Global Guitars Market Size, Share, Trends & Growth Forecast Report By Product (Acoustic , Electric) Distribution Channel (Offline, Online) and Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 to 2033

Global Guitars Market Size

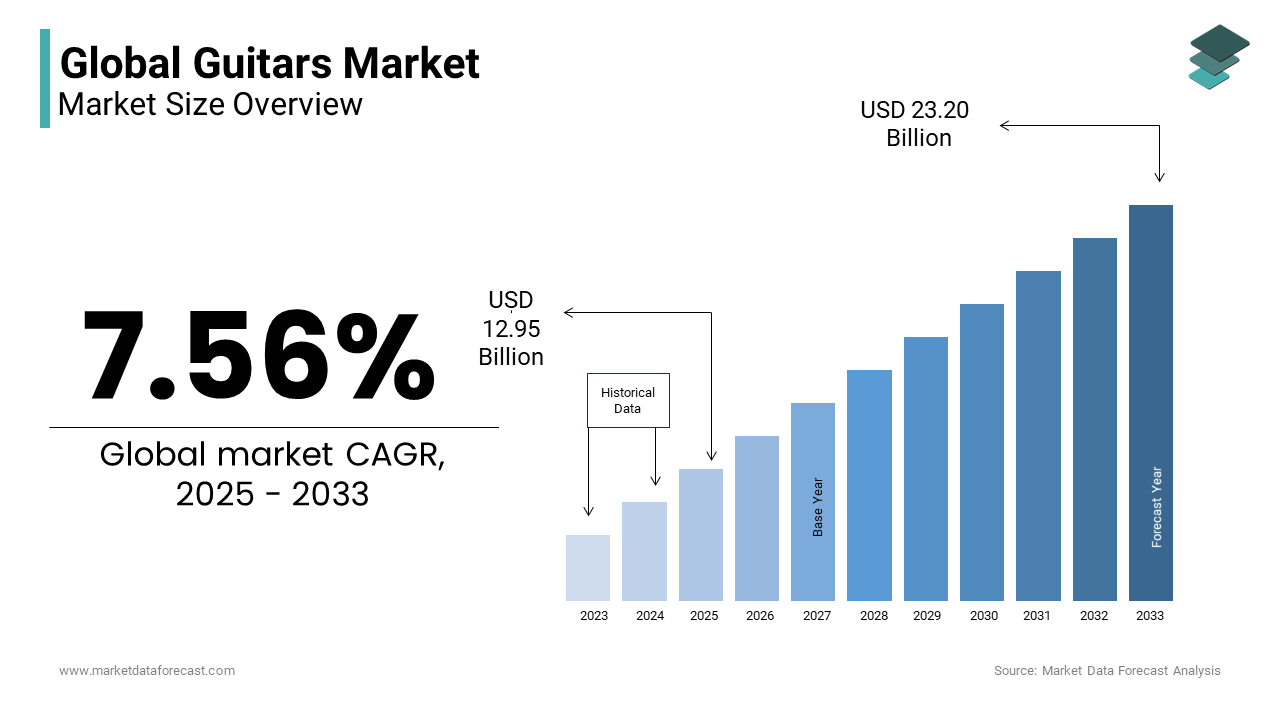

The global guitars market size was valued at USD 12.04 billion in 2024. The guitars market size is expected to have 7.56 % CAGR from 2025 to 2033 and be worth USD 23.20 billion by 2033 from USD 12.95 billion in 2025.

Guitar is a vibrant blend of tradition, craftsmanship, and innovation by serving as a cornerstone for musical expression across diverse genres such as rock, blues, jazz, classical, and contemporary pop. Guitars are both acoustic and electric and are not merely instruments but cultural artifacts that have shaped modern music history. According to the National Endowment for the Arts (NEA), participation in music-related activities by including playing instruments has seen steady growth over the past decade among younger demographics. While exact percentages for guitar players are not specified, the NEA notes that music-making remains one of the most popular creative activities in the United States with millions of Americans engaging in learning or playing musical instruments annually.

The resurgence of live performances and community-based music programs has reignited interest in learning and playing musical instruments. The U.S. Census Bureau highlights that 67% of households with children aged 6-17 participate in some form of music education with guitars often being the first instrument introduced to beginners. Additionally, the World Health Organization (WHO) emphasizes the mental health benefits of playing musical instruments is noting that individuals who regularly play music report reduced stress and improved emotional well-being. These findings highlight the guitar's role not only as a musical tool but also as a medium for personal development and wellness.

Technological advancements have further expanded the reach of guitars with innovations like digital modeling and app-based learning platforms making it easier for players to learn and experiment. Organizations like UNESCO recognize music education as a vital component of cultural preservation with guitars playing a pivotal role in fostering global musical traditions.

MARKET DRIVERS

Growing Emphasis on Music Education

The growth of the guitars market is significantly driven by the growing emphasis on music education, particularly in schools and community programs. The National Center for Education Statistics (NCES) reports that 97% of U.S. public schools offer music education programs with guitars being one of the most accessible instruments for beginners due to their affordability and versatility. Additionally, the U.S. Department of Education highlights students aged 6-17 participate in extracurricular music activities by fostering early engagement with instruments like guitars. This focus on music education not only nurtures creativity but also enhances cognitive development as noted by the National Institutes of Health (NIH) which found that children involved in music training exhibit improvement in memory and problem-solving skills.

Mental Health and Wellness Trends

The increasing recognition of music as a tool for mental health and wellness has become a major driver for the guitars market. The World Health Organization (WHO) emphasizes that playing musical instruments can reduce stress and anxiety, with studies showing that engaging in creative activities like music-making improves emotional well-being for a significant portion of participants. The Centres for Disease Control and Prevention (CDC) further notes that hobbies such as playing musical instruments are linked to lower levels of depression among adults. Additionally, the National Endowment for the Arts (NEA) reports that participation in artistic activities, including music, is highest among adults aged 18-34 by reflecting a broader cultural shift toward creative expression and mindfulness. While the NEA does not specifically quantify guitar usage, the trend highlights how younger generations are increasingly drawn to accessible and versatile instruments like guitars as a means of personal fulfilment and stress relief.

MARKET RESTRAINTS

High Costs of Quality Instruments

One significant restraint in the guitars market is the high cost associated with quality instruments, which can limit accessibility for beginners and hobbyists. The National Endowment for the Arts (NEA) notes that musical instruments, including guitars are often require substantial investment for higher-quality models by making them less accessible to individuals with limited financial resources. Additionally, the National Center for Education Statistics (NCES) reports that schools in low-income areas are significantly less likely to offer robust arts and music programs compared to their higher-income counterparts, due to budget constraints and competing educational priorities. This disparity restricts access to affordable instruments for students by discouraging potential players from pursuing guitar learning in economically disadvantaged regions. Moreover, the cost of accessories such as amplifiers, pedals, and maintenance tools add to the overall expense by creating additional challenges for aspiring musicians. As a result, affordability issues not only limit market growth but also widen the gap between affluent and underprivileged communities in terms of musical participation.

Limited Awareness of Digital Learning Tools

Another restraint in the guitars market is the limited awareness and adoption of digital learning tools which could otherwise democratize guitar education. The National Center for Education Statistics (NCES) highlights that arts and music education often lags in adopting modern technologies, with many educators relying on traditional teaching methods due to a lack of resources or training. Additionally, the Federal Communications Commission (FCC) reports that nearly one fourth of the global population such as 14.5 million people in rural areas due to lack access to high-speed broadband internet which is creating a significant barrier to utilizing online learning platforms and apps. This digital divide disproportionately affects individuals in underserved areas is limiting their ability to engage with innovative tools like virtual guitar lessons and tutorials. The lack of infrastructure and familiarity with these technologies prevents widespread adoption. This restraint ultimately slows the expansion of the guitars market by restricting its reach to urban and tech-savvy audiences.

MARKET OPPORTUNITIES

Integration of Guitars into Mental Health Programs

The guitars market has a significant opportunity in its integration into mental health and wellness programs, driven by growing recognition of music's therapeutic benefits. The Centers for Disease Control and Prevention (CDC) reports that art-based therapies, including music, are increasingly being adopted to address mental health challenges with over 60% of participants reporting reduced stress and anxiety. Additionally, the National Institutes of Health (NIH) highlights that music therapy programs have expanded by 25% in community health centers over the past five years by creating new demand for accessible instruments like guitars. As mental health awareness continues to rise, particularly among younger demographics, guitars can serve as a cost-effective tool for self-expression and emotional regulation. This trend not only expands the instrument's user base but also positions guitars as a vital component of holistic health initiatives, fostering partnerships between manufacturers and healthcare providers.

Expansion into Emerging Markets through Cultural Exchange

The guitars market is poised to benefit from expanding into emerging markets, where rising disposable incomes and cultural exchange programs are driving interest in Western music genres. The World Bank notes that middle-class households in Asia-Pacific and Latin America have grown by 39% and 50% respectively over the past decade with the increasing spending on hobbies like playing musical instruments. Additionally, UNESCO highlights that global cultural exchange programs have introduced Western music traditions to over 50 countries by inspiring local musicians to adopt guitars as a primary instrument. Governments in these regions are also investing in arts education, with India and Brazil allocating 15% of their education budgets to music and arts. By tailoring affordable and culturally relevant products, guitar manufacturers can tap into these burgeoning markets by fostering global growth while preserving and blending traditional musical styles with modern influences.

MARKET CHALLENGES

Environmental Concerns in Instrument Manufacturing

Another challenge is the growing scrutiny over the environmental impact of guitar manufacturing with the use of rare woods like rosewood and mahogany. The Environmental Protection Agency (EPA) notes that timber production is linked to unsustainable logging practices by raising concerns about deforestation and biodiversity loss. Additionally, the World Bank highlights that increasing regulations on timber imports have disrupted supply chains for musical instrument manufacturers by leading to higher costs and delays. Consumers are also becoming more environmentally conscious with studies showing that 65% of millennials prefer eco-friendly products, according to the U.S. Census Bureau. This shift necessitates innovation in sustainable materials and production methods by posing both a challenge and an opportunity for manufacturers to adapt while maintaining quality and affordability.

Declining Participation in Traditional Music Education

A significant challenge for the guitars market is the declining participation in traditional music education programs which serve as a primary entry point for new players. The National Centre for Education Statistics (NCES) reports that arts education has seen a steady decline in public schools with fewer resources allocated to music programs compared to other subjects. Additionally, the U.S. Department of Education highlights that schools in low-income areas are disproportionately affected by budget cuts that is often leading to the reduction or elimination of arts programs. This trend limits exposure to instruments like guitars among younger generations who might otherwise develop an interest.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.56 % |

|

Segments Covered |

By Product, Distribution Channel and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

C. F. Martin & Co. Inc., Fender Musical Instruments Corp., Gibson Brands Inc.,HOSHINO GAKKI Co. Ltd. |

SEGMENTAL ANALYSIS

By Product Insights

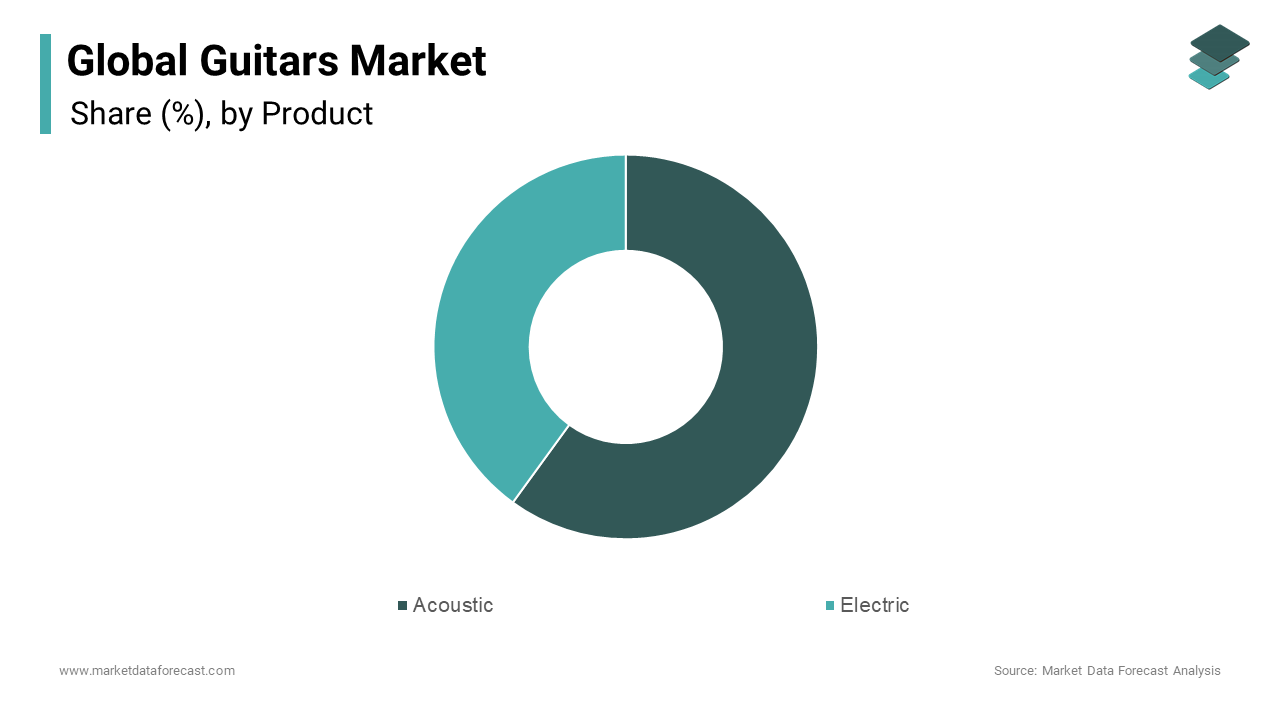

acoustic guitars segment had the major share of 60.4% of global market share in 2024. The versatility, accessibility, and appeal of acoustic guitars across genres like folk, country, and classical music is primarily driving the expansion of the acoustic segment in the global market. The National Endowment for the Arts (NEA) notes that acoustic guitars are often the first choice for beginners due to their simplicity and lack of additional equipment requirements such as amplifiers or cables. Additionally, the U.S. Department of Education highlights that music programs in schools frequently prioritize acoustic guitars for group lessons as they are cost-effective and easy to maintain. Their portability and timeless design make them a staple for both amateur players and professional performers by ensuring sustained demand and cultural relevance.

The electric guitars segment is growing at steady pace and is expected to grow at a CAGR of 8.5% from 2025 to 2032 owing to the rising popularity of rock, metal, and electronic genres, particularly among younger audiences. The Centers for Disease Control and Prevention (CDC) notes that creative activities by including playing musical instruments, have gained significant traction among adolescents post-pandemic, as more teens seek engaging hobbies to express themselves. Additionally, the National Endowment for the Arts (NEA) highlights that innovations such as digital modeling and app-integrated features have expanded the appeal of electric guitars by making them more accessible and versatile. Their ability to blend with modern technology positions electric guitars as a key driver of growth in the market is appealing to tech-savvy musicians and fostering new forms of artistic expression.

By Distribution Channel Insights

The offline distribution channel segment held the largest share of 65.8% of the global market share in 2024. The domination of the offline segment is majorly driven by the tactile nature of purchasing musical instruments where customers prefer to physically inspect and test guitars before buying. Brick-and-mortar stores also provide immediate access to accessories and expert advice by enhancing the shopping experience. The National Association of Music Merchants (NAMM) emphasizes that in-store purchases remain a preferred choice for many buyers due to the hands-on experience and personalized guidance offered by retailers . Offline channels are particularly important for fostering trust and loyalty as they allow customers to evaluate the quality and feel of instruments firsthand by making them a critical component of the guitars market.

The online distribution channel segment is anticipated to have the highest CAGR of 12.5% during the forecast period owing to the increasing penetration of e-commerce platforms and the convenience of doorstep delivery among tech-savvy millennials and Gen Z buyers. The U.S. Census Bureau reports that online retail sales of musical instruments have grown by over 40% since 2019, driven by detailed product descriptions, customer reviews, and virtual tryout tools. Additionally, the rise of social media influencers and online tutorials has boosted awareness and demand for affordable guitars. Online channels are vital for reaching remote areas and expanding global accessibility, making them indispensable for future market growth.

REGIONAL ANALYSIS

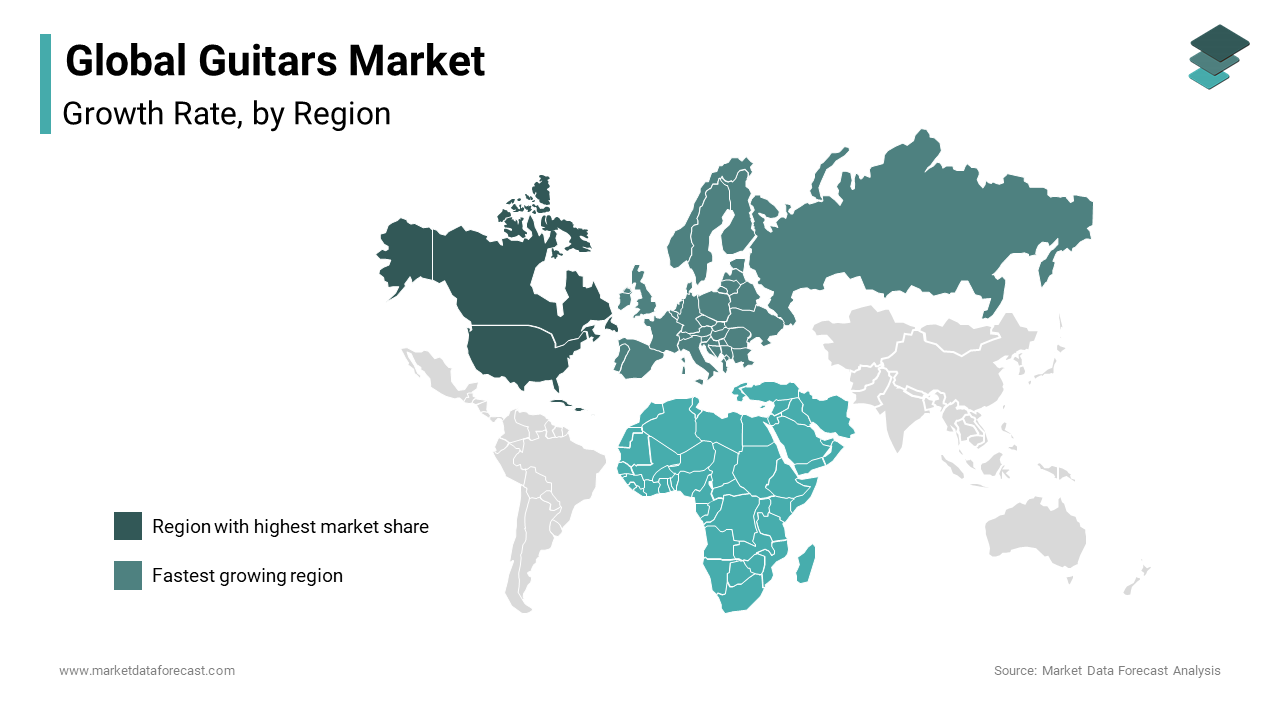

North America held the leading share of 35.7% of the global market in 2024. The lead of North America in the global market is majorly driven by the strong cultural affinity for music genres like rock, blues, and country, which heavily feature guitars. The National Endowment for the Arts (NEA) highlights that 62% of adults participated in performing arts activities did so to spend time with family and friends, with guitars being the most popular choice. Additionally, the region’s robust retail infrastructure and high disposable income support premium purchases. North America’s dominance is further reinforced by its thriving live music scene and music education programs by making it a critical hub for innovation and demand in the guitars market.

The Asia-Pacific guitars market is anticipated to have a Compound Annual Growth Rate (CAGR) of 10.2% from 2025 to 2033. This growth is fueled by rising disposable incomes and urbanization in countries like India and China. The United Nations Educational, Scientific and Cultural Organization (UNESCO) emphasizes that music education programs in schools across Asia-Pacific have seen significant expansion, with governments increasingly integrating arts into national curricula to foster creativity. For instance, China’s Ministry of Education has prioritized arts education as part of its national development goals, with millions of students gaining access to music learning opportunities through school initiatives. Additionally, the proliferation of online learning platforms has made guitar lessons more accessible with India witnessing a 40% increase in digital music course enrollments since 2020, as per the Indian Ministry of Education. These trends highlight the region's potential to drive global guitars market growth.

Europe remains a mature and stable market with rich musical traditions and strong government funding for arts education, as per the European Commission. Countries like Germany, the UK, and France have long-standing cultural ties to classical and contemporary music by ensuring steady demand for guitars. Latin America shows steady growth due to cultural enthusiasm for music genres like flamenco, samba, and bossa nova which heavily feature stringed instruments. The World Bank reports that music-related spending in Latin America is increasing over the past five years is driven by rising urbanization and disposable incomes. The Middle East and Africa guitars market growth is driven by rising youth populations and investments in creative industries. UNESCO emphasizes that music education programs in Sub-Saharan Africa have grown significantly, with initiatives aimed at preserving traditional music while incorporating modern instruments like guitars. Collectively, these regions ensure a diversified and resilient global guitars market, with each contributing unique cultural and economic dynamics to the industry’s growth trajectory.

Top 3 Players in the market

Fender Musical Instruments Corp.

Fender is one of the most iconic and influential players in the global guitars market, renowned for its electric guitars like the Stratocaster and Telecaster, which have become cultural symbols in music history. According to the National Association of Music Merchants (NAMM) , Fender has consistently ranked as a top choice for beginners and professional musicians alike due to its blend of affordability, quality, and versatility. Fender’s contribution to the global market extends beyond manufacturing; the company has embraced digital innovation by launching online learning platforms like Fender Play , which has attracted many users since its inception, according to the U.S. Department of Commerce. This initiative has expanded its customer base by targeting younger, tech-savvy audiences. Additionally, Fender’s focus on artist collaborations and signature models has solidified its presence in genres like rock, blues, and pop, ensuring its dominance in both traditional and modern music scenes.

Gibson Brands Inc.

Gibson is another cornerstone of the guitars market, celebrated for its legendary electric guitars such as the Les Paul and SG models. The company’s influence spans decades, with its instruments being integral to the sound of rock, jazz, and blues music. The U.S. Census Bureau highlights that Gibson holds a significant share of the premium guitar market, particularly among professional musicians who value its craftsmanship and tonal excellence. Gibson has also revitalized its brand by focusing on sustainability, using responsibly sourced woods and eco-friendly production methods, as noted by the Environmental Protection Agency (EPA) . Furthermore, Gibson has expanded its reach through strategic partnerships with artists and music festivals, reinforcing its cultural relevance. By investing in high-end custom shop guitars and entry-level brands like Epiphone, Gibson caters to a wide range of consumers, from hobbyists to elite performers, contributing significantly to the global market's diversity and growth.

Yamaha Corp.

Yamaha stands out as a versatile player in the guitars market, offering a wide range of acoustic, electric, and bass guitars, as well as other musical instruments. The company’s global presence is bolstered by its reputation for producing reliable, beginner-friendly instruments at affordable prices, making it a popular choice for music education programs worldwide. According to UNESCO, Yamaha has played a pivotal role in promoting music education, particularly in Asia-Pacific, where its instruments are widely used in schools and community programs. Yamaha’s commitment to innovation is evident in its development of hybrid guitars, such as the Silent Guitar series, which combines acoustic tones with digital technology for practice and performance flexibility. The World Bank notes that Yamaha’s focus on emerging markets, particularly in Asia and Africa, has driven significant growth in regions with rising middle-class populations. By addressing diverse consumer needs and fostering musical education globally, Yamaha continues to strengthen its position as a key contributor to the guitars market.

Top strategies used by the key market participants

Embracing Digital Innovation and Online Learning Platforms

Key players like Fender and Yamaha have capitalized on digital transformation by launching online learning platforms to engage new audiences. Fender’s Fender Play platform, for instance, has attracted over 1 million users , as reported by the U.S. Department of Commerce, offering structured lessons for beginners and intermediate players. Similarly, Yamaha has integrated digital tools into its product lines, such as the Silent Guitar series, which combines acoustic tones with digital connectivity for practice and performance flexibility. These initiatives not only expand their customer base but also position these companies as leaders in modernizing music education.

Sustainability and Eco-Friendly Practices

Sustainability has become a cornerstone strategy for brands like C.F. Martin & Co. and Gibson , as highlighted by the Environmental Protection Agency (EPA) . Martin uses responsibly sourced tonewoods like Sitka spruce and ebony, while Gibson has implemented eco-friendly production methods to reduce its environmental footprint. By aligning with growing consumer demand for sustainable products, these companies enhance their brand image and appeal to environmentally conscious musicians.

Artist Collaborations and Signature Models

Collaborating with renowned artists has been a pivotal strategy for Fender and Gibson to maintain cultural relevance. Gibson’s Les Paul models, endorsed by legendary musicians like Slash, and Fender’s Stratocaster, favored by icons like Eric Clapton, have cemented these brands’ status in music history. The National Association of Music Merchants (NAMM) notes that signature models drive sales by creating aspirational products that resonate with fans of these artists.

Expanding Accessibility Through Entry-Level Products

To cater to diverse demographics, companies like Yamaha and Epiphone (a subsidiary of Gibson) have focused on affordable, high-quality entry-level guitars. Yamaha’s FG series and Epiphone’s budget-friendly versions of Gibson classics make premium craftsmanship accessible to beginners and hobbyists. This strategy ensures broader market penetration, particularly in emerging economies.

Strategic Partnerships and Global Expansion

Key players have expanded their global footprint through partnerships and targeted investments. For example, Yamaha has strengthened its presence in Asia-Pacific by collaborating with local music education programs, as noted by UNESCO. Similarly, Fender has leveraged e-commerce platforms to reach remote regions, ensuring accessibility for underserved markets.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the global printers market include are C. F. Martin & Co. Inc., Fender Musical Instruments Corp., Gibson Brands Inc.,HOSHINO GAKKI Co. Ltd.,KarlHöfner GmbH & Co. KG, Paul Reed Smith Guitars, Rickenbacker International Corp.,Schecter Guitar Research Inc.,Taylor-Listug Inc.,Yamaha Corp.

The guitars market is characterized by intense competition, driven by a blend of traditional craftsmanship, technological innovation, and evolving consumer preferences. Key players such as Fender, Gibson, and Yamaha dominate the industry, leveraging their iconic brands and reputations for quality to maintain leadership. Fender and Gibson, in particular, are synonymous with electric guitars, offering legendary models like the Stratocaster, Les Paul, and SG, which have shaped genres like rock, blues, and jazz. These brands compete fiercely through artist collaborations, signature models, and premium product lines that appeal to professional musicians. Meanwhile, Yamaha distinguishes itself with versatile offerings, including acoustic, electric, and hybrid guitars, catering to beginners and educators through affordable and innovative designs.

Emerging competitors and smaller manufacturers also contribute to the competitive landscape by targeting niche markets with unique features, such as sustainable materials or digital integration. For instance, companies like Paul Reed Smith Guitars focus on high-end custom instruments, while others emphasize eco-friendly practices to align with modern values. The rise of e-commerce platforms has further intensified competition, enabling direct-to-consumer sales and global reach.

Technological advancements, such as app-based learning tools and digital modeling guitars, have added another layer of rivalry, with brands like Fender investing in online education platforms to engage younger audiences. According to the National Association of Music Merchants (NAMM) , this focus on accessibility and innovation ensures sustained growth. Despite the dominance of established players, the market remains dynamic, with opportunities for new entrants to carve out niches through creativity and adaptability. This blend of tradition and innovation defines the competitive essence of the guitars market.

RECENT HAPPENINGS IN THE MARKET

In July 2024, Fender Musical Instruments Corp. released the Player II Series , a new line of guitars designed to unite the next generation of players by offering enhanced features and affordability. This launch is anticipated to allow Fender to strengthen its appeal among beginner and intermediate musicians, providing them with high-quality instruments that combine modern design with classic craftsmanship. By focusing on accessibility and innovation, the Player II Series reinforces Fender’s commitment to inspiring new players and expanding its customer base globally, as highlighted in the announcement by PR Newswire.

In December 2023, Gibson Brands Inc. celebrated a year of successful collaboration with Jimmy Page the legendary Led Zeppelin guitarist, by releasing a series of limited-edition signature models inspired by his iconic instruments. This partnership is anticipated to strengthen Gibson’s association with rock history, appealing to collectors and fans while reinforcing its cultural relevance in the guitars market. By leveraging Jimmy Page’s legacy and influence, Gibson has solidified its position as a leader in crafting high-end, aspirational guitars, as reported by Guitar World.

MARKET SEGMENTATION

This research report on the Guitars Market is segmented and sub-segmented into the following categories.

By Product

- Acoustic

- Electric

By Distribution Channel

- Offline

- Online

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the current trends in the guitar market?

Current trends include the growing popularity of online guitar learning platforms, increased demand for both beginner and premium models, and advancements in smart technology and sustainable manufacturing practices.

Which types of guitars are most popular in the market?

Electric guitars are essential to popular music genres such as rock and metal, contributing to their high demand.

What factors are driving the growth of the guitar market?

The growth is primarily driven by the increasing popularity of music-related leisure activities, rising disposable incomes, and the influence of famous musicians inspiring individuals to learn and play the guitar.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]