Global Healthcare Analytical Testing Services Market Size, Share, Trends & Growth Forecast Report By Product Type and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Healthcare Analytical Testing Services Market Size

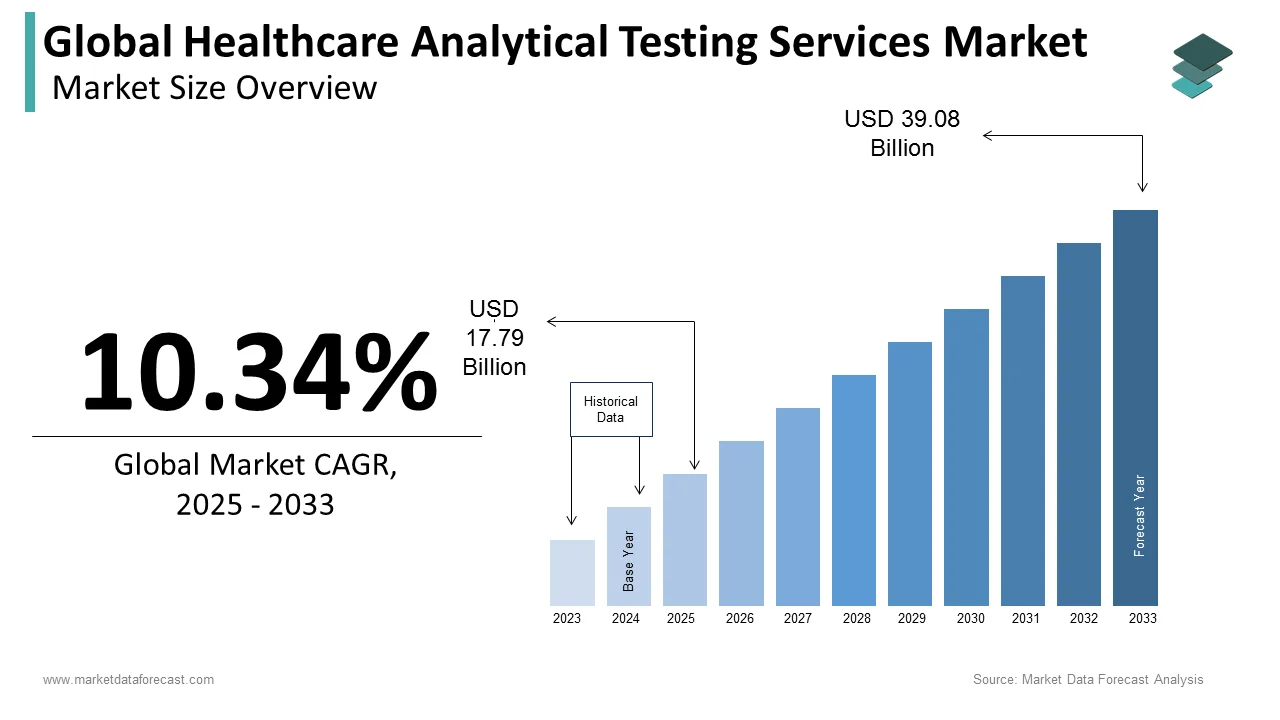

The size of the global healthcare analytical testing services market was worth USD 16.12 billion in 2024. The global market is anticipated to grow at a CAGR of 10.34% from 2025 to 2033 and be worth USD 39.08 billion by 2033 from USD 17.79 billion in 2025.

Analytical testing is an important aspect of the drug discovery and manufacturing process. Validated analytical testing yields quantitative and qualitative findings that can be used to monitor and ensure the consistency and safety of intermediates, raw materials, and finished goods. The healthcare industry is rapidly evolving; QbD is becoming increasingly important in pharmaceutical processes such as drug production, formulations, analytical methods, and biopharmaceuticals. The role of various analytical instruments in a pharmaceutical assay and a detailed literature review of the instrumentation used in pharmaceutical analysis, the progression of techniques from the older titrimetric approach to the advanced hyphenated technique stages. During the forecast period, the healthcare analytical testing services market is expected to grow in terms of new drug development trials, analytical testing, and outsourcing analytical services.

MARKET DRIVERS

The rising use of analytical testing services by the pharmaceutical, biotechnology, and medical device industries drives the global healthcare analytical testing services market growth.

The invention of pharmaceuticals launched a new era in human health. Various chemical and instrumental methods for estimating drugs have been established regularly to make drugs fulfill their purpose. These pharmaceuticals can produce impurities at various stages of growth, transportation, and storage, making them dangerous to administer and necessitating their detection and quantification. Analytical instrumentation and techniques are critical for this. A range of analytical techniques, including chromatographic, titrimetric, electrophoretic, spectroscopic, and electrochemical approaches, have been used in pharmaceutical analysis. Pharmaceutical research has historically played an important role in advancing pharmaceutical production, guided by pharmacology and clinical sciences and powered by chemistry.

The rise in the number of biologics in development is expected to drive the global healthcare analytical testing services market. Biopharmaceutical companies are raising production around the world. In India, approximately 100 biopharmaceutical companies actively engage in therapeutic product research and development, manufacturing, and marketing. Developing a method to test a potential API analytically is a crucial step in the drug development process. However, unless the approach adheres to specific requirements, the path to regulatory approval will be short-lived. To validate methods, consider accuracy, specificity, precision, and the limit of detection, linearity, the limit of quantitation, and range. Human growth hormone, insulin, and red blood cell stimulating agents have introduced decades ago, but the targets have grown exponentially with new genetic knowledge.

The growing prevalence of chronic disorders is accelerating the global healthcare analytical testing services market growth. CVDs killed almost 17.9 million people in 2016, accounting for 31% of all human deaths, according to the World Health Organization. Heart attacks and strokes are responsible for about 85 percent of these deaths. According to the World Health Organization's Global Burden of Disease Study, there were nearly 251 million COPD cases worldwide in 2016. Nearly 90% of COPD deaths occur in low and middle-income countries. Positive outcomes for chronic disease treatment have been identified, including decreased symptoms of chronic pulmonary diseases and heart failure and decreased mortality.

Growing the use of outsourcing R&D and Continuous outsourcing from pharma companies is driving the market's rapid development globally. Companies are rapidly outsourcing high-tech services. R&D outsourcing enables firms to specialize in core knowledge-intensive tasks and growing innovation; however, R&D outsourcing can weaken internal capabilities. It is important to carry out R&D and innovation activities in collaboration with other businesses. Because of increased competition, market globalization, and other new features of the modern world, businesses have been compelled to use their best resources and core competencies to capitalize on business opportunities and succeed. Product innovation rises primarily due to domestic outsourcing, while process innovation rises due to domestic and foreign R&D outsourcing. International outsourcing provides an additional benefit, primarily to exporters.

The rising adoption of QbD analysis in the pharmaceutical industry is a plus to the healthcare analytical testing services market.

To get their product approved for sale, the pharmaceutical industry needs regulatory approval. Even though the QbD solution provides quality products with cost-effective processes, which is the primary requirement. Moving inside the design space does not necessitate post-approval adjustments, lowering the cost. The QbD approach to generic drug products is recommended beginning in January 2013. In this area, the pharmaceutical industry is the most strictly regulated since authoritative regulatory bodies regulate it.

Additionally, growing innovation in R&D for new medical technologies, increased investments, technical advancements, increased access to healthcare, and vigorous research and development activities for drug development and the growing geriatric population are expected to drive growth to the global healthcare analytical testing services market. Regulatory agencies increasingly demand more analytical details on drug and process development, which is estimated to favor the healthcare analytical testing services market. Government initiatives and FDA approval are on the rise. The FDA was granted the authority to allow biosimilars, biologics, and chemical drugs, including interchangeable ones, to ensure the biosimilar product's protection, effectiveness, and efficiency.

MARKET RESTRAINTS

High costs associated with the R&D and the new drug development process are majorly hindering the global healthcare analytical testing services market. The lack of skilled and technical professionals and researchers in the healthcare industry has hampered the market. Loss of flexibility and control, more risk of miscommunication, turnaround time can increase, and time-consuming sending/receiving samples has hindered the outsourcing. The market's development is hampered by the strict drug approval of the drug in various therapies.

Impact of COVID-19 on the Healthcare Analytical Testing Services Market

The World Health Organization has issued laboratory testing recommendations for COVID-19 in suspected human cases. Recognizing that the global spread of COVID-19 has greatly increased the number of reported cases and the geographic area where laboratory testing is needed, increased COVID-19 molecular testing has resulted in a global scarcity of molecular testing reagents for COVID-19 and other molecular diagnostics. The number of clinical trials is increasing, as is outsourcing analytical testing by pharmaceutical companies of covid-19 new drugs. Many companies are attempting to research covid-19 vaccines. Although some sectors will see a reduction in demand, some companies' clinical trials will be stopped due to the shutdown. The COVID-19 pandemic is prolonging changes in medical care, spurring innovation and growing pains in technology that enable patients to engage with the healthcare system remotely. In recent months, the COVID-19 outbreak has had a major effect on clinical microbiology laboratories. Finally, random-access, integrated devices with scalable capacities available at the point of care will aid in the rapid and reliable diagnosis and monitoring of SARS-CoV-2 infections, significantly assisting in managing this outbreak.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.34% |

|

Segments Covered |

By Product Type and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

LabCorp, Source BioScience, Eurofins Scientific, Intertek Group plc, RA Health Sciences, Laboratory Corporation of America, Merck Group KGaA, Charles River Laboratories, PSTERIS plc, BioReliance Corporation, WuXi AppTec, Pace Analytical, and PPD, Inc., and Others. |

SEGMENTAL ANALYSIS

By Product Type

Based on the product, the prescription segment is predicted to lead the global healthcare analytical testing services market and account for a market share of 57.6% in 2024. The enormous amount of analytical research needed to sustain a product from the invention, growth, and clinical trials, through manufacturing and marketing accounts for most of this segment's market share. Analytical research is one of the most often outsourced operations for pharmaceutical firms because it necessitates highly trained personnel with advanced equipment.

Due to the increasing regulatory pressure for more accurate chemical analysis of medical products, the medical device product category segment is expected to rise at the fastest CAGR of more than 11% during the forecast period.

REGIONAL ANALYSIS

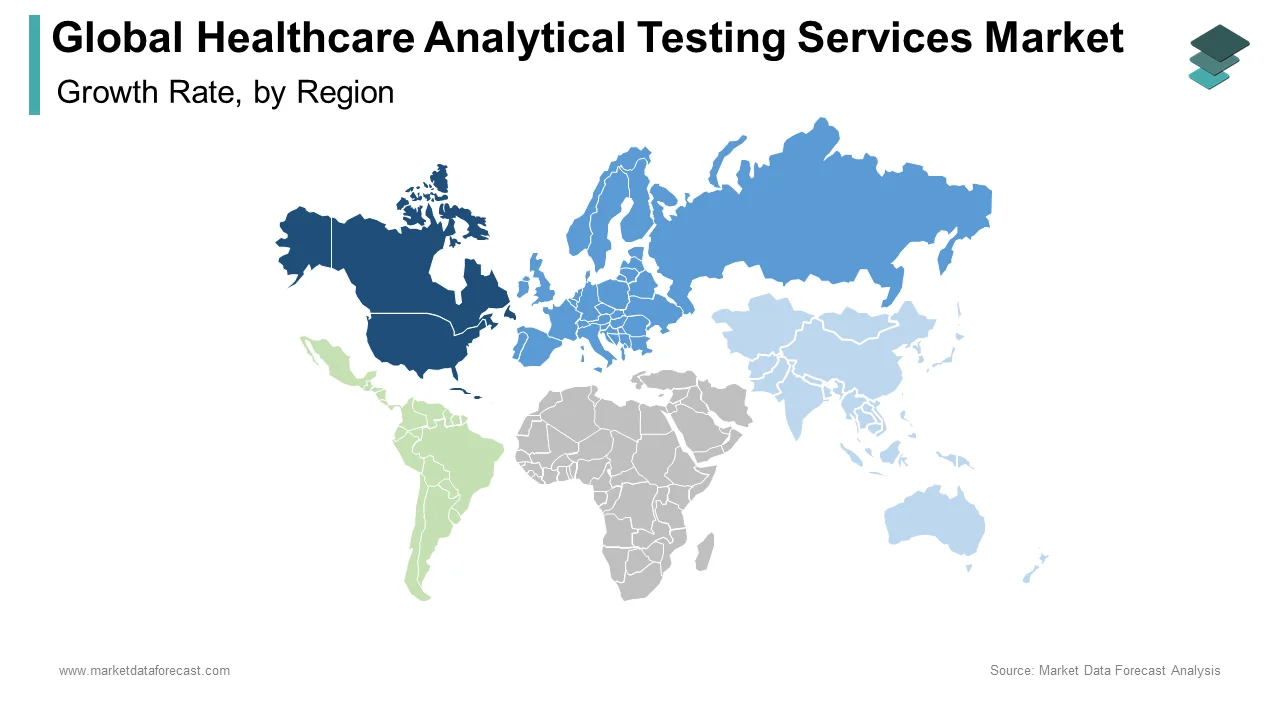

Geographically, the North American regional market is forecasted to occupy a significant share of the global healthcare analytical testing market during the forecast period. The market growth is attributed to the presence of many pharmaceutical and biopharmaceutical companies in the region. A Significant spike has been noticed in the clinical trials and research activities in North America, which is expected to increase the market growth. In the regional market, the U.S. is estimated to account for the leading share in the next five years due to the growing healthcare infrastructure and favorable reimbursement policies. However, increasing acceptance of the quality-by-design approach in pharma research further adds to the market growth. On the other hand, the Canadian market is expected to witness healthy growth during the forecast period.

The European market was the second-largest regional market globally in 2024 and it is anticipated to register a high CAGR during the forecast period and the growth of the European market is driven by the growing healthcare expenditure and adoption of advanced technologies in healthcare. In Europe, the UK accounted for the leading share in 2024 and is forecasted to increase its share throughout the forecast period. Conversely, Germany has been growing at a promising CAGR for a couple of years and is projected to share lucrative growth in the European market.

The Asia-Pacific market is considered the fastest-growing regional market globally and is estimated to register the fastest CAGR during the forecast period. Emerging countries like China, Japan, and India are significantly contributing to the APAC market, and the support is likely to continue throughout the forecast period. In 2024, the Indian market witnessed a stable growth rate, which is estimated to be continuing during the forecast period. The Indian government's initiative to provide subsidies to biosimilar manufacturers is expected to fuel market growth.

KEY MARKET PARTICIPANTS

LabCorp, Source BioScience, Eurofins Scientific, Intertek Group plc, RA Health Sciences, Laboratory Corporation of America, Merck Group KGaA, Charles River Laboratories, PSTERIS plc, BioReliance Corporation, WuXi AppTec, Pace Analytical, and PPD, Inc. are some of the notable companies operating in the global healthcare analytical testing services market.

RECENT MARKET DEVELOPMENTS

- In January 2020, LabCorp's Drug Development Company introduced Preclinical, Clinical, and Post-Approval Cell and Gene Therapy Development Solutions.

- In December 2019, Frontage Labs partnered with J&J Corporate Services, Inc. (US) to expand its operation in Canada and North America's west coast.

- Chemical Solutions Ltd. (CSL) (US), a research laboratory specialized in elemental and heavy metal testing for fruit, nutraceuticals, pharmaceutical, and cosmetic products, was acquired by SGS in May 2019.

- In March 2018, at its Malvern, Pennsylvania plant, Charles River Laboratories added 2,800-ft2 cleanrooms dedicated to GMP microbial and mammalian cell banking.

MARKET SEGMENTATION

This research report on the global healthcare analytical testing services market has been segmented and sub-segmented based on the product type and region.

By Product Type

- Medical Device

- Extractable & Leachable

- Material Characterization

- Physical

- Bioburden

- Sterility

- Other Tests

- Pharmaceutical

- Bioanalytical

- Method Development & Validation

- Stability

- Other Services

By Region

- North America

- The U.S.

- Canada

- Rest of North America

- Europe

- UK

- Germany

- France

- Spain

- Italy

- Rest of EU

- Asia-Pacific

- India

- China

- Japan

- Australia

- South Korea

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Argentina

- Chile

- Rest of Latin America

- Middle East and Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]