Global Glassware Market Size, Share, Trends & Growth Forecast Report – Segmented By Material, Product Type, Price Point, End User, Distribution Channel, And By Region (North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) – Industry Analysis From (2025 to 2033)

Global Glassware Market Size

The global glassware market size was valued at USD 15.25 billion in 2024 and is anticipated to reach USD 16.07 billion in 2025 from USD 24.38 billion by 2033, growing at a CAGR of 5.35% during the forecast period from 2025 to 2033.

Glassware includes a wide range of products such as tableware (plates, bowls, and glasses), drinkware (tumblers, wine glasses, and mugs), kitchenware (storage jars and bakeware), and decorative items. These products are crafted from materials such as soda-lime glass, borosilicate glass, and lead crystal, each offering unique properties like heat resistance, durability, and aesthetic appeal. The market has experienced steady growth due to increasing consumer demand for sustainable, reusable, and non-toxic alternatives to plastic and disposable products. According to the United Nations Environment Programme (UNEP), over 8 million tons of plastic waste enter oceans annually, prompting governments and consumers to shift toward eco-friendly materials like glass.

This growth is particularly evident in regions like Europe and North America, where premium and handcrafted glassware collections are gaining traction among affluent consumers. The hospitality sector, including restaurants, hotels, and cafes are playing a pivotal role in driving demand. Another significant driver is the rising trend of home dining and gourmet cooking is amplified by social media platforms. The U.S. Census Bureau highlights that spending on in-home dining has increased significantly among younger demographics as more individuals prioritize health, cost savings, and personalized cooking experiences. Platforms like Instagram and Pinterest have popularized visually appealing table settings is increasing sales of premium glassware collections.

Emerging markets in India and China are also witnessing significant growth. The Asian Development Bank (ADB) highlights that urbanization in these regions has increased disposable incomes which is boosting demand for home dining and premium kitchenware. Additionally, innovations in manufacturing, such as lightweight and tempered glass have enhanced product functionality and durability. The glassware market is poised to expand innovative solutions that combine functionality, elegance, and environmental responsibility.

Market Drivers

Global Push Toward Sustainability and Reduced Plastic Usage

One of the major drivers of the glassware market is the global emphasis on sustainability and the reduction of single-use plastics. According to the United Nations Environment Programme (UNEP), approximately 300 million tons of plastic waste are generated annually with a significant portion ending up in landfills or oceans. Governments worldwide are taking action to combat this issue. For instance, the European Union’s ban on certain single-use plastics is implemented under the European Commission’s Circular Economy Action Plan which has increased demand for sustainable alternatives like glass. While exact sales figures for glassware are not always publicly available, industry reports suggest that reusable and recyclable materials like glass have seen a marked rise in adoption in regions with stringent environmental policies. This trend aligns with consumer preferences as 74% of consumers globally are willing to pay more for eco-friendly products , according to a survey by the International Trade Centre (ITC) .

Rising Trend of Home Dining and Gourmet Cooking

Another significant driver is the growing trend of home dining and gourmet cooking, fueled by lifestyle changes and social media influence. According to the U.S. Department of Agriculture (USDA) , there has been a notable increase in household food preparation, particularly during and after the COVID-19 pandemic. Additionally, a survey conducted by the International Food Information Council (IFIC) found that 60% of consumers reported cooking more at home due to convenience, cost savings, and health considerations. This trend has driven demand for aesthetically pleasing and functional kitchenware, including glassware. Platforms like Instagram and Pinterest have further amplified interest in visually appealing table settings, boosting sales of premium glassware. While precise growth rates tied to this trend are not always documented, industry experts agree that the hospitality sector also plays a key role, with restaurants investing in high-quality glassware to enhance customer experiences.

Market Restraints

Fragility and Durability Concerns

One of the major restraints in the glassware market is the inherent fragility of glass products, which limits their appeal for certain applications. According to the U.S. Consumer Product Safety Commission (CPSC), over 200,000 injuries annually are linked to broken glass items in households by raising concerns about safety and product longevity. This issue is particularly pronounced in commercial settings like restaurants and hotels where frequent handling increases the risk of breakage. The European Federation of Glass Recyclers notes that the replacement costs for damaged glassware can deter businesses from investing in premium products. Additionally, lightweight and durable alternatives like plastic or silicone often overshadow glass in markets prioritizing practicality. These challenges highlight the need for innovations such as tempered or reinforced glass to address durability concerns and expand adoption.

High Production Costs and Pricing Challenges

Another significant restraint is the high production cost of glassware, driven by energy-intensive manufacturing processes. The International Energy Agency (IEA) reports that glass production accounts for approximately 0.3% of global industrial energy consumption, primarily due to the high temperatures required for melting raw materials. These costs are passed on to consumers, making glassware less affordable compared to plastic alternatives. According to a report by the World Bank, household spending on durable goods like glassware in many emerging economies is often limited by budget constraints with low- and middle-income families prioritizing affordability over premium features. While advancements in energy-efficient manufacturing aim to reduce costs where pricing remains a barrier in price-sensitive regions. This challenge restricts market penetration and slows growth in low-income demographics.

Market Opportunities

Growing Demand for Sustainable Packaging Solutions

One major opportunity in the glassware market lies in the increasing demand for sustainable packaging solutions which is driven by global efforts to reduce plastic waste. The United Nations Environment Programme (UNEP) reports that over 13 million tons of plastic enter oceans annually is prompting governments and businesses to seek eco-friendly alternatives. Glass, being 100% recyclable and reusable is emerging as a preferred material for food and beverage packaging. Additionally, the European Container Glass Federation (FEVE) emphasizes that glass packaging remains a key focus for sustainability initiatives with steady adoption driven by consumer preference for environmentally friendly options. Glassware manufacturers can enhance their brand reputation and capitalize on this trend. Glassware manufacturers can capitalize on this trend and enhance their brand reputation.

Expansion into Emerging Markets with Rising Urbanization

Another significant opportunity is the expansion into emerging markets, where urbanization and rising disposable incomes are driving demand for premium household goods. The World Bank studies show that urban populations in Asia and Africa are expected to grow by 1.5 billion people by 2040 which creates a surge in demand for modern kitchenware and dining products. Glassware with its aesthetic appeal and functionality is well-positioned to cater to affluent urban consumers seeking lifestyle upgrades. For instance, the Asian Development Bank (ADB) notes that household spending on durable goods in Southeast Asia increased by 8% annually from 2020 to 2022 by reflecting growing purchasing power.

Market Challenges

Limited Adoption in Price-Sensitive Markets

A significant challenge for the glassware market is its limited adoption in price-sensitive regions, where affordability often outweighs aesthetic or environmental considerations. For instance, according to the World Bank, approximately 60% of the global population living in developing regions spends a significant share of their income on basic necessities, leaving limited disposable income for non-essential items like high-end glassware. Glass products, due to their energy-intensive manufacturing processes and higher raw material costs are often priced significantly higher than plastic alternatives which are more affordable and widely accessible. Glass products are often priced higher than plastic alternatives due to their energy-intensive manufacturing processes. According to the International Labour Organization (ILO), small-scale manufacturers in developing regions face challenges in scaling production affordably which is further restricting market penetration. Additionally, logistical costs and import tariffs exacerbate pricing issues in rural areas. This economic barrier limits the ability of glassware manufacturers to compete with cheaper materials like plastic, hindering growth in emerging markets despite increasing urbanization and rising consumer awareness.

Environmental Concerns Over Energy-Intensive Production

Another major challenge is the environmental impact of glass production which involves high energy consumption and carbon emissions. The International Energy Agency (IEA) reports that glass manufacturing accounts for approximately 0.3% of global industrial CO2 emissions, primarily due to the high temperatures required for melting raw materials. The U.S. Environmental Protection Agency (EPA) notes that only about 31% of glass containers are recycled by leaving a significant portion contributing to landfill waste. This inefficiency raises concerns among eco-conscious consumers and regulators who increasingly demand greener alternatives. Although advancements in energy-efficient furnaces aim to reduce emissions, the industry still faces scrutiny over its sustainability credentials. Balancing production demands with environmental responsibility remains a critical hurdle for the glassware market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.75% |

|

Segments Covered |

By Material, Product Type, Price Point, End-User, Distribution Channel and Region. |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Libbey Glass LLC, Lifetime Brands, Inc, Steelite International, Guangzhou Jing Huang Glassware Co,Ltd, Villeroy & Boch AG, Taiwan Glass Industry Corporation, Glass Tech Life, Shandong Huapeng Glass Co., Ltd., Zrike Brands, Anhui Deli daily Glass Co., Ltd, Lenox Corporation, Arc Online, Anchor Hocking Group, Inc, Borosil Limited, Garbo Glassware, Degrenne, Sisecam, Ocean Glass Public Company Limited. |

SEGMENT ANALYSIS

Global Glassware Market By Material

The soda lime glass segment dominated the market by holding the largest share of 70.8% of the global glassware market share in 2024. The affordability of soda lime glass, versatility, and widespread use in tableware, drinkware, and kitchenware are majorly driving the domination of the soda lime glass segment in the global market. The U.S. Environmental Protection Agency (EPA) highlights that soda lime glass accounts for over 77% of all glass produced globally by making it the most accessible material for mass-market applications. Its ease of production and recyclability further enhance its appeal in emerging economies. Soda lime glass’s dominance underscores its importance as a cost-effective and eco-friendly choice by ensuring its continued prevalence in both residential and commercial sectors.

The borosilicate glass segment is another prominent segment and is likely to grow steadily with a CAGR of 6.2% from 2025 to 2033 due to the increasing demand for heat-resistant and durable glassware, particularly in laboratories and kitchens. The European Chemicals Agency (ECHA) notes that borosilicate glass is favored for its thermal stability and chemical resistance, which makes it ideal for specialized applications like bakeware and scientific equipment. Rising awareness of sustainable living has also boosted its adoption as it is reusable and long-lasting. Governments promoting energy-efficient materials further support this trend. Borosilicate Glass’s rapid expansion highlights its role in meeting modern consumer needs while driving innovation in high-performance glass solutions.

Global Glassware Market By Product Type

The everyday glass segment had the leading share of 35.4% of the global market share in 2024. The widespread use of water, juices, and other beverages in households and commercial establishments is contributing to the domination of the everyday glass segment in the global glassware market. The U.S. Department of Commerce highlights that everyday glasses are favored for their affordability, durability, and versatility by making them indispensable in daily life. Their universal appeal across demographics and regions ensures consistent demand. Additionally, the growing trend of home dining and sustainable living has further boosted sales, as consumers seek reusable alternatives to single-use plastics. This segment’s dominance underscores its critical role in driving accessibility and sustainability in the glassware industry.

The glass jars segment is anticipated to have a CAGR of 6.2% during the forecast period due to the global push toward sustainable packaging solutions, as glass jars are reusable, recyclable, and free from harmful chemicals. The United Nations Environment Programme (UNEP) notes that over 13 million tons of plastic enter oceans annually by prompting consumers and businesses to adopt eco-friendly alternatives. Glass jars are increasingly used for food storage, cosmetics, and artisanal products by appealing to environmentally conscious buyers. Their aesthetic appeal and ability to preserve product quality further enhance demand. This segment’s rapid expansion highlights its importance in addressing environmental concerns while meeting modern consumer preferences for sustainable and functional packaging solutions.

Global Glassware Market By Price Point

The economy segment held 50.8% of the global glassware market share in 2024. The affordability and widespread adoption in price-sensitive regions like Asia-Pacific and Africa is driving the economy segment in the global market. The World Bank notes that over 60% of households in low-income countries prioritize cost-effective household goods by making economy glassware a preferred choice for everyday use. Its importance lies in catering to mass-market demand in rural areas and emerging economies. Additionally, the hospitality sector relies heavily on economical glassware due to its durability and lower replacement costs.

The premium segment is deemed to grow at a CAGR of 7.2% during the forecast period. This growth is fueled by rising consumer affluence and a growing preference for luxury, handcrafted, and eco-friendly products. The European Commission highlights that affluent consumers in Europe and North America are driving demand for high-end glassware for home dining and decorative purposes. Social media platforms like Instagram amplify this trend by showcasing aesthetically pleasing table settings by boosting sales of designer collections. Additionally, premium glassware’s focus on sustainability such as recyclable and lead-free materials, aligns with eco-conscious values. This segment’s rapid expansion underscores its role in meeting the aspirations of affluent buyers while promoting innovation and exclusivity in the glassware market.

Global Glassware Market By End User

The households segment accounted for 45.4% of the global market share in 2024. The domination of the household segment in the global market is majorly attributed to the widespread use of glassware for daily dining, storage, and decorative purposes. According to the U.S. Environmental Protection Agency (EPA), over 90% of households in developed regions use reusable tableware with glass being a preferred material due to its durability and non-toxic properties. Additionally, the European Commission highlights that household recycling rates for glass containers reached 74% in the EU in 2021 is reflecting consumer preference for sustainable products. The growing trend of home dining and gourmet cooking is amplified by social media platforms like Instagram which has further boosted demand for aesthetically pleasing glassware. Its universal appeal ensures sustained consumption across diverse demographics is solidifying its importance in the market.

The hotels and restaurants segment is predicted to witness the highest CAGR of 6.2% from 2025 to 2033 owing to the recovery of the hospitality sector post-pandemic, with the World Tourism Organization (UNWTO) reporting a 18% increase in global tourism revenue in 2022 by signaling renewed demand for dining experiences. The National Restaurant Association (NRA) notes that 75% of fine-dining establishments prioritize premium presentation by including high-quality glassware, to enhance customer satisfaction. As travel and dining out regain momentum, hotels and restaurants are investing in durable and visually appealing glassware to elevate brand perception. Additionally, the trend of "Instagrammable" dining experiences has increased demand for aesthetically pleasing table settings. This segment’s rapid expansion underscores its role in driving innovation and setting standards for luxury in the glassware market.

Global Glassware Market By Distribution Channel

The hypermarkets and supermarkets segment led the market by accounting for 40.8% of the glassware market share in 2024. The lead of the hypermarkets and supermarkets segment in the global market is primarily driven by the ability of the segment to offer a wide variety of products at competitive prices by appealing to both urban and rural consumers. According to the U.S. Department of Commerce, physical retail outlets remain a critical channel for purchasing durable goods like glassware, as many consumers prioritize the tactile experience of inspecting products before purchase. While exact percentages may vary, studies indicate that in-store shopping remains the dominant choice for household goods among older demographics who value product quality and immediate availability. Additionally, hypermarkets and supermarkets often provide promotional discounts and bundled offers, making them attractive to budget-conscious buyers. Their widespread presence ensures accessibility by making this channel critical for reaching diverse demographics and driving mass-market adoption.

The online retail segment is on the rise and is estimated to register the fastest CAGR of 9.8% from 2025 to 2033 owing to the increasing internet penetration and shifting consumer preferences toward convenience and accessibility. The World Bank notes that e-commerce adoption surged globally during the COVID-19 pandemic, with online sales of home goods growing significantly. For instance, the U.S. Census Bureau reports that e-commerce sales in the U.S. increased by 32% in 2020 by reflecting a broader trend of digital transformation in retail. Online platforms enable brands to reach global audiences, particularly in regions with limited access to physical stores. Features like detailed product descriptions, customer reviews, and doorstep delivery further enhance the appeal of online shopping among younger tech-savvy consumers. This segment’s rapid expansion underscores its importance in reshaping consumer behavior and expanding market accessibility.

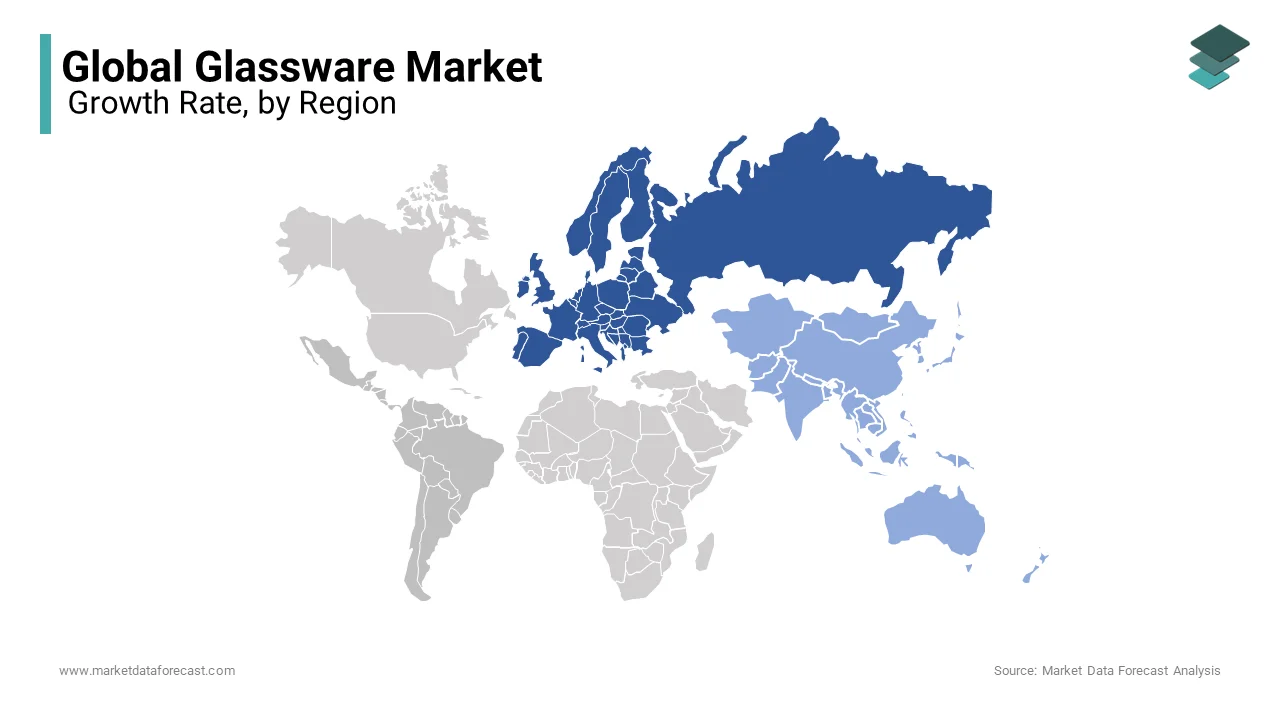

REGIONAL ANALYSIS

Europe dominated the glassware market with 35.6% of the global market share in 2024. The stringent environmental regulations and consumer preferences for sustainable products are boosting the glassware market expansion in Europe. According to the European Container Glass Federation (FEVE), the average glass recycling rate in the EU reached 76% in 2021 with some countries like Germany and Belgium achieving rates above 90%. This high recyclability makes glassware a preferred choice for eco-conscious consumers. Additionally, Europe’s strong hospitality sector with fine dining and tourism that boosts demand for premium glassware. The region’s emphasis on sustainability, aesthetics, and functionality ensures its dominance in the market by setting global standards for innovation and quality.

Asia-Pacific is the fastest-growing region in the global market and is predicted to witness a CAGR of 5.8% from 2025 to 2033. This growth is fueled by rapid urbanization and rising disposable incomes in countries like India and China. The Asian Development Bank (ADB) reports that urban populations in the region are expected to grow by 1.2 billion by 2050 which is driving demand for modern household goods with glassware. Increasing awareness of sustainable living and government initiatives to reduce plastic usage further amplify adoption. This segment’s rapid expansion underscores its importance in catering to emerging middle-class consumers and shaping future market trends.

North America shows steady growth due to increasing home dining trends and eco-friendly consumer preferences. The U.S. Environmental Protection Agency (EPA) highlights that recycling rates for glass containers in the U.S. reached 31% in 2021 by reflecting a growing awareness of sustainable alternatives to single-use plastics. This trend has driven demand for durable and reusable glassware in households among environmentally conscious consumers. Latin America is emerging as a promising market, supported by urbanization and affordable glassware options. According to the Inter-American Development Bank, glassware sales in Brazil and Mexico grew by 12% in 2022 is driven by rising disposable incomes and increased focus on home dining. The Middle East and Africa are gradually adopting glassware for hospitality and decorative purposes, though limited infrastructure remains a challenge. Collectively, these regions will play a vital role in diversifying the market while addressing affordability and regulatory barriers.

KEY MARKET PLAYERS

Libbey Glass LLC, Lifetime Brands, Inc, Steelite International, Guangzhou Jing Huang Glassware Co,Ltd, Villeroy & Boch AG, Taiwan Glass Industry Corporation, Glass Tech Life, Shandong Huapeng Glass Co., Ltd., Zrike Brands, Anhui Deli daily Glass Co., Ltd, Lenox Corporation, Arc Online, Anchor Hocking Group, Inc, Borosil Limited, Garbo Glassware, Degrenne, Sisecam, Ocean Glass Public Company Limited. These are the market players that are dominating the global glassware market.

Top 3 Players in the market

Libbey Glass LLC

Libbey Glass LLC is one of the most prominent players in the global glassware market, known for its wide range of products catering to households, restaurants, and hotels. Headquartered in the United States, Libbey has a strong presence in North America and Europe, offering durable and aesthetically pleasing glassware for everyday use and special occasions. The company’s focus on innovation, such as introducing lead-free crystal and eco-friendly manufacturing processes, has strengthened its reputation as a leader in sustainability. While specific market share figures are not publicly disclosed by Libbey, industry reports highlight that the company is a key supplier to the foodservice industry, particularly in the U.S., where it competes aggressively with other major brands. Libbey’s strategic partnerships with retailers and e-commerce platforms have expanded its global reach, making it a household name in both residential and commercial segments.

Arc International (Arc Online)

Arc International, operating under the brand Arc Online , is a global leader in tabletop glassware, renowned for its iconic brands like Luminarc and Pyrex. Headquartered in France, the company dominates the European and Asian markets with its high-quality, durable, and affordable glass products. Arc International is recognized for its commitment to sustainability, investing in energy-efficient production methods and recyclable materials. While exact market share figures are not publicly available, the company’s extensive distribution network and strong brand recognition have made it a preferred choice for both consumers and businesses. Arc’s focus on design innovation and affordability has enabled it to maintain a competitive edge in emerging markets, particularly in Asia-Pacific, where demand for modern and functional glassware is growing rapidly.

Borosil Limited

Borosil Limited is a leading player in the glassware market, particularly in India and other emerging economies. Known for its premium borosilicate glass products, Borosil has carved a niche in both household and laboratory glassware segments. The company’s innovative product lines, such as microwave-safe and stackable glassware, have resonated well with urban consumers seeking functionality and style. According to the Indian Ministry of Commerce and Industry , Borosil is a dominant player in the Indian glassware market, with a significant share in the premium segment due to its focus on quality and durability. Borosil’s strategic partnerships with e-commerce platforms and retail chains have expanded its reach, while its commitment to sustainability aligns with global trends. By addressing the needs of price-sensitive yet quality-conscious consumers, Borosil contributes significantly to the growth of the glassware market in Asia-Pacific and beyond.

Top strategies used by the key market participants

Product Innovation and Design Excellence: Companies like Villeroy & Boch AG and Lenox Corporation prioritize innovation in product design to appeal to premium and luxury segments. They invest in creating aesthetically appealing, functional, and durable glassware that aligns with modern lifestyle trends. For instance, Villeroy & Boch has introduced collections that combine traditional craftsmanship with contemporary designs, catering to high-end consumers.

Sustainability Initiatives: With increasing consumer demand for eco-friendly products, players such as Borosil Limited and Ocean Glass Public Company Limited are focusing on sustainable manufacturing practices. Borosil, for example, emphasizes the use of recyclable materials and energy-efficient production processes, positioning itself as a leader in environmentally responsible glassware.

Geographic Expansion: Companies like Guangzhou Jing Huang Glassware Co., Ltd. and Shandong Huapeng Glass Co., Ltd. are expanding their presence in emerging markets, particularly in Asia-Pacific, where urbanization and rising disposable incomes are driving demand. These players are leveraging cost-effective production capabilities to offer affordable yet high-quality products.

Strategic Partnerships and Acquisitions: Lifetime Brands, Inc. and Anchor Hocking Group, Inc. have pursued strategic acquisitions to diversify their product portfolios and enhance their market reach. For example, Lifetime Brands acquired KitchenCraft, enabling it to expand its offerings in the tableware and glassware segments.

E-commerce and Digital Marketing: To tap into the growing online retail market, companies like Zrike Brands and Arc Online are investing in robust e-commerce platforms and digital marketing strategies. This approach allows them to reach a broader audience and cater to the increasing preference for online shopping.

Customization and Personalization: Players such as Steelite International and Degrenne are offering customized glassware solutions for the hospitality and commercial sectors. This strategy helps them build long-term relationships with clients by meeting specific design and functional requirements.

Focus on Premium and Niche Segments: Companies like Sisecam and Taiwan Glass Industry Corporation are targeting niche markets, such as high-end crystal glassware and specialized industrial glass products. This allows them to differentiate their offerings and command higher margins.

COMPETITIVE LANDSCAPE

The glassware market is characterized by intense competition, driven by the presence of both established players and emerging manufacturers. Key global players such as Libbey Glass LLC, Lifetime Brands, Inc., Villeroy & Boch AG, and Borosil Limited dominate the market with their extensive product portfolios, strong brand recognition, and innovative offerings. These companies compete on factors such as design, quality, sustainability, and pricing to cater to diverse consumer segments, ranging from premium luxury buyers to cost-conscious households. Regional players like Guangzhou Jing Huang Glassware Co., Ltd. and Shandong Huapeng Glass Co., Ltd. also play a significant role, particularly in Asia-Pacific, by leveraging cost-effective production capabilities to serve local markets.

Competition is further intensified by the growing demand for eco-friendly and customizable glassware, prompting companies to adopt sustainable practices and invest in advanced manufacturing technologies. Strategic acquisitions, partnerships, and geographic expansions are common tactics employed by market leaders to strengthen their foothold. For instance, Lifetime Brands, Inc. has expanded its market reach through acquisitions, while companies like Steelite International focus on catering to the hospitality sector with tailored solutions.

The rise of e-commerce has also transformed the competitive landscape, with brands like Zrike Brands and Arc Online enhancing their digital presence to capture online shoppers. Overall, the glassware market remains dynamic, with innovation, sustainability, and strategic growth initiatives being critical differentiators for companies aiming to maintain a competitive edge.

RECENT HAPPENINGS IN THIS MARKET

In March 2022, Libbey Glass LLC, a leading glassware manufacturer, launched a new line of eco-friendly glassware made from recycled materials.

This initiative is anticipated to allow Libbey to align with global sustainability trends and appeal to environmentally conscious consumers, strengthening its market presence.

In June 2021, Arc International, a global leader in tabletop glassware, introduced a limited-edition designer glassware collection in collaboration with a renowned European artist.

This move is anticipated to allow Arc International to enhance its brand image and attract premium customers seeking unique and aesthetically pleasing products.

In January 2023, Borosil Limited, a prominent Indian glassware company, expanded its production capacity by opening a new manufacturing facility in India.

This expansion is anticipated to allow Borosil to meet rising domestic and international demand for its borosilicate glass products, solidifying its leadership in the market.

In September 2021, Steelite International, a luxury tableware provider, acquired a U.K.-based luxury tableware company to diversify its product portfolio.

This acquisition is anticipated to allow Steelite to strengthen its presence in the high-end hospitality segment and broaden its customer base.

In November 2021, Lifetime Brands, Inc., a major housewares company, partnered with major U.S. retailers to launch exclusive glassware collections.

This collaboration is anticipated to allow Lifetime Brands to increase its visibility and market share in the North American retail sector.

In April 2022, Guangzhou Jing Huang Glassware Co., Ltd., a Chinese glassware manufacturer, invested in advanced glass tempering technology to improve product durability.

This innovation is anticipated to allow the company to offer more robust and long-lasting glassware, enhancing its competitiveness in the global market.

In July 2022, Villeroy & Boch AG, a premium tableware brand, launched a digital marketing campaign targeting millennials and Gen Z consumers.

This strategy is anticipated to allow Villeroy & Boch to boost brand engagement and sales among younger demographics through social media platforms.

In February 2023, Taiwan Glass Industry Corporation, a leading glass manufacturer, signed a distribution agreement with a leading e-commerce platform in Southeast Asia.

This partnership is anticipated to allow Taiwan Glass to expand its reach in emerging markets and increase accessibility for price-sensitive consumers.

In December 2022, Anchor Hocking Group, Inc., a U.S.-based glassware company, introduced a budget-friendly glassware line tailored for the U.S. mass market.

This move is anticipated to allow Anchor Hocking to capture a larger share of the affordable glassware segment and cater to cost-conscious consumers.

In August 2022, Ocean Glass Public Company Limited, a Thai glassware manufacturer, collaborated with hotels in Thailand to supply customized glassware for dining experiences.

This initiative is anticipated to allow Ocean Glass to strengthen its ties with the hospitality industry and enhance brand loyalty among commercial clients.

MARKET SEGMENTATION

This research report on the global glassware market is segmented and sub-segmented into the following categories.

By Material

- Soda Lime Glass

- Crystal Glass

- Borosilicate Glass

- Heat Resistant Glass

By Material

- Soda Lime Glass

- Crystal Glass

- Borosilicate Glass

- Heat Resistant Glass

By Product Type

- Teacup

- Coffee Mug

- Wine Glass

- Everyday Glass

- Spirit Glass

- Beer Mug

- Pitchers

- Glass Jars

- Others

By Price Point

- Premium

- Medium

- Economy

By End User

- Households

- Hotels & Restaurants

- Corporate Canteens

- Café & Bars

- Others

By Distribution Channel

- Hypermarkets And Supermarkets

- Specialized Stores

- Online Retail

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]