Global Surgical Sutures Market Size, Share, Trends and Growth Forecast Report – Segmented By Product (Sutures & Automated Suturing Devices), Application (Cardiovascular Surgeries, General Surgeries, Gynecological Surgeries, Orthopedic Surgeries, Ophthalmic Surgeries, Orthopedic Surgeries, Ophthalmic Surgeries and Other Applications), End User and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2025 to 2033)

Global Surgical Sutures Market Size

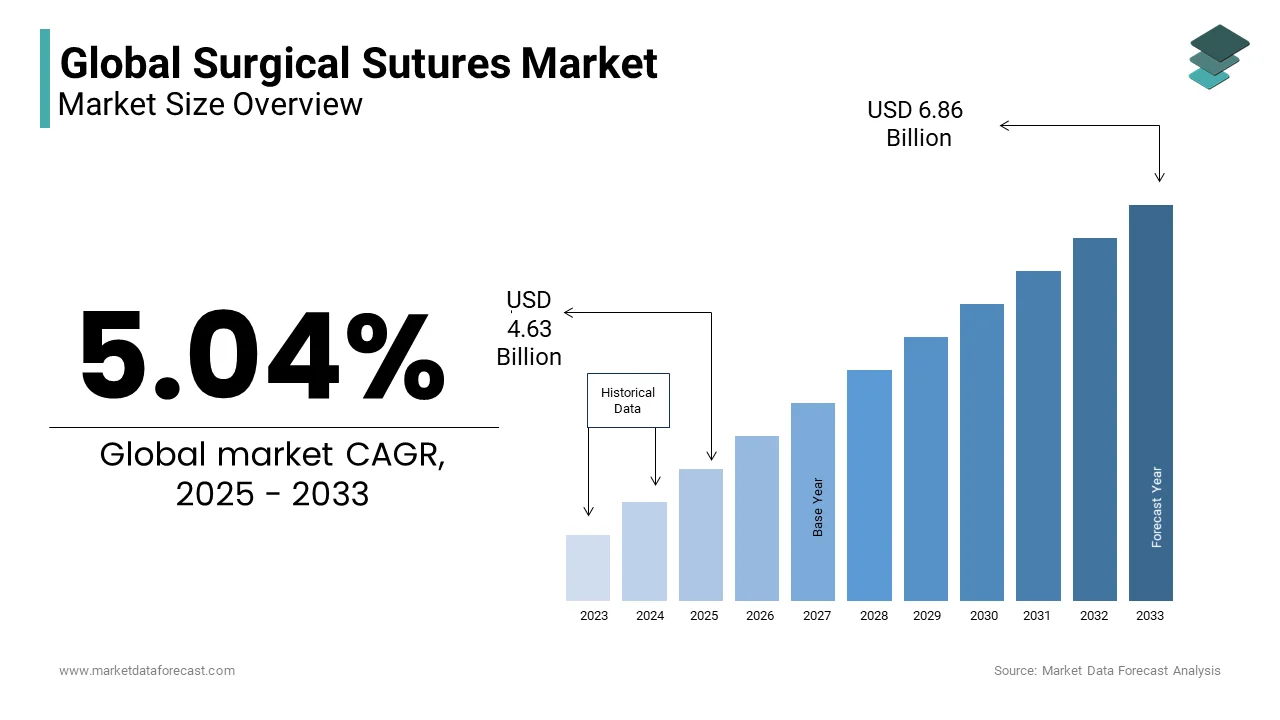

In 2024, the global surgical sutures market was valued at USD 4.41 billion and it is expected to reach USD 6.86 billion by 2033 from USD 4.63 billion in 2025, growing at a CAGR of 5.04 % during the forecast period.

Surgical sutures are a standard medical device for wound closure and stitching up surgical openings. These devices are used in the form of a needle and different threads used to close and let the wounds heal. Surgical sutures come in two basic types absorbable and non-absorbable. The absorbable type does not need to be removed, while the doctor removes the non-absorbable sutures after the healing process. the threads of the sutures are made of either synthetic or natural material and are sterilized before use. The threads can be single-stranded or can have a braided multiple-strand structure to add more stability. These surgical sutures are an essential part of the healing process for patients. Therefore, it is essential to correctly choose the suitable suture leading to demand in the market

Surgical sutures are acting as one of the essential tools in the modern healthcare and have been using to close wounds and incisions with precision and efficacy. The demand for surgical sutures has been growing at a consistent pace over the last few years and the market for surgical sutures foreseeing a promising future ahead. The growing prevalence of surgeries, increasing number of advancements in surgical techniques and Y-O-Y growth in the geriatric population who are prone to various medical conditions that require surgical intervention are majorly responsible for the continuously growing demand for surgical sutures. These factors are expected to continue drive the demand for surgical sutures during the forecast period and promote the worldwide market growth. Currently, the United States, China, India, Germany, and Japan tops the list among the leading consumers of surgical sutures worldwide. The U.S. led the surgical sutures market worldwide in 2023. High volume of surgical procedures across the U.S. and increasing investments by the medical facilities to stay updated with advanced medical devices and medical technologies are majorly propelling the surgical sutures market in the U.S. Developing countries such as China and India are also experiencing substantial demand for surgical sutures due to the growing awareness about the importance of surgical interventions to treat various medical conditions. As discussed above, the demand for surgical sutures is likely to be high during the forecast period and the global market for surgical sutures is expected to have a lucrative future ahead.

MARKET DRIVERS

The growing number of surgeries being performed worldwide is one of the major factors propelling the surgical sutures market growth.

For instance, according to statistics, nearly 234.2 million major surgeries are performed yearly. Additionally, the growing complications after surgery lead to demand for proper surgical sutures. According to the WHO stats, up to 25% of the patients who undergo surgery experience complications after it. Furthermore, the growing cases of chronic illnesses leading to people requiring surgeries support the market's growth. For example, according to the WHO reports, around 41 million people die yearly due to chronic noncommunicable diseases such as cardiovascular problems, diabetes, cancer, and respiratory disorders. Additionally, the growing number of organ transplantation surgeries due to the failure of body parts in patients supports the growing surgery rates.

The growing geriatric populations prone to injuries and diseases support the market growth.

The rising cases of traffic accidents and injuries also support the need for the market. According to WHO stats, traffic accidents leave around 20 to 50 million people with non-fatal injuries yearly. Additionally, the growing development in the production of sutures by industries to create new and more efficient products and make the recovery process faster supports the market's growth. For example, Dolphin sutures, the Indian company, displayed its latest innovative sutures at the Medica 2022 event in Germany. The company showcased new products like Barbed sutures, PTFE & UHMWPE Sutures, Antibacterial suture Range, etc.

In addition, the growing adoption of technological developments to manufacture innovative surgical advancements, increasing investments, and a rising number of government initiatives promote the surgical sutures market growth. Furthermore, the growing clinical trials to gouge the efficiency of different types of sutures also support the market growth. For example, in 2019, the US government conducted a clinical trial to test the efficiency of two types of absorbable sutures in thyroid incision surgeries.

MARKET RESTRAINTS

The availability of alternative devices hinders the global surgical sutures market growth.

However, there has been a rise in surgical staplers compared to sutures, which could threaten the surgical suture market's development. The use of surgical staplers is due to many advantages, such as low cost, effectiveness, reliability, speed, and the ability to reduce infection; thus, doctors favor staplers over surgery sutures. Aside from that, other available pharmaceuticals decrease the probability of surgery, reducing the need for surgical sutures.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.04 % |

|

Segments Covered |

By Product, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis; Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Market Players |

Johnson & Johnson, Inc., B. Braun Melsungen AG, Smith & Nephew plc, Demetech Corporation, Conmed Corporation, W.L. Gore & Associates, Boston Scientific Corporation, 3M Healthcare, Medtronic Inc., and Sutures India Pvt Ltd. |

SEGMENTAL ANALYSIS

By Product Insights

The absorbable suture segment is forecasted to lead the global surgical sutures market, whereas the future of this segment is to have the fastest growth rate in the coming years. Furthermore, increasing demand for biodegradable product types to reduce side effects after surgeries is leveraging the market's growth. As a result, the synthetic suture segment is estimated to account for the leading shares during the forecast period within the sub-segments of absorbable sutures. At the same time, the natural sutures are projected to showcase a healthy CAGR. On the other hand, the non-absorbable suture segment is expected to have a lower growth rate than absorbable sutures as they are not widely used. However, using these non-absorbable sutures in long-term surgeries and tissue closures, which require a long time to close and are more internally complicated, leads to growth for the market.

By Application Insights

The surgery segment is ruling with the highest share of the market currently. Furthermore, a rise in surgeries for cardiovascular-related issues focuses on expanding the size of this segment. In addition, the growing cases of heart problems, rising Blood pressure, and high cholesterol support the segment's growth.Additionally, the orthopedic surgeries application is next in line in delivering promising growth during the forecast period. The rising incidents of road accidents and geriatric populations with bone problems like osteoporosis and arthritis lead to demand for the segment. In addition, the growing cases of spinal cord injuries and surgeries also support the segment.

By End-User Insights

The hospital segment dominates the market with the most significant share of the global market from the past decade. The increasing construction of hospitals and the growing flow of patients rapidly magnify the segmental growth. Additionally, the presence of professional surgeons in hospital settings supports the market's growth.Other end-users like ambulatory care services and special surgical centers are also expected to grow during the forecast period due to the growing cases of patients opting for these services. In addition, the long waiting lists and time of admission in hospitals, along with high charges and service costs, are leading to more growth for these other segments.

REGIONAL ANALYSIS

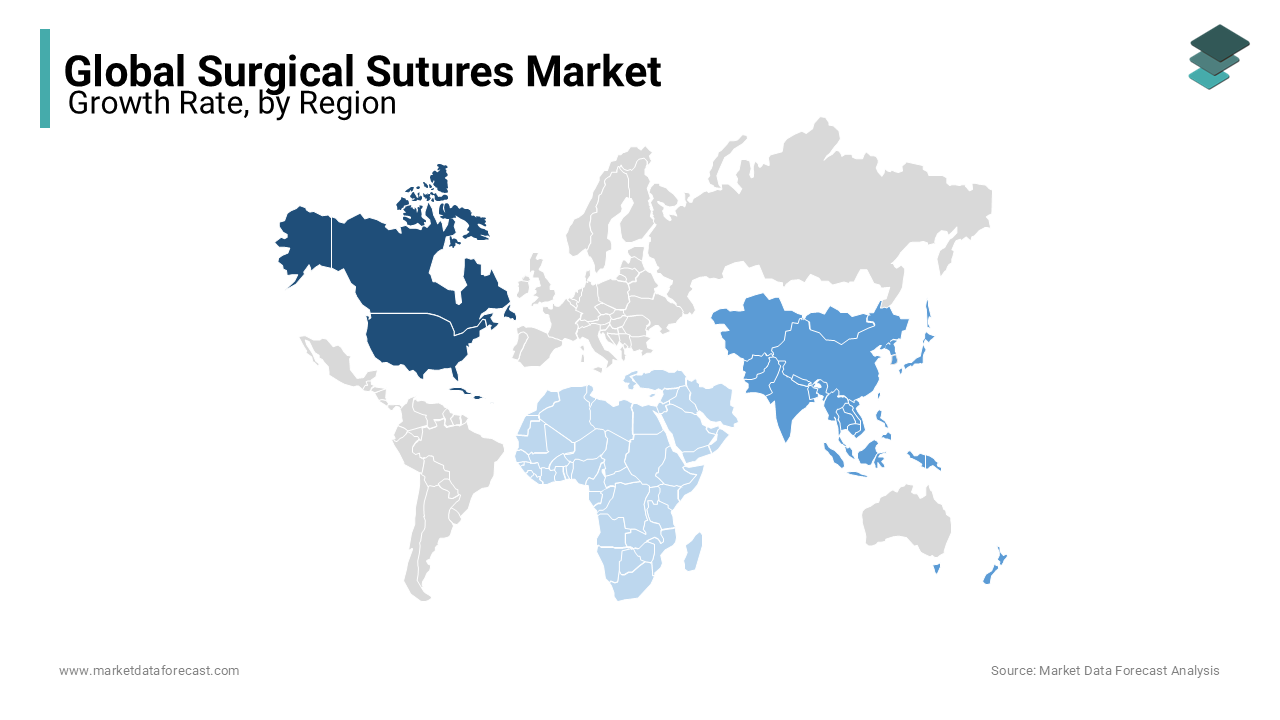

North America was the biggest regional segment in the global market in 2023 and captured a share of 39% of the global market in 2023 and is estimated to continue its dominance throughout the forecast period owing to the adoption of the latest surgical sutures in hospitals and the presence of several notable market participants primarily. North America has advanced healthcare infrastructure with state-of-the-art medical facilities and technologies and usually stays at the top in the adoption of the usage of all types of medical equipment including surgical sutures. The growing number of surgical procedures that includes elective and non-elective surgeries across the North American region is promoting the growth of the North American market. For instance, in the U.S. alone, on an average 51 million surgeries are recorded annually. Continuous technological advancements in surgical techniques and materials that enhance the efficacy and safety of surgical procedures are further supporting the growth of the North American region. The U.S. holds the largest share of the North American market, followed by Canada.

The Asia Pacific market accounted for a substantial share of the global market in 2023 and is anticipated to showcase a promising CAGR during the forecast period owing to the rising funds from government organizations to bring advancements in the healthcare infrastructure and increasing focus on improving treatment procedures. The disposable income of the population of the Asia-pacific countries is increasing, which is resulting in the greater affordability of surgical procedures and contributing to the expansion of the Asia-Pacific market. In the Asia-Pacific region, countries such as Thailand and Singapore have become hubs for medical tourism and people worldwide have been visiting these countries for surgical procedures, which is also promoting the growth rate of the regional market. China, Japan and India are likely to play a leading role in the Asia-pacific market for surgical sutures.

Europe is expected to hold a considerable share of the worldwide market during the forecast period. Europe has a well-established healthcare system and provides high-quality healthcare delivery and accessibility to their population. Y-O-Y growth in the aging population suffering from various conditions including orthopedic and cardiovascular diseases and going through surgeries in Europe is one of the major factors propelling the growth of the European market. As per the statistics published by the United Nations, the population of age above 65 years in Europe is expected to reach 169 million by 2050. An increase in the patient population of chronic diseases undergoing surgical interventions in Europe is further contributing to the European market expansion. Germany, France and the UK are the key players in the European market.

Latin America is forecasted to be growing at a CAGR of 5.1% during the forecast period. Brazil and Mexico are predicted to capture the major share of the Latin American market during the forecast period.

The Middle East and Africa market is projected to have an inclined growth rate during the forecast period. The growing investments from governments to improve healthcare infrastructure and services and expand the capabilities of surgical procedures across Middle East and Africa is propelling the regional market growth. Saudi Arabia, United Arab Emirates and South Africa are anticipated to hold that largest share of the Middle East and Africa market during the forecast period.

KEY MARKET PLAYERS

Notable companies in the global surgical sutures market profiled in this report are Johnson & Johnson, Inc., B. Braun Melsungen AG, Smith & Nephew plc, Demetech Corporation, Conmed Corporation, W.L. Gore & Associates, Boston Scientific Corporation, 3M Healthcare, Medtronic Inc., and Sutures India Pvt Ltd. These major players expand their market share by applying strategies such as mergers, acquisitions, partnerships, and launches.

RECENT HAPPENINGS IN THE MARKET

- In February 2023, Origami surgical, a new jersey based company, announced that it received FDA clearance for its new stitch kit device for robotic surgeries.

- In January 2021, DKSH extended a partnership with Healthium Medtech to deliver high-quality surgical medical device products.

- In November 2020, Healthium Medtech launched a knotless tissue closure device called Trubarb™, intended for suturing.

- The Endoscopy Division of Smith & Nephew's company introduced UltraBraid, a high-strength polyethylene suture for affixing soft tissue to bone.

- In August 2016, Ethicon introduced two new suture technologies named STRATAFIX Spiral PDS Plus and STRATAFIX Spiral Monocryl Plus Knotless Tissue Control Devices.

MARKET SEGMENTATION

This research report on the global surgical sutures market has been segmented and sub-segmented based on product, application, end-user, and region.

By Product

- Sutures

- Absorbable sutures

- Natural sutures

- Synthetic sutures

- Non-Absorbable sutures

- Nylon sutures

- Proline sutures

- Stainless steel sutures

- Other Non-absorbable sutures

- Absorbable sutures

- Automated Suturing devices

- Disposable

- Reusable

By Application

- Cardiovascular Surgeries

- General Surgeries

- Gynecological Surgeries

- Orthopedic Surgeries

- Ophthalmic Surgeries

- Orthopedic Surgeries

- Ophthalmic Surgeries

- Other Applications

By End User

- Hospitals

- Other End-Users

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

Who are the prominent companies in the surgical sutures market?

Johnson & Johnson, Inc., B. Braun Melsungen AG, Smith & Nephew plc, Demetech Corporation, Conmed Corporation, W.L. Gore & Associates, Boston Scientific Corporation, 3M Healthcare, Medtronic Inc., and Sutures India Pvt Ltd are playing a key role in the surgical sutures market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]