Global Green Technology and Sustainability Market Size, Share, Trends & Growth Forecast Report – Segmented By Technology (Internet of Things (IoT), Cloud Computing, Artificial Intelligence (AI) and Analytics, Digital Twin, Cybersecurity, and Blockchain), Industry (Energy and Utilities, Transportation and Logistics, Industrial Manufacturing, Automotive, FMCG and Retail, and Others) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Green Technology and Sustainability Market Size

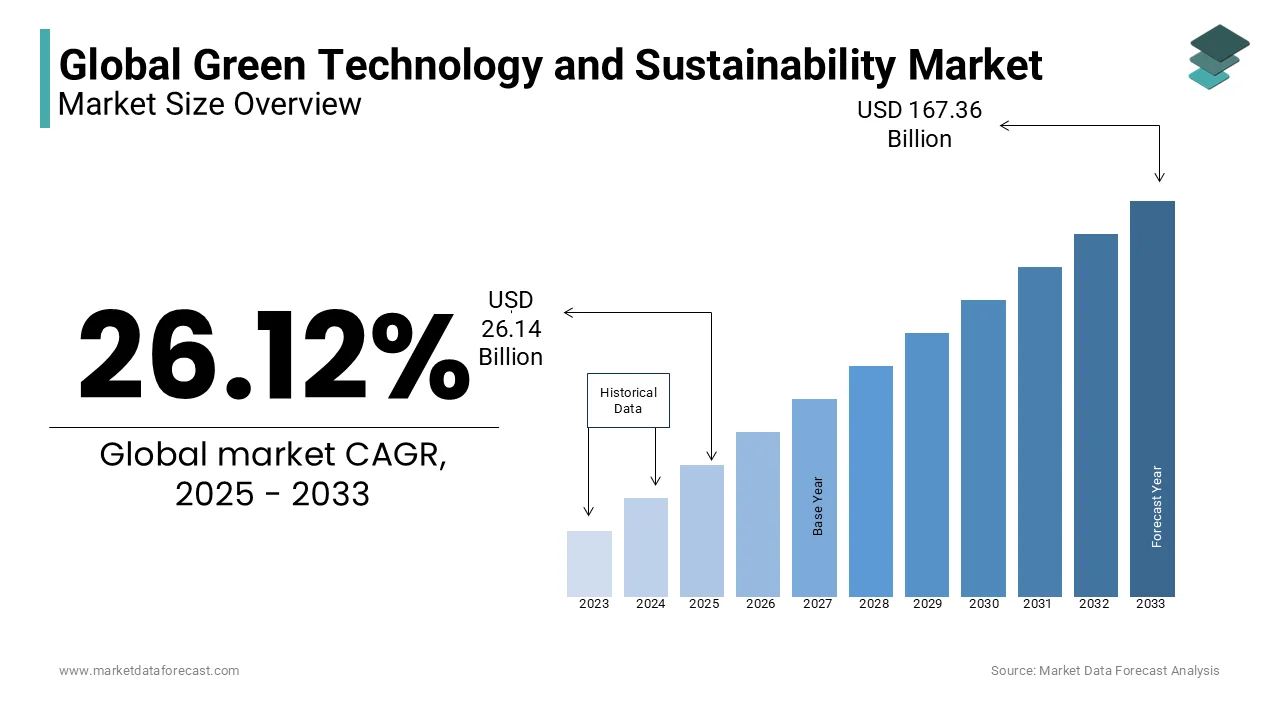

The size of the global green technology and sustainability market was worth USD 20.73 billion in 2024 and is expected to grow at a promising CAGR of 26.12% from 2025 to 2033 and reach USD 26.14 billion in 2025 and USD 167.36 billion by 2033.

The Green Technologies and Sustainability Solutions Market encompasses a range of innovations designed to address environmental challenges by reducing resource consumption by enhancing energy efficiency, and minimizing waste. These technologies include renewable energy systems, energy-efficient buildings, water purification methods, sustainable agriculture practices, and waste management solutions. Companies are increasingly investing in green technologies to meet both regulatory pressures and consumer demand for eco-friendly products.

Renewable energy technologies, especially solar, wind, and hydrogen are expanding rapidly as energy providers shift toward clean sources. Solar photovoltaic costs have dropped by nearly 85% over the past decade by making solar energy more accessible than ever. According to the International Renewable Energy Agency (IRENA), renewables could provide 90% of global power by 2050 which is driven by increased efficiency and government subsidies. Companies in the energy sector are investing heavily in these technologies, aiming to reduce carbon emissions and secure a long-term with sustainable energy supply.

MARKET DRIVERS

Government Regulations and Policies

Governments worldwide are enforcing strict environmental regulations to curb emissions and promote sustainability. The European Union's Green Deal aims for a carbon-neutral Europe by 2050 by setting mandates for emissions reduction and renewable energy adoption. In the U.S., the Inflation Reduction Act of 2022 dedicates $369 billion to clean energy initiatives. Such regulations incentivize businesses to adopt green technologies from carbon capture to waste reduction to comply and benefit from tax breaks and grants by accelerating green tech investments across industries.

Corporate Social Responsibility (CSR) Initiatives

Corporations are increasingly committing to sustainability goals to boost brand reputation and align with consumer expectations. Studies show that over 60% of consumers are more likely to support brands with eco-friendly practices. Companies like Microsoft and Google have committed to achieving carbon neutrality by 2030 by driving them to invest heavily in renewable energy and carbon offset initiatives. This demand for sustainable operations propels green technology adoption as companies leverage these technologies to meet CSR goals and respond to stakeholder pressures.

Consumer Demand for Sustainable Products

Consumers are driving change, with a marked shift toward sustainable products and services. A survey by IBM indicates that nearly 80% of global consumers value sustainability and are willing to change their purchasing habits to support eco-friendly businesses. This demand has led companies to innovate with sustainable packaging, renewable energy, and greener supply chains. Industries such as fashion and consumer goods are adopting circular economy models, while automotive companies are ramping up electric vehicle production to meet the growing appetite for environmentally conscious products.

MARKET RESTRAINTS

High Initial Costs

The upfront costs of green technologies such as solar panels, wind turbines, and carbon capture systems are often high, posing a financial barrier for many companies and consumers. For instance, installing commercial solar systems can cost between $50,000 and $100,000 by making it challenging for smaller businesses to invest. Although operational costs and energy savings balance this over time with the initial expenditure can deter adoption. Financial incentives are available in some regions but they’re not universal where limiting green technology adoption in areas lacking subsidies or financing options.

Infrastructure Limitations

Existing infrastructure particularly in energy and transportation which often lacks compatibility with green technologies is creating costly and complex integration challenges. For example, electric vehicle (EV) adoption is hindered by the limited availability of charging stations, especially in rural areas. According to the International Energy Agency (IEA), reaching net-zero emissions by 2050 requires the installation of 40 million EV chargers globally by 2030. Upgrading infrastructure is essential but time-intensive and costly which slows the integration of sustainable solutions across various industries and regions.

Regulatory and Policy Variability

Inconsistent environmental regulations and sustainability policies across countries and regions create challenges for companies operating in multiple markets. For instance, carbon tax rates, renewable energy incentives, and waste management regulations vary significantly that impacts companies’ strategic planning and cost structures. According to a World Bank report, only 23% of global emissions are covered by carbon pricing and illustrating uneven regulatory frameworks. This lack of global policy cohesion can slow down technology adoption, hinder innovation, and create compliance complexities for companies with global operations.

MARKET OPPORTUNITIES

Expansion in Energy Storage Solutions

As renewable energy adoption rises, energy storage solutions present a major opportunity to stabilize supply. Advanced batteries and grid-scale storage enable renewable energy to be stored and deployed on demand by reducing reliance on fossil fuels during low-generation periods. BloombergNEF forecasts a 30-fold increase in global energy storage capacity by 2030, driven by demand from renewable-heavy grids and electric vehicles. Innovations in battery chemistry, such as solid-state and lithium-sulfur, are also enhancing storage efficiency, positioning energy storage as a cornerstone for reliable and green energy grids.

Development of Carbon Capture and Utilization (CCU) Technologies

Carbon capture and utilization (CCU) provides an opportunity to reduce industrial emissions while producing valuable products, like synthetic fuels or construction materials. CCU creates a circular model by transforming CO₂ into usable resources unlike traditional carbon capture which involves storage. The global CCU is projected to grow rapidly as industries seek ways to meet emission targets. Companies in sectors like cement and steel are investing in CCU to reduce carbon intensity, potentially capturing over 800 million tons of CO₂ annually by 2030, according to industry estimates.

MARKET CHALLENGES

Supply Chain Vulnerabilities

The green tech sector depends on rare earth metals and specialized components, which are often sourced from limited global suppliers. For example, lithium, essential for batteries, is primarily mined in a few countries, making the supply chain susceptible to geopolitical tensions and market fluctuations. According to the International Energy Agency (IEA), demand for lithium could increase 40-fold by 2040. This reliance on critical materials exposes green tech companies to supply disruptions and price volatility which is complicating efforts to scale technologies like EVs and renewable energy storage.

Technology Scalability Issues

Many green technologies are still evolving and scaling them for widespread use is complex. Technologies such as hydrogen fuel cells, advanced biofuels, and certain carbon capture solutions require substantial R&D investment and infrastructure adjustments before they can operate on a large scale. For instance, producing green hydrogen remains costly due to energy-intensive electrolyzer technology. The high cost and complexity of scaling these technologies delay adoption by requiring significant funding and innovation to become competitive with established alternatives.

Consumer Education and Acceptance

Shifting consumer behaviors and gaining public trust in new technologies present ongoing challenges. Despite environmental benefits, some sustainable solutions like alternative proteins, electric vehicles, and bio-based packaging are facing hesitancy due to perceived drawbacks such as higher costs, unfamiliarity, or misconceptions about efficacy. For instance, a survey by Deloitte found that 45% of potential EV buyers hesitate due to range anxiety. Educating consumers and building widespread acceptance requires targeted outreach and evidence-based communication from companies which can be resource-intensive but essential for market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

26.12% |

|

Segments Covered |

By Technology, Industry and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

General Electric (GE), IBM Corporation, Schneider Electric, Microsoft Corporation, Siemens AG, Enel Group, Accenture, Cisco Systems, Delta Electronics, and NetApp. |

SEGMENTAL ANALYSIS

By Technology Insights

Artificial Intelligence (AI) and Analytics currently represent the largest segment by holding approximately 30% of the market share. AI and analytics play a critical role in optimizing energy use, monitoring environmental impact, and enhancing decision-making processes in sustainable operations. For example, AI algorithms can predict energy demands which helps utilities reduce emissions and costs by adjusting supply accordingly. According to PwC, AI-driven solutions have the potential to reduce global greenhouse gas emissions by up to 4% by 2030. The segment's growth reflects the essential role of AI in creating data-driven efficiencies across industries with sustainability and emissions monitoring become central to corporate and regulatory strategies.

Blockchain is projected to reach a CAGR of 60% during the forecast period 2025-2033. Blockchain’s unique ability to provide transparency, security, and traceability is driving rapid adoption across green supply chains and carbon credit markets. For instance, blockchain facilitates the verification of renewable energy certificates (RECs) and carbon offsets by helping companies meet sustainability commitments with verifiable data. The technology is increasingly important for transparency in tracking emissions and supply chains by supporting regulatory compliance, and building consumer trust, as accurate, immutable records become indispensable in the drive toward sustainability.

By Industry Insight

Energy and Utilities is the largest segment by accounting for 35% of the market share. This sector leads due to its crucial role in transitioning to renewable energy sources, enhancing grid efficiency, and reducing carbon emissions. Technologies such as smart grids, energy storage systems, and renewable energy sources like solar and wind power are transforming energy generation and distribution. According to the International Energy Agency (IEA), renewable energy sources are projected to supply nearly 90% of the global power increase by 2050. As energy and utilities play a pivotal role in climate change mitigation, investment in green technologies within this sector remains strong.

The Transportation and Logistics segment is emerging with an estimated compound annual growth rate (CAGR) of 25% during the forecast period 2025-2033. Growth in this sector is driven by the urgent need to reduce emissions in transportation by a leading source of global CO₂ emissions. Advances in electric vehicles (EVs), sustainable fuels, and smart logistics systems are enabling significant reductions in environmental impact. The demand for green technology in transportation is accelerating as companies and governments prioritize sustainable mobility solutions to meet climate goals with electric vehicle sales surging by 55% in 2022 alone.

REGIONAL ANALYSIS

North America is holding 28% of the global market share owing to robust demand in the U.S. and Canada. Strong government policies, tax incentives, and corporate investments in renewable energy and sustainable practices contribute to a projected CAGR of 15% through 2033. The U.S. leads the market with landmark policies such as the Inflation Reduction Act of 2022 channeling billions into clean energy. The region’s commitment to lowering emissions and promoting green technologies is expected to drive substantial growth in areas like electric vehicles and sustainable agriculture.

Europe is the second largest of the market share during the forecast period. Europe has ambitious environmental policies like the European Green Deal which aims for net-zero emissions by 2050 led by Germany, France, and the Nordic countries. This regulatory support, coupled with consumer demand for eco-friendly products, strengthens Europe’s position in renewable energy, green manufacturing, and circular economy practices. Future growth will likely come from advanced energy storage, green hydrogen production, and sustainable transportation innovations.

Asia-Pacific (APAC) green technologies and sustainability solutions market is showcasing a CAGR of approximately 20% during the forecast period. China, Japan, and South Korea lead the APAC market with large-scale investments in solar energy, electric vehicles, and waste management technologies. China alone is responsible for over 50% of global solar panel production which is highlighting APAC’s manufacturing prowess. Rapid urbanization, government-led sustainability initiatives, and increasing private investment are fueling APAC's growth by positioning it as a crucial player in the global green technology transition.

Latin America is deemed to have significant CAGR in the foreseen years. Brazil, Chile, and Mexico lead the region, especially in renewable energy initiatives and sustainable agriculture. Latin America has a strong renewable energy base, particularly in hydropower and bioenergy, and governments are increasingly incentivizing green tech to address deforestation, pollution, and climate change. Despite challenges like limited funding, Latin America’s vast natural resources offer considerable potential for future growth in sustainable technologies.

Middle East and Africa (MEA) are expected to grow at a Moderate CAGR during the future period. The United Arab Emirates and Saudi Arabia are pioneering green technology projects in the region, particularly in solar energy and water desalination. MEA’s focus is increasingly on reducing dependence on fossil fuels with ambitious green goals laid out in Vision 2030 initiatives across Gulf nations. The region’s strategic importance and natural resources are expected to drive moderate growth in green technologies over the coming years.

KEY MARKET PLAYERS

General Electric (GE), IBM Corporation, Schneider Electric, Microsoft Corporation, Siemens AG, Enel Group, Accenture, Cisco Systems, Delta Electronics, and NetApp are some of the major players in the global green technology and sustainability market.

RECENT HAPPENINGS IN THE MARKET

- November 2023: Schneider Electric, a leader in energy management and automation, integrated Microsoft Azure OpenAI into its operations. Purpose: To harness generative AI for boosting productivity and developing innovative sustainability solutions.

- May 2024: Microsoft announced a five-year agreement with Brookfield Renewable to supply over 10.5 gigawatts of renewable energy. Purpose: To meet sustainability goals and support the growing demand for cloud services.

- April 2024: Apple committed to achieving carbon neutrality across its entire business and manufacturing supply chain by 2030. Purpose: To reduce environmental impact and lead in corporate sustainability efforts.

- September 2024: Amazon announced plans to power its operations with 100% renewable energy by 2025, accelerating its original 2030 target. Purpose: To strengthen its commitment to sustainability and lower carbon emissions.

- August 2024: Google invested in advanced geothermal energy projects to supply 24/7 carbon-free energy to its data centers. Purpose: To advance its goal of operating entirely on carbon-free energy by 2030.

- May 2024: Intel launched a new line of energy-efficient processors designed to reduce power consumption in data centers. Purpose: To support sustainable computing and meet growing demand for energy-efficient technology.

- March 2024: IBM introduced a suite of AI-driven tools to help businesses monitor and reduce carbon footprints. Purpose: To provide clients with solutions for achieving sustainability targets.

- October 2024: Dell Technologies announced a partnership with a leading recycling firm to enhance its product take-back program. Purpose: To promote a circular economy and reduce electronic waste.

- November 2024: Cisco Systems launched a new initiative focused on designing and manufacturing products with energy efficiency and recyclability. Purpose: To minimize environmental impact and support customer sustainability goals.

- December 2024: Siemens expanded its smart building technology offerings aimed at reducing energy consumption in commercial properties. Purpose: To lead in energy-efficient infrastructure solutions.

MARKET SEGMENTATION

This research report on the global green technology and sustainability market is segmented and sub-segmented into the following categories.

By Technology

- Internet of Things (IoT)

- Cloud Computing

- Artificial Intelligence (AI) and Analytics

- Digital Twin

- Cybersecurity

- Blockchain

By Industry

- Energy and Utilities

- Transportation and Logistics

- Industrial Manufacturing

- Automotive

- FMCG and Retail

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

How big is the global green technology and sustainability market?

The size of the global green technology and sustainability market was valued at USD 20.73 bn in 2024.

What is the CAGR of the green technology and sustainability market for the coming years?

The global green technology and sustainability market is likely to witness a CAGR of 26.12% from 2025 to 2033.

Which region is expected to lead the green technology and sustainability market globally?

North America is predicted to hold the major share of the worldwide market during the forecast period.

Who are the key players in the green technology and sustainability market?

Companies playing a notable role in the green technology and sustainability market include General Electric Company (U.S.), IBM Corporation (U.S.), Schneider Electric (France), Sensus (Xylem Inc.) (U.S.), Oracle Corporation (U.S.), Microsoft Corporation (U.S.), CropX Inc. (Israel), ENGIE Impact (France), Cority (Canada) and Taranis Visual Ltd. (U.S.).

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]