Global Quadricycle Market Size, Share, Growth, Trends & Forecast Research Report – Segmented By Propulsion (Electric, Internal Combustion Engine (ICE)), Application (Household, Commercial), Type (Light quadricycles, Heavy quadricycles), End-Use (Resorts and Museums, Industrial Facilities, Personal Mobility, Other End Uses), Price range (Economy, Mid-range, Premium and By Region North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis From (2025 to 2033)

Global Quadricycle Market Size

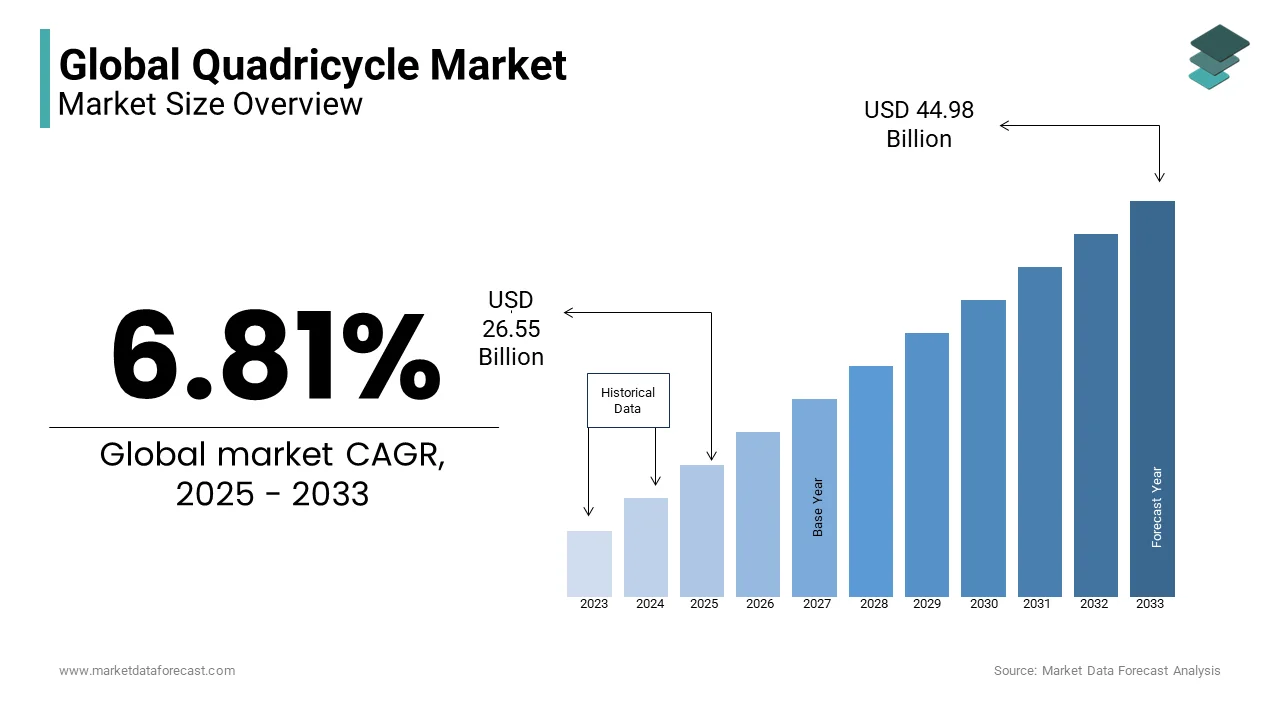

The global quadricycle market size was valued at USD 24.86 billion in 2024 and is anticipated to reach USD 26.55 billion in 2025 from USD 44.98 billion by 2033, growing at a CAGR of 6.81% during the forecast period from 2025 to 2033.

Quadricycle is a niche yet rapidly evolving segment within the broader automotive industry and is characterized by lightweight, compact, and energy-efficient vehicles designed for urban mobility. Quadricycles are classified into light quadricycles (L6e) and heavy quadricycles (L7e) under European regulations are gaining traction as sustainable alternatives to traditional cars and particularly in congested urban environments. These vehicles, often electrically powered, cater to the growing demand for eco-friendly transportation solutions, aligning with global efforts to reduce carbon emissions and combat climate change. With a focus on affordability, low operational costs, and ease of maneuverability, quadricycles are increasingly being adopted for short-distance commuting, last-mile delivery services, and shared mobility platforms.

Emerging economies in Asia-Pacific and Latin America are also showing promising growth potential and is fueled by urbanization and increasing demand for cost-effective mobility solutions. Key players in the industry are investing heavily in R&D to enhance battery efficiency, safety features, and design aesthetics, further propelling market expansion. As urbanization intensifies and environmental concerns escalate, the quadricycle market is poised to play a pivotal role in shaping the future of urban transportation.

Leading manufacturers, including Renault, Bajaj Auto, and Aixam-Mega, are investing heavily in advanced technologies to enhance battery efficiency, safety features, and design aesthetics. For instance, Renault’s Twizy model has become a benchmark in the segment, with over 30,000 units sold globally since its launch. Additionally, the shift toward electric quadricycles is gaining traction, with electric models accounting for nearly 40% of total quadricycle sales in Europe in 2022, as per data from the International Energy Agency.

Market Drivers

Urbanization and Congestion Challenges

Rapid urbanization has led to increased traffic congestion in cities worldwide, creating a demand for compact and agile vehicles like quadricycles. According to the United Nations Department of Economic and Social Affairs, 68% of the global population is projected to live in urban areas by 2050, up from 55% in 2018. This urban density has exacerbated traffic issues, particularly in Europe and Asia, where cities like Paris and Delhi face severe congestion. Quadricycles, with their small footprint and ease of maneuverability, offer an effective solution. For instance, the European Environment Agency reports that quadricycles reduce urban traffic congestion by occupying 50% less road space compared to traditional cars, making them ideal for crowded cityscapes.

Stringent Emission Regulations and Sustainability Goals

Governments worldwide are implementing strict emission norms to combat climate change, driving the adoption of eco-friendly vehicles like quadricycles. The European Union’s CO2 emission standards mandate a 37.5% reduction in emissions from new vehicles by 2030, compared to 2021 levels, as stated by the European Commission. Quadricycles, particularly electric models, align with these goals by emitting significantly fewer pollutants. The International Energy Agency highlights that electric quadricycles produce zero tailpipe emissions, contributing to cleaner urban air. In 2022, electric quadricycles accounted for 40% of total quadricycle sales in Europe, reflecting their growing role in achieving sustainability targets and reducing reliance on fossil fuels.

Market Restraints

Limited Safety Standards and Consumer Perception

Quadricycles face challenges due to their relatively lower safety standards compared to conventional vehicles. According to the European Transport Safety Council, quadricycles are not subject to the same rigorous crash-testing requirements as passenger cars, leading to concerns about occupant safety. For instance, the Euro NCAP safety ratings reveal that quadricycles often score significantly lower in crash tests, with some models achieving only 2 out of 5 stars. This perception of compromised safety has hindered consumer confidence, particularly in regions like North America, where safety is a top priority. The National Highway Traffic Safety Administration highlights that stricter safety regulations in the U.S. have limited the adoption of quadricycles, as they often fail to meet federal motor vehicle safety standards.

Limited Range and Infrastructure for Electric Quadricycles

The adoption of electric quadricycles is constrained by their limited driving range and inadequate charging infrastructure. The International Energy Agency reports that most electric quadricycles have an average range of 80-100 kilometers on a single charge, which is insufficient for longer commutes. Additionally, the lack of widespread charging infrastructure, particularly in developing regions, poses a significant barrier. For example, the Central Electricity Authority of India states that only 1,800 public charging stations were operational in 2022, serving a population of over 1.3 billion. This infrastructure gap discourages potential buyers, as highlighted by the Society of Indian Automobile Manufacturers, which notes that range anxiety remains a critical factor limiting the growth of electric quadricycles in emerging markets

Market Opportunities

Urban Mobility Solutions

Urban congestion is a growing issue worldwide, especially in large cities. Quadricycles present a viable solution for this, offering compact size, low operating costs, and environmental benefits. The United Nations projects that by 2050, nearly 70% of the global population will reside in urban areas, intensifying the need for alternative transportation solutions. In response, the European Commission has identified shared mobility systems as a key focus area, including quadricycles for last-mile transportation in cities. Additionally, in densely populated areas like Paris, the introduction of compact vehicles like quadricycles is encouraged to reduce road congestion and pollution, as seen in the city’s implementation of low-emission zones.

Government Support for Eco-friendly Transport

Environmental concerns have led governments to promote sustainable transportation options, benefiting quadricycles. For instance, the European Union has introduced strict CO2 emission regulations, targeting a 37.5% reduction in emissions from new cars by 2030. Quadricycles, especially electric models, align with these policies due to their lower carbon footprint. In India, the government’s push for electric vehicle adoption under the FAME II scheme offers incentives for electric quadricycle manufacturers. According to the Ministry of Heavy Industries and Public Enterprises, FAME II aims to reduce fossil fuel dependency and cut vehicular emissions by promoting electric mobility, presenting an opportunity for the quadricycle market to expand in eco-conscious regions

Market Challenges

Regulatory Barriers

The regulatory environment for quadricycles is evolving, particularly regarding emissions. In India, the introduction of BS-VI emission standards has raised the production cost for manufacturers. BS-VI norms, which came into effect in April 2020, require a 68% reduction in particulate matter and a 25% reduction in nitrogen oxide emissions compared to the previous BS-IV standards. For quadricycles, especially those with internal combustion engines, meeting these requirements is expensive, leading to increased production costs. According to a report by the Ministry of Heavy Industries and Public Enterprises, this has resulted in the cost of production rising by approximately 10-15%, which could raise prices for consumers. Moreover, the push for electric vehicles under the government’s FAME II scheme is pressuring quadricycle manufacturers to shift to electric models, requiring additional investment in technology development.

High Initial Costs and Affordability Concerns

One of the primary challenges facing the quadricycle market is the high initial cost, particularly for electric models, which can deter price-sensitive consumers. According to the International Energy Agency, the average price of an electric quadricycle in Europe ranges between €8,000 and €12,000, significantly higher than traditional gasoline-powered alternatives. This cost barrier is particularly pronounced in emerging markets, where affordability is a critical factor. The World Bank reports that in countries like India, where per capita income is approximately $2,100, such high upfront costs limit the adoption of quadricycles. Despite lower operational costs, the initial investment remains a significant hurdle, especially for low- and middle-income consumers who prioritize affordability over long-term savings.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.81% |

|

Segments Covered |

By Propulsion, Application, End-Use, Price range, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Suzuki Motor Corporation (Japan), Honda Motor Co., Ltd. (Japan), Toyota Motor Corporation (Japan), Aixam (France), Ligier Group (France), Citroen (France), Renault Group (France), Italcar Industrial S.r.l. (Italy), Alke (Italy). |

SEGMENT ANALYSIS

Global Quadricycle Market Analysis By Propulsion

The internal combustion engine (ICE) segment dominated the market by accounting for 63.6% of the global market share in 2024. It is growing at a slower pace but remains dominant due to increasing regulatory pressures for lower emissions and the growing popularity of electric vehicles. The global sales of internal combustion vehicles still far outpace electric models, particularly in regions like North America, parts of Europe, and Asia. As of 2022, the sales of ICE vehicles worldwide were approximately 80 million units, which further supports the dominance of this segment.

However, the CAGR of the electric segment is much higher and stands at 10.1% for the forecast period owing to the push for sustainable transportation, government incentives, and advancements in battery technology and charging infrastructure. For instance, in Europe, electric quadricycle sales are expected to grow by over 15% annually in certain markets and is driven by aggressive emissions regulations and carbon reduction targets.

Global Quadricycle Market Analysis By Application

The commercial segment held 60.6% of the global market share in 2024. The growth of this segment is primarily driven by the increasing adoption of quadricycles for last-mile delivery, urban mobility, and tourist rentals because businesses seek more fuel-efficient, low-emission solutions to navigate dense urban environments. According to a report by the International Transport Forum (ITF), urban road transport accounts for over 40% of total CO2 emissions in cities. The adoption of quadricycles can help reduce this impact by offering more eco-friendly alternatives to conventional cars and motorcycles.

The household segment is anticipated to register a CAGR of 9.1% from 2025 to 2033. This rapid growth is attributed to the rising demand for compact, affordable, and eco-friendly personal transport solutions and especially in urban areas with congestion and parking limitations. The increasing adoption of electric quadricycles in households further fuels this growth, as they present a practical alternative to conventional vehicles. According to the European Environment Agency (EEA), transportation accounts for approximately 30% of Europe’s total greenhouse gas emissions with private cars being the major contributors.

Global Quadricycle Market Analysis By Type

The light quadricycle segment remains the largest by holding for 68.7% of the global market share in 2024. Light quadricycles are particularly favored for their compact size and cost-efficiency and is making them ideal for urban mobility solutions. The European Environment Agency (EEA) has reported that light vehicles, such as quadricycles, contribute significantly to reducing urban traffic congestion and CO2 emissions. For example, in France, quadricycles are exempt from road taxes, offering an added economic incentive. Light quadricycles also meet EU emissions standards, which is crucial in markets with tightening environmental regulations. Moreover, electric versions of light quadricycles offer a greener alternative for city transport, contributing to the EU's 2030 climate goals to reduce transport emissions by 30%. This trend of eco-conscious urban transport is driving the segment's dominance in urban areas.

The heavy quadricycle segment is experiencing the highest CAGR of 9.5% from 2025 to 2033. This rapid growth is driven by the increasing adoption of heavy electric quadricycles for commercial use and particularly in last-mile delivery and urban logistics. Heavy quadricycles can carry larger payloads (up to 450 kg) which makes them suitable for transporting goods, such as food, packages, or medical supplies, in dense urban environments. According to the International Transport Forum (ITF), commercial fleets are moving toward low-emission vehicles, and electric heavy quadricycles play a key role in this transition. Additionally, European regulations (e.g., the EU Green Deal) mandate cities to lower transport emissions, further boosting the demand for these vehicles. Heavy electric quadricycles like the Bajaj Qute and Tazzari GL Imola are offering up to 300 km ranges on a single charge and can reduce last-mile delivery costs by up to 40% compared to traditional vehicles. The combination of lower operational costs, greater payload capacity, and environmental incentives makes this segment crucial for sustainable urban mobility.

Global Quadricycle Market Analysis By End Use

The personal mobility segment led the market by holding 45.5% of the global market share in 2024. The appeal of quadricycles in personal mobility is driven by the increasing urbanization and the need for affordable, eco-friendly transport. According to the European Environment Agency (EEA), the transport sector contributes to 30% of Europe’s CO2 emissions with private cars being the largest emitter. In response, governments are promoting low-emission vehicles, and cities like Paris and Rome have begun to incentivize the use of light, electric quadricycles through tax exemptions and lower parking fees. These vehicles are also 10-15% cheaper to maintain compared to conventional cars, making them increasingly attractive for short-distance commutes in congested urban areas. The market is expected to continue growing, particularly as electric versions of quadricycles gain popularity, with electric quadricycles accounting for over 40% of personal mobility sales by 2027.

The industrial facilities segment is anticipated to witness the highest CAGR of 8.5% from 2025 to 2033. This is primarily due to the increasing use of electric quadricycles in industries for internal transport and material handling. Quadricycles’ ability to navigate small, crowded spaces within factories, warehouses, and distribution centers makes them a highly efficient option. Electric industrial quadricycles have a lower operational cost (reaching up to 60% lower compared to traditional vehicles) which is contributing to increased profitability for companies looking to reduce overheads. They are also seen as a sustainable choice for industries seeking to reduce their carbon footprint. Additionally, regulations such as the EU Green Deal, aiming to make Europe carbon neutral by 2050 are likely to fuel the transition to electric and low-emission vehicles in industrial applications, accelerating growth in the segment

Global Quadricycle Market Analysis By Price Range

The economy segment dominated the global quadricycle market and accounted for 60.1% of the global market share in 2024. The dominance of economy segment is majorly attributed to the increasing need for affordable as well as energy-efficient urban mobility solutions. The price range for economy quadricycles typically falls between USD 4,000 to USD 8,000 and is making them accessible to a broad demographic, particularly in emerging markets like India and Africa. According to the European Environment Agency (EEA), there is a strong push towards low-emission, small vehicles due to the growing urban population, which in 2022 stood at 56.2% of the global population. These vehicles are not only cheaper to buy but also cost-efficient to maintain, with maintenance costs 20-30% lower than traditional cars. Additionally, they support the EU’s 2030 goal to reduce transport emissions by 30%.

The premium segment is emerging at the fastest rate and is anticipated to experience a CAGR of 10.84% from 2025 to 2030. This growth is driven by the increasing demand for luxury electric quadricycles in cities, particularly in Europe and North America, where environmental consciousness is rising among high-income consumers. Premium quadricycles, typically priced between USD 8,000 to USD 15,000, are equipped with high-end features such as advanced safety systems, greater driving range, faster charging times, and luxury interiors. This trend reflects an increasing shift towards sustainable luxury with consumers increasingly willing to pay a premium for vehicles that combine eco-friendliness with advanced technologies. In addition, premium electric quadricycles are becoming more widely used in urban tourist markets and luxury resorts, further fueling the demand for these high-end, eco-conscious vehicles.

REGIONAL ANALYSIS

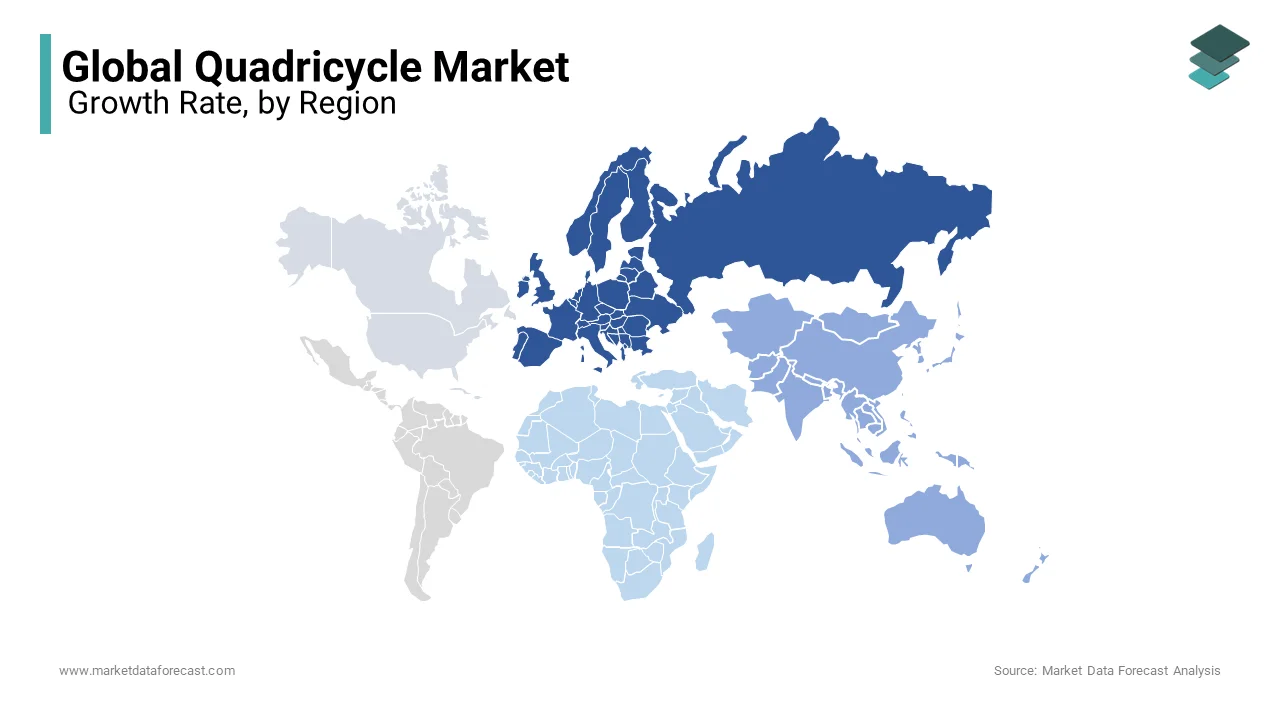

Europe is the most dominating regional market for quadricycles currently worldwide and even accounted for 40.5% share of the global quadricycle market in 2024 owing to the strong regulatory support of Europe for environmentally friendly transportation and a growing focus on urban mobility solutions. The European Union has set ambitious CO2 reduction goals, targeting a 37.5% reduction in emissions from new cars by 2030, which is fueling the demand for quadricycles, especially electric models. In 2020, the EU reported a 15% increase in electric vehicle registrations, and quadricycles are part of this growth, contributing to cleaner urban environments. Countries like France, Germany, and the UK are leading the adoption of these vehicles, with over 100,000 quadricycles registered across Europe in 2021, as per the ACEA - European Automobile Manufacturers Association.

Asia-Pacific is witnessing the highest growth and is expected to expand at a CAGR of 25.1% from 2025 to 2033. The region's increasing urbanization with over 1.5 billion people living in urban areas by 2025 and is driving the demand for compact and efficient vehicles like quadricycles. China alone plans to invest over USD 60 billion in electric vehicle infrastructure by 2030, which includes incentives for electric quadricycles. India, with its burgeoning middle class, is also expected to see a surge in quadricycle adoption, with sales projected to grow by 20% annually. By 2030, India is expected to contribute to over 15% of the global electric quadricycle market, according to the India's Ministry of Heavy Industries.

The quadricycle market in North America remains niche and is primarily due to stringent safety regulations and consumer preferences for larger vehicles. The U.S. National Highway Traffic Safety Administration does not classify quadricycles as passenger vehicles, creating regulatory challenges that limit their adoption. Additionally, the lack of widespread awareness and infrastructure for small, eco-friendly vehicles has hindered market growth. However, there is potential in urban areas for last-mile delivery services and shared mobility platforms. According to the U.S. Department of Energy, electric vehicle sales are expected to reach 40% of total vehicle sales by 2030 and thereby supporting quadricycle adoption.

Latin America shows moderate growth potential for the quadricycle market, driven by urbanization, rising fuel costs, and the need for affordable mobility solutions. Brazil is the leading market in the region, with increasing adoption of quadricycles for urban commuting and delivery services. The Brazilian Automotive Industry Association reports a 10% year-on-year increase in quadricycle sales in 2022 and is fueled by their cost-effectiveness and suitability for congested cities. However, challenges such as limited charging infrastructure for electric models and inconsistent regulatory frameworks across countries may slow growth. Government initiatives promoting sustainable transportation could further boost the market in the coming years.

The quadricycle market in the Middle East and Africa is in its early stages but shows promise and particularly in urban areas for last-mile delivery and shared mobility. The International Energy Agency notes that electric quadricycles are gaining traction in countries like South Africa and the UAE, driven by urbanization and the need for sustainable transport solutions. However, the region faces significant challenges including limited charging infrastructure and low consumer awareness. According to the African Development Bank, only 1% of vehicles in Africa are electric, highlighting the untapped potential for quadricycles. With supportive policies and infrastructure development, the MEA region could see gradual growth in the quadricycle market over the next decade.

KEY MARKET PLAYERS

Suzuki Motor Corporation (Japan), Honda Motor Co., Ltd. (Japan), Toyota Motor Corporation (Japan), Aixam (France), Ligier Group (France), Citroen (France), Renault Group (France), Italcar Industrial S.r.l. (Italy), Alke (Italy). These are the market players that are dominating the global quadricycle market.

COMPETITIVE LANDSCAPE

The competition in the global quadricycle market is intensifying as key players strive to capture market share in the growing demand for compact, efficient, and eco-friendly vehicles. Leading automakers such as Renault, Bajaj Auto, and Polaris Industries dominate the market with their established product lines and innovative solutions. Renault has been a frontrunner with its electric Twizy quadricycle, which has been particularly successful in European urban markets. Similarly, Bajaj Auto focuses on providing affordable, fuel-efficient quadricycles like the RE60, mainly targeting emerging markets in India and Southeast Asia. Polaris Industries has gained a strong foothold in North America through its GEM brand of electric low-speed vehicles, catering to both urban and commercial sectors.

The competition is further fueled by emerging players entering the market with new models, often targeting specific niches such as off-road or luxury electric quadricycles. Additionally, the increasing shift toward sustainable mobility solutions has led many companies to prioritize electric vehicles, intensifying the race to develop innovative electric quadricycle models that comply with stringent emissions regulations.

Price sensitivity, consumer education, and regulatory compliance are key factors driving competition, with companies increasingly investing in marketing, after-sales services, and technological advancements to differentiate themselves and gain a competitive edge. The quadricycle market is expected to continue evolving, with new players emerging and existing ones intensifying their efforts.

Top 3 Players in the Market

Renault (France)

Renault's progress into the quadricycle market began with the launch of the Renault Twizy in 2011. The Twizy is a compact, fully electric quadricycle designed for urban environments. Renault recognized the need for small, eco-friendly vehicles suited for congested cities and areas with strict emissions regulations. The Twizy was marketed primarily in Europe and later expanded to other regions like the Middle East and Latin America. The vehicle's small size, ability to navigate through traffic, and zero-emissions electric engine quickly garnered attention from environmentally conscious consumers and city dwellers.

Bajaj Auto (India)

Bajaj Auto, a leading Indian vehicle manufacturer, entered the quadricycle market with the Bajaj RE60 in 2012. The RE60 was introduced as a safer, more efficient, and affordable alternative to the traditional three-wheeled auto-rickshaws that are commonly used for public transportation in India and other developing countries. The RE60 was designed as a low-emission, four-wheel vehicle with better safety features and is aiming to provide a more comfortable and environmentally friendly option for urban commuters.

Polaris Industries (United States)

Polaris Industries made its entry into the quadricycle market through the acquisition of Global Electric Motorcars (GEM) in 2011. GEM is known for its electric vehicles, particularly low-speed electric vehicles (LSEVs) and quadricycles used for short-distance travel. These vehicles have been predominantly used in gated communities, resorts, airports, and urban settings where low-speed vehicles are permitted. Polaris leveraged GEM's expertise to expand its product offerings and cater to the growing demand for sustainable transportation solutions.

Top strategies used by the key market participants

Product Innovation and Diversification

Leading companies are focusing on developing new and improved models of quadricycles to meet evolving consumer needs and environmental standards. By offering electric quadricycles, automakers are tapping into the growing demand for eco-friendly vehicles that comply with emissions regulations. For example, Renault has continuously refined its Twizy electric quadricycle to improve performance, safety, and user experience. The company has also explored the development of more versatile electric vehicles in the same compact category, positioning itself as a leader in sustainable urban mobility. Polaris Industries is leveraging its acquisition of Global Electric Motorcars (GEM) to diversify its product offerings. Polaris continues to develop low-speed electric vehicles for both recreational and urban use which is expanding its quadricycle portfolio.

Strategic Partnerships and Collaborations

Partnerships with local and global companies, as well as collaborations with governments and environmental organizations, are another key strategy. These alliances help companies increase market penetration, improve technology, and access new customer bases. Bajaj Auto has partnered with various international distributors and manufacturers to expand its reach in emerging markets. The company also collaborates with governments to provide affordable and environmentally friendly transportation solutions. Renault has also collaborated with various government agencies across Europe to support the adoption of electric vehicles, including quadricycles. These collaborations often involve providing subsidies or incentives to encourage consumers to purchase eco-friendly vehicles.

Focus on Sustainability and Green Mobility

Sustainability is a driving force for many players in the quadricycle market. Key players are focusing on green mobility solutions to meet increasing environmental concerns and regulations related to transportation emissions. Renault, with its electric vehicles, plays a significant role in Europe’s transition toward cleaner transportation. Renault’s continued investment in electric quadricycles and its commitment to the European Union’s goals for reducing CO2 emissions have solidified its position in the market. Polaris Industries is focusing on expanding its electric fleet, particularly through its GEM models. As urban areas move toward zero-emissions zones, Polaris’s focus on low-speed electric vehicles positions it well to benefit from the growing demand for sustainable transportation

Recent Happenings In This Market

On February 2024, the UK's Department for Transport initiated a consultation to consider integrating international vehicle regulations into the Great Britain type approval scheme. The proposed changes include accepting additional United Nations (UN) safety and environmental standards, which could impact the approval process for quadricycles.

On March 2024, the Indian Ministry of Heavy Industries announced the Electric Mobility Promotion Scheme 2024, allocating INR 500 crore to promote the adoption of electric two-wheelers and three-wheelers. The scheme, effective from April 1 to July 31, 2024, offers demand incentives to customers purchasing domestically manufactured electric vehicles, potentially influencing the quadricycle segment.

MARKET SEGMENTATION

This research report on the global Quadricycle market size is segmented and sub-segmented into the following categories.

By Propulsion

- Electric

- Internal Combustion Engine (ICE)

By Application

- Household

- Commercial

By Type

- Light Quadricycles

- Heavy Quadricycles

By End Use

- Resorts and Museums

- Industrial Facilities

- Personal Mobility

- Other End Uses

By Price Range

- Economy

- Mid-range

- Premium

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current market size of the global quadricycle market?

The current market size of the global quadricycle market size was valued at USD 26.55 billion in 2025

What market drivers are driving the global quadricycle market?

Challenges that are the urbanization and congestion challenge stringent emission regulations and sustainability goals.

What challenges are faced by the global quadricycle market?

The regulatory barriers, high initial costs, and affordability concerns are the main challenges in the global quadricycle market.

Who are the market drivers that are dominating the global quadricycle market?

Suzuki Motor Corporation (Japan), Honda Motor Co., Ltd. (Japan), Toyota Motor Corporation (Japan), Aixam (France), Ligier Group (France), Citroen (France), Renault Group (France), Italcar Industrial S.r.l. (Italy), Alke (Italy).

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]