Global Green Energy Market Size, Share, Trends, & Growth Forecast Report – Segmented By Type (Solar Photovoltaic (PV), Wind Energy, Hydroelectric Power, Biofuels, Geothermal Energy) End-Users (Residential, Industrial, Commercial) & Region - Industry Forecast From 2024 to 2032

Global Green Energy Market Size (2024 to 2032)

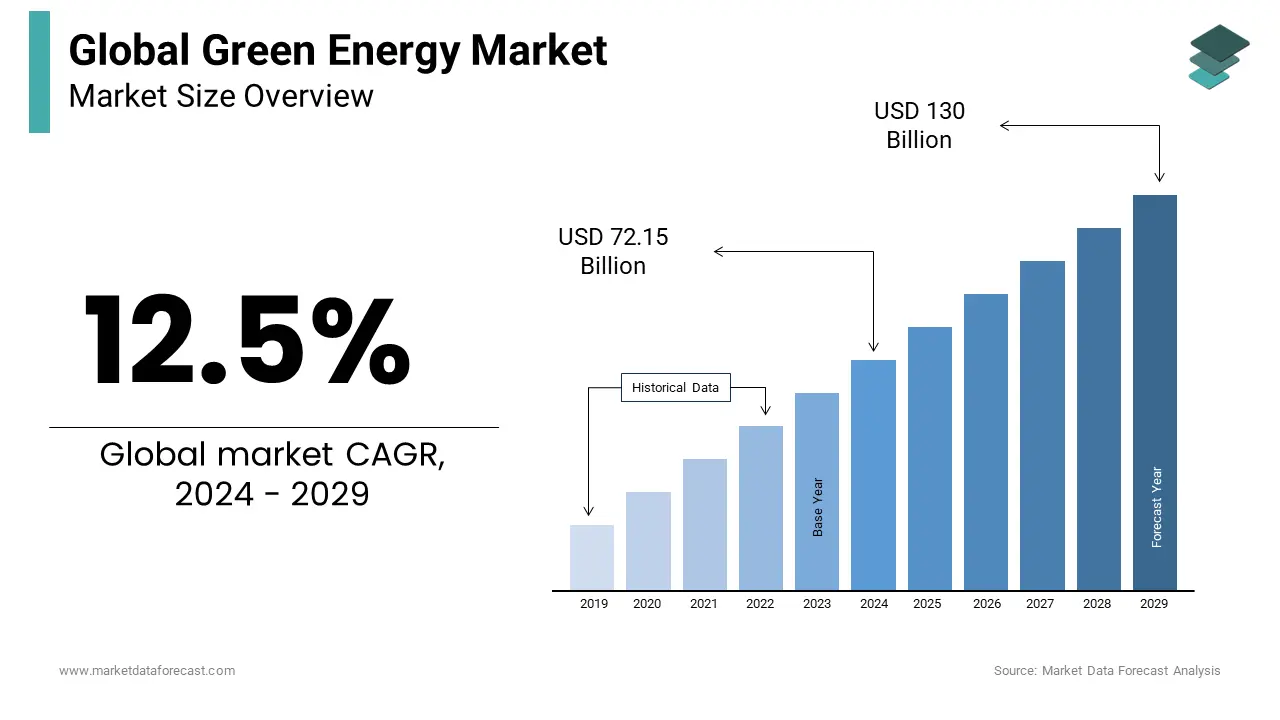

The size of the global green energy market was worth USD 64.13 Billion in 2023. The global market is anticipated to grow at a CAGR of 12.5% from 2024 to 2032 and be worth USD 185.12 billion by 2032 from USD 72.15 billion in 2024.

Current Scenario of the Global Green Energy Market

Green Energy is derived from natural sources such as sunlight, wind, and water. It is found in abundance and considered environmentally friendly. The energy produced is clean and safe as renewable energy generation has far lower emissions compared to burning fossil fuels. It also complies with government regulations of producing carbon-free energy, one of the most preferred forms of energy, to reduce the negative impact of non-renewable energy.

MARKET DRIVERS

Intergovernmental organizations and governments of various developing and developed countries are setting targets to reduce carbon footprint and provide subsidies to encourage green energy initiatives.

They spend more than USD 420 Billion each year to subsidize green energy. Countries such as China and India subsidize taxes, and the USA, Saudi Arabia, and Russia provide financial support for establishing green energy infrastructure., Other factors like growing population, global warming, industrialization, urbanization depletion of conventional resources, climate crisis due to carbon emissions, and combustion of fossil fuels act as drivers for the Green energy market by creating an inclination towards efficient green energy over non-renewable resources. Further, Green energy also has great potential to reduce prices and dependency on fossil fuels in the long term by replacing fossil fuels.

MARKET RESTRAINTS

The green energy market needs heavy initial investments to build infrastructure. Finding a potential site for installing solar and wind power and constructing a hydro-thermal project is costly and sometimes results in vain.

These investments increase the cost of providing electricity during the early years. So initially, green energy is relatively more expensive than fossil fuel., The other restraint is green energy industry requires skilled workers to install, operate, and maintain the infrastructure. Sometimes manpower who can work in certain climatic conditions can be necessary to maintain infrastructure. Other factors, like more dependency on fossil fuels, no 24 hrs production, and lacking supporting infrastructure, impede the green energy market.

MARKET OPPORTUNITIES

Green Energy Market possesses great opportunities for growth. With rapid globalization and industrialization, developed countries are adopting alternatives like green energy as a form of fuel to reduce carbon emissions. The green energy market can also increase its penetration in developing countries by creating awareness among people about green energy and its efficiency. The governments of developed and developing countries are promoting different forms of green energy under green schemes. They are also providing financial support under green energy bonds and subsidizing the infrastructure and production costs.

The green energy market has the scope of creating jobs and fostering new technology innovations in the production of fuel. Another great opportunity for the green energy market is transforming the global electricity mix. Globally, around one-quarter of electricity comes from green energy forms, which can be increased in the forecasted period.

IMPACT OF COVID-19 ON THE GLOBAL GREEN ENERGY MARKET

During COVID-19, transportation is restricted across the globe, and the whole focus has shifted to containing and treating the virus. Every industry is harshly affected by a disrupted supply chain, production cuts, and lockdowns levied globally. The green energy market also recorded negative growth due to the COVID-19 pandemic. This is because of the transportation challenges and safety regulations that delayed the construction of green energy installations, such as wind turbine manufacturing in China and Germany and onshore wind and solar PV installation in the North American region. The limited availability of spares also affected Germany’s Nordex SE, and plant maintenance too became a major issue owing to less manpower. Further, the green energy market is also affected by project delays, cancellation of orders, and low investments due to the outbreak.

The pandemic’s lockdown measures brought down the global energy demand by 6%. A drop of 9% in oil demand and 8% in coal is expected. A paradigm shift from non-renewable energy to green energy is observed in the forecasted period as its share in the global electricity mix has been growing. An instance such as the USA is increasing its green energy consumption by 40% and India by 45%.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

12.5% |

|

Segments Covered |

By Type, End-Users, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Yingli Green Energy Holding Co. Ltd., Hanwha Q Cells GmbH, National Hydroelectric Power Corporation (NHPC) Ltd., Suntech Power Holdings Co. Ltd., Archer Daniels Midland Company, Aventine Renewable Energy Inc, JA Solar Holdings Co. Ltd., Suzlon Energy Ltd., U.S. Geothermal Inc., Kyocera Solar Inc., Enphase Energy Inc., Trina Solar Ltd., Calpine Corporation, First Solar Inc., and Others. |

SEGMENTAL ANALYSIS

Global Green Energy Market Analysis By Type

The hydropower share in the green energy market is valued to surpass USD 371.8 billion in the forecasted period. Factors such as the increase in new hydropower projects, more investment into hydropower and pumped storage projects, and government support for projects are major drivers of hydropower share growth in the green energy market.

The solar power share in the green energy market is valued at USD 225 million in the forecasted period. Provisions like government incentives & tax rebates to install solar panels, the surge in rooftop solar installation, and its application in the architectural sector have made solar power the second-largest growing energy in the green energy market.

Global Green Energy Market Analysis By End-Users

By end user, the residential segment is in the first position in the green energy market. An increase in Solar and geothermal heat pump installations are expected to drive the growth of the market. At the same time, the commercial end-user segment is expected to increase due to government regulations.

REGIONAL ANALYSIS

North American region is expected to register a CAGR of more than 7.2% in the Green Energy Market during the forecast period. It leads the market due to the higher adoption of geothermal, wind, and hydroelectrical energy. It has vast offshore wind energy installations and is even expected to grow by 30% in the forecasted period.

Asia-Pacific region is gaining momentum and is expected to be the second largest by region. In Asia, China became the largest bioelectricity producer and a key player in wind power, solar, and hydropower. The geothermal power sector has demand in India and China.

KEY PLAYERS IN THE GLOBAL GREEN ENERGY MARKET

Companies playing a prominent role in the global green energy market include Yingli Green Energy Holding Co. Ltd., Hanwha Q Cells GmbH, National Hydroelectric Power Corporation (NHPC) Ltd., Suntech Power Holdings Co. Ltd., Archer Daniels Midland Company, Aventine Renewable Energy Inc, JA Solar Holdings Co. Ltd., Suzlon Energy Ltd., U.S. Geothermal Inc., Kyocera Solar Inc., Enphase Energy Inc., Trina Solar Ltd., Calpine Corporation, First Solar Inc., and Others.

RECENT HAPPENINGS IN THE GLOBAL GREEN ENERGY MARKET

- In April 2023, Sulzon group bagged a project of developing a 50.4MW wind power project from Green Infra Wind Energy Ltd. to supply wind turbines and execute the whole project.

- In April 2023, a joint venture investment agreement was made between National Hydroelectric Power Corporation (NHPC) Ltd and the Kathmandu government to establish a 480 MW Hydro project in Nepal.

DETAILED SEGMENTATION OF THE GLOBAL GREEN ENERGY MARKET INCLUDED IN THIS REPORT

This research report on the global green energy market has been segmented and sub-segmented based on type, end-users and region.

By Type

- Solar Photovoltaic (PV)

- Wind Energy

- Hydroelectric Power

- Biofuels

- Geothermal Energy

By End-Users

- Residential

- Industrial

- Commercial

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What will be the Green Energy market value by the end of 2032?

The hydrogen peroxide market is expected to reach USD 185.12 billion by 2032.

Which segment has the dominant shares based on the region in the green energy market?

The North American region, with a CAGR of 12.5%, has the largest share of the market.

Mention the top key players in the green energy market.

National Hydroelectric Power Corporation (NHPC) Ltd., Suntech Power Holdings Co. Ltd., Archer Daniels Midland Company, and JA Solar Holdings Co. Ltd. are the top key players in the market.

What are the restraints in the green energy market?

High costs for installations, the need for skilled workers, and dependency on fossil fuels are restraints in the green energy market.

What are the drivers of the green energy market?

Government subsidies, climate crisis, globalization, urbanization, population increase, and fossil fuel depletion are driving market growth.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com