Global Gluten Feed Market Size, Share, Trends, & Growth Forecast Report - Segmented By Source (Corn, Wheat, Barley, Rye And Others), Livestock (Cattle, Swine, Poultry, Aquaculture And Others), And By Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis From 2025 To 2033

Global Gluten Feed Market Size

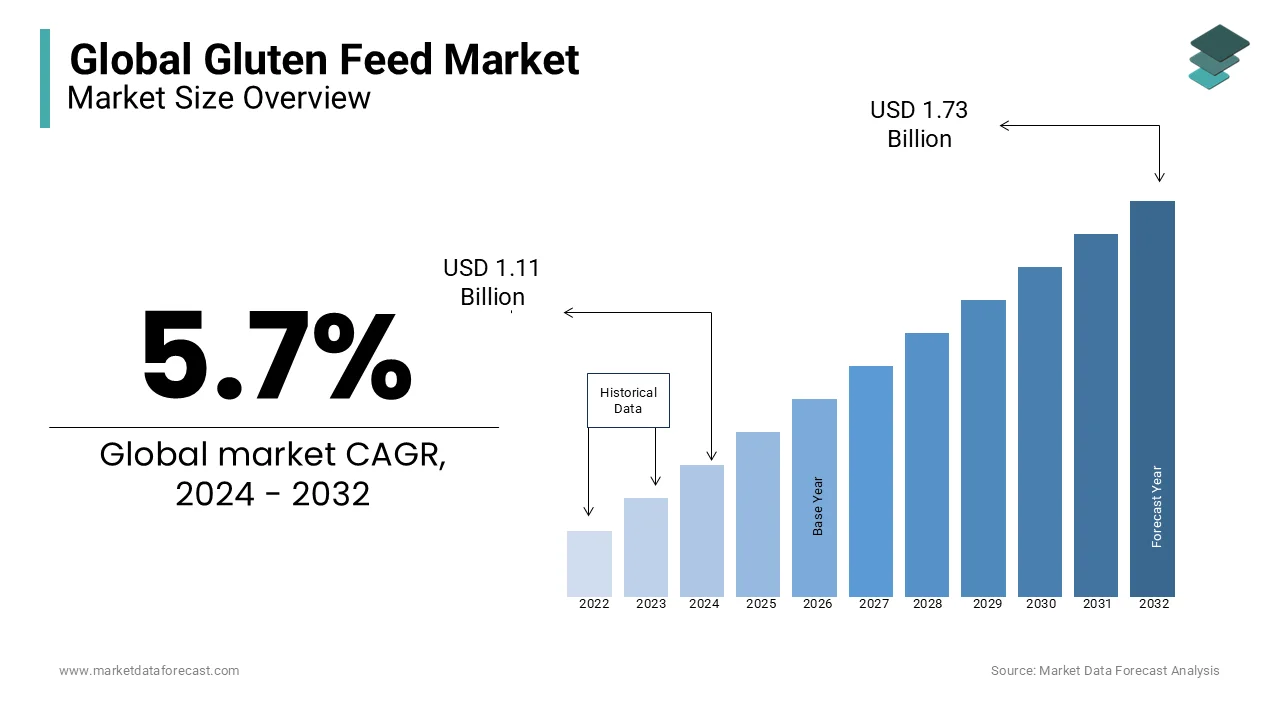

The global gluten feed market was valued at USD 1.11 billion in 2024 and is anticipated to reach USD 1.17 billion in 2025 from USD 1.83 billion by 2033, growing at a CAGR of 5.7% from 2025 to 2033.

The gluten-fed market is showcasing immense potential during the forecast period. The market continues to build up momentum, with the rise in demand for protein in animal feed. Gluten feed is typically popular with producers who are close to processing plants in order to make transportation cost-effective. Gluten is a composition of storage proteins, namely glutelin and prolamins, generally found in wheat and other related grains like barley, rye, corn, etc. Gluten is added to feeds for a pet in order to enhance the protein content and, as a result, maintain animal health.

Gluten feed is typically popular with producers who are close to processing plants in order to make transportation cost-effective. Gluten is a composition of storage proteins, namely glutelin and prolamins, generally found in wheat and other related grains like barley, rye, corn, etc. Gluten is added to feeds for a pet in order to enhance the protein content and, as a result, maintain animal health.

CURRENT SCENARIO OF THE GLOBAL GLUTEN FEED MARKET

The gluten-fed market is showcasing immense potential during the forecast period. The market continues to build up momentum, with the rise in demand for protein in animal feed. Currently, the market is witnessing a shift towards functional feeds. This trend not only provides nutrition but also enhances performance and well-being. One of the reasons behind this inclination is the progressive recognition of gluten feed for its role in improving gut health and overall animal livestock performance, resulting in a higher acceptance rate as a protein source among animal farmers. Moreover, advances in processing technologies are allowing for its better extraction and utilization from the grains.

Market Drivers

Gluten feed has recently come up as a potential substitute for fish meal in aquaculture feed, resulting in significant growth in the market. Other major factors driving the market for gluten-based feed include the strong demand for gluten-based feed in developing countries and the use of corn gluten feed as a cost-effective substitute for expensive grain-based feed. This feed type, especially vital wheat gluten (VWG) and corn gluten meal (CGM), has emerged as a viable alternative to fish meal in aquaculture diets. These sources are rich in protein and have favorable amino acid profiles, making them suitable for various fish species. The economic feasibility of this is also a reason why market players are seeking alternative protein sources, ultimately propelling the market growth.

Moreover, strong demand in developing nations accelerates the market. Emerging economies are experiencing a rapid surge in farm animals and fish production owing to rising population and urbanization.

Another factor that will benefit the market in the coming years is the integration with precision farming, including data-driven feeding strategies and tailored nutrition plans. Climate change, growing greenhouse emissions, and other external factors have significantly affected the immunity and overall health of animals, and dedicated solutions are needed to deal with this problem. So, the rise of precision agriculture offers opportunities for incorporating this field into data-managed nourishing approaches. It utilizes technology to optimize feed formulations based on real-time data can improve its usage efficiency in animal diets.

Market Restraints

Apart from the drivers, the market has also been facing some challenges and restraints. Some of them are sensitivity to gluten, availability of alternatives to local feed, change in regulations for feed safety in the European Union regarding GM organisms in gluten feed imports, and sulfur toxicity, which is a rising concern for feed manufacturers. The European Union has some of the strictest regulations concerning genetically modified organisms (GMOs). This feed types derived from GM crops must adhere to exact safety assessments, labelling requirements, and traceability measures. Such a legal environment can complicate the import and marketing activities in the European market.

The availability of alternatives to local options is derailing the trajectory of market growth. It poses a major obstruction for market players, as livestock breeders increasingly look for diverse and cost-effective feeding choices. This is fuelled by sustainability concerns, economic pressures, and changing consumer preferences.

Market Opportunities

North America holds potential opportunities for the expansion of the gluten feed market. This can be attributed to the strong livestock industry, innovative practices, and sustainability focus. The United States and Canada have a robust livestock sector, particularly in beef and poultry, which consistently escalates the demand for high-quality animal feeds. Moreover, the adoption of unique dietary practices among cultivators enhances efficiency and sustainability, increasing the appeal of gluten feed. Furthermore, the market in the region is also seeing rising emphasis on sustainable agriculture positions as an environmentally friendly option derived from by-products.

Market Challenges

Volatile prices of raw materials is among the major challenges impeding the expansion of the gluten feed market. Companies in this market rely heavily on grains such as corn and wheat for their production. Given the escalating necessity for food security for the expanding world population, the cost of wheat and corn is bound to increase or decrease as per global pressure. Price fluctuations are also due to weather events, supply chain issues worldwide, and armed and geopolitical tensions are mainly impacting production costs and profitability.

Apart from this, the gradual surge in awareness of gluten sensitivity among customers is influencing the decisions of livestock farmers or keepers regarding animal food ingredients. While primarily a worry for human consumption items, this is leading to hesitance in using gluten-based feeds.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.7% |

|

Segments Covered |

By Source, Livestock, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Ingredion Incorporated, The Roquette Group, Archer Daniels Midland Company, Cargill Incorporated, Tate & Lyle Plc, Bunge Ltd., Grain Processing Corporation, Agrana Group, Commodity Specialists Company, Tereos Syral. |

SEGMENT ANALYSIS

Global Gluten Feed Market By Source

The corn sub-segment dominates this category, holding a substantial share of the gluten feed market. It is expected to maintain its position during the forecast period. Corn-based gluten feed is recognized for its high protein content, i.e., between 20 percent to 50 percent. This makes it an attractive option for livestock breeders who are searching to enhance the nutritional value of their animal food. In addition, abundant production also drives the segment’s market share as it is one of the most widely cultivated crops worldwide, particularly in the region of North America, where it is a staple in both human and animal diets.

Global Gluten Feed Market By Livestock

The market based on livestock segmentation poultry accounted for the largest share in the market due to increasing awareness among farmers regarding poultry and the adoption of intensive farming techniques. The segment’s market size is expanding as farmers are becoming more knowledgeable about the nutritional needs of poultry and the advantages of incorporating this type of feed into their diets. Moreover, there is demand across the world for the by-products of this segment (meat and eggs), which continues to grow its market share with consumers wanting protein-rich diets.

REGIONAL ANALYSIS

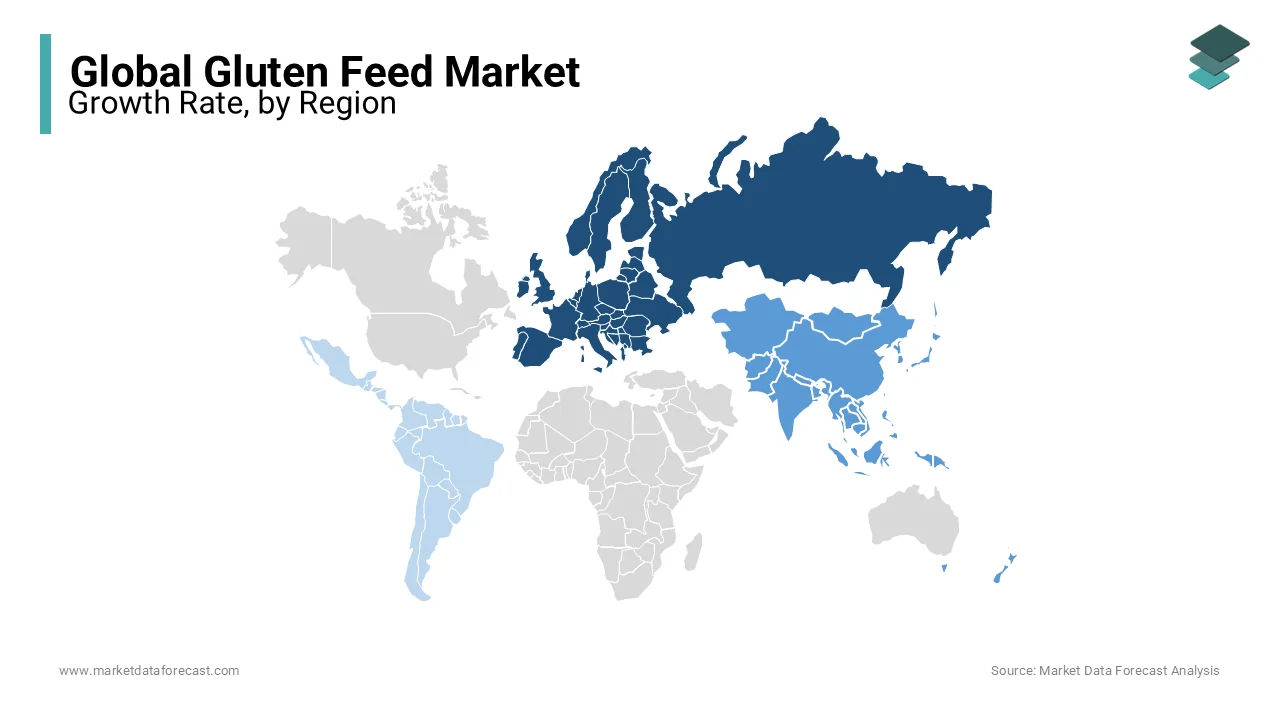

The Gluten Feed market was dominated by Europe, with the overall market share of over 35% globally. It was followed by Asia-Pacific and North America. The expansion of the animal feed landscape in Europe can largely be attributed to rising meat consumption and growing urbanization. Furthermore, heightened consumer awareness about the advantages of protein-rich diets has contributed to its greater consumption alongside a burgeoning population. Hence, this escalation in meat consumption is projected to cause a growth in the market share of this region.

The Asia Pacific is predicted to grow at a rapid pace in the coming few years. The Asia-Pacific market is expected to show rapid growth in the years to come. Both China and India are major players in the APAC market. China is undergoing a noteworthy shift in its diet, leaning more towards animal products, which is driving up the demand for grains to address its feed shortages. Unfortunately, this transition is putting a strain on resources and contributing to environmental challenges equally China and beyond. So, this may create a hindrance to the expansion of market size in the country.

- As per research published in Science Direct, over the span of 1980 to 2019, feed maize consumption witnessed a remarkable surge, jumping from 5 million tons to a staggering 195 million tons, i.e. a three-fold rise. Currently, a substantial 71 per cent of the maize produced in the country is utilised for animal feed, along with 26 per cent of tubers and 16 per cent of wheat. To maintain self-sufficiency in maize the area dedicated to it has doubled during this period, expanding to 41.3 million hectares from 20.3 million hectares.

In addition, in the last few years, there’s been a perceptible transition to gluten-free grains and diet in India, which is propelled by a range of reasons. This shift isn’t just a buzzword it’s an answer to the inconvenience and health problems linked to gluten for certain individuals. Despite that, the Indian market is likely to follow an upward trajectory owing to the presence of a large and varied consumer base.

Latin America holds a key position in the gluten feed market and is expected to maintain a steady growth rate during the forecast period. Brazil leads the regional market and is the top grain exporter in the world. It predicts exporting a maximum of 153 million tons of grains in the 2023-24 season, which would make the nation the biggest exporter of grains, first-ever exceeding the United States. This makes Brazil an extremely important player not only domestically but also globally.

- According to a study, the feed industry in Brazil is facing challenges and opportunities to continue its growth trajectory. After experiencing a significant boost of more than 60 percent since 2010, production could see a further increase of 25 percent in the coming years.

Moreover, various market players in the region have made notable investments to enhance local capacity. Likewise, one of the main objectives of Be8’s recently inaugurated factory is to substitute vital gluten with a yearly manufacturing capacity of nearly 27,000 tons. This is to maintain domestic supply to market and potentially export to countries like Chile and Mercosur nations such as Paraguay, Uruguay, and Argentina.

KEY MARKET PLAYERS

Some of the major companies dominating the market, by their products and services, include Ingredion Incorporated, The Roquette Group, Archer Daniels Midland Company, Cargill Incorporated, Tate & Lyle Plc, Bunge Ltd., Grain Processing Corporation, Agrana Group, Commodity Specialists Company, Tereos Syral.

RECENT HAPPENINGS IN THIS MARKET

- In December 2024, Be8, a company rooted in Rio Grande do Sul with a global footprint in renewable energy, reported the launch of a new factory park in Passo Fundo (RS) that will seamlessly combine energy production with animal feed bran and vital gluten. This initiative will revolutionise the agribusiness production chain in Brazil by maximising the use of the same raw materials for various purposes. The factory park will simultaneously cater to the animal nutrition, food, and biofuel sectors all at once.

- In April 2024, Innovafeed, a prominent company in the manufacturing of insect ingredients for top-quality plant nutrition, pet food, and animal feed, formally started its its North American Insect Innovation Center (NAIIC) in Decatur (Illinois). Moreover, this pilot factory is the initial step of the growing industrial expansion of the French agtech into North America and targets to expand commercialization and production of insect-based protein in the USA. Further, the launch of NAIIC marks a significant landmark in Innovafeed’s growth within North America. The selection of Decatur, Illinois, is strategic; situated in the heart of the corn belt and near ADM’s North American headquarters, as well as the biggest corn milling operations globally, this region presents substantial opportunities for future site expansion.

MARKET SEGMENTATION

This research report on the global gluten feed market has been segmented and sub-segmented based on Source, Livestock, and region.

By Source

- Corn

- Barley

- Wheat,

- Rye and others

By Livestock

- cattle

- poultry

- swine

- Aquaculture and others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What is the current market size of the global gulten feed market?

The current market size of the global gluten feed market was valued at USD 1.17 billion in 2025

How big is the global gulten feed market?

The global gluten feed market was valued at USD 1.11 billion in 2024 and is anticipated to reach USD 1.17 billion in 2025 from USD 1.83 billion by 2033, growing at a CAGR of 5.7% from 2025 to 2033.

Who are the market players that are dominating the global gulten feed market?

Roquette Group, Archer Daniels Midland Company, Cargill Incorporated, Tate & Lyle Plc, Bunge Ltd., Grain Processing Corporation, Agrana Group, Commodity Specialists Company, Tereos Syral. These are the market players that are dominating the global gulten feed market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]