Global Healthcare Interoperability Solutions Market Size, Share, Trends & Growth Forecast Report By Type, Level, Deployment, Application End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Healthcare Interoperability Solutions Market Size

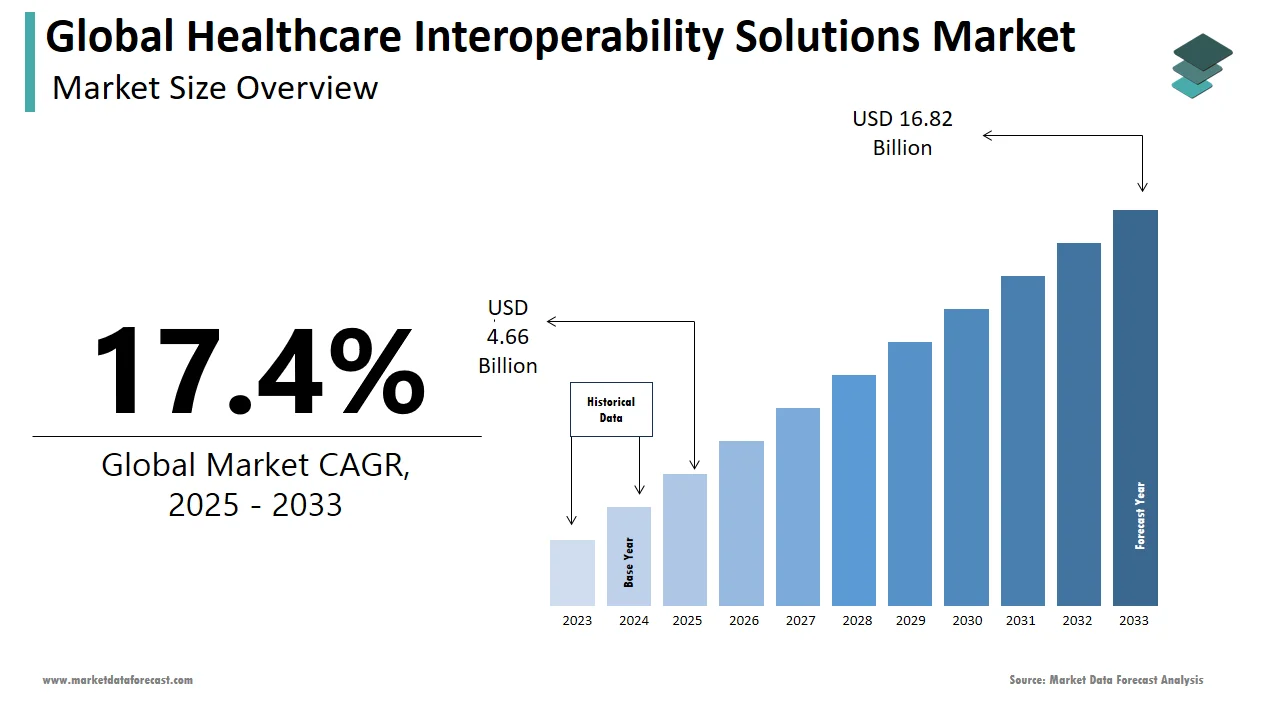

The global healthcare interoperability solutions market was worth US$ 3.97 billion in 2024 and is anticipated to reach a valuation of US$ 16.82 billion by 2033 from US$ 4.66 billion in 2025, and it is predicted to register a CAGR of 17.4% during the forecast period 2025-2033.

MARKET DRIVERS

The growing usage of integrated healthcare systems and rising penetration of digital technologies in the healthcare industry, including the adoption of cloud technology and AI technologies propel the growth of the healthcare interoperability solutions market. The enormous need for outsourcing solutions for operations such as pharmacy automation and electronic health records (EHR) to improve patient care and safety contributes to the market growth. Better care coordination and better patient outcomes are made possible by the deployment of integrated healthcare information systems to transfer patient data to healthcare providers. Communication between healthcare providers in transferring data is improved and lowered by interoperability solutions.

The growing number of initiatives from the governments of various countries in favor of healthcare interoperability solutions drive market growth. For the transmission of patient data to healthcare provider, the governments of various countries have established several norms and laws. Governments in various countries have provided funds and other incentives to entice healthcare organizations to use interoperability solutions. The market for interoperability solutions is also growing as a result of the increasing usage of telehealth and electronic health records on a global scale. For ease of communication among healthcare professionals, interoperability solutions are crucial in telehealth and electronic health records.

The rising demand for digital technologies and their acceptance in the healthcare sector supports the healthcare interoperability solutions market growth. Technologies such as artificial intelligence and machine learning have advanced quickly, and interoperability solutions are necessary to make these technologies function properly. Healthcare providers are driving market expansion by utilizing digital interoperability solutions, such as video conferencing, online counseling, online conversations, and interoperability software. These technologies can help to decrease redundant clinical interventions, such as imaging studies and lab orders, which fuel patient data security and improve clinical care by using pertinent clinical data. The government's introduction of numerous healthcare reforms has increased demand for the interoperability solution. The use of various technical tools helps to grow the market for healthcare interoperability solutions. Government support and the use of digital technologies aid in the effective deployment of healthcare interoperability solutions in the marketplace.

The rapid adoption of interoperability solutions by healthcare authorities, growing investments to upgrade healthcare facilities, favorable government initiatives to improve patient care, high government funding, advancement of software technology and a focus on patient-centric care to boost the market growth.

MARKET RESTRAINTS

Concerns regarding the security and privacy of patient health information, stringent regulations and compliance requirements primarily limit the adoption of interoperability solutions and hamper the market growth. Lack of standardization, complex IT infrastructure and high upfront costs associated with the implementation of healthcare interoperability solutions further hinder the market growth. Inadequate planning and strategic vision for interoperability and the shortage of trained personnel further limits the market’s growth rate.

Impact of COVID-19 on the Global Healthcare Interoperability Solutions Market

The COVID-19 pandemic situation has increased the need for interoperability solutions, and it has boosted the market's growth. During the COVID-19 pandemic, many people use digital technologies quickly due to social isolation, lockdown, and other restrictions, so the demand for technologies like telehealth for remote patient monitoring, electronic health records, and telemedicine platforms to provide remote care is heavily dependent on interoperability solutions. A wide range of digital tools was developed in response to the rise in demand for remote monitoring and counseling. During the crucial COVID-19 pandemic period, there is a great need for the rapid transfer of information to healthcare providers for treatment. The pandemic highlighted the value of telehealth as a dependable and scalable solution in times of medical emergency.

Due to the smooth transmission of patient data and the ability to track and analyze information about vaccination status, interoperability solutions like vaccine management also contribute to the market's growth. In pandemic situations, where digitalization is booming, this has a positive impact on the market for interoperability solutions. A favorable effect on the market for healthcare interoperability solutions for vaccination and antiviral medication research and development. Using interoperability solutions and other technologies is crucial for maintaining healthcare information.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

17.4% |

|

Segments Covered |

By Type, Level, Deployment, Application, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Koninklijke Philips NV, Allscripts Healthcare Solutions, Cerner Corporation, Inc., Capsule Technologies Inc., Orion Health Group Limited, NextGen Healthcare Inc., OSP Labs, Quality Systems, Inc., Ciox Health, ViSolve, Inc., Smith Medical, InterSystems Corporation, Optum Insights, Infor, Inc., Medicity, iNTERFACEWARE, Epic Systems Corporation, Jitterbit, and Others. |

SEGMENTAL ANALYSIS

By Type Insights

Based on type, the services segment is expected to account for the leading share of the global market during the forecast period owing to the growing complexity of healthcare IT systems and interoperability challenges requiring specialized consulting, implementation, and support services. The rising demand for expertise in system integration, interface development, and data mapping to ensure smooth interoperability between different healthcare applications and the increasing need for customization, configuration, and training services to optimize the use of interoperability solutions in specific healthcare environments further fuel the growth rate of the services segment in the global market. The growing importance of data governance, privacy, and security in healthcare data exchange drives the demand for consulting and compliance services and supports segmental growth. Ongoing maintenance, upgrades, and support requirements for healthcare interoperability solutions to ensure continuous and efficient data exchange further boost the growth rate of the services segment in the worldwide market.

The solutions segment is predicted to witness a healthy CAGR during the forecast period. Factors such as the growing demand for electronic health records (EHRs) integration and interoperability to enhance patient care and data exchange efficiency and rapid adoption of healthcare IT systems and platforms for seamless data exchange and integration across different healthcare settings primarily drive the solutions segment in the worldwide market. The growing need for real-time access to patient information, diagnostic data, and medical records to support clinical decision-making and improve patient outcomes, regulatory mandates and incentives promoting interoperability and data sharing among healthcare providers and increasing focus on population health management and the need for data integration to support coordinated care and analytics support the growth of the solutions segment in the global market.

By Level Insights

Based on the level, the structural segment held the largest share of the worldwide market in 2024 and the segmental domination is likely to continue during the forecast period. Advancements in interoperability standards, such as Health Level Seven International (HL7) and Fast Healthcare Interoperability Resources (FHIR) and the rising implementation of application programming interfaces (APIs) for secure data exchange, primarily drive the growth of the structural segment in the global market. Integration of healthcare systems and technologies, including electronic medical records (EMRs) and picture archiving and communication systems (PACS) and rising emphasis on data governance and privacy further boost the growth rate of the structural segment in the worldwide market.

By Deployment Insights

Based on deployment, the on-premises segment held the leading share of the global market in 2024 and is estimated to grow at a moderate CAGR during the forecast period. The compliance and security concerns that lead healthcare organizations to prefer maintaining control over their data within their own infrastructure is one of the key factors driving the growth of the on-premises segment. The integration possibilities of on-premises with existing legacy systems and infrastructure that cannot be easily migrated to the cloud is another major factor favoring segmental growth. Customization and tailored solutions required by organizations with specific data governance and regulatory requirements, reliability and high availability of data within the organization's premises further boost the growth rate of the on-premises segment in the global market.

The cloud-based segment is anticipated to grow at the fastest CAGR during the forecast period. The scalability and flexibility of cloud-based solutions enable seamless integration and interoperability across different healthcare systems and cost-effectiveness and reduced capital expenditure due to the elimination of infrastructure requirements drive the cloud-based segment in the worldwide market. Accessibility and availability of data from anywhere, anytime, promoting efficient healthcare delivery, rapid deployment and implementation that allow healthcare organizations to quickly adopt interoperability solutions further promote the growth of the cloud-based segment in the worldwide market.

By Application Insights

Based on the application, the diagnosis segment accounted for the largest share of the global market in 2024 and the segmental domination is anticipated to grow at a moderate CAGR during the forecast period.

The treatment segment is expected to register the fastest CAGR during the forecast period.

By End-User Insights

Based on the end user, the hospital segment led the market in 2024 and is estimated to hold a notable share of the global market during the forecast period. The growing adoption of electronic health records and health information exchange solutions to improve patient care, reduce errors, and enhance efficiency, the rising need for care coordination, and the growing focus on patient-centered care majorly propel the segmental growth.

The ambulatory surgical centers segment is expected to grow at a steady CAGR during the forecast period owing to the number of outpatient procedures due to their convenience and cost-effectiveness, rising need for efficient data management and increasing need for integration with hospital systems.

REGIONAL ANALYSIS

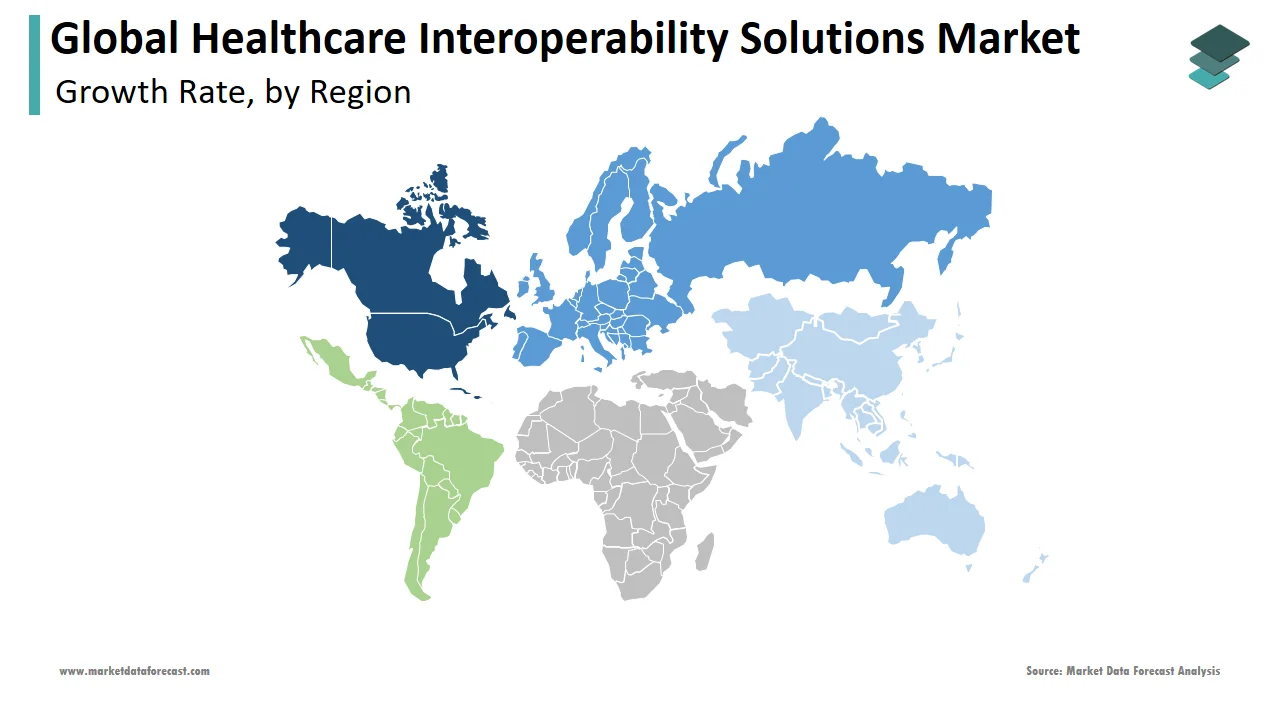

North America dominated the healthcare interoperability solutions market in 2024. The North American market is expected to grow at a prominent CAGR during the forecast period due to factors such as the rising adoption of electronic health records (EHRs) and health information exchange (HIE) solutions, an increasing number of government initiatives to promote interoperability and data sharing and rising demand for value-based care models. The U.S. accounted for the leading share of the North American market in 2024 and the domination of the U.S. is expected to continue throughout the forecast period. On the other hand, the Canadian market is estimated to register a healthy CAGR during the forecast period.

Europe is another major regional market for healthcare interoperability solutions worldwide and is expected to hold a substantial share of the global market during the forecast period. Factors such as the growing adoption of healthcare IT solutions, supportive government policies and regulations and the increasing need for data analytics and population health management primarily propel the European market growth. The UK and Germany are anticipated to control the major share of the European market during the forecast period.

APAC is the most lucrative regional market for healthcare interoperability solutions worldwide and is anticipated to register the fastest CAGR during the forecast period. The presence of a large population, rising burden of chronic diseases, growing investments in healthcare IT infrastructure and rising demand for telemedicine and remote patient monitoring solutions fuels the regional market growth. India, China and South Korea are expected to play a key role in the APAC market in the coming years.

Latin America had a considerable share of the global market in 2024 and is estimated to grow at a healthy CAGR in the coming years. The growing number of improvements in the healthcare infrastructure and investments in healthcare IT, rising demand for affordable and accessible healthcare solutions and increasing emphasis on improving patient outcomes and care quality majorly promote the Latin American market growth. Brazil and Mexico are predicted to occupy the leading share of the Latin American market during the forecast period.

MEA held a moderate share of the global market in 2024 and is projected to grow at a steady CAGR during the forecast period. The growing burden of chronic diseases, increasing healthcare expenditure and increasing number of initiatives by the governments of MEA countries to improve healthcare access and quality contributes to the MEA market growth.

KEY MARKET PARTICIPANTS

Some of the key players operating in the healthcare interoperability solutions market profiled in this report are Koninklijke Philips NV, Allscripts Healthcare Solutions, Cerner Corporation, Inc., Capsule Technologies Inc., Orion Health Group Limited, NextGen Healthcare Inc., OSP Labs, Quality Systems, Inc., Ciox Health, ViSolve, Inc., Smith Medical, InterSystems Corporation, Optum Insights, Infor, Inc., Medicity, iNTERFACEWARE, Epic Systems Corporation, Jitterbit, and many others.

RECENT MARKET DEVELOPMENTS

In November 2020, Google Cloud partners with Deloitte and KPMG to launch a healthcare interoperability platform designed to assist healthcare institutions in understanding the existing state of their data and where it remains, mapping a path to standardization and integration, and using data in a secure, accurate, and compliant manner.

MARKET SEGMENTATION

This research report on the global healthcare interoperability solutions market has been segmented and sub-segmented based on the type, level, deployment, application, end-user, and region.

By Type

- Solutions

- EHR Interoperability

- HIE Interoperability

- Enterprise Interoperability

- Others

- Services

By Level

- Foundational

- Structural

- Semantic

By Deployment

- Cloud-Based

- On-Premises

By Application

- Diagnosis

- Treatment

- Others

By End-User

- Hospitals

- Ambulatory Surgical Centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What are the key factors driving the growth of the healthcare interoperability solutions market?

The growing adoption of electronic health records (EHRs), the growing need to improve patient outcomes and reduce healthcare costs, and the rise of value-based care models are propelling the growth of the healthcare interoperability solutions market.

Which regions are leading the healthcare interoperability solutions market?

The healthcare interoperability solutions market is led by North America, with Europe and Asia-Pacific expected to show significant growth in the coming years.

What are some of the challenges faced by the healthcare interoperability solutions market?

The lack of standardization in healthcare data, data privacy and security concerns, and the need for interoperability between different healthcare systems and applications are some of the key challenges to the healthcare interoperability solutions market.

Who are some of the key players in the healthcare interoperability solutions market?

Cerner Corporation, Allscripts Healthcare Solutions, Inc., Epic Systems Corporation, IBM Corporation, and InterSystems Corporation are some of the notable companies in the healthcare interoperability solutions market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]