Global Hair Care Market Size, Share, Trends & Growth Forecast Report – Segmented By Product (Hair Colorants, Shampoo, Conditioner, Hair Oil, Others), Distribution Channel (Supermarket/Hypermarket, Specialty Stores, Online Stores, Others) And By Region (North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) – Industry Analysis From (2025 to 2033)

Global Hair Care Market Size

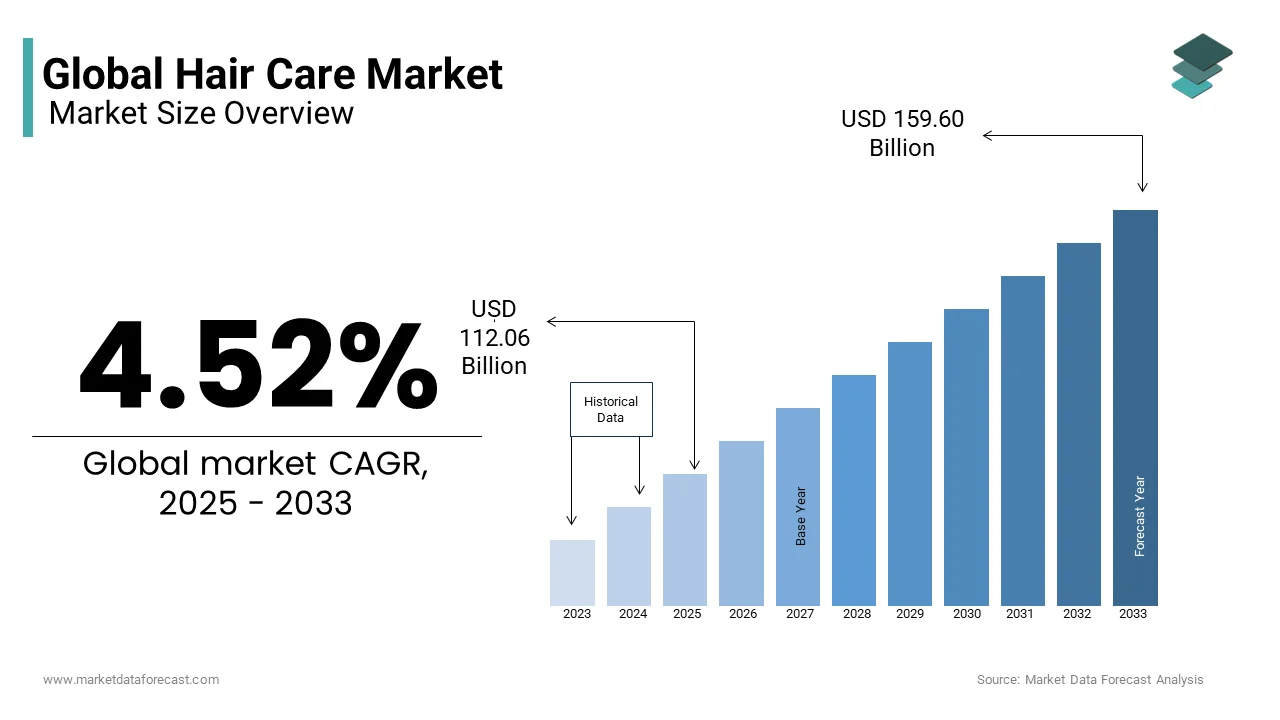

The global hair care market size was valued at USD 107.21 billion in 2024 and is anticipated to reach USD 112.06 billion in 2025 from USD 159.60 billion by 2033, growing at a CAGR of 4.52% during the forecast period from 2025 to 2033.

Current Scenario of the Global Hair Care Market

Hair care includes products and treatments designed to maintain scalp health, enhance hair aesthetics, and address common hair-related concerns. These include shampoos, conditioners, hair oils, serums, styling products, and treatments formulated to tackle issues such as dryness, dandruff, hair thinning, and scalp disorders. With advancements in dermatological science and biotechnology, the hair care market is witnessing an increasing emphasis on personalized hair care solutions tailored to different hair types, ethnicities, and environmental conditions.

Hair health is a significant concern worldwide, with various factors influencing its quality, including genetics, lifestyle, pollution, diet, and hormonal changes. According to the American Academy of Dermatology, it is normal to lose between 50 to 100 hairs per day as part of the natural hair growth cycle. However, excessive hair loss affects approximately 80 million individuals in the United States alone, with androgenetic alopecia being the most prevalent form of hair loss.

Environmental factors also play a critical role in hair health. Research indicates that exposure to high levels of air pollutants, including particulate matter and heavy metals, can lead to scalp inflammation, increased hair shedding, and weakened hair strands. Furthermore, studies highlight the growing correlation between stress and hair disorders, with chronic stress linked to conditions such as telogen effluvium and alopecia areata.

The growing preference from consumers for natural and chemical-free formulations is another emerging trend in the global hair care market. Studies suggest that certain ingredients commonly used in hair care products can strip the hair of its natural oils, leading to dryness and increased susceptibility to damage. As a result, there is a rising demand for organic and plant-based ingredients, including argan oil, coconut oil, biotin, and keratin, known for their restorative and protective properties.

Market Drivers

Increasing Consumer Awareness and Demand for Natural Products

The growing consumer preference for natural and organic hair care products is a key driver of the market. According to the Organic Trade Association, the U.S. organic personal care market, including hair care, grew by 9% in 2021, reaching $13 billion. Consumers are increasingly prioritizing sulfate-free, paraben-free, and plant-based formulations due to rising concerns about synthetic chemicals. Certifications like USDA Organic and COSMOS have gained prominence, ensuring product authenticity and transparency. The Environmental Working Group (EWG) reports that nearly 60% of consumers now check ingredient labels before purchasing personal care products, reflecting a shift toward informed decision-making and sustainable consumption.

Rising Prevalence of Hair-related Disorders

Hair-related disorders, such as alopecia and dandruff, are becoming more common globally, fueling demand for specialized hair care solutions. The American Academy of Dermatology estimates that approximately 80 million men and women in the United States alone are affected by hereditary hair loss. In India, a study conducted by the Indian Journal of Dermatology highlights that a substantial share of the population experiences dandruff-related issues, driving demand for medicated shampoos and treatments. The World Health Organization (WHO) has identified stress, pollution, and poor nutrition as significant contributors to scalp problems. These trends underscore the increasing need for targeted and effective hair care solutions.

Market Restraints

High Costs of Premium and Specialized Products

The high cost of premium and specialized hair care products is a significant restraint, particularly in price-sensitive markets. According to the U.S. Bureau of Labor Statistics, personal care products, including hair care, experienced an average annual price increase of 3.8% from 2017 to 2022, slightly above the general inflation rate. This upward trend has made organic and medicated products less accessible to budget-conscious consumers. A report by the World Health Organization highlights that affordability remains a barrier in low-income regions, where households spend less of their income on non-essential items like premium hair care. Additionally, a study published by the National Center for Biotechnology Information (NCBI) notes that sourcing certified organic ingredients and advanced formulations increases production costs. These factors limit market penetration, particularly among middle- and low-income demographics, hindering broader industry growth.

Stringent Regulatory Standards and Compliance Challenges

Stringent regulatory standards and compliance requirements present a major challenge for the hair care industry, especially for smaller players. The U.S. Food and Drug Administration (FDA) mandates rigorous safety testing and labeling requirements, which can be costly and time-intensive. Similarly, the European Union’s REACH regulation, enforced by the European Chemicals Agency (ECHA), requires companies to ensure the safety of all chemical ingredients, adding to operational complexities. A report by the International Trade Centre indicates that compliance with global regulatory frameworks can increase production costs by 10-20%, disproportionately affecting small and medium-sized enterprises. Furthermore, the FDA reports that non-compliance with labeling and ingredient transparency rules leads to product recalls, which can cost companies millions annually. These regulatory hurdles slow innovation and market entry, limiting the availability of affordable and diverse hair care solutions globally.

Market Opportunities

Growing Demand for Sustainable and Eco-Friendly Packaging

The increasing consumer preference for sustainable and eco-friendly packaging presents a significant opportunity for the hair care market. According to a report by the Environmental Protection Agency (EPA), packaging waste from the cosmetics industry, including hair care, accounts for over 70% of the sector's total waste, prompting calls for greener alternatives. The United Nations Environment Programme (UNEP) states that 60% of consumers globally are willing to pay more for products with recyclable or biodegradable packaging, as sustainability becomes a key purchasing factor. This trend is driving innovation in materials such as bioplastics, glass, and refillable containers. Companies adopting eco-friendly practices can enhance brand loyalty and appeal to environmentally conscious consumers, particularly in regions like Europe and North America.

Expansion into Emerging Markets with Rising Disposable Incomes

The expansion into emerging markets offers a lucrative opportunity for the hair care industry, driven by rising disposable incomes and urbanization. The World Bank reports that the middle-class population in Asia and Africa is expected to grow by approximately 150 million people by 2030, significantly boosting spending on personal care products. In 2023-24, the estimated average Monthly Per Capita Expenditure (MPCE) in rural and urban India was Rs. 4,122 and Rs. 6,996, respectively, excluding the value of items received free of cost through various social welfare programs. These regions present untapped potential for hair care brands to introduce affordable, culturally relevant products. By leveraging localized marketing strategies and distribution networks, companies can capitalize on this growth and establish a strong presence in high-potential markets.

Market Challenges

Counterfeit Products and Intellectual Property Concerns

The proliferation of counterfeit hair care products poses a significant challenge to the market, undermining brand reputation and consumer trust. According to the Organisation for Economic Co-operation and Development (OECD), counterfeit goods account for approximately 2.5% of global trade in 2019 which climbed to 3.3% in 2023, with personal care products being one of the most affected categories. The U.S. Food and Drug Administration (FDA) has issued warnings about counterfeit shampoos and conditioners that often contain harmful substances like diethylene glycol, which can cause severe health risks, including skin irritation and allergic reactions. A report by the Global Brand Counterfeiting Report estimates that the beauty and personal care industry loses $30.3 billion annually due to counterfeit products. These illicit items are widely available on e-commerce platforms, making it difficult for consumers to distinguish between genuine and fake products. Brands face challenges in enforcing intellectual property rights, particularly in regions with weak regulatory frameworks, complicating efforts to combat this issue effectively.

Limited Access to Clean Water for Product Usage

Limited access to clean water in many regions presents a major challenge for the hair care market, as water is essential for product application and rinsing. The World Health Organization (WHO) reports that over 2 billion people globally lack access to safely managed drinking water services, with rural areas in Sub-Saharan Africa and South Asia being the most affected. This scarcity restricts the use of water-based hair care products such as shampoos and conditioners, limiting market penetration in these regions. A report by the United Nations Children's Fund (UNICEF) highlights that inadequate water infrastructure disproportionately impacts women and children, who are primary users of hair care products. Additionally, the Intergovernmental Panel on Climate Change (IPCC) emphasizes that water scarcity is expected to worsen due to climate change, with global water demand projected to exceed supply by 40% by 2030. This challenge necessitates innovation in water-efficient or no-rinse formulations to cater to underserved populations.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.52% |

|

Segments Covered |

By Product, Distribution Channel Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

L'Oréal S.A. (France), Coty Inc. (U.S.), Henkel AG & Co. KGaA (Germany), Unilever PLC (U.K.), The Procter & Gamble Company (U.S.), Revlon, Inc. (U.S.), Kao Corporation (Japan), Natura & Co. (Brazil), Johnson & Johnson Services, Inc. (U.S.), Aveda Corporation (U.S.). |

SEGMENT ANALYSIS

Global Hair Care Market Analysis By Product

The shampoo segment held 32.2% of the global market share in 2024. The universal appeal and daily usage across demographics is primarily contributing to the domination of the shampoo segment in the global hair care market. The World Health Organization emphasizes that a sizeable portion of households globally use shampoo regularly, making it an essential personal care product. Innovations such as sulfate-free, anti-dandruff, and moisturizing formulations cater to diverse consumer needs, further boosting demand. Its affordability, coupled with widespread availability, ensures consistent demand in both developed and emerging markets, solidifying its position as the largest segment.

On the other hand, the hair colorants segment is estimated to grow at a CAGR of 8.2% over the forecast period owing to the rising demand for personalized grooming and the increasing prevalence of gray hair due to aging populations. A study published by the National Center for Biotechnology Information (NCBI) highlights that a notable percentage of women aged 40-60 use hair colorants to maintain youthful appearances. Additionally, social media trends have encouraged younger consumers to experiment with bold and vibrant colors, driving adoption. Innovations like ammonia-free and plant-based dyes cater to health-conscious consumers. As urbanization accelerates in the Asia-Pacific region, countries like India and China are expected to contribute significantly to this growth, making hair colorants a focal point for manufacturers aiming to meet evolving beauty standards.

Global Hair Care Market Analysis By Distribution Channel

The supermarkets and hypermarkets segment accounted for 40.1% of the global market share in 2024 due to their widespread presence, convenience, and ability to offer a wide range of products under one roof. The U.S. Department of Agriculture highlights that a significant share of consumers prefer purchasing personal care items, including hair care, from these outlets due to trust in product authenticity and availability of discounts. Additionally, supermarkets/hypermarkets benefit from high footfall and impulse buying behaviour. Their established supply chains and accessibility across urban and rural areas make them indispensable for manufacturers aiming to maximize reach.

In contrast, the online store segment is rapidly growing and is predicted to showcase a CAGR of 11.8% over the forecast period owing to factors such as rising internet penetration and e-commerce adoption and particularly in Asia-Pacific and North America. The U.S. Census Bureau notes that e-commerce retail sales grew by 10.9% in 2022, with beauty and personal care products being a significant contributor. Convenience, competitive pricing, and access to customer reviews enhance consumer preference for online shopping. Platforms like Amazon and Alibaba have expanded their beauty segments, offering personalized recommendations and subscription services. This shift underscores the importance of digital strategies for brands aiming to capitalize on evolving consumer habits.

REGIONAL ANALYSIS

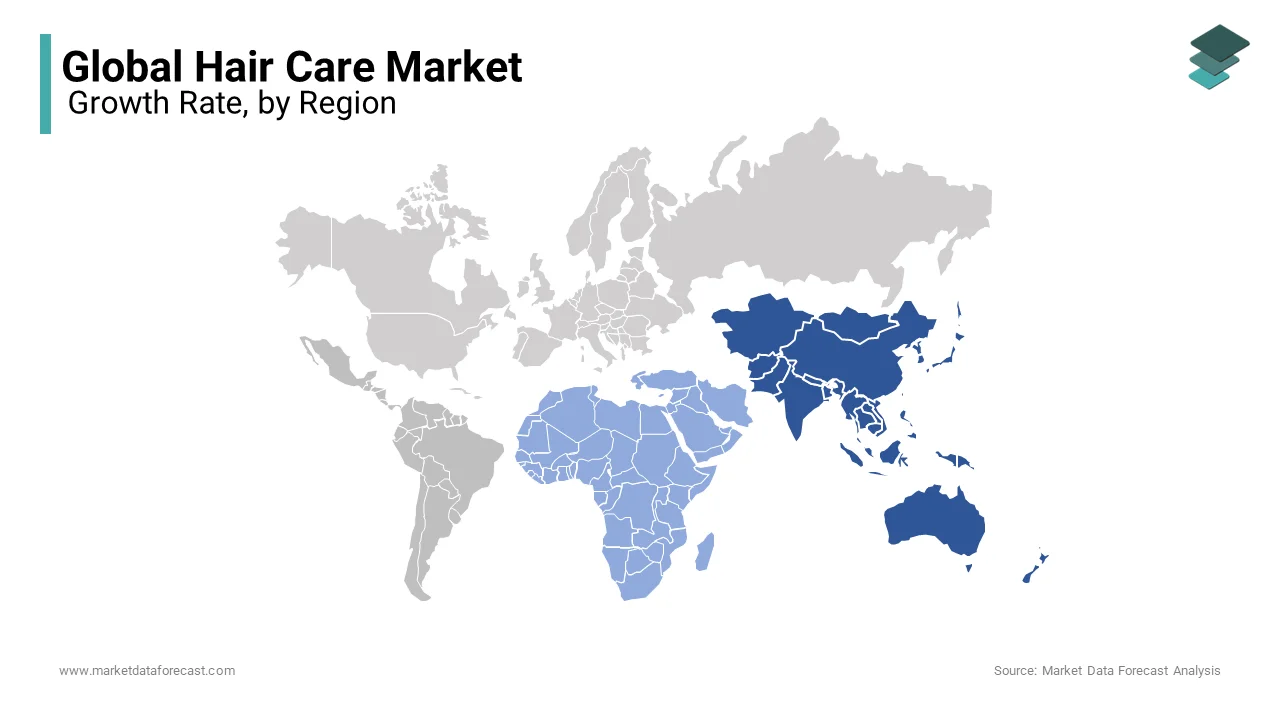

Asia-Pacific dominated the hair care market by accounting for 38.2% of the global market share in 2024. The leading role of Asia-Pacific region in the global market is majorly attributed to its large population, rising disposable incomes, and rapid urbanization. The World Bank highlights that over 50% of the global middle-class population resides in Asia, fueling demand for both premium and affordable hair care products. Countries like China and India are key contributors due to their cultural emphasis on grooming and increasing adoption of global beauty trends. Additionally, the growing popularity of natural and Ayurvedic formulations boosts demand. The region’s economic growth and diverse consumer preferences make it a critical hub for manufacturers aiming to expand globally.

The Middle East and Africa hair care market is anticipated to grow at a CAGR of 6.8% from 2025 to 2033. Factors such as rising awareness about personal grooming, urbanization, and increasing investments in the beauty industry are driving the regional market expansion. The African Development Bank notes that Africa’s beauty market is driven by a youthful population and growing demand for halal-certified and natural products. Additionally, the UAE and Saudi Arabia are emerging as luxury hubs, with imports of high-end hair care products rising annually, according to the International Trade Centre. A study by Euromonitor highlights that social media trends and celebrity endorsements further boost demand. This region’s rapid expansion underscores its potential for brands targeting untapped markets.

North America grew steadily in the global hair care. The region’s growth is driven by innovation in sustainable and organic products, aligning with consumer demand for eco-friendly solutions. A report by the U.S. Department of Agriculture (USDA) highlights that sizeable portion of consumers in the U.S. prefer sulfate-free and paraben-free formulations. Additionally, the rise of personalized hair care solutions, such as custom shampoos and conditioners, has gained traction, particularly among younger demographics. Canada contributes significantly due to its growing adoption of natural and vegan products, supported by stringent environmental regulations.

Europe continues to progress in the hair care market despite recent challenges at the economic front. Germany and France are the largest contributors, driven by strict regulatory standards favoring eco-friendly and cruelty-free products under the European Union’s REACH regulation. The European Environment Agency reports that a large percentage of consumers prioritize sustainability, boosting demand for biodegradable packaging and plant-based formulations. The region’s focus on premiumization and luxury hair care products also supports growth, with the UK’s post-pandemic recovery spurring demand for salon-quality treatments. Europe’s hair care market is fueled by rising urbanization and increasing investments in clean beauty innovations.

Latin America represents a growing market for hair care. Brazil is the largest contributor, accounting for over 45% of the region’s revenue, driven by its well-established cosmetics industry and cultural emphasis on grooming. The Brazilian Ministry of Economy notes that the country’s hair care market grew by considerably in 2022 which is supported by demand for natural and locally sourced ingredients like açaí and coconut oil. Mexico and Argentina also show significant potential due to rising disposable incomes and urbanization. Social media trends and celebrity endorsements further drive product adoption, particularly among millennials and Gen Z.

Top 3 Players in the market

L'Oréal S.A.

L'Oréal, headquartered in Clichy, France, is the world's largest cosmetics and beauty company. Founded in 1909, it has a diverse portfolio encompassing hair care, skin care, makeup, and fragrances. In the hair care segment, L'Oréal offers a wide range of products under various brands, catering to different consumer needs and preferences. The company's commitment to research and development has led to innovative products that have significantly influenced global hair care trends.

Henkel AG & Co. KGaA

Henkel, a German multinational, operates in both consumer and industrial sectors. Within its Beauty Care division, Henkel offers a variety of hair care products, including shampoos, conditioners, hair colorants, and styling products. The company markets these products under well-known brands such as Schwarzkopf, Syoss, and Dial, serving both retail consumers and professional salons. Henkel's focus on innovation and quality has solidified its position as a leader in the global hair care market.

Coty Inc.

Coty is an American multinational beauty company with a strong presence in the hair care industry. The company develops, manufactures, and markets a wide range of hair care products, including shampoos, conditioners, styling products, and hair colorants. Coty's acquisition of several beauty brands from Procter & Gamble in 2016 expanded its portfolio, making it a significant player in the global hair care market.

Top strategies used by the key market participants

KEY MARKET PLAYERS

L'Oréal S.A. (France), Coty Inc. (U.S.), Henkel AG & Co. KGaA (Germany), Unilever PLC (U.K.), The Procter & Gamble Company (U.S.), Revlon, Inc. (U.S.), Kao Corporation (Japan), Natura & Co. (Brazil), Johnson & Johnson Services, Inc. (U.S.), Aveda Corporation (U.S.). these are the market players that are dominating the global hair care market.

COMPETITIVE LANDSCAPE

Product innovation and R&D investment play a crucial role in maintaining a competitive edge. Companies continuously develop advanced formulations, AI-driven personalization, and biotech solutions to enhance hair care effectiveness. For example, L’Oréal’s AI-powered scalp analysis and Henkel’s biodegradable, sulfate-free formulations showcase their commitment to science-backed hair care innovations. Coty, on the other hand, emphasizes vegan and cruelty-free products, responding to growing consumer demand for ethical beauty solutions.

Mergers, acquisitions, and strategic partnerships help companies expand their market reach and strengthen their portfolios. L'Oréal's acquisition of Carol’s Daughter enabled it to dominate the ethnic hair care segment, while Henkel’s purchase of Zotos International bolstered its professional hair care division. Similarly, Coty’s acquisition of Wella from Procter & Gamble allowed it to expand its presence in the salon and professional hair care market.

Digital transformation and e-commerce expansion have reshaped the hair care industry, with brands leveraging D2C (Direct-to-Consumer) models, influencer marketing, and AI-driven personalization to engage consumers. L'Oréal’s ModiFace technology, for instance, provides virtual try-ons for hair colors, while Henkel utilizes big data analytics to predict consumer preferences. Coty’s strategic partnerships with Amazon and Sephora have also strengthened its online presence and enhanced accessibility.

RECENT HAPPENINGS IN THIS MARKET

- In December 2024, Mayfair Equity Partners successfully exited its investment in Tangle Teezer, a British haircare brand renowned for its innovative detangling brushes. The firm had previously invested in Tangle Teezer, contributing to its global expansion and product development. The exit underscores Mayfair's strategy of partnering with high-growth consumer brands and realizing value through strategic sales.

- In October 2024, European-based beauty and personal care platform Sodalis Group acquired HRB Brands from Tengram Capital Partners, a middle-market private equity firm. HRB Brands is a leading hair care and skin cleansing business, encompassing twenty brands such as Alberto VO5, Zest, Coast, Brut, Pert, Sure, Zero Frizz, Rave, SGX NYC, and Thicker Fuller Hair. This acquisition enhances Sodalis Group's portfolio and expands its presence in the North American market.

MARKET SEGMENTATION

This research report on the global hair care market is segmented ans sub-segmented into the following categories.

By Product

- Hair Colorants

- Shampoo

- Conditioner

- Hair Oil

- Others

By Distribution Channel

- Supermarket/Hypermarket

- Specialty Stores

- Online Stores

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]