Global Silage Inoculant Market Size, Share, Trends, & Growth Forecast Report – Segmented By Type (Lactobacillus Plantarum, Pediococcus Pentosaceus, Enterococcus Faecium, Lactobacillus Buchneri, Lactobacillus Brevis, Propionibacteria Freundenreichii and Others), Application (Cereal Crops, Pulse Crops and Others) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) - Industry Analysis (2025 to 2033)

Global Silage Inoculant Market Size

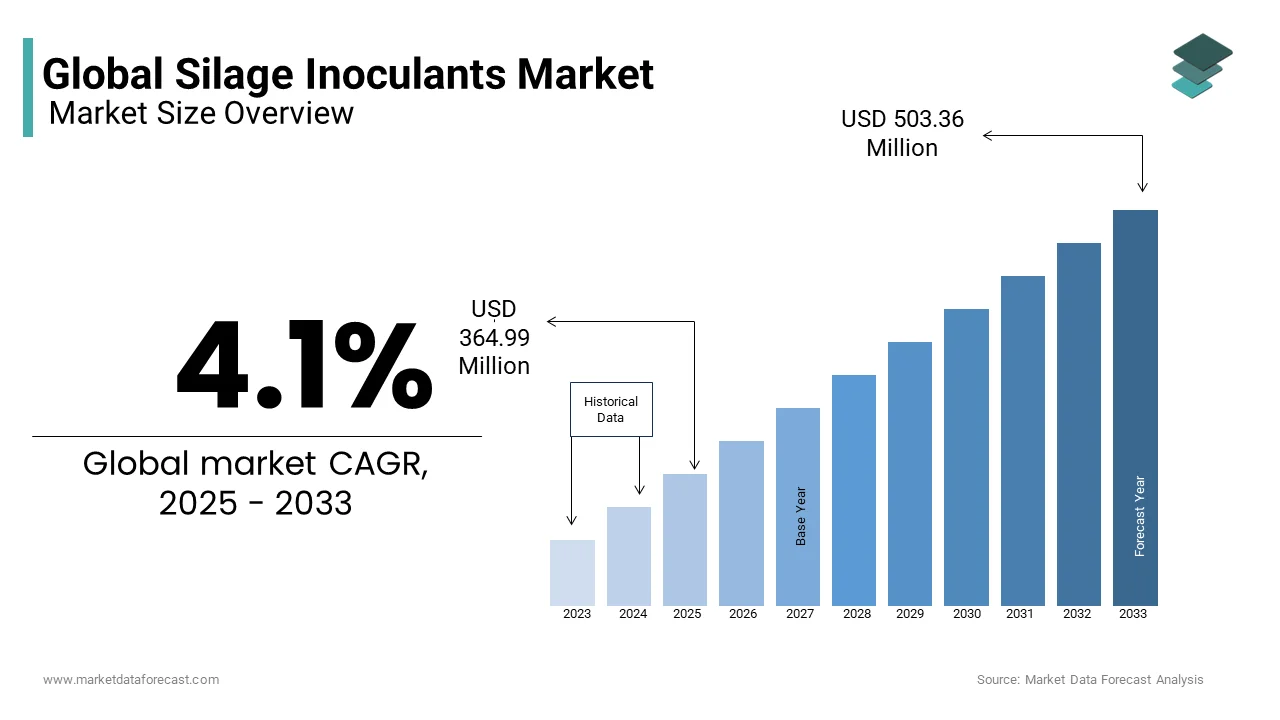

The global silage inoculant market was valued at USD 350.61 million in 2024 and is anticipated to reach USD 364.99 million in 2025 from USD 503.36 million by 2033, growing at a CAGR of 4.1% during the forecast period from 2025 to 2033.

The global silage inoculant market is experiencing steady growth. The growth of the market is driven by the increasing demand for high-quality animal feed and rising awareness of the benefits of silage inoculants in improving feed preservation and nutritional value. Silage inoculants, typically composed of lactic acid bacteria, are added to silage to enhance fermentation and improve feed digestibility for livestock, leading to better health and productivity in animals.

North America and Europe lead the market due to advanced livestock management practices and high dairy and meat consumption, with large agricultural economies like the United States and Germany at the forefront. However, the Asia-Pacific region is expected to see the fastest growth, driven by rising demand for dairy and meat products in countries like China and India, where livestock production is expanding. Sustainable farming practices and regulatory encouragement for natural additives further propel market growth. Additionally, innovations in inoculant formulations such as multi-strain inoculants targeting specific feed crops are enhancing the effectiveness of these products, making them increasingly essential for modern, high-yield agricultural operations.

MARKET DRIVERS

Demand for Dairy and Meat Products

With the rising global demand for dairy and meat products, livestock producers are focused on improving feed quality to boost animal health and productivity. High-quality silage ensures better digestion and nutrient absorption, directly impacting milk yield, weight gain, and overall livestock productivity. Silage inoculants improve the fermentation process by promoting the growth of beneficial bacteria, which stabilize the silage and retain its nutrient content. According to recent industry data, well-preserved silage with inoculants can increase feed efficiency by up to 15%. This demand for nutrient-rich, efficiently preserved feed is particularly high in regions with extensive dairy and beef industries, such as North America and Europe, making silage inoculants essential for optimal feed management.

As farmers become more knowledgeable about the advantages of silage inoculants, adoption rates are increasing globally. Inoculants help reduce spoilage and nutrient loss in silage, which is critical in minimizing feed costs and wastage. Studies show that inoculated silage can retain up to 80% of its original dry matter, compared to 60-70% in untreated silage. This has spurred adoption in cost-sensitive markets, as inoculants help maximize the feed value of stored crops, reducing the need for additional feed supplements. Growing awareness programs, often led by agricultural extension services and agribusinesses, highlight the role of inoculants in enhancing silage quality and support their use across both small-scale and industrial farming operations.

Rapid Expansion in Livestock Farming to Meet the Growing Demand for Animal-Based Proteins

Emerging markets, particularly in Asia-Pacific and Latin America, are experiencing rapid expansion in livestock farming to meet the growing demand for animal-based proteins. Countries like China, India, and Brazil are increasing their livestock populations, intensifying the need for high-quality, cost-effective feed solutions. Silage inoculants help these producers optimize their feed resources, particularly in areas where climate conditions can make feed preservation challenging. For example, China’s dairy industry is expected to grow significantly, with increased government support for efficient feed practices that include silage inoculants. As livestock farming grows in these regions, the adoption of silage inoculants is projected to rise sharply, making emerging markets a major growth area for the global silage inoculant market.

MARKET RESTRAINTS

High costs associated with silage inoculants are a significant restraint to the global market growth.

Silage inoculants can be relatively expensive, making them less accessible for small-scale farmers, particularly in developing regions. The cost of inoculants often depends on the formulation and strains used, with advanced multi-strain products being costlier. This expense, added to other input costs, can discourage adoption, especially in price-sensitive markets like Asia and Africa where smallholder farming is predominant. For instance, a 2022 report indicated that farmers in these regions prioritize basic feed over additives, limiting inoculant use to larger farms. Additionally, without subsidies or financial incentives, many farmers struggle to justify their investment in inoculants despite the potential long-term benefits, which restricts market growth.

Despite the benefits of silage inoculants, a lack of awareness and technical understanding among farmers, particularly in emerging economies, limits adoption. Many farmers are unaware of the role inoculants play in improving silage quality, preserving nutrients, and reducing spoilage. In regions like Latin America and parts of Asia, traditional silage methods are common, with less focus on additive use. Without adequate training or information on silage management, farmers often miss out on the advantages of inoculants, reducing overall market penetration. Educational programs are crucial but can be costly and challenging to implement widely, especially in rural areas where access to agricultural support is limited.

The effectiveness of silage inoculants can vary significantly depending on climate and storage conditions, which poses a challenge in certain regions. In hot, humid climates, for example, silage can spoil quickly if not stored properly, limiting the efficacy of inoculants. Regions like Southeast Asia and parts of Africa face challenges with rapid silage degradation due to their warm climates, which can counteract the benefits of inoculants. Furthermore, poor storage infrastructure in these regions can exacerbate spoilage, reducing the inoculants’ impact on feed quality. As a result, farmers in these areas may be discouraged from investing in inoculants if environmental conditions prevent reliable results, impacting market expansion in such climates.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

4.10% |

|

Segments Covered |

Based on Type, Application Type, And Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Cargill, ADM, Dupont, Volac, Nutreco, Lallemand, ForFarmers and CHr.Hansen. |

SEGMENTAL ANALYSIS

By Type Insights

The lactobacillus plantarum segment accounted for 36.6% of the global market share in 2023. This dominance is due to its high efficacy in producing lactic acid, which lowers the pH of silage rapidly and stabilizes it, reducing spoilage and enhancing nutrient retention. Lactobacillus plantarum is especially favored in the dairy and cattle sectors, where preserving feed quality is essential for milk production and animal health. Studies have shown that inoculants containing Lactobacillus plantarum can improve dry matter retention by up to 10% compared to untreated silage. Widely applicable across various crops, this inoculant type is popular in North America and Europe, where high-yield livestock production is prevalent. This broad effectiveness and widespread adoption in key livestock markets contribute to its position as the leading segment.

The lactobacillus buchneri segment is the fastest-growing segment and is estimated to grow at a CAGR of 8.5% over the forecast period. Known for its ability to produce acetic acid, Lactobacillus buchneri extends silage stability during aerobic exposure, which reduces spoilage when silage is opened and exposed to air. This feature is particularly valuable for large farms where silage might be stored and used over longer periods. As climate conditions and storage challenges increase, demand for Lactobacillus buchneri has risen, especially in regions with humid climates where silage spoilage is common. This inoculant type is gaining popularity in North America and Europe, where livestock farms are adopting longer-lasting, spoilage-resistant silage solutions to improve feed efficiency. The rising focus on reducing waste and enhancing silage quality in high-demand livestock industries positions Lactobacillus buchneri as a key growth area in the silage inoculant market.

By Application Insights

The cereal crops segment led the market and captured 61.8% of the global market share in 2023. This dominance is due to the widespread use of corn, sorghum, barley, and other cereals in livestock feed, particularly in dairy and beef farming. Corn silage, for instance, is one of the most popular types of forage because it provides high energy content essential for livestock productivity. Inoculants improve the fermentation quality of cereal crops, enhancing digestibility and nutrient preservation, which translates to better milk yield and weight gain in animals. The high demand for cereal-based silage, especially in North America and Europe, where intensive livestock production is common, is a major factor supporting this segment’s dominance in the market. Cereal crops are favored for their high biomass yield and energy content, making them ideal for silage production.

On the other hand, the pulse crops segment is the fastest-growing segment in the silage inoculant market and is predicted to grow at a CAGR of 6.6% over the forecast period. Pulse crops, including legumes like alfalfa and clover, are gaining popularity in silage production due to their high protein content and nitrogen-fixing properties, which enhance soil fertility. As livestock producers seek to provide more balanced, nutrient-dense feed, the use of protein-rich pulse silage has increased, particularly in dairy farming where protein intake directly influences milk yield and quality. The expansion of pulse crops in silage production is notable in regions like North America and Europe, where alfalfa is widely grown and incorporated into dairy diets. Additionally, the demand for sustainable and high-protein feed sources supports growth in this segment, as pulses reduce the need for supplemental protein in animal diets, aligning with sustainable and cost-effective farming practices.

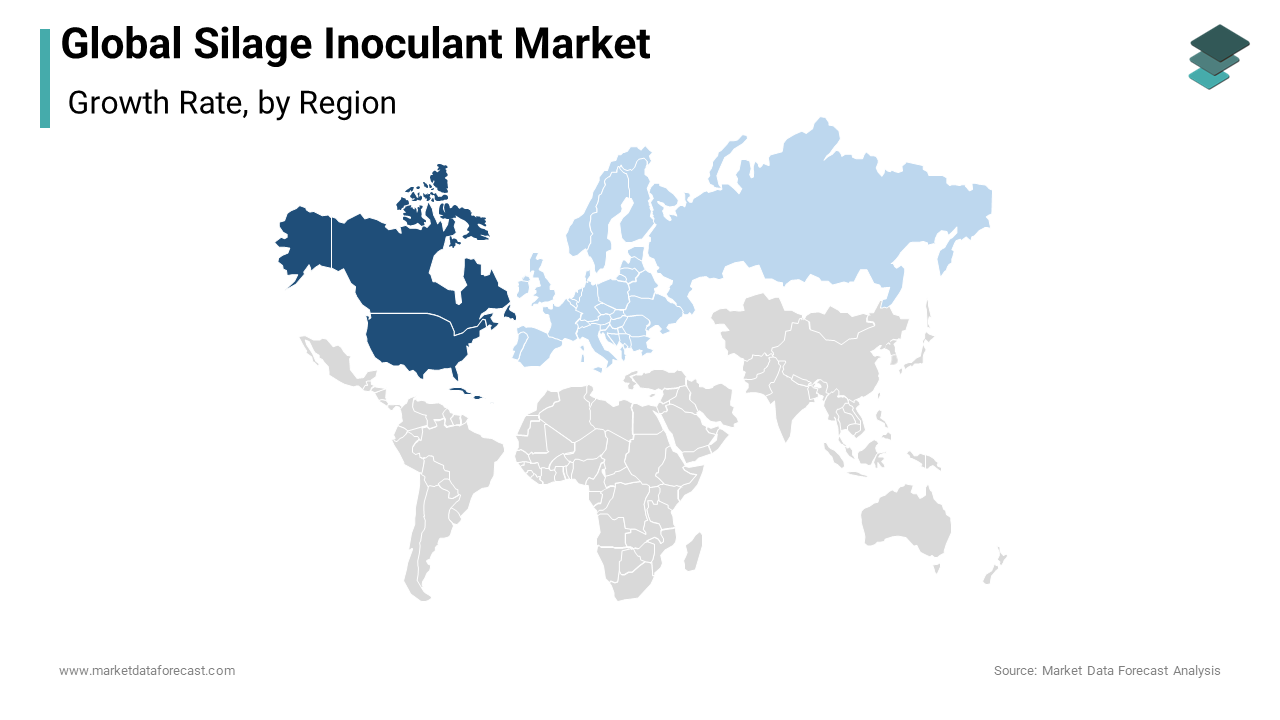

REGIONAL ANALYSIS

North America is one of the largest regions in the global silage inoculant market and accounted for 38.3% of the global market share in 2023. The region’s strong presence is driven by a well-established livestock industry and high demand for quality forage in dairy and beef production. The United States, in particular, leads the market due to its extensive dairy and beef operations, which prioritize feed efficiency and quality. The North American market is expected to grow at a CAGR of around 4-5% from 2023 to 2028, supported by advanced agricultural practices and increased awareness of silage inoculant benefits. Furthermore, the rising adoption of sustainable farming practices and an emphasis on reducing feed wastage drive the demand for high-quality silage inoculants in the region.

Europe is another major regional segment in the global silage inoculant market. The growth of the European market is fueled by a strong dairy industry and an increasing focus on sustainable agriculture. Leading markets include Germany, France, and the United Kingdom, where dairy farming is prominent. European farmers have also shown a strong interest in eco-friendly additives, driving demand for bio-based silage inoculants that support sustainable and high-efficiency feed practices.

Asia-Pacific is a rapidly growing region in the global silage inoculant market and is projected to grow at the highest CAGR of 7.88% over the forecast period. The expansion is driven by increased livestock production in countries like China, India, and Japan, where demand for dairy and meat products is rising due to population growth and changing dietary preferences. Government initiatives supporting livestock production, alongside the adoption of modern agricultural practices, are boosting the use of silage inoculants in the region. Additionally, Asia-Pacific’s climate poses challenges in feed preservation, making inoculants an attractive solution to minimize spoilage and improve feed quality.

Latin America had a smaller share of the global market in 2023 and is witnessing steady growth owing to the expanding livestock farming, particularly in Brazil and Argentina. As the region’s dairy and meat production increases to meet both local and export demand, the need for efficient feed solutions like silage inoculants rises. Latin America’s warm climate also poses challenges for feed preservation, which is encouraging farmers to adopt inoculants to reduce spoilage and maintain feed quality, particularly in countries where dairy farming is a major industry.

The market in the Middle East and Africa is expected to see gradual growth over the forecast period and is predicted to register a CAGR of 4.12%. Livestock production in the MEA region, particularly in countries like South Africa, Saudi Arabia, and Egypt, is expanding as demand for animal products rises. However, economic limitations and a lack of awareness about silage inoculants somewhat restrain the market. Despite these challenges, the MEA market is gradually adopting silage inoculants as livestock farmers seek cost-effective ways to enhance feed quality and stability in regions with challenging climates.

KEY MARKET PLAYERS

Some of the major key players involved in the global inoculant market are Cargill, ADM, Dupont, Volac, Nutreco, Lallemand, ForFarmers, CHr.Hansen and Others. Existing companies such as ADM and Nutreco have been actively involved in the acquisition of regional players to strengthen their market presence. Key strategies such as investments in R&D are being employed by major companies to meet the growing demand for silage inoculants.

MARKET SEGMENTATION

This research report on the global silage inoculant market is segmented and sub-segmented based on type, application and region.

By Type

- Lactobacillus Plantarum

- Pediococcus Pentosaceus

- Enterococcus faecium

- Lactobacillus Buchneri

- Lactobacillus Brevis

- Propion Nibacteria Freundenreichii

- Others

By Application

- Cereal Crops

- Pulse Crops

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current size of the Global Silage Inoculant Market?

As of the latest available data, the global silage inoculant market size is estimated at USD 364.99 million in 2025.

Which region dominates the Global Silage Inoculant Market?

North America currently holds the largest market share in the global silage inoculant market, accounting for approximately 26% of the total market.

What are the key trends driving the growth of the silage inoculant market in Europe?

In Europe, the growing trend towards sustainable farming practices and increasing awareness of the benefits of silage inoculants for animal nutrition are major factors driving market growth.

How has the Asia-Pacific silage inoculant market evolved in recent years?

The Asia-Pacific silage inoculant market has witnessed robust growth due to the expanding livestock industry, the adoption of modern farming techniques, and the increasing demand for high-quality animal feed.

Which type of silage inoculant is most commonly used in European countries?

Lactic acid bacteria-based silage inoculants are widely used in European countries due to their effectiveness in promoting fermentation and preserving forage quality.

In application segment which crop is mostly applied in global silage inoculant market?

In the application segment, Cereal is the most widely applied crop with silage inoculants.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]