Global Humira Market Size, Share, Trends & Growth Forecast Report By Type (Humira Syringe & Humira Pen), Application and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Humira Market Size

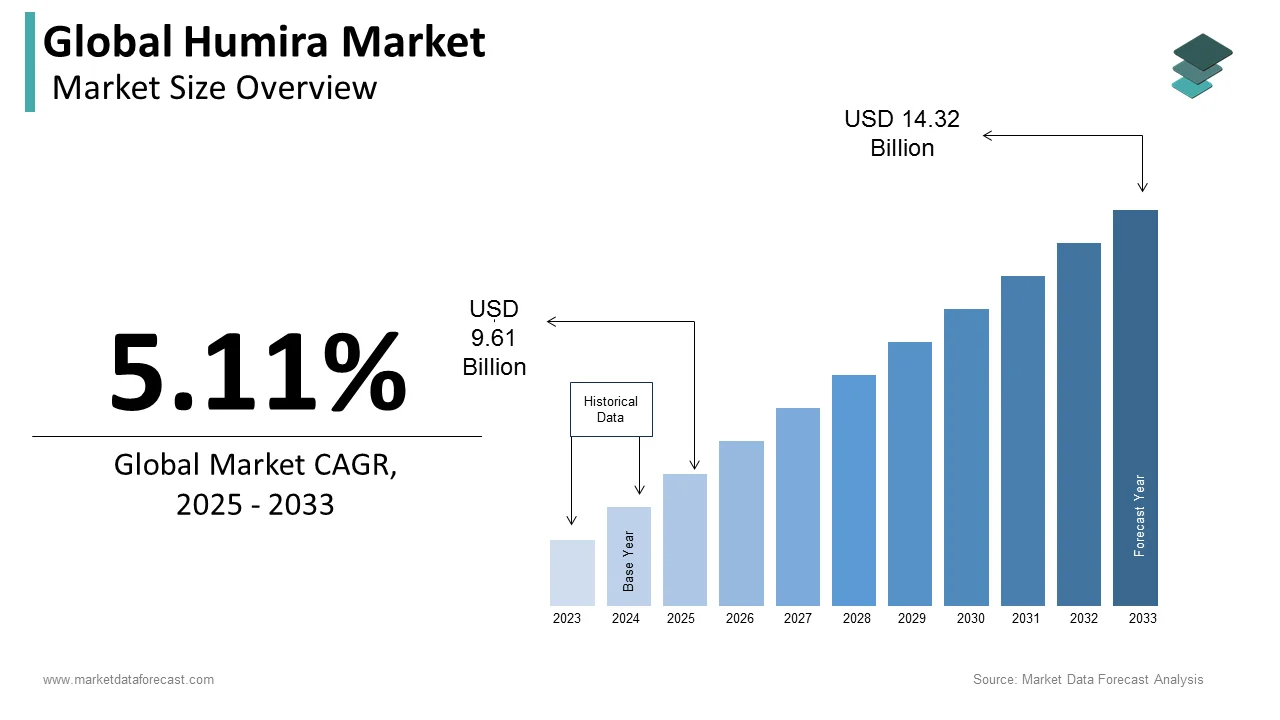

The size of the global humira market was worth USD 9.14 billion in 2024. The global market is anticipated to grow at a CAGR of 5.11% from 2025 to 2033 and be worth USD 14.32 billion by 2033 from USD 9.61 billion in 2025.

Humira was initially approved in the United States and is now available in more than 60 countries. Humira is used for various diseases where the patient fails to respond to other treatments. Humira is also known as adalimumab, which is used in the form of injections under the skin. Physicians generally prescribe this medication only when a patient has no response to the other treatment procedures. Initially, it was approved by the U.S. government to use this medication for various diseases like rheumatoid arthritis, psoriatic arthritis, and others. Therefore, the market size is expected to grow tremendously during the forecast period.

MARKET DRIVERS

An increasing number of patients with diseases such as arthritis due to lifestyle changes and the rise in capital income in developed and developing countries are propelling the global Humira market. The forefront of driving the global Humira market is the increase in global arthritis. It, in turn, is mainly due to the rapid growth of the elderly population. According to the Centers for Disease Control and Prevention (CDC), an estimated 24% of U.S. adults, which is 58.5 million people are suffering from arthritis. The population aged above 60 is anticipated to reach 2.1 billion by 2050, as per the prediction by World Health Organization (WHO). Most women have arthritis in old age due to calcium loss in the body. Sedentary lifestyles have also led to the development of another condition called arthritis or psoriasis. They all contribute to consuming the product. In addition, sedentary, such as an increased prevalence of Crohn's disease and ulcerative colitis. Also, factors such as improved disease diagnostics and strong support for effective biopharmaceuticals are forecasted to drive the growth of the global Humira market. However, due to its biological properties, Humira is an expensive drug. Monthly costs range from USD 2,000 to USD 3,000, which is one factor that hinders market growth. On the other hand, the emergence of the latest technologies and the launch of various treatment procedures in favor of the end-users is likely to bolster the development of the market.

Technological advancements and increased R&D activity for Humira biosimilars' development are anticipated to offer growth opportunities. In addition, increasing support from the various governments through investments is to surge growth opportunities for the market. Key market players are actively investing to take advantage of untapped opportunities in Latin America and the Asia-Pacific region, and opportunities for market growth will remain soon. Furthermore, after the blockbuster drug patent expired, Humira's entry provided new opportunities for key players in the market.

MARKET RESTRAINTS

However, the lack of skilled persons treating the disease with proper dosage form slightly declines the Humira market's growth. The high cost of treatment procedures remained a challenging factor for the market. The high price of clinical trials and R&D is a significant challenge witnessed by market operators. Despite high R&D spending, manufacturers must keep their products low, further limiting growth opportunities in the global Humira market. Lack of reimbursement for biopharmaceutical treatments also harms the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Analysed |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Analysed |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Market Leader Profiled |

Pfizer, Amgen, Novartis AG, Boehringer Ingelheim GmbH, Mylan N.V., and AbbVie, among others. |

SEGMENTAL ANALYSIS

By Type Insights

The Humira syringes segment is forecasted to account for the most significant share in the global Humira market during the forecast period due to the rising elderly population globally.

By Application Insights

The Ankylosing spondylitis application segment is estimated to register most of the share in the global Humira market.

REGIONAL ANALYSIS

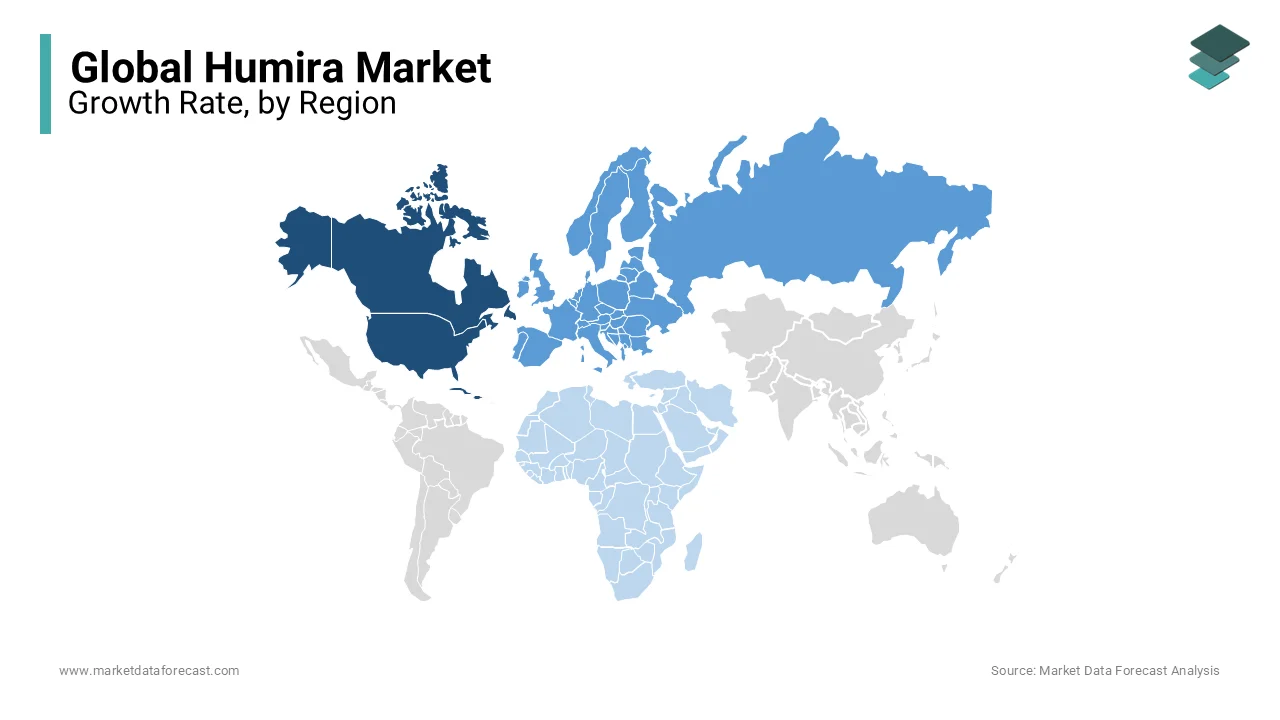

The North American Humira market had the largest share in the global Humira market in 2024, with the latest technology developments and various innovative drugs to enhance treatment procedures. In addition, factors such as the availability of advanced healthcare facilities, technological advancements, and the launch of numerous revolutionary pharmaceuticals are accelerating the North American regional market's growth rate. As a result, the United States was the largest market in the North American market in 2020, accounting for a market share of 65%.

The European Humira market was the second-largest regional market in 2024 owing to the surge in Crohn's disease cases. As a result, Europe has been gradually growing over the last few years. Developing countries such as the United Kingdom and Germany dominate the Humira market owing to the growing scale of pharmaceutical firms and an increasing desire to enhance productivity in the European region. Europe has been growing steadily over the past few years with the rising scale of pharmaceutical companies and increasing demand to expand productivity.

The APAC Humira market is one of the fastest-growing regions in the global market and is quickly catching up to North America in terms of market share. China, India, and Japan are driving Humira's growth in the Asia Pacific.

Brazil, Mexico, and Argentina are the most prosperous countries in Latin America for the Humira market. Brazil is the only one of these countries with a biopharmaceutical regulatory policy, making it a key market. Brazilian patients are also becoming more conscious of biopharmaceutical choices, propelling Humira to the top of the market.

The Middle East and Africa are inclined to substantial growth opportunities during the forecast period.

KEY MARKET PLAYERS

A few promising companies operating in the global Humira market profiled in this report are Pfizer, Amgen, Novartis AG, Boehringer Ingelheim GmbH, Mylan N.V., and AbbVie.

RECENT MARKET DEVELOPMENTS

- Humira's decline in 2019 was expected, as it was the first year the medicine faced biosimilar competition in Europe. As a result, overseas sales dropped by 31%. On the other hand, Humira resisted international erosion and remained a growing force in the United States, which accounted for USD 16.1 billion of its sales this year, up from USD 14.9 billion in 2019.

- Cadila Pharmaceuticals announced the launch of Cadalimab, an adalimumab biosimilar to AbbVie's Humira, in India in August 2020.

- AbbVie stated in May 2019 that it had settled its patent battle with Boehringer Ingelheim over adalimumab. It is a significant settlement because it resolves all Humira-related patent litigation in the United States and opens the door for another biosimilar producer wishing to enter the country.

- In November 2018, AbbVie Inc. announced a patent license agreement with Pfizer Inc for Humira and adalimumab. According to the terms of the deal, AbbVie Inc. awarded Pfizer a non-exclusive license for Humira. As a result of this deal, the company was able to grow its adalimumab market around the globe.

- In 2018, Hetero Drugs Ltd. Launched its biosimilar Humira, marketed as Mabura, while Glenmark Pharmaceuticals Ltd. Signed a licensing agreement with Zydus Cadila to create another adalimumab brand, Adaly. Cipla Ltd. Has since entered the race with Plamumab, an in-licensed variant of adalimumab. Some internet pharmacies also list Envira (adalimumab) from local manufacturer Emcure Pharmaceuticals Ltd., though specifics were not immediately available. Humira is the original branded product.

- In September 2016, Amgen got FDA clearance for AMJEVITA, which is authorized to treat all inflammatory diseases, just like Humira. Because of this product approval, the company has risen to the top of the biotechnology market.

MARKET SEGMENTATION

This research report on the global Humira market has been segmented and sub-segmented based on type, application, and region.

By Type

- Humira Syringe

- Humira Pen

By Application

- Ankylosing Spondylitis

- Rheumatoid Arthritis

- Crohn's Disease

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Frequently Asked Questions

What is driving the growth of the Humira market?

The growth of the Humira market is being driven by factors such as the increasing prevalence of autoimmune diseases, the effectiveness of Humira in treating these diseases, and the expanding indications for Humira.

Who are the key players in the Humira market?

Pfizer, Amgen, Novartis AG, Boehringer Ingelheim GmbH, Mylan N.V., and AbbVie are some of the major players in the humira market.

What are the challenges faced by the Humira market?

Some of the challenges faced by the Humira market include the expiration of patents for the drug, the introduction of biosimilar competitors, and pricing pressures from payers and healthcare systems.

What is the current size of the global Humira market?

The global humira market size was worth USD 9.14 billion in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]