Global Health Insurance Market Size, Share, Trends, COVID-19 Impact & Growth Forecast Report By Service Provider, Coverage Type, Product Type, Insurance Plan Type, Demographics and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2025 to 2033)

Global Health Insurance Market Size

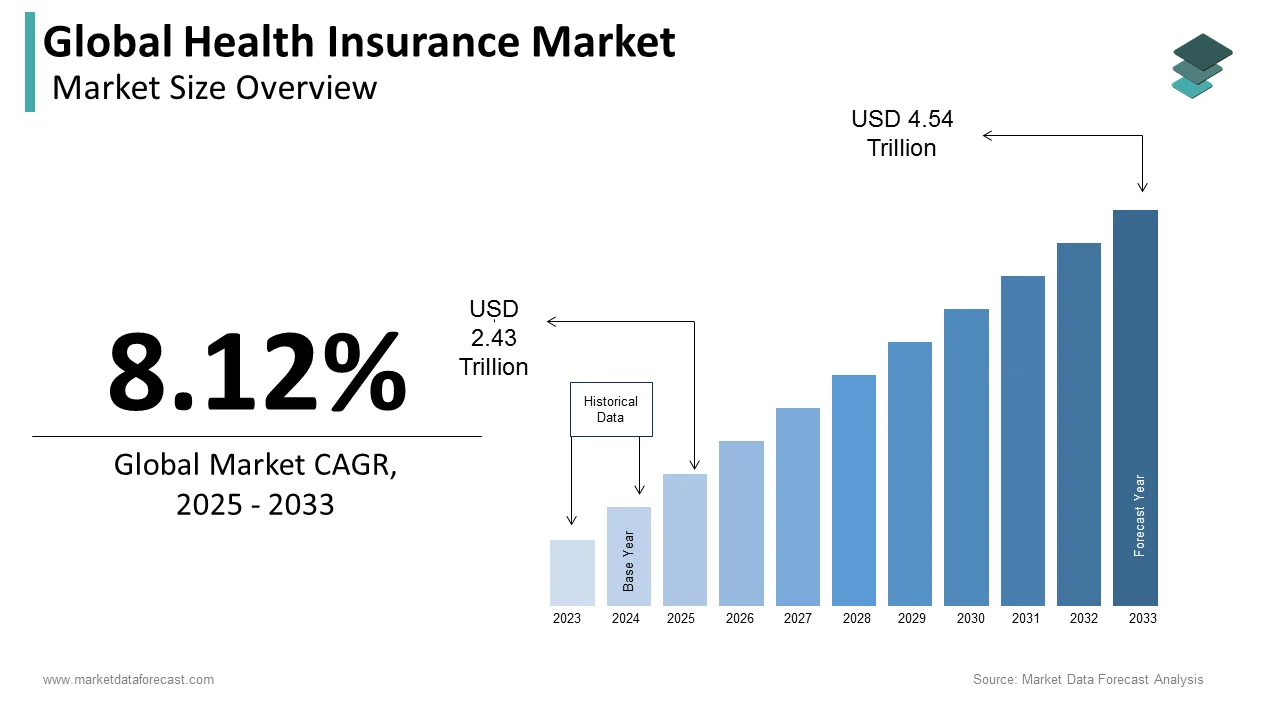

The size of the global health insurance market was valued at USD 2.25 trillion in 2024. The global market size is further expected to be valued at USD 4.54 trillion by 2033 from USD 2.43 trillion in 2025, growing at a CAGR of 8.12% from 2025 to 2033.

The health insurance market has steadily grown forward in the last few years. The rising medical service expenditure and surge in the quantity of daycare processes are factors contributing to the market growth. Moreover, government authorities in several nations are actively engaged in spreading knowledge and understanding regarding the significance of health insurance. According to a study, in 2022, approximately half, i.e., 47.4% of nonelderly uninsured adults, had not seen a doctor or medical professional in the past 12 months, in contrast to 16.6 percent with private insurance and 14% with public coverage. Hence, there will be huge growth opportunities for this market in the coming years.

MARKET DRIVERS

High Costs Associated With Medical Diagnosis and Treatments

Moreover, the aging world population is also propelling the industry forward. China, which is a global manufacturing hub and a developed economy, is struggling with population aging, and most nations in Europe also have this pattern. Additionally, compulsory provision for health insurance in public and private sectors is increasing the growth rate of the health insurance market. Countries with young populations, such as India, are also a lucrative marketplace. Lately, in 2024, the Insurance Regulatory and Development Authority of India (IRDAI) data also sheds light on how young adults are increasingly more financially careful than previous generations, and around 70% of young people actually have monetary protection as one of their major life objectives. Such industry dynamics are influencing the demand to launch healthcare insurance policies in favor of the public.

The development of health insurance mobile platforms that utilize sophisticated technologies such as artificial intelligence (AI), the Internet of things (IoT), big data analytics, and predictive analysis for ease of the claims process and policy management gives a positive outlook for the health insurance market. Apart from this, a big section of the African and Asian population is uninsured, providing enormous potential for prominent industry players. According to WHO data, about 11 million people in Africa and 550 million individuals in the Asia Pacific experience disastrous and exorbitant health expenses yearly.

MARKET RESTRAINTS

Stringent procedures and extensive documentation for Medicare advantages restrict the expansion of the health insurance market. In addition, limited coverage, high costs and poor results are regular issues in the United States health care system. According to a survey of privately and publicly insured adults, around 6 in 10 individuals with insurance stated difficulty with accessing their health insurance during 2022. The portion grows to three-quarters for people in average or bad health, three-fourths needed for mental health services, and nearly 8 in 10 applied this system maximum.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.12% |

|

Segments Covered |

By Service Provider, Coverage Type, Product Type, Insurance Plan Type, Demographics and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Aetna Inc. (CVS Health Corporation), Zurich Insurance Group AG, AIA Group Limited, United Health Group Inc., Allianz SE Prudential PLC, Aviva Plc, International Medical Group Inc. (Sirius International Insurance Group Ltd.), Berkshire Hathaway Inc. and Cigna Corporation |

SEGMENTAL ANALYSIS

By Service Provider Insights

The private segment is anticipated to lead the health insurance market with a considerable market share during the forecast period. This is basically due to the increasing penetration of private companies in emerging countries or areas. In addition, these providers are providing unique policies and plans with all of the advantages, which include rising customer preference.

The public segment is likely to expand positively across the forecast period because of the low premium charges and the need for basic health insurance in several nations like Germany, Denmark and others. Moreover, the launch of new government initiatives for the low- and middle-income classes will boost the growth of the public segment.

By Coverage Type Insights

The life-term coverage segment is the leading segment and accounted for 70% of the global health insurance market share in 2023. This segment’s command is highlighted by the varied advantages provided by life policies, such as guaranteed death benefits and permanent coverage. Furthermore, it also supports corporate employees in saving taxes by investing in these types of plans.

On the other hand, the term insurance segment has quickly risen upwards in the last few years and is expected to hold a substantial share of the global health insurance market during the forecast period. This can be credited to its low cost and extensive coverage. Also, it majorly involves health insurance for safety and protection against the heightening expenditure of communicable and chronic disease treatments and in case of emergencies like critical illnesses, this is the perfect choice to safeguard medical costs.

By Product Type Insights

The medical insurance segment is predicted to hold the largest share of the health insurance market share during the forecast period owing to the rising prevalence of sedentary culture, the increasingly obese population suffering from various medical problems, and the growing number of accidents happening on a regular basis.

On the other hand, the critical illness insurance segment is expected to play a notable role in the global market during the forecast period and be the second-largest segment in the global market. Moreover, diabetes, cancer, heart disease, and other chronic conditions are rapidly becoming regular, which is driving the segment’s market share.

By Demographics Insights

The adult segment is believed to account for the major share of the health insurance market throughout the forecast period owing to a large section of adults being provided health insurance by their employers. The huge popularity of employer-sponsored medical plans is a major driving factor in the market. In addition, they regularly obtain health insurance plans that cover all family members, including children and elderly parents. Moreover, insurance organizations offer a wide range of products customized to adults, consisting of individual policies, family cover, and plans with specific clauses or features, for example, maternity coverage or preventive care.

By Insurance Plan Type Insights

The preferred provider organizations (PPOS) segment has been the dominant category in the health insurance market over the forecast period. It enables policyholders with considerable flexibility and options in terms of healthcare company selection. Unlike Health Maintenance Organizations (HMOs), which normally need members to choose a basic care physician and get referrals for expert treatment, PPOs allow people to explore any medical facility provider, specialist, or hospital they want. Further, customers desiring control over their medical decisions favor segmental expansion.

By End-User Insights

The individual segment continues to be at the top position and is forecasted to follow an upward trajectory in the coming years. This popularity can be credited to a huge volume of customers purchasing individual health schemes as they are also tailor-made. Moreover, it enables more control over allowance, coinsurance and advantages and is not reliant on employment status.

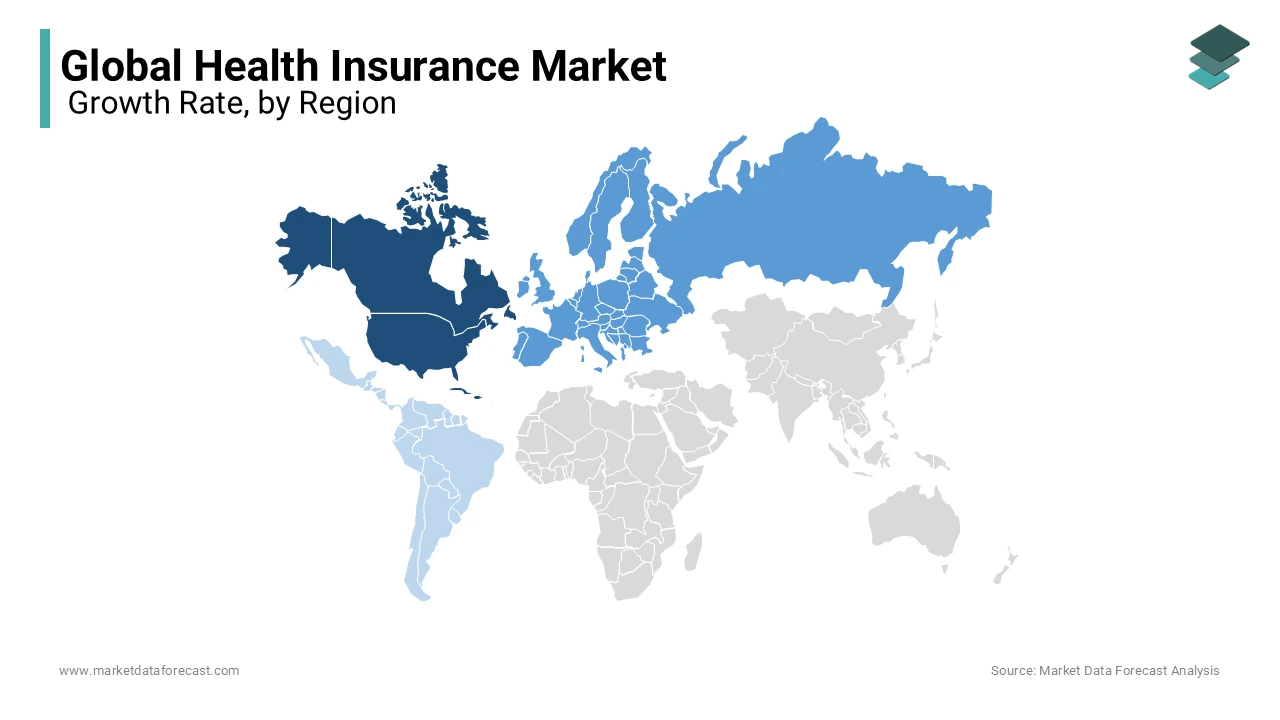

REGIONAL ANALYSIS

North America led the health insurance market worldwide in 2023 and is anticipated to lead the health insurance market throughout the forecast period. Government programs provide affordable Medicare and Medicaid security, and the significant presence of an unfit population covered by health-care policies is expected to propel the region’s market size. Additionally, the expensive medical services in this industry, along with favorable healthcare reimbursement plans, fuel the market growth.

Europe is projected to be the second-largest market during the forecast period due to strict federal regulations necessitating the general public to possess at least one health insurance policy. In addition, rising public cognizance of the significance of medical coverage plans will expand the European market growth.

Also, because of the growing penetration of private companies in subcontinent areas and the introduction of plans by central and state governments, the Asia Pacific market is believed to be the fastest-growing industry, with the highest CAGR throughout the estimation period. Additionally, the rising incidence of chronic diseases and densely populated economies like China and India further influence the market size. Owing to the limited presence of insurance players in the emerging markets of Latin America, the Middle East and Africa are estimated to hold lower market shares during the forecast period.

KEY MARKET PARTICIPANTS

Aetna Inc. (CVS Health Corporation), Zurich Insurance Group AG, AIA Group Limited, United Health Group Inc., Allianz SE Prudential PLC, Aviva Plc, International Medical Group Inc. (Sirius International Insurance Group Ltd.), Berkshire Hathaway Inc. and Cigna Corporation are some of the prominent companies in the global health insurance market.

RECENT HAPPENINGS IN THE MARKET

- In June 2024, Zurich Insurance purchased a 70 per cent stake in Kotak Mahindra General Insurance in a Rs 5560-crore i.e. 670 million dollars transaction from Kotak Bank after it was granted regulatory approvals.

- In November 2023, the Fair-Trade governing body CCI on approved the purchase of an extra stake in Niva Bupa Health Insurance Company by Bupa Singapore Holdings Pte.

MARKET SEGMENTATION

This research report on the global health insurance market has been segmented and sub-segmented based on service provider, coverage type, product type, insurance plan type, demographics and region.

By Service Provider

- Private

- Public

- Standalone Health Insurers

By Coverage Type

- Life-Time Coverage

- Term Insurance

By Product Type

- Medical Insurance

- Critical Illness Insurance

- Family Floater Health Insurance

- Others

By Demographics

- Minor

- Adults

- Senior Citizen

By Insurance Plan Type

- Preferred Provider Organizations (PPOS)

- Point of Service (POS)

- Health Maintenance Organizations (HMOs)

- Exclusive Provider Organizations (EPOS))

- Indemnity Health Insurance

- Health Savings Account (HSA)

- Qualified Small Employer Health Reimbursement Arrangements (QSEHRAS)

- Others

By End-User

- Individuals

- Corporate/ Employer-Sponsored Group Plans

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How big is the health insurance market?

The global health insurance market was worth USD 2.25 trillion in 2024 and is estimated to be worth USD 2.43 trillion in 2025.

What is the major factor driving the health insurance market growth?

The growing costs associated with the diagnosis and treatment is boosting the health insurance market growth.

Which segment by coverage type is dominating the health insurance market?

The life-term segment is leading the health insurance market.

Who are the major players in the global health insurance market?

Companies playing a key role in the global health insurance market include Aetna Inc. (CVS Health Corporation), Zurich Insurance Group AG, AIA Group Limited, United Health Group Inc., Allianz SE Prudential PLC, Aviva Plc, International Medical Group Inc. (Sirius International Insurance Group Ltd.), Berkshire Hathaway Inc. and Cigna Corporation.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]