Global Healthcare RCM Outsourcing Market Size, Share, Trends & Growth Forecast Report By Type, Services, End-user, and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Healthcare RCM Outsourcing Market Size

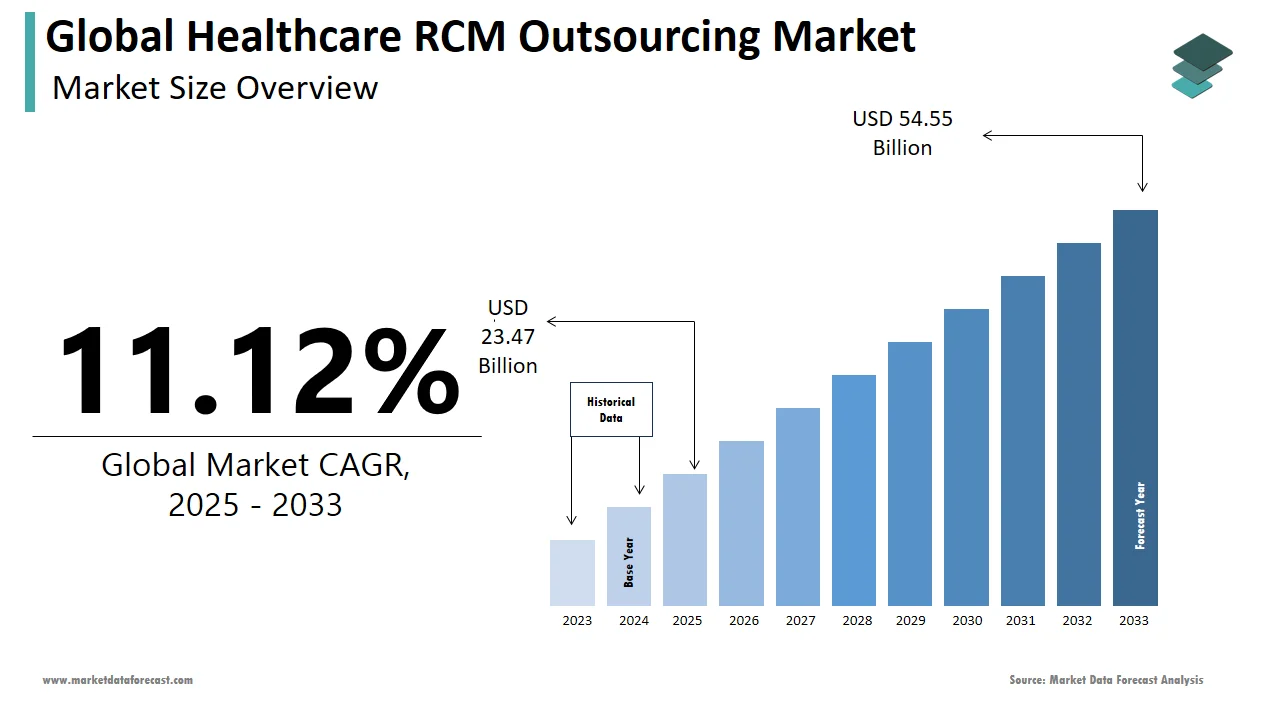

The global healthcare RCM outsourcing market was worth US$ 21.12 billion in 2024 and is anticipated to reach a valuation of US$ 54.55 billion by 2033 from US$ 23.47 billion in 2025, and it is predicted to register a CAGR of 11.12% during the forecast period 2025-2033.

The financial method of collecting medical expenses to raise income for a healthcare institution is known as healthcare revenue cycle management. It allows organizations to be billed for delivering care while collecting contact details from patients, treatment codes, and insurance company names as part of the billing process. To begin, physician-recorded care is translated into medical statements. Following that, codes are assigned to these documents. The claims are then forwarded, published, and adjudicated by the payer. Following the premium payout, hospital providers charge patients for the unpaid amount. Because of the complexity of this operation, most healthcare facilities tend to outsource the Revenue Cycle Management process to concentrate on value-based services. AR calling systems, healthcare collection services, patient claims processing services, revenue enhancement services, billing consistency services, and other services are all part of healthcare revenue cycle management. The RCM outsourcing partner has expertise in these products, which aid in increasing productivity. Since these partners are not responsible for other medical processes, they constantly focus on patient care and uphold the high quality of care distribution and medical diagnosis. Furthermore, these partners will ensure that reimbursements are made on schedule. With well-trained personnel and cutting-edge technologies, these agents completed precise billing while minimizing mistakes such as incorrect names or codes. Furthermore, RCM outsourcing legitimately collects fees, which aids in market growth.

MARKET DRIVERS

Growing healthcare expenditure and YOY growth in hospital admissions propel the global healthcare RCM outsourcing market growth.

The rise in healthcare costs is a significant driver of the global healthcare revenue cycle management outsourcing market. Governments have been reforming or implementing healthcare laws for decades. The Health Information Technology for Economic and Clinical Health Act (HITECH) "Meaningful Use" regulations, for example, has required the implementation of EMRs/EHRs that aid RCM programs by preserving all of a patient's health information. These laws must boost hospital running costs. In addition, hospitals are experiencing financial management problems, necessitating increased billing speed. Industry leaders have implemented significant advances in non-clinical technologies to save money, such as reduced operating costs. As a result, the market for RCM outsourcing by healthcare has increased.

The growing patient population suffering from various diseases is promoting the growth rate of the healthcare RCM outsourcing market.

As disease prevalence rose, so did hospital admissions, necessitating reliable and timely billing. According to WHO, cardiovascular diseases (CVDs) claim an estimated 17.9 million lives per year, and diabetes affects about 422 million individuals globally, with the majority living in low- and middle-income countries. According to the Centers for Disease Control and Prevention, one in every ten individuals in the United States has a chronic disease. Per year, noncommunicable diseases (NCDs) kill 41 million people worldwide, accounting for 71% of all deaths. Every year, almost 15 million people between the ages of 30 and 69 die due to an NCD, with low- and middle-income countries responsible for 85 % of these premature deaths. Also, according to the Centers for Disease Control and Prevention, almost 136 million people attend emergency rooms in the United States each year. Between July and September 2019, almost 1.5 million people were admitted to NHS hospitals in England. In England, there were over six million accident and emergency (A&E) visitors in each part of the year in 2018/19. When the number of hospitals grows, so does the need for revenue cycle management, and as a result, there is a high demand for healthcare RCM outsourcing.

MARKET RESTRAINTS

Strict reimbursement policies limit the growth of the healthcare RCM outsourcing market.

Strict reimbursement policies, on the other hand, may hinder the healthcare RCM outsourcing sector. Payment plans have been revised to improve customer loyalty. These policies mandated documentation such as providing solid, validated proof of adequate care to ensure clarity. Further, those attempting to identify therapy protocols must have proof of efficacy to justify therapeutic implementations. These strict policies make it difficult for the market to enter the healthcare RCM outsourcing sector.

Impact Of COVID-19 On The Global Healthcare RCM Outsourcing Market

The COVID-19 epidemic has been an enormous source of concern for healthcare institutions around the country. It has a significant positive effect on sales and the revenue cycle management industry. While the government and payers have implemented policies to help ease sales cycle problems caused by COVID-19, physician practices, healthcare networks, and medical centers continue to face financial challenges from COVID-19. Also, using a dependable medical billing provider to handle COVID-19 claims is a significant relief for hospitals. These agents concentrate on collecting personal security devices, delivering telemedicine, and pursuing cash services to brace for the industry impacts of COVID-19. As a consequence, the market for RCM outsourcing rises. Furthermore, in addition to freeing up resources, outsourcing medical billing during COVID-19 provided financial support. As hospitals manage in-house medical codes and billing, they must spend a predetermined amount regardless of worker results. However, as hospitals outsource, they must pay a share of monthly net collections during the pandemic. Furthermore, digital patient services such as telehealth and virtual patient control and convergence of all patient touchpoints, including preparation, payment, and telehealth, to minimize no-shows and improve satisfaction, have increased in COVID–19, increasing the need for RCM outsourcing. Many ambulatory surgery centers outsource to sales cycle management outsourcing as they rely on opening their patient care areas safely due to COVID-19. Many competent ASC revenue cycle management firms have a team of experienced personnel whose sole duty is to provide timely and legal coding, billing, and collection services while keeping the accounts receivable at or below industry levels.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

11.12% |

|

Segments Covered |

By Type, Services, End-user, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Conifer Health Solutions, MedAssets, Parallon Business Solutions, Emdeon Business Services, McKesson, The SSI Group, GeBBS Healthcare, optum360, Change Healthcare (Emdeon), Cerner, Allscripts Healthcare, Athenahealth, Experian Information Solutions, Inc., Epic Systems Corporation, CareCloud Corporation, NXGN Management, LLC., Quest Diagnostics, launches, partnerships, collaborations, mergers, acquisitions., and Others. |

SEGMENTAL ANALYSIS

By Type Insights

Based on the type, the pre-intervention RCM services segment is anticipated to lead the market during the forecast period owing to the popularity of the services. The front-end services sector includes pre-intervention activities such as insurance coverage, patient admission, eligibility verification, and appointment scheduling. Because the accuracy of patient data dictates an efficient delivery of reimbursement or the full and final financial settlement, the medical billing outsourcing market in the United States is seeing development in the front-end services segment in 2020 and the coming years. The process begins with collecting data from patients, continues with the submission of documentation records and analysis, and concludes with paying medical expenses. In addition, Healthcare revenue cycle management encompasses various administrative services.

By Services Insights

Based on service, the back-end segment is expected to hold a significant global market share in 2024. The rising demand to reduce healthcare costs worldwide and the growing requirement to control cash flow in back-office administration and IT management systems of healthcare providers, payers, and the life science segment is driving the expansion of the healthcare IT outsourcing market.

By End User Insights

Due to the end user's financial ability to outsource RCM, the hospital segment is expected to hold a significant market share during the forecast period. Hospitals are having financial management challenges, which necessitate faster billing. In addition, industry leaders have incorporated significant advances in non-clinical technology, such as lower operational expenses, to save money. As a result, the healthcare market for RCM outsourcing has grown.

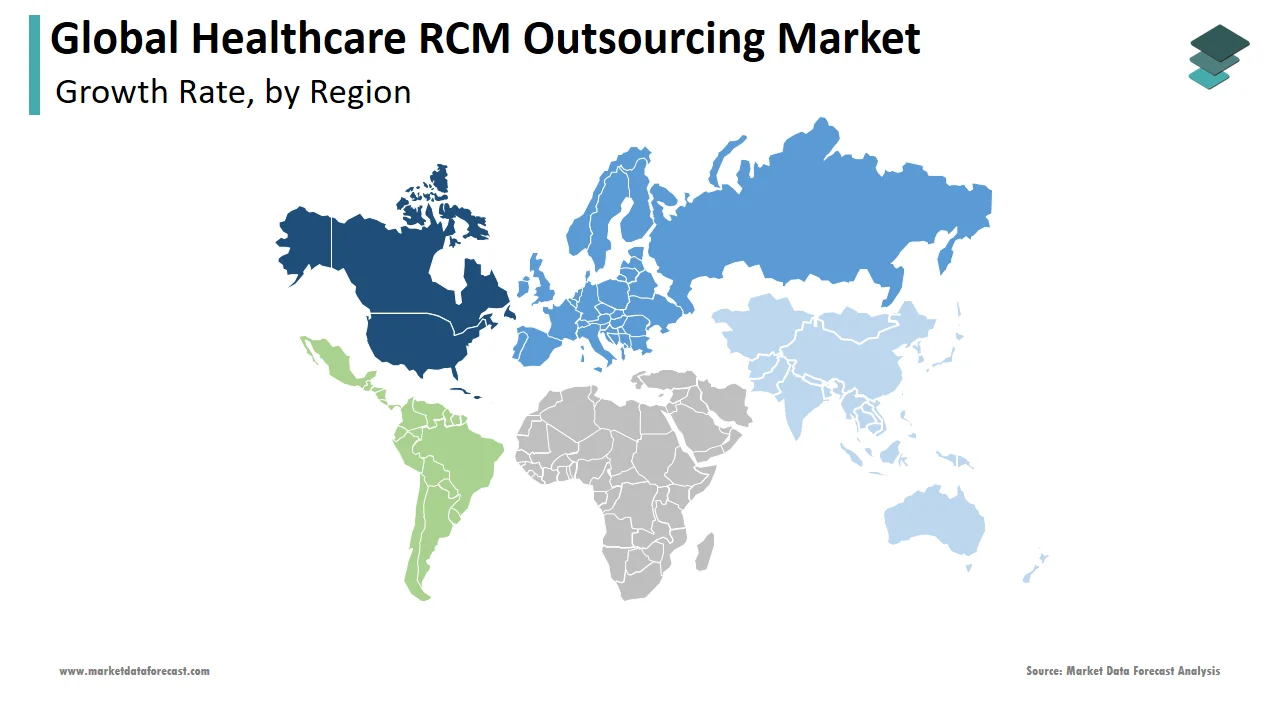

REGIONAL ANALYSIS

Due to the increased use of advanced technologies such as electronic health record (EHR) systems and hospital information systems, North America is the leading global market. As nations such as the United States see an exponential surge in healthcare expenditures, outsourcing RCM is one of the most efficient ways to reduce expenses for patients and healthcare providers. One of the key factors that will fuel growth in the healthcare RCM outsourcing market in the United States is the rising consolidation in the industry. Inorganic growth, higher profits, productivity, scalability, and broader product offerings have prompted several high-profile mergers and acquisitions. In addition, accounts healthcare RCM outsourcing services manage accounts and billing appropriately, well-equipped with effective hardware and software solutions.

In addition, medical billing is completed when the required papers are received from the healthcare centers. All processes, like insurance guarantees and AR collections, are followed up within a few days. The rising patient population and need for medical aid assist North America's dominance in the global revenue cycle management outsourcing market. Reduced needless medical expenditures, limits on conventional finance procedures, and advancements in cloud-based solutions contribute to this region's growth. Over the last several years, governments in this country have implemented stringent healthcare rules, resulting in a significant increase in the running expenses of healthcare institutions and medical billing organizations. This has opened up opportunities for outsourcing businesses to assist them with revenue cycle management, a primary driver of the global healthcare RCM outsourcing market's development.

KEY MARKET PLAYERS

Some of the promising players operating in the global healthcare RCM outsourcing market covered in this report are Conifer Health Solutions, MedAssets, Parallon Business Solutions, Emdeon Business Services, McKesson, The SSI Group, GeBBS Healthcare, optum360, Change Healthcare (Emdeon), Cerner, Allscripts Healthcare, Athenahealth, Experian Information Solutions, Inc., Epic Systems Corporation, CareCloud Corporation, NXGN Management, LLC., Quest Diagnostics, and among others. These players focus on launches, partnerships, collaborations, mergers, and acquisitions.

RECENT MARKET HAPPENINGS

On 3 June 2020, R1, a leading sales cycle management systems provider in Chicago, acquired Cerner RevWorks' consulting market and private, non-federal customer partnerships. As part of the deal, Cerner would expand R1's sales cycle capability and experience to Cerner customers and potential opportunities, assisting clinicians in driving long-term financial gains while improving patient outcomes.

MARKET SEGMENTATION

This research report on the global healthcare RCM outsourcing market has been segmented and sub-segmented based on type, services, end-user, and region.

By Type

- Pre-intervention

- Intervention

- Post-intervention

By Services

- Back-end

- Middle

- Front-end

By End User

- Hospitals

- Other End Users

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

How big is the global healthcare rcm outsourcing market?

The global healthcare RCM outsourcing market size was worth USD 21.12 billion in 2024.

Which region is growing the fastest in the global healthcare rcm outsourcing market?

The Asia-Pacific region is anticipated to grow the fastest in the global healthcare rcm outsourcing market.

Which segment by service type held the major share of the healthcare rcm outsourcing market?

Based on services, the back-end segment accounted for the leading share of the healthcare RCM outsourcing market.

Who are the leading players in the healthcare rcm outsourcing market?

Conifer Health Solutions, MedAssets, Parallon Business Solutions, Emdeon Business Services, McKesson, The SSI Group, GeBBS Healthcare, optum360, Change Healthcare (Emdeon), Cerner, Allscripts Healthcare, Athenahealth, Experian Information Solutions, Inc., Epic Systems Corporation, CareCloud Corporation, NXGN Management, LLC., Quest Diagnostics are some of the notable players in the healthcare RCM outsourcing market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]