Global Healthcare BPO Market Size, Share, Trends & Growth Forecast Report – Segmented By Provider Service (Medical Billing, Medical Coding, Medical Transcription and Finance & Accounts), Payer Service (Claims Management, Integrated Front-end Services and Back-office Operations, Member Management, Provider Management, Billing and Accounts Management, Analytics and Fraud Management and H.R. Services), Pharmaceutical Service (Research and Development, Manufacturing and Non-clinical Services) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2025 to 2033)

Global Healthcare BPO Market Size

The global healthcare bpo market size was valued at USD 280.15 billion in 2024. The healthcare bpo market size is expected to have 9.81% CAGR from 2025 to 2033 and be worth USD 650.38 billion by 2033 from USD 307.63 billion in 2025.

Although healthcare represents only 5-10% of the total BPO deals in the market, which is relatively low compared to other industries, such as banking, financial services, and manufacturing, the growth potential is high due to the growing demand for quality care. Healthcare Business process outsourcing can be defined as a strategy adopted by a healthcare company to grow its business by outsourcing tasks to another third-party company to reduce costs, active processing, and transactions.

MARKET DRIVERS

The growing healthcare administrative burdens are primarily promoting the healthcare BPO market growth worldwide.

An increasing number of people seeking insurance, the pressure to cut healthcare delivery costs, consolidation of the healthcare system, pharmaceutical companies facing patent cliffs, and the mandatory implementation of ICD-10 codes are the major factors fuelling the global healthcare BPO market. With the ever-growing demand for healthcare, the need for outsourcing the services is expected to provide niche opportunities for I.T. companies to poach upon.

The growing incidences of cardiovascular diseases are promoting the need for healthcare BPO services and boosting the global market growth.

For instance, according to WHO stats, cardiovascular diseases (CVDs) are the leading cause of death globally, taking an estimated 17.9 million lives each year, and emergency help services are significant factors driving the demand for the healthcare business process outsourcing (BPO) market. Furthermore, rising awareness of treatment procedures and services hospitals provide fuels the market's need. Besides, the Healthcare BPO Market is accelerated by growing prevalence to increase the performance and efficiency of hospital operational systems.

Furthermore, globally, the rising demand to minimize social-economic risks is likely to outshine the need for the healthcare BPO market. Increasing support from the government through investments and providing better quality treatment procedures is to surge growth opportunities for the healthcare BPO market. Furthermore, the availability of skilled operators in customer care services significantly influences the demand for the global healthcare BPO market. Additionally, during the pandemic, when emergency communication was severely required, BPOs were far-reaching agencies aiding support worldwide.

With the rising trend of virtual healthcare with the rapid advancement in healthcare software and I.T. sectors, along with advanced remote care facilities available to patients, there is an increasing need for 24/7 assistant services. In addition, the rising adoption of the Internet of Things (IoT) and AI advancements, especially in the post-COVID-19 era, are encouraging market advancement. Furthermore, increasing cloud-based systems and E-commerce websites built for better patient care are promoting the development of the industry. Additionally, rising investments from key market players in global sales and extension of business are helping the need for BPOs.

MARKET RESTRAINTS

The concerns about losing control over the outsourced process, doubts regarding service/product quality, and the threat to data security are factors limiting the growth of the global healthcare BPO market. Further, the cost of installing and maintaining the systems is comparatively high, restricting the market's demand. Rapid changes in economic strategies may also negatively impact the market's growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Provider Service, Payer Service, Pharmaceutical Service, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Leaders Profiled |

Cognizant Technology Solutions Corporation (U.S.), Accenture PLC (U.S.), Genpact Limited, Tata Consultancy Services Ltd. (India), Infosys BPO Ltd. (India), and Xerox Corporation (U.S.). |

SEGMENTAL ANALYSIS

By Provider Service Insights

The medical billing segment is expected to represent the largest share of the provider services segment in the current market scenario, owing to an increase in the number of people insured. In addition, the rapid adoption of telehealth services is escalating the growth rate of this segment. The medical coding segment is next to the medical billing segment holding the dominant market share. Increasing incidences of chronic diseases are leveling up the demand for this segment. The medical transcription segment is expected to have the fastest growth rate in the foreseen years. Growing awareness of the latest healthcare techniques boosts the market's growth rate. The finance & accounts segment will have prominent growth opportunities in the forecast period.

By Payer Service Insights

The claims management segment is held with the most significant shares due to the increasing number of patients adopting e-health services. In addition, growing chronic disease incidences are expanding the market's growth rate. The integrated front-end services and back-office operations segment will likely have the highest CAGR shortly, increasing prevalence to improve the quality of healthcare services through online consultancy. Member and provider management segments will have a significant growth rate in the forecast period. Rising support from the government and increasing telemedicine investments by private organizations are promoting market demand. Billing and accounts management is estimated to have an inclined growth rate in the coming years. The analytics and fraud management segment is to have the highest shares in the foreseen years, with the increasing cyber-attacks and growing concerns towards privacy policies fuelling the growth rate of this segment. The H.R. services segment is projected to have a slow growth rate.

By Pharmaceutical Service Insights

The segment of non-clinical is expected to account for the highest CAGR during the forecast period. In addition, factors like pricing pressure and the requirement of large field forces have further contributed to the emergence of contract sales organizations in the pharmaceutical industry.

The research and development segment is forecasted to be growing at a significant rate during the forecast period. Increasing research and development activities with the growing prevalence of introducing quality drugs or vaccines propel the demand for this segment. Increasing COVID-19 cases is also one of the factors for the segment to grow during this period. The manufacturing segment is positioned second in leading the highest shares of the market. Growing demand to propel the production rate is evaluating the demand of this segment.

REGIONAL ANALYSIS

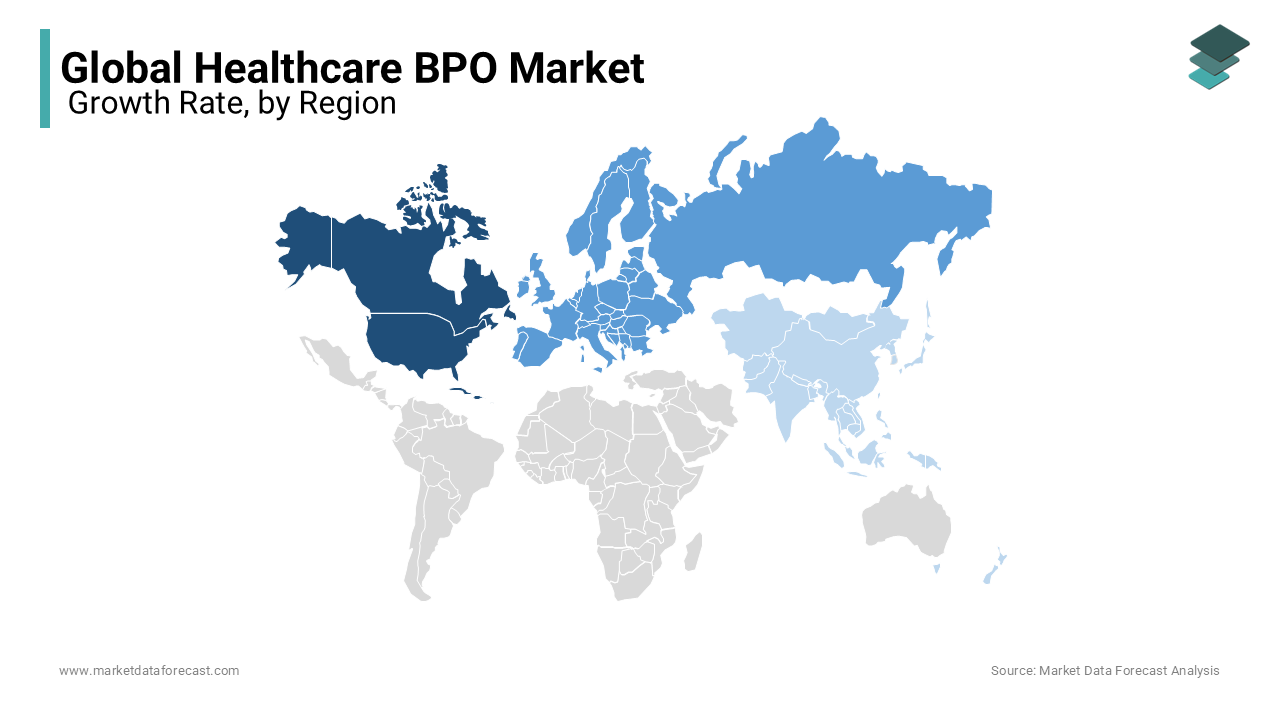

The North American region is dominating the global healthcare BPO market. It is likely to maintain the trend owing to the growing demand for I.T., big data, and cloud computing in healthcare, continually increasing pressure on healthcare firms to reduce costs, and changes in regulatory scenarios.

The European market has been growing tremendously over the past decade. Moreover, it has the same growth rate in foreseen years with the rise in the number of healthcare centers and increasing demand for analyzing finance and accounting services.

Asia Pacific will likely witness significant growth during the forecast period due to increasing healthcare expenditure, an excellent workforce, and resources in developing countries like India and China. The introduction of the APAC Act has dramatically wedged the U.S. healthcare payer market. As the act expanded insurance access to more than 35 million U.S. citizens, the rise in claims processing has led to the large-scale outsourcing of these services by payers.

The market in Middle East and Africa is inclined to have a steady CAGR during the forecast period.

KEY MARKET PLAYERS

Some of the notable companies playing a crucial role in the market of Healthcare BPO are Cognizant Technology Solutions Corporation (U.S.), Accenture PLC (U.S.), Genpact Limited, Tata Consultancy Services Ltd. (India), Infosys BPO Ltd. (India), and Xerox Corporation (U.S.).

RECENT HAPPENINGS IN THE MARKET

- In June 2024, Access Healthcare, a supplier of healthcare business process outsourcing (BPO) services, intends to invest 190 crores in expanding its delivery operations and establishing a new campus in Chennai. The business revealed on Tuesday that it had purchased a 1.57-acre block of land in Chennai for roughly 50 crore rupees from an I.T. services provider to build a new campus for its BPO and I.T. activities. In addition, the business announced that it would demolish the current building and construct a campus with a working capacity of 7,000 employees spread across about 2.5 lakh square feet.

- In October 2024, The CCI granted Betaine B.V. approval on Monday to purchase Hinduja Global Solutions Ltd.'s global healthcare BPO services. According to a release, the deal entails Betaine purchasing certain assets, contracts, and employees from Hinduja Global Solutions and their global healthcare business process outsourcing (BPO) services.

- In May 2024, In the upcoming 12 months, Omega Healthcare wants to hire 18,000 specialists as it expands its operations in India. According to the company's statement, the expansion is anticipated to include operations in Bangalore, Chennai, and Hyderabad. The process has already gotten thanks to the hiring of 4,500 professionals by the technology-enabled healthcare service provider over the next two months underway.

- In May 2024, Since COVID-19 was first announced in Jamaica, the Global Services Sector (GSS) has created 12 new sites, hired close to 10,000 more people, and raised earnings to more than US$850 million yearly. However, the business wants more, according to Gloria Henry, head of the Global Services Association of Jamaica (GSAJ). To provide more senior industry roles, the GSAJ collaborates with its partners in large-scale company operations.

MARKET SEGMENTATION

This research report on the global healthcare BPO market has been segmented based on the provider service, payer service, pharmaceutical service, and region.

By Provider Service

- Medical Billing

- Medical Coding

- Medical Transcription

- Finance & Accounts

By Payer Service

- Claims Management

- Integrated Front-end Services and Back-office Operations

- Member Management

- Provider Management

- Billing and Accounts Management

- Analytics and Fraud Management

- H.R. Services

By Pharmaceutical Service

- Research and Development

- Manufacturing

- Non-clinical Services

- Sales and Marketing services

- Supply Chain Management

- Other Non-Clinical Applications

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which region is growing the fastest in the global healthcare BPO market?

Geographically, the North American healthcare BPO market accounted for the largest share of the global market in 2024.

At What CAGR, the global healthcare BPO market is expected to grow from 2024 to 2033?

The global healthcare BPO market is estimated to grow at a CAGR of 9.81% from 2024 to 2033.

Which are the significant players operating in the global healthcare BPO market?

Cognizant Technology Solutions Corporation (U.S.), Accenture PLC (U.S.), Genpact Limited, Tata Consultancy Services Ltd. (India), Infosys BPO Ltd. (India), and Xerox Corporation (U.S.) are some of the significant players operating the global healthcare BPO market

How much is the global healthcare BPO market going to be worth by 2033?

As per our research report, the global healthcare BPO market size is projected to be USD 650.38 billion by 2033.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]