Global Spices Market Size, Share, Trends & Growth Forecast Report Segmented By Product Type (Whole Spices, Ground Spices, Spice Blends and Herbs), Application, Distribution and Region (North America, Europe, Asia Pacific, Latin America, Middle East And Africa), Industry Analysis From 2024 to 2032

Global Spices Market Size

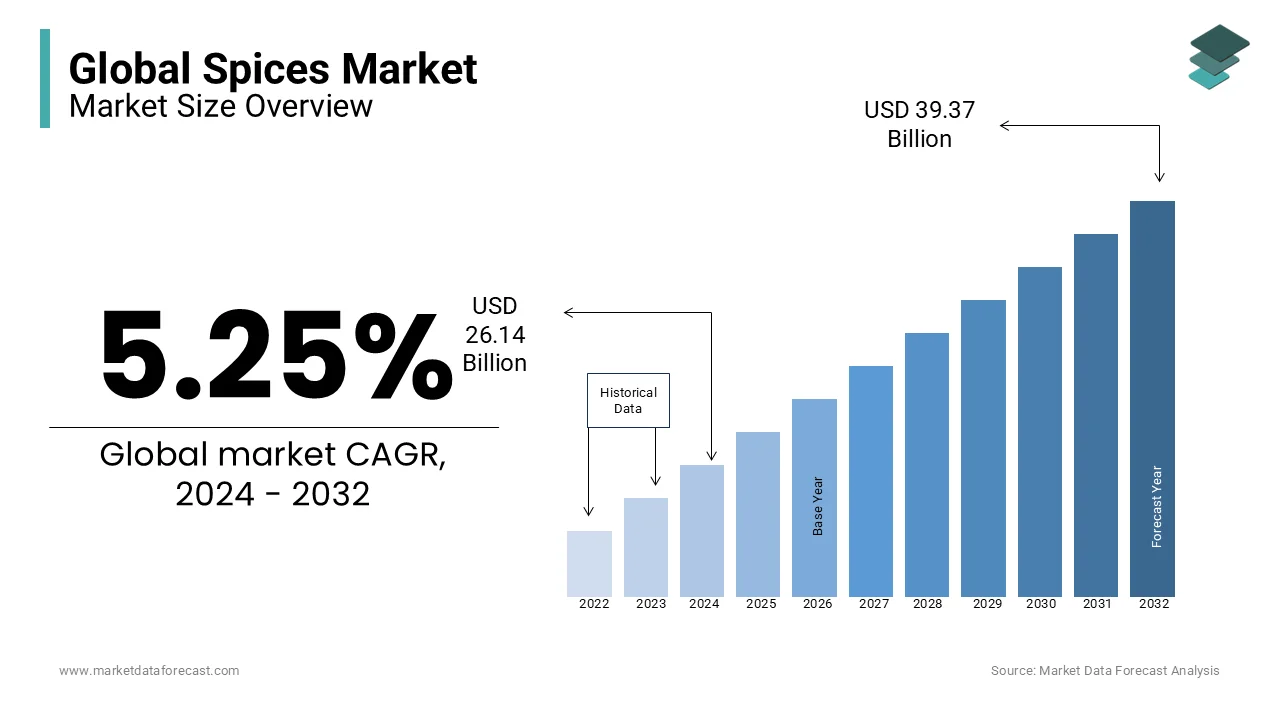

The global spices market size was valued at USD 24.84 billion in 2023 and is anticipated to reach USD 26.14 billion in 2024 from USD 39.37 billion by 2032, growing at a CAGR of 5.25%, growing at a CAGR of 5.25% from 2024 to 2032.

Spices like turmeric, ginger, and cinnamon are gaining popularity due to their well-documented health benefits. For instance, turmeric, known for its anti-inflammatory properties, is linked to improved joint health and better immune system function, supported by clinical studies showing reduced inflammation markers after regular consumption. In agriculture, spice crops are significant, and India produces around 70% of the world's spices and exports to over 180 countries. Notably, this industry employs millions of farmers globally, with India alone supporting over 6 million families. Environmental concerns also influence the market, as climate change affects crop yields. For example, rising temperatures have reduced black pepper production in Vietnam, which is the leading exporter worldwide, by approximately 15% in recent years.

MARKET DRIVERS

Growing Consumer Preference for Natural and Functional Ingredients

The increasing focus on health and wellness is a key driver of the spices market. Consumers are shifting away from artificial additives because they are favoring natural ingredients with functional health benefits. Spices like turmeric, being rich in curcumin, have been shown to reduce inflammation and improve cardiovascular health. Studies indicate that global turmeric consumption has increased by 10% annually over the past decade and is fuelled by its inclusion in functional foods, beverages, and supplements. The widely used Ginger for digestive health has seen similar growth due to the rising demand of the herbal tea and natural remedy sectors. This trend boosts the market for health-driven spice products.

Rising Global Demand for Ethnic and Exotic Cuisines

Consumers are seeking authentic flavors from diverse cuisines owing to the expansion of globalization and cultural exchanges. This has increased the demand for spices like cumin, cardamom, and paprika. For example, cumin exports from India grew by 20% in 2022, largely influenced by rising consumption in the Middle East, Europe, and the U.S. Similarly, paprika is increasingly used in global snacks and processed foods, with its export volume rising by 15% over the past five years. The growing popularity of street food, ethnic restaurants and fusion cooking underscores the vital role of spices in enhancing culinary experiences worldwide.

MARKET RESTRAINTS

Impact of Climate Change on Spice Production

Climate change is a significant restraint affecting spice cultivation globally. Unpredictable weather patterns, rising temperatures and water scarcity are reducing crop yields. For instance, black pepper production in Vietnam declined by 15% between 2020 and 2023 due to extreme heat and drought. Likewise, saffron yields in Iran have dropped as water availability dwindles, leading to higher prices and supply shortages. These environmental factors not only disrupt global supply chains but also increase production costs, challenging market growth and affordability for consumers and manufacturers reliant on these spices.

Volatility in Spice Prices

Price volatility caused by supply-demand imbalances, geopolitical tensions, and logistical challenges poses a restraint to the spices market. For example, turmeric prices surged by 25% in 2022 owing to lower production in India caused by erratic rainfall. Transportation costs are exacerbated by rising fuel prices, which further add to the instability. Such fluctuations create difficulties for businesses in planning procurement and pricing strategies, which potentially lead to decreased demand from cost-sensitive buyers. Export-dependent markets are particularly vulnerable because price instability affects their competitiveness in global trade, challenging the market’s ability to sustain consistent growth.

MARKET OPPORTUNITIES

Expansion of Organic and Sustainable Spice Farming

The rising consumer demand for organic and sustainably sourced spices presents a significant opportunity for growth. According to industry reports, organic spice demand has increased by over 12% annually as consumers prioritize environmental sustainability and pesticide-free products. India and Sri Lanka are expanding organic certification programs for spices like cinnamon and turmeric, which is boosting their global appeal. Certifications such as Fair Trade and Rainforest Alliance further enhance marketability. For instance, organic ginger exports from India grew by 18% in 2023 to highlight the potential for premium pricing and market differentiation through sustainable farming practices that appeal to eco-conscious consumers.

Innovation in Spice-Based Products

Innovation in spice-derived products, such as spice blends, extracts, and essential oils, is creating new market opportunities. These value-added products cater to both culinary and non-culinary industries, including cosmetics and pharmaceuticals. For example, the demand for curcumin supplements grew by 14% in 2022 due to its recognized anti-inflammatory benefits. Similarly, chili pepper extract is extensively used in pain relief creams and functional beverages is gaining traction globally. Spice companies can capitalize on these trends by developing innovative offerings that meet evolving consumer preferences in diverse market segments.

MARKET CHALLENGES

Adulteration and Quality Control Issues

The prevalence of adulteration in the spices market is a significant challenge, undermining consumer trust and market reputation. Studies show that approximately 25% of spices tested globally fail quality checks due to contamination or the presence of unauthorized additives. For instance, adulteration in turmeric with synthetic colorants like lead chromate has raised health concerns. Stricter regulatory enforcement and advanced testing methods are needed to combat this issue. Businesses face additional costs to ensure compliance with global quality standards, such as those set by the FDA and European Food Safety Authority, which create financial and operational burdens for spice producers.

Fragmented Supply Chains

The spices market is heavily reliant on fragmented and complex supply chains, which pose logistical challenges. Many spices are sourced from smallholder farmers in developing regions, making standardization and efficient transportation difficult. For example, India accounts for nearly 70% of global spice production, yet fragmented distribution channels result in delays and increased costs. These inefficiencies are exacerbated by geopolitical tensions and disruptions like the COVID-19 pandemic, which exposed vulnerabilities in international trade. Addressing these challenges requires investment in infrastructure, digital tracking systems and stronger collaborations between producers, distributors, and governments to ensure a streamlined and reliable supply chain.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

5.25% |

|

Segments Covered |

By Product Type, Application & Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC. PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

McCormick & Company, Olam International, Ajinomoto Co., Inc., Everest Spices, Sensient Technologies Corporation, Givaudan, Kerry Group plc, DS Group (Catch Spices), Bart Ingredients Company Ltd, SHS Group (Schwartz Spices). |

SEGMENT ANALYSIS

By Product Type Insights

The whole spices segment led the market and accounted for 45.5% of the global spices market share in 2023. Whole spices like black pepper, cloves and cardamom are highly preferred in both home cooking and commercial food preparation because they retain their natural flavour and aroma longer than processed spices. For example, India is the largest spice producer with significant quantities of whole spices which is contributing to nearly 70% of its total spice export revenue. Their importance is further underscored by demand from the food service and retail sectors, where freshness and authenticity are prioritized.

The spice blends segment is estimated to be the fastest-growing segment and is predicted to witness a CAGR of 7.5% over the forecast period. This rapid growth is driven by the increasing popularity of ready-to-use products that save time while delivering authentic flavors. Consumers, especially in urban areas, show interest in spice blends for international cuisines, such as garam masala, Cajun mix, and Italian seasoning. For example, the demand for spice blends in the U.S. rose 12% year-over-year in 2022 due to the growing interest in home cooking during the pandemic. Their importance lies in convenience, consistency, and the ability to cater to diverse culinary preferences globally.

By Application Insights

The Food and Beverage segment occupied 40.4% of the global market share in 2023. This dominance is due to the extensive use of spices in culinary applications for flavor enhancement, preservation, and health benefits. Key spices like turmeric, black pepper, and cumin are staples in traditional and modern cuisines worldwide. The rising trend of clean-label and natural food products further boosts spice usage in the industry. For example, the inclusion of spices in functional foods and beverages, such as turmeric lattes, is growing steadily, with global turmeric drink consumption increasing by 15% annually. This segment is critical due to its integral role in food processing and the global demand for diverse and authentic flavors.

The ready-to-eat meals segment is swiftly emerging in the spices market and is projected to witness the fastest CAGR of 8.2% over the forecast period. This rapid growth is driven by the increasing demand for convenient and flavourful meal options among busy consumers. Spices are essential in creating authentic taste profiles for pre-packaged meals such as Indian curries or Mediterranean dishes. For instance, the ready-to-eat food industry in the U.S. expanded by 10% year-on-year in 2022, with spice-infused products driving a significant portion of this growth. This segment's importance lies in addressing consumer convenience while ensuring high-quality taste and innovation in meal offerings globally.

By Distribution Channel Insights

Supermarkets and hypermarkets are the top distribution channels in the global spices market, and this segment captured 45.3% of the global market share in 2023. These stores dominate due to their wide reach, convenience, and ability to offer a wide variety of spice products, which include branded, private-label, and bulk options. Supermarkets provide consumers with the opportunity to compare products and access promotions, making them a preferred choice for household spice purchases. For example, in the U.S., over 70% of consumers purchase their spices from supermarkets due to accessibility and trust in established brands. This segment's importance lies in its capacity to cater to both mass-market and premium customer demands efficiently.

The online retail segment is growing rapidly and is expected to register a promising CAGR of 9.1% over the forecast period. The growth is fuelled by increasing e-commerce adoption, particularly among millennials and urban populations. Online platforms like Amazon, Instacart, and specialty spice e-retailers provide convenience, product variety, and easy access to exotic and organic spices that may not be available locally. The pandemic accelerated this trend, with online spice sales in India growing by 25% in 2021, reflecting a global shift toward digital purchasing. The importance of this segment lies in its ability to reach geographically dispersed consumers and offer personalized purchasing experiences through recommendations and reviews.

REGIONAL ANALYSIS

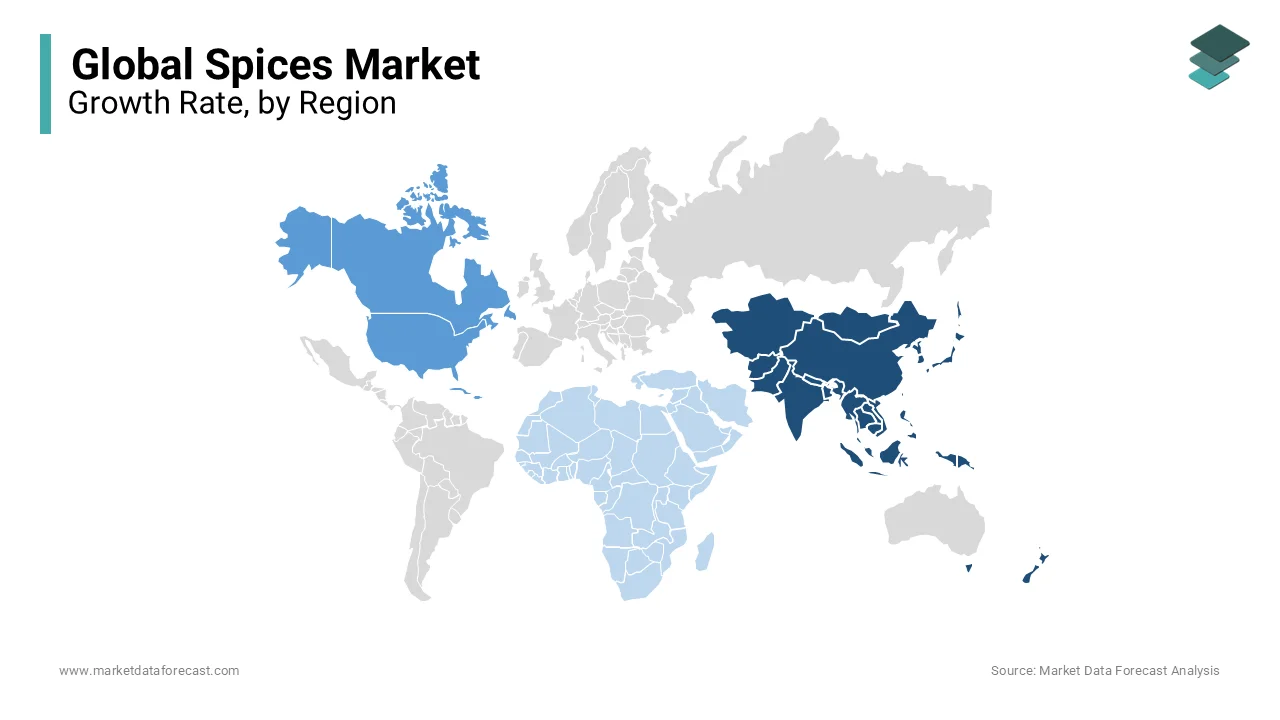

Asia-Pacific is the most dominating region in the global spices market and captured more than one-third of the global market share in 2023. The dominance of the Asia-Pacific region is majorly attributed to countries like India, Vietnam, and China, which are leading producers and exporters of spices. India, for example, supplies 75% of the world's turmeric and over 50% of its cumin. The region is expected to maintain a high growth trajectory because of rising domestic consumption and strong export demand. Also, the increasing adoption of processed food and rising global interest in Asian cuisines further boost the market. This region is forecast to grow at a steady CAGR, driven by innovation in spice-based products.

North America is a notable regional market for spices worldwide. North America is led by the United States and holds a prominent position in the spices market due to high imports and increasing demand for ethnic and organic spices. The U.S. is a major importer of black pepper and paprika, which reflects the growing popularity of international cuisines. The demand for spices like turmeric and ginger for their medicinal properties is increasing due to consumers prioritizing health and wellness. The region’s spices market is projected to grow at a CAGR of 5-6%, fuelled by consumer interest in clean-label products and convenience.

Europe is a significant market for spices, with countries like Germany, the Netherlands, and the UK leading imports. European consumers value organic and sustainably sourced spices, creating opportunities for certifications like Fair Trade. The rising interest in diverse global cuisines and the shift toward plant-based diets are driving demand for flavourful, natural ingredients. Steady growth is expected as companies innovate in spice blends and extracts to cater to health-conscious consumers.

Latin America is an emerging player, with countries like Brazil and Mexico leading the region’s spice production and consumption. Spices such as chili, coriander, and oregano are widely cultivated and integrated into traditional cuisines. Brazil has recently expanded its export of processed spice products. The region’s spices market is forecast to grow steadily due to the increasing focus on spice cultivation for international trade and the growth of the local food industry.

The Middle East and Africa hold a smaller share of the global spices market but present untapped potential. Ethiopia and Nigeria are expanding their spice production capacities, particularly for chili and ginger. The region's spice market growth is supported by increasing investments in agriculture and infrastructure. Moreover, the traditional use of spices in Middle Eastern cuisine ensures a consistent domestic demand. Future growth is anticipated as these countries strengthen their export capabilities.

COMPETITIVE LANDSCAPE

The spices market is highly competitive and is characterized by the presence of numerous global, regional, and local players. Major multinational companies like McCormick & Company, Olam International, and Everest Spices dominate the global market with strong supply chains, extensive product portfolios, and innovative offerings. These companies focus on quality control, branding, and value-added products such as pre-mixed spice blends, extracts, and organic spices to differentiate themselves.

Regional players, particularly in spice-producing nations like India, Vietnam, and Indonesia, cater to local markets while also exporting significant volumes globally. India, for instance, dominates the production of spices like turmeric, cumin, and black pepper, while Vietnam leads in pepper exports. Local companies often compete on pricing and availability but face challenges in maintaining consistent quality and adhering to international standards.

The competition is also intensifying due to rising demand for organic and sustainably sourced spices, pushing companies to invest in certification programs and sustainable farming practices. Start-ups and niche players are entering the market with innovative, health-focused products such as curcumin supplements and spice-based beverages, challenging traditional players.

E-commerce has further heightened competition, enabling small brands to reach global customers. As consumer preferences evolve, companies must continually innovate and adapt to maintain competitive advantage.

KEY MARKET PLAYERS

McCormick & Company, Olam International, Ajinomoto Co., Inc., Everest Spices, Sensient Technologies Corporation, Givaudan, Kerry Group plc, DS Group (Catch Spices), Bart Ingredients Company Ltd, SHS Group (Schwartz Spices) are some of the notable companies dominating the global spices market.

RECENT HAPPENINGS IN THE MARKET

- In August 2024, the Spices Board under the Indian Government initiated an extensive scheme for improving the export of spices and value-added spice items along with enhancing the cardamom’s productivity. The board released several programs as part of the scheme, including Sustainability in the Spice Sector through Progressive, Innovative, and Collaborative Interventions for Export Development (SPICED). This will be put into effect over the remaining time of the 15th Finance Commission cycle, up to FY 2025-26, with an overall sanctioned outlay of 422.30 crore rupees.

- In May 2024, the ICAR-National Research Centre for Grapes (NRCG) and Agilent Technologies reported the signing of a strategic partnership to co-develop modern analytical workflows and resolve vital gaps or loopholes in emerging food safety protocols.

MARKET SEGMENTATION

This research report on the global spices market is segmented and sub-segmented into the following categories.

By Product Type

- Whole Spices

- Ground Spices

- Spice Blends

- Herbs

By Application

- Food and Beverage

- Meat and Poultry

- Sauces and Condiments

- Snacks

- Bakery Products

- Ready-to-Eat Meals

- Pharmaceuticals

- Cosmetics and Personal Care

- Others (e.g., animal feed)

By Distribution Channel

- Online Retail

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East And Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]