Global Processed Meat Market Size, Share, Trends & Growth Forecast Report - Segmented By Type (Beef, Poultry, Pork, Mutton), Nature (Organic, Conventional), Form (Frozen, Canned, And Chilled), Distribution Channel (Off-Trade, On-Trade), And Region (North America, Europe, Asia Pacific, Latin America, Middle East And Africa) – Industry Analysis From 2025 To 2033

Global Processed Meat Market Size

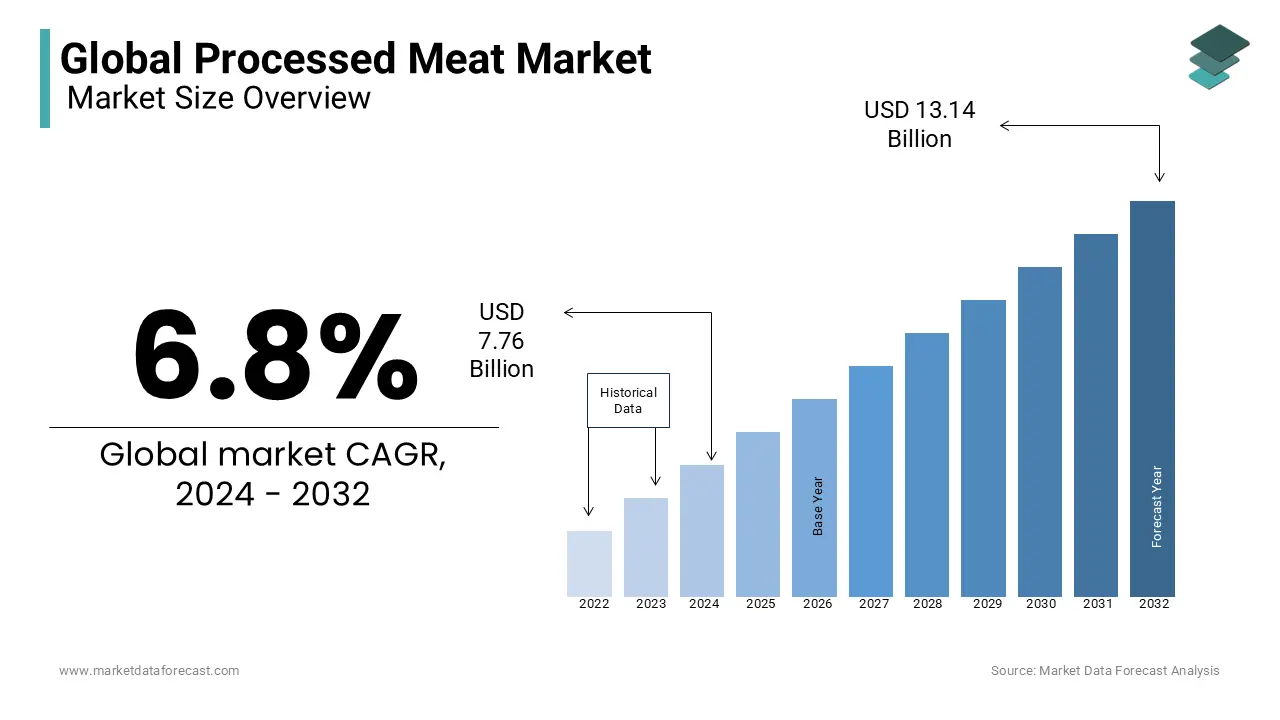

The global processed meat market size was calculated to be USD 7.76 billion in 2024 and is anticipated to be worth USD 14.03 billion by 2033 from USD 8.29 billion In 2025, growing at a CAGR of 6.80% during the forecast period.

Processed meat is the form of meat that is modified to increase the shelf-life or to enhance the taste. Various methods of processing meat involve salting, curing, fermentation, smoking, boiling, frying, or adding chemical preservatives. Processed meat is usually composed of pork or beef, significantly less frequently poultry. Processed meat products include bacon, ham, sausages, hot dogs, and canned meat. Meat processing is mainly done to increase the shelf-life of the meat, as cooking and salting prolong the life of fresh meat.

Current Scenario of the Global Processed Meat Market

The escalating technological advancements leading to innovations in the processing and preservation techniques, like the introduction of high-pressure processing (HPP) and advanced freezing techniques, are significantly impacting the market expansion in the coming years due to enhancements in the quality and shelf-life of the meat. The increasing R&D investments by the manufacturers to develop innovative forms of ready-to-cook food premixes that reduce the food preparation time are expected to accelerate the adoption rate across people, providing market growth opportunities in the forecast period. The growing product launches and approvals as consumers seek flavored meat products and rising demand for organic processed meat are all expected to augment the global market growth in the forecast period.

MARKET DRIVERS

The increasing consumption of meat, majorly pork, which is the second most consumed worldwide, is majorly driving the expansion of the global processed meat market.

Pork is the most consumed meat in European and Asian regions. The rising awareness among the people regarding the health benefits of consuming meat and the sedentary lifestyle of the population is demanding processed meat, enhancing the global market revenue. Processed meat is widely popular in the food industry as it is widely accepted as a standard fast-food product that is highly preferred by working people and the younger population, boosting the expansion of the market. The increasing adoption of sedentary lifestyle habits influencing people to adopt ready-to-eat food products and the growing disposable incomes of the population is accelerating the global processed meat market revenue.

The change in purchasing patterns of the consumers where they prefer processed food to reduce the cooking time fueling the market growth. The expanding fast-food chains such as KFC, McDonald's, and Burger King are widely investing in processed meat, which is rising in consumption across developing regions, to enhance market share expansion in the coming years. According to a United States Center for Disease and Control Prevention report, about 37% of Americans consume fast food regularly. The consumption of processed meat in the developed regions has escalated the market growth in the recent period. The increasing demand for protein-rich foods and expanding dietary habits among people are driving the global demand for meat.

MARKET RESTRAINTS

The major restraining factor for the processed food market is the carcinogenicity characteristic of humans.

According to the International Agency for Research on Cancer (IARC), the World Health Organization classifies processed meat as Group 1 carcinogenic to humans as the IARC found sufficient evidence that consumption of processed meat by humans causes colorectal cancer. This is expected to hamper the expansion of the market growth. The over-consumption of processed meat leads to various health effects like increased risk of cardiovascular diseases, gastric cancer, and stroke. According to a research publication report, stated that processed red meat consumption increases the risk of Alzheimer's disease. The high consumption of processed meat leads to an upsurge in cholesterol and fat levels in the body, leading to an unhealthy lifestyle. Rising obesity levels are estimated to make it challenging for market players to expand the market across the globe. Various stringent regulations and the high cost of meat products are estimated to impede global market expansion.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.8% |

|

Segments Covered |

By Processing Type, Nature, Form, Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

NH Foods Ltd, Smithfield Foods Inc., Cargill Incorporated, ConAgra Foods Inc., National Beef Packing Company LLC, Tyson Foods Inc., Cherkizovo Group, JBS, Hormel Foods Corporation, and Marfrig Global Foods |

SEGMENTAL ANALYSIS

Global Processed Meat Market Analysis By Processing Type

The pork segment dominated the global processed meat market revenue with a significant share of 39.3% in 2023. The increasing consumption of pork in breakfast and lunch across Asian countries fuels the segment growth. Pork is widely used in various products like bacon, sausages, and ham, driving the demand for the segment and contributing to global market expansion.

The poultry segment had a significant market share in the global market due to its high consumption level in various regions. The low cost and preference for white meat over red meat boosted the segment's growth. The poultry and pork segments equaled the global market share due to the highly adopted meat forms across the population.

The mutton segment is estimated to grow the fastest during the forecast period due to increasing consumer awareness of its health benefits. The growing consumption of mutton and innovative mutton product launches will propel the segment's growth in the coming years.

Global Processed Meat Market Analysis By Nature

The organic processed meat segment held the most significant global market share due to rising demand for organic products. The demand for organic food products has increased in the recent period. The increasing awareness among consumers regarding the low-risk factors of organic processed meat consumption of conventional products to avoid the significant health effects is augmenting the demand for organic products, leading to market growth. The organic segment is estimated to increase at a CAGR of around 7.4% during the forecast period.

Global Processed Meat Market Analysis By Form

The chilled segment dominated the global market with the largest share due to consumer demand for freshness and minimal processing, which are vital segment drivers. The chilled meats are refrigerated but not frozen, which provides the texture and taste of fresh meat, fueling the market growth in this segment. The consumer perception of consuming chilled meat is healthier than frozen or canned meat, boosting the segment growth.

The frozen segment is estimated to grow prominently during the forecast period due to its convenience, longer shelf life, and preservation of nutritional value, which drive the market in this segment.

Global Processed Meat Market Analysis By Distribution Channel

The off-trade segment held a significant share by dominating the global market due to the high sales in hypermarkets and supermarkets. Offline sales involve a high consumer base due to the accessibility of a wide selection of products according to consumer needs, which boosts consumers' preference for offline sales. Hypermarkets and supermarkets are easily convenient for consumers seeking varieties and value of products.

The on-trade segment is estimated to have the fastest growth during the forecast period due to the growing adoption of digital shopping among consumers. The pandemic has boosted digital shopping features among consumers due to price variations, payment methods, and delivery processes.

REGIONAL ANALYSIS

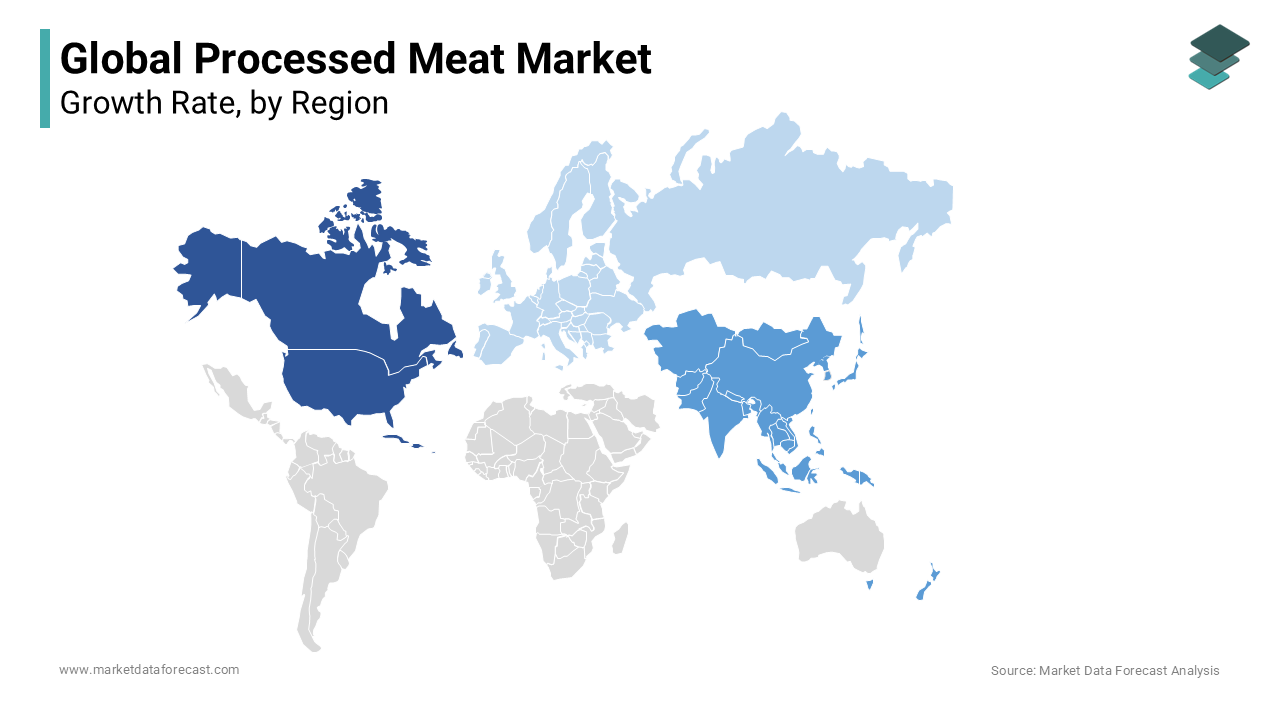

The North American region dominated the global market with the greatest share due to the increasing consumption of meat products like bacon and pork for breakfast and lunch. North America dominated beef production with a significant share of 34.21% in 2023. The growing demand for protein-rich food, presence of major market players, continuous product launches, and innovations are estimated to enhance the regional market growth.

The Asia Pacific region is estimated to grow fastest, with a significant CAGR during the forecast period. The growing population is demanding high amounts of meat, the adoption of busy lifestyles, and the growing disposable incomes of the people are all boosting the market growth.

The European region is estimated to have prominent growth opportunities during the forecast period. The increasing number of new product launches and growing awareness of organic products are driving the German market's growth.

KEY PLAYERS IN THE GLOBAL PROCESSED MEAT MARKET

The major players in the global processing market are NH Foods Ltd, Smithfield Foods Inc., Cargill Incorporated, ConAgra Foods Inc., National Beef Packing Company LLC, Tyson Foods Inc., Cherkizovo Group, JBS, Hormel Foods Corporation, and Marfrig Global Foods

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Cargill Inc. acquired two meat plants to expand its production and distribution of supermarket case-ready beef and pork.

- In May 2023, Tyson Foods Claryville launched its new expanded cocktail sausage manufacturing capacity to meet the high customer demand for Hillshire Farm brand products.

- In April 2023, the HERDEZ brand launched its Mexican refrigerated entrees line with two varieties HERDEZ Chicken Shredded in Mild Chipotle Sauce and HERDEZ Carnitas Slow-cooked pork.

- In April 2023, Swift Prepared Foods, a subsidiary of JBS USA, opened Principe Foods, which produces high-quality Italian meats.

- In October 2022, Yonezo Arita, a local cattle producer in Japan, formed a new company with three other farmers called Scrum Export Meat Miyazaki Co. The company aims to export beef to Muslims worldwide by expanding its export business.

DETAILED SEGMENTATION OF THE GLOBAL PROCESSED MARKET INCLUDED IN THIS REPORT

This research report on the global processed meat market has been segmented and sub-segmented based on processing type, nature, form, distribution channel, and region.

By Processed Type

- Beef

- Poultry

- Pork

- Mutton

By Nature

- Organic Processed meat

- Conventional Processed meat

By Form

- Frozen

- Canned

- Chilled

By Distribution Channel

- Off-trade

- Hypermarkets/Supermarkets

- Specialty stores

- On-trade

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What are the main factors driving the growth of the processed meat market?

Factors driving growth include increasing urbanization, changing dietary habits, convenience of processed meat products, rising demand for protein-rich foods, and expanding fast-food chains.

2. What are the regulatory challenges facing the processed meat industry?

Due to their potential health risks, the industry faces regulatory scrutiny regarding food safety standards, labeling requirements, and restrictions on certain additives like nitrites and phosphates.

3. What role does technology play in the processed meat industry?

Technology advancements in food processing, packaging, and preservation methods enable manufacturers to improve efficiency, extend shelf life, and meet consumer demand for convenience and safety.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]