Global Ophthalmology Devices Market Size, Share, Trends & Growth Analysis Report – Segmented By Application (Diagnostics & Monitoring Devices, Surgery Devices and Vision Care Devices), Disorders (Cataract, Glaucoma, Refractor Disorders and Vitreo Retinal Disorder), Devices (Canaloplasty Devices and Computerized Field Analyser) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2024 to 2032)

Global Ophthalmology Devices Market Size

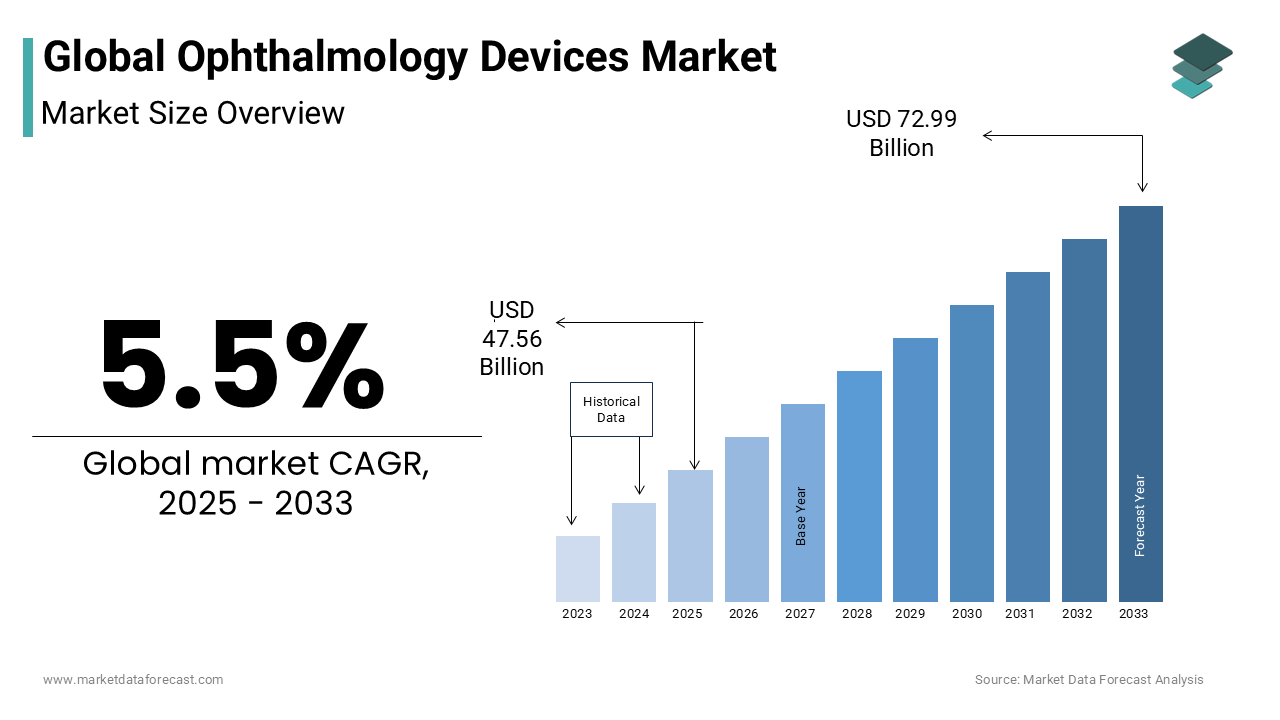

The global ophthalmology devices market size was valued at USD 45.08 billion in 2024 and is estimated to be worth USD 72.99 billion by 2033 from USD 47.56 billion in 2025, growing at a CAGR of 5.5% during the forecast period.

An ophthalmology device is used to diagnose and treat various eye diseases. Ophthalmologists and optometrists use various ophthalmology equipment during treatment procedures. Slit-lamp microscope, fundus camera, tonometer, retinal scanner, and ocular coherence tomography are some ophthalmology devices. Considering the growing population suffering from various eye diseases worldwide, the need for ophthalmology devices is expected to grow in the coming years. These devices provide high accuracy, personalized medicine, and patient comfort, so the adoption of these is growing in all parts of the world.

MARKET DRIVERS

The growing aging population worldwide is expected to drive the ophthalmology devices market growth.

With growing age, people are much more likely to face vision problems and eye-related diseases. This increasing incidence of eye diseases among the aging population promotes the demand for ophthalmology devices. In addition, in some situations, the aged population undergoes surgeries to correct vision issues. The growing number of ophthalmology surgeries being performed worldwide is fuelling the need for the ophthalmology devices market. According to the statistics published by WHO, 1.4 billion people are expected to be 60 or more by 2030.

The growing patient count suffering from various eye diseases propels the ophthalmology devices market. Eye disease prevalence is increasing worldwide. Age-related macular degeneration, cataracts, and diabetic retinopathy are some of the common eye diseases. As the World Health Organization (WHO) mentioned, around 196 million people suffer from age-related macular degeneration, which is expected to reach 288 million by 2040. In addition, the rising prevalence of diabetes is expected to contribute to the ophthalmology devices market growth. IDF Diabetes Atlas says an estimated 463 million adults had diabetes in 2019, and it is predicted to reach 783 million by 2045.

In addition, the increasing adoption of technological advancements in ophthalmology treatments contributes to the growth of the global ophthalmology devices market. Recent years have seen ophthalmology devices as one of the fastest-growing medical device markets. Ophthalmology has benefited in recent years from increased spending on healthcare, government investments, and the continual advancement of medicine. As the medical world's most rapidly growing sector, the ophthalmology devices market is increasing demand for solutions to improve the lives of millions. There is a tremendous opportunity in the global ophthalmic devices market due to the increasing prevalence of aging and ocular disease, which includes cataracts, and refractive and glaucoma surgeries, among other things. Growing awareness among individuals and rapid approvals will likely sustain the growth soon. Furthermore, the shortage of ophthalmology device providers in existing economies and the rise in age-related eye diseases create more opportunities for the industry to grow significantly in the coming years.

MARKET RESTRAINTS

High costs of ophthalmology devices are one of the key factors hampering the market growth.

In addition, some countries lack reimbursement policies and stringent regulatory requirements, and competition from alternative treatments is expected to hinder market growth. Furthermore, factors such as the lack of healthcare insurance in emerging countries, a lack of awareness among individuals about diseases such as glaucoma, and poor healthcare infrastructure are anticipated to impede market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

Segments Covered |

By Application, Type of Disorder, Device, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Alcon Inc., Abbott Medical Optics Inc., Johnson & Johnson, Essilor International, Bausch and Lomb Inc., Topcon Corporation, Nidek Co Ltd., HAAG-Streit Group, Carl Zeiss Meditec, Hoya Corporation, and Ziemer Ophthalmic System. |

SEGMENTAL ANALYSIS

Global Ophthalmology Devices Market By Type of Disorder

The cataract segment held the most significant share of the global ophthalmology devices market in 2023, and the domination of the segment is expected to continue during the forecast period. The increasing employment of ophthalmology devices for cataract surgeries primarily drives the segment's growth. For instance, an estimated 20.5 million cataract surgeries were recorded in 2019, estimated to reach 24.4 million by 2040.

On the other hand, the refractor disorders segment is anticipated to occupy a significant share of the global ophthalmology devices market during the forecast period. The increasing patient population suffering from myopia, hyperopia, and astigmatism drives the segment's growth rate. In addition, the growing adoption of technological developments in manufacturing ophthalmology devices for refractor disorders and the growing focus of manufacturers to manufacture cost-effective ophthalmology devices are further propelling the segment's growth rate.

Global Ophthalmology Devices Market By Application

The vision care devices segment is expected to dominate the global ophthalmology devices market based on the application. The growing adoption of vision care devices and the increasing aging population drive segmental growth.

REGIONAL ANALYSIS

Geographically, the North American ophthalmology devices market held the most outstanding share of the global market in 2023, while Asia-Pacific is expected to develop at the fastest rate. In the United States, diabetic retinopathy is expected to be the leading cause of blindness. During the forecast period, the region's dominance is predicted to continue and is considered one of the most significant regional segments. Factors such as the growing aging population across North American countries, increasing patient count suffering from eye diseases, and rising demand for advanced ophthalmic devices are fuelling the market growth in North America. The population of more than 65 in the North American region is expected to reach 98 million by 2060. In addition, an estimated 20 million Americans above 40 years are suffering from age-related macular degeneration, says National Eye Institute. Favorable reimbursement policies in the North American region are anticipated to favor regional market growth.

During the forecast period, the European ophthalmology devices market is predicted to showcase promising growth owing to favorable government initiatives and increasing R&D efforts by the key market participants to bring advanced ophthalmology devices to the market. The growing aging population is expected to boost the European ophthalmology devices market. According to the statistics published by United Nations, 17% of the European population aged above 67 years in 2020 is expected to reach 30% by 2050. In addition, the growing patient population suffering from diabetes in Europe is expected to boost the market growth. A considerable amount of the European population suffers from various eye diseases such as age-related macular degeneration, cataracts, glaucoma, diabetic retinopathy, and dry eye syndrome. Europe has a 3% to 4% prevalence of visual impairment.

The Asia-Pacific ophthalmology devices market is estimated to progress at the fastest CAGR in the coming years. The increasing incidence of eye diseases due to the growing aging population, increasing exposure to blue light, and rising prevalence of chronic diseases among the APAC countries are expected to promote the ophthalmology devices market growth in APAC. The prevalence of eye diseases is growing significantly in APAC countries such as China, India, and Japan.

The Latin American ophthalmology devices market is estimated to hold a considerable share of the worldwide market during the forecast period.

The MEA ophthalmology devices market is predicted to witness a moderate CAGR in the coming years.

KEY MARKET PLAYERS

Some key market participants leading the global ophthalmology device market include Alcon Inc., Abbott Medical Optics Inc., Johnson & Johnson, Essilor International, Bausch and Lomb Inc., Topcon Corporation, Nidek Co Ltd., HAAG-Streit Group, Carl Zeiss Meditec, Hoya Corporation, and Ziemer Ophthalmic System.

RECENT MARKET HAPPENINGS

- In January 2023, Radiance Therapeutics Inc., a U.S.-based biotechnology company, announced to showcase their work and research at the Glaucoma Research Foundation headline event, Glaucoma 360 New Horizons 2023.

- In July 2022, Carl Zeiss Meditec and Precise Bio partnered to develop and commercialize tissue-based implants for ophthalmology.

- In January 2020, Bausch + Lomb, a leading eye health business of Bausch Health Companies, announced the U.S. launch of expanded parameters for BiotrueOneday for Astigmatism daily disposable contact lenses.

- In November 2019, Baring Private Equity announced that its affiliated private equity funds agreed to acquire Lumenis, a leading provider of energy-based medical devices across the fields of ophthalmology, ENT, and gynecology.

- In May 2019, Novuson Surgical, a medical device company, secured funding from HOYA Corporation to finalize the UltraStat 3mmVessel/Divider development using Direct Therapeutic UltraSound (DTU).

- In October 2016, HOYA Corporation announced an agreement to acquire Performance Optics, LLC, a global ophthalmic lens manufacturer. This acquisition will strengthen HOYA's ability to provide customers with a broad portfolio.

DETAILED SEGMENTATION OF THE GLOBAL OPHTHALMOLOGY DEVICES MARKET INCLUDED IN THIS REPORT

This research report on the global ophthalmology devices market has been segmented & sub-segmented based on application, type of disorder, device, and region.

By Type of Disorder

- Cataract

- Glaucoma

- Refractor Disorders

- Vitreo Retinal Disorder

By Device

- Canaloplasty Devices

- Computerized Field Analyser

By Application

- Diagnostics & Monitoring Devices

- Surgery Devices

- Vision Care Devices

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What are some of the noteworthy players in the ophthalmology devices market?

Alcon Inc., Abbott Medical Optics Inc., Johnson & Johnson, Essilor International, Bausch and Lomb Inc., Topcon Corporation, Nidek Co Ltd., HAAG-Streit Group, Carl Zeiss Meditec, Hoya Corporation, and Ziemer Ophthalmic System. are some of the key market players.

Does this report include COVID-19 impact on the ophthalmology devices market?

This report has an in-depth analysis of COVID-19 impact on the ophthalmology devices market.

Which region accounted for the major share of the global ophthalmology devices market in 2023?

Geographically, the North American region played a dominant role in the global ophthalmology devices market in 2023.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]