Global Healthcare Advertising Market Size, Share, Trends & Growth Forecast Report By Type (Traditional, Online, Public Relations, Unique Branding and Awareness, Internal Marketing, Employer Marketing, Physician Referrals and Others), Technology (Telemedicine, Artificial Intelligence, Personal Data Tracking and Others), Format, Form of Engagement, Approach, Application and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2025 to 2033)

Global Healthcare Advertising Market Size

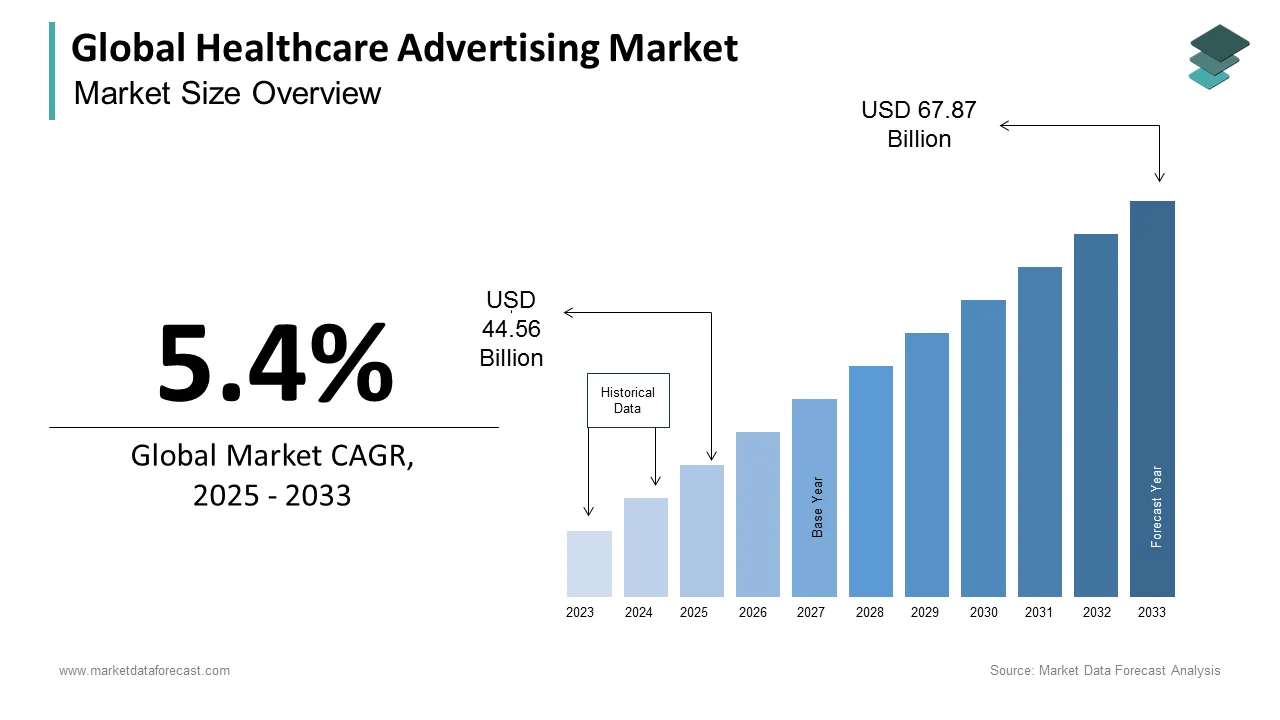

The size of the global healthcare advertising market was worth USD 42.28 billion in 2024. The global market is anticipated to grow at a CAGR of 5.4% from 2025 to 2033 and be worth USD 67.87 billion by 2033 from USD 44.56 billion in 2025.

The healthcare advertising market is growing quickly as healthcare becomes more digital and consumers actively seek health information. This market includes ads for medications, medical devices, wellness products and healthcare services that target both healthcare professionals and the general public. With more people looking for health information online, digital platforms such as social media, search engines, and video are now essential channels for healthcare brands to reach and engage their audiences. The rapidly growing aging population and increasing rates of chronic conditions are fuelling the demand for healthcare advertising services as these raise the demand for healthcare services and advertising. Pharmaceutical and biotech companies are especially active in investing in campaigns to inform people about treatment options and increase brand visibility. Strict regulations from organizations like the FDA (U.S.) and EMA (Europe) ensure that healthcare ads are honest and accurate and push companies to provide clear and reliable information. The rise of data-driven and personalized advertising, with companies using tools like AI to tailor messages to specific audiences is another notable trend in the healthcare advertising market currently.

MARKET DRIVERS

Digital Transformation and Online Engagement

The shift toward digital healthcare is a major driver of the healthcare advertising market as consumers increasingly seek medical information online. For instance, as per the statistics of Pew Research, 70% of people look up health information on the internet before consulting a doctor and this trend has prompted healthcare companies to invest in digital ads across platforms like social media, search engines, and video to meet audiences where they are. Additionally, digital advertising allows for better targeting and personalization, helping healthcare brands reach consumers more effectively and providing tailored health information and treatment options.

Aging Population and Prevalence of Chronic Diseases

An aging global population and rising rates of chronic conditions such as diabetes, heart disease, and cancer are expanding the demand for healthcare services and products. According to the World Health Organization (WHO), the global population aged 60 and above will reach 2 billion by 2050. This demographic shift is prompting increased spending in healthcare, with more advertising focused on reaching older adults and addressing chronic health issues. Pharmaceutical and medical device companies are capitalizing on this demand, educating audiences on treatment options and preventive measures through targeted ads.

Regulatory Push for Transparency and Ethical Advertising

Governments and regulatory bodies, such as the FDA (U.S.) and EMA (Europe), mandate transparency and accuracy in healthcare advertising. This regulatory environment drives companies to create clear, reliable advertisements that inform and educate consumers. This has also led to the rise of branded and unbranded educational campaigns that foster trust and improve public understanding of health conditions. Transparent advertising boosts engagement, as consumers are more likely to trust brands providing accurate, helpful information. In this regulated environment, healthcare brands are investing in high-quality, informative campaigns that comply with these standards.

MARKET RESTRAINTS

Strict Regulatory Environment

The healthcare advertising market is highly regulated by agencies such as the FDA in the U.S. and the EMA in Europe, which impose strict guidelines on promoting medical products. For example, the FDA requires pharmaceutical ads to list all potential side effects, limiting ad length and messaging simplicity. This regulatory complexity can delay campaign approvals and restrict creativity, making it challenging for brands to communicate effectively. Additionally, the need for compliance increases costs, as companies must invest in legal and regulatory reviews to avoid penalties, adding significant barriers for smaller firms and new market entrants.

High Costs and Budget Constraints

Healthcare advertising, particularly on digital platforms, can be costly. Digital advertising costs have risen by over 20% annually in some cases, putting pressure on healthcare companies to allocate significant budgets. For instance, in the U.S., the average cost-per-click for healthcare keywords on search engines is among the highest across industries (source: WordStream). This expense can be a barrier for smaller healthcare companies, especially those competing with established brands that have more substantial advertising budgets. The rising costs of digital advertising and competition for visibility make it challenging for companies to achieve the desired reach within budget constraints.

Privacy Concerns and Data Restrictions

Growing privacy concerns and tightening data regulations, such as the General Data Protection Regulation (GDPR) in Europe, limit healthcare advertisers’ ability to collect and use consumer data for targeted marketing. These restrictions make it harder for companies to personalize advertising and reach specific audiences, as they cannot access as much personal health data. For instance, many users are opting out of data tracking, limiting companies’ insights into consumer behavior. This restraint impacts the effectiveness of targeted healthcare ads and may lead to increased spending on broad, less efficient campaigns as companies comply with evolving privacy laws.

MARKET OPPORTUNITIES

Personalization Through AI and Machine Learning

AI and machine learning enable healthcare advertisers to deliver highly personalized messages, an effective strategy as consumers increasingly expect tailored content. Reports from Deloitte show that 80% of consumers are more likely to engage with personalized ads. AI-driven insights allow advertisers to understand individual health needs, preferences, and behaviors, leading to more relevant campaigns. With AI, healthcare brands can segment audiences accurately, improving engagement and conversion rates. As technology advances, personalization will be a critical differentiator in healthcare advertising, helping brands build trust and resonate with consumers.

Expansion of Health and Wellness Market

Rising consumer interest in health and wellness provides a broadening market for healthcare advertising. The Global Wellness Institute estimates the wellness market to be valued at over $4 trillion, encompassing nutrition, mental health, fitness, and preventive healthcare. This shift enables healthcare advertisers to diversify, targeting not only those seeking medical care but also wellness-oriented consumers. Advertising in this expanding sector allows brands to engage audiences focused on maintaining health proactively rather than reactively and promotes a more holistic approach to healthcare that aligns with current consumer trends.

MARKET CHALLENGES

Balancing Transparency and Consumer Trust

Consumers increasingly expect transparency, especially in healthcare, yet achieving this without overwhelming audiences with complex information is challenging. Over 60% of consumers say they trust healthcare brands that clearly explain their products and services (source: Edelman Trust Barometer). However, conveying technical medical information in accessible language is difficult, especially within the constraints of short-form digital ads. Failing to balance transparency and simplicity can impact trust, and consumers may disengage if ads are perceived as unclear or overly complex.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2025 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Technology, Format, Form of Engagement, Approach, Application & Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Market Players |

Syneos Health, Havas Health & You. (A Subsidiary of Havas Group), MCCANN WORLDGROUP (A Subsidiary of IPG), Wunderman Thompson (A Subsidiary of WPP plc), RevLocal, HLM Digital, Dobies Health Marketing, The Communications Strategy Group Inc., Healthcare Success, LLC, PUBLICIS GROUPE, CDM New York, FCB Worldwide, Inc. (A Subsidiary of IPG), VMLY&R (A Subsidiary of WPP plc), AbelsonTaylor, Inc., Thrive Internet Marketing Agency, LEVO Healthcare Consulting, Sagefrog Marketing Group, LLC, Distill Health, Trajectory |

SEGMENTAL ANALYSIS

By Type Insights

The traditional advertising segment dominated the market and accounted for 30.8% of the global market share in 2023. Traditional advertising includes TV, radio, and print ads and is the largest segment in healthcare advertising. This dominance is due to its broad reach, especially among older demographics who may not engage with digital platforms as much. Traditional ads are effective for building brand recognition and trust, particularly in the pharmaceutical and hospital sectors, where consumers expect established, credible sources. Television, for example, is still a preferred medium for healthcare advertising, as it reaches a wide audience and allows for detailed storytelling that resonates with viewers.

However, the online advertising segment is anticipated to register a CAGR of 12.28% over the forecast period. The shift toward digital platforms is fueled by consumers’ increasing preference for online health information and rising internet and smartphone usage. Digital ads on social media, search engines, and video platforms enable healthcare brands to reach target audiences with personalized messages, improving engagement and conversion. Additionally, online advertising offers valuable metrics and insights, allowing brands to refine their strategies in real time. With younger consumers relying heavily on digital sources, online advertising is critical for future growth in healthcare.

By Technology Insights

The telemedicine segment led the market and accounted for 50.8% of the global market share in 2023. The prominence of telemedicine in healthcare advertising is largely due to the rapid adoption of virtual health services, which surged during and after the COVID-19 pandemic. Telemedicine platforms now serve as a primary advertising channel, as they offer healthcare providers direct access to patients seeking real-time consultations and health information online. By promoting their services through telemedicine platforms, healthcare organizations can engage patients who are increasingly opting for remote consultations. Telemedicine’s reach and accessibility make it a highly effective medium for advertising a wide range of healthcare services and products.

The Artificial Intelligence (AI) segment is predicted to grow at the fastest CAGR of 16.66% over the forecast period. AI-powered tools enable healthcare advertisers to analyze vast amounts of data, uncover patient insights, and deliver highly personalized ads based on individual health needs. For example, AI can optimize ad placements and personalize messaging in real-time, improving engagement and conversion rates. AI’s ability to streamline campaign targeting and content personalization is driving its rapid adoption in healthcare advertising, particularly as consumers increasingly prefer tailored health information and recommendations.

By Format Insights

The display advertising segment held the leading position, accounting for 44.8% of the global market share in 2023. Display ads are highly visible and easily accessible, making them effective for brand awareness and targeting a broad audience. Healthcare companies use display ads on popular websites and social media platforms to reach both consumers and healthcare professionals. The format’s visual nature allows advertisers to present brand messages in a compelling way, often driving higher engagement rates, especially for large-scale healthcare campaigns and pharmaceutical ads.

The video advertising segment is growing rapidly and is expected to witness the fastest-growing CAGR of 15.3% over the forecast period. The growth of the video segment is driven by consumers’ increasing preference for video content, particularly on platforms like YouTube and Facebook, where health-related videos are highly popular. Video ads allow healthcare brands to explain complex topics, such as treatment options or health conditions, in an engaging and easily digestible format. Additionally, video content can reach a large audience, providing educational value while also building trust. The high engagement and storytelling potential of video ads makes them a crucial investment area for healthcare advertisers aiming to boost user interaction and awareness.

By Form of Engagement Insights

The healthcare facility segment held the major share of the global market in 2024. The growth of the healthcare facility segment is majorly driven by the extensive use of traditional media such as print, television, and radio by healthcare facilities aiming to attract patients and increase service awareness. Healthcare facility advertising encompasses advertising efforts by hospitals, clinics, and healthcare institutions. For example, in the U.S., healthcare advertising spending surged by 11.5% in 2022, with a considerable share dedicated to traditional channels.

On the other hand, the online segment is the fastest growing in the healthcare advertising market and is predicted to showcase a CAGR of 12.44% over the forecast period. This rapid growth is fuelled by the digital transformation within healthcare as providers increasingly rely on digital channels, including websites, social media, and online advertising, to reach patients. Additionally, more patients now look to online sources for health information, making digital advertising a pivotal means of patient engagement. Online advertising also provides a cost-effective, highly targeted, and measurable approach, which is attractive to healthcare marketers. U.S. digital ad spending in healthcare, for instance, is forecasted to grow by 10% in 2024, reflecting an industry-wide shift toward digital strategies. In summary, while the Healthcare Facility segment currently leads the market, the Online segment is growing quickly, driven by digital adoption and evolving consumer behavior.

By Application Insights

The pharmaceuticals segment had the major share of the global market in 2024 and is expected to continue holding the dominating position throughout the forecast period owing to the substantial investments made by pharmaceutical companies in advertising their products to both healthcare professionals and consumers. This segment's prominence is seen in the U.S. alone, where pharmaceutical advertising spending reached approximately $6.58 billion in 2020, underscoring the importance of marketing in promoting new medications and educating the public on treatment options. The pharmaceuticals segment plays a vital role in driving consumer awareness and influencing prescribing behaviors.

On the other hand, the biopharmaceuticals segment is experiencing the fastest growth and is projected to grow at a CAGR of 8.5% from 2024 to 2032. This rapid expansion is attributed to ongoing innovations in biopharmaceuticals, particularly in developing biologics and personalized medicine, which require targeted advertising to educate healthcare providers and patients. Increased regulatory approvals and growing market competition within the biopharmaceutical space have also accelerated advertising efforts to differentiate products and capture market share. This growth highlights the segment’s importance in bringing advanced, often life-changing treatments to market and improving patient outcomes through effective communication and awareness strategies.

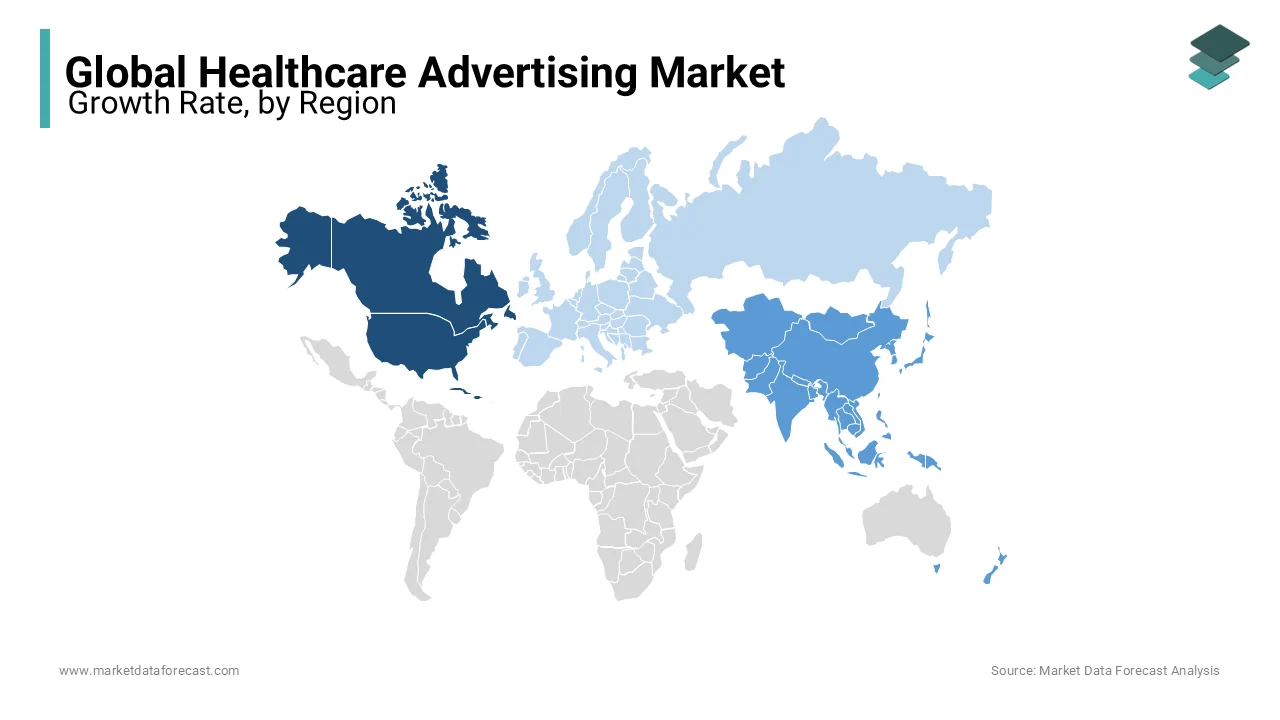

REGIONAL ANALYSIS

North America currently dominates the healthcare advertising market and the domination is majorly driven by high healthcare expenditure and a strong pharmaceutical industry. The United States, which alone accounts for nearly 50% of the global healthcare advertising market as of 2024, is the primary contributor within this region. The presence of major pharmaceutical companies and high investments in healthcare marketing further fuel this dominance. Canada follows as a key player, supported by its robust healthcare framework. The Key trends in this region include digital marketing advancements and growing direct-to-consumer advertising in healthcare.

Europe stands as the second-largest region in the global healthcare advertising market, with Germany, the United Kingdom, and France leading in terms of market share. Germany’s advanced pharmaceutical industry and strong healthcare systems make it the regional leader, followed closely by the United Kingdom and France. The European market is set to grow at a promising CAGR over the forecast period owing to the increasing adoption of digital marketing in healthcare and greater public awareness of health and wellness issues. Factors such as stringent advertising regulations and a high demand for transparency in healthcare advertising influence this market. Nevertheless, Europe’s continued investment in digital health solutions supports its steady growth outlook.

The Asia-Pacific region is witnessing the fastest growth in the global healthcare advertising market. This rapid expansion is driven by rising healthcare infrastructure investments, digitalization, and growing awareness of healthcare services. China and India are the primary contributors to this regional growth, fueled by their large populations and expanding pharmaceutical sectors. China’s healthcare advertising market benefits from a strong digital landscape, while India’s market expansion is linked to the growth of its generic pharmaceutical industry. Other contributing factors include the rising penetration of mobile health applications and telemedicine services, which support broader access to healthcare information and services across the region.

Latin America holds a relatively smaller share of the global healthcare advertising market but is experiencing steady growth due to increased healthcare investments and expanding marketing activities. Brazil and Mexico are the dominant countries within this region, with improved healthcare infrastructure and heightened health awareness initiatives supporting market expansion. The demand for healthcare advertising in Latin America is increasingly influenced by a shift towards digital health platforms and social media channels, which are particularly effective in reaching the younger population segments across the region.

The Middle East and Africa region represents the smallest share of the global healthcare advertising market; however, it is expected to expand modestly over the next few years. The market growth in this region is majorly driven by increased healthcare spending and the growing adoption of digital marketing. The United Arab Emirates and South Africa are the leading countries within this region, supported by their well-developed healthcare sectors and greater investments in healthcare initiatives. Efforts to increase public health awareness and improve healthcare infrastructure are further supporting market growth, although challenges like limited digital infrastructure and economic constraints continue to influence the overall pace of expansion.

KEY MARKET PLAYERS

The major players operating in the global healthcare advertising market profiled in this report are Syneos Health, Havas Health & You. (A Subsidiary of Havas Group), MCCANN WORLDGROUP (A Subsidiary of IPG), Wunderman Thompson (A Subsidiary of WPP plc), RevLocal, HLM Digital, Dobies Health Marketing, The Communications Strategy Group Inc., Healthcare Success, LLC, PUBLICIS GROUPE, CDM New York, FCB Worldwide, Inc. (A Subsidiary of IPG), VMLY&R (A Subsidiary of WPP plc), AbelsonTaylor, Inc., Thrive Internet Marketing Agency, LEVO Healthcare Consulting, Sagefrog Marketing Group, LLC, Distill Health, Trajectory, and others. These players adopt expansion, merger and acquisition, partnership, and collaboration strategies to gain market share.

RECENT HAPPENINGS IN THE MARKET

- In February 2023, Publicis Groupe announced its entry into the healthcare advertising industry. It made the announcement with the introduction of Heartbeat, a specialized agency that works on the development of innovative and engaged advertising campaigns for healthcare brands.

- In March 2023, Havas Health and You announced the acquisition of Influitive, which is a significant digital healthcare marketing agency. The primary aim of the acquisition is to strengthen the position of Havas Health and You in the digital healthcare marketing sector.

- In September 2023, Deeplntent, a US-based healthcare advertising platform, announced the launch of Deeplntent Copilot. The major aim of the launch is to optimize the campaign strategies and maximize media investments by enhancing the performance and efficiency of healthcare advertising.

MARKET SEGMENTATION

This research report on the global healthcare advertising market has been segmented and sub-segmented based on type, technology, format, engagement, approach, application & region.

By Type

- Traditional

- Television

- Print

- Magazines And Medical Journals

- Newspaper

- Others

- Radio

- Others

- Online

- Online Advertising

- Search Engine Optimization

- Mobile-First Website

- Social Media Advertising

- Others

- Public Relation

- Publicity

- Sponsorships

- Community Events

- Others

- Unique Branding and Awareness

- Internal Marketing

- Events

- Text And Email

- Phone Communication

- Patient Experience

- Others

- Employer Marketing

- Meeting And Presentation

- Business Targets

- Others

- Physician Referrals

- Others

By Technology

- Telemedicine

- Artificial Intelligence

- Personal Data Tracking

- Others

By Format

- Display

- Search

- Video

By Form of Engagement

- Healthcare Facility

- Online

- In-Home / In Person

- Others

By Approach

- Detailing (Healthcare Professional)

- Personal Data Tracking

- Telemedicine

- Artificial Intelligence

- Others

- Direct To Consumer Advertising

- Personal Data Tracking

- Telemedicine

- Artificial Intelligence

- Others

By Application

- Fitness And Diet Product and Service

- Over The Counter

- Health Hygiene

- Medical Insurance

- Corrective Lenses and Glasses

- Medical Devices and Equipment

- Pharmaceutical

- Prescription Medicines

- Biotech Companies

- Biopharmaceuticals

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How much was the value of the global healthcare advertising market in 2024?

The global healthcare advertising market is growing at a moderate pace. The market size was valued at USD 42.28 billion in 2023.

What is the projected value of the healthcare advertising market in North America by 2033?

The North American healthcare advertising market size is predicted to be USD 67.87 billion by 2033.

Who are the major players in the healthcare advertising market?

Syneos Health, Havas Health & You, MCCANN WORLDGROUP, Wunderman Thompson, RevLocal, HLM Digital, Dobies Health Marketing, The Communications Strategy Group Inc., Healthcare Success, LLC, PUBLICIS GROUPE, CDM New York, FCB Worldwide, Inc., VMLY&R, AbelsonTaylor, Inc., Thrive Internet Marketing Agency, LEVO Healthcare Consulting, Sagefrog Marketing Group, LLC, Distill Health and Trajectory are some of the promising players in the healthcare advertising market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]