Global Guar Gum Market Size, Share, Trends, & Growth Forecast Report - Segmented By Application, Grade, Function and Region, Industry Analysis (2025 To 2033)

Global Guar Gum Market Size

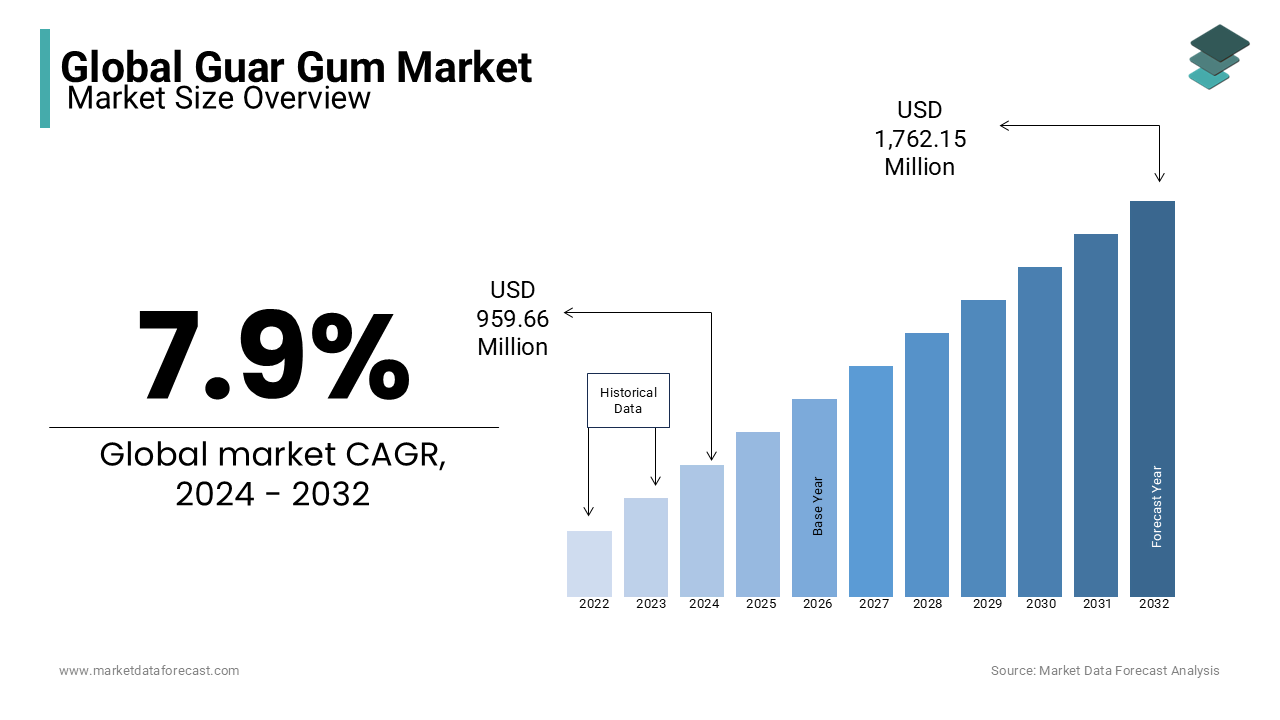

The global guar gum market size was calculated to be USD 0.95 billion in 2024 and is anticipated to be worth USD 1.89 billion by 2033 from USD 1.03 billion In 2025, growing at a CAGR of 7.90% during the forecast period.

Guar black has numerous applications in sectors like food, oil and gas, and pharmaceuticals. It functions as a friction-reducing agent, binder, thickener, stabilizer, and gelling agent. Guar Black is known as Guar Gum as an alternative. It is an abundant source of high-quality galactic-metal polysaccharides. It is obtained from guar seeds. Plant seeds are dried in the sun and then separated and processed into flour known as guar gum powder. Guar rubber partitions are also used in many other industries. However, guar black is processed according to the final product's requirements. Guar gum powder is more concentrated than cornstarch. Therefore, it is widely used as a thickener, plasticizer, and binder. It has a natural ability to bind water molecules and is easily soluble in water. Guar or guarlan gum is made from soybeans and is used in various industries due to its thickening and stabilizing properties. The seeds are peeled, sieved, and crushed to obtain a product. It is produced as a whitish, free-flowing powder and is classified as galactomannan. These are polysaccharides, sugar galactose, and mannose compounds and have a higher solubility than grasshopper bean gum. They are very stable in the pH range of 5-7.

MARKET DRIVERS

The growing demand for ready-to-eat foods and frequent changes in eating habits among people propels the gaur gum market growth.

Guar black as an additive provides a long and stable shelf life for processed foods, which is supposed to promote market growth. Increased product penetration in the pharmaceutical industry is assumed to be one of the main factors driving the overall market growth. The aging population and the increase in non-communicable diseases and chronic disabilities are driving the growth of the pharmaceutical industry. As a result, product consumption is likely to increase. Raw materials, demand, and supply costs mainly determine product prices. Several underlying factors, such as the availability of alternatives, current market trends, and the growth of the consumer industry, influence demand and supply. Most Genz people prefer to eat food outside, and it is roughly estimated that more than 44% of this population completely rely on eating any snack, whether it be ready-to-eat or convenient products.

The increased application of gaur gum due to the multifunctional nature of healthy food consumers and increased health awareness promotes market growth.

The demand for organic products like guar gum has risen with the rise in consumer knowledge about healthy living and nutrition intake. Guar black is a natural ingredient with several health benefits, including lower cholesterol, serum low-density lipoprotein (LDL) triglycerides, and improved glucose tolerance. This factor has led food manufacturers to use natural gums in a variety of food applications. In the food industry, black guar is used in frozen foods, baked goods, dairy products, sauces, and salad dressings, thickeners for candies, beverages, stabilizers, emulsifiers, binders, coatings, texturing agents, and gelling agents. In addition to the food industry, the properties of guar gum, as a binder, crushing, waterproofing, and gelling, are ideal additives for a variety of industries, such as oil and gas, mining, explosives, textiles, pharmaceuticals, textiles, and water treatment.

The global demand for prepared food is increasing along with the busy consumer lifestyle. The global market for fast food has been influenced by factors such as increased use of home technology, extended work hours, and rising consumer incomes. For instance, in India, the participation of women in work has gradually increased in the past few years.

- According to the Periodic Labour Force Survey (PLFS) survey in India, women's participation was increased to 37% in 2023 from 23.3% in 2018. The rising participation of women in the workforce will eventually shift people to depend on ready-to-eat food products that straightly promote the demand for the launch of healthy snack products, which will propel the growth rate of the guar gum market.

It enhances quality as one of the essential food additives in convenient foods like guar black soup, cakes, pastries, bread, gravy, and snacks. Guar gum market growth is anticipated to intensify as consumer interest in processed foods increases. It also aids in reducing the overall fat content of foods, as it increases your preference for low-calorie, fat diets that favor guar gum. This trend helps the guar gum market. It is used as a fat substitute in black guar convenience foods.

MARKET RESTRAINTS

The main limitation of the global guar gum market is the appearance of gluten-free alternatives, such as silicon fiber and chia seeds. It has recently lost its luster due to oversupply and reduced demand. Additionally, a drop in oil prices has affected the market as oil and gas exploration activity declines worldwide.

- The European Commission has issued warnings about high intake due to the presence of dioxin, which weakens the immune system. Weekly exports and massive inventory loads may limit the growth rate of the market in the near future.

MARKET OPPORTUNITIES

The rapid adoption of the most advanced technologies in the F&B industry is attributed to leveraging the growth opportunities for the guar gum market during the forecast period. The rising applications of guar gum in the production of cosmetics in favor of the public's interest are ascribed to leverage the growth rate of the market. Various studies have proven that the use of guar gum in cosmetics is completely safe for any skin type with merely no side effects in regular use. The use of guar gum in cosmetics has been expanding in the past few years due to its effective properties in keeping the skin moist for a longer time. Also, the rising use of guar gum in manufacturing dietary supplements is actively elevating the growth rate of the guar gum market. The rising prominence for the use of dietary supplements in most young people is ascribed to the prominence of guar gum in the coming years. In recent times, people are more familiar with using dietary supplements to stay healthy and avoid the risk of various chronic diseases.

- According to the Council of Responsible Nutrition, three-quarters of Americans use dietary supplements to meet the essential nutritional value to lead an active and healthy lifestyle.

MARKET CHALLENGES

Lack of knowledge over the effective use of guar gum is solely to degrade the growth rate of the market. The high usage of guar gum in food products may lead to intestinal obstruction and death. The use of gaur gum is moderately safe for every person, but rarely, it may trigger an allergic reaction in some people suffering from other diseases, which limits the growth rate of the market. People are advised to check the labeling before consuming processed or convenient food products.

Stringent rules and regulations by the government to promote safe food products are likely to hinder the growth rate of the guar gum market.

- European Commission posed strict action to follow standard regulations to promote food safety measures. In this account, the Panel on Food Additives and Nutrient Sources made a re-evaluation of the use of guar gum as a food additive. The Panel committee strictly mentioned avoiding using guar gum in infant foods to avoid causing serious health conditions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.9% |

|

Segments Covered |

By Grade, Function, Application, Food &Beverage Application, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Cargill, E.I. Dupont De Nemours and Company, Ingredion Incorporated, Shree Ram Industries, Dabur India Ltd, Hindustan Gums and Chemical Limited, Lucid Group, Supreme Gums Private Limited, Rama Gum Industries, and Guangrao Liuhe Chemical Co., Ltd. |

SEGMENTAL INSIGHTS

Based on grade, the food-grade segment dominated the guar gum market in 2023.

Gaur gum is generally used in the food industry to meet high-quality standards. As guar gum is a naturally derived food additive with a natural taste and odor, it is best suited for a wide variety of food applications. Also, the rising preference for bakery food products is all set to elevate the growth opportunities for guar gum in the food-grade segment. Gaur gum acts as a thickening agent and emulsifier that gives proper texture to gluten-free baked goods.

The pharmaceutical segment is likely to register a prominent CAGR during the forecast period. Guar gum is very relevant in the manufacturing process of drugs in the pharmaceutical industry. It has excellent properties in the pharmaceutical industry that act as a stabilizer. It is very effective in controlling blood glucose levels and is used in manufacturing medicines for diabetic persons. The plant-derived natural polymer has huge value in manufacturing various drugs that are used to treat cancer. Many research studies have shown that the presence of nanoparticles in plant-derived gaur gum acts as a carrier for anticancer therapeutics, which are highly capable of treating various types of cancer and will propel the growth rate of the market in the coming years.

Based on function, the thickening segment had the major share of the worldwide market in 2023.

The thickening segment is attributed to holding the largest share of the gaur gum market, whereas the binding segment is likely to hit the highest CAGR by the end of 2029. The growing prominence of gluten-free food products is one of the common factors for the use of gaur gum as a thickening agent in most food products. Shifting the trend towards whole wheat flour instead of refined flour as it is gluten-free is gearing for the use of natural additives that are escalating the segmental expansion.

- According to the Food and Drug Administration (FDA), the rising number of people suffering from celiac disease is constantly changing the mindset to gradually for gluten-free products. More than 3 Million Americans are suffering from this disease and are seriously opting for gluten-free food products. 31% of adults in the United States follow gluten-free diets.

Guar gum is very effective in manufacturing drugs with a special thickening and binding quality. Thickening and binding are one of the most important features while producing a drug. At the same, the water-binding properties of guar gum are highly useful for making ice creams with proper stabilization.

Based on application, the food & beverages segment is deemed to grow at the fastest CAGR.

The growing need for the launch of innovative food products in favor of the consumer's preference is substantially to promote growth opportunities for the guar gum market in the food and beverage sector. The prominence of producing dairy and cheese products with the help of guar gum is likely to fuel the growth rate of the market.

- According to the US Department of Agriculture (USDA), the US has increased the production rate of cheese in the past few years. In 2023, the cheese production in the US was more than 1.1 million metric tons. The prominence of the use of guar gum in making cheese is attributed to leveraging new opportunities for the market in the forecast period.

The bakery & confectionery products sub-segment under F&B segment is predicted to witness a promising CAGR during the forecast period. The growing disposable income, especially in both developed and developing countries, substantially leverages the demand for guar gum in the bakery & confectionery products segment. The dairy & frozen products segment will likely show huge growth opportunities for the guar gum market in the future. The need to supply high-quality dairy and frozen products, according to the rising population, mostly in urban areas, is anticipated to promote the use of guar gum in various food applications that shall amplify the market's growth rate.

- According to the United Nations, 68% of the people in the world will live in urban areas by 2050, which is a sign of launching innovative food products with efficient outcomes.

The oil & gas segment is likely to account for a notable share of the guar gum market during the forecast period. The expanding scale of the oil and gas companies is likely to promote the demand for guar gum, which will fuel the growth rate of the market.

REGIONAL ANALYSIS

North America had 44.1% of the share in the global market in 2023.

The North American region emerged as the most promising regional segment for gaur gum in the worldwide market. In particular, the United States is estimated to be the largest market for guar gum, as the adoption of hydraulic cracking and oil well drilling in the oil and gas industry has grown significantly. This trend is anticipated to continue during the forecast period due to the availability of abundant, technically recoverable oil and gas resources. The increase in the number of oil platforms in the United States is one of the main factors in the growth of the regional market. This has resulted in increased demand for products, leading to a higher price. The rising demand for snacking options, especially among adults, is substantially leveraging the growth rate of the gaur gum market. Furthermore, the efforts of the United States government to strengthen exploration activities are expected to positively impact market growth.

- According to the National Center for Biotechnology Information, snacks are more common in the American diet, where more than 90% of adults in America eat one or three snacks per day.

Europe holds a substantial share of the worldwide market.

The food processing sector is among the principal consumers of guar gum in Europe. Knowledge of the product's weight loss benefits is foreseen to increase demand. The growing awareness of the use of guar gum for weight loss will greatly enhance the growth rate of the market. The obesity-related issues, especially among women, are increasing due to lifestyle changes and improper food habits. The rising awareness of following a proper diet and the adoption of quality lifestyle changes can avoid the risk of various diseases. Top companies' strategies to attract people by adding naturally derived food additives to processed or confectionery products are collective to promote the growth rate of the European market.

Asia-Pacific is projected to showcase the fastest CAGR.

Population growth, growth in disposable income, and rapid urbanization in the Asia-Pacific region have dramatically increased the consumption of processed foods. Due to this, the demand for products in the area is growing. China and India are deemed to become significant consumers due to the rapid growth of oil and gas exploration activities and the presence of vast technologically recoverable resources. India is one the world leaders in producing gaur. India is subjected to produce 80% of guar, whereas 70% of it is cultivated in Gujarat.

KEY PLAYERS IN THE GLOBAL GUAR GUM MARKET

Cargill, E.I. Dupont De Nemours, and Company, Ingredion Incorporated, Shree Ram Industries, Dabur India Ltd, Hindustan Gums and Chemical Limited, Lucid Group, Supreme Gums Private Limited, Rama Gum Industries, and Guangrao Liuhe Chemical Co., Ltd. are some of the notable players in the global gaur gum market.

RECENT HAPPENINGS IN THE MARKET

- In January 2017, Ingredion Incorporated completed the acquisition of TIC Gums. Because TIC Gums provides an advanced texturing system for the food and beverage industry, including a wide range of guar gum products, this acquisition support product has been integrated to enhance the product portfolio.

- Lucid Group started processing Guar Split at Guar's new division plant in Meglasiya, Rajasthan. With this prior integration, the Lucid Group has full control over the supply chain.

DETAILED SEGMENTATION OF THE GLOBAL GUAR GUM MARKET INCLUDED IN THIS REPORT

This research report on the global guar gum market has been segmented and sub-segmented based on grade, function, application & region.

By Grade

- Food-Grade

- Industrial-Grade

- Pharmaceutical-Grade

By Function

- Thickening

- Gelling

- Binding

- Friction Reducing

- Other Functions

By Application

- Oil & Gas

- Food & Beverages

- Bakery & Confectionery Products

- Dairy & Frozen Products

- Beverages

- Sauces & Dressings

- Others

- Mining & Explosives

- Paper Manufacturing

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What factors are driving the growth of the guar gum market?

Factors such as increasing demand for natural food additives, growth in the pharmaceutical industry, expanding oil drilling activities, and the rising popularity of gluten-free products are driving the growth of the guar gum market.

2. What are the challenges faced by the guar gum industry?

Challenges include price volatility due to fluctuations in guar bean production, competition from alternative thickeners and stabilizers, regulatory issues related to food and pharmaceutical applications, and environmental concerns in regions where guar is grown.

3. What are the future trends and opportunities in the guar gum market?

Future trends may include increased demand for organic and non-GMO guar gum, advancements in extraction and processing technologies, expanded applications in new industries, and strategic collaborations among key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]