Global Gourmet Salt Market Size, Share, Trends & Growth Forecast Report – Segmented By Type (Fleur De Sel, Sel Gris, Himalayan Salt, Flake Salt And Specialty Salt), Application (Bakery & Confectionery, Meat & Poultry Products, Seafood Products, Sauces & Savory), And Region (North America, Europe, Asia Pacific, Latin America, And Middle East & Africa) - Industry Analysis (2025 To 2033)

Global Gourmet Salt Market Size

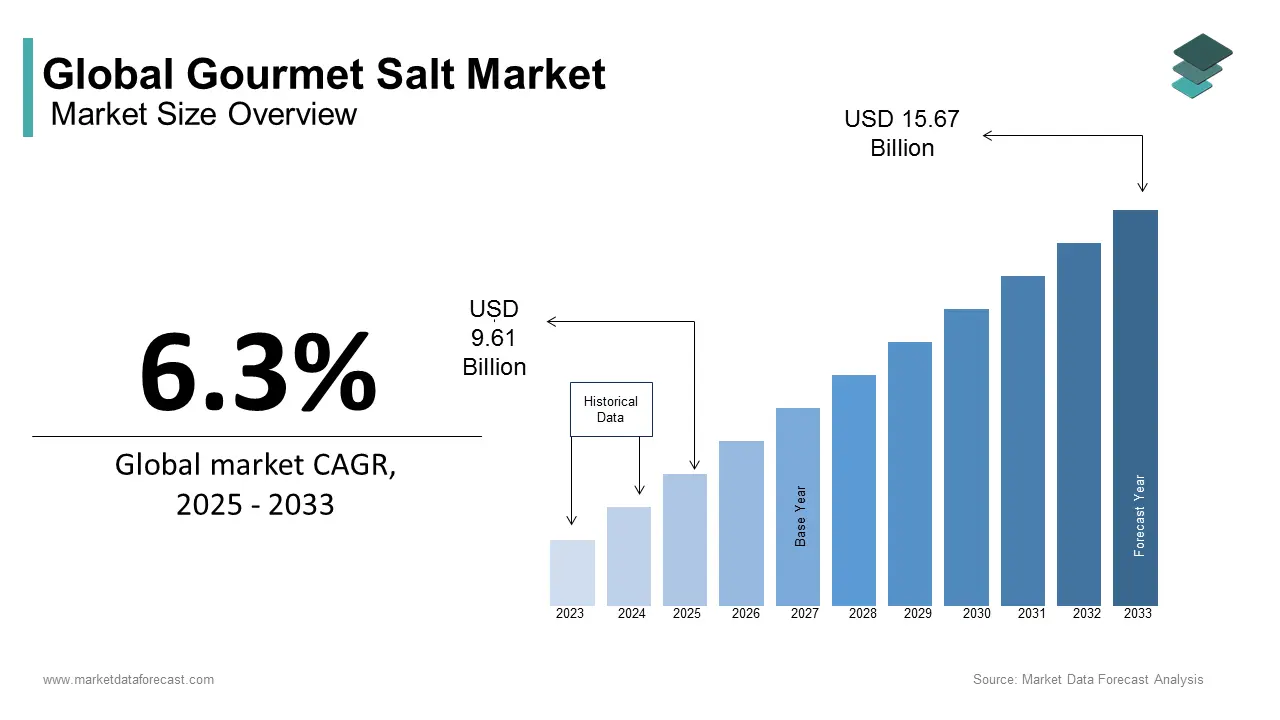

The global gourmet salt market size was worth USD 9.04 billion in 2024 and the global market size is expected to grow at a CAGR of 6.3% from 2025 to 2033 and be worth USD 15.67 billion by 2033 from USD 9.61 billion in 2025. The rapid urbanization of emerging economies and the changing lifestyle of consumers have increased the call for gourmet salt.

Gourmet salt is a naturally harvested raw sea salt (primarily sea salt) that adds flavor and dressing to food. It also gives food an almost exotic flavor and moisture. It is a high-quality salt commonly used in cooking to improve the taste and attractiveness of food. Gourmet salt has a high mineral content and better solubility. It can be added to different types of spices and herbs to improve the aroma and color of the fragrance. Gourmet salt is not refined, but it is harvested naturally with relatively low sodium content and without additives. As exposure to global media and international trade rises, the awareness for a variety of dishes among consumers has risen. By using gourmet salt, chefs enhance their recipes by improvising and enhancing their sensual sensations, increasing their appeal. Gourmet salt is used in a variety of applications including seafood, bakery, confectionery, flavoring, and poultry. It is used to preserve canned foods to extend shelf life. 'Fleur de sel' is one of the most popular gourmet salts used in a variety of foods, such as grilled meat, vegetable dishes, and salads. Gourmet salt is also used to keep food longer to preserve canned food.

Current Scenario of the Global Gourmet Salt Market

The global gourmet salt market has experienced a significant surge in the recent past. The global market is anticipated to have a promising future during the forecast period owing to the global culinary renaissance and an increasing focus on premium ingredients. Across the world, high consumption of gourmet salt can be seen in the United States, France, Japan, and Australia. The rising trend of gourmet foods and increasing interest from consumers to try varieties such as Himalayan pink salt, fleur de sel, and smoked sea salt to enhance their dishes are promoting the popularity of gourmet salt. In Japan, gourmet salt has become an essential ingredient in its cuisine, especially in sushi and sashimi preparation. To address the growing demand and increasing competition in the market, companies have been employing strategies such as expanding product lines, partnering with renowned chefs and restaurants to enhance brand credibility, and leveraging online platforms and social media to engage with consumers and showcase the unique qualities of their salts to strengthen their position in the market and gain increased market share.

MARKET DRIVERS

The rising demand in the food and beverage and food service industries is propelling the global gourmet salt market growth.

They are unrefined sea salt that is harvested by hand and gives food a rich texture. Due to positive characteristics such as food flavor, color, unique taste, rich food shape, and pleasant aroma, worldwide demand is supposed to show high growth in the coming years. They are widely used in canning and canned food applications as preservatives to increase shelf life. At the same time, it helps maintain the moisture content of the product. This use is expected to fuel the growth of the global gastronomic salt industry in the near future.

The rising health awareness and the onset of health disorders due to high levels of sodium in the body are assumed to spur market growth. Live cooking shows and other gourmet foods encourage the use of gourmet salt. The industry continues to seek innovative product launches and the adoption of new strategies to increase market profits.

Gourmet salt is also applied to dressings and condiments.

International culture has created a demand for traditional cuisine in large cities, and as a result, the application of gourmet salt has increased. This is due to the special flavor that allows you to mix traditional flavors and flavors in your food. This salt also gained popularity among professional chefs in luxury hotels. Gourmet salt also has a high-yield margin for retailers due to its readily available and cost-effective mobile doorbell and acts as a market driver. As the number of gourmet restaurants has increased over the past five years worldwide, it is having a positive impact on the gourmet salt market. The growing wave of Westernization and the increasing popularity of natural or organic foods are key factors driving the gourmet market worldwide. As consumer tastes for specialty and artisanal foods develop, the increasing willingness of consumers to spend high prices on gourmet foods favors the growth of the global market. Emerging gourmet restaurants around the world are expected to become a key opportunity for global market growth. The growth of cooking and food programs is also presumed to set growth prospects for the near future.

MARKET RESTRAINTS

Gourmet salt is seldom expensive and market availability is limited, limiting the market growth.

Compared to other sea salts, infusion, smoked, and fresh natural products are expected to reduce the shelf life of gourmet salt, limiting the growth of the gourmet salt market during the outlook period. Since these salts have a delicate flavor, they are expected to retain their aroma for a long time, thus inhibiting the growth of the gourmet salt business. Machinery and labor costs are also expected to hamper the expansion of the global gourmet salt market. Furthermore, a lack of awareness about the health benefits of gourmet salt in developing countries is estimated to hamper market growth during the projection period. Additionally, due to the high price, manufacturers are opting for the growth of the gourmet salt market by choosing existing salts that are expected to affect the demand for gourmet salt.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

6.3% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Morton Salt, Inc, Saltworks, Inc, Murray River Gourmet Salt, Infosa, Alaska Pure, Cheetham Salt Ltd, Cargill Inc, Pyramid Salt Pty. Ltd, Maldon Crystal Salt Co, Amagansett Sea Salt Co and Others. |

SEGMENTAL ANALYSIS

Global Gourmet Salt Market Analysis By Type

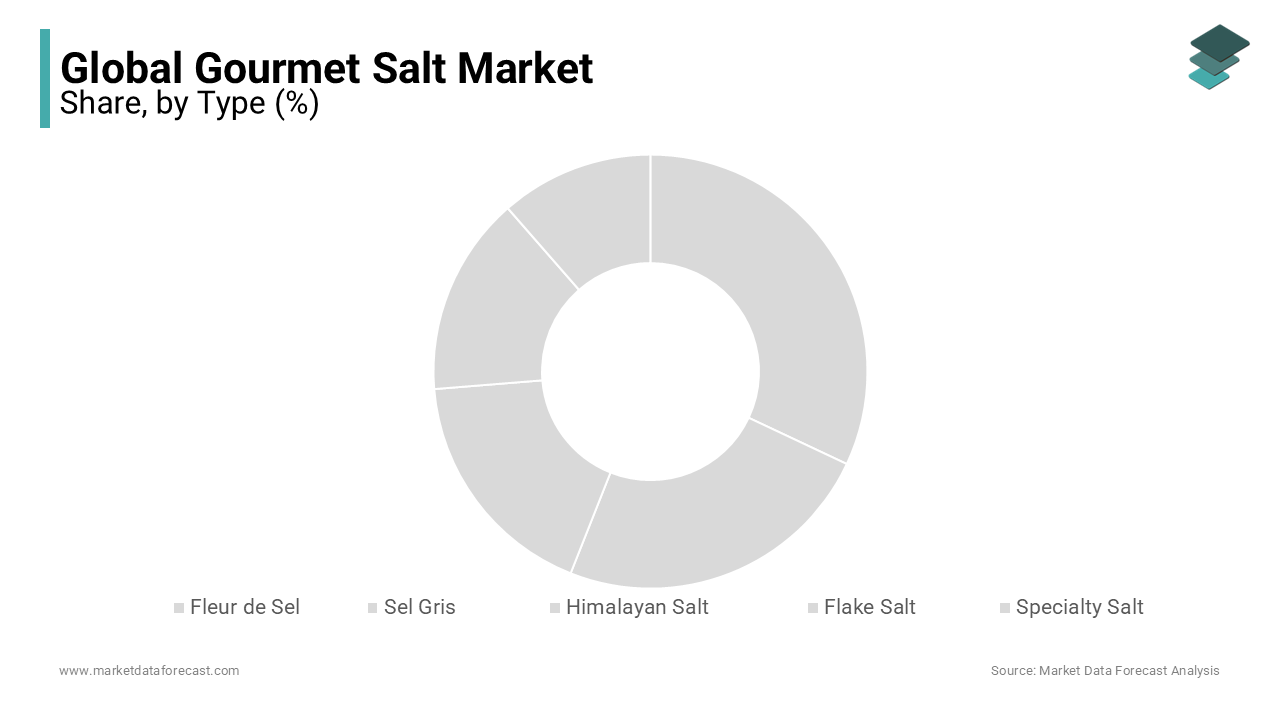

The Himalayan salt segment led the market, accounting for 48.7% of the global gourmet salt market share in 2023, and is also predicted to be the fastest-growing segment in the worldwide market during the forecast period. Himalayan salt is popular as a premium gourmet ingredient. The domination of the Himalayan salt segment is majorly attributed to the increased usage of Himalayan salt in both culinary and non-culinary sectors. The growing awareness among people regarding the health benefits of Himalayan salt such as lower sodium content and higher mineral content, including iron, potassium, and calcium is estimated to drive the Himalayan salt segment in the global market during the forecast period. The rapid adoption of Himalayan salt in various industries including food processing, spa and wellness, and home décor is promoting the segmental expansion.

The Sel Gris is predicted to witness a healthy CAGR during the forecast period. Sel Gris is also popular as grey salt and has been recognized for its mineral-rich profile and unique flavor profile. The rising popularity of French cuisine worldwide and the growing trend for natural and unrefined food products are propelling the growth of the Sel Gris segment in the global market.

The Fleur de Sel segment is anticipated to hold a considerable share of the global market during the forecast period. The growing usage of Fleur de Sel by renowned chefs and food enthusiasts worldwide and the increasing adoption of Fleur de Sel in the food service industry are contributing to the expansion of the segment in the global market.

Global Gourmet Salt Market Analysis By Application

The bakery and confectionery segment emerged as the largest segment in the global market in 2023, accounting for 38.4% of the global market share. The lead of the bakery and confectionery segment is estimated to continue throughout the forecast period. The growing popularity of gourmet desserts and increasing preference among consumers for high-quality and flavorful bakery products are favoring the growth of the bakery and confectionery segment in the global market. North America and Europe have been increasingly using gourmet salts in bakery and confectionery and the trend is likely to continue during the forecast period and propel the segmental growth.

The meat and poultry segment had a substantial share of the global market in 2023 and is expected to witness a prominent CAGR during the forecast period. Gourmet salt can enhance the flavor, texture, and juiciness of meats and due to this, the usage of gourmet salts has increased exponentially in recent years. This trend is likely to continue during the forecast period and contribute to the growth of the meat and poultry segment in the worldwide market. The rising adoption of gourmet salt by premium meat producers and butchers is further boosting the growth rate of the bakery and confectionery segment in the global market.

The seafood products segment is projected to register a healthy CAGR during the forecast period. Factors such as increasing usage of gourmet salt in seafood preparation to enhance the natural flavors of fish and shellfish and rising awareness among chefs regarding the ability of gourmet salt to elevate the taste and presentation of seafood dishes are propelling the seafood products segment in the global market.

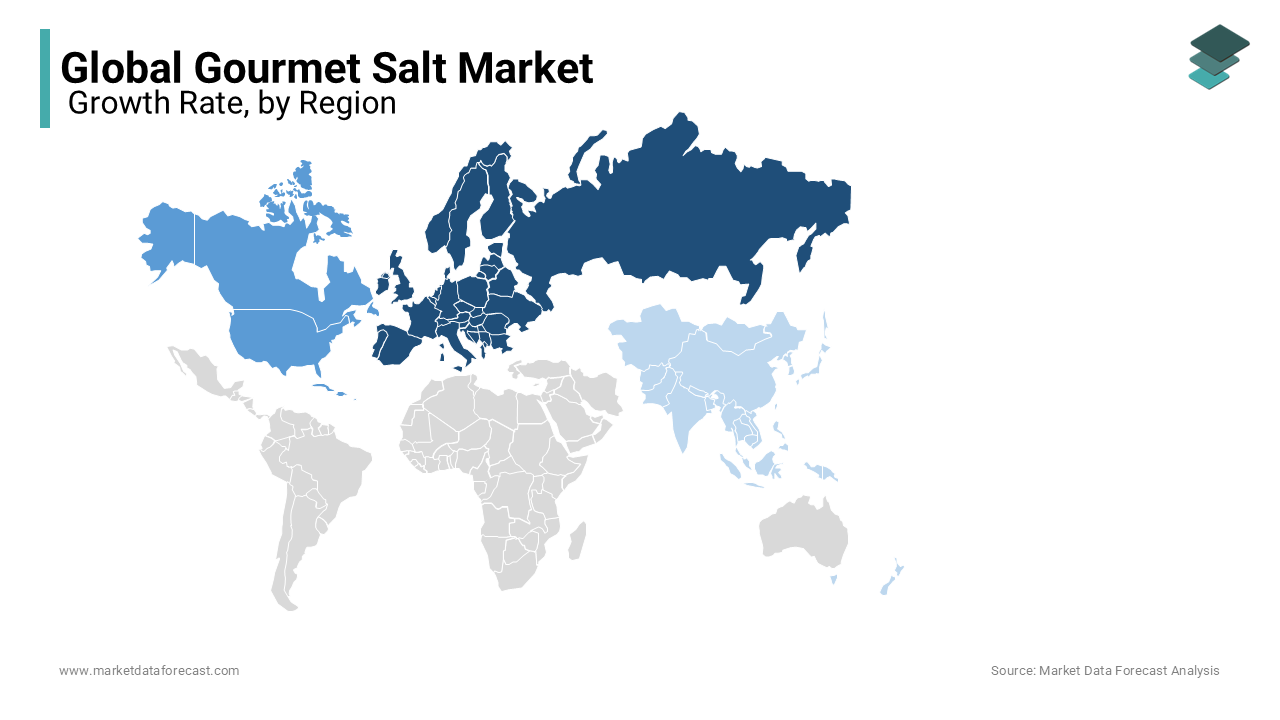

REGIONAL ANALYSIS

Europe was the leading player in the global market in 2023 and held 37.1% of the global market share. During the forecast period, Europe is estimated to register a promising CAGR. Europe was the largest consumer and manufacturer of gourmet salt. The growth of the European market is primarily credited to the increasing usage of gourmet salt in processed foods in European countries, including Germany, France, Spain, and Italy is rapid. Western Europe is considered the most abundant and fastest-growing market for gourmet salt and is the largest producer and consumer of gourmet salt. The high demand for processed foods is driving the market mainly in countries such as Italy, Germany, Spain, and France.

North America is anticipated to witness substantial growth during the forecast period. Factors such as the preferences of American consumers, strict regulatory changes in food, rising awareness among consumers regarding the health benefits associated with gourmet salts, and the growing trend of home cooking and gourmet cuisine are propelling the growth of the North American market.

The Asia-Pacific regional segment is predicted to register a healthy CAGR during the forecast period owing to the improvements in living standards, health-conscious behavior among the public, the presence of emerging economies, and the expanding food and beverage industry. The rising demand for processed foods and advancements in the food and beverage industry is further favoring the gourmet salt market in the Asia-Pacific region.

KEY PLAYERS IN THE GOURMET SALT MARKET

Companies playing a major role in the global gourmet salt market include Morton Salt, Inc., Saltworks, Inc., Murray River Gourmet Salt, Infosa, Alaska Pure, Cheetham Salt Ltd., Cargill Inc., Pyramid Salt Pty. Ltd., Maldon Crystal Salt Co., and Amagansett Sea Salt Co.

RECENT HAPPENINGS IN THE MARKET

In January 2021, Cargill Inc., which is one of the promising companies in the global gourmet salt market, announced the launch of a new purified sea salt flour. This purified sea salt flour has tricalcium phosphate and is believed to improve flowability and caking resistance.

DETAILED SEGMENTATION OF THE GLOBAL GOURMET SALT MARKET INCLUDED IN THIS REPORT

This research report on the global gourmet salt market has been segmented and sub-segmented based on type, application, and region.

By Type

- Fleur de Sel

- Sel Gris

- Himalayan Salt

- Flake Salt

- Specialty Salt

By Application

- Bakery & Confectionery

- Meat & Poultry Products

- Seafood Products

- Sauces & Savory

By Region

- North America

- The United States

- Canada

- Rest of North America

- Europe

- The United Kingdom

- Spain

- Germany

- Italy

- France

- Rest of Europe

- The Asia Pacific

- India

- Japan

- China

- Australia

- Singapore

- Malaysia

- South Korea

- New Zealand

- Southeast Asia

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of LATAM

- The Middle East and Africa

- Saudi Arabia

- UAE

- Lebanon

- Jordan

- Cyprus

Frequently Asked Questions

1. What are the popular uses of Gourmet Salt?

Gourmet salt is used to enhance the flavor and presentation of dishes in upscale restaurants and home kitchens. It can be sprinkled on cooked food, used in marinades, incorporated into rubs for meats, or even used to rim cocktail glasses.

2. What factors influence the price of Gourmet Salt?

The price of gourmet salt can vary based on factors such as the source (e.g., sea salt vs. Himalayan salt), harvesting methods, rarity (such as black lava salt), and any additional processing or flavoring involved.

3. What are some trends in the Gourmet Salt market?

Trends in the gourmet salt market include the rise of flavored salts (such as truffle-infused salt), gourmet salt blends, increased interest in artisanal and small-batch salt producers, and a growing demand for sustainable and ethically sourced salts.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]