Global Healthcare Biometrics Market Size, Share, Trends & Growth Forecast Report By Technology, Application, End-user, and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Healthcare Biometrics Market Size

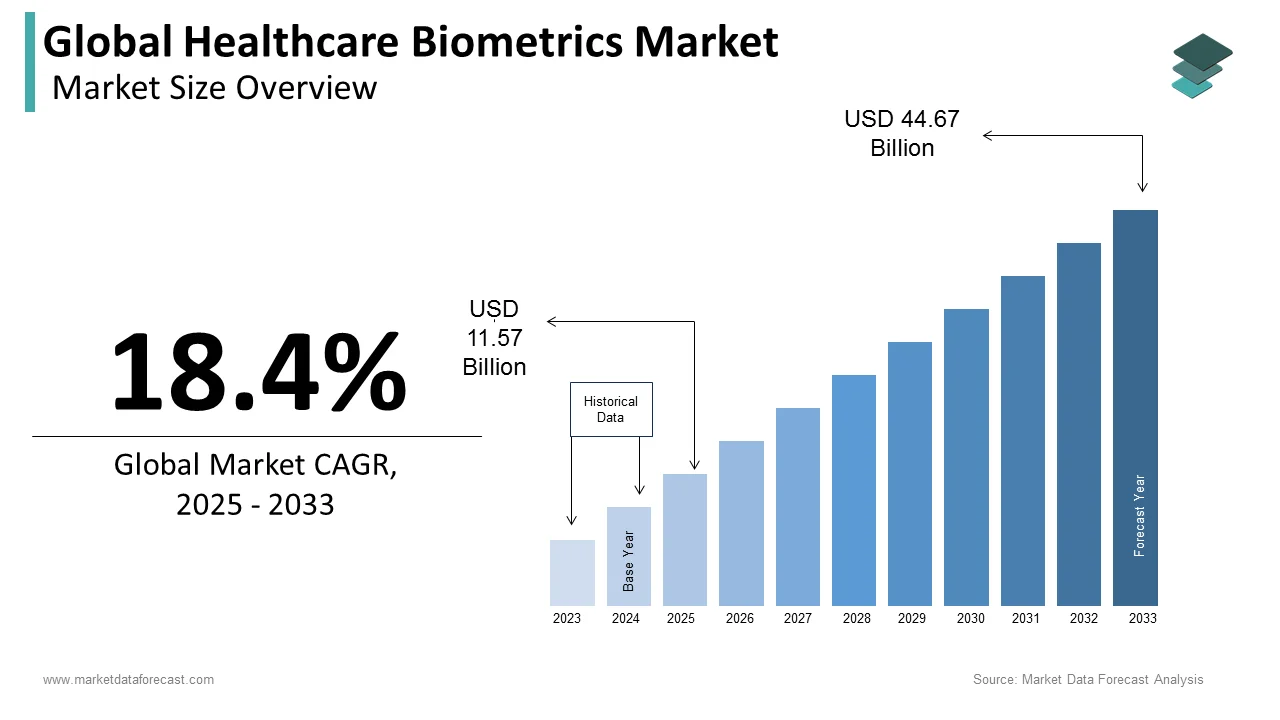

The size of the global healthcare biometrics market was worth USD 9.77 billion in 2024. The global market is anticipated to grow at a CAGR of 18.4% from 2025 to 2033 and be worth USD 44.67 billion by 2033 from USD 11.57 billion in 2025.

MARKET DRIVERS

The growing need for contactless identification and authentication solutions, the rising demand for biometrics-based solutions for remote patient monitoring, and the rising adoption of biometrics in healthcare applications majorly drive the growth of the healthcare biometrics market.

Biometrics will play an increasingly important role in healthcare in the future. Biometric technologies can help improve patient identification accuracy, leading to better patient care. However, privacy concerns will need to be addressed before biometrics can be widely adopted in healthcare. The nontraditional biometric modalities such as behavioral, EKG, finger vein and iris/retina are showing promise, but they face stiff competition from established modalities such as fingerprint, face and voice biometrics. Furthermore, the government is working to implement several regulations to ensure hospital security. Today, any health company must adhere to severe security standards. Government assistance is another market boost. Biometrics are required in critical care hospital rooms. Positive market developments are being caused by the government's efforts to strengthen security. These approaches have greatly decreased fraud and data threats.

Growing concerns regarding healthcare data breaches, advancements in biometric technologies, rapid adoption of electronic health records (EHRs) and an increasing number of initiatives from the governments of various countries promoting biometric adoption propel the healthcare biometrics market growth. The rising focus on patient privacy and data protection, growing digitalization of healthcare and increasing prevalence of medical identity theft further drive the growth of the healthcare biometrics market.

Factors such as the growing adoption of telehealth and remote patient monitoring, increasing demand for personalized medicine, improved fraud prevention and insurance claim management, growing geriatric population, increasing demand for accurate patient identification in clinical trials and rising need for prevention of drug diversion and prescription fraud contribute to the healthcare biometrics market growth.

MARKET RESTRAINTS

Privacy concerns associated with the usage of biometrics in the healthcare industry majorly hamper market growth. Patient misidentification is a global problem that negatively impacts care quality, patient safety and well-being. According to the report, the top reasons for patient misidentification include patient registration errors (64% of healthcare professionals polled by the Ponemon Institute said patient misidentification occurs frequently), time constraints when treating patients (60%), and duplicate medical records in the system (30%). The usage of Social Security Numbers (SSNs) in the United States does little to address the problem. Poor awareness among people regarding the potential benefits of using biometrics impedes market growth. People are also a barrier to biometric adoption. Many people are unfamiliar with biometrics and may worry about using it. Furthermore, some people may be concerned about the accuracy of biometrics or perceive that it is not secure. High costs associated with implementing and maintaining biometrics further inhibit the market’s growth rate. The healthcare biometric system is expensive, demanding further investment on the part of hospital and clinic administrators. As a result, patients must pay more for treatment, raising the entire cost of the healthcare system. This has an oppressive impact on the market's growth.

Impact of COVID-19 on the Global Healthcare Biometrics Market

The impact of COVID-19 on healthcare biometrics has been remarkable, leading to an upsurge in demand for biometric solutions due to the shift towards contactless methods for identification and authentication. This surge is driven by the need for remote patient monitoring and other healthcare applications that rely on biometrics-based solutions. The Asia-Pacific region based on population density is expected to be the fastest-growing market for healthcare biometrics. For instance, facial recognition and temperature screening using biometrics have become prevalent in public spaces to screen individuals for COVID-19. Biometric authentication and data utilization are also vital in tracking the spread of the virus, ensuring secure access to healthcare facilities, and safeguarding patient information. The pandemic has significantly expedited the adoption of biometrics in the healthcare sector. Notably, the Indian Government has introduced a national biometric identification program called Aadhaar, which boasts over 1.3 billion registered users. Aadhaar has been instrumental in monitoring the spread of COVID-19 and facilitating access to essential services such as healthcare and food provisions. To promote the use of biometric technologies in the healthcare industry, the Indian government has allocated a substantial $100 million. As the world continues to grapple with the pandemic, the role of biometrics in safeguarding people's health and safety is set to become increasingly vital.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

18.4% |

|

Segments Covered |

By Technology, Application, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

NEC Corporation, 3M Cogent, Inc., Imprivata, Inc., BIO-key International, Inc., Crossmatch Technologies, Inc., Suprema Inc., Fujitsu Limited, BioEnable Technologies, Morpho (A Subsidiary of Safran SA), Integrated Biometrics, Siemens AG, Genkey Solutions B.V., Aratek, Nuance Communications, Inc., Qualcomm Technologies, Inc., and Others. |

SEGMENTAL ANALYSIS

By Technology Insights

Based on the technology, the fingerprint recognition segment is expected to hold the leading share of the global market during the forecast period. Finger recognition is the widely adopted and established biometric technology due to its accuracy and convenience and this trend is likely to continue in the coming years and propel the segmental growth. The benefits of fingerprint recognition such as seamless and user-friendly authentication, reducing the risk of medical errors and growing demand for secure patient identification and protection of healthcare data further fuel the segment's growth rate.

The biometric card segment is anticipated to account for a notable share of the worldwide market during the forecast period. The enhanced security that biometric card offers by combining multiple biometric technologies into a single card is one of the major factors driving segmental growth. The robust authentication for access control, patient identification, and secure healthcare transactions, the growing need for multi-factor authentication in healthcare systems and compliance with strict data protection regulations and mitigates the risk of fraud and identity theft further contribute to the growth of the biometric card segment.

The face recognition segment is also estimated to account for a considerable share of the global market in the coming years.

By Application Insights

Based on application, the medical record and data center security segment was the largest segment in 2024 and is expected to continue its dominance worldwide during the forecast period. The medical record and data center security segment is also estimated to witness the fastest CAGR among all the segments in the global market during the forecast period. Increasing concerns about healthcare data breaches and unauthorized access to sensitive medical records, rapid adoption of electronic health records (EHRs) and digitalization of healthcare systems and stringent regulatory requirements for patient data protection, such as HIPAA and GDPR drive the growth of the medical record and data center security segment in the global market. The rising need for secure authentication methods to ensure only authorized personnel can access and modify patient records and the increasing demand for robust security solutions to safeguard patient privacy and maintain data integrity further boost the growth rate of the segment in the global market.

The patient identification and tracking segment is estimated to account for a substantial share of the global market during the forecast period. The growing need for accurate and secure patient identification to reduce medical errors and improve patient safety and the rising need to mitigate the risk of medical identity theft and fraud by implementing robust biometric authentication drives segmental growth. The rising need to streamline healthcare processes to enhance workflow efficiency and reduce administrative burdens and the growing need to align with regulatory requirements for patient privacy and data protection further propel the growth of the patient identification and tracking segment.

By End User Insights

Based on end-user, the hospitals and clinics segment is expected to hold the major share of the worldwide market during the forecast period. The growing demand for secure patient identification and access control to ensure the right patient receives the right care and the increasing need for efficient and accurate authentication methods to streamline healthcare workflows and reduce errors propel the growth of the hospital and clinic segment in the worldwide market.

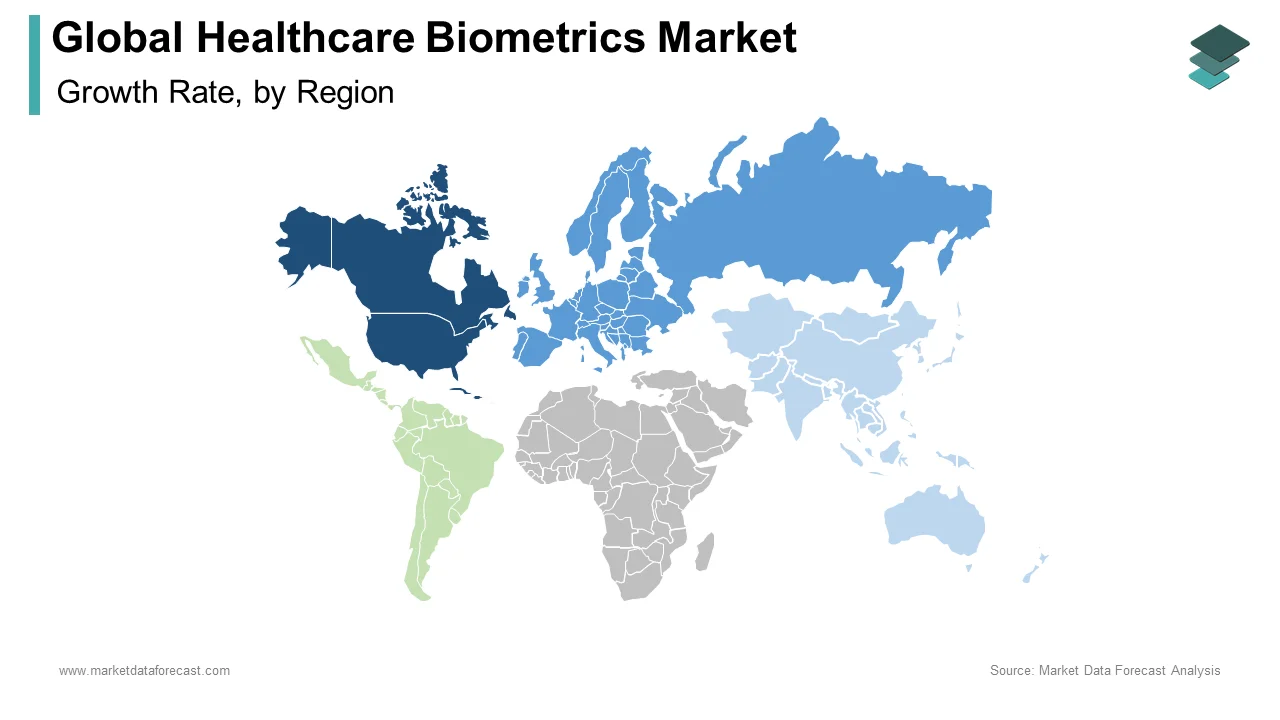

REGIONAL ANALYSIS

North America led the market in 2024. The domination of the North American region in the worldwide market is expected to continue throughout the forecast period. Growing concerns over healthcare data breaches and identity theft, strong government support and initiatives promoting the adoption of biometrics in healthcare, rapid adoption of electronic health records (EHRs) and emphasis on interoperability and technological advancements and investments in biometric solutions for healthcare majorly drive the growth of the healthcare biometrics market in the North American region. The U.S. is anticipated to account for the major share of the North American market in the coming years, followed by Canada.

Europe is another key regional market for healthcare biometrics and is estimated to occupy a substantial share of the worldwide market during the forecast period. Stringent data protection regulations, such as GDPR, that drive the adoption of biometrics for secure patient identification and data management and growing digitalization of healthcare systems and interoperability initiatives propel the healthcare biometrics market in the European region. The growing demand for secure access control and authentication solutions in hospitals, clinics and research institutions and an increasing number of collaborations between industry players, research institutions and governments to drive innovation in healthcare biometrics further contributes to the European market growth.

APAC is the most lucrative regional market for healthcare biometrics and is predicted to witness the fastest CAGR in the worldwide market during the forecast period. Rapid digital transformation and modernization of healthcare systems in countries like China, India, and Japan and rising emphasis on patient safety, data security, and privacy in healthcare, growing demand for advanced healthcare technologies and solutions for patient identification, remote monitoring, and data management and increasing number of initiatives and investments from the governments of APAC countries to promote the adoption of biometrics in healthcare promote the market growth in the Asia-Pacific region.

KEY MARKET PLAYERS

Some of the notable companies operating in the global healthcare biometrics markets are NEC Corporation, 3M Cogent, Inc., Imprivata, Inc., BIO-key International, Inc., Crossmatch Technologies, Inc., Suprema Inc., Fujitsu Limited, BioEnable Technologies, Morpho (A Subsidiary of Safran SA), Integrated Biometrics, Siemens AG, Genkey Solutions B.V., Aratek, Nuance Communications, Inc., Qualcomm Technologies, Inc., and others.

RECENT MARKET DEVELOPMENTS

- On 24 February 2021, Aratek officially launched the a700 fingerprint scanner. The A700 is well-suited to access control applications and can support applications in various industries, including banking, law enforcement, telecommunications, and healthcare.

- On 5 April 2021, Mastercard teamed with b. well Connected Health to enable healthcare businesses to provide real-time digital identity verification using biometrics online and in-person via the individual's smartphone. The collaboration adds Mastercard ID Verification to the b. well platform, which connects patient data from healthcare providers, insurers, pharmacies, and patients' applications and devices for safe information exchange and prescription management.

MARKET SEGMENTATION

This research report on the global healthcare biometrics market has been segmented and sub-segmented based on technology, application, end-user, and region.

By Technology

- Single-factor Authentication

- Iris Recognition

- Face Recognition

- Signature Recognition

- Hand Recognition

- Voice Recognition

- Fingerprint Recognition

- Multi-factor Authentication

- Biometric Card

- Password

- Others

- Other Technologies

By Application

- Medical Record and Data Centre Security

- Patient Identification and Tracking

- Care Provider Authentication

- Home/Remote Patient Monitoring

- Other Applications

By End User

- Hospital/Clinics

- Research and Clinical Laboratory

- Other End Users

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What is the current size of the healthcare biometrics market?

The global healthcare biometrics market size was valued at USD 9.77 billion in 2024.

What are some key drivers of growth in the healthcare biometrics market?

The growing demand for secure and accurate patient identification systems, rising concerns over medical identity theft and fraud, and the growing need to streamline healthcare operations and reduce costs majorly drive the growth of the healthcare biometrics market.

What are some of the challenges associated with implementing biometrics in healthcare?

Concerns over data privacy and security, interoperability issues, and the need for standardized biometric protocols and regulations are some of the major challenges to the healthcare biometrics market.

Who are the key players in the healthcare biometrics market?

NEC Corporation, 3M Cogent, Inc., Imprivata, Inc., BIO-key International, Inc., Crossmatch Technologies, Inc., Suprema Inc., Fujitsu Limited, BioEnable Technologies, Morpho (A Subsidiary of Safran SA), Integrated Biometrics, Siemens AG, Genkey Solutions B.V., Aratek, Nuance Communications, Inc., Qualcomm Technologies, Inc. are some of the notable players in the healthcare biometrics market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]