Global Healthcare Contract Management Software Market Size, Share, Trends & Growth Forecast Report By Product & Service, End-Users and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Healthcare Contract Management Software Market Size

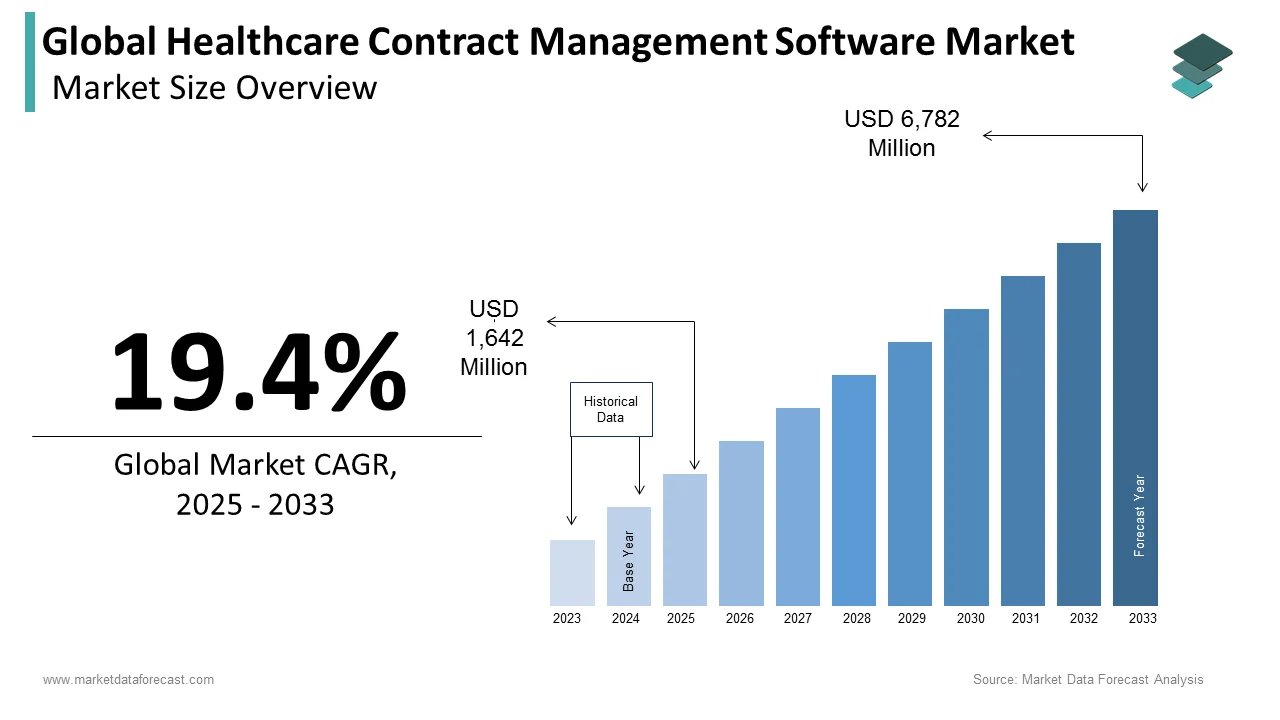

The size of the global healthcare contract management software market was worth USD 1,375 million in 2024. The global market is anticipated to grow at a CAGR of 19.4% from 2025 to 2033 and be worth USD 6,782 million by 2033 from USD 1,642 million in 2025.

Contract management is an important element of every company, and the healthcare business is no different. With ever-changing healthcare laws, hospitals and other healthcare providers must keep their budgets and operational expenses in check, particularly compliance-related expenditures. Starting with individual files and serving up notes, everything has to be handled with the utmost precision, including maintaining employee databases, supplier records, updating patient files, and maintaining employee databases. In addition, behind personnel expenditures, supply chain expenditures are the second greatest expense for these businesses. These costs are increasing at a higher rate than other operational costs; thus, businesses seek new and better methods to decrease or control their expenditure, including using a contract management system. The development and maintenance of contracts, Service Level Agreements (SLAs), and Procurement Master Agreements are managed by a Contract Management System (CMS), also known as Control Lifecycle Management.

Contact management software is used by legal teams, HR teams, sales teams, procurement teams, and procurement teams for hospitals, physician clinics, healthcare providers, healthcare payers, medical device manufacturers, pharma and & biotechnology companies, and research organizations. Some of the important elements of healthcare contract management software include utilizing healthcare contract management software to monitor conversations and innovations, to ensure that all employees are open to the standard rules and guidelines, to increase visibility and transparency, to enhance efficiency, accuracy, and accessibility by allowing relevant parties and individuals to access and review contracts from anywhere and at any time.

MARKET DRIVERS

The rising adoption of contract management systems is expected to drive the global healthcare contract management software market.

The key factor driving the healthcare contract management software market is the increased adoption of contract management systems. Today's healthcare professionals must navigate a plethora of contract formats. The numerous forms include physician and non-physician employment agreements, vendor contracts, equipment leasing and service contracts, pharmacy and research partnerships, and managed care. As a result, healthcare organizations aim to transition digitally to manage operations better, harness data for insights and compliance, increase operational proficiencies, and deal with various difficulties. As a result, the need for contract management processes grows, directly influencing how a healthcare organization operates. According to the most recent research, healthcare providers spend $157 billion on manual contract administration each year. Every healthcare business establishes contracts with different individuals/parties, and roughly % of these contracts are lost. This necessitates the implementation of an effective hospital contract management system. Only then will companies be able to deliver the greatest patient care, reduce operational costs, maintain regulatory compliance, limit risks, and others

Regulatory compliance in the healthcare sector further drives the healthcare contract management software market.

Another factor driving the healthcare contract management software market is the growing demand in the healthcare sector for regulatory compliance. Healthcare industries comply with government regulations like HIPAA, HITECH, Stark, False Claims Act, and Joint Commission (JACHO). Increased inspection of the healthcare business by compliance requirements necessitates using AI-based contract management software for healthcare enterprises to provide easy contract creation. Furthermore, tight privacy regulations are sensitive to health, medical treatments, and payments, as well as complicated paperwork. To remain compliant and competitive, these concerns must be addressed right away. Meaningful usage (MU) and the Health Insurance Portability and Accountability Act (HIPPA) also examine government requirements. MU supports the electronic communication of claims, patient information, and electronic records for patients and the HIPPA legislation, which focuses on safeguarding the privacy and security of health information, including in electronic health records (EHR). In addition, a Corporate Integrity Agreement is required by many healthcare firms. As part of a civil settlement, this document lays out the duties that each party agrees to. The presence of these regulatory authorities is driving market growth.

Technological advancement provides growth opportunities for the healthcare contract management software market.

However, technological breakthroughs such as machine learning and artificial intelligence allow the healthcare contract management software market to grow. However, numerous technological advancements like machine learning and artificial intelligence create development opportunities for the healthcare contract management software market. Machine learning and artificial intelligence (AI) aid in recognizing and interpreting clauses and other data. It may help businesses evaluate contracts faster, organize vast amounts of contract data more readily, aid in contract discussions, and improve the number of contracts they can negotiate and sign. Organizations will be able to adjust healthcare contract management software with the help of these solutions.

MARKET RESTRAINTS

Lack of experience and cyberattacks limit the healthcare contract management software market. The lack of in-house IT experience and healthcare providers' cyber-attacks on new contract management systems, on the other hand, are likely to limit the growth of the healthcare contract management software market.

SEGMENTAL ANALYSIS

Global Healthcare Contract Management Software Market Analysis By Product & Service

Due to the increasing development in the use of software in the contract lifecycle process, the software segment is expected to increase at the fastest CAGR throughout the forecast period. In the Software segment, the market for Contract lifecycle management is expected to develop at the fastest rate. The increased use of this segment in optimizing contract lifecycle procedures and preserving complicated contract documents in the contract repository for all contracts is attributed to its high growth. CLM (Contract lifecycle management) software helps lawyers find similar contracts in the library for reference, which may be read digitally in Microsoft Word, PowerPoint, and Excel formats. This helps reduce review time and allows businesses to find weaknesses in their systems. This software also improves the efficiency and transparency of reporting mechanisms and management controls, allowing businesses to ensure compliance with government regulations.

Global Healthcare Contract Management Software Market Analysis By End-User

During the forecast period, the market for healthcare payers is expected to develop at the fastest rate. The high growth rate of this segment can be attributed to the growing demand for healthcare payers to reduce regulatory compliance risks. Furthermore, contract management software is essential for healthcare payers since it aids them in efficiently processing claims.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

19.4% |

|

Segments Covered |

By Product & Service, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Icertis, Optum Inc., CobbleStone Software, ScienceSoft, Concord, Contract Logix LLC., Apttus Corporation, Determine Inc., Experian Plc., nthrive Inc., Coupa Software Inc., Volody, Mize, 2Agree, Jaggaer, IBM Corporation, Newgen Software Technologies Limited, and others., and Others. |

SEGMENTAL ANALYSIS

By Product & Service Insights

REGIONAL ANALYSIS

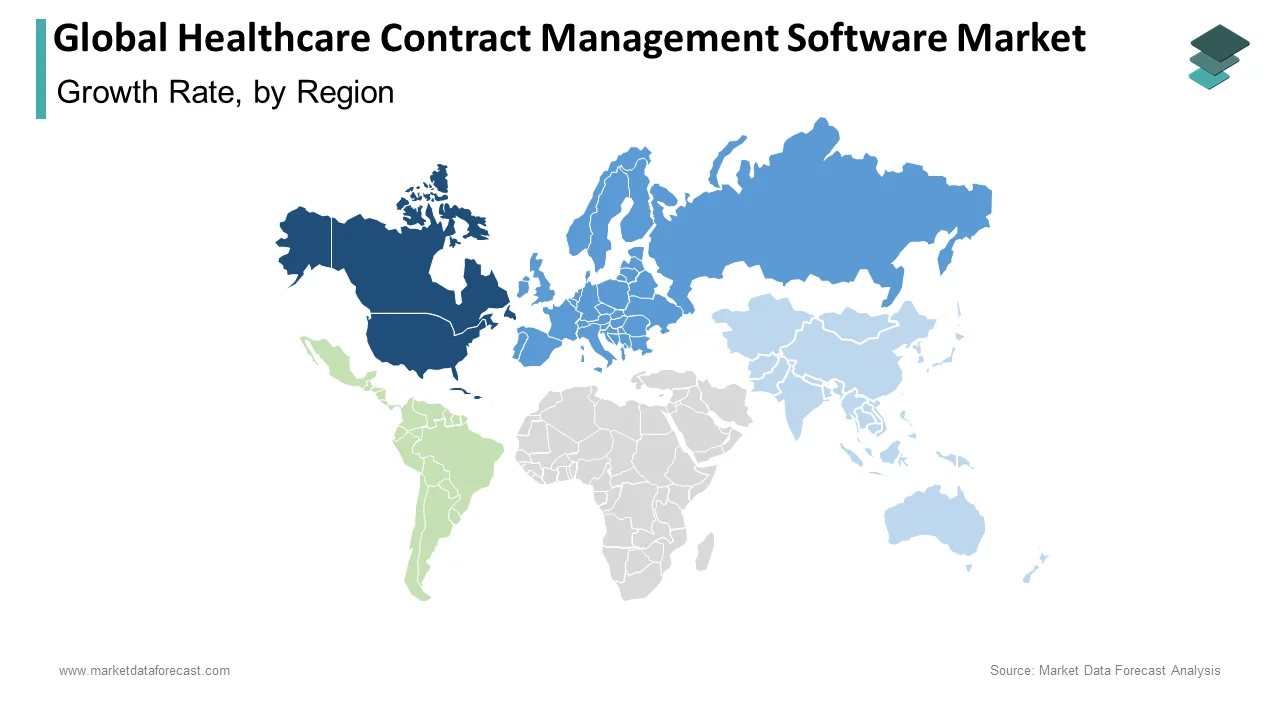

Due to the prevalence of improved healthcare facilities, favorable reimbursement rules, and the expansion of the insurance sector, North America is expected to dominate the global healthcare contract management software market during the forecast period. The presence of key players in the region, such as Coupa, Docusign, Icertis, Apttus, and Zycus, is a major driving force for the North American market's growth. Players in the contract management software market in this area invest heavily in research and development. In addition, organizations in North America are required to keep a detailed record of their contracts. The rise can be attributed to advantageous reimbursement policies, government mandates like Meaningful Use (MU), and the Health Insurance Portability and Accountability Act. MU supports the electronic exchange of claims, patient information, and electronic records for patients, which focuses on safeguarding the privacy and security of health information, including that included in electronic health records (EHR). As a result, these businesses may improve contract management transparency by creating clear policies and employing efficient contract management tools. Furthermore, favorable regulations such as the Health Insurance Portability and Accountability Act (HIPAA) encourage the region's use of contract management software.

During the forecast period, the healthcare contract management software market in APAC is predicted to develop at the fastest rate. Much of this development is driven by a growing need for comprehensive transparency, fast return on investment (ROI), and high levels of data security, as well as an increased requirement for effective contract administration software. Contract management software to handle patient contracts and patient transfer agreements are in great demand since a rising number of healthcare firms in Asia are actively working toward digitization to optimize their whole workflow and ensure patient care and safety.

KEY MARKET PLAYERS

Some of the promising companies operating in the global healthcare contract management software market analyzed in this report are Icertis, Optum Inc., CobbleStone Software, ScienceSoft, Concord, Contract Logix LLC., Apttus Corporation, Determine Inc., Experian Plc., nthrive Inc., Coupa Software Inc., Volody, Mize, 2Agree, Jaggaer, IBM Corporation, Newgen Software Technologies Limited, and others.

These players are involved in new product launches, strategic collaborations, and regional expansion.

RECENT MARKET HAPPENINGS

- In May 2021, Mitratech acquired ContractRoom, a contract lifecycle management (CLM) platform, to offer end-to-end contract services. Mitratech claims that this purchase would allow it to build on its point solutions and become a one-stop shop for contract lifecycle management (CLM).

- In July 2020, The LinkSquares Partner Program launched LinkSquares, the leading AI-powered contract administration and analysis platform.

MARKET SEGMENTATION

This research report on the global Healthcare Contract Management Software Market has been segmented and sub-segmented based on product & service, end-users, and region.

By Product & Service

- Software

- Contract Lifecycle Management

- Contract Repository/Document Management

- Services

- Support & Maintenance

- Implementation and Integration

- Training & Education

By End-User

- Healthcare Providers

- Hospitals

- Physician Clinics

- Other Healthcare Providers

- Healthcare Payers

- Medical Device Manufacturers and Pharma & Biotechnology Companies

- Research Organizations

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What is the CAGR of the healthcare contract management software market?

The global healthcare contract management software market is estimated to witness a CAGR of 19.4% from 2025 to 2033.

What are the main drivers of the healthcare contract management software market?

The growing complexity of healthcare contracts, the need to improve compliance and reduce risk, the growing adoption of electronic health records, and the desire to optimize contract performance and reduce costs majorly boost the growth rate of the healthcare contract management software market.

What are some challenges faced by the healthcare contract management software market?

The complexity of healthcare contracts, the need for integration with other systems, the cost and time required for implementation and training, and the need for customization to meet the specific needs of healthcare organizations are primarily challenging the growth of the healthcare contract management software market.

What are some of the key players in the healthcare contract management software market?

Concord, Experian Health, Icertis, nThrive, Onit, and Optum are some of the noteworthy players in the healthcare contract management software market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]