Global Gymnastics Equipment Market Size, Share, Trends & Growth Forecast Report By Age Group (Children (5-12 years), Teenagers (13-19 years), Adults (20-59 years), Seniors (60 years and above)), Equipment Type, Material, usage type, end-user and Region (North America, Europe, Asia Pacific, Latin America and Middle East & Africa), Industry Analysis From 2025 to 2033

Global Gymnastics Equipment Market Size

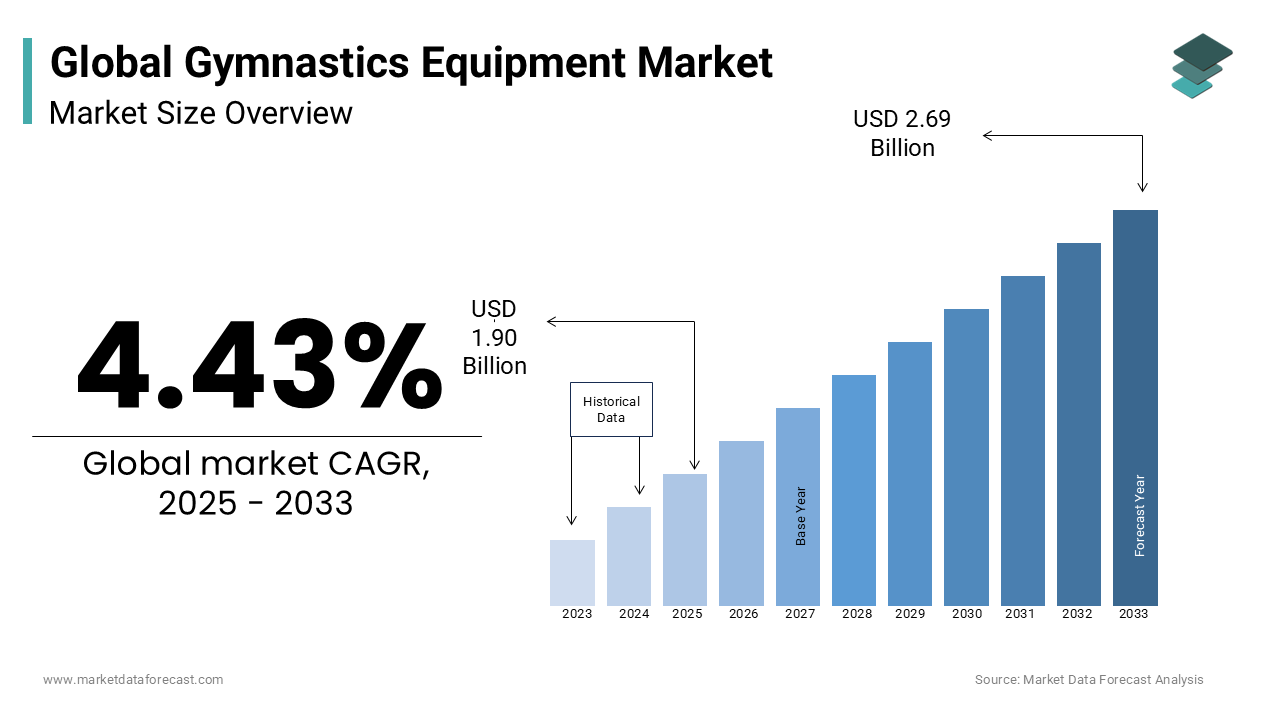

The global gymnastics equipment market was worth USD 1.82 billion in 2024. The European market is estimated to grow at a CAGR of 4.43% from 2025 to 2033 and be valued at USD 2.69 billion by the end of 2033 from USD 1.90 billion in 2025.

The gymnastics equipment market includes products like balance beams, vaults, rings, and mats used in both training and competitions. This market has seen steady growth due to rising interest in gymnastics as a sport and fitness activity.

According to the International Gymnastics Federation (FIG), over 30 million people across the world actively participate in gymnastics, either at a professional or recreational level. The Olympic Games continue to be a major driver of interest, with gymnastics being one of the most-watched events. In the 2020 Tokyo Olympics, gymnastics events attracted millions of viewers globally which shows the sport's extensive popularity.

The increasing popularity of gymnastics, both as a competitive sport and a recreational activity, is a significant factor driving this growth. More people are participating in gymnastics, leading to higher demand for quality equipment. Additionally, there is a growing emphasis on fitness and health, encouraging individuals to engage in physical activities like gymnastics.

Technological advancements have also played a role in market expansion. Manufacturers are developing innovative equipment that enhances safety and performance, attracting more users. Moreover, government initiatives promoting sports participation have contributed to the market's growth. Efforts to encourage physical activity among youth and adults alike have increased interest in gymnastics, further boosting equipment demand.

MARKET DRIVERS

Growing Emphasis on Physical Fitness and Health

The global focus on physical fitness is a key driver for the gymnastics equipment market. The World Health Organization states that physical inactivity contributes to 3.2 million deaths annually prompting governments to promote sports like gymnastics. Schools and fitness centers are incorporating gymnastics into their programs to combat sedentary lifestyles. According to the Centers for Disease Control and Prevention, regular participation in gymnastics improves flexibility and reduces obesity rates by 25%. Equipment like mats and balance beams supports safe training making it accessible for all age groups. Governments are investing in public health campaigns with the U.S. Department of Health reporting a 20% rise in gymnastics-based activities since 2020. This growing awareness drives demand for durable and versatile gymnastics equipment in the world.

Increased Participation in Competitive Sports

The rise in competitive sports participation significantly boosts the gymnastics equipment market. According to the International Gymnastics Federation, a 30% increase in registered gymnasts globally over the past decade driven by scholarships and career opportunities. Competitive events require advanced equipment like uneven bars and vaults ensuring precision and safety. The U.S. Department of Education states that sports scholarships motivate students with over 10,000 athletes benefiting annually. Additionally, the American College of Sports Medicine states that structured training improves athletic performance by 40%. As more countries invest in sports infrastructure the demand for high-quality gymnastics equipment grows. This trend fosters innovation and supports the development of cutting-edge tools for athletes.

MARKET RESTRAINTS

High Costs of Advanced Equipment

The high cost of advanced gymnastics equipment acts as a significant restraint for widespread adoption. The U.S. Department of Commerce stresses that professional-grade equipment like rings and parallel bars can cost up to $5,000 per unit making it unaffordable for small gyms and schools. Maintenance expenses add to the burden with annual costs reaching $1,000 per machine according to the Federal Communications Commission. Budget constraints limit access to premium equipment especially in developing regions. The International Labour Organization states that only 20% of educational institutions in low-income areas can afford such investments. While basic models are available they lack durability and advanced features. These financial barriers hinder the growth of gymnastics programs despite rising interest.

Safety Concerns and Injury Risks

Safety concerns pose a major challenge for the gymnastics equipment market. According to the National Safety Council, gymnastics accounts for over 86,000 injuries annually in the U.S. alone due to improper equipment or inadequate supervision. Faulty designs or poor-quality materials exacerbate these risks. The U.S. Consumer Product Safety Commission reveals that 30% of gymnastics-related injuries occur from falls on substandard mats or flooring. Parents and institutions hesitate to invest in equipment without guaranteed safety standards. Additionally, the Centers for Disease Control and Prevention emphasize that injury risks discourage beginners from participating. Addressing these concerns requires stricter regulations and better-quality assurance measures to rebuild trust among users.

MARKET OPPORTUNITIES

Integration of Technology in Equipment Design

Technological advancements offer immense potential for the gymnastics equipment market. The National Institute of Standards and Technology states that smart equipment embedded with sensors improves training accuracy by 35%. For instance, sensor-equipped mats track landing impact helping athletes refine techniques. The U.S. Department of Energy reveals that energy-efficient manufacturing reduces production costs by 20% enabling affordable innovations. Additionally, the International Health Racquet and Sportsclub Association sheds lights on a 25% rise in demand for tech-enabled fitness tools since 2021. Such innovations appeal to both recreational users and professional athletes. By integrating technology manufacturers can enhance user experience and cater to modern fitness trends driving market expansion.

Expansion into Emerging Markets

Emerging markets present a significant opportunity for the gymnastics equipment market. The World Bank shows that urbanization in Asia and Africa will reach 60% by 2030 creating demand for recreational and competitive sports facilities. Schools and community centers in these regions are adopting gymnastics as part of physical education programs. The United Nations emphasizes that governments in developing countries allocate 15% of their budgets to youth sports initiatives. Affordable and durable equipment like foam mats and balance beams is in high demand. According to the International Gymnastics Federation participation rates in emerging economies have grown by 40% since 2018. Expanding into these regions ensures long-term growth and accessibility for diverse user groups.

MARKET CHALLENGES

Limited Awareness in Rural Areas

Limited awareness about gymnastics remains a challenge particularly in rural and underserved regions. The U.S. Department of Agriculture through its study notes that only 10% of rural schools include gymnastics in their curriculums due to lack of resources and trained instructors. This gap restricts participation and limits equipment sales. The Centers for Disease Control and Prevention point out that rural communities face higher obesity rates with physical activity levels 30% lower than urban areas. Without proper promotion and infrastructure gymnastics struggles to gain traction. Additionally, the National Education Association states that funding disparities leave rural schools unable to invest in sports programs. Bridging this awareness gap is crucial for equitable access to gymnastics and its benefits.

Environmental Concerns Over Material Use

Environmental concerns related to material production challenge the gymnastics equipment market. The Environmental Protection Agency states that manufacturing synthetic materials like polyurethane emits harmful gases contributing to air pollution. Traditional materials like wood also face scrutiny due to deforestation risks. The International Organization for Standardization found that 40% of consumers now prioritize eco-friendly products influencing purchasing decisions. Manufacturers must adopt sustainable practices to meet these expectations. However, transitioning to green alternatives increases production costs by 25% according to the U.S. Department of Commerce. Balancing environmental responsibility with affordability is a pressing issue requiring innovative solutions to maintain market relevance.

REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Age Group, Equipment Type, Material, Usage type, end-user and Country |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

PEGA Group, Gymnova S.A.R.L., Brevetti Montorfano S.p.A., Janssen Fritsen bv, Flexx, Sportika Sdn Bhd, Gymnastics Unlimited Inc., Eleiko Sport AB, Spieth Gymnastics Equipment, The Gopher Group, Core Health Fitness, Podwall Sport, Ace Sporting Goods Co., Ltd., Funtrix, and Technogym S.p.A). |

SEGMENTAL ANALYSIS

By Age Group Insights

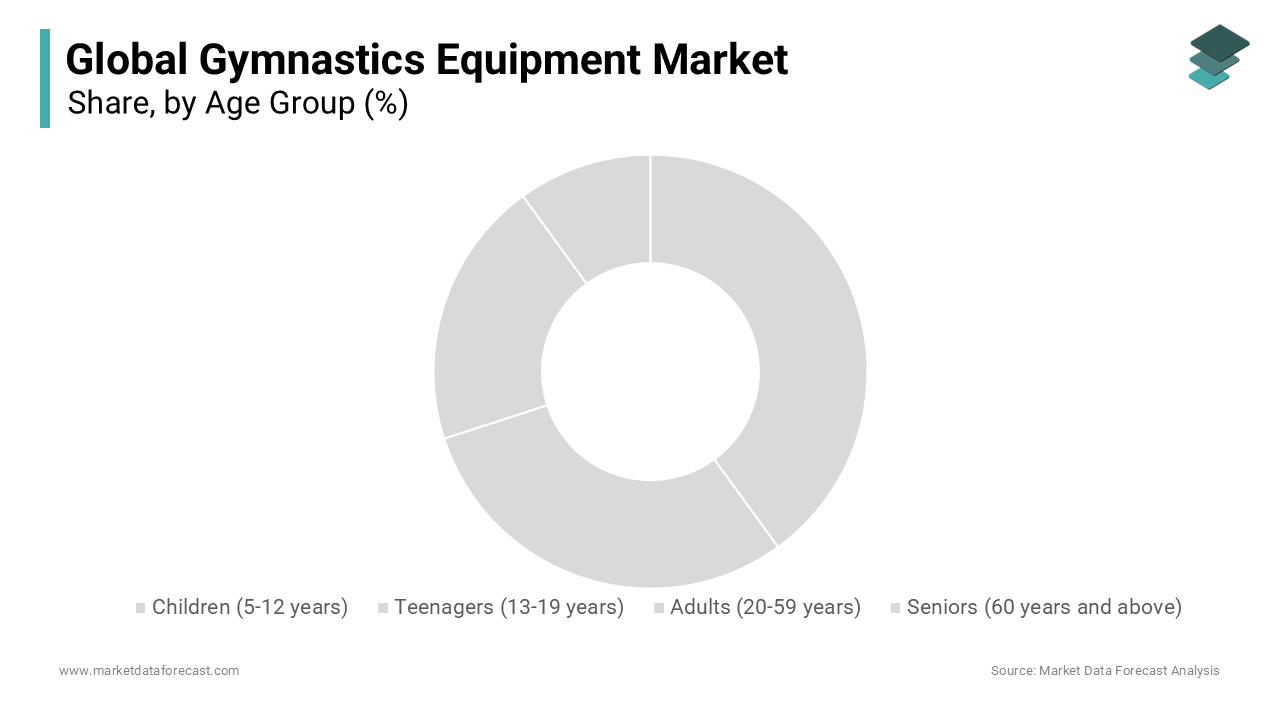

The Children (5-12 years) segment led the market and held a market share of 40% in 2024. It propels because children are introduced to gymnastics early as part of school programs and extracurricular activities. The U.S. Department of Education states that over 60% of schools include gymnastics in physical education curriculums. This age group benefits from improved motor skills and flexibility which are crucial for development. According to the Centers for Disease Control and Prevention regular physical activity reduces childhood obesity by 25%. Gymnastics equipment like mats and balance beams is essential for safe training. Their importance lies in promoting fitness and healthy habits from a young age.

The Adults (20-59 years) segment is progressing at a CAGR of 8.5% in the future as the growth is driven by rising awareness of fitness and wellness among adults. The World Health Organization states that 1 in 4 adults globally does not meet physical activity guidelines prompting more people to join recreational gymnastics. Gyms and fitness centers report a 30% increase in adult gymnastics classes since 2020, according to the International Health Racquet and Sportsclub Association. Adults use equipment like foam mats and parallel bars for strength training and injury prevention. Their focus on health makes this segment critical for market expansion and innovation.

By Equipment Type Insights

The Mats flooring prevailed in the market by having a 35.3% market share in 2024 as the versatility and usage across all age groups and skill levels is contributing the prominence of this segment. The National Safety Council brings to light that mats reduce injury risks by 40% during gymnastics training. Schools and gyms prioritize safety making mats essential for floor exercises and landing zones. According to the U.S. Consumer Product Safety Commission proper flooring prevents over 10,000 gymnastics-related injuries annually. Mats are also cost-effective and easy to maintain. Their importance lies in ensuring safety and enhancing performance in gymnastics activities.

The rings segment is developing at the fastest CAGR of 9.2% from 2025 to 2033 owing to the increasing participation in competitive gymnastics and cross-training programs. The International Gymnastics Federation observes a 25% rise in competitive gymnasts globally since 2018. Rings improve upper body strength and core stability making them popular in fitness routines. The American College of Sports Medicine states that functional training equipment like rings boosts muscle engagement by 30%. Their versatility appeals to both professional athletes and fitness enthusiasts driving demand and innovation in this segment.

By Material Insights

The Foam segment possessed the dominant market share at 45.7%. It is lightweight durable and provides excellent cushioning for safety which is primarily driving the leading position of this segment. The U.S. Consumer Product Safety Commission states that foam-based equipment reduces impact injuries by 50% during gymnastics activities. Foam mats and padding are widely used in schools and gyms due to their affordability and ease of maintenance. According to the National Institute of Standards and Technology foam materials meet safety standards for shock absorption and durability. Their importance lies in ensuring user safety and comfort during training sessions.

The polyurethane segment is accelerating at a CAGR of 10.3% over the forecast period which is influenced by its superior durability and resistance to wear and tear. The International Organization for Standardization notes that polyurethane lasts 30% longer than traditional materials like wood or nylon. Fitness centers and professional gyms prefer polyurethane for high-intensity training equipment. The U.S. Department of Commerce sees a 25% increase in demand for durable gymnastics equipment since 2021. Polyurethane’s ability to withstand heavy use makes it vital for long-term investments in the market.

By Usage Type Insights

The recreational segment captured the biggest market share at 50.2% in 2024 owing to the recreational gymnastics that attracts a wide audience including beginners and casual users. The Centers for Disease Control and Prevention states that recreational sports participation improves mental health by 20%. Schools and community centers promote gymnastics as a fun way to stay active. According to the International Health Racquet and Sportsclub Association over 70% of fitness centers offer recreational gymnastics programs. Equipment like mats and balance beams is affordable and accessible making it ideal for casual training.

The competitive segment is rising at a CAGR of 9.8% during the forecast period. The progress is fuelled by the rising interest in competitive sports and scholarships. The International Gymnastics Federation found a 30% increase in competitive gymnasts globally since 2020. Schools and clubs invest in advanced equipment like vaults and uneven bars to prepare athletes for competitions. The U.S. Department of Education observes that sports scholarships motivate students to pursue competitive gymnastics. This segment’s focus on skill development and excellence drives innovation and market growth.

By End User Insights

The Gymnastics clubs segment held the largest market share at 35.1% in 2024 because clubs are hubs for training and competitions requiring diverse equipment. The International Gymnastics Federation states that over 5,000 gymnastics clubs operate globally catering to all age groups. Clubs invest in high-quality equipment like balance beams and vaults to ensure safety and performance. According to the U.S. Department of Education clubs play a key role in nurturing talent for national and international competitions. Their importance lies in fostering skill development and promoting gymnastics as a sport.

The fitness centers segment is growing at a CAGR of 11.2% from 2025 to 2033. The growth of segment is driven by the integration of gymnastics into fitness routines for strength and flexibility. The International Health Racquet and Sportsclub Association identifies a 40% rise in gymnastics-based fitness programs since 2021. Equipment like mats and rings is used for functional training appealing to adults seeking holistic workouts. The World Health Organization says that gymnastics-inspired exercises improve cardiovascular health by 25%. Fitness centers’ focus on innovative workouts makes this segment a key driver of market expansion.

REGIONAL ANALYSIS

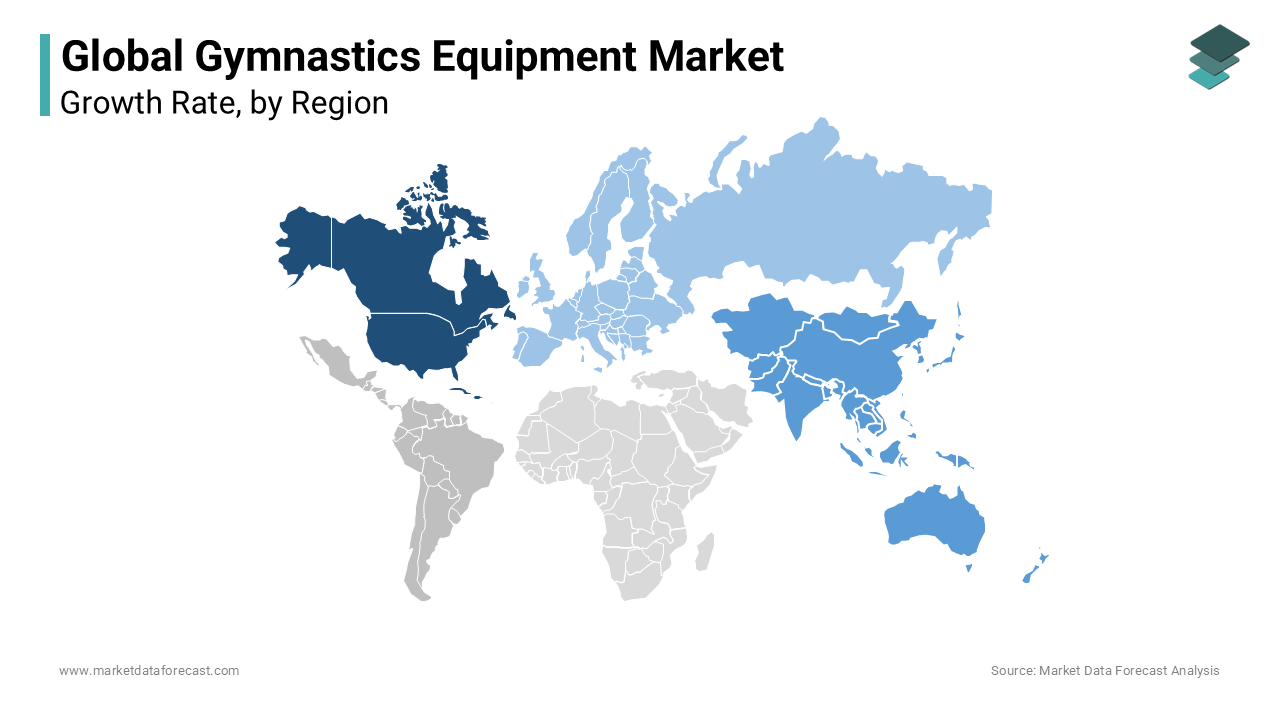

North America led the gymnastics equipment market with a 40.2% share in 2024. Its dominance comes from strong participation, with 4.8 million U.S. kids in gymnastics in 2021, per the U.S. Census Bureau. The U.S. Department of Health reports $1.2 billion spent yearly on sports programs, fueling equipment demand. This region drives global trends due to its advanced facilities and high interest in fitness. In the coming years, growth will likely continue as 70% of U.S. adults prioritize health, according to the CDC in 2022. Investments in training centers will keep North America a key player, shaping the market’s future.

Europe holds a steady position in the gymnastics equipment market, driven by its active population. Eurostat noted 60% of adults exercised in 2022, supporting consistent demand. Countries like Germany and the UK host major events, boosting equipment needs. The European Commission invested €400 million in sports in 2023, enhancing facilities. In the next few years, Europe will maintain growth as fitness awareness rises. With 25% of youth in sports programs, per the EU Sports Council in 2022, demand will stay strong. Europe’s focus on quality infrastructure ensures it remains a reliable market, adapting to new trends slowly but steadily.

Asia-Pacific stands as the fastest expanding region with a 5.6% CAGR from 2025 to 2033. Rising incomes and sports interest drive this surge. China’s National Bureau of Statistics reported 300 million sports participants in 2022,while India’s Ministry of Youth Affairs spent $350 million on sports in 2023. This growth is vital as it opens new markets. In the future, Asia-Pacific will expand rapidly with 40% of its population under 30, per UN data in 2022, eager for fitness. Government support and urbanization will push equipment sales higher, making it a hotspot for innovation and opportunity in the coming years.

Latin America’s gymnastics equipment market is set to grow as sports gain traction. Brazil’s Ministry of Sports recorded 150 events in 2023, increasing equipment use. About 15% of youth joined sports in 2022, per Brazil’s National Institute which is showing rising interest. In the coming years, the region will see moderate growth as governments invest more. With $200 million spent on sports facilities in Mexico in 2023, per Mexico’s Sports Commission, infrastructure is improving. Latin America’s young population and event-driven demand will lift the market steadily, though economic challenges may slow progress compared to faster-growing regions.

The Middle East and Africa lag but show promise in the gymnastics equipment market. The African Union reported a 25% rise in youth sports in 2022, hinting at future growth. Saudi Arabia invested $500 million in sports in 2023, per its Ministry of Sports, aiming to boost participation. Over the next few years, this region will grow slowly as awareness spreads. With 50% of Africa’s population under 20, per UN estimates in 2022, potential is high. However, limited facilities and funding will keep progress gradual, positioning it as an emerging market with long-term possibilities.

Top 3 Players in the market

Abeo SA

Abeo SA is a leading company in the gymnastics equipment market, renowned for its comprehensive range of products that cater to various gymnastics disciplines. The company's commitment to quality and innovation has solidified its position in the market. Abeo SA focuses on integrating advanced technologies and materials into its equipment, ensuring safety and performance for athletes. Their product line includes athletic bars, pommel horses, rings, balance beams, vaults, and floors, addressing the diverse needs of gymnasts. The company's global presence and strategic partnerships have enabled it to expand its reach, contributing to the overall growth of the gymnastics equipment market.

American Athletic, Inc. (AAI Gymnastics)

American Athletic, Inc., commonly known as AAI Gymnastics, is a prominent manufacturer of gymnastics equipment with a rich history in the market. The company offers a wide array of products, including mats, beams, bars, vaults, and rings, designed to meet the rigorous demands of both training and competition. AAI's dedication to quality and safety has made it a trusted choice among gymnastics clubs, schools, and professional training centers. The company's continuous efforts to innovate and adapt to the evolving needs of gymnasts have reinforced its strong market presence.

Mizuno Corporation

Mizuno Corporation, a global sports equipment and apparel company, has made significant contributions to the gymnastics equipment market. Leveraging its extensive experience in sports manufacturing, Mizuno produces high-quality gymnastics apparatus that meet international standards. The company's product range includes various equipment essential for gymnastics training and competitions. Mizuno's commitment to innovation and excellence has strengthened its position in the market, catering to the needs of both amateur and professional gymnasts worldwide.

Top strategies used by the key market participants

Strategic Collaborations and Partnerships

Establishing strong partnerships with gymnastics clubs, schools, and professional athletes plays a vital role in brand visibility and credibility. Leading companies collaborate with national gymnastics federations and event organizers to supply equipment for competitions, gaining worldwide recognition. Sponsorship of top gymnasts and teams also enhances brand reputation and encourages consumer trust. Moreover, partnerships with fitness centers and training academies help drive sales by demonstrating product effectiveness in real-world scenarios. Joint ventures with sports retailers ensure wider product distribution, making equipment more accessible to a broader audience. These collaborations create mutually beneficial relationships that enhance market presence and revenue growth.

Emphasis on Sustainability

Sustainability is becoming a crucial focus in the gymnastics equipment market. Companies are adopting eco-friendly manufacturing processes by using recyclable and non-toxic materials in their products. Innovations like biodegradable mats and energy-efficient production methods help reduce environmental impact while maintaining product quality. Consumers and organizations increasingly prefer sustainable options, making it a key competitive advantage. Some companies have also implemented carbon footprint reduction programs and support environmental initiatives to strengthen their corporate social responsibility (CSR) image. By integrating sustainability into their business model, brands attract eco-conscious customers and differentiate themselves in an market that is becoming more environmentally aware.

Diversification of Product Portfolio

To reach a broader audience, top gymnastics equipment companies expand their product offerings to cater to different age groups and skill levels. From beginner-friendly equipment for young children to high-performance apparatus for elite gymnasts, a diverse product range allows companies to target various customer segments. Additionally, integrating multi-purpose fitness equipment, such as tumbling tracks and balance trainers, appeals to a wider demographic, including general fitness enthusiasts. Customization options, including adjustable equipment and personalized designs, further enhance customer appeal. By continually introducing new and versatile products, companies increase customer engagement and brand loyalty, ensuring long-term growth and sustainability in a competitive market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

PEGA Group, Gymnova S.A.R.L., Brevetti Montorfano S.p.A., Janssen Fritsen bv, Flexx, Sportika Sdn Bhd, Gymnastics Unlimited Inc., Eleiko Sport AB, Spieth Gymnastics Equipment, The Gopher Group, Core Health Fitness, Podwall Sport, Ace Sporting Goods Co., Ltd., Funtrix, and Technogym S.p.A are some of the key market players in the

The gymnastics equipment market is highly competitive, with numerous companies striving to lead the market. Major brands such as Abeo SA, AAI Gymnastics, and Mizuno continuously enhance their products by using advanced technology and innovative materials. Their goal is to provide safer and more efficient equipment for athletes. Smaller businesses also enter the market by offering budget-friendly options or specialized designs.

To stand out, companies focus on durability and user comfort. Many collaborate with well-known gymnasts and sports organizations to boost their reputation. Some businesses expand into international markets where interest in gymnastics is increasing.

Eco-friendly manufacturing is becoming a key factor. Many brands adopt sustainable materials and minimize waste, attracting environmentally conscious buyers.

The rise of online shopping has transformed how businesses compete. Companies can now reach customers directly, making it easier for buyers to compare features and prices before making a decision.

As participation in gymnastics grows, so does the demand for high-quality equipment. This expansion creates opportunities but also requires businesses to constantly innovate. Companies that prioritize cutting-edge designs, superior craftsmanship, and customer satisfaction will continue to thrive in this fast-moving market.

RECENT MARKET DEVELOPMENTS

- In January 2025, British Gymnastics introduced its 'Reform '25' action plan to enhance safety, fairness, and enjoyment in gymnastics. This initiative includes updated flexibility guidance, a new Performance Director for Strategy & Culture, and partnerships with the English Institute of Sport to launch the 'Gymnastics & Beyond' program. These efforts aim to improve training environments and equipment quality.

- In December 2024, the Murraylands Gymnastics Academy in South Australia secured a $1.5 million federal grant to build a modern gymnastics facility at the Murray Bridge Showgrounds. The new center, three times larger than the existing one, will feature advanced equipment, an 11-meter-high ceiling, and foam pits, significantly improving gymnastics training and competition capabilities.

- In February 2025, Sportsafe partnered with Spieth Gymnastics, an FIG-approved brand, to supply a comprehensive range of high-quality gymnastics equipment. This collaboration is expected to support the next generation of gymnasts by improving access to Olympic-standard apparatus and essential training tools in schools and training centers.

MARKET SEGMENTATION

This research report on the gymnastics equipment market is segmented and sub-segmented based on age group, equipment type, material, usage type, end-user and region.

By Age Group

- Children (5-12 years)

- Teenagers (13-19 years)

- Adults (20-59 years)

- Seniors (60 years and above)

By Equipment Type

- Mats Flooring

- Balance Beams

- Vaults

- Uneven Bars

- Parallel Bars

- Pommel Horse

- Rings

By Material

- Wood

- Metal

- Foam

- Nylon

- Polyurethane

- Glass Fiber

By Usage Type

- Recreational

- Competitive

- Professional

By End User

- Gymnastics Clubs

- Schools

- Fitness Centers

- Recreation Centers

- Individuals

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What challenges does the Gymnastics Equipment Market face?

Challenges include the high cost of some equipment and the need for constant innovation to meet the evolving needs of athletes. Additionally, competition from alternative fitness equipment and changing consumer preferences can impact the market.

What are the growth prospects for the Gymnastics Equipment Market?

The Gymnastics Equipment Market is expected to grow due to increasing participation in gymnastics and other fitness activities globally. Technological advancements in equipment design and a focus on enhancing athlete performance will also drive growth.

Why has the demand for gymnastics equipment increased?

The demand for gymnastics equipment has increased due to growing interest in fitness and competitive gymnastics. Additionally, more schools and sports centers are offering gymnastics programs, fueling further demand.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]