Global Pea Protein Market Size, Share, Trends & Growth Forecast Report - Segmented By Type (Concentrated, Isolated, Textured), Application (Snacks & Bakery Products, Meat Extenders, Meat Substitute, Food & Beverages, Other Food Application), And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis From 2025 To 2033

Global Pea Protein Market Size

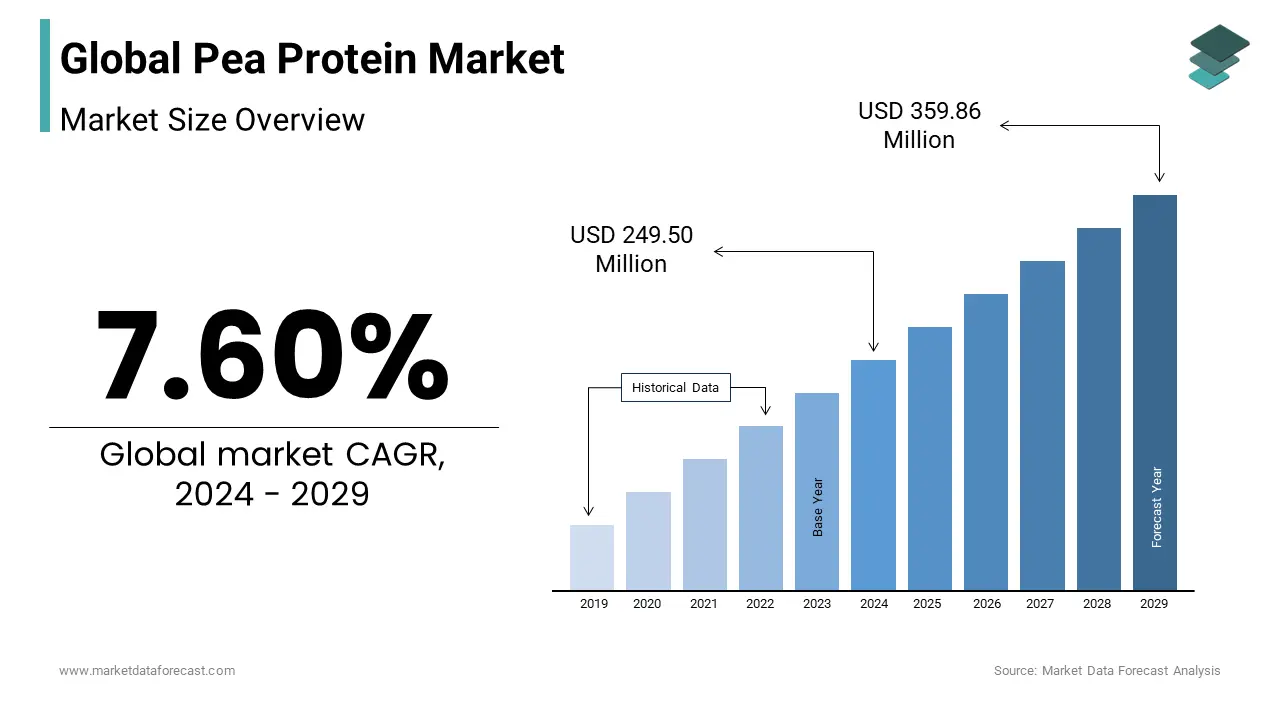

As per our analysis report, the global pea protein market was calculated to be USD 249.50 million in 2024 and is anticipated to be worth USD 482.37 million by 2033 from USD 268.46 million In 2025, growing at a CAGR of 7.60% during the forecast period.

Protein powder is available in a variety of forms, such as whey protein, brown rice protein powder, soy protein, and pea protein. However, pea protein is becoming increasingly popular due to its high nutrient content and numerous applications in the food and beverage industry. Pea protein products can replace most other proteins in a wide range of foods without affecting the taste, color, or texture of the product, and in some cases, can save money. Pea protein is preferred over others as it is gluten-free and daily. It is easy to digest and does not cause bloating. Pea protein is particularly useful for many medical applications, such as maintaining healthy muscles, controlling weight, strengthening metabolism, regulating blood sugar, improving blood circulation, and calcium absorption. As a result, it is gradually increasing as an essential alternative to other available forms of protein.

Trends in spending on prepared foods in developing countries and the multifunctional nature of pea protein are vital factors that are supposed to drive growth in the global pea protein market during the projection period.

CURRENT SCENARIO OF THE GLOBAL PEA PROTEIN MARKET

The pea protein is famous for its neutral taste, versatility, and easy-to-integrate into several recipes without overpowering other flavors. This is one of the reasons why the United States, Canada, Germany, the United Kingdom, and India are the top pea protein-consuming countries. Also, the demand for pea protein-based products in Germany is surging due to the rising vegetarian population, with around 10 percent of people eating plant-based diets. And, among them, India is projected to register the fastest growth rate in this market. This is especially propelled by the heightening consumption of food and beverages, snacks, and bakery items. Moreover, in terms of the per capita consumption rate, Iceland tops the list with 141.01 grams, followed by Hong Kong with 137.93 grams, then Lithuania and the United States with 125.18 and 113.73 grams, respectively.

Besides this, according to a December 2023 study, corn zein and other viscoelastic plant proteins can be utilised to give the required textural qualities to plant-based meat alternatives instead of existing used components.

Also, as compared to America, flexitarianism is more popular in Europe, with around 27 percent of the total people in the region. The US lags with a lower percentage. Currently, the American market is highly dominated by Chinese high-protein content (HPC) pea protein. So, in February 2024, the US Department of Commerce (DOC) imposed heavy preliminary duties between 112 and 270 percent on particular pea protein imported from China. Hence, this is expected to have a considerable effect on the industry.

MARKET DRIVERS

Y-o-Y growth in the demand for plant-based protein sources from consumers is one of the major factors boosting the pea protein market worldwide.

Health consciousness and environmental awareness among consumers have been growing exponentially over the last few years, resulting in the increasing search for promising plant-based protein sources such as pea protein. Consumers have been increasingly adding plant-based proteins into their diets to get habituated to healthier eating habits, and this trend is gradually taking flight. For instance, a study conducted by the Plant Based Foods Association (PBFA) and The Good Food Institute (GFI) in 2021 confirmed that plant-based food sales in the United States were worth USD 7 billion in 2020 and increased by 27%. This trend indicates that consumers have been increasingly shifting to plant-based alternatives such as pea protein due to their nutritional value and sustainability. The rapid adoption of vegan and vegetarian diets is further propelling the growth of the global pea protein market.

The number of entering the path of veganism is on the rise worldwide. As per a study by Vegetarian Times, more than 9.7 million people in the U.S. are vegans, and people turning vegan and following vegetarian diets in the U.S. have experienced a tremendous increase in recent years. Approximately 5% of the entire UK population is vegetarian, and another 3% of the population is vegan in the UK, according to a study conducted by the Journal of the Academy of Nutrition and Dietetics. An estimated 14% of the European population consumes a vegetarian or flexitarian diet, according to a survey by Ipsos Retail Performance. These trends indicate that the shift towards plant-based diets is happening promisingly in different parts of the world and resulting in the increasing demand for plant-based protein sources such as pea protein. In addition to that, several social media influencers, celebrities and health advocates have been spreading word of mouth on plant-based lifestyles, which is further resulting in the increasing adoption of veganism and vegetarian diets. The growing vegan population is contributing to the increasing demand for plant-based protein sources like pea protein and further aiding the global pea protein market growth.

The rapid adoption of allergen-friendly alternatives to soy and dairy proteins is driving the pea protein market growth.

Pea protein is an allergen-friendly alternative to common allergens like soy and dairy proteins and is a preference for consumers who have food allergies and intolerances. A substantial amount of population suffers food allergies worldwide. For instance, an estimated 32 million Americans have food allergies and soy and dairy are some of the major allergens. People who have lactose intolerance usually also have an issue with the dairy proteins and such people have been adopting the plant-based diets to fulfil their nutritious needs, which is contributing to the pea protein market growth.

Furthermore, factors such as increasing preference from consumers to consume only that can contribute to health and wellness and increasing usage of pea protein from the sports nutrition industry are supporting the global market growth. The rising usage of pea protein in food fortification, growing incidence of lactose intolerance and dairy allergies and increase in the number of initiatives from the governments of various countries to promote plant-based diets and the expansion of the dietary supplements market worldwide are favoring the growth of the global pea protein market.

MARKET RESTRAINTS

Cost and taste are the major obstacles to the large-scale adoption of pea protein.

This is hurting both the United States and Europe. Close to 38 per cent of Europeans consider price as the primary hindrance.

From the North American point of view, competition from established proteins, lack of consumer awareness, and market fragmentation are decreasing the market growth rate in the region. Soy and whey have a strong presence and producers favour these for making items like veggie burgers. This is because of lower production costs and a more stable supply than pea protein. At the same time, only premium products may utilize pea protein to serve niche consumer expectations. In Europe, cultural integration, misconceptions, and limited options are hurdles for the pea protein market. Hence, companies are producing food and beverage products and also enhancing promotional activities to solve these general problems.

Interestingly, around 32 per cent state that they cannot ignore the texture while eating plant-based items. But, manufacturing a gel-like structure with the help of pea protein under heat can be difficult and have a negative effect as well.

Along with the growing demand for other vegetable proteins, the expense of pea protein is also limiting the market. The high availability of different sources of plant-based protein, such as soy products with similar benefits, can be a problem for industrial profitability and impede the growth of the pea protein market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.60% |

|

Segments Covered |

By Type, Application, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

A&B Ingredients, Consucra-Groupe Warcoing, Axiom Foods, Inc, Burcon NutraScience Ltd, Roquette Freres, Nutri-Pea Limited |

SEGMENT ANALYSIS

Global Pea Protein Market Analysis By Type

The isolated segment is expected to continue its growth trajectory during the forecast period of the pea protein market. This is mainly due to the evolving customer choices and shift to eating gluten-free and highly nutritious foods. Further, the swift growth in the application of isolates in almost every consumable item, like baked products, fruit mixes, milkshakes, and energy drinks, contributes to the segment’s development. They are included with many artificial sweeteners and colors, stabilizing agents, and non-allergic ingredients, and emulsification is anticipated to considerably spike the consumption of pea protein isolates. Moreover, it is becoming increasingly popular throughout the sports and fitness industry for protein supplements, energy drinks, etc., and creating growth opportunities for prominent companies in the market to launch new products.

Likewise, the textured segment is another category that is rapidly gaining traction as an alternative to animal proteins. As per the research paper, the industry has already begun favoring food compositions with plant-based ones. Also, lately, the consciousness regarding environmental protection and medical concerns has caused changes in customer behavior toward plant-based proteins, and the associated market has experienced swift expansion with an increasing inflow of investments and new substitutes. However, this comparatively new industry requires enhancements in product quality like color, texture, and flavor to come on par with cheese and meet consumables. On the other hand, the greatest restraint for this segment is building an anisotropic structure with the same textural qualities. To solve this, operational ingredients coupled with modern and emerging technologies have been developed and incorporated to produce meat-like textures to equivalent goods. Despite the help of wheat gluten or methylcellulose, this issue is only addressed to a certain degree. So, the demand for chemically free and natural elements is rising.

Global Pea Protein Market Analysis By Application

The meat substitute segment is rapidly increasing its share in the pea protein market and is forecasted to move forward at a faster pace throughout the projection period. This can be credited to the change in consumer eating habits towards a vegan diet and having plant-based nutritious items. This rise in knowledge and understanding of health problems among people such as diabetes, obesity, etc. So as a result, it is boosting the consumption of pea protein goods instead of meat and elevating the segment’s overall revenue generation. Moreover, the demand for pea protein is also fuelled by the rising customer awareness of processed and red meat containing large quantities of saturated fats and their adverse impacts on health. However, the deforestation and effects of climate change or global warming on natural vegetation because of extensive animal rearing may slow down the segment’s progress. On the other way, this problem can further circulate awareness among people and transition their dietary habits to food consisting of plants and meat substitutes and away from non-vegetarian foods. Therefore, it is expanding the pea protein demand and providing potential prospects for prominent industry players to innovate new products.

REGIONAL ANALYSIS

North America was the largest consumer, with 42.7% of the global share in 2019. The highest demand for gluten-free items in the United States, strong growth in the sports nutrition industry, and growing concern about cardiovascular disease caused by meat consumption are essential factors that have a positive impact on growth. Significant increases in production in the food processing sector in Mexico are expected due to increased imports of machinery to facilitate the application of baked and processed meats and, consequently, baked goods and meat products.

Europe was the second-largest consumer in 2019. It is supposed to lead the local market as concerns about lactose intolerance have increased along with changes in consumer orientation of plant products. However, stagnant growth in the food and beverage industry in key markets such as Germany, France, and the UK will continue to be a deterrent during the forecast period due to rising utility costs coupled with stringent environmental regulations to limit production.

The Asia Pacific region is assumed to show the fastest CAGR of 8.9% by volume during the forecast period. Significant gains from functional food imports from Japan, China, and India are expected to remain favorable factors for the forecast years. In addition, along with the expansion of the retail chain and hotel and restaurant industry arrangements, supermarkets are expected to play an essential role in promoting the growth of the food and beverage industry. As a result, positive prospects for the food and beverage industries in countries such as China and India are foreseen to increase demand for pea protein ingredients.

Latin America, the Middle East, and Africa are likely to witness the growth of emerging markets in the coming years. The positive prospects for the sports nutrition sector in Brazil, Chile, and Argentina are anticipated to provide a significant range for industrial improvement in Latin America during the forecast period.

KEY MARKET PLAYERS

Major Key Players in the Global Pea Protein Market are A&B Ingredients, Consucra-Groupe Warcoing, Axiom Foods, Inc., Burcon NutraScience Ltd, Roquette Freres, Nutri-Pea Limited

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Roquette introduced the four specially created multipurpose pea proteins. It is intended to enhance the texture, creativity and taste of plant-based food and protein-rich wholesome products under the well-known NUTRALYS portfolio. This includes NUTRALYS H85 (hydrolysate), NUTRALYS T Pea 700M (textured), NUTRALYS Pea F853M (isolate) and NUTRALYS T Pea 700FL (textured)

- In February 2024, Louis Dreyfus Company press released the building of the new manufacturing factory for pea protein in North America. It is being constructed specially for its plant protein business at the location of their current industrial complex in Yorkton, Saskatchewan, Canada. Also, it is estimated to be ready by 2025 end.

- In March 2023, Burcon, one of the major participants in the global pea protein market, announced their plans to buy Canada's Merit plant from the receiver. With this acquisition, Burcon believes that they can improve their production capacity of pea protein and strengthen their position in the global pea protein market.

- In January 2021, Roquette, a key player in the global pea protein market, announced that they finished constructing their pea protein plant in Manitoba, which was made with USD 600 million. Roquette believes that this state-of-the-art facility would significantly increase their production capacity for pea protein and offer them possibilities to address the increasing demand for pea protein from consumers.

- In May 2020. Brenntag, which is a renowned chemical distribution company, announced their partnership with Axiom Foods to distribute plant-based ingredients in the U.S. and Canada. This partnership is believed to expand the product portfolio of plant-based products, including pea protein of Brenntag to spread their presence throughout the North American region with the help of Axiom Foods’s expertise.

DETAILED SEGMENTATION OF GLOBAL PEA PROTEIN MARKET INCLUDED IN THIS REPORT

This research report on the global pea protein market has been segmented and sub-segmented based on type, application, & region.

By Type

- Concentrated

- Isolated

- Textured

By Application

- Snacks and Bakery products

- Meat extenders

- Meat substitute

- Food & Beverages

- Other food application

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What are the opportunities for growth and innovation in the pea protein market?

Opportunities for growth and innovation in the pea protein market include expanding into new geographic regions, developing value-added pea protein ingredients with enhanced functionality and nutritional benefits, investing in research and development to improve processing techniques and product quality, and collaborating with food manufacturers to create innovative pea protein-based food products.

2. What are the challenges facing the pea protein industry?

Challenges facing the pea protein industry include competition from other plant-based protein sources, such as soy, rice, and wheat protein, price volatility of raw materials, limitations in flavor masking and texture improvement, regulatory complexities, and the need for infrastructure investment to support increased production capacity.

3. What are the emerging applications of pea protein?

Emerging applications of pea protein include plant-based meat alternatives, dairy alternatives (such as non-dairy milk, yogurt, and cheese), nutritional supplements, sports nutrition products, baked goods, snacks, and confectionery items. Pea protein's neutral flavor and functional properties make it a versatile ingredient in food formulation.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]