Global Glucose Monitoring Devices Market Size, Share, Trends & Growth Analysis Report – Segmented By Device Type (Continuous Wearable Devices and Self-Monitoring Devices), Self-Monitoring Devices, Application & Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) - Industry Forecast (2024 to 2032)

Global Glucose Monitoring Devices Market Size (2024 to 2032)

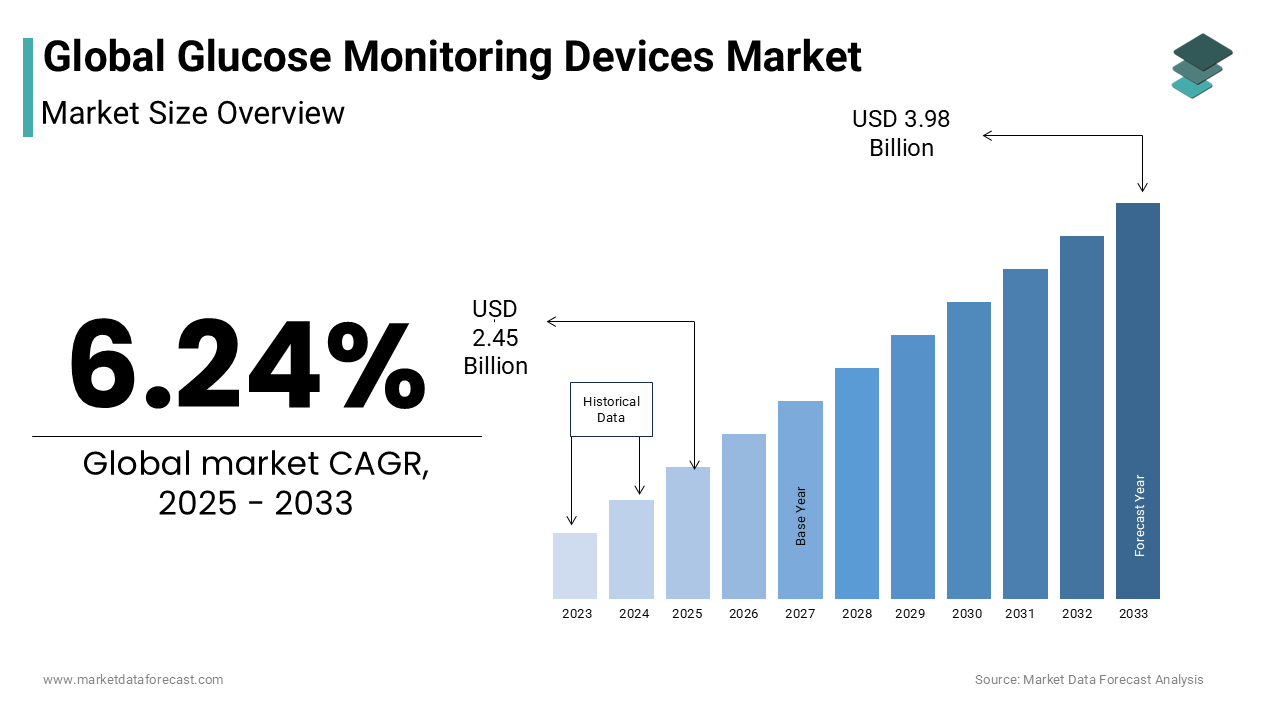

The global market for glucose monitoring devices is fast-growing and is expected to be worth USD 3.76 billion by 2032 from USD 2.31 billion in 2024, at a CAGR of 6.24% from 2024 to 2032.

Glucose monitoring devices detect the sugar level in our blood and are of several kinds, including glucose meters, testing strips, and lancets. The device offers the facility of self-testing using a single glucose meter and different strips. These devices consume less time than glucose testing by conventional methods in laboratories. These devices can be easily handled and potable, so they allow the test to be performed by the patient at their home's convenience, making them popular. It offers the services of monitoring glucose levels in our blood as it tests quantitatively.

MARKET DRIVERS

The growing number of diabetic patients is one of the key drivers driving the global glucose monitoring devices market.

The increasing prevalence of diabetes cases is due to an unhealthy lifestyle, low diet, excess alcohol consumption, and lack of physical activity. Also, healthcare expenditures are increasing, which leads to an increase in spending on self-monitoring blood glucose devices. According to the International Diabetes Federation (IDE), an estimated 537 million adults have diabetes, which is further anticipated to grow to 643 million by 2030 and 683 million by 2045.

The geriatric population worldwide and technological developments further promote the growth of the glucose monitoring devices market.

The rising adoption of continuous monitoring systems and improving technological advancements in blood glucose monitoring devices propel the demand for glucose monitoring devices. Moreover, increasing awareness among people about diabetes preventive care methods and introducing new products are accelerating market growth. In addition, the adoption of the latest technologies in healthcare and increasing disposable income in urban areas are likely to propel the growth of the glucose monitoring devices market. In addition, the rising focus on developing innovative techniques favoring the end-users is favoring the market.

The rise in the number of people who are taking insulin also drives the glucose monitoring devices market forward.

Nearly 450 million people worldwide live with diabetes. Among them, over 70 million people are taking insulin. People suffering from type 1 and type 2 diabetes use this insulin according to the dosage to recover. These people must check their glucose levels in the blood to take the required amount of insulin into their bodies. For this reason, these people are now using these glucose monitoring devices at home to check their levels and take insulin according to the results. This device also helps these people take their daily food intake to stay healthy.

Furthermore, other factors include a considerable number of patients, growing accessibility to quality healthcare services to the public, rising awareness regarding point-of-care testing, and increasing government healthcare expenditure in developing countries that provide immense global glucose monitoring devices market growth opportunities. In addition, high capacity in used markets in existing economies is regarded to produce many opportunities for future global glucose monitoring devices market growth.

MARKET RESTRAINTS

The growing number of product recalls is a significant threat to market growth, and the market is anticipated to see a decline in its growth rate.

Manufacturing defects or errors in results are some of the major causes that lead to a product recall. Also, the accessibility of continuous glucose monitors (CGM) hinders the growth of the glucose monitoring devices market. Furthermore, inadequate reimbursement policies in undeveloped countries and high costs for maintaining the devices restrict the glucose monitoring devices market growth over the forecast period. In addition, establishing glucose meter accuracy is a significant challenge for the market players. The lack of skilled people in hospitals and clinics is also hindering the growth of the glucose monitoring devices market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

Segments Covered |

By Device Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Roche Diagnostics, LifeScan, Bayer Health Care, Abbott Diabetes, AgaMatrix Inc., Arkray Inc., Medtronic, DexCom Inc., Nova Biomedical Corporation, Terumo Europe NV. |

SEGMENTAL ANALYSIS

Global Glucose Monitoring Devices Market Analysis By Device Type

The continuous wearable devices segment led the market in 2023. The continuous glucose monitoring results help patients regulate their food intake, exercise, and medications. The device contains sensors for checking the glucose levels from the interstitial fluid. The sensor has a period where it can be used in one place and then replaced. This device monitors the glucose levels over time, allowing the patients to identify low and high sugar levels, which are more dangerous.

The Self-monitoring devices segment also had a considerable share in the global market in 2023 owing to the increased awareness of healthy life, fewer hospital check-ups due to the pandemic, and an easy way to check glucose levels independently. This self-monitoring glucose is a procedure in which a person with diabetes can check their blood sugar using glucose meters. Based on the reading, they can have their treatment or medication. These self-monitoring devices are portable and can be carried out anywhere. The doctor preferred these devices to the diabetes patients to check their glucose level twice a week for good health. These devices are primarily used for older people who cannot walk or move from one place to another without anyone's support. These devices are also used by people who are suffering from chronic diseases to know the severity of the diseases. Considering all these factors, the segment is estimated to grow steadily during the forecast period.

Global Glucose Monitoring Devices Market Analysis By Application

The hospital segment had the highest global market share by application in 2023. Increasing advanced infrastructure and growing usage of technically advanced devices in hospitals drive the segment growth forward. For instance, these glucose monitoring devices are used in hospitals to check the glucose level in the patient's body. In addition, less blood retrieval, less pain, and less time for the result are the factors that increase the use of these devices in hospitals, which drives segment growth.

REGIONAL ANALYSIS

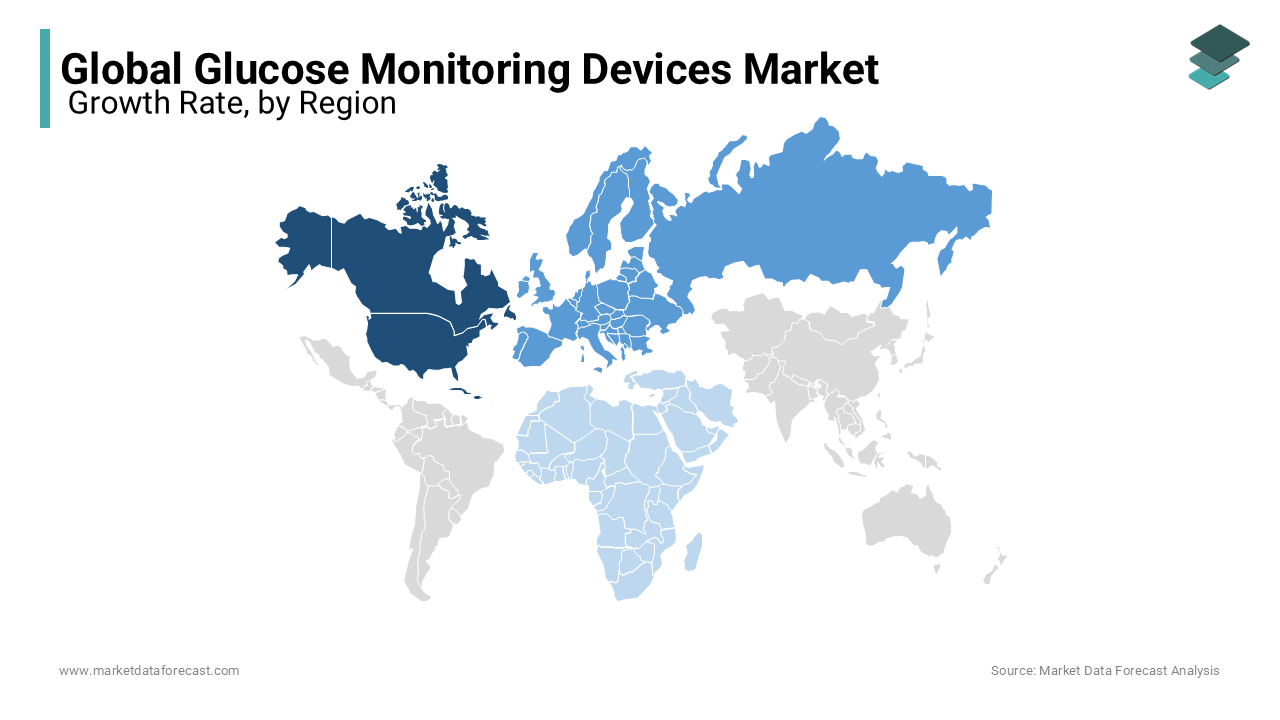

The North American glucose monitoring devices market had a significant share of the global market in 2023. Factors such as the growing prevalence of diabetes and the adoption of advanced technology systems propel market growth in North America. Moreover, increasing expenditure in the healthcare industry and awareness among the people regarding the management of diabetes are propelling the market growth of the glucose monitoring devices market in this region. In recent years medical devices such as blood glucose monitors and insulin pumps are becoming more critical for the management of diabetes for many Canadians. The government in Canada invests in research and development of glucose monitoring devices to help diabetes patients. Several awareness programs have been conducted by the Canadian government about the symptoms of diabetes and taking steps to prevent diabetes. In these programs, they are also aware of the usage of glucose monitoring devices for any age group above two years old. These programs also mention having a healthy diet and sufficient sleep to prevent diabetes. The U.S. occupies the most extensive consumer base globally, and the Asia Pacific has become the fastest-growing market in 2023.

Following North America, the European glucose monitoring devices market had a substantial share of the global market in 2023. The increasing geriatric population and investment expenditure in the healthcare industry contribute to the market growth in this region. Also, the increasing prevalence of launching innovative products in favor of consumers is ascribed to propelling market growth in Europe. The increasing overweight and obesity among many people in Europe drive this region's glucose monitoring device market. Obesity and overweight is the main reason for the occurrence of sugar in the blood. In Europe, nearly 1.2 million deaths annually due to being overweight. Europe, the U.K., and Germany are anticipated to account for most of the share during the forecast period. Nearly 8 million people with diabetes live in Germany, which drives the market forward. According to the research, the number of people with type 2 diabetes in Germany will continue to increase over the next twenty years. As a result, people are more conscious about the sugar level in the body by taking regular check-ups. Although due to their busy schedule, most people cannot go to the hospitals for diabetes check-ups, these people use glucose monitoring devices at home, which helps to maintain their diet and predict diabetes issues.

The Asia Pacific glucose monitoring devices market is anticipated to register the fastest CAGR in the global market. The rising prevalence of diabetes patient pool is majorly fuelling the market in this region. According to the reports, it was estimated that 7.1% of the population of India was suffering from diabetes in 2019. Furthermore, the increasing geriatric population and awareness among the public on diabatic management control are fulfilling the market growth during the forecast period. Increasing longer life expectancies and decreased fertility rates rapidly increase the older population in the Asia Pacific region. By 2050, one in five people in Asia Pacific will be over 60. Increasing older people in this region results in increasing diabetes cases which drives the market forward. In addition, in many evolving markets, such as China & India, governmental funding for health care & health insurance is improving and becoming more prevalent.

The glucose monitoring devices market in Latin America also has a significant market share. Brazil holds the largest share of the market. New technologies are used for diabetes treatment in Brazil. Many key players are manufacturing glucose monitoring devices with advanced technology. Sensor-based glucose monitoring devices are used in Brazil for diabetes, which drives the market forward in this region.

The glucose monitoring devices market in Middle East Africa is anticipated to register a moderate share in the global glucose monitoring devices market over the forecast period. Factors such as increasing diabetes awareness and diabetic management awareness among people are expanding the demand for the glucose monitoring devices market.

KEY PLAYERS IN THE GLUCOSE MONITORING DEVICES MARKET

Some of the most promising companies leading the Global Glucose monitoring devices market profiled in this report are Roche Diagnostics, LifeScan, Bayer Health care, Abbott Diabetes, AgaMatrix Inc., Arkray Inc., Medtronic, DexCom Inc., Nova Biomedical Corporation, Terumo Europe NV.

RECENT HAPPENINGS IN THIS MARKET

- In 2022, Abbott announced that it had launched a new bio wearable that will continuously monitor glucose and ketone levels using the sensor. The device is approved by the U.S. Food and Drug Administration, which helps improve people's lives with life-threatening diabetes.

- In 2022, DexCom, Inc. announced that it had secured CE Mark for its G7 Continuous Glucose Monitoring (CGM) System in Europe, which is used for diabetes patients over two years old.

- In 2020, Medtronic plc and Tandem Diabetes Care, Inc. partnered with each other to develop advanced technologies in the field of diabetes.

- In 2022, Senseonics Holdings, Inc. announced that it had the approval of the Food and Drug Administration (FDA) for the next-generation system named Eversense® E3 CGM System, which is used for continuous glucose monitoring.

- In 2021, Roche signed an agreement with Eli Lilly to deliver glucose monitoring devices using insulin pen therapy.

DETAILED SEGMENTATION OF THE GLOBAL GLUCOSE MONITORING DEVICES MARKET INCLUDED IN THIS REPORT

This market research report on the global glucose monitoring devices market has been segmented and sub-segmented based on device type, application, and region.

By Device Type

- Continuous Wearable Devices

- Self-Monitoring Devices

By Application

- Hospitals

- Clinics and Diagnostic Centers

- Home Setting

- Ambulatory Settings

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How big is the glucose monitoring devices market?

The global glucose monitoring devices market size was worth USD 2.31 billion in 2024.

What is the growth rate of the glucose monitoring market in North America?

The North America glucose monitoring devices market is anticipated to be growing at a CAGR of 5.66% from 2024 to 2032.

Which is anticipated to be growing the fastest in the global glucose monitoring devices market?

The Asia-Pacific region is forecasted to witness the fastest CAGR in the global market during the forecast period.

Who are some of the notable players in the glucose monitoring devices market?

Roche Diagnostics, LifeScan, Bayer Health care, Abbott Diabetes care Inc, AgaMatrix Inc, Arkray Inc, Medtronic, DexCom Inc, Nova Biomedical Corporation, and Terumo Europe NV are a few of the key players in the glucose monitoring devices market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]