Global Germanium Market Size, Share, Trends & Growth Forecast Report – Segmented By Type (Germanium Ingot, Germanium Tetrachloride, High Purity GeO2, Others) Application (PET, Electronics & Solar, Fiber Optics, IR Optics, Others) And By Region (North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) – Industry Analysis From (2025 to 2033)

Global Germanium Market Size

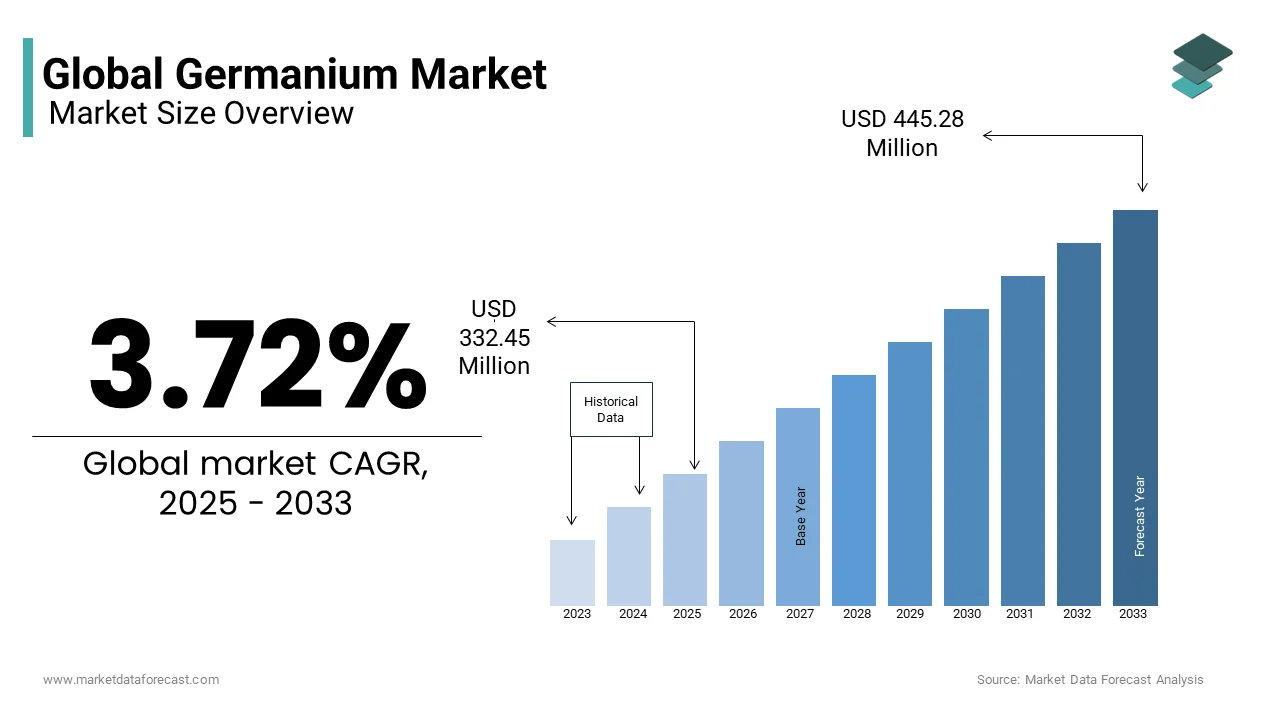

The global germanium market size was valued at USD 320.53 million in 2024 and is anticipated to reach USD 332.45 million in 2025 from USD 445.28 million by 2033, growing at a CAGR of 3.72% during the forecast period from 2025 to 2033.

Current Scenario of the Global Germanium Market

Germanium is a rare metalloid with high optical clarity, semiconductor properties, and infrared transparency, which makes it essential in fiber optics, infrared optics, electronics, and solar technologies. Due to its rarity, germanium is typically extracted as a by-product from zinc ore processing and coal fly ash recovery, with China being the dominant producer.

Germanium is a strategic material, with approximately 35% of its global use in fiber optics, 30% in infrared optics, and 15% in electronics. It is also used in high-efficiency solar cells, particularly in space applications, where over 90% of satellites incorporate germanium-based solar panels due to their durability and efficiency in extreme environments. Furthermore, the growing demand for infrared thermal imaging technology in military, security, and medical sectors has increased reliance on germanium-based optics, as it is one of the few materials transparent to infrared radiation.

China is the largest producer of germanium, accounting for approximately 93% of the global supply in 2021, according to Statista. This dominance underscores China's significant influence over the global germanium market. Recognizing its strategic importance, the United States Department of the Interior included germanium in its 2022 Final List of Critical Minerals, emphasizing its role in economic and national security. Likewise, the European Union has identified germanium as a critical raw material due to its indispensable applications in high-tech industries.

In 2023, China imposed export controls on germanium compounds, effective from August 1, 2023, as reported by the United States International Trade Commission. This moves growing concerns over supply chain vulnerabilities, particularly for countries dependent on germanium imports for advanced semiconductor and defense technologies. As a result, nations such as the United States, Canada, and European countries are exploring alternative sourcing methods, recycling initiatives, and domestic production to reduce reliance on Chinese exports.

With geopolitical tensions and technological advancements reshaping the demand for rare elements, the strategic importance of germanium is expected to continue to rise during the forecast period.

Market Drivers

Increasing Demand for Fiber Optic Communication Systems

The global demand for high-speed internet and 5G networks has significantly driven the Germanium market due to its critical role in fiber optic cables. Germanium enhances signal transmission efficiency in telecommunications infrastructure. The U.S. Geological Survey (USGS) states that Germanium is extensively used in fiber optics, with approximately 35% of its global consumption attributed to this sector in 2022. As countries like China and the U.S. invest heavily in 5G infrastructure, the demand for Germanium is expected to rise further. The USGS also reports that global Germanium production was approximately 120 metric tons in 2022, reflecting its growing importance in modern communication technologies.

Rising Use in Infrared Optics and Defense Applications

Germanium’s transparency to infrared radiation makes it indispensable for thermal imaging, night-vision equipment, and missile guidance systems, driving its demand in defense applications. The Stockholm International Peace Research Institute (SIPRI) reports that global military expenditure reached $2.2 trillion in 2022, with significant investments in advanced optics and sensors. Additionally, the increasing adoption of autonomous vehicles, which rely on LiDAR systems using Germanium lenses, further boosts demand. According to the USGS, about 40% of Germanium usage is linked to infrared applications, highlighting its dual utility in defense and automotive sectors. The U.S. Department of Defense (DoD) underscores the strategic importance of Germanium in cutting-edge defense technologies. This dual demand ensures sustained market growth, as industries increasingly rely on Germanium-based components for precision and reliability.

Market Restraints

Limited Availability and Supply Chain Vulnerabilities

The Germanium market is constrained by its limited availability and supply chain vulnerabilities. Germanium is primarily a byproduct of zinc refining and coal fly ash, making its production reliant on these industries. According to the U.S. Geological Survey (USGS), global Germanium production in 2022 was approximately 120 metric tons, with China dominating over 65% of the supply chain. This heavy reliance on China creates risks, as geopolitical tensions or export restrictions could disrupt global availability. The USGS also reports that recycling contributes only about 30% of the total Germanium supply, limiting alternative sourcing options. Additionally, stricter environmental regulations in key producing regions have curtailed primary production. For instance, Europe’s stringent mining policies have reduced zinc smelting activities, indirectly affecting Germanium output. These factors collectively restrict supply, posing challenges for industries dependent on this critical material.

High Production Costs and Price Volatility

High production costs and price volatility are significant restraints in the Germanium market. Extracting and refining Germanium is energy-intensive, contributing to elevated costs. The U.S. Geological Survey (USGS) highlights that Germanium prices are highly sensitive to fluctuations in zinc and coal markets, which are themselves influenced by economic and environmental factors. In 2022, Germanium prices increased by approximately 20% due to supply disruptions caused by China's environmental policies, which reduced coal fly ash processing. Furthermore, the absence of dedicated Germanium mines forces industries to rely on byproduct recovery, adding complexity and cost to the supply chain. These uncertainties hinder investment in applications like infrared optics and fiber optics, where stable pricing is essential. The USGS emphasizes the need for advanced extraction technologies to reduce costs and stabilize supply.

Market Opportunities

Growing Adoption in Renewable Energy Technologies

The Germanium market is set to benefit from the increasing adoption of renewable energy technologies, particularly in high-efficiency solar cells. Germanium is essential for multijunction photovoltaics, which are used in space applications and concentrated solar power systems due to their superior efficiency. According to the International Energy Agency (IEA), global solar energy capacity grew by 22% in 2022, with projections indicating sustained growth as countries invest in clean energy transitions. The U.S. Geological Survey (USGS) confirms that Germanium-based solar cells achieve efficiency rates exceeding 30%, making them ideal for advanced applications like satellites. NASA reports that Germanium is widely used in satellite solar panels, driven by the growing demand for space exploration missions. Global renewable energy investments reached $495 billion in 2022, as per the IEA, highlighting the expanding opportunities for Germanium in sustainable energy solutions.

Expansion in Semiconductor and Electronics Applications

The rising demand for semiconductors presents a significant opportunity for the Germanium market, driven by its unique properties such as high electron mobility. Germanium is increasingly used in next-generation semiconductor devices, including high-speed transistors and quantum computing components. The U.S. Geological Survey (USGS) notes that Germanium's role in semiconductor manufacturing is expanding due to its ability to enhance performance in miniaturized and energy-efficient devices. Additionally, the U.S. Department of Commerce highlights that the CHIPS Act allocates $52.7 billion to boost domestic semiconductor production, creating new demand for materials like Germanium. These developments position the Germanium market to capitalize on technological innovations and secure long-term growth prospects.

Market Challenges

Environmental Regulations Impacting Extraction and Processing

The Germanium market is significantly challenged by stringent environmental regulations affecting its extraction and processing. Germanium is primarily recovered as a byproduct of zinc smelting and coal fly ash, both of which are energy-intensive processes with substantial environmental impacts. The U.S. Environmental Protection Agency (EPA) has enforced stricter emission standards on zinc smelters, reducing their operational capacity and indirectly limiting Germanium supply. Furthermore, China, which produces over 65% of global Germanium, according to the U.S. Geological Survey (USGS), has implemented tighter environmental policies on coal processing, further constraining output. These regulatory measures have increased production costs and reduced availability.

Competition from Alternative Materials

The Germanium market faces significant challenges due to competition from alternative materials that offer similar functionalities at lower costs. Silicon, for example, dominates the semiconductor industry due to its abundance and affordability. Similarly, in fiber optics, advancements in polymer-based materials and other substitutes threaten to reduce Germanium's market share. The U.S. Geological Survey (USGS) highlights that such competition has led to slower demand growth for Germanium in certain sectors. With industries increasingly prioritizing cost-effectiveness, Germanium’s higher price point makes it less competitive. This poses a significant challenge for market expansion in an era where cost-sensitive solutions are prioritized globally.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.72% |

|

Segments Covered |

By Type, Application, and Region. |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Yunnan Chihong Zinc & Germanium Co., Ltd., Umicore, Teck Resources Limited, JSC Germanium, PPM Pure Metals GmbH, Indium Corporation, China Germanium Co., Ltd., AXT, Inc., 5N Plus, Noah Chemicals |

SEGMENT ANALYSIS

Global Germanium Market Analysis By Type

The germanium ingots segment accounted for the major share of 40.3% of the global market in 2024. The domination of the ingots segment is primarily attributed to its critical applications in semiconductors, infrared optics, and fiber optics. Germanium Ingots are essential for manufacturing high-efficiency solar cells, thermal imaging systems, and infrared lenses, with the semiconductor industry accounting for over 35% of demand. According to the International Energy Agency (IEA), global solar energy capacity rose notably, driven by investments in renewable energy technologies. Germanium Ingots' versatility and importance in advanced industries ensure their sustained dominance in the market, making them a cornerstone for technological innovation and industrial growth.

The high purity GeO2 segment is projected to exhibit a CAGR of 8.7% over the forecast period due to the rising demand in fiber optic communication systems, particularly for low-loss optical fibers used in 5G and broadband expansion. The International Telecommunication Union (ITU) reports that global internet traffic is expected to grow substantially in 2025, necessitating robust fiber optic infrastructure. High Purity GeO2 is also critical in semiconductor doping processes, further accelerating demand. The U.S. Geological Survey (USGS) highlights its role in meeting the needs of modern communication and electronics industries, underscoring its growing importance in cutting-edge applications.

Global Germanium Market Analysis By Application

The electronics & solar segment had 35.5% of the global market share in 2024. The critical role of Germanium in semiconductors, high-efficiency solar cells, and infrared optics is driving the domination of the electronics and solar segment in the global market. The International Energy Agency (IEA) highlights that global solar energy capacity grew by 22% in 2022, supported by investments in renewable energy technologies. Germanium's unique properties, such as high electron mobility and transparency to infrared radiation, make it indispensable for advanced electronics and photovoltaics. These factors solidify its leadership in the Germanium market.

The fiber optics segment is experiencing a swift rise and predicted to grow at a CAGR of 8.9% over the forecast period owing to the increasing demand for high-speed internet, 5G infrastructure, and data transmission systems. Cisco’s Annual Internet Report states that global internet traffic is expected to grow by 27% annually through 2025, necessitating robust fiber optic networks. Germanium is essential for manufacturing low-loss optical fibers, making it critical for modern communication systems. Additionally, advancements in LiDAR systems for autonomous vehicles are driving further demand. The U.S. Geological Survey (USGS) emphasizes Germanium's role in enabling cutting-edge technologies, ensuring sustained growth in this segment.

REGIONAL ANALYSIS

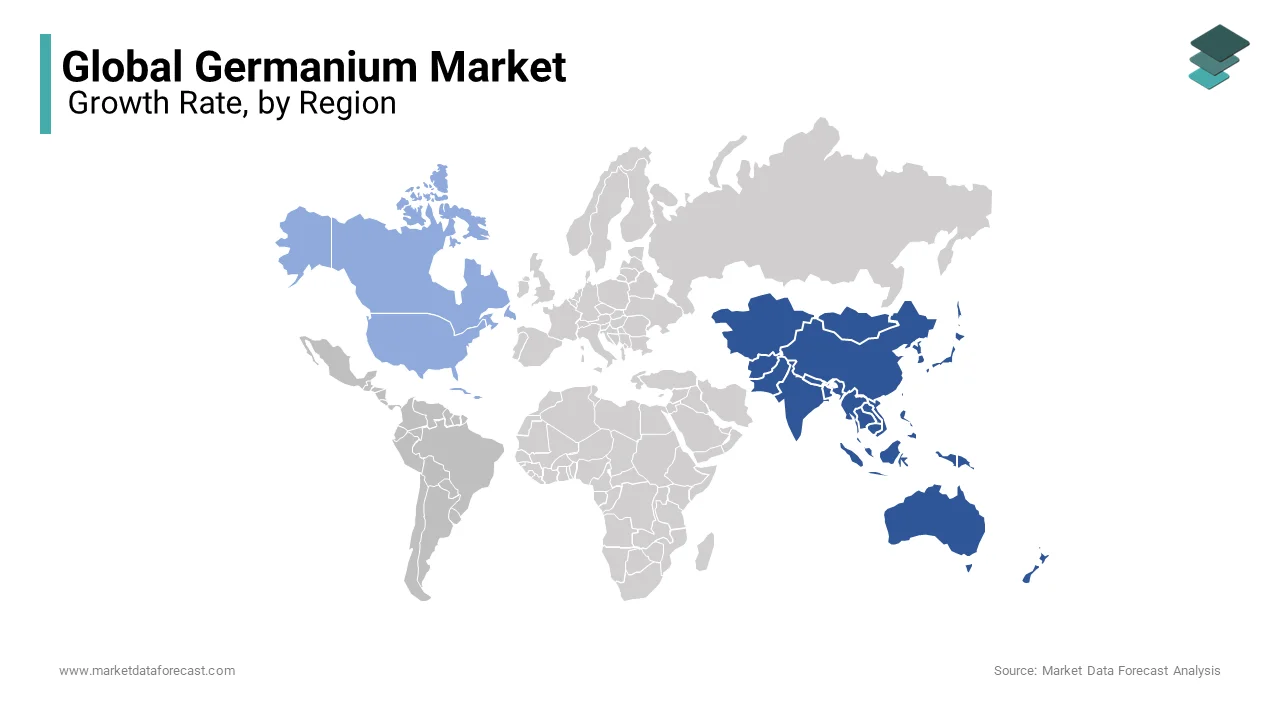

Asia-Pacific led the Germanium market by accounting for 65.4% of global market share in 2024. China is the largest producer, contributing a significant portion of global supply, primarily as a byproduct of zinc smelting and coal fly ash processing. The region's leadership is driven by its strong manufacturing base in semiconductors, fiber optics, and solar energy technologies. According to the International Energy Agency (IEA), Asia-Pacific accounted for 60% of global renewable energy capacity additions in 2022, with solar energy being a key contributor. This underscores the region’s pivotal role in meeting global Germanium demand, supported by government policies promoting clean energy and technological innovation.

North America is developing rapidly in the Germanium market with an estimated CAGR of 7.8% during the forecast period. This growth is driven by significant investments in semiconductor manufacturing, bolstered by the CHIPS Act, which allocates $52 billion to enhance domestic production. The Semiconductor Industry Association (SIA) reports that North America’s semiconductor business grew considerablyin 2022, increasing demand for materials like Germanium. Advancements in 5G, AI, and quantum computing further accelerate this trend. The U.S. Geological Survey (USGS) highlights efforts to reduce reliance on imports through local Germanium recovery initiatives, solidifying North America’s importance in the global supply chain.

Europe

Europe is expected to witness steady growth in the Germanium market and is driven by investments in renewable energy and environmental regulations. According to solar power Europe , solar energy capacity in the region grew by 47% in 2022, with projections indicating sustained growth under the European Green Deal. Germany and France are leading this transition, driving demand for Germanium in photovoltaics and fiber optics. The European Environment Agency highlights that recycling initiatives under the EU’s circular economy framework aim to recover critical materials, including Germanium, though specific recovery rates remain sector-dependent. While Europe accounts for approximately 15% of the global Germanium market, its focus on sustainability and technological innovation ensures steady demand growth in the coming years.

Latin America

Latin America shows moderate growth potential in the Germanium market which is supported by its mineral wealth and telecommunications investments. The United Nations Economic Commission for Latin America and the Caribbean (ECLAC) reports that mining investments in the region are projected to grow by 3-4% annually through 2030, providing opportunities for Germanium extraction as a byproduct of zinc and copper mining. Brazil and Chile are emerging players due to their mineral resources and growing semiconductor industries. However, logistical challenges and limited refining infrastructure constrain rapid expansion. Latin America currently contributes less than 5% to the global Germanium market, with gradual improvements expected as processing capabilities develop.

Middle East & Africa

The Middle East and Africa are poised for incremental growth in the Germanium market, propelled by mining investments and renewable energy projects. The African Development Bank notes that mining investments in Africa are projected to grow by 5-6% annually through 2030, unlocking potential for Germanium recovery from zinc and coal processing. In the Middle East, digital transformation and 5G infrastructure development are increasing demand for fiber optics, where Germanium plays a critical role. However, political instability and underdeveloped industrial infrastructure remain barriers. Collectively, these regions account for less share of the global Germanium market, but their focus on resource development and technology adoption positions them for gradual growth in the coming years.

Top 3 Players in the market

Yunnan Germanium

Yunnan Germanium is China's first and Asia's largest producer and supplier of germanium products. The company operates a fully integrated supply chain, including germanium mining, enrichment, purification, refining, deep processing, and research and development. Its production capabilities allow it to supply high-purity germanium materials essential for applications in fiber optics, infrared optics, and the solar energy sector. By leveraging its large-scale production and advanced refining techniques, Yunnan Germanium plays a crucial role in meeting global demand for germanium-based technologies.

China Germanium Co., Ltd. (CNGE)

China Germanium Co., Ltd. (CNGE) is a leading manufacturer specializing in high-purity materials of rare metals, particularly germanium. The company is engaged in the separation, purification, deep processing, regeneration, and recycling of germanium, indium, and other rare metal materials. CNGE is one of the few companies in the world capable of large-scale production of germanium wafers used in solar cells, making it a key contributor to advancements in solar energy technology. Its commitment to refining and recycling ensures a stable and sustainable supply of germanium for high-tech applications.

Umicore

Umicore, headquartered in Belgium, is a global leader in materials technology and recycling. The company produces and markets high-purity germanium products, including compounds used for doping optical fibers, semiconductor wafers, and infrared optics. Through its expertise in material refining and recycling, Umicore ensures a sustainable and environmentally friendly supply of germanium. The company plays a significant role in supporting industries such as telecommunications, aerospace, and renewable energy, positioning itself as a key player in the global germanium market.

Top strategies used by the key market participants

Vertical Integration and Supply Chain Control

Leading germanium producers focus on vertical integration to ensure a stable and cost-effective supply chain. Companies like Yunnan Germanium and China Germanium Co., Ltd. (CNGE) control the entire production process, from mining and purification to refining and processing. By managing their supply chains internally, these companies reduce dependence on external suppliers, enhance product quality, and optimize production costs. This strategy is particularly vital given that germanium is classified as a critical material by many governments, making supply chain security a top priority.

Technological Advancements and R&D Investments

Key players in the germanium market heavily invest in research and development (R&D) to create high-purity germanium and develop advanced applications. Umicore specializes in high-purity germanium for semiconductors, fiber optics, and infrared optics, catering to high-tech industries such as aerospace and defense. Meanwhile, CNGE has pioneered the development of germanium wafers for solar energy, playing a crucial role in space and terrestrial solar power projects. These R&D investments not only enhance product capabilities but also open doors to emerging technologies, such as quantum computing and AI-driven semiconductor manufacturing.

Expanding Market Presence and Global Partnerships

To maintain their competitive edge, germanium producers establish global partnerships and expand into international markets. Umicore collaborates with European and U.S. technology firms to supply germanium for advanced electronics and renewable energy projects, strengthening its global footprint. Similarly, Yunnan Germanium has increased exports to Japan, South Korea, and North America, securing a steady customer base in high-demand regions. By forming strategic alliances and expanding into new markets, these companies mitigate risks associated with single-market dependence and gain a competitive advantage on a global scale.

KEY MARKET PLAYERS

Yunnan Chihong Zinc & Germanium Co., Ltd., Umicore, Teck Resources Limited, JSC Germanium, PPM Pure Metals GmbH, Indium Corporation, China Germanium Co., Ltd., AXT, Inc., 5N Plus, Noah Chemicals. These are the market players that are dominating the global germanium market.

COMPETITIVE LANDSCAPE

The global germanium market is highly competitive and concentrated, with a few dominant players controlling most of the production and supply. China holds the majority of the world's germanium reserves, making Chinese companies such as Yunnan Germanium and China Germanium Co., Ltd. (CNGE) key players in the market. These companies benefit from government-backed policies and strong mining infrastructure, allowing them to control pricing and supply availability. However, geopolitical tensions and export restrictions have prompted non-Chinese companies to seek alternative supply sources, increasing competition.

European and North American firms, such as Umicore and Teck Resources, compete by focusing on high-purity germanium production, recycling, and advanced applications in industries like semiconductors, fiber optics, infrared optics, and renewable energy. Their expertise in refining and sustainability efforts helps them differentiate from Chinese producers.

Competition in the market is also driven by technological advancements and innovation. Companies invest heavily in R&D to develop new germanium-based materials for solar panels, high-speed electronics, and military applications. Additionally, the push for germanium recycling is creating a competitive edge for companies that can efficiently recover and refine the metal.

Overall, competition in the germanium market is shaped by supply chain control, technological innovation, and geopolitical factors, making it a dynamic and evolving market.

RECENT HAPPENINGS IN THIS MARKET

- In October 2024, Gécamines, the Democratic Republic of Congo's state mining company, announced its first shipment of germanium concentrates to Europe. This shipment, produced at a new plant in Lubumbashi, is destined for Umicore in Belgium for further processing and application in high-tech industries. This investment marks Congo's strategic move to become a significant player in the global strategic metals market.

- In October 2024, Nyrstar, a global multi-metals company, initiated a feasibility study for a $150 million project aimed at recovering up to 80% of the annual U.S. consumption of gallium and germanium. The project, linked to Nyrstar's zinc smelter in Clarksville, Tennessee, reflects efforts to bolster domestic production of these critical minerals and reduce reliance on foreign suppliers.

MARKET SEGMENTATION

This research report on the global germanium market is segmented and sub-segmented into the following categories.

By Type

- Germanium Ingot

- Germanium Tetrachloride

- High Purity GeO2

- Others

By Application

- PET

- Electronics & Solar

- Fiber Optics

- IR Optics

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]