Global Tooling Market Size, Share, Trends & Growth Forecast Report Segmented By Product Type (Dies & Molds, Forging, Jigs & Fixtures, Machine Tools & Gauges), End-User (Automotive, Electronics & Electrical, Aerospace, Marine & Defense, Plastics Industry, Construction & Mining & Others) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East And Africa), Industry Analysis From (2025 to 2033)

Global Tooling Market Size

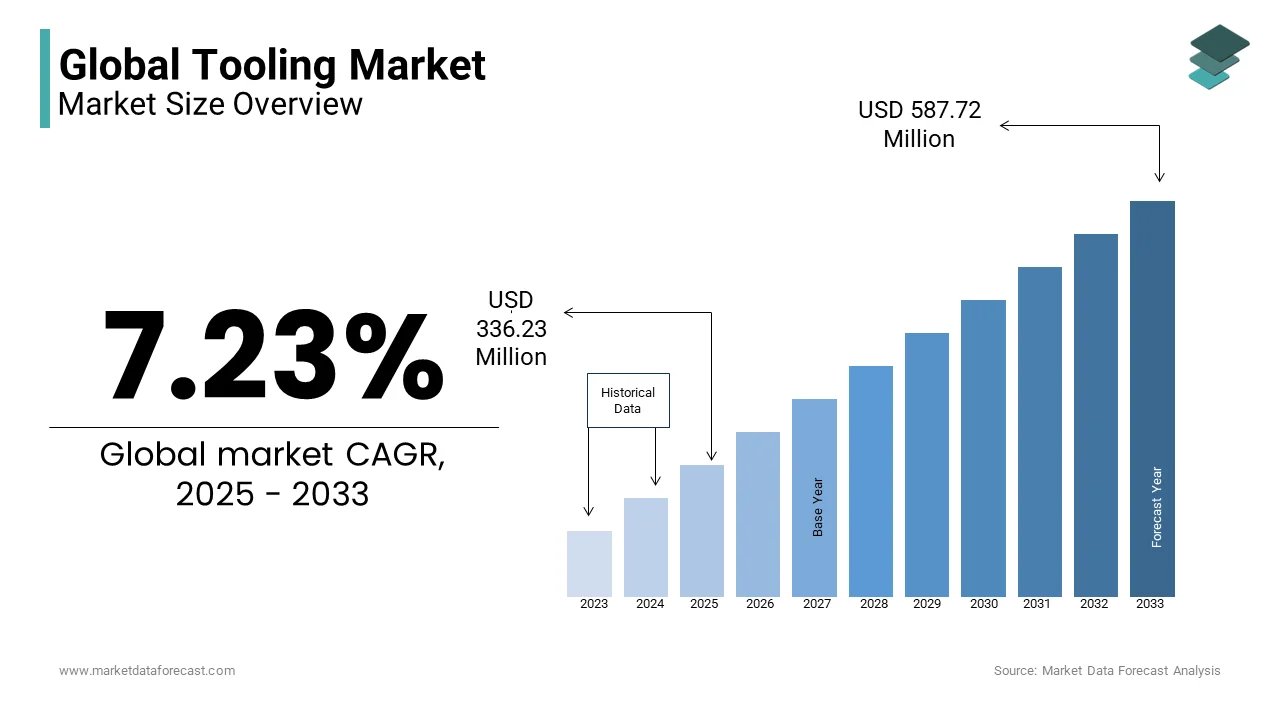

The global tooling market size was valued at USD 313.56 million in 2024 and is anticipated to reach USD 336.23 million in 2025 from USD 587.72 million by 2033, growing at a CAGR of 7.23% from 2025 to 2033.

Tooling is a foundational component of global manufacturing and provides essential equipment such as molds, dies, jigs, and fixtures for industries like automotive, aerospace, electronics, and consumer goods. According to the U.S. Bureau of Economic Analysis (BEA), the manufacturing sector contributed $2.3 trillion to the U.S. GDP in 2022, with tooling playing a critical role in enabling production processes. According to International Organization of Motor Vehicle Manufacturers (OICA), the need for precision components in vehicle manufacturing was over 85 million vehicles produced globally in 2022.

Technological advancements are contributing significantly the global tooling market. For instance, the U.S. Department of Energy (DOE) highlights that additive manufacturing (3D printing) is reducing tooling production times by 50-70% and costs by 20-30% in aerospace and defense applications. Additionally, the adoption of Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) systems has improved precision and efficiency, with the National Institute of Standards and Technology (NIST) reporting that these technologies can reduce errors by 30-40%.

MARKET DRIVERS

Technological Advancements in Manufacturing Processes

The tooling market is being driven by continuous technological advancements in manufacturing processes such as 3D printing and automation. The integration of these technologies into production lines enables faster, more precise, and cost-efficient tooling processes. For instance, additive manufacturing is transforming how molds and tools are created by reducing lead times by up to 50% compared to traditional methods. According to the U.S. Department of Energy, automation and digitalization in manufacturing are enhancing productivity and reducing waste is driving demand for high-performance tools. The growing adoption of Industry 4.0 is expected to further bolster these trends by improving tooling efficiency across multiple industries.

Global Industrial Growth and Infrastructure Development

The rapid industrialization and large-scale infrastructure projects in emerging economies are significantly boosting the tooling market. For example, the Asian Development Bank projects that global infrastructure investment will require approximately $94 trillion by 2040. This demand is pushing the need for advanced, durable, and high-precision tooling in sectors such as automotive, aerospace, and construction. According to the U.S. Bureau of Labor Statistics, the demand for tools used in construction and manufacturing is expected to rise by 10% between 2020 and 2030, directly correlating with the growth of infrastructure projects and industrial production in developing nations.

MARKET RESTRAINTS

High Initial Investment Costs

The tooling market faces a restraint due to the significant initial investment required for advanced machinery and tools. High capital expenditures are particularly challenging for small and medium-sized enterprises (SMEs) in industries like automotive and aerospace. According to the U.S. Small Business Administration, nearly 30% of small manufacturing businesses face financial constraints due to the high cost of acquiring specialized equipment. The need for continuous upgrading to stay competitive further escalates costs by deterring investment in the tooling sector. This factor limits the adoption of cutting-edge tools for smaller manufacturers by ultimately impacting growth in the market.

Skilled Labor Shortages

The tooling market is also constrained by a shortage of skilled labor, particularly in regions experiencing rapid industrial growth. Skilled professionals in areas like CNC machining, mold making, and tool design are in high demand but short supply. The U.S. Bureau of Labor Statistics reports a projected 10% decline in the number of machinists by 2030 due to an aging workforce and insufficient training programs. This labor shortage leads to increased operational costs and delays in production, which could hinder the growth of the tooling market in sectors that require specialized and high-precision tools.

MARKET OPPORTUNITIES

Expansion in Electric Vehicle (EV) Manufacturing

The rise in electric vehicle (EV) production presents a significant opportunity for the tooling market. As automakers shift toward EVs, there is a growing demand for specialized tooling for battery components, electric drivetrains, and lightweight materials. The U.S. Department of Energy reports that U.S. EV sales grew by 83% in 2022, and the trend is expected to continue which is driving the need for precision tooling in manufacturing processes. This growth opens new avenues for tooling companies to innovate and supply advanced tools tailored to the specific requirements of EV manufacturing in high-precision areas like battery assembly and electric motor production.

Government Initiatives for Infrastructure and Manufacturing Revitalization

Government programs aimed at revitalizing manufacturing and infrastructure development globally provide an opportunity for tooling market expansion. In the U.S., the Infrastructure Investment and Jobs Act, passed in 2021, allocates $550 billion to modernize the nation’s infrastructure, including transportation, water, and energy systems. The U.S. Bureau of Economic Analysis projects that infrastructure development will lead to a sustained increase in demand for high-quality tooling, especially in sectors like construction, energy, and aerospace. These investments are expected to enhance tooling requirements for precision manufacturing, creating growth opportunities for tooling companies in the coming years.

MARKET CHALLENGES

Fluctuating Raw Material Prices

The tooling market faces challenges due to fluctuating raw material costs, particularly for metals like steel, aluminum, and tungsten, which are essential for tool manufacturing. Prices of these materials can vary greatly based on global supply chain disruptions and geopolitical factors. For instance, the U.S. Department of Commerce reported that steel prices saw a 70% rise in 2021 due to supply chain challenges and increased demand. These fluctuations make it difficult for tooling companies to maintain stable pricing models which can hinder profit margins and disrupt the cost structure of manufacturing in small and medium enterprises that rely on tight margins.

Supply Chain Disruptions

Supply chain disruptions are a significant challenge for the tooling market with lead times for materials and finished tools often stretching beyond expected timeframes. The COVID-19 pandemic exacerbated global supply chain issues, leading to delays and increased costs for raw materials and manufacturing components. According to the U.S. Census Bureau, more than 30% of manufacturers in the U.S. reported difficulties in obtaining key supplies in 2021. These disruptions are ongoing, resulting in a lack of consistency in inventory and production schedules. Tooling companies must adapt to these challenges to meet customer demands without compromising quality or delivery timelines.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.23% |

|

Segments Covered |

By End-User, Application, and Region. |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bharat Forge, Carlson Tool & Manufacturing Corp., Doosan Machine Tools Co., Ltd., Godrej & Boyce Manufacturing Co. Ltd., Omega Tool Corp, Parpas S.p.A (GRUPPO PARPAS), Samvardhana Motherson Group, Unique Tool & Gauge Inc., Sandvik AB, Yamazaki Mazak Corporation. |

SEGMENT ANALYSIS

Global Tooling Market Analysis By Product Type

The dies & molds segment played the leading role in the global tooling market by capturing 40.8% of the global market share in 2024. Dies and molds are critical in the production of high-precision components used in industries like automotive, aerospace, and consumer electronics. According to the U.S. International Trade Commission, the automotive sector alone accounts for over 60% of global mold usage. The importance of dies and molds lies in their ability to produce high-volume is intricate parts with tight tolerances with essential for the mass production of complex products. This market dominance is a direct result of increasing industrial automation and demand for precision-engineered components.

The machine tools segment is growing rapidly and is estimated to showcase a CAGR of 7.4% from 2025 to 2033. This growth is largely attributed to the ongoing expansion of automated manufacturing and Industry 4.0 technologies, which rely on advanced machine tools for precision and efficiency. According to the U.S. Department of Commerce, the automation of production lines is expected to enhance the demand for machine tools, particularly in sectors such as aerospace and automotive, where high precision is vital. Machine tools are crucial for improving production efficiency, reducing waste, and enabling faster manufacturing processes.

Global Tooling Market By End-user Industry

The automotive segment dominated the market and held 40.8% of the global market share in 2024. According to the U.S. International Trade Administration, the automotive industry represents over 40% of global tooling demand. The sector’s growth is largely due to the ongoing demand for high-quality, durable components for cars, trucks, and electric vehicles. In 2022, U.S. vehicle production alone reached 13.8 million units, further driving tooling requirements. As electric vehicle (EV) production expands, the need for specialized tooling, especially for battery manufacturing, is expected to grow. The automotive sector’s tool usage is essential in producing components that meet stringent quality and safety standards.

The Aerospace, Marine & Defense segment is anticipated to witness the highest CAGR of 8.5% over the forecast period owing to the increased production of advanced aircraft, military vehicles, and defense equipment, which require highly specialized tooling for precise and durable components. The U.S. Bureau of Economic Analysis reports that aerospace manufacturing saw a 3.8% increase in output in 2021 which is contributing to an expanded need for advanced tooling solutions. For aerospace parts, such as turbine blades, fuselages, and lightweight composites as military budgets grow and commercial aviation recovers post-pandemic where tooling is becoming increasingly important. The demand for tooling solutions that meet rigorous performance standards in this sector is projected to propel the market’s growth rate.

REGIONAL ANALYSIS

North America played a major role in the global tooling market in 2024 and occupied 35.8% of global market share. The U.S. is a key driver in this region, with the automotive, aerospace, and defense industries contributing significantly to tooling demand. According to the U.S. Bureau of Economic Analysis, the aerospace manufacturing industry in the U.S. alone accounted for over $240 billion in output in 2021 which is driving significant tooling requirements. North America's strong manufacturing base, coupled with technological advancements and automation, makes it the leading region in tooling, with the demand for high-precision tools in EV and aerospace production increasing.

Asia-Pacific is the fastest-growing regional market for tooling worldwide and is expected to register a CAGR of 7.8% from 2025 to 2033. The region's rapid industrialization in countries like China, Japan, and India has significantly contributed to this growth. The automotive industry in China alone saw a production of over 25 million vehicles in 2022, according to the China Association of Automobile Manufacturers which is driving demand for tooling market. Additionally, the growth of the electronics industry in the region has spurred demand for precision tooling solutions. Asia-Pacific's expanding industrial infrastructure and manufacturing capacity are key factors behind this fast-paced growth.

Europe is expected to maintain steady growth due to its established automotive, aerospace, and electronics industries. The European Commission reported a recovery in manufacturing output in 2021, particularly in Germany and Italy, contributing to increased tooling demand. The rising electric vehicle production in Europe is expected to play a vital role in leveraging the demand for tooling. According to the European Automobile Manufacturers' Association, the EU’s EV market share reached 17.8% in 2022 is boosting tooling requirements further.

Latin America is projected to grow steadily, with Brazil and Mexico leading the demand for tooling in the automotive and manufacturing sectors. The U.S. International Trade Administration notes that Mexico is a significant hub for automotive production particularly for parts manufacturing.

Middle East and Africa are expected to experience moderate growth, primarily driven by demand in the construction, mining, and automotive sectors. The African Development Bank forecasts substantial infrastructure development in Africa, which is likely to spur demand for tooling in the construction and mining industries. Similarly, the Middle East’s focus on diversifying its economy into manufacturing, particularly in the UAE and Saudi Arabia, will likely contribute to a moderate increase in tooling demand over the coming years.

KEY MARKET PLAYERS

Bharat Forge, Carlson Tool & Manufacturing Corp., Doosan Machine Tools Co., Ltd., Godrej & Boyce Manufacturing Co. Ltd., Omega Tool Corp, Parpas S.p.A (GRUPPO PARPAS), Samvardhana Motherson Group, Unique Tool & Gauge Inc., Sandvik AB, Yamazaki Mazak Corporation. These are the market players that are dominating the tooling market.

Top 3 Key Players in the Market

Bharat Forge

Bharat Forge, based in India, is a leading player in the global tooling market, particularly recognized for its strong presence in the automotive and aerospace sectors. The company manufactures precision-engineered components for a variety of industries, including automotive, defense, and power generation. Bharat Forge’s contribution to the tooling market is substantial, with its ability to provide high-quality forging tools and solutions for precision manufacturing. In 2021, the company reported significant growth in exports, with a notable increase in automotive tooling demand. Bharat Forge’s focus on technological advancements, such as the development of advanced CNC machining tools and its expansion into electric vehicle (EV) parts, positions it as a key global player.

Carlson Tool & Manufacturing Corp.

Carlson Tool & Manufacturing Corp., headquartered in the United States, is a recognized leader in the production of high-quality tooling and precision machining services. Specializing in custom dies, molds, and complex tooling solutions for industries like automotive, aerospace, and consumer goods, Carlson Tool plays a crucial role in enhancing manufacturing efficiency globally. The company has built a reputation for innovation, providing precision tooling for high-volume manufacturing processes. Its contribution to the global tooling market is evident in its high-precision dies and molds used in the mass production of parts that require tight tolerances. Carlson Tool's focus on providing customized tooling solutions has helped it maintain a competitive position in the global market.

Doosan Machine Tools Co., Ltd.

Doosan Machine Tools, a South Korean manufacturer, is a significant player in the global tooling market, offering advanced machine tools, including CNC machines and automated systems. The company provides essential tooling solutions for various industries, including automotive, aerospace, energy, and medical devices. Doosan’s contributions to the tooling market are vast, as its cutting-edge technologies in precision machining and automation are essential for enhancing the productivity and efficiency of manufacturers worldwide. In 2021, Doosan Machine Tools reported an increase in sales driven by the rising demand for automated machinery and high-precision tools. Their machines are integral in the production of complex parts, directly impacting the growth and innovation within the tooling market.

Top Strategies Used By The Key Market Participants

Customer-Centric Approach and Customization

One key strategy for leading players like Yamazaki Mazak Corporation and Unique Tool & Gauge Inc. is focusing on a customer-centric approach, offering tailored solutions that meet specific customer needs. These companies invest in understanding the unique requirements of their clients in industries such as aerospace, automotive, and electronics. By offering highly customizable tools and personalized services, such as rapid prototyping and low-volume production, companies can establish long-term relationships with clients and build brand loyalty. Additionally, providing excellent customer support and after-sales services further strengthens their position in the market by ensuring satisfaction and repeat business.

Product Line Expansion

Many leading tooling companies are expanding their product lines to offer a broader range of solutions, catering to the diverse needs of the manufacturing sectors they serve. Companies like Godrej & Boyce Manufacturing Co. Ltd. have expanded their tooling product portfolios by integrating additive manufacturing and hybrid machining technologies, addressing the growing demand for flexibility in production. By offering a wider array of products—such as precision tooling, cutting tools, and specialized automation equipment—these companies can serve a wider market, appeal to different industries, and increase revenue streams. This strategy also helps companies diversify their revenue sources and reduce dependency on any single market.

Cost Leadership and Operational Efficiency

Cost leadership is another important strategy employed by key players in the tooling market, particularly for companies like Samvardhana Motherson Group. By focusing on operational efficiency and streamlining manufacturing processes, these companies can reduce production costs and pass on the savings to customers, making their products more competitive in price-sensitive markets. Operational improvements, such as adopting lean manufacturing practices and reducing waste, not only boost profitability but also help companies maintain a competitive edge over rivals. Furthermore, cost leadership strategies enable companies to cater to emerging markets where cost efficiency is paramount to success.

Training and Talent Development

To stay ahead of the curve in a rapidly evolving market, leading tooling companies focus on building a skilled workforce through extensive training and talent development initiatives. Companies like Sandvik AB invest in training programs to upskill their employees in the latest manufacturing technologies and industry best practices. By fostering a culture of continuous learning, these companies ensure that they remain at the forefront of technological advancements. Additionally, investing in workforce development helps companies improve their product quality, reduce errors, and enhance productivity, which in turn strengthens their position in the competitive tooling market.

COMPETITIVE LANDSCAPE

The tooling market is highly competitive, characterized by a mix of established global players and specialized regional manufacturers. The competition is driven by the increasing demand for precision, high-quality tools and the need for advanced solutions across industries such as automotive, aerospace, electronics, and consumer goods. Leading companies like Bharat Forge, Doosan Machine Tools, and Sandvik AB dominate the market by leveraging technological innovation, robust product offerings, and a global presence. These companies continually invest in research and development to enhance their tooling capabilities, incorporating automation, artificial intelligence, and 3D printing technologies to stay ahead of the competition.

However, regional players also play a significant role in the market, particularly in emerging economies where industrial growth is accelerating. Companies in Asia-Pacific, such as Yamazaki Mazak Corporation, have been rapidly expanding, capitalizing on the region’s manufacturing boom, while companies in Latin America and Africa focus on serving local industries such as automotive and construction.

Price competition is also a key factor, as companies are continually striving to offer cost-effective solutions while maintaining high standards of quality and precision. Additionally, customer relationships, customization, and after-sales service are essential for differentiation in this competitive market. Overall, the tooling market remains dynamic, with ongoing innovation and geographic diversification shaping the competitive landscape.

RECENT HAPPENINGS IN THIS MARKET

- February 2024, Sandvik AB: Sandvik AB, a global leader in tooling solutions, acquired Cambrio, a provider of advanced software for automation and additive manufacturing. This acquisition is anticipated to expand Sandvik's digital and automation capabilities, enabling customers to benefit from integrated tooling and software solutions for advanced manufacturing.

- November 2023, Doosan Machine Tools Co., Ltd.: Doosan Machine Tools launched a new line of high-speed CNC machines designed for the automotive and aerospace industries. This launch is expected to strengthen Doosan's market position by addressing the growing demand for precision tools in high-performance sectors.

- July 2023, Bharat Forge: Bharat Forge, a major player in precision tooling, formed a strategic partnership with General Electric Aviation to supply advanced tooling for jet engine manufacturing. This partnership is expected to boost Bharat Forge’s market presence, especially in the aerospace sector, by supplying cutting-edge components.

- April 2023, Carlson Tool & Manufacturing Corp.: Carlson Tool expanded its custom tooling services by introducing new rapid prototyping capabilities using additive manufacturing technologies. This expansion is expected to meet the growing demand for faster production times and custom tooling solutions across multiple industries.

- June 2022, Omega Tool Corp: Omega Tool Corp. opened a new manufacturing facility in Mexico to serve the North American automotive sector. This expansion is anticipated to strengthen Omega Tool’s geographic reach and provide more efficient access to tooling demands in the region.

- January 2022, Parpas S.p.A (GRUPPO PARPAS): Parpas launched a new multi-axis machining center aimed at improving precision and flexibility for the aerospace industry. This launch is expected to strengthen Parpas’ position in the aerospace sector, addressing the growing demand for complex, high-precision parts.

- October 2021, Samvardhana Motherson Group: Samvardhana Motherson Group acquired VMT GmbH, a leading supplier of advanced machining tools for the automotive and defense industries. This acquisition is expected to enhance Samvardhana Motherson’s product portfolio and expand its presence in the high-precision tooling market.

- March 2021, Yamazaki Mazak Corporation: Yamazaki Mazak opened a new global technology center in the United States to showcase its advanced machine tool solutions and provide hands-on training. This investment is expected to reinforce Yamazaki Mazak’s commitment to customer service and position it as a leader in advanced manufacturing technologies.

- May 2020, Godrej & Boyce Manufacturing Co. Ltd.: Godrej & Boyce launched a new range of high-precision machining tools for the aerospace and defense industries. This launch is expected to strengthen Godrej’s market presence in the aerospace sector, driven by demand for lightweight and durable components.

- December 2020, Unique Tool & Gauge Inc.: Unique Tool & Gauge Inc. introduced a new line of precision gauges tailored for the electric vehicle manufacturing sector. This launch is expected to strengthen Unique Tool’s market position by tapping into the rapidly growing EV market and the need for high-precision tools in EV component production.

MARKET SEGMENTATION

This research report on the global tooling market is segmented and sub-segmented into the following categories.

By Product Type

- Dies & molds

- Forging

- Jigs & Fixtures

- Machine Tools

- Gauges

By End-user Industry

- Automotive

- Electronics & Electrical

- Aerospace, Marine & Defense

- Plastics Industry

- Construction & Mining

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current market size of the global tooling market?

The current market size of the global tooling market size was valued at 336.23 million in 2025

What market drivers are driving the global tooling market?

The technological advancements in manufacturing processes and industrial growth, and infrastructure development are the market drivers in the global tooling market.

What segments are covered in the global tooling market?

The segments in the global tooling market are the Product type and End-User are covered in this market.

Who are the market drivers that are driving the global tooling market?

Bharat Forge, Carlson Tool & Manufacturing Corp., Doosan Machine Tools Co., Ltd., Godrej & Boyce Manufacturing Co. Ltd., Omega Tool Corp, Parpas S.p.A (GRUPPO PARPAS), Samvardhana Motherson Group, Unique Tool & Gauge Inc., Sandvik AB, Yamazaki Mazak Corporation. These are the market players that are dominating the global tooling market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]