Global Seed Market Size, Share, Trends & Growth Forecast Report – Segmented By Crop (Field Crops and Fruit & Vegetable Crops), Availability (Commercial Seeds and Saved Seeds), Seed Treatment (Treated and Untreated), Seed Trait (Insecticide Resistant, Herbicide Tolerant, Other Stacked Traits) and Region (North America , Europe, Asia Pacific, Latin America, Middle East And Africa) – Industry Analysis From 2024 to 2029

Global Seed Market Size (2024 to 2032)

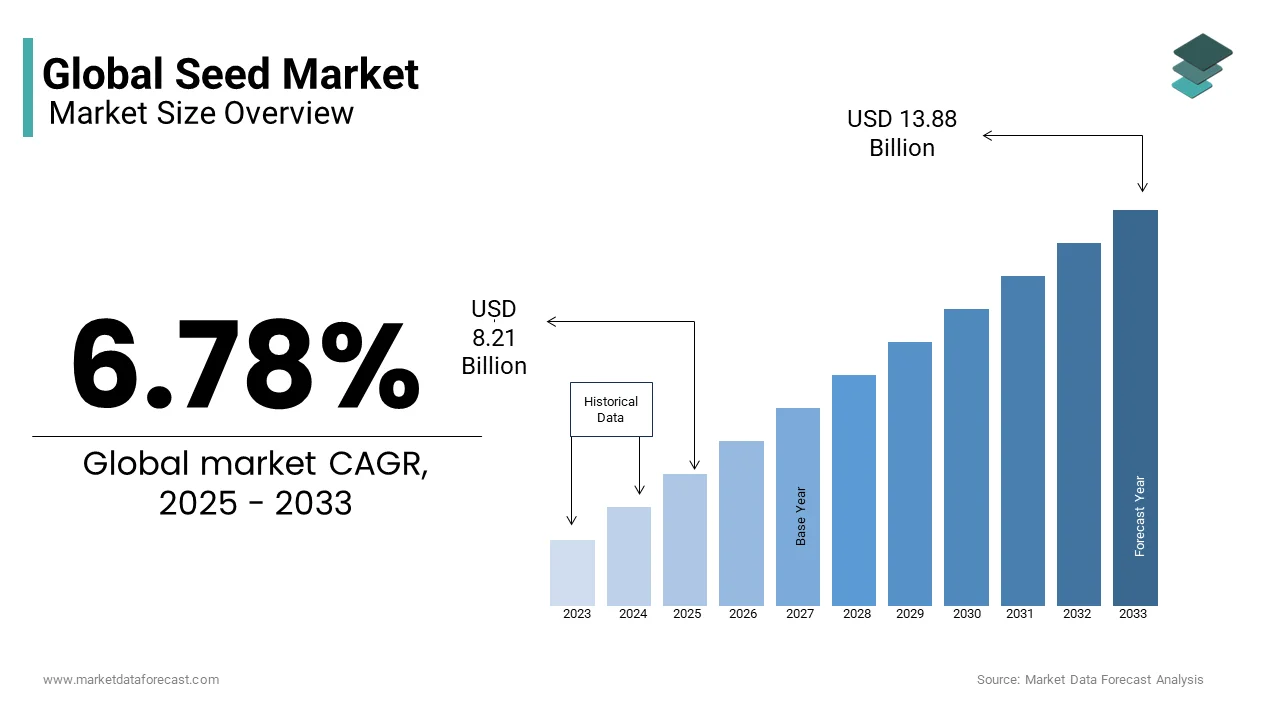

The global seed market size was valued at USD 7.2 billion in 2023 and it is expected to reach USD 7.69 billion in 2024, growing at a CAGR of 6.78% from 2024 to 2032 and anticipated to reach USD 12.99 billion by 2032.

Current Scenario Of The Global Seed Market

Seeds are the most important pillar of society and the agricultural sector. Governments and companies around the world annually allocate over 60 billion dollars for grains and seedlings. The seed market is expected to grow tremendously because of the steady increase in the production and consumption of wheat, rice, and corn. As per the United States Department of Agriculture’s (USDA) report released in May 2024, the global wheat production rate is set to have record levels in China, India, Canada, Kazakhstan, the US, and Pakistan. Similarly, rice production will reach an all-time high in the Asia Pacific, particularly in India, Pakistan, and Bangladesh, along with better crops in China. There, the global seed market share will increase in the short term, and in the long run, the industry will witness a significant expansion.

MARKET DRIVERS

The incremental increasing trend in wheat, rice, and corn production and consumption is driving the seed market size forward. One of the reasons is the surge in production among the main wheat exporters, including the European Union, Russia, the United States, and Canada. According to a May 2024 Study by USDA, the global Wheat production for 2024-25 is estimated to rise by 10.5 million tons to 798.2 million tons. India and China are the biggest players, each with more than 3.4 million tons. Consistent government support programs in both countries have elevated the demand for seeds. The high prices in Pakistan have led to greater cultivation areas, which have also pushed the seed market forward.

In addition, technological breakthroughs are significantly contributing to the expansion of the seed market. The emergence of genetic modification (GM) and genome editing techniques has helped in the innovation of seed development. These technologies enable the manipulation of plant DNA which results in the creation of genetically modified and hybrid seeds with highly desirable traits.

Furthermore, the adoption of biotechnological advances has redefined the industry landscape as farmers are increasingly looking for seeds offering greater resilience and performance. Companies invest substantially in R&D to introduce novel and customized varieties to meet the growing demand for sustainable and high-yield agriculture worldwide.

MARKET RESTRAINTS

Climate change and environmental factors present significant restraints to the seed market. This impacts the adaptability and performance of seed varieties. It disrupted the soil ecosystem and global food security. Climate irregularities can lower the physiological, biochemical and morphological qualities which ultimately decreases the seed’s cultivation value and field performance. According to a study of 30 species under different conditions, the seedling vigour and germination in hotter months were more severely affected in self-pollinated breeding systems and dicots yearly type. This is a major factor derailing the market growth rate.

Low crop production in areas with limited water supply is another problem hindering the upward trajectory of the seed market size.

MARKET OPPORTUNITIES

Modern agricultural methods and seed farming technology for sustainable cultivation are providing potential prospects for market growth. Enhancing seed types to rapidly increase the yield, accessibility, and stock levels in developing countries such as South Asia and Saharan Africa is a key prospect for prominent industry players. Making public-private collaborations can open the way for the seed market.

Moreover, informal seed farmers can shift to formal private companies and improve input logistics for producers and industry. In addition, the advances in seed breeding systems to enhance seed production quality are expected to propel the market forward. It decreases the developmental time for newer varieties.

MARKET CHALLENGES

The negative impact of Genetically Modified (GM) crops is a major challenge for the seed market. Insect resistance and potential human health risks have weakened their positive effects, which is hurting the demand for GM seeds. Moreover, ongoing mistrust about GMOs, the absence of early-phase studies, and poor science communication by seed companies have only compounded challenges. Many industry players have used climate goals as a PR strategy, which creates confusion among customers and governing authorities. Hence, such promotional and market share-capturing methods are affecting the expansion of the seed industry.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

6.78% |

|

Segments Covered |

Crop, Availability, Seed Treatment, Seed Trait, Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Monsanto Company (Now part of Bayer AG), Bayer AG, Syngenta AG, Corteva Agriscience (Formerly DowDuPont), BASF SE, Limagrain, KWS SAAT SE, Groupe InVivo, Sakata Seed Corporation, Enza Zaden, Rijk Zwaan, Burrus Seed Farms, Land O'Lakes, Inc. (WinField United), Takii & Co., Ltd., DLF Seeds, Emerald Seed Company, Delta Seeds, Gansu Dunhuang Seed Co., Ltd., Nunhems (Bayer Crop Science) |

SEGMENT ANALYSIS

Global Seed Market By Crop

The field crops segment holds a major share of the seed market in 2023 and is expected to grow at a healthy CAGR during the forecast period. It dominated the industry due to its extensive cultivation and critical role in food production worldwide. For instance, maize, wheat, and rice are staple crops for billions of people and serve as primary sources of calories. Further, the reduction in human immunity has surged the demand for protein meals which is increasing the use of seeds for field crops. Also, the growing biofuel and animal feed industries and the shift towards organic and healthy lifestyles are accelerating the segment’s growth.

Global Seed Market By Availability

The commercial seeds segment led this category in 2023 and is projected to grow at a faster rate in the seed market during the forecast period. Their wide availability and consistency make them the preferred choice for many farmers, particularly in large-scale commercial farming. Besides this, the need to create maximum yield and climate-resilient seed type is driving the segment forward. Furthermore, the rising cognizance among cultivators about the use of biotech and hybrid crops is projected to expand the commercial seed segment.

However, saved seeds are still popular among organic and sustainable agriculture practitioners, as they may better suit local conditions and are often considered more in line with traditional, non-industrial farming practices.

Global Seed Market By Seed Treatment

The treated seeds segment had the major share of the global market in 2023. The primary reason for their dominance is the perceived economic benefits and risk reduction associated with pre-treatment. Likewise, the implementation of the “In China, for China” strategy by Clariant for supplying unique and tenable solutions for superior quality has increased the use of treated seeds and is also engaging the development of biodegradable and bio-based substitutes to completely stop the use of banned polymers. Meanwhile, the untreated seeds segment is expected to progress at a steady CAGR during the forecast period.

Global Seed Market By Seed Trait

The herbicide-tolerant seeds segment is showing dominance and is estimated to hold the biggest CAGR in the seed market, particularly for crops like soybeans and maize. Whereas the insecticide-resistant category has also gained significant revenue share after the herbicide-tolerant segment. This is because they offer an effective and environmentally friendlier means of pest control.

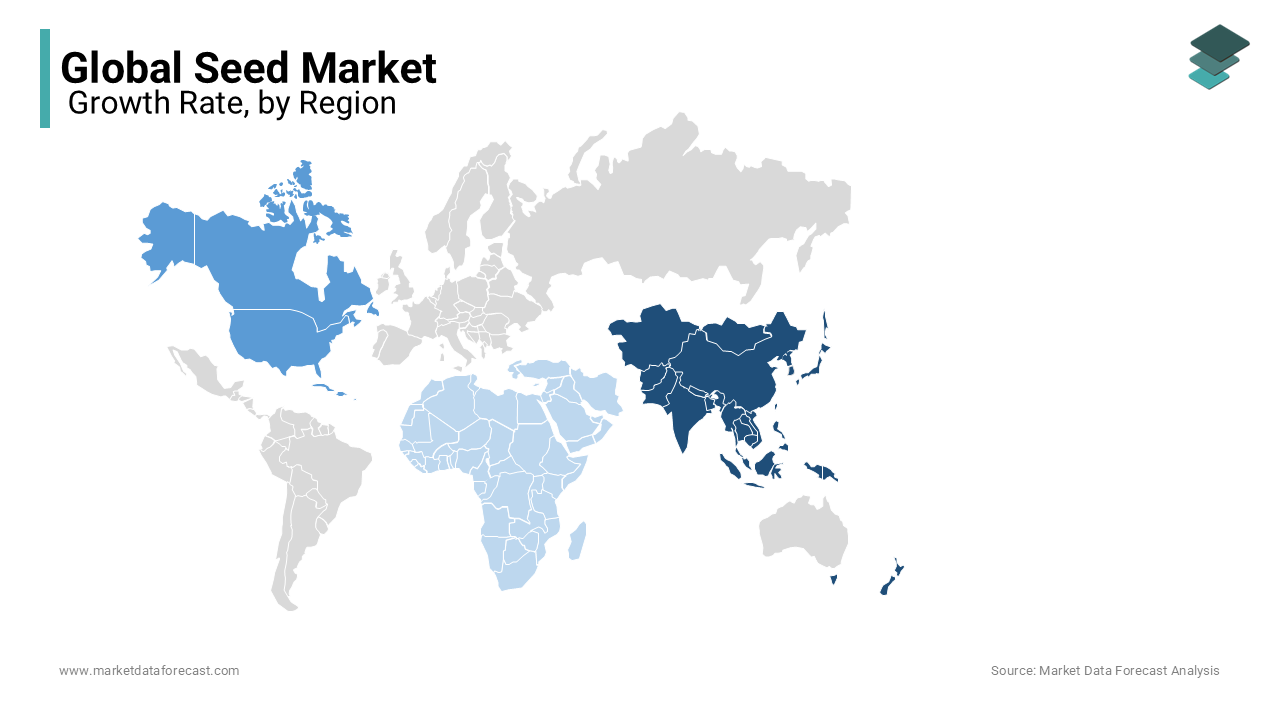

REGIONAL ANALYSIS

Asia Pacific holds a prominent share of the seed market, with countries like China and India being major players. The Indian industry is predicted to experience the biggest rise in food, seed, and industrial (FSI) utilization because of the government’s food security initiatives and persistent population growth. This is expected to boost the country's seed industry. Moreover, the FSI application in China and Pakistan is also forecasted to increase with the growing population and higher local supplies. Also, China is the leading player in transgenic crop approvals for production and boasts the largest use of commercial seeds.

North America is the second dominant region in the seed market. This is because the region is set to rebound with better potential for the United States and Canada. Moreover, the extensive use of advanced seed technologies, including genetically modified (GM) crops, also contributed to the expansion of the regional market value. The U.S. winter wheat yield is estimated to be higher on the expanded harvested area. The 2024-25 U.S. corn industry is forecasted at 14.9 billion bushels with greater domestic use, larger supplies, bigger ending inventory, and exports.

Europe's seed market is expected to see moderate growth in the short term, but in the long run, it is believed to expand rapidly. This is due to the unfavorable rains lowering the cultivation area last fall, which is leading to a reduction in wheat production in the 2024-25 season. The region’s supply chain is disrupted by the Russia-Ukraine war, and subsequent difficulties in importing fertilizers have impacted crop production, which ultimately decreases the demand for seeds in the region. However, a large percentage of SMEs are owned by big multinational companies like BASF, private companies such as the Dutch Rijk Zwaan, and cooperatively owned companies for example, the French.

Limagrain, which dominates certain market segments.

Latin America is projected to propel at a higher CAGR during the forecast period for the seed market. The regional industry is moving forward due to the high concentration of oilseeds, soybean production, and favorable weather conditions. Moreover, Brazil holds the maximum market share as it has a high seed replacement rate. Corn is the biggest crop category among hybrids because of its extensive use in different industries, and farmers seek higher cultivation with rapid adaptability to various climate conditions and soil types. Besides this, the increased application of biofuel in making fuel is also fuelling the seed market growth rate.

The Middle East and Africa have huge potential for seed market players. The technological advancements in seed development have paved the way for sustainable agricultural practices. This attribute will surge the demand for seeds and ensure food security across the region, adjusting to weather forecasts and accelerating economic growth.

KEY MARKET PLAYERS

Monsanto Company (Now part of Bayer AG), Bayer AG, Syngenta AG, Corteva Agriscience (Formerly DowDuPont), BASF SE, Limagrain, KWS SAAT SE, Groupe InVivo, Sakata Seed Corporation, Enza Zaden, Rijk Zwaan, Burrus Seed Farms, Land O'Lakes, Inc. (WinField United), Takii & Co., Ltd., DLF Seeds, Emerald Seed Company, Delta Seeds, Gansu Dunhuang Seed Co., Ltd., Nunhems (Bayer Crop Science) are some of the market players dominating the global seed market.

RECENT HAPPENINGS IN THE GLOBAL SEED MARKET

- In June 2024, RiceTec and its partner Savannah Seeds launched the FullPage Rice Cropping Solution to the Indian industry in partnership with ADAMA. It is particularly designed for direct-seeded rice (DSR). It combined SQUAD seed treatment, SmartRice Genetics, and FullPage's innovative IMI herbicide tolerance quality.

- In May 2024, 12 organizations inked a contract with the International Seed Federation at the World Seed Congress 2024 to counter unlawful seed practices.

DETAILED SEGMENTATION OF THE GLOBAL SEED MARKET INCLUDED IN THIS REPORT

This research report on the global seed market has been segmented & sub-segmented based on the crop, availability, seed treatment, seed trait and region.

By Crop

- Field Crops

- Fruit & Vegetable Crops

By Availability

- Commercial Seeds

- Saved Seeds

By Seed Treatment

- Treated

- Untreated

By Seed Trait

- Herbicide-Tolerant

- Insecticide Resistant

- Other Stacked Traits

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

what is the size of global seed market ?

As per our analysis report, the global Seed Market is expected to reach USD 11.25 billion by 2028.

what is the CAGR of global seed market?

The Global seed market is expected to be valued at a CAGR of 6.78% by the end of 2028.

what are key market players in seed market?

Monsanto Company (Now part of Bayer AG), Bayer AG, Syngenta AG, Corteva Agriscience (Formerly DowDuPont), BASF SE, Limagrain, KWS SAAT SE, Groupe InVivo, Sakata Seed Corporation, Enza Zaden, Rijk Zwaan, Burrus Seed Farms, Land O'Lakes, Inc. (WinField United), Takii & Co., Ltd., DLF Seeds, Emerald Seed Company, Delta Seeds, Gansu Dunhuang Seed Co., Ltd., Nunhems (Bayer Crop Science)

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]