Global Healthcare Equipment Leasing Market Size, Share, Trends & Growth Forecast Report By Product, End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Healthcare Equipment Leasing Market Size

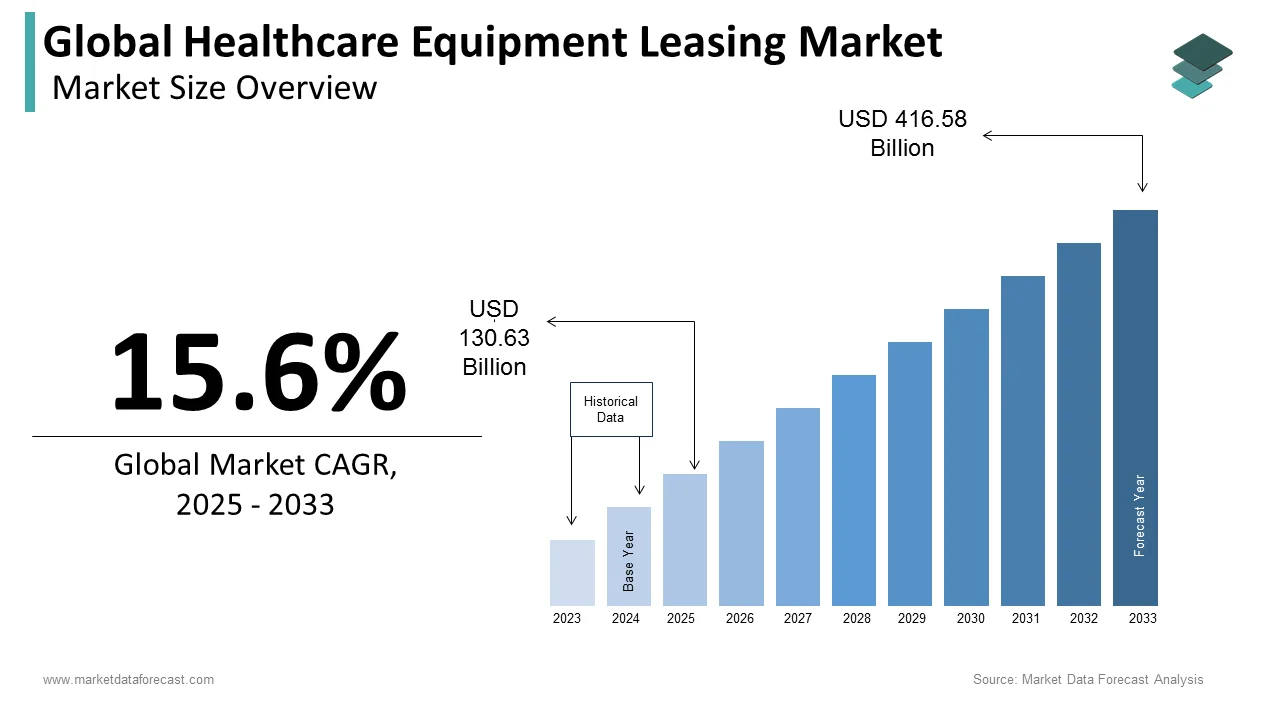

The size of the global healthcare equipment leasing market was worth USD 113 billion in 2024. The global market is anticipated to grow at a CAGR of 15.6% from 2025 to 2033 and be worth USD 416.58 billion by 2033 from USD 130.63 billion in 2025.

Healthcare equipment leasing is a contract under which the equipment manufacturer permits hospitals and other healthcare facilities to use medical devices for a set amount of time in return for a certain sum. Medical devices such as an x-ray machine, MRI, surgical equipment, home healthcare equipment, and diagnostic imaging are needed in all hospitals. If they wish to serve patients, they must provide this equipment, but they will not obtain it due to unforeseen conditions. Leasing medical devices are the safest option in this situation.The key advantage of leasing healthcare equipment is that constant innovation necessitates improved technologies, and leasing equipment provides the opportunity to substitute outdated technology with new or updated technology. Furthermore, healthcare equipment leasing provides a comparative edge that may aid in keeping up with the most recent developments in equipment and technology. Again, after the agreement expires, the facility has the option of returning the leased equipment, purchasing it, or continuing the contract. Patient care is also improved by removing outdated equipment as soon as possible and reducing the risk to the healthcare facility.

MARKET DRIVERS

Cost efficiency is one of the major drivers for the global healthcare equipment leasing market growth.

The primary driver of the healthcare equipment leasing industry is cost efficiency. Many hospitals are under pressure to balance their budgets, so healthcare equipment leasing plays a vital role in ensuring that hospitals have enough of the necessary equipment to treat patients. Since this healthcare equipment lease process requires monthly payments, it relieves pressure on current budgets. The corporation could save money by avoiding big one-time payments, which would help value estimation and supply chain processes. Furthermore, certain leasing deals cover repair and maintenance costs, meaning users won't have to think about paying those out-of-pocket expenses. Furthermore, many small hospitals cannot afford to purchase equipment that requires spending the whole cost of medical equipment at once. These hospitals requested that specialized devices be leased. Furthermore, leasing equipment can be completed without a down payment and has a flexible repayment date. Another appealing aspect of medical equipment leasing is that the annual mortgage fees are set over the loan term. This removes all purchase-related inflation expenses as well as any unexpected increases in the expense of the equipment. Many of these cost-effective advantages raise the healthcare equipment leasing industry.

The tax benefits associated with leasing healthcare equipment are further fuelling the market's growth rate.

The demand for leasing options grows even further as a result of the simple tax return program. Lease fees should be considered as an expense rather than a fixed gain as depreciating equipment. Lease fees are entirely tax-deductible against taxes as paid, which encourages the use of leasing equipment. Furthermore, there are no upfront PST or GST charges for leases, and taxes are charged on individual monthly installments. Furthermore, fees for equipment leasing are called additional costs and are thus deductible from the company's net earnings under common law provisions. This gross benefit calculates the taxable part of revenue for corporate tax or income tax purposes. In other words, annual equipment leasing fees reduce the company's net earnings, lowering the corporation tax or income tax bill. Furthermore, since the corporation does not buy the rental equipment, it is not subject to Value Added Tax (VAT) on its purchase, although it will be added to the invoice.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, End Users, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Challenges, Opportunities, Challenges, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leader Profiled |

De Lage Landen International BV, National Technology Leasing Corporation |

SEGMENTAL ANALYSIS

By Product Insights

Based on the product, the durable medical equipment leasing segment is predicted to lead the global healthcare equipment leasing market during the forecast period. Increased demand for home care and high medical equipment expenses and the growing way to reduce healthcare expenses, growing handicapped population are driving the segment, resulting in increased demand for long-term care and personal mobility and safety devices. Some of the benefits of durable medical equipment (DME) rental companies include preventive maintenance, components replacement and engineer labor, uptime guarantee, and 24/7 call centers. As a result, the quality problems related to DME rental services are minimized by these offered services. Iron lungs, oxygen tents, nebulizers, continuous positive airway pressure (CPAP) devices, catheters, transfer benches, hospital beds, patient lifts, transfer or stretcher chairs, and wheelchairs are examples of durable medical equipment (DME). Renting innovative, durable medical equipment is a cost-effective way to stay up with evolving technology. Rising concerns about healthcare services and regulatory changes in the field are expected to boost the market.

By End-User Insights

Based on End-User, in 2020, the hospital segment had the highest revenue share in the market, owing to higher patient visitation than laboratories and institutions and an increasing need to keep up with technological advancements. The increased need for therapeutic and monitoring devices is also driving the segment. This need is due to global improvements in healthcare infrastructure and ongoing technical developments in durable medical equipment. Increased demand for rental equipment is driven by regulatory changes or initiatives implemented by hospitals for healthcare services. When buy or lease options are not available or permitted, hospitals, emergency rooms, and other healthcare providers need capital equipment on rent. The variety of rented or leased products reduces the impact of rising demand. Startup hospitals and medical facilities will continue to help the business in the future as they reclaim their position as the sector's largest customer group. An increase will aid this in new hospitals, medical facilities, and even individual medical practitioners.

REGIONAL ANALYSIS

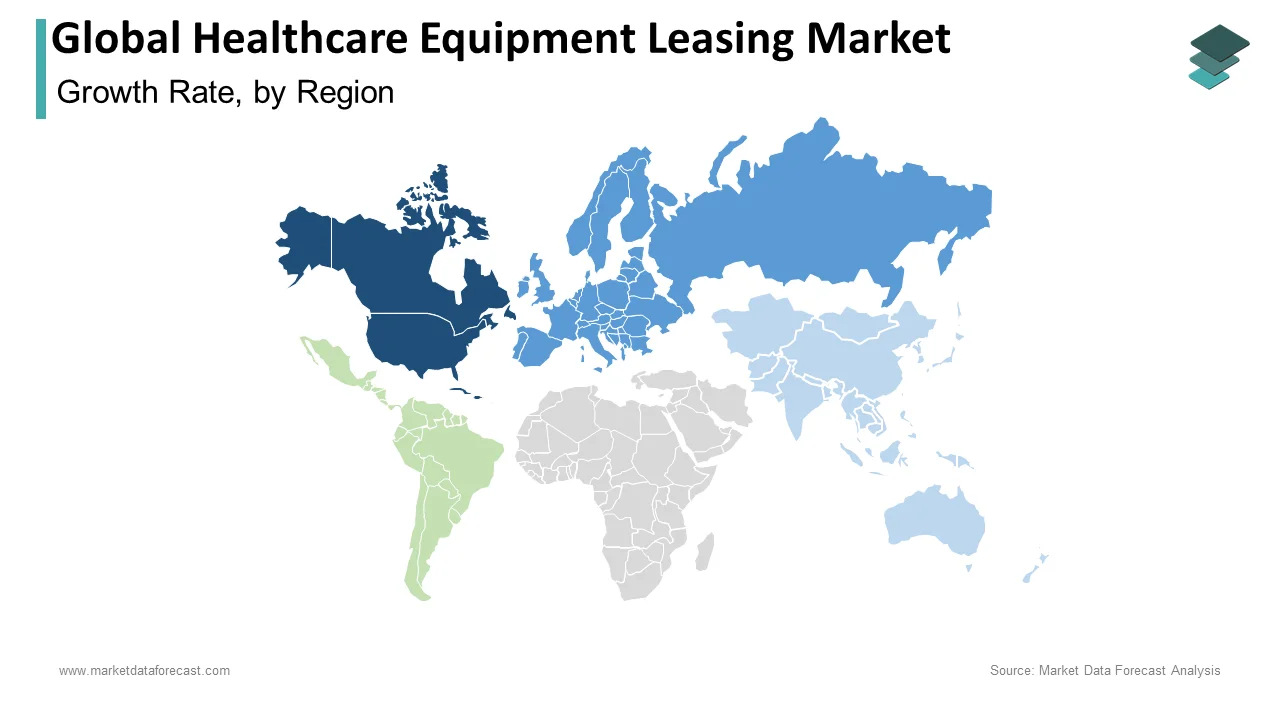

Based on the region, due to the rapid urbanization of medical equipment finance, North America is likely to lead the global healthcare equipment leasing market. The region's healthcare equipment leasing market may also be fueled by expanding demand for diagnostic procedures for detecting diseases, developing healthcare and pharmaceutical businesses, and a growing population. As a result, North America led the DME (Durable Medical Equipment) rental market in 2020, accounting for the most revenue. The region's market growth is expected to be aided by the recent economic slump and high prevalence of lifestyle-related diseases.

During the next few years, Asia Pacific is expected to have the highest CAGR. Increasing the older population base and developing consistent government operations in emerging countries are critical development boosters for the regional market's development.

In terms of revenue, the region was followed by Europe in 2020. Educational institutions and research labs anticipate reduced operations and purchase costs, promoting greater use of rental equipment overall. In these regions, a large geriatric patient population is predicted to fuel significant market growth and a greater incidence of chronic medical disorders such as high blood pressure, diabetes, CVDs, and respiratory diseases.

MARKET KEY PLAYERS

Some of the key players operating in the global healthcare equipment leasing market covered in this report are De Lage Landen International BV, National Technology Leasing Corporation, Rotech Healthcare, Inc., GE Capital, Oak Leasing Ltd., Siemens Financial Services GmbH, Hill-Rom Holdings Inc., Stryker Corp., Tokyo Century Corp, The Blackstone Group Inc., Agfa-Gevaert NV, and Teachers Insurance and Annuity Association of America.Some of the operating players are working on partnership strategies to share technology or to support business.

RECENT MARKET HAPPENINGS

- On 10 May 2021, Kontrol Technologies Corp. has announced a partnership with RCAP Leasing, a leading Canadian lending firm, to provide lease loan solutions to customers of BioCloud, a real-time analyzer developed to identify airborne viruses.

- Some are working on an acquisition strategy to expand their business. Such as, on 16 November 2018, TIAA Bank announced the purchase of a $1.5 billion portfolio of GE Capital's Healthcare Equipment Finance (HEF) business's healthcare equipment leases and loans. This greatly extends TIAA Bank's commercial banking market and strengthens its capacity to offer a wide range of financial options to institutional customers and support a much larger number of healthcare providers.

MARKET SEGMENTATION

This research report on the global healthcare equipment leasing market has been segmented and sub-segmented based on product, end-users, and region.

By Product

- Durable Medical Equipment (DME) Leasing

- Surgery & Therapy Equipment Leasing

- Personal & Home Care Equipment Leasing

- Others

By End-User

- Hospitals

- Diagnostic Centers

- Clinics

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

Who are the key players in the healthcare equipment leasing market?

Some key players include GE Healthcare Finance Services, Siemens Financial Services, and Philips Medical Capital.

What factors are driving the growth of the healthcare equipment leasing market?

The growth of the healthcare equipment leasing market is being driven by factors such as rising healthcare costs, the need for advanced medical equipment and technology, and the trend towards value-based care.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]