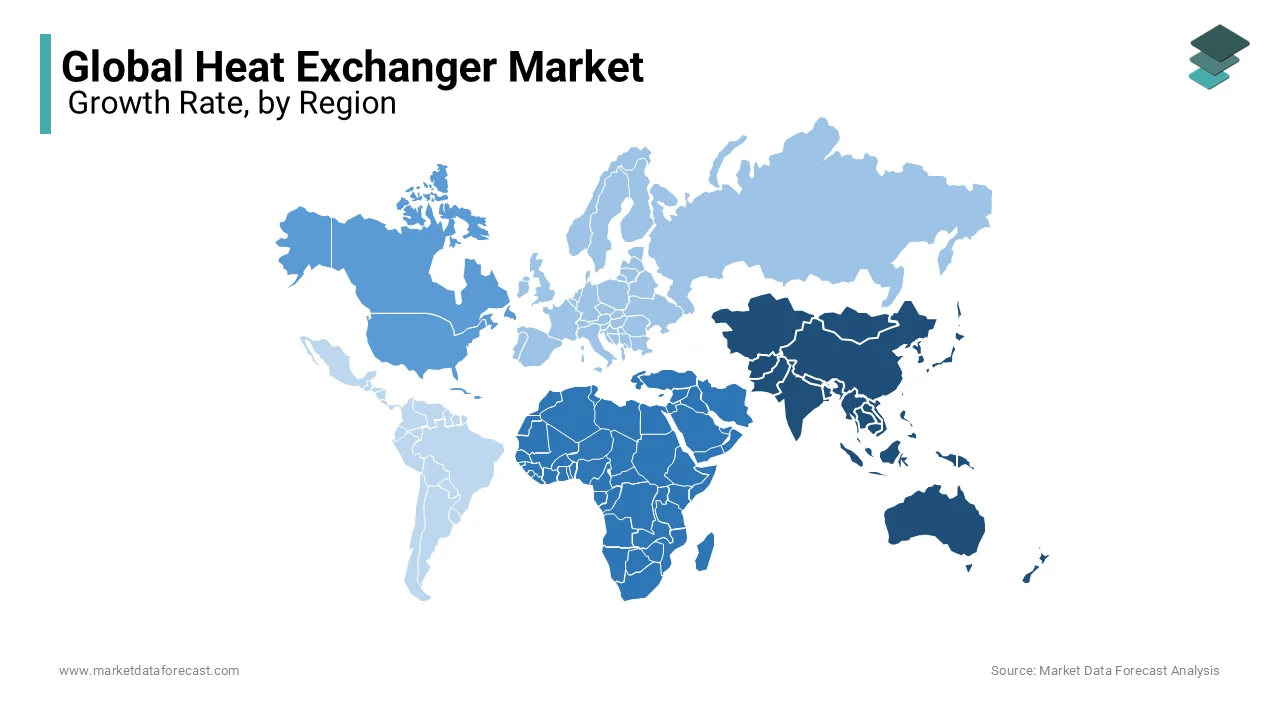

Asia-Pacific dominated the heat exchanger market with 40.3% of the global share in 2024 owing to the rapid industrialization, urbanization, and investments in energy infrastructure across countries like China and India. According to the U.S. Energy Information Administration, Asia-Pacific accounts for over 50% of global energy consumption, with industries such as chemical, power, and HVACR heavily reliant on heat exchangers. Additionally, government initiatives, such as China’s 14th Five-Year Plan emphasizing green technologies, further boost adoption. The region's focus on sustainable energy solutions and its manufacturing hubs make it a critical driver of market growth.

The Middle East and Africa region is projected to register a CAGR of 6.8% from 2025 to 2033. This growth is fueled by expanding oil and gas operations, desalination projects, and renewable energy investments. For instance, Saudi Arabia’s Vision 2030 aims to diversify energy sources by driving demand for advanced heat exchangers. According to te U.S. Department of Energy, the Middle East holds 48% of global proven oil reserves by necessitating efficient thermal management systems. The rising urbanization and infrastructure development further propel HVACR applications. Their heat exchanger markets will play a pivotal role in supporting economic and environmental goals as these regions prioritize energy efficiency and industrial modernization.

North America, Europe, and Latin America are expected to witness steady growth, driven by energy efficiency regulations and industrial upgrades. According to the U.S. Environmental Protection Agency, North America’s focus on reducing industrial emissions supports heat exchanger adoption, while Europe’s Green Deal accelerates demand for sustainable solutions. Latin America’s market, though smaller, benefits from mining and power sector expansions, with the International Energy Agency projecting a 4.5% annual growth in energy demand. Collectively, these regions will contribute significantly to innovation and technological advancements in the heat exchanger market, ensuring balanced global progress.

KEY MARKET PLAYERS

The major players in the global heat exchanger market include ALFA LAVAL (Sweden), Kelvion Holding GmbH (Germany), Danfoss (Denmark), Exchanger Industries Limited (Canada), Mersen (France), API Heat Transfer (US), Boyd (US), H. Güntner (UK) Limited (Germany), Johnson Controls (Ireland), Xylem (US), Wabtec Corporation (US), SPX FLOW (US), LU-VE S.p.A. (Italy), Lennox International Inc. (US), and Modine Manufacturing Company (US).

Top 3 Players in the Market

Alfa Laval (Sweden)

Alfa Laval is a global leader in the heat exchanger market, renowned for its innovative and energy-efficient solutions. Alfa Laval’s expertise spans multiple industries, including chemical, food and beverage, HVACR, and marine, with its plate heat exchangers being particularly prominent. The U.S. Department of Energy recognizes Alfa Laval’s contributions to sustainable technologies, such as compact heat exchangers that reduce energy consumption by up to 30%. By focusing on decarbonization and circular economy initiatives, Alfa Laval has established itself as a pioneer in eco-friendly thermal management solutions, driving both market growth and environmental progress.

Kelvion Holding GmbH (Germany)

Kelvion is another key player, commanding a significant share of the heat exchanger market due to its diverse product portfolio and global presence. According to the International Energy Agency, Kelvion’s gasketed plate heat exchangers and cooling systems are widely adopted in energy-intensive sectors like power generation and HVACR. The company emphasizes modular designs that enhance operational flexibility and energy efficiency, contributing to an estimated 12% reduction in energy losses for industrial processes. Kelvion’s commitment to innovation is evident in its partnerships with renewable energy projects, such as geothermal and solar thermal systems. Its ability to deliver customized solutions tailored to specific industrial needs its position as a market leader by fostering long-term customer relationships and expanding its global footprint.

Danfoss (Denmark)

Danfoss ranks among the top contributors to the heat exchanger market, leveraging its expertise in refrigeration and air conditioning applications. The company’s market share is bolstered by its focus on smart and connected heat exchanger technologies, which align with the growing demand for IoT-enabled solutions. According to the U.S. Environmental Protection Agency, Danfoss’s role in advancing low-global-warming-potential (GWP) refrigerants, which are critical for sustainable HVACR systems. With innovations like microchannel heat exchangers, Danfoss achieves up to 40% higher efficiency compared to traditional designs, as noted in their sustainability reports. By addressing both regulatory compliance and energy efficiency challenges, Danfoss continues to shape the future of thermal management.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Strategic Collaborations and Partnerships

Key players in the heat exchanger market, such as Alfa Laval and Danfoss, have increasingly focused on strategic collaborations to expand their technological capabilities and geographic reach. For instance, Alfa Laval has partnered with renewable energy firms to develop heat exchangers for solar thermal and geothermal applications, aligning with global decarbonization goals. According to the International Renewable Energy Agency, such partnerships enable companies to tap into emerging markets while addressing sustainability challenges. Similarly, Danfoss collaborates with HVACR system integrators to incorporate IoT-enabled heat exchangers, enhancing operational efficiency. These alliances not only strengthen market positions but also foster innovation by combining expertise across industries.

Investments in Research and Development

Investments in R&D are a cornerstone strategy for leaders like Kelvion and Mersen, enabling them to introduce cutting-edge solutions tailored to evolving industrial needs. The U.S. Department of Energy studies shows that that Kelvion’s focus on developing compact and modular heat exchangers has reduced material usage by up to 20%, appealing to cost-conscious industries. Meanwhile, Mersen’s advancements in corrosion-resistant materials have extended the lifespan of heat exchangers in harsh environments. By prioritizing R&D, these companies maintain a competitive edge, offering products that enhance energy efficiency and comply with stringent environmental regulations.

Expansion into Emerging Markets

Market leaders are aggressively expanding their presence in high-growth regions like Asia-Pacific and the Middle East. For example, Johnson Controls has established manufacturing hubs in India and China to cater to the rising demand for HVACR systems in urbanized areas. The International Energy Agency notes that such expansions allow companies to capitalize on regional industrialization and infrastructure development. Additionally, SPX FLOW has invested in localized production facilities in Latin America to serve mining and power sectors, reducing lead times and logistical costs. This geographic diversification ensures sustained revenue growth and strengthens brand visibility in untapped markets.

Mergers and Acquisitions

Mergers and acquisitions are pivotal strategies used by companies like Wabtec Corporation and Xylem to consolidate their market share. Wabtec’s acquisition of strategic assets in Europe has expanded its portfolio of heat exchangers for rail and industrial applications. Similarly, Xylem’s acquisition of smaller players specializing in water-cooling technologies has bolstered its position in the power and desalination sectors. These moves enable companies to integrate complementary technologies, streamline operations, and offer comprehensive solutions.

COMPETITIVE LANDSCAPE

The heat exchanger market is characterized by intense competition, driven by the presence of established global players and emerging regional firms striving to capture market share. Leading companies such as Alfa Laval, Kelvion Holding GmbH, and Danfoss dominate the landscape, leveraging their extensive product portfolios, technological expertise, and strong distribution networks. These players focus on innovation, sustainability, and customization to maintain their competitive edge. For instance, Alfa Laval’s emphasis on energy-efficient solutions and renewable energy applications has positioned it as a pioneer in eco-friendly thermal management systems. Similarly, Danfoss’s advancements in IoT-enabled heat exchangers cater to the growing demand for smart HVACR systems, aligning with global digitalization trends.

Regional players, particularly in Asia-Pacific, are also gaining traction by offering cost-effective solutions tailored to local industrial needs. This has intensified price-based competition, especially in emerging markets. Additionally, mergers and acquisitions have become a key strategy for consolidating market positions, with companies like Wabtec Corporation and Xylem acquiring niche players to expand their capabilities. The U.S. Department of Energy studies revealed that collaborations with renewable energy projects further differentiate competitors in this dynamic market.

Despite the dominance of global leaders, smaller firms are challenging the status quo by focusing on specialized applications, such as cryogenic or high-pressure heat exchangers. This fragmented yet competitive environment fosters innovation but also necessitates continuous investment in R&D and strategic expansions to meet evolving customer demands and regulatory standards.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Alfa Laval, a Swedish leader in heat transfer solutions, introduced a new range of energy-efficient plate heat exchangers designed for renewable energy applications. This product update, featured in Thermal Control Magazine have shown that the company’s focus on enhancing thermal efficiency while reducing environmental impact. The new heat exchangers are specifically optimized for use in solar thermal and geothermal systems, aligning with global decarbonization goals.

- In April 2023, SPX FLOW, a U.S. process solutions provider, introduced a corrosion-resistant heat exchanger line designed for harsh industrial environments. This development is expected to address key challenges in chemical and mining sectors, enhancing its market appeal.

- In February 2023, Mersen, a French advanced material solutions provider, invested $50 million in R&D to develop advanced materials for electric vehicle battery cooling systems. This investment is expected to tap into the booming EV market and diversify its product portfolio.

MARKET SEGMENTATION

This research report on the global heat exchanger market is segmented and sub-segmented into the following categories.

By Type

- Shell & Tube

- Plate & Frame

- Air Cooled

By Material

- Metal

- Alloys

- Brazing Clad Materials

By End-Use Industry

- Chemical

- Energy

- Hvacr

- Food & Beverage

- Power

- Pulp & Paper

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current size of the global heat exchanger market?

The global heat exchanger market is valued at approximately USD 24.81 billion as of 2025.

What are the key trends influencing the heat exchanger market?

Key trends include a focus on energy efficiency, the adoption of renewable energy, and technological advancements in heat exchanger designs.

How are environmental regulations impacting the heat exchanger market?

Stringent environmental regulations are pushing industries to adopt energy-efficient heat exchangers to reduce emissions.

What materials are commonly used in manufacturing heat exchangers?

Common materials include stainless steel, carbon steel, nickel alloys, and aluminum, chosen for their thermal conductivity and corrosion resistance.

What is the future outlook for the global heat exchanger market?

The market is expected to grow steadily, driven by technological advancements and increasing demand for energy-efficient systems.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]