Global Healthcare Cybersecurity Market Size, Share, Trends & Growth Forecast Report By Type(Ransomware Malware and spyware, Distributed Denial of Services (DDoS), Phishing and spear-phishing), Security Type, End-users and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Healthcare Cybersecurity Market Size

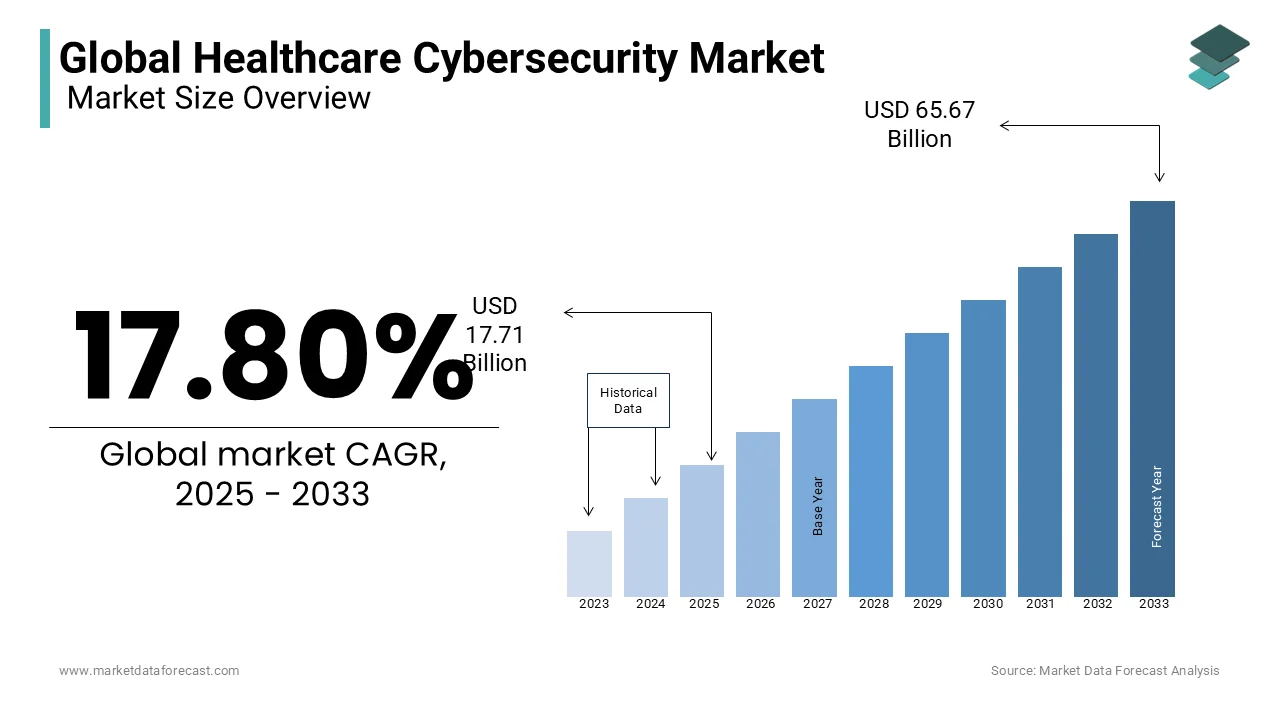

The size of the global healthcare cybersecurity market was worth USD 15.03 billion in 2024. The global market is anticipated to grow at a CAGR of 17.80% from 2025 to 2033 and be worth USD 65.67 billion by 2033 from USD 17.71 billion in 2025.

Shifting trend towards the digitalization in the healthcare has exposed the sector to an increasing number of online threats such as ransomware, phishing and data breaches and health management made up 25.4 per cent of cyber incidents around the world in 2023, as per the Ponemon Institute.

Moreover, stringent regulations like HIPAA and GDPR are pushing organizations to adopt innovative solutions like AI-driven risk detection and zero-trust frameworks. However, some of the barriers comprising constrained budgets and a shortage of skilled experts continue to impede progress. The efforts to safegurd patient information and maintain uninterrupted services are driving market growth and this is because stakeholders prioritize protection against evolving dangers. In addition, greater awareness and technological breakthroughs positions this market for sustained expansion in the years to come by addressing the important need for robust cybersecurity in the medical services domain.

MARKET DRIVERS

The growing healthcare data worldwide and the increasing number of cyberattacks in the healthcare industry propel the global healthcare cybersecurity market growth.

The healthcare industry is responsible for 30% of the data being generated worldwide across all industries on a daily basis and this industry has also been experiencing numerous cyber-attacks and data theft incidents every year, which has fuelled the need for healthcare cybersecurity solutions. According to the data published by the U.S. Department of Health and Human Services report, 45 million in 2021, 34 million in 2020 and 14 million in 2018 were impacted by healthcare cyber-attacks. According to the Data Breach Barometer report, there were 31,611,235 healthcare records exposed in 2019; it is double compared to 2018. Due to such incidents, the healthcare industry has been facing severe financial damage and considering the same, several healthcare organizations have been using cybersecurity solutions to protect PII, PHI, and other essential data adhering to primary security criteria and HIPAA compliance guidelines for the improvement of best practices to be followed with security audits. These include secure communication, data protection, authentication, and authorization, and staff security training. To prevent unauthorized data access and modification, communication across devices and services is secured, called secure communication. Data Protection involves storing data encryption to prevent data breach attacks. Restricted Network Access and its control are installed by appropriate organizational authorities to protect system services, Network access, and applications. Authentication and Authorization are implementing a firm password policy for a robust and secure authentication process that helps restrict access without proper authentication. Staff Security Training involves updating systems and services for fixed vulnerabilities and training and education for Cybersecurity for all staff responsible for protecting patient data.

The growing number of cybercrime cases in the healthcare sector, such as data stealing, mining, and thefts are further promoting the growth of the healthcare cybersecurity market.

An estimated 847,376 cybercrime cases were registered in 2021, which is 7% up from 2020, according to the FBI's Internet Crime Report 2021. Government initiatives to help cybersecurity systems and tighten them play an essential role in promoting the market's growth rate. Ransomware and malware are frequently heard in medical data thefts and hacking. Basic security controls like event response systems, data loss prevention, antivirus, mobile device management, data recovery, backup, email gateway, security awareness, same encryption, firewall, etc., help improve Cybersecurity in healthcare. Advanced security controls such as network fragmentation, business continuity, anti-theft devices, disaster recovery programs, connection testing, digital forensics, and others are much more advanced in helping the healthcare sector improve Cybersecurity. Hence, healthcare professionals have adopted upgraded cybersecurity systems, which augments market growth. In addition, the newly introduced telemedicine consulting and other online platforms for treating chronic disease patients are propelling the growth of the healthcare cybersecurity market.

In addition, stringent regulations for healthcare organizations for the protection of patient data, rising adoption of cloud computing in healthcare, and growing awareness among healthcare organizations regarding the importance of cyber security and the potential risks of cyber-attacks fuel the market’s growth rate. Furthermore, the rising adoption of electronic health records (EHRs) and telemedicine technologies, the growing volume of sensitive patient data and personal health information (PHI) stored electronically, the high cost of data breaches and reputational damage for healthcare organizations, the emergence of new threats such as ransomware, phishing, and social engineering attacks and the growing number of healthcare devices and Internet of Things (IoT) technologies support the growth rate of the healthcare cybersecurity market.

MARKET RESTRAINTS

Poor awareness among healthcare organizations regarding the potential benefits of healthcare cybersecurity in undeveloped and developing countries, the scarcity of skilled IT professionals, and the high costs associated with healthcare cybersecurity software majorly hamper the market's growth rate. In addition, poor support from government authorities in some countries, limited IT budgets and resources for cybersecurity in healthcare organizations, resistance to change and reluctance to adopt new cybersecurity technologies and solutions hinder market growth. Difficulty in keeping up with rapidly evolving cybersecurity threats and technologies and challenges in integrating cybersecurity with clinical workflows and processes further inhibit the growth rate of the healthcare cybersecurity market.

MARKET OPPORTUNITIES

Growing Adoption of IoT and Connected Medical Devices

The increasing integration of IoT and connected devices in clinical service and facilities presents significant opportunities for the expansion of the healthcare cybersecurity. Likewise, according to a survey 2023 by the Healthcare Information and Management Systems Society (HIMSS) revealed that 79 per cent of hospitals use at least 50 linked systems per facility. However, 57 per cent of these devices run on outdated software and thereby turning them susceptible to digital attacks. Networked equipment monitors critical wellness metrics that includes heart rates and glucose levels but their weaknesses pose risks to patient safety. By make sure of robust IT security protocols for IoT devices can protect patients and improve trust in advanced medical technologies.

Increasing Threat of Ransomware Attacks on Healthcare Systems

Ransomware attacks on medical centers have surged which affects one in three hospitals globally, revealed be a 2023 Ponemon Institute report. These attacks disrupt services and this leads to delays in treatment for 70.3 per cent of affected patients who are often with severe consequences for critical care. Additionally, stolen health records contain sensitive data that includes patient histories and financial information and fetch up to 250 dollars per entry on the dark web. Resolving the problem of ransomware threats with advanced cybersecurity systems ensures uninterrupted patient care and prevents financial and reputational damages for healthcare institutions.

MARKET CHALLENGES

Limited Cybersecurity Budgets

One of the key challenges in the healthcare cybersecurity market is insufficient budgets allocated to cybersecurity measures. According to a 2023 HIMSS survey, 60% of organizations in medical field spend less than 6 per cent of their IT budgets on online safety and it happened despite handling highly sensitive data. This underinvestment makes it tough to implement modern security solutions, train staff and stay updated with evolving or emerging dangers. Restricted locations usually force companies to depend on old systems an as a result of which increasing vulnerability to breaches. Mitigating this challenge requires prioritizing cyber defense as a core operational necessity rather than a secondary expense.

Shortage of Skilled Cybersecurity Professionals

The healthcare sector faces a critical shortage of proficient IT security expert and thus impacting its ability to respond to emerging threats. A 2022 report by (ISC) found a global scarcity of more than 3.4 million online security professionals and of which healthcare is being one of the most affected industries. This insufficiency hampers effective risk detection, incident response and system updates. Additionally, this industry’s reliance on legacy devices and instruments increases the complexity of protection management. Therefore, bridging this gap in skills through specialized training programs and collaborations with cybersecurity firms is essential to fortify the industry’s defenses.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Security, End-Users, And Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

McAfee, LLC, FireEye, Atos SE, Palo Alto Networks, Inc., Cisco Systems, Inc., Fortified Health Security, Lockheed Martin Corporation, Palo Alto Networks, Inc., Booz Allen Hamilton, Inc., and IBM Corporation. |

SEGMENTAL ANALYSIS

By Type Insights

The ransomware segment had the largest worldwide market share in 2024 and is expected to grow at a substantial CAGR during the forecast period. The increasing number of data breaches majorly drives the segmental growth and increasing awareness and preference of hackers for ransomware. The growing number of ransomware attacks and the impact of the COVID-19 pandemic further fuel the growth rate of the segment.

The malware and spyware segment is another promising segment among all and is predicted to witness a notable CAGR during the forecast period. The growing adoption of EHR and the increasing use of mobile devices in healthcare settings boost the segment's growth.

By Security Type Insights

The application security segment captured the largest share of the global healthcare security market in 2024 and is estimated to grow at a healthy CAGR during the forecast period. The segmental growth is majorly driven by the rising usage of software applications in healthcare organizations and growing investments by healthcare organizations in application security to safeguard their software applications from cyber-attacks.

On the other hand, the network security segment is expected to grow at a notable CAGR during the forecast period owing to the increasing threat of cyber-attacks targeting healthcare networks such as DDos and malware.

The cloud security segment is anticipated to witness a healthy growth rate during the forecast period. Factors such as the increasing adoption of cloud computing in healthcare organizations, the rising adoption of cloud computing in the healthcare industry and the increasing need among healthcare organizations to ensure that their cloud environments are secure in order to protect sensitive data are propelling the segmental growth.

By End Users Insights

The hospital segment held the leading share of the healthcare cybersecurity market in 2024 and is expected to grow rapidly during the forecast period. Hospitals collect and store sensitive data of their patients and due to this, hospitals have become a lucrative target to cybercriminals. The growing threat of cyber-attacks targeting healthcare organizations is one of the key factors propelling market growth.

REGIONAL ANALYSIS

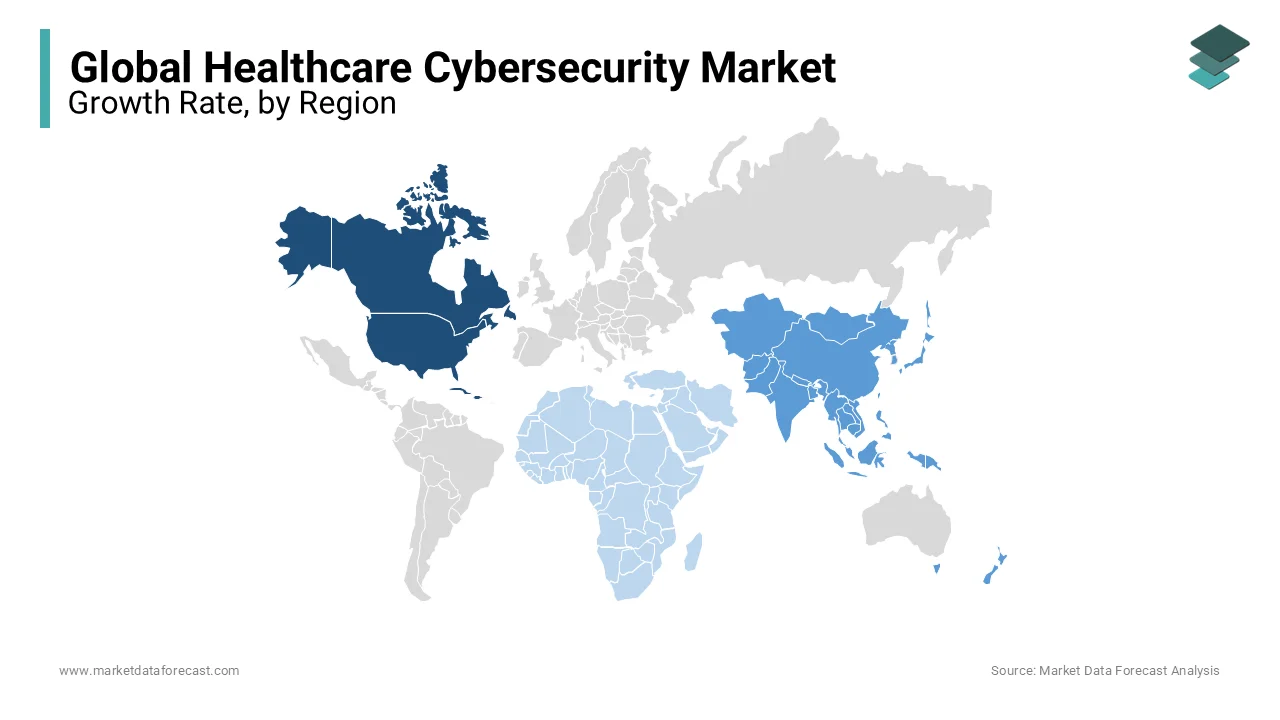

North America held the largest worldwide market share in 2024 and is expected to grow promisingly during the forecast period.

The growth of the North American market is majorly driven by the rapid adoption of digital transformation in the healthcare industry and the growing number of data breach cases. According to US data breaches and exposed records, there were 1473 data breaches, with over 164.68 million sensitive records exposed in 2019. The presence of key market participants in North America is further fuelling the growth rate of the North American market. Strict regulatory framework for data protection and privacy, such as HIPAA and HITECH Acts in the U.S. is another key factor boosting the North American market growth. The U.S. held the major share of the North American market, followed by Canada in 2023 and the same trend is anticipated to continue during the forecast period. Technological developments, the presence of sophisticated healthcare infrastructure, the growing number of initiatives by the North American governments in favor of healthcare cybersecurity, the rising usage of mHealth and the growing geriatric population worldwide support the growth rate of the North American market.

Asia-Pacific is expected to showcase the highest CAGR in the worldwide market during the forecast period. Factors such as a large population base and increasing healthcare expenditure in countries like China and India and rising adoption of digital healthcare systems and mobile health (mHealth) solutions majorly boost the regional market growth. In addition, rapidly evolving healthcare infrastructure and technological advancements, growing awareness about cybersecurity threats among healthcare organizations, and an increasing number of government initiatives for the digitalization of healthcare systems further fuel the growth rate of the APAC market during the forecast period. China held the largest share of the APAC market in 2024 and is expected to rise at a notable CAGR during the forecast period owing to the large patient population and increasing adoption of digital healthcare systems. On the other hand, India and Japan are predicted to grow at a healthy CAGR during the forecast period.

Europe held a substantial share of the global market in 2024 and is expected to grow at a prominent CAGR during the forecast period. The growth of the European market is driven by the stringent regulatory standards for data protection and privacy, such as the General Data Protection Regulation (GDPR), the rising adoption of electronic health records (EHRs) and digital healthcare systems, and an increasing number of cyber-attacks on healthcare systems and increasing awareness about cybersecurity among healthcare organizations. Factors such as the presence of major market players offering advanced cybersecurity solutions and growing investment in healthcare IT infrastructure by government and private entities further promote the growth rate of the European market. The UK captured the major share of the European healthcare cybersecurity market, followed by Germany and France in 2024.

Latin America is anticipated to project a steady CAGR during the forecast period. The rising demand for advanced healthcare services and adoption of digital healthcare systems, the growing number of cyber-attacks on healthcare systems and increasing healthcare expenditure and government initiatives for healthcare modernization majorly drive the Latin American market growth. Brazil had the leading share of the Latin American market in 2024.

The MEA had a moderate share of the worldwide market in 2024 and is expected to grow steadily during the forecast period owing to the rising adoption of digital healthcare systems and telemedicine solutions, growing healthcare expenditure and increasing number of government initiatives for healthcare modernization.

KEY MARKET PLAYERS

Some of the notable companies operating in the global healthcare cybersecurity market profiled in this report are McAfee, LLC, FireEye, Atos SE, Palo Alto Networks, Inc., Cisco Systems, Inc., Fortified Health Security, Lockheed Martin Corporation, Palo Alto Networks, Inc., Booz Allen Hamilton, Inc., and IBM Corporation.

RECENT HAPPENINGS IN THE MARKET

- In November 2022, the CEO of MedCrypt, Mike Kijewski, and a San Diego-based medical device cybersecurity software maker, launched MedCrypt, which is a Y Combinator graduate providing software for insulin pumps and heart rate monitors to radiology tools based on AI and autonomous robots, all the products for whom the FDA would consider as a medical device.

- In November 2022, the global leader in automated Cybersecurity, Forescout Technologies, Inc., Forescout Assist for OT/ICS, and Forescout Assist for Healthcare to enable IT security teams access to new threat detection. Organizations can gain seamless remote access to Forescout security experts with Forescout Assist, including data scientists, investigators, engineers, researchers, and threat hunters, to identify, prioritize and mitigate cyber threats.

- In 2020, GE Healthcare developed a new cybersecurity solution (skeye) to detect, analyze, and respond to cybersecurity threats in private and government hospitals. Also, this company offers 360-degree threat visibility and resolution to defend against vulnerabilities.

- In 2019, Atos launched its first comprehensive cybersecurity solution to manage security services, cloud security, and identity management in the healthcare sector. It offers almost 300 healthcare organizations across the US to adopt these strategies against cyber-attacks.

- In 2019, Mediate announced the expansion of clinical IoT and general IoT medical devices that enable accurate and comprehensive medical device management to protect from the risk of cyber-attacks.

MARKET SEGMENTATION

This research report on the global healthcare cybersecurity market has been segmented and sub-segmented based on type, security, end-users, and region.

By Type

- Ransomware

- Malware and spyware

- Distributed Denial of Services (DDoS)

- Phishing and spear-phishing

By Security Type

- Application Security

- Cloud Security

- Content Security

- Endpoint Security

- Network Security

- Wireless Security

- Other

By End Users

- Pharmaceutical Industries

- Biotechnology Industries

- Hospitals

- Medical Devices Companies

- Health Insurance Companies

- Other

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

which region accounted for the largest share in the global healthcare cybersecurity market ?

The healthcare cybersecurity market in North America is expected to grow significantly and hold the largest share of revenue during the forecast period.

who are the key players of the global healthcare cybersecurity market?

McAfee, LLC, FireEye, Atos SE, Palo Alto Networks, Inc., and Cisco Systems, Inc. are the key players in the global healthcare cybersecurity market.

what is the compound annual growth rate (CAGR%) of the healthcare cybersecurity market during the forecast period?

The global healthcare cybersecurity market is expected to grow at a CAGR of 17.80% during the forecast period.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]