Global Health Insurance Exchange Market Size, Share, Trends, and Growth Forecast Report By Type (Services, Software and Hardware), Application (Government Agencies, Third Party Administrators (TPAs) and Health Plans or Payers) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2025 to 2033)

Global Health Insurance Exchange Market Size

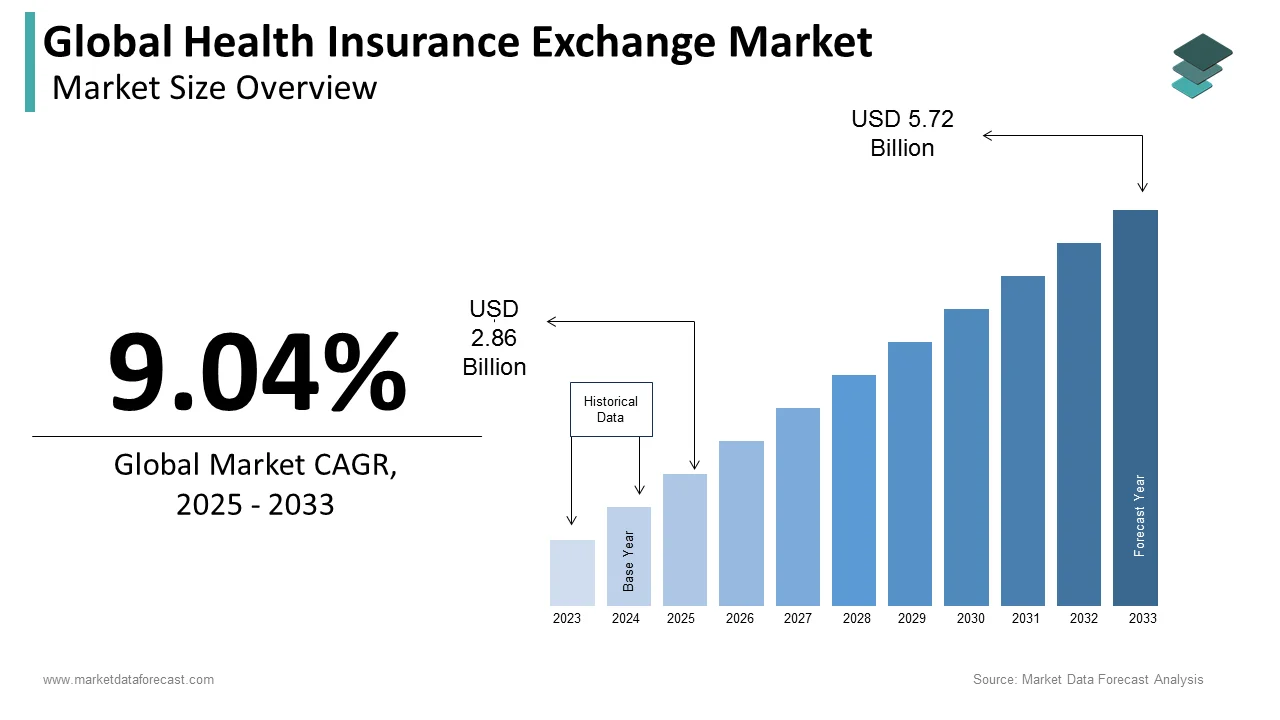

The global health insurance exchange market was valued at USD 2.62 billion in 2024. The global market is further anticipated to grow at a CAGR of 9.04% from 2025 to 2033 and be worth USD 5.72 billion by 2033 from USD 2.86 billion in 2025.

The health insurance exchange market has been growing steadily over the last few years and is anticipated to witness promising growth during the forecast period due to the increasing awareness among people regarding the benefits of health insurance and regulatory changes that mandate health coverage. The demand for health insurance exchange is high in countries such as the U.S., UK and Germany compared to the other countries worldwide. In the U.S., the Affordable Care Act (ACA) established state and federal exchanges to facilitate the purchase of health insurance. As per the statistics of the Centers for Medicare & Medicaid Services (CMS), the number of enrollments in Health Insurance Marketplaces touched 12 million in 2023, which was a substantial increase from the previous years. In the UK and Germany, public health systems are complemented by private exchange markets to address the need for additional coverage options. Currently, the global health insurance exchange market has stiff competition and companies such as UnitedHealth Group, Anthem and Cigna are playing a dominating role. Market participants are adopting strategies such as technology integration, personalized service, and competitive pricing to strengthen their position in the global market. Investments in digital platforms to streamline enrollment processes, partnerships with healthcare providers, and the implementation of value-based care models are some other major strategies being used by the market participants to do well in the global market.

MARKET DRIVERS

YoY Growth in the Demand for Affordable Health Insurance

Healthcare costs are growing exponentially and continually. These situations have made it mandatory for individuals and families to adopt health insurance options that match their budgets. For instance, as per the Kaiser Family Foundation, the average annual premium was USD 7739 for individual coverage and USD 22,221 for family coverage in employer-sponsored plans in 2021. However, health insurance exchanges often provide more affordable options due to competitive pricing and subsidies. According to the Centers for Medicare & Medicaid Services (CMS), around 87% of the people who selected their plans via Health Insurance Marketplace received benefits such as premium tax credits and paid lower monthly premiums in 2021. The need for affordable insurance solutions is likely to increase further during the forecast period and fuel the demand for health insurance exchanges and propel global market growth.

Growing Number of Initiatives and the Expansion of Healthcare Programs from the Governments

For instance, the Affordable Care Act (ACA) played a major role in establishing the health insurance marketplaces and promoted access to coverage for everybody in the U.S. As of 2021, more than 12 million took health insurance plans using the exchanges developed by the ACA. The American Rescue Plan Act of 2021 provided subsidies and made coverage more affordable to the American population. In addition, several states in the U.S. have established their own exchanges to provide personalized options to their people. The growing efforts from the governments of various countries to improve and expand healthcare programs are likely to result in the growth of the health insurance exchange market.

In addition to that, factors such as the adoption of technological advancements in insurance platforms, rising adoption of health insurance exchanges among employers, increasing number of private health insurance options and Y-o-Y growth in the digital and telehealth services are supporting the growth of the health insurance exchange market. The growing patient population of chronic diseases, favorable regulations from the governments of several countries, increasing middle-class population, growing number of improvements in the healthcare infrastructure, rising focus on preventative care and increasing emphasis on the development of personalized insurance plans are contributing to the expansion of the global health insurance exchange market.

MARKET RESTRAINTS

High Administrative and Operational Costs

In addition to the above, complexities of insurance plan options, limited awareness and understanding among consumers, regulatory and compliance challenges, and concerns about cybersecurity and data privacy are impeding the growth of the health insurance exchange market. Insufficient network coverage in rural areas, resistance from traditional insurance brokers, technical issues with online platforms and political instability and changes in healthcare policies are hindering the growth rate of the global market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.04% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

UnitedHealth Group, Anthem, Inc., Aetna (a CVS Health Company), Cigna Corporation, Humana Inc., Centene Corporation, Molina Healthcare, Inc., Blue Cross Blue Shield Association, Kaiser Permanente, WellCare Health Plans, Inc., Bupa, AXA, Allianz SE, Aviva plc, Munich Re Group, Discovery Limited, Ping An Insurance, China Life Insurance Company, Nippon Life Insurance and Mitsui Sumitomo Insurance Group |

SEGMENTAL ANALYSIS

By Type Insights

The services segment was the largest segment and accounted for 61.4% of the global market share in 2023 and is estimated to grow at a healthy CAGR during the forecast period. The dominance of the services segment is primarily attributed to the increasing demand for consulting, implementation and support services. The rising adoption of health insurance exchange platforms by governments and private organizations is likely to boost the demand for specialized services to ensure smooth operation and compliance with regulations and contribute to the expansion of the services segment in the global market. For instance, according to Deloitte, about 70% of health insurance exchanges depend on third-party services for implementation and maintenance.

The software segment is predicted to register the fastest CAGR in the global market during the forecast period. The growing adoption of technological advancements such as AI and Machine Learning to promote the capabilities of software, increasing digital transformation in healthcare and rising emphasis on user-friendly interfaces in health insurance exchanges are propelling the growth of the software segment in the global market.

By Application Insights

The government agencies segment led the market by accounting for 44.8% of the global market share in 2023 and is predicted to grow at a steady CAGR during the forecast period. Government agencies are major players in the global health insurance exchange market. The growth of the government agencies segment is majorly driven by the regulatory mandates, increasing efforts to improve public health access and the rapid implementation of health reforms such as the Affordable Care Act in the United States. According to the data from the OECD, more than 80% of the governments of OECD countries have developed government-led health insurance exchanges to streamline healthcare access in their respective countries.

The Third-Party Administrators (TPAs) segment is a notable segment and is projected to witness a notable CAGR during the forecast period in the worldwide market. TPAs play an important role in managing the administrative aspects of health insurance exchanges such as enrollment, claims processing and customer service. As per the Health Insurance Marketplace Report, more than 60% of the administrative workload for private health insurance exchanges globally is currently being handled by the TPAs.

The health plan segment is expected to grow at the fastest CAGR in the global market during the forecast period. Health payers provide a wide range of insurance products to consumers through exchanges. An increase in insurance plans is boosting the expansion of the segment in the global market. For instance, as per the statistics of the National Association of Insurance Commissioners, more than 50% of the insurance plans offered on exchanges are provided by private health insurers.

REGIONAL ANALYSIS

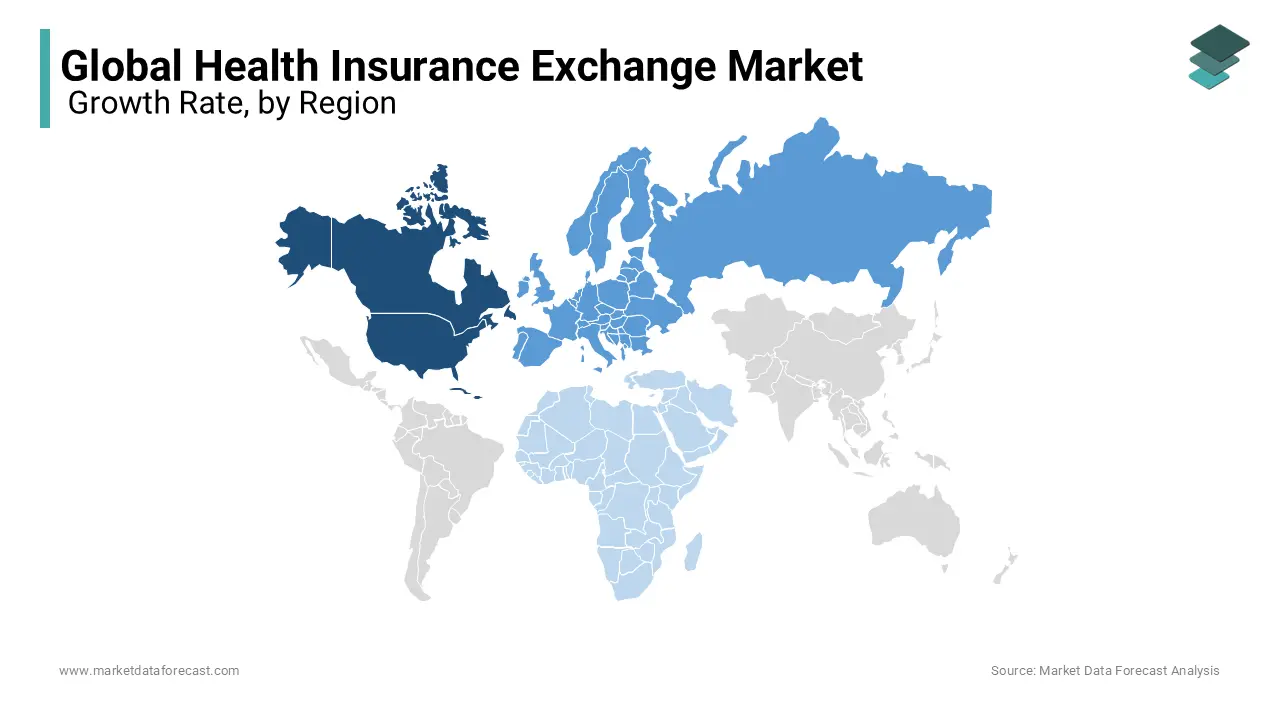

North America is the leader in the global health insurance exchange market. North America emerged as the most dominating region in the global market in 2024 by holding 46.2% of the global market share. The high adoption of health insurance exchanges due to regulatory frameworks such as the Affordable Care Act is primarily boosting the North American market growth. The presence of advanced healthcare infrastructure and high healthcare expenditure are further contributing to the expansion of the North American market. For instance, as per the data of OECD, the healthcare expenditure per capita was USD 11702 in 2023, which was the highest among all the regions.

Europe was the second-largest regional segment in the global health insurance exchange market in 2024. Europe is also predicted to account for a notable share of the worldwide market during the forecast period. According to Eurostat, more than 75% of the European population have government-provided or employer-provided health insurance coverage. The rising adoption of digital health initiatives, mandates from the governments of European countries for healthcare coverage and the presence of well-established healthcare systems are propelling the health insurance exchange market in Europe. As per the data of the European Commission, approximately 70% of the countries in Europe implemented health insurance exchanges.

Asia-Pacific is anticipated to be the most lucrative region in the worldwide market in the coming years. The Asia-Pacific region is growing at the fastest pace compared to the other regions. Factors such as rising awareness of healthcare among the population of Asia-Pacific countries, increasing disposable income and initiatives from the governments of Asia-Pacific countries to expand healthcare access are propelling the health insurance exchange market in the Asia-Pacific region. According to data from the World Health Organization (WHO), more than 100 million people in China and India will use health insurance exchanges in 2023, which clearly indicates the growing demand for health insurance exchanges in this region. The growing healthcare expenditure in the Asia-Pacific is also contributing to the regional market expansion. For instance, as per the statistics of the World Bank, healthcare expenditure in the Asia-Pacific region is growing at a 6.6% y-o-y growth rate.

Latin America is projected to witness a healthy CAGR during the forecast period in the global market. The health insurance exchange market is growing steadily in the Latin American market. Improvements in the healthcare infrastructure in this region, rise in healthcare spending, and growing demand for affordable health coverage are driving the health insurance exchange market in Latin America. Brazil and Mexico are key markets in the Latin American region. According to data from the Pan American Health Organization, more than 30 million people in Brazil and Mexico will utilize health insurance exchanges in 2024.

The Middle East & Africa region is an emerging market for health insurance exchanges. The health insurance exchange market in MEA is predicted to grow at a noteworthy CAGR during the forecast period. The governments of Middle Eastern and African countries have been putting significant efforts into improving healthcare access in this region, which is expected to favor the regional market during the forecast period. The growing investments in the healthcare industry in this region and the growing patient population suffering from chronic diseases are further supporting the health insurance exchange market in the Middle East and Africa.

KEY MARKET PLAYERS

UnitedHealth Group, Anthem, Inc., Aetna (a CVS Health Company), Cigna Corporation, Humana Inc., Centene Corporation, Molina Healthcare, Inc., Blue Cross Blue Shield Association, Kaiser Permanente, WellCare Health Plans, Inc., Bupa, AXA, Allianz SE, Aviva plc, Munich Re Group, Discovery Limited, Ping An Insurance, China Life Insurance Company, Nippon Life Insurance and Mitsui Sumitomo Insurance Group are some of the major players in the global health insurance exchange market.

MARKET SEGMENTATION

This research report on the global health insurance exchange market has been segmented and sub-segmented based on type, application and region.

By Type

- Services

- Software

- Hardware

By Application

- Government Agencies

- Third-Party Administrators (TPAs)

- Health Plans or Payers

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the predicted CAGR of health insurance exchange market for the next five years?

The global health insurance exchange market is expected to grow at a CAGR of 9.04% from 2025 to 2033.

Which segment by application dominated the health insurance exchange market in 2024?

The government agencies segment held the largest share of the global market in 2024.

Who are the key players in the health insurance exchange market?

UnitedHealth Group, Anthem, Inc., Aetna (a CVS Health Company), Cigna Corporation, Humana Inc., Centene Corporation, Molina Healthcare, Inc., Blue Cross Blue Shield Association, Kaiser Permanente, WellCare Health Plans, Inc., Bupa, AXA, Allianz SE, Aviva plc, Munich Re Group, Discovery Limited, Ping An Insurance, China Life Insurance Company, Nippon Life Insurance and Mitsui Sumitomo Insurance Group are some of the major companies in the global market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]