Global Helicopters Market Size, Share, Trends, & Growth Analysis Report – Segmented By Original Equipment Manufacturer (Civil, Commercial and Military), Application (Offshore and Onshore) & Region - Industry Forecast From 2024 to 2032

Global Helicopters Market Size (2024 to 2032)

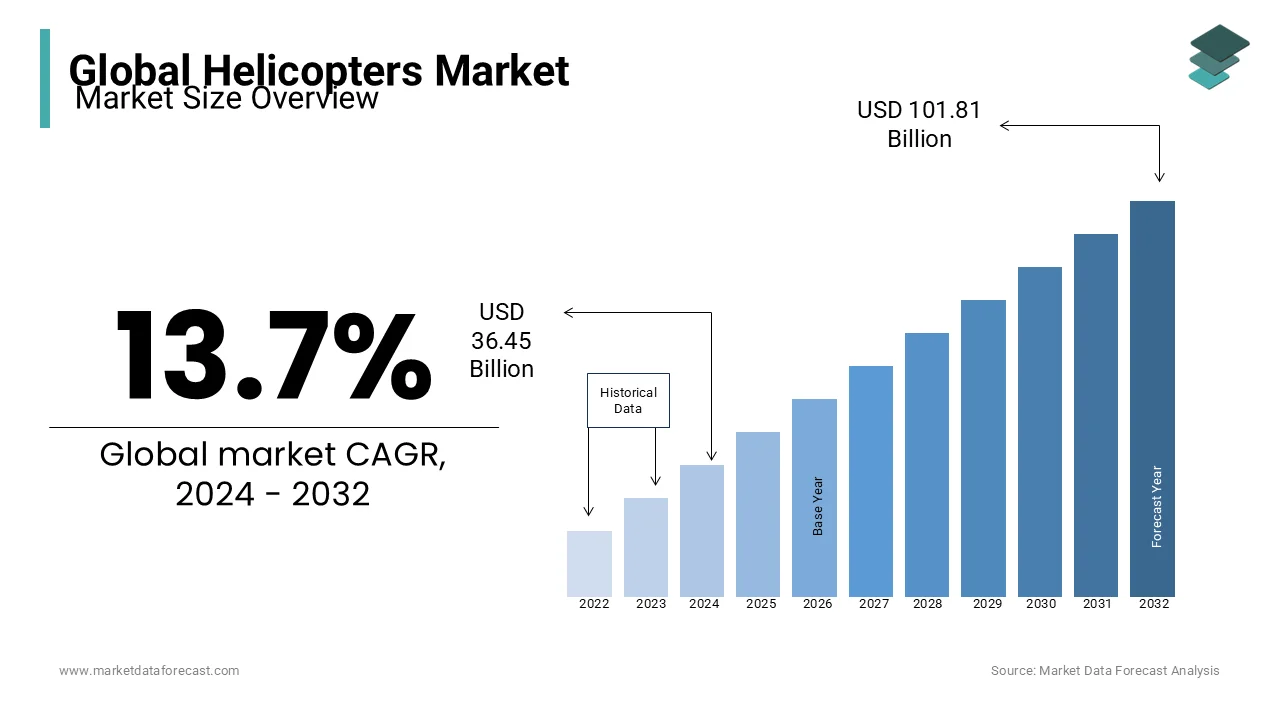

The global market for helicopters was worth USD 32.06 billion in 2023. The global market is expected to grow from USD 36.45 billion in 2024 to USD 101.81 billion by 2032, at a CAGR of 13.7% from 2024 to 2032.

The global helicopters market is experiencing steady growth, driven by increasing demand across both military and civilian sectors. In the defense sector, helicopters play a critical role in operations such as troop transport, search and rescue, and medical evacuation, prompting investments in advanced military helicopter models. Countries such as the United States, India, and China are expanding their helicopter fleets to enhance national security, and modernization programs are driving growth in medium and heavy-lift models. For instance, the U.S. Army has allocated substantial budgets toward acquiring new Chinook and Black Hawk helicopters.

On the civilian side, the demand is growing in sectors like oil and gas, emergency medical services, and urban air mobility. The oil and gas industry relies on heavy-lift helicopters to transport equipment to remote offshore rigs, while emergency services are adopting helicopters for critical medical transport. The market is also seeing a rise in innovation with the integration of electric and hybrid-electric propulsion technologies aimed at reducing emissions and operational costs.

With advancements in avionics, navigation systems, and fuel efficiency, the helicopters market is set to expand further. The Asia-Pacific region is emerging as a high-growth area, particularly in countries like India and Japan, where infrastructure projects and government investments are driving demand.

GLOBAL HELICOPTERS MARKET TRENDS

Rising Demand for Military Helicopters and Fleet Modernization

Military and defense applications continue to drive significant demand for helicopters, with countries prioritizing fleet expansion and modernization to enhance capabilities in tactical transport, search and rescue, and medical evacuation. Global military helicopter spending reached approximately $28 billion in 2022, and is projected to grow at a compound annual growth rate (CAGR) of 4.5% through 2030. The U.S. Army, for example, has invested in new UH-60 Black Hawks and CH-47 Chinooks, while European countries are updating fleets with models like the NH90. This trend reflects global security concerns and the need for versatile, mission-capable helicopters.

Growth in Civil and Commercial Applications, Especially in Oil and Gas and Emergency Services

Civil applications for helicopters are growing in sectors like oil and gas, emergency medical services (EMS), and urban air mobility. The oil and gas industry is heavily reliant on heavy-lift helicopters to transport personnel and equipment to offshore rigs, with demand expected to increase as global energy production expands. Emergency services also contribute to growth; for example, helicopter EMS (HEMS) saw a 12% rise in demand in 2022, as countries invested in helicopters for critical medical transportation. Companies like Airbus and Leonardo are meeting this demand with specialized helicopter models tailored for commercial applications.

Adoption of Hybrid-Electric and Environmentally Sustainable Technologies

The helicopter market is increasingly focused on sustainability, with manufacturers exploring hybrid-electric and fully electric propulsion systems to reduce emissions. Research and development in this area have accelerated, with major players like Airbus and Bell developing hybrid-electric prototypes expected to launch by 2030. The global push toward sustainability is evident in the European Union’s environmental regulations, which target a 55% reduction in emissions by 2030. This trend aligns with the aviation industry's goal to adopt greener technology, providing a strong growth opportunity as regulatory standards tighten and demand for eco-friendly aircraft rises.

MARKET DRIVERS

Increasing Defense Budgets and Modernization Initiatives

Rising global defense budgets are a primary driver of demand in the helicopter market, as countries prioritize fleet expansion and upgrades for military readiness. In 2022, global defense spending reached $2.24 trillion, with a substantial portion allocated to rotary-wing aircraft procurement. The U.S., for instance, has invested heavily in new models like the Sikorsky UH-60 Black Hawk and Boeing CH-47 Chinook, while European nations are modernizing with multi-role helicopters such as the Airbus H225M. These investments aim to enhance tactical transport, medical evacuation, and search-and-rescue capabilities, fueling growth across defense markets.

Rising Demand in Oil and Gas and Emergency Medical Services (EMS)

The oil and gas sector relies on heavy-lift helicopters to transport equipment and personnel to offshore drilling sites, especially in remote areas. This demand is expected to grow, with the global offshore oil market forecasted to expand at a compound annual growth rate (CAGR) of 4% through 2028. Additionally, demand for EMS helicopters is increasing as countries invest in life-saving infrastructure. Helicopter emergency medical services (HEMS) saw a 12% increase in adoption in 2022, as governments focused on improving access to critical care in remote and urban areas alike.

Advances in Hybrid-Electric and Fuel-Efficient Technologies

The helicopter industry is undergoing a technological shift as manufacturers integrate hybrid-electric systems and fuel-efficient engines to align with global sustainability goals. Airbus, for instance, is developing hybrid-electric helicopter prototypes projected to launch by 2030, aiming to reduce emissions by up to 30%. This trend is further encouraged by regulatory pressures in regions like the European Union, where emission reduction targets of 55% by 2030 are set. As a result, there is strong demand for advanced helicopters that meet environmental standards, supporting long-term market growth.

MARKET RESTRAINTS

High Acquisition and Operational Costs

The high costs associated with purchasing and operating helicopters significantly restrain market growth, particularly for commercial operators and smaller defense budgets. For instance, a Sikorsky UH-60 Black Hawk can cost over $21 million per unit, while the hourly operating cost for heavy-lift helicopters like the CH-53K King Stallion can range from $5,000 to $10,000. Maintenance costs add to this financial burden, as helicopters require frequent inspections and part replacements to ensure safety and reliability. This financial barrier limits adoption, especially in developing markets and among cost-sensitive sectors like oil and gas.

Stringent Environmental Regulations and Emission Standards

Environmental regulations pose a significant challenge for helicopter manufacturers, who must now meet increasingly strict emissions and noise standards. In regions like the European Union, regulatory bodies are enforcing stringent emission reduction targets, including a 55% emissions reduction goal by 2030. Meeting these standards requires significant R&D investments in sustainable technologies, which increases production costs. Additionally, noise restrictions in urban areas limit helicopter usage, affecting demand in sectors such as emergency medical services and urban air mobility.

Shortage of Skilled Pilots and Technicians

The helicopter market faces a skills gap, with a shortage of qualified pilots and maintenance technicians limiting operational capacity. According to a 2023 report by the International Air Transport Association (IATA), the aviation industry will require over 600,000 new technicians by 2030, while current training resources are insufficient to meet this demand. This shortage affects both military and commercial sectors, leading to increased training costs and operational delays. For emerging markets, the lack of skilled personnel is a particularly significant barrier, hampering growth potential and limiting expansion opportunities.

MARKET OPPORTUNITIES

Expansion in Urban Air Mobility (UAM) and Air Ambulance Services

Urban air mobility (UAM) is an emerging sector with significant growth potential for helicopters, particularly in congested metropolitan areas. With UAM projected to become a $9 billion market by 2030, demand for helicopters and advanced air taxis is expected to rise as cities explore solutions for traffic congestion. Additionally, helicopter emergency medical services (HEMS) are expanding globally; in 2022, HEMS saw a 12% rise in demand as governments and private healthcare providers invested in air ambulance services to enhance rapid response capabilities. The growing need for quick medical transport in both urban and remote areas presents a lucrative market for helicopters designed for emergency services.

Growth in Offshore Wind Energy Projects and Oil and Gas Operations

The global transition toward renewable energy has led to a surge in offshore wind projects, creating new demand for helicopters to transport equipment and personnel to offshore sites. The offshore wind energy sector is expected to grow at a compound annual growth rate (CAGR) of 15% through 2030, particularly in Europe and Asia-Pacific, where countries are heavily investing in clean energy infrastructure. This expansion complements the ongoing demand in the offshore oil and gas sector, where helicopters are essential for remote logistics. Companies like Airbus and Leonardo are developing specialized heavy-lift helicopter models tailored for energy projects, seizing growth opportunities in this field.

Adoption of Hybrid and Fully Electric Helicopters

The helicopter market is poised for growth as manufacturers develop hybrid and electric models, aligning with global sustainability goals and stricter environmental regulations. By 2030, the hybrid-electric and electric helicopter segment is expected to reach a market value of $4.2 billion. Major players, including Bell and Airbus, are already testing prototypes of hybrid-electric helicopters, targeting emissions reductions of up to 30% compared to traditional models. This push toward sustainable aviation offers a competitive edge for companies investing in eco-friendly models, opening opportunities in regions with stringent emissions targets, such as the European Union.

MARKET CHALLENGES

Complex Regulatory Compliance and Certification Requirements

Meeting regulatory and certification standards is a significant challenge for helicopter manufacturers. Each country or region, such as the United States (FAA), Europe (EASA), and others, enforces strict safety, emissions, and noise regulations, which can differ substantially. These complex requirements increase development time and costs, as each model must be certified for multiple markets. For instance, delays in certification of hybrid-electric models due to stringent environmental and safety standards have pushed back launch timelines for major players like Airbus. This regulatory complexity not only raises operational costs but can also delay market entry, hindering the growth of innovative models.

Dependence on Economic Conditions and Government Budgets

The demand for helicopters, especially in military and public service sectors, is heavily influenced by economic conditions and government budgets. Economic downturns or budget reallocations can significantly impact procurement plans and market growth. For instance, during the COVID-19 pandemic, some countries delayed or reduced defense spending, affecting orders for new helicopters. According to the Stockholm International Peace Research Institute, global defense budgets saw fluctuations post-pandemic, impacting the steady flow of defense contracts in developing markets. This dependency on economic stability and public funding makes the helicopter market susceptible to financial uncertainties, impacting both production and demand.

Supply Chain Disruptions and Component Shortages

Global supply chain disruptions, exacerbated by the COVID-19 pandemic and geopolitical tensions, have created ongoing challenges in obtaining critical helicopter components. Shortages in key materials, such as semiconductors and specialized aerospace-grade metals, have delayed production schedules and increased costs for manufacturers. In 2022, Airbus reported extended delivery times due to delays in securing components, impacting production rates and delivery commitments. Such supply chain disruptions not only impact the operational capacity of manufacturers but can also strain relationships with clients, who rely on timely deliveries for fleet expansion or replacement.

Impact of COVID-19 on the helicopters market

The COVID-19 pandemic significantly impacted the global helicopters market, causing production delays, supply chain disruptions, and decreased demand across commercial sectors. Lockdowns and restrictions limited workforce availability, leading to temporary shutdowns and delayed production schedules for major manufacturers such as Airbus and Boeing. Additionally, a global shortage of essential components, including semiconductors and aerospace-grade materials, further affected manufacturing timelines and increased costs. The commercial helicopter sector, including oil and gas transport and tourism, faced reduced demand due to limited travel and paused infrastructure projects. However, the pandemic underscored the importance of helicopters in emergency medical services (EMS) and critical supply transport, which saw increased deployment for pandemic response efforts. The military sector remained relatively stable as governments maintained essential defense spending. Post-pandemic, the market is gradually recovering, with renewed focus on supply chain resilience and an increased interest in digital MRO solutions to enhance operational efficiency and reliability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

13.7% |

|

Segments Covered |

By Original Equipment Manufacturer, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Helicopter Inc. (Airbus Group), Agusta Westland, Bell Helicopter, Korea Aerospace Industries (KAI), Avicopter, Eurocopter, PZL Swidnik, Enstrom Helicopter Corporation, Kaman Aerospace, Sikorsky Aircraft Corporation, Columbia Helicopters, Leonardo S.p.A., Lockheed Martin Corporation (Sikorsky), MD Helicopters Inc., Boeing Rotorcraft Systems, Jiangxi Changhe Aviation Industry Ltd., Robinson Helicopter Company, Russian Helicopters, JSC, and Textron Inc. |

SEGMENTAL ANALYSIS

Global Helicopters Market Analysis By OEM

The military segment is the largest segment in the helicopters market and accounted for 55.4% of the global market share in 2023. The growth of the military segment is majorly driven by global defense budgets and the need for advanced, multi-mission helicopters for operations such as tactical transport, search and rescue, and medical evacuation. Global defense spending, which reached $2.24 trillion in 2022, reflects an ongoing focus on fleet modernization and new acquisitions. Key players like Sikorsky and Airbus are capitalizing on this demand with models like the UH-60 Black Hawk and NH90, which are widely adopted by armed forces. The U.S., India, and China are among the primary contributors to military helicopter spending, enhancing this segment’s growth and stability.

The commercial segment is projected to grow at a CAGR of 5.2% over the forecast period. An increase in the demand from sectors like offshore oil and gas, emergency medical services (EMS), and urban air mobility are propelling the expansion of the commercial segment in the global market. For instance, the offshore oil and gas industry requires heavy-lift helicopters for remote transport, while the EMS market saw a 12% rise in helicopter demand in 2022 due to increased investments in critical medical transport. Innovations in hybrid-electric technology and regulatory shifts favoring sustainable aviation are also boosting demand for new commercial models, particularly in regions like Asia-Pacific and Europe.

Global Helicopters Market Analysis By Application

The onshore segment led the market and captured 60.8% of the global market share in 2023. The growth of the onshore segment is primarily driven by diverse applications, including emergency medical services (EMS), law enforcement, and firefighting. For example, EMS helicopters saw a 12% increase in demand in 2022 as governments expanded air ambulance services for critical care. Additionally, onshore operations in agriculture, search and rescue, and surveillance contribute to sustained demand. The U.S., Europe, and parts of Asia-Pacific lead this segment due to government investments in public safety and medical infrastructure, highlighting the essential role of helicopters in enhancing emergency response capabilities.

The offshore segment is anticipated to progress at a CAGR of 5.5% from 2024 to 2032. The growth of the offshore segment is primarily fueled by demand from the oil and gas and renewable energy industries, especially for transporting personnel and equipment to remote sites. The global offshore wind energy sector, expected to grow at a CAGR of 15% through 2030, is boosting demand for helicopters in Asia-Pacific and Europe. The need for reliable transport solutions in offshore drilling and wind farms, where helicopters play a critical logistics role, is driving this segment’s rapid expansion, particularly in regions investing heavily in energy infrastructure.

REGIONAL ANALYSIS

North America dominated helicopters market and held 30% of the global market share in 2023. The North American market is driven by high defense spending, especially in the U.S., where military helicopters are crucial for operations such as search and rescue, transport, and medical evacuation. The U.S. Department of Defense has increased procurement of multi-mission helicopters like the UH-60 Black Hawk, aligning with fleet modernization initiatives. Additionally, the region’s strong demand for emergency medical services (EMS) and offshore helicopters supports the commercial sector. Canada also contributes to growth with investments in helicopters for search and rescue and EMS. The U.S. dominates the North American market, with over 70% of the regional share due to substantial defense and public safety budgets. Canada focuses on EMS and firefighting applications, enhancing regional demand for specialized onshore helicopters.

Europe is predicted to witness a CAGR of 4.4% over the forecast period. The demand for helicopters in Europe is primarily driven by military upgrades and commercial applications in offshore wind energy and EMS. Countries like France, Germany, and the United Kingdom are modernizing their military fleets, investing in advanced helicopters like the Airbus H225M. The European Union’s push for sustainable energy is also contributing to increased demand for offshore transport helicopters in support of wind energy projects. Additionally, Europe’s stringent safety and environmental regulations are pushing for fuel-efficient and hybrid-electric helicopter solutions, boosting demand for eco-friendly models. France and Germany are key markets, focusing on defense and rescue applications. The U.K. leads in offshore helicopter demand due to its significant investments in the North Sea oil and wind energy sectors, reinforcing the region’s reliance on specialized heavy-lift helicopters.

The helicopters market in Asia Pacific projected to grow at the highest CAGR of 5.3% over the forecast period. The market growth in the Asia-Pacific is primarily fueled by rising defense budgets, rapid fleet expansions, and increasing demand for EMS and offshore applications. Countries like China, India, and Japan are investing heavily in military and multi-purpose helicopters to enhance defense capabilities. Additionally, the expansion of offshore oil and gas operations in Southeast Asia, coupled with infrastructure investments, is driving demand for both onshore and offshore helicopters. Japan and South Korea are also prioritizing search and rescue and disaster response capabilities. China is the region’s largest market, with strong government support for military expansion. India follows, with a focus on defense and EMS, while Japan leads in onshore applications for disaster management and search and rescue.

Latin America held 10.8% of the global market share in 2023. The law enforcement, EMS, and offshore oil and gas are the factors propelling the helicopters market in Latin America. Brazil and Mexico lead in helicopter procurement for various public safety applications, including surveillance, firefighting, and medical transport. The offshore oil industry in Brazil further supports demand for heavy-lift helicopters for logistics. However, limited budgets and economic fluctuations in some Latin American countries can impact procurement capacity and overall market growth. Brazil is the largest market in Latin America, with a strong focus on offshore transport and public safety applications. Mexico also contributes significantly, driven by helicopters for security operations and emergency response.

KEY PLAYERS IN THE GLOBAL HELICOPTERS MARKET

Companies playing a leading role in the global helicopters market include Helicopter Inc. (Airbus Group), Agusta Westland, Bell Helicopter, Korea Aerospace Industries (KAI), Avicopter, Eurocopter, PZL Swidnik, Enstrom Helicopter Corporation, Kaman Aerospace, Sikorsky Aircraft Corporation, Columbia Helicopters, Leonardo S.p.A., Lockheed Martin Corporation (Sikorsky), MD Helicopters Inc., Boeing Rotorcraft Systems, Jiangxi Changhe Aviation Industry Ltd., Robinson Helicopter Company, Russian Helicopters, JSC, and Textron Inc.

RECENT MARKET HAPPENINGS

- In March 2023, Airbus Group launched the H160M helicopter model for both civil and military applications, targeting increased versatility and fuel efficiency. This release enhances Airbus’s portfolio in multi-mission helicopter solutions to meet global demand.

- In January 2022, Leonardo S.p.A. expanded its AW609 program for civil certification, aiming to secure regulatory approvals in the U.S. and Europe. This move positions Leonardo to tap into urban air mobility and civilian transport markets.

- In October 2022, Bell Helicopter launched its Bell 360 Invictus prototype, specifically designed for the U.S. Army’s Future Attack Reconnaissance Aircraft program. This initiative aligns Bell with future military needs, enhancing its competitive edge in defense.

- In May 2023, Korea Aerospace Industries (KAI) partnered with Lockheed Martin to co-develop a multi-role helicopter for the South Korean military, strengthening KAI’s capabilities in defense aviation and regional partnerships.

- In September 2021, Russian Helicopters (JSC) unveiled its new Ka-62 civil helicopter model, focused on regional transport and oil and gas applications. This expansion broadens Russian Helicopters’ commercial offerings and market reach.

- In November 2022, Boeing Rotorcraft Systems delivered upgraded CH-47F Block II Chinook helicopters to the U.S. Army, enhancing payload capacity and efficiency. This delivery reaffirms Boeing’s commitment to supporting modernized military requirements.

- In August 2022, Sikorsky Aircraft Corporation, a Lockheed Martin subsidiary, introduced a hybrid-electric helicopter prototype, aiming for reduced fuel consumption and lower emissions. This innovation aligns with industry sustainability goals, positioning Sikorsky as a leader in eco-friendly aviation.

- In April 2023, Robinson Helicopter Company launched a new digital flight training program, aimed at providing virtual maintenance and pilot training to enhance safety and operational skills, boosting Robinson’s customer support capabilities.

- In December 2021, Textron Inc. acquired Pipistrel, an electric aircraft manufacturer, to integrate electric propulsion technology into its rotorcraft division. This acquisition accelerates Textron’s move toward sustainable, hybrid-electric helicopter models.

- In February 2023, Enstrom Helicopter Corporation launched a new variant of its popular 480B helicopter, incorporating advanced avionics and safety features tailored for EMS and law enforcement. This upgrade strengthens Enstrom’s presence in the onshore helicopter segment.

DETAILED SEGMENTATION OF THE GLOBAL HELICOPTERS MARKET INCLUDED IN THIS REPORT

This research report on the global helicopter market has been segmented and sub-segmented into the following categories.

By OEM

- Civil

- Commercial

- Military

By Application

- Offshore

- Onshore

By Region

- North America

- Asia-Pacific

- Europe

- Latin America

- Middle East & America

Frequently Asked Questions

What factors are driving the growth of the global helicopter market?

Key drivers include increasing demand for emergency medical services (EMS), search and rescue operations, and law enforcement activities. Additionally, the rise in defense budgets and modernization programs globally contributes to market growth.

What technological advancements are influencing the helicopter market?

Innovations such as advanced avionics, the integration of artificial intelligence, electric and hybrid propulsion systems, and the development of unmanned aerial vehicles (UAVs) are significantly impacting the helicopter market.

What is the role of helicopters in the oil and gas industry?

Helicopters play a crucial role in the oil and gas industry by transporting personnel and equipment to offshore rigs and remote locations. They provide a vital link for logistical support, ensuring the efficiency and safety of operations.

How is the demand for military helicopters shaping the market?

The demand for military helicopters is a major market driver, with countries investing in advanced rotorcraft for defense and surveillance missions. Modernization programs and procurement of new-generation helicopters are boosting market growth, especially in regions like Asia-Pacific and the Middle East.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]