Global Healthcare Cold Chain Logistics Market Size, Share, Trends & Growth Forecast Report By Product, Services, Storage Techniques and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Healthcare Cold Chain Logistics Market Size

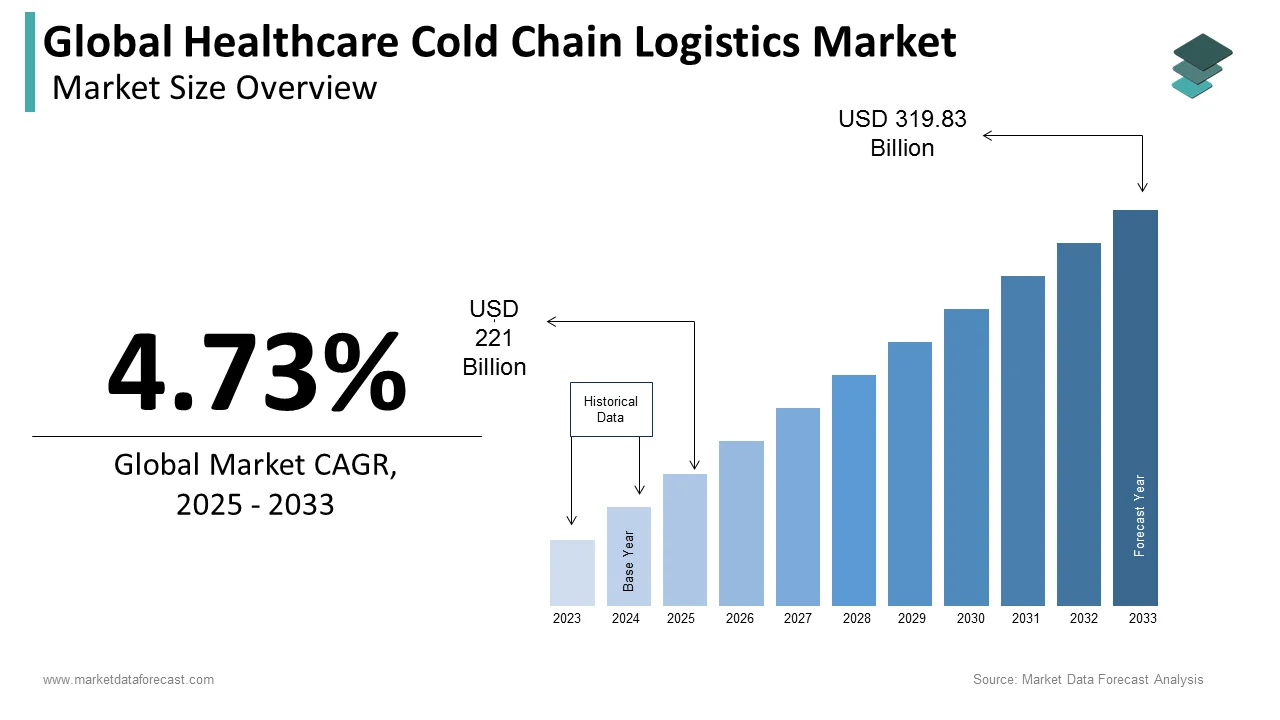

The size of the global healthcare cold chain logistics market was worth USD 211 billion in 2024. The global market is anticipated to grow at a CAGR of 4.73% from 2025 to 2033 and be worth USD 319.83 billion by 2033 from USD 221 billion in 2025.

The cold chain is a network of cold stores, freezers, and cold boxes arranged and managed to keep healthcare goods intact during delivery, storage, and shipment from the factory to the point of use. Vaccines, biologics, oncology drugs, certain forms of insulin, and other medications are among the products used in healthcare for cold chain logistics. Most cold chain products must be stored between 2 and 8 degrees Celsius, while frozen products must be kept below 10 degrees Celsius.

The cold chain logistics store healthcare supplies at the proper temperature range during warehouse storage and transport, package and ship according to recommended protocols, maintain recommended cold chain conditions in the supply chain, and store and treat properly at point of care locations. In addition, there is a growing need for all types of medications that aid in treating an increasing number of chronic and lifestyle-related diseases. These medications use cold chain logistics to ensure safe distribution to patients.

MARKET DRIVERS

Rising adoption by pharmaceutical companies is predicted to drive the global healthcare cold chain logistic market.

The rising acceptance of pharmaceuticals is a major factor driving the growth of the healthcare cold chain market. Pharmaceutical companies are developing novel therapies, approaches, and drugs to combat the growing prevalence of chronic and lifestyle-related diseases. Since the last few decades, cellular therapies, biomarker imaging, and regenerative medicines have been requested, necessitating effective temperature and time regulation. Temperature excursions are critical for pharmaceutical drugs because they require temperature-controlled storage and delivery to preserve potency and other properties. Furthermore, cold chain management significantly advances temperature sensors, data loggers, telematics, and cloud storage applications. These allow track and trace and real-time remote temperature control safety aspects critical to the pharmaceutical industry.

Moreover, quality assurance of pharmaceutical products raises the need for cold chain logistics, as this cold chain logistics assures that pharmaceutical products work properly. For example, if defective biologics are injected into patients, they will cause side effects; therefore, major regulatory bodies such as Good Distribution Practices enforce temperature rules for most pharma drugs to ensure patient safety and effectiveness. As a result, the pharmaceutical industry is increasing its use of cold-chain logistics.

Technological advances propel the healthcare cold chain logistics market further.

Because of technological innovation, the healthcare sector has grown enormously over the past two decades. Cutting – edge technological raises market revenue from R & D and delivery of healthcare goods. Cold chain logistics is now being boosted by recent developments in temperature control and data recording, which have the ability to preserve the value of healthcare goods, reduce pollution, save resources, and improve health and safety. Furthermore, next-generation monitoring technology improves transparency and protection. It can potentially interfere with a package that requires urgent maintenance or redirection to avoid an excursion caused by delay, package integrity, or other factors. The recently improved monitoring technologies, such as augmented GPS (Bluetooth, WiFi, IoT), next-generation data loggers, and upgraded applications, allow quicker, more precise transparency in transporting pharmaceutical goods.

Furthermore, most carriers now have the ability to remotely monitor the temperature of shipments to ensure that it remains within reasonable limits. IoT has also advanced the healthcare cold chain logistics market; IoT devices in trucks and warehouses allow remote temperature control and automated warnings when temperatures reach dangerous thresholds. These technological solutions help to reduce the substantial risk of product loss due to temperature variations and cooling system malfunctions.

Impact of COVID–19 on the global Healthcare cold chain Logistics Market

COVID-19 has hampered the global healthcare industry, and the country is in its toughest era, with economic slowdowns. COVID-19 placed a lockout and social distancing, resulting in the closure of industrial and operating facilities. This results in a decrease in the supply chain model. The coronavirus situation widens the divide between demand and supply, straining the healthcare cold chain logistics industry. On the other hand, as the number of cases grows, so does the demand for medications. This growing market raises the demand for cold chain logistics. Furthermore, the leading COVID-19 vaccine candidates are known as “cold chain” drugs, which necessitate complex packaging and transportation requirements from the time they leave a manufacturer's facility before they meet a healthcare provider or patient at the point of administration or dispensation.

The experience of distributors in shipping cold chain goods and other specialty therapies would be crucial in supplying COVID-19 vaccines. Distributors are prepared to protect the integrity of pioneering COVID-19 therapies thanks to industry investments in cutting-edge, temperature-controlled supply chain protocols. Furthermore, governments and organizations are assisting in distributing the Covid-19 vaccine by funding cold chain logistics. For example, the Indian government has budgeted over Rs 35,000 crore for the COVID-19 vaccine and its delivery, which would provide a big boost to the Indian market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.73% |

|

Segments Covered |

By Product, Services, Storage Techniques, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

American Airlines, Inc., DB Schenker, FedEx Corporation, Marken Ltd., AmerisourceBergen Corporation, Continental Carbon Company, DHL International GmbH, KUEHNE + NAGEL, Cavalier Logistics, and Others. |

SEGMENTAL ANALYSIS

By Product Insights

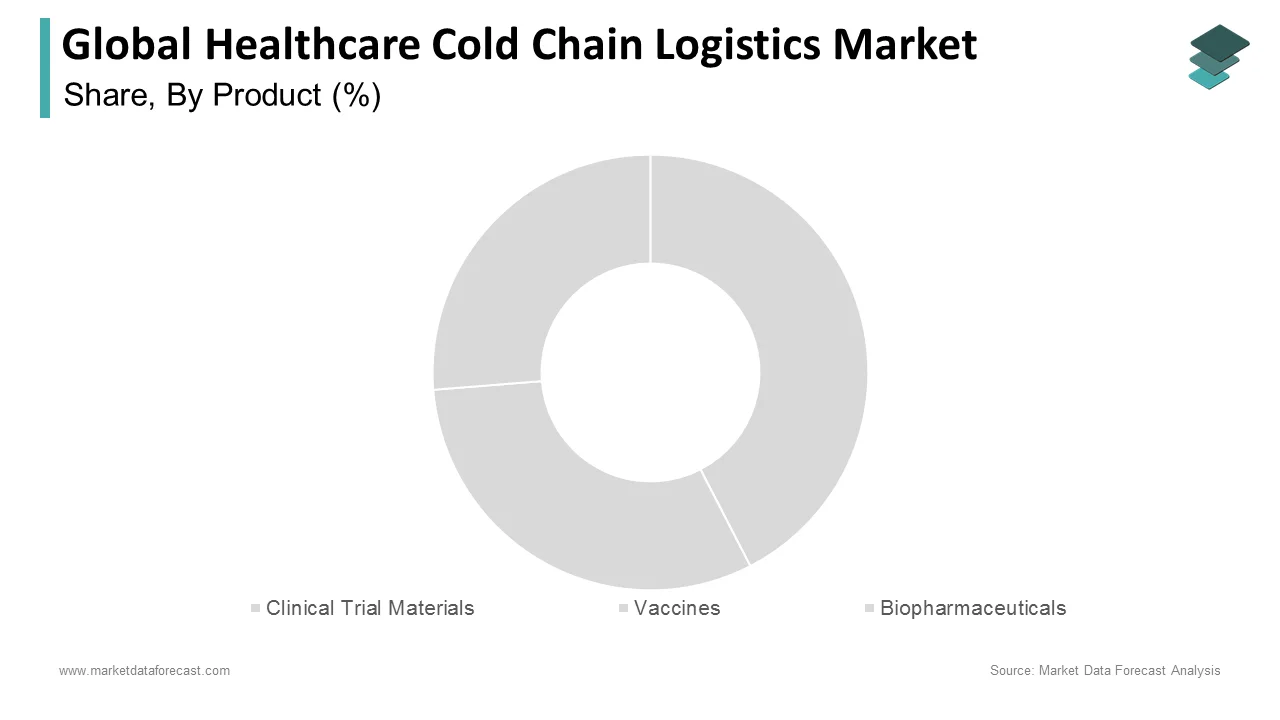

Based on Product, the Vaccination segment holds the majority of market value. In 2022, the segment was valued at USD 4 billion in the healthcare cold chain logistics industry. Pharmaceutical companies are primarily concerned with product quality and sensitivity. With more complex biological-based medications, shipments of hormone therapies, vaccinations, and complicated proteins that need cold chain refinements, cold chain logistics are becoming more important.

Meanwhile, by 2033, the Biopharmaceuticals segment will have the greatest CAGR and overtake the vaccines segment. Biopharmaceutical goods have grown at a far faster rate than small molecule medications (also known as chemical medications), and vaccines are why the total sales volume of temperature-controlled pharmaceutical goods is growing at the double the rate of the pharmaceutical sector as a whole.

By Services Insights

Based on the services, in 2024, the transportation segment is expected to be extremely profitable. By 2028, the segment is estimated to surpass a market valuation of USD 9.2 billion for healthcare cold chain logistics. In certain nations, it is believed that 80 percent of pharmaceuticals lose their potency due to insufficient temperature control during cold chain transportation. Even the smallest changes in temperature or storage conditions can compromise the integrity and viability of certain vaccinations. Refrigerated trucks, refrigerated railcars, refrigerated cargo, and air cargo are among the types of transportation used.

By Storage Techniques Insights

Based on the storage techniques, the Electrical Refrigeration segment holds the largest share of the market. Dozens of warehouses with cold chain systems are built to ensure that temperature-sensitive items are stored and transported in the best possible conditions. The vital links that the cold chain solutions system provides are critical to various export sectors. A single failure in the logistics network can result in catastrophic product and capital losses. Furthermore, online grocers are increasing their need for cold storage. The Pfizer-developed synthetic mRNA-based COVID vaccine (now the most promising candidate) must be kept at -70°C (-94°F) or below. This significantly complicates vaccine usage and delivery in temperate and equatorial climates, where distances between populous areas are great and suitable cold chain infrastructure is lacking.

REGIONAL ANALYSIS

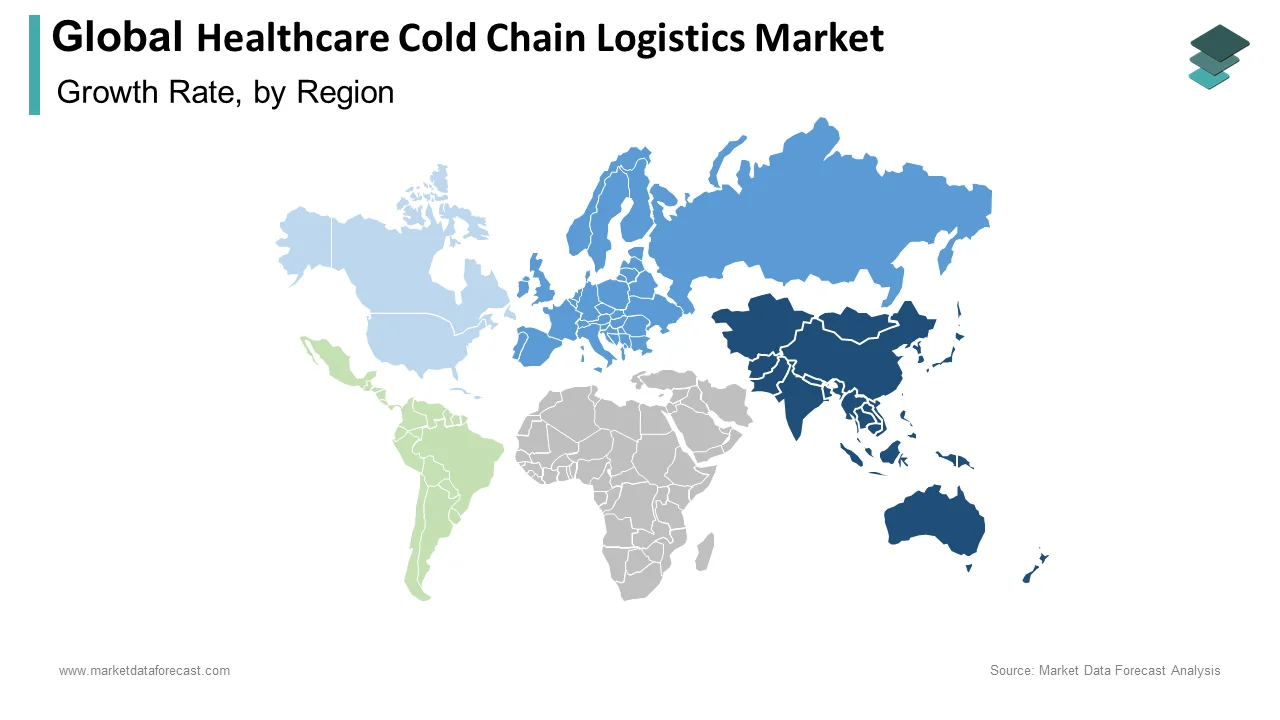

Based on region, the market for global healthcare cold chain logistics is dominated by the Americas. Factors such as the presence of a significant number of service providers and the existence of a major pharmaceutical manufacturing industry promote market growth in this region. Furthermore, online grocers are increasing their need for cold storage. Over the next five years, rising online grocery purchases in the United States are expected to increase demand for up to 100 million sq ft of cold storage space.

Developing countries such as India are likely to contribute to the growth of the healthcare cold logistics chain market in the Asia Pacific. This is due to the fact that these countries export a large number of pharmaceutical items to poor and rising countries to meet their healthcare demands. This necessitates a robust cold chain logistical system for the safe delivery of pharmaceutical products.

KEY MARKET PARTICIPANTS

Companies dominating the global healthcare cold chain logistic market profiled in this report are American Airlines, Inc., DB Schenker, FedEx Corporation, Marken Ltd., AmerisourceBergen Corporation, Continental Carbon Company, DHL International GmbH, KUEHNE + NAGEL, and Cavalier Logistics., and Others.

RECENT MARKET DEVELOPMENTS

- On 25 January 2021, Varcode, a supplier of automated, time- and temperature-sensitive supply chain systems, announces a strategic partnership with PL Developments (PLD), a maker, packager, and distributor of healthcare devices, to expand the reach and scope of Varcode's cold chain control technologies.

- On 7 April 2021, CEVA Logistics has launched a new sub-brand to further improve patient quality through the company's extensive healthcare logistics services. CEVA FOR PATIENTS also provides end-to-end logistics options to healthcare and pharmaceutical providers that put the customer at the forefront of the supply chain. The company is now launching a new temperature-sensitive logistics product as part of the suite of solutions, which will go into operation in the second quarter of 2021.

MARKET SEGMENTATION

This research report on the global healthcare cold chain logistics market has been segmented and sub-segmented based on product, services, storage techniques, and region.

By Product

- Clinical Trial Materials

- Vaccines

- Biopharmaceuticals

By Services

- Storage

- Transportation

- Packaging

- Others

By Storage Techniques

- Electrical Refrigeration

- Dry Ice

- Gel Packs

- Liquid nitrogen

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What is the growth rate of the healthcare cold chain logistics market?

The global healthcare cold chain logistics market is expected to grow at a CAGR of 4.73% from 2025 to 2033.

What are the main drivers of the healthcare cold chain logistics market?

The growing demand for biopharmaceutical products, the growing need for temperature-sensitive drug distribution, and the rising awareness among consumers about the importance of proper storage and transportation of temperature-sensitive drugs are majorly driving the growth of the healthcare cold chain logistics market.

What are some challenges faced by the healthcare cold chain logistics market?

The complexity of the supply chain, the high costs associated with temperature-controlled transportation and storage, the lack of standardization in the industry, and the need for specialized equipment and expertise are majorly challenging the growth of the healthcare cold chain logistics market.

What are some of the key players in the healthcare cold chain logistics market?

DHL, FedEx, UPS, AmerisourceBergen, Cardinal Health, and Kuehne + Nagel are some of the notable players in the healthcare cold chain logistics market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]