Global Silos Market Size, Share, Trends & Growth Forecast Report Segmented By Product Type, Type, Material, Capacity, Installation, Application, Distribution Channel and Region (North America, Europe, Asia Pacific, Latin America, Middle East And Africa), Industry Analysis From 2024 to 2032

Global Silos Market Size

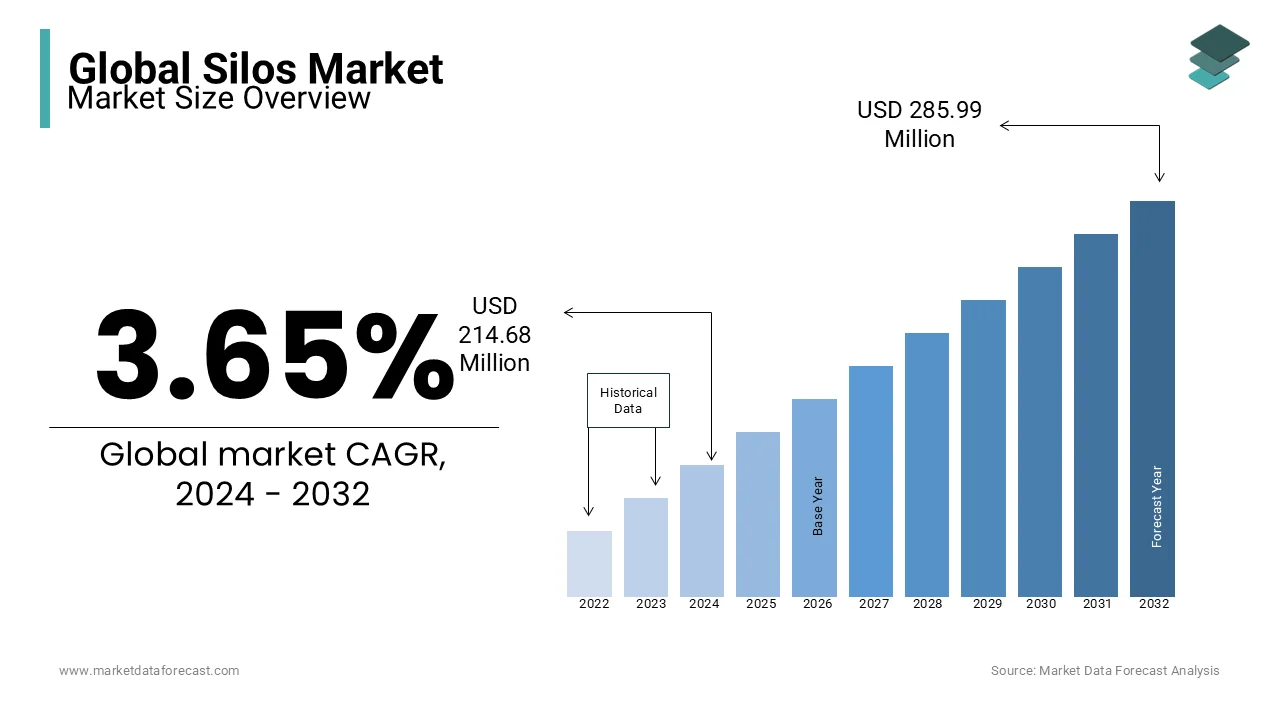

The global silos market size was valued at USD 207.68 million in 2023 and is anticipated to reach USD 214.68 million in 2024 from USD 285.99 million by 2032, growing at a CAGR of 3.65% from 2024 to 2032.

Silos play a critical role in agriculture where they help reduce post-harvest losses that account for approximately 14% of global food production annually, as per the Food and Agriculture Organization (FAO). They are used for storing grains, seeds, and feed to ensure preservation against pests and weather damage. In the construction sector, these are indispensable for storing cement and aggregates. For instance, according to the United States Geological Survey (USGS), global cement production reached 4.4 billion metric tons in 2022, highlighting the demand for silos in infrastructure development. Additionally, modern silos equipped with automated monitoring systems align with Industry 4.0 trends, enhancing efficiency by tracking temperature and humidity to prevent material degradation. Steel silos are preferred due to their durability and cost-effectiveness, while concrete silos cater to large-scale industrial needs. As per the United Nations, demand for advanced storage solutions continues to grow because of urbanization impacting over 56% of the global population. The silos market addresses critical challenges in resource preservation and operational efficiency that contribute to sustainability and industrial progress

Market Drivers

Rising Focus on Food Security and Reducing Post-Harvest Losses

Food security remains a global priority, with the United Nations estimating that the world must increase food production by 60% by 2050 to meet population growth. FAO stated that post-harvest losses, which account for approximately 14% of food globally, drive the demand for grain silos as they ensure safe storage and reduce spoilage. For example, in sub-Saharan Africa, improved grain storage systems could save up to 4 million tons of food annually. Silos equipped with advanced climate control and pest management systems are crucial in preserving agricultural produce and addressing global food supply challenges effectively.

Infrastructure Development and Urbanization

Rapid urbanization, with over 56% of the global population living in urban areas, fuels construction and infrastructure projects, according to the UN. Also, the report by the USGS said that Cement production is a critical component of urban growth, reaching 4.4 billion metric tons in 2022, elevating demand for cement silos. Additionally, smart city projects and renewable energy installations require efficient storage solutions for materials like aggregates and biomass. The use of industrial silos enhances operational efficiency by enabling bulk storage and streamlined logistics, which makes them indispensable in large-scale construction and industrial applications worldwide.

Market Restraints

High Initial Investment Costs

The high initial costs associated with silo construction and installation act as a significant restraint in the market. Steel and concrete silos require substantial capital investment, which can be prohibitive for small and medium-scale enterprises. For example, the cost of constructing a steel grain silo ranges from $25 to $30 per ton of storage capacity, depending on the size and technology used. Additionally, advanced features like automated climate control and real-time monitoring systems further increase expenses. These costs pose challenges for adoption in regions with limited financial resources in low-income countries, where agriculture and infrastructure development are critical.

Maintenance and Operational Challenges

Silos require regular maintenance to ensure structural integrity and prevent contamination or material degradation. For instance, in agriculture, stored grains can suffer from mold and pest infestations if silos are not properly cleaned and monitored, contributing to global post-harvest losses of 14% annually, as per the FAO. In industrial applications, improper handling can lead to material blockages or reduced efficiency which then requires downtime for repairs. The cost of maintenance and repairs can account for 5-10% of annual operational budgets and adds to the long-term expense, deterring adoption and use in cost-sensitive industries.

Market Opportunities

Adoption of Smart Silo Technologies

The integration of IoT and advanced monitoring systems in silos offers significant growth opportunities. Smart silos equipped with real-time sensors monitor parameters like temperature, humidity, and inventory levels, enhancing operational efficiency. For instance, the Food and Agriculture Organization stated that IoT adoption in agriculture is expected to grow by 10.1% annually, fuelled by the need for precision farming. These technologies help reduce post-harvest losses by providing timely alerts for corrective actions, particularly in regions with limited resources. The energy sector also benefits, as automated systems in cement and biomass silos optimize material handling, aligning with Industry 4.0 trends for sustainable and efficient operations.

Expansion of Renewable Energy Storage

The increasing focus on renewable energy projects presents opportunities for silos in biomass and energy storage. Biomass energy production, a key contributor to clean energy, reached 6% of the global energy supply in 2022, as per the International Energy Agency. Silos play a critical role in storing raw materials like wood pellets and agricultural residues used in biomass energy plants. Demand for silos tailored for energy applications is expected to rise with countries investing heavily in renewable energy to meet net-zero goals. This expansion aligns with global efforts to sustainable energy systems while improving storage and logistics efficiency.

Market Challenges

Space Constraints in Urban and Semi-Urban Areas

As urbanization expands, finding adequate land for silo construction has become increasingly challenging. As per the United Nations, with over 56% of the global population living in urban areas, high land prices and limited availability in cities restrict silo installations, especially for industrial applications like cement and aggregate storage. In dense urban areas, vertical expansion is often prioritized, further complicating silo construction. This challenge is significant for sectors like agriculture, where proximity to transport hubs is essential for efficient operations. Limited space forces businesses to rely on temporary or less efficient storage solutions to impact overall productivity and supply chain efficiency.

Environmental and Regulatory Challenges

Strict environmental regulations regarding waste management and emissions during silo operations create challenges for manufacturers and operators. For instance, dust emissions from cement silos must comply with air quality standards, as cement production accounts for nearly 7% of global CO₂ emissions, according to the International Energy Agency. Meeting these requirements involves investing in advanced filtration systems, which increases operational costs. Additionally, improper disposal of spoilage from agricultural silos can lead to soil and water contamination to attract penalties. Navigating these regulations while maintaining profitability requires continuous upgrades and adherence to stringent compliance standards, posing a significant hurdle for the silos market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

3.65% |

|

Segments Covered |

By Product Type, Type, Material, Capacity, Installation, Application & Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC. PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

CST Industries, AGI (Ag Growth International), Silos Córdoba, Behlen Manufacturing Co., Mysilo, PRADO Silos, SCAFCO Grain Systems Co., Bentall Rowlands, Symaga, Superior Grain Equipment. |

SEGMENT ANALYSIS

By Product Type Insights

The flat-bottom silos segment represented the largest share of the global market and held 40.9% of global market share in 2023. These silos are preferred for long-term storage of bulk materials like grains, seeds, and animal feed due to their high storage capacity and cost efficiency. Flat-bottom silos are widely used in agriculture, which employs over 27% of the global workforce, according to the World Bank. Their durable construction and ability to maintain grain quality make them indispensable for food security initiatives. For example, India and China, key grain producers, increasingly invest in flat-bottom silos to reduce post-harvest losses, which average 10-15% of total output in these regions.

The hopper-bottom silos segment is projected to grow at the fastest CAGR of 7.2% during the forecast period. Their conical base facilitates easy unloading to make them ideal for short-term storage and frequent material turnover. This feature is crucial for industrial applications, such as cement and biomass storage, where efficient discharge is essential. In 2022, global cement production exceeded 4.4 billion metric tons to drive the demand for hopper-bottom silos. Additionally, their suitability for smaller-scale farms and storage facilities aligns with the rising adoption of precision agriculture. The growth is further fueled by increasing renewable energy projects where hopper silos are used for storing biomass materials.

By Type Insights

The dry silo segment is the most significant in the global silos market and captured 65.1% of the global market share in 2023. These silos are designed to store dry materials such as grains, cement, and biomass by making them essential across agriculture, construction, and renewable energy sectors. For example, global grain production exceeded 2.7 billion metric tons in 2022, according to FAO, necessitating extensive use of dry silos to minimize post-harvest losses and maintain quality. Additionally, the construction industry, which relies on cement silos, produced over 4.4 billion metric tons of cement worldwide in 2022, according to USGS. Their ability to store bulk materials for long durations with minimal spoilage makes dry silos critical to multiple industries.

The wet silos segment is estimated to be a promising segment over the forecast period and will grow at a CAGR of 6.8%. These silos are primarily used for storing liquid or semi-liquid materials such as slurry, molasses, and wastewater, which are increasingly important in agriculture and industrial processes. For instance, livestock farming, which produces significant amounts of slurry, accounted for over 14.5% of global greenhouse gas emissions in 2022, with the need for wet silos to manage and utilize waste sustainably. Additionally, wet silos are integral to biogas production, a renewable energy source gaining traction as countries work towards net-zero emissions targets. This rising focus on sustainability and resource management fuels the demand for wet silos.

By Material Insights

The steel silos segment dominated the market in 2023 by occupying 50% of the global market share. The growth of the steel silos segment is majorly driven by their durability, cost-effectiveness, and versatility in many industries. Steel is highly resistant to environmental factors, making it ideal for long-term storage of grains, cement, and industrial materials. According to the World Steel Association, global crude steel production reached 1.88 billion metric tons in 2022, ensuring abundant availability of this material. Steel silos are extensively used in agriculture, where global grain production exceeds 2.7 billion metric tons (FAO). Their modular design, ease of installation, and adaptability to modern automation systems contribute to their widespread adoption in industries.

The reinforced polymer segment is anticipated to record the highest CAGR of 7.5% over the forecast period. Their lightweight, corrosion-resistant properties make them ideal for storing chemicals, fertilizers, and specialized materials. The International Fertilizer Association reported global fertilizer demand at 200 million metric tons in 2022, highlighting the growing need for corrosion-resistant storage solutions. Additionally, polymer silos are increasingly adopted in wastewater treatment facilities, where they resist chemical degradation and offer easy customization. As sustainability gains prominence, the recyclability of polymer materials further drives demand. These silos also align with emerging trends in lightweight infrastructure, supporting faster installation and lower maintenance costs, particularly in regions prioritizing eco-friendly storage solutions.

By Capacity Insights

The 100-500 tons capacity silos segment was the largest segment in the global market in 2023 and accounted for 40.1% of global market share. This capacity range balances storage efficiency and operational flexibility, making it highly suitable for small to medium-sized farms, construction projects, and industrial facilities. In agriculture, where global grain production surpassed 2.7 billion metric tons in 2022 this segment is ideal for reducing post-harvest losses and ensuring food security. Additionally, in the construction industry, silos in this capacity range are extensively used for storing cement and aggregates, supporting projects of varying scales. The affordability, ease of transportation, and versatility of 100-500 ton silos drive their widespread adoption.

The above 1000 tons capacity segment is expected to register the fastest growth during the forecast period. These silos are essential for large-scale applications in agriculture and industrial sectors, such as grain storage for export or cement storage for megaprojects. For instance, Brazil, a leading grain exporter, shipped over 125 million metric tons of soybeans and corn in 2022 (FAO), necessitating large-capacity silos to support its supply chain. Similarly, increasing investments in large-scale infrastructure and renewable energy projects worldwide drive demand for high-capacity silos to store bulk materials like biomass. Their efficiency in handling massive volumes enhances operational scalability, contributing to rapid growth.

By Installation Insights

The fixed silos segment accounted for the leading share of the global silos market in 2023. Fixed silos are permanent structures and are favored for their durability, high capacity, and suitability for long-term storage of materials such as grains, cement, and chemicals, in agriculture, where global grain production reached 2.7 billion metric tons in 2022 where fixed silos play a critical role in reducing post-harvest losses. Similarly, in the construction sector, fixed silos are extensively used to store cement, supporting the production of over 4.4 billion metric tons of cement globally, according to the United States Geological Survey. Their robust design and ability to integrate with automation systems make them indispensable for large-scale industrial and agricultural applications.

The portable silos segment is estimated to register a CAGR of 6.9% over the forecast period. Their mobility and flexibility make them ideal for temporary storage in industries like construction and renewable energy. For instance, portable silos are widely used at construction sites for easy on-site storage and mixing of materials like cement and aggregates. Additionally, the rise in small and medium-sized farms, particularly in Asia and Africa, drives demand for portable grain silos to ensure food security in rural areas. Portable silos are also gaining traction in the biogas industry, where they store biomass materials in remote renewable energy facilities. This adaptability and ease of installation fuel their rapid growth.

By Application Insights

The agriculture segment led the market and held 40.3% of the global market share in 2023. Silos are essential for storing grains, seeds, and animal feed, reducing post-harvest losses, and preserving material quality. Global grain production exceeded 2.7 billion metric tons in 2022 (FAO), with significant contributions from major producers like the U.S., China, and India. Grain silos address the challenge of storage in regions with limited infrastructure, helping ensure food security. Additionally, agricultural silos contribute to reducing global post-harvest losses, which account for approximately 14% of total production annually (FAO). Their widespread use in farming operations underlines their importance in this sector.

The energy segment is an emerging segment and is predicted to progress at a CAGR of 7.5% over the forecast period. Silos are increasingly used for storing biomass, wood pellets, and other renewable energy materials. According to the International Energy Agency highlighting the sector's growth, biomass energy production accounted for 6% of the global energy supply in 2022. Silos in the energy sector facilitate efficient material handling and storage, particularly in renewable energy projects. Additionally, biogas facilities, which rely on silos for storing feedstock, are expanding rapidly as countries prioritize sustainability and net-zero targets. The growing demand for renewable energy globally drives the adoption of advanced storage solutions, with the energy sector as a key growth driver in the silos market.

By Distribution Channel Insights

The direct sales segment dominated the market by accounting for 70.7% of global market share in 2023. Manufacturers primarily rely on direct channels to provide customized solutions for large-scale industrial and agricultural operations. For instance, large agribusinesses and cement producers often purchase silos directly from manufacturers to ensure tailored designs that meet specific capacity and operational requirements. In agriculture, where global grain production exceeds 2.7 billion metric tons annually (FAO), direct sales allow seamless communication between suppliers and buyers, enabling precise customization. Additionally, direct sales channels facilitate long-term partnerships, technical support, and after-sales services, which are critical for large-scale silo users.

However, the indirect sales segment is growing rapidly and is predicted to showcase a CAGR of 7.74% over the forecast period. Indirect sales through distributors, e-commerce platforms, and retailers are the quickest-expanding segment. The growth is driven by the rising demand for portable and small-capacity silos among small and medium-sized enterprises (SMEs). Indirect channels provide easier access to silo solutions for smaller businesses in regions with fragmented markets, such as Africa and Latin America. The global e-commerce sector, growing at over 15% annually (UNCTAD) and also plays a crucial role in expanding the reach of silo manufacturers to remote and underserved markets. This channel's convenience, cost-effectiveness, and ability to cater to a wider audience drive its rapid growth trajectory.

REGIONAL ANALYSIS

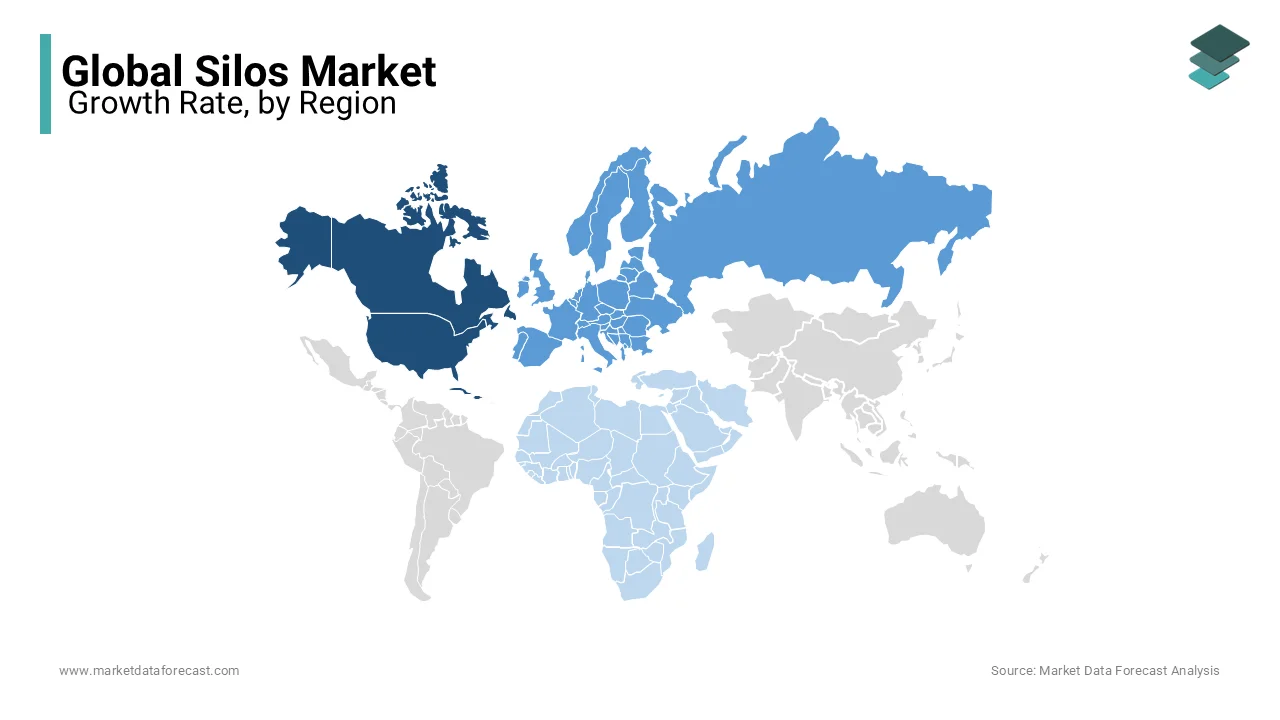

North America led the silos market worldwide in 2023 and is predicted to hold the leading position in the worldwide market throughout the forecast period. North America has a robust position in the silos market driven by advancements in agriculture and infrastructure. The United States is a leading country, with its agricultural sector contributing $1.3 trillion to GDP in 2021, according to the United States Department of Agriculture. The region focuses heavily on grain silos to reduce post-harvest losses, which account for approximately 12% of crop yields annually. Silos are also extensively used in the construction sector, where cement production exceeded 96 million metric tons in 2022, as per the USGS. The region is expected to see steady growth with increasing adoption of smart silos and infrastructure modernization.

Europe is a key player in the global silos market by emphasizing sustainability and advanced storage technologies. The region’s agriculture sector is supported by the Common Agricultural Policy (CAP), which allocates over €55 billion annually for sustainable farming, according to the European Commission. Germany, France, and Italy lead in silo adoption for grain and cement storage. Eurostat stated that Europe’s growing renewable energy sector, which provided 22% of its electricity in 2021, drives demand for biomass silos. The region is expected to grow steadily as regulatory compliance and investments in smart silos align with its sustainability goals.

Asia-Pacific dominates the global silos market due to rapid industrialization and agricultural development. India and China are key contributors, with India producing over 310 million metric tons of food grains annually. Modern silos are increasingly adopted to address the region’s 10-15% post-harvest loss rates, ensuring food security. Additionally, USGS’s report revealed that China’s cement production, which accounts for 55% of the global total in 2022, highlights the region’s demand for cement silos. Asia-Pacific’s market is predicted to grow the fastest, driven by urbanization and government investments in infrastructure.

Latin America shows significant potential in the silos market supported by its strong agricultural base. Brazil is the largest exporter of soybeans, contributing 40% of global soybean exports in 2022. Grain silos are critical for supporting the region’s export-driven economy, reducing losses during transportation. Infrastructure development in Mexico and Argentina further supports the demand for cement and aggregate silos.

The Middle East and Africa region have a smaller but growing presence in the silos market, driven by food security initiatives and infrastructure development. Countries like Nigeria and Ethiopia are investing in grain silos to combat post-harvest losses, which exceed 30% in some areas, said to FAO. The Gulf Cooperation Council (GCC) nations rely heavily on silos for cement storage, as the region’s construction industry accounts for 6% of its GDP. As governments focus on modernizing agricultural practices and urban development, the region’s silo market is expected to expand steadily.

Competitive Landscape

The silos market is highly competitive, driven by diverse applications across agriculture, construction, and industrial sectors. Global players like CST Industries, AGI (Ag Growth International), Silos Córdoba, and Behlen Manufacturing dominate due to their advanced product offerings and extensive distribution networks. These companies focus on innovation, such as smart silos with IoT-enabled monitoring systems, to meet evolving industry demands. Regional competitors, particularly in emerging markets like Asia-Pacific and Latin America, compete by offering cost-effective solutions tailored to local needs. For instance, in India and Brazil, manufacturers emphasize grain silos designed to reduce post-harvest losses, which are critical for food security in these regions.

The market is also seeing the entry of niche players focusing on specific applications, such as biomass silos for renewable energy or lightweight silos for portable storage. E-commerce platforms have further intensified competition by enabling smaller manufacturers to access global markets. Price competitiveness and compliance with environmental regulations remain key challenges for players, particularly in regions like Europe, where sustainability standards are stringent. To gain a competitive edge, companies are prioritizing strategic partnerships, product customization, and investment in sustainable and advanced storage technologies to cater to the diverse and growing global demand for silo systems.

KEY MARKET PLAYERS

CST Industries, AGI (Ag Growth International), Silos Córdoba, Behlen Manufacturing Co., Mysilo, PRADO Silos, SCAFCO Grain Systems Co., Bentall Rowlands, Symaga, Superior Grain Equipment. These are the market players that are dominating the global silos market.

RECENT HAPPENINGS IN THE MARKET

- In January 2025, the Food Corporation of India (FCI) called for proposals to build 2.5 MT of advanced wheat storage facilities through a public-private partnership (PPP) framework. It is also reported that contracts for constructing such cutting-edge grain storage places would be allocated, and at the same time, 35 silos having a collective capacity of more than 2.8 MT have been functioning.

- In December 2024, Sovda unveiled its latest Precision Silo blending and loading machine, which has a green coffee capacity of 4,800 kilograms.

- In February 2024, Silos Spain introduced a new scalable platform to be deployed between silos created by the company enabling the availability of components placed at the same level as two adjacent silos.

MARKET SEGMENTATION

This research report on the global silos market is segmented and sub-segmented into the following categories.

By Product Type

- Bag Silos

- Blending Silos

- Bunker Silos

- Flat-Bottom Silos

- Hopper-Bottom Silos

- Tower Silos

- Others (Synthetic Silos, etc.)

By Type

- Dry Silos

- Wet Silos

By Material

- Concrete

- Reinforced Polymer

- Steel

- Wood

- Others (Carbon Fiber, etc.)

By Capacity

- Below 100 tons

- 100-500 tons

- 500-1000 tons

- Above 1000 tons

By Installation

- Portable Silos

- Fixed

- Bottom/Underground Silos

- Elevated/Above the Ground Silos

- Custom-Built Silos

By Application

- Cement Industry

- Chemical Industry

- Food Processing

- Energy Sector

- Pharmaceutical Industry

- Plastic and Polymer Industry

- Agriculture

- Mining and Metals

- Others (Paper, paint, coatings industry, etc.)

By Distribution Channel

- Direct Sales

- Indirect Sales

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East And Africa

Frequently Asked Questions

What is the current market size of the global silos market?

The global silos market size is anticipated to reach USD 285.99 million by 2032 at a CAGR of 3.65%

what are the driving factors of the silos market?

The driving factor of the silos market is the United Nations estimating that the world must increase food production by 60% by 2050 to meet population growth. FAO stated that post-harvest losses, which account for approximately 14% of food globally, drive the demand for grain silos

Which is the most dominating region in the global silos market?

North America led the silos market worldwide in 2023 and is predicted to hold the leading position in the worldwide market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]