Global Fruit And Vegetable Seeds Market Size, Share, Trends & Growth Forecast Report - Segmented By Trait (Gm And Conventional), Type (Brassica, Cucurbit, Leafy, Root Bulb, Solanaceae And Other Seeds) Form (Organic And Inorganic), Farm Type (Indoor And Outdoor), And Region (North America, Europe, Asia Pacific, Latin America, and Middle East and Africa) - Industry Analysis From 2025 to 2033

Global Fruit and Vegetable Seeds Market Size

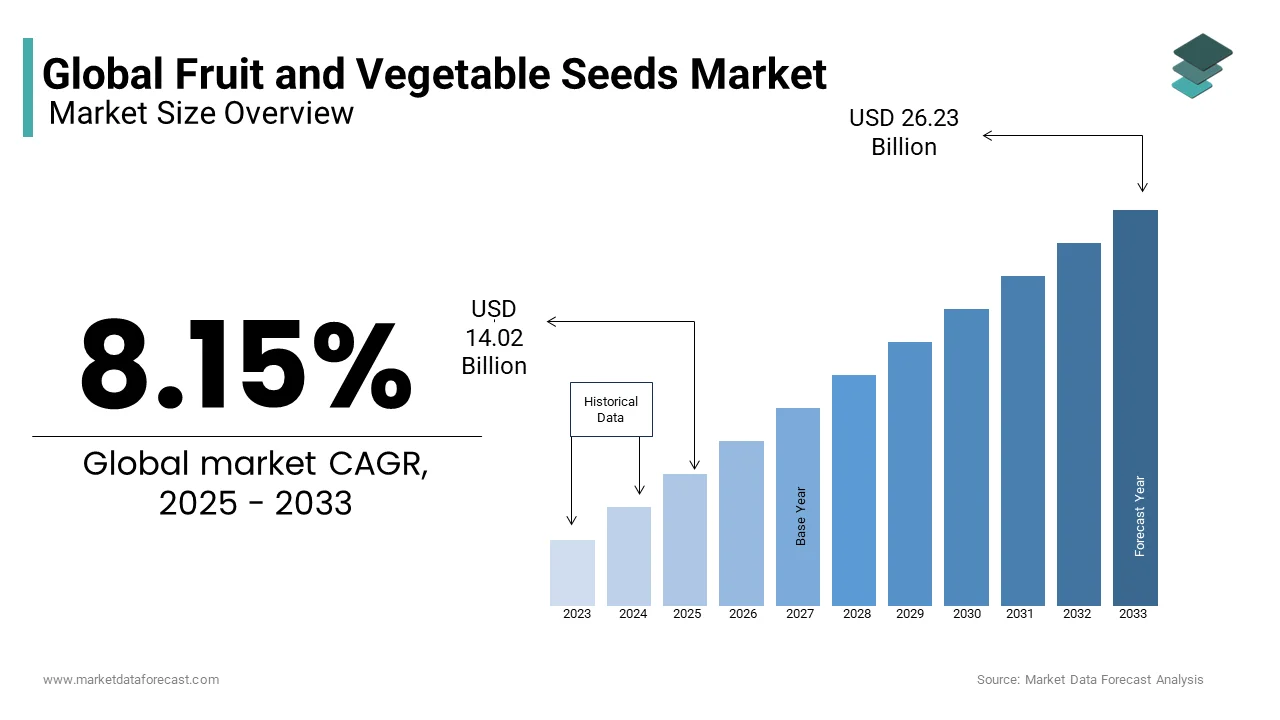

The global market for fruit and vegetable seeds was valued at USD 12.96 billion in 2024 and is anticipated to reach USD 14.02 billion in 2025 from USD 26.23 billion by 2033, at a CAGR of 8.15% between 2025 and 2033.

This market is a pivotal segment of global agriculture, as the quality of seeds directly influences crop yield, disease resistance, and adaptability to varying environmental conditions. With the global population expected to reach 9.7 billion by 2050, the demand for efficient, sustainable, and high-yielding food production is increasing. High-quality seeds are critical in meeting these growing food needs while ensuring resource efficiency. The utilization of premium seeds enhances crop yields by optimizing growing conditions and providing better resistance against diseases, pests, and climate variability. Furthermore, these seeds contribute to the more efficient use of resources, such as water and nutrients, which aligns with modern sustainable farming practices. The demand for organic and non-genetically modified (non-GMO) seeds is also rising, driven by consumer preferences for healthier, environmentally friendly products.

CURRENT SCENARIO OF THE GLOBAL FRUITS AND VEGETABLES SEEDS MARKET

The fruit and vegetable seeds market is experiencing an upward growth trajectory. It is a highly competitive market, with a blend of niche producers, long-established brands and companies, and emerging players. Moreover, in the last few years, mergers and acquisitions comprising big multinational organizations have reshaped the biotechnology and seed sector and have decreased the number of players in the market. The recent merger involving DuPont and Dow, ChemChina’s purchase of Syngenta, and Bayer’s integration with Monsanto have significantly transformed the dynamics of the seed market worldwide. Also, numerous industry experts and stakeholders have raised concerns about the growing consolidation and its potential effects on product choice, innovation, and pricing in the seed and genetically modified (GM) technology markets. Additionally, the market witnesses the development of new technologies for breeding, like CRISPR and other Genomediting methods, which are leading the way.

KEY TRENDS IN THE FRUITS AND VEGETABLE SEEDS MARKET

Increasing Demand for Organic Seeds

There is a notable rise in the demand for organic seeds, fueled by growing consumer awareness around health and environmental sustainability. As consumers increasingly prefer organic fruits and vegetables, farmers are adopting organic seeds to meet this demand. In 2023, Europe’s organic food market saw a 15% growth, with organic seeds emerging as a key segment within the agriculture sector. Countries such as Germany, France, and Italy are witnessing substantial growth in organic farming, and this trend is expected to continue as consumer demand for organic, eco-friendly products rises.

Focus on Sustainable Agriculture

Sustainability is at the forefront of the agricultural sector, with significant investments being made in research to develop seeds that perform under sustainable farming practices. These seeds are designed to require fewer inputs, such as water, fertilizers, and pesticides, while maintaining high yields. For instance, in 2022, Syngenta introduced a line of drought-resistant vegetable seeds that have seen widespread adoption in water-scarce regions. The adoption of sustainable agricultural practices is gaining momentum, particularly in areas affected by climate change, as these seeds help reduce farming's environmental impact while sustaining productivity.

MARKET DRIVERS

Rising Global Demand for Fruits and Vegetables

Global demand for fresh fruits and vegetables is rising, driven by population growth, urbanization, and increased health consciousness. According to the Food and Agriculture Organization (FAO), global fruit and vegetable production has risen by 20% in the last decade, largely due to demand from urban centers in the Asia-Pacific and Africa regions. As consumers shift toward healthier diets, the need for high-quality, high-yielding seeds is growing to support increased fresh produce consumption.

Technological Advancements in Seed Production

Technological innovations, including genetic modification and hybridization techniques, are enhancing seed quality and improving crop resilience to climate change, pests, and diseases. Technologies like CRISPR and advanced gene editing allow for precise modifications that increase both yield potential and the nutritional value of fruits and vegetables. Bayer’s hybrid seeds, for example, have demonstrated a 30% increase in yields in regions affected by adverse climate conditions. These advancements are critical as farmers seek solutions to climate-related challenges while maximizing output.

Sustainability and Organic Farming Trends

The rising demand for non-GMO and organic food products has led to a surge in demand for organic seeds. As of 2023, organic farming constituted 9.3% of agricultural land in Europe, according to IFOAM, and this trend is expected to continue as consumer preferences increasingly favor sustainability and health-conscious choices. The organic farming sector in the U.S. has also experienced steady growth, with a 12% annual increase since 2015. As companies look to capitalize on the growing market for organic products, the development of organic seeds that meet regulatory standards and offer high yields remains a strategic focus.

MARKET RESTRAINTS

High R&D Costs

The development of new seed varieties requires substantial investment in research, testing, and field trials. Companies must allocate significant resources to breeding programs and genetic studies to produce seeds that are high-yielding, disease-resistant, and adaptable to diverse climates. Furthermore, these seeds must comply with international standards and regulatory requirements, further increasing development costs. For example, Corteva Agriscience invests millions annually in R&D for hybrid seeds that can withstand various environmental stresses.

Regulatory Hurdles

Regulations regarding genetically modified organisms (GMOs) vary significantly across countries, posing challenges for seed producers. For instance, Europe has a stringent regulatory framework on GMOs, limiting the commercialization of genetically modified seeds, whereas the United States and Brazil have more relaxed regulations. This regulatory divergence creates barriers for global seed companies, requiring them to navigate complex legal frameworks and adapt their product offerings based on local regulations.

MARKET OPPORTUNITIES

Emerging markets, particularly in Latin America and Africa, offer substantial growth potential for the fruit and vegetable seeds market. These regions are seeing increased agricultural investments, supported by government initiatives and international aid programs aimed at enhancing food security. Brazil, for example, has witnessed a boom in agricultural exports, driving demand for high-quality seeds to boost productivity. Similarly, Africa is undergoing a transformation in agriculture, with a focus on improving yields through advanced seed usage. These regions are expected to be key growth drivers for the global seed market over the next decade.

MARKET CHALLENGES

Seed-borne diseases are on the rise, leading to low crop yields. It is one of the major issues the fruit and vegetable market has faced for a long time and continues to suffer from it. For many years, several pathogens have been linked to crops, and in some situations, life-threatening infections and significant economic damage have been reported. For instance, in Bangladesh, there is a serious infection of bakanae disease in rice fields across the country. In the United States and Canada, the fungus Colletotrichum truncatum has been reported in the region of North Dakota and Montana, which caused the athracnose of chickpeas and lentils. According to the Bangladesh Journals Online, Fusarium fujikuroi, and Fusarium equiseti are the two fungal species of Fusarium which caused major loss of rice every year. The infection rate of Fusarium fujikuroi was highest in Bbuganj upazila i.e. 11.11 per cent and Agailjhara with 8.83 per cent is at second position.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2025 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.15% |

|

Segments Covered |

By Trait, Type, Form, Farm Type, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bayer CropScience AG, Syngenta AG, Monsanto Company, Advanta Limited, Groupe Limagrain, Takii & Co Ltd., Sakata Seed Corporation, Mahyco, Western Bio Vegetable Seeds Ltd., Mahindra Agri. |

SEGMENT ANALYSIS

Global Fruit And Vegetable Seeds Market Analysis By Trait

The genetically modified (GM) seeds segment currently hold a substantial share of the global seed market. These seeds are widely adopted in regions such as North America and South America, where farmers prioritize high yields and resistance to pests. The GM seed market is forecast to grow at a compound annual growth rate (CAGR) of 7% over the next five years, driven by continuous advancements in seed technology. In contrast, conventional crop seeds continue to dominate in regions with stringent regulations on GMOs, particularly in Europe. The conventional seeds segment is projected to expand at a CAGR of 4.5%, spurred by the increasing demand for organic and non-GMO farming practices.

Global Fruit And Vegetable Seeds Market Analysis By Type

Among seed types, Solanaceae seeds such as including tomatoes, peppers, and eggplants is leading the market and captured 30.8% of the global market share in 2023. These crops are integral to both large-scale commercial farming and smallholder agriculture, with widespread consumption globally. The Brassica segment, which includes crops such as broccoli and cabbage, is expected to grow at a CAGR of 6%, driven by rising demand for fiber-rich, health-conscious diets. Root bulbs like carrots and onions are experiencing growth, particularly in the Asia-Pacific region, due to the increasing demand for staple vegetables.

Global Fruit And Vegetable Seeds Market Analysis By Form

The organic seeds segment is witnessing significant growth, particularly in developed markets such as North America and Europe, where consumer demand for organic food products is strong. Although organic seeds account for only 15% of the global seed market, this segment is anticipated to grow at a CAGR of 8%, outpacing the growth rate of inorganic seeds. Conversely, inorganic seeds continue to dominate with 85% of the market share, driven primarily by their extensive use in conventional farming systems.

Global Fruit And Vegetable Seeds Market Analysis By Farm Type

The indoor farming sector, which includes vertical farming and greenhouse cultivation, is experiencing increased demand for specialized seeds optimized for controlled environments. This segment is projected to grow at a CAGR of 9%, fueled by the rise in urban farming and sustainable agriculture practices. Despite this growth, outdoor farming continues to hold the largest market share, accounting for 80% of total seed sales.

REGIONAL ANALYSIS

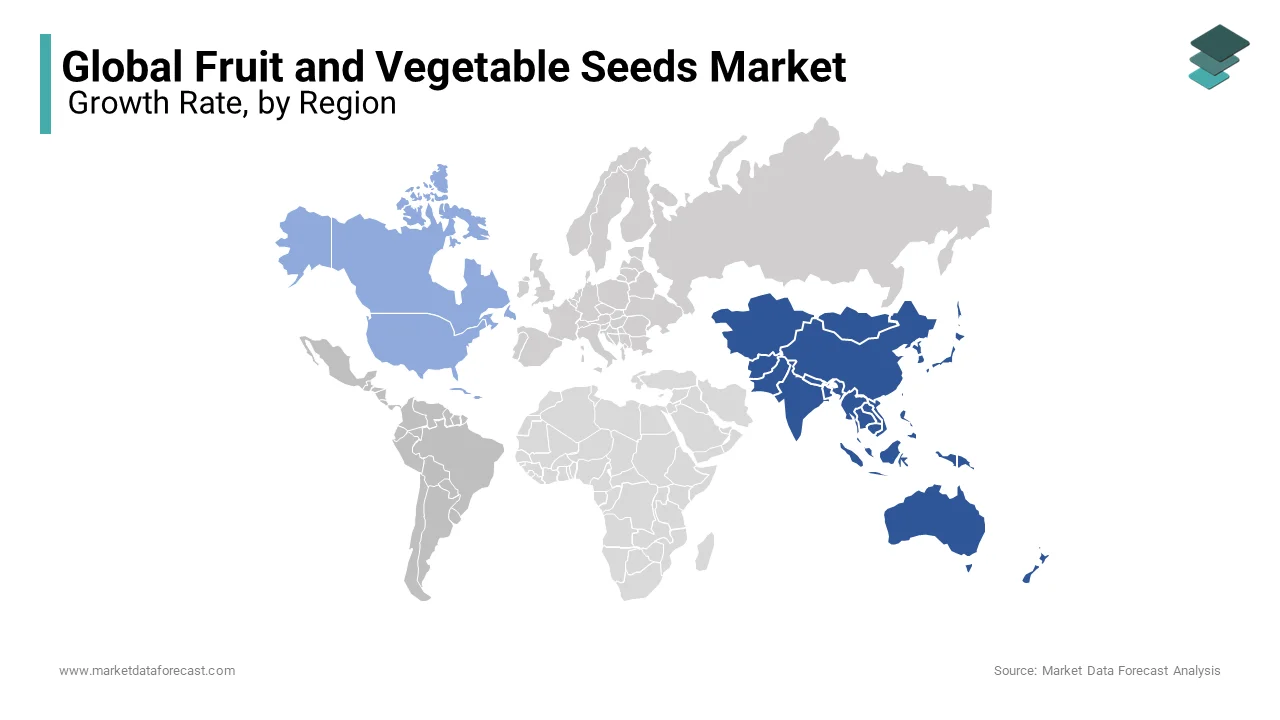

The Asia-Pacific region is the leading market for fruit and vegetable seeds, with major contributors like China and India, both of which have large agricultural sectors and are adopting advanced seed technologies. The region represents nearly 40.7% of the global fruits and vegetable seeds market, with China alone contributing 25%. Growth in the region is largely driven by government initiatives aimed at improving agricultural productivity and increasing consumer demand for healthier food options. The Asia-Pacific market is projected to grow at a CAGR of 6.5%, with a focus on developing seeds that are resilient to climate change.

North America plays a significant role in the global market, benefiting from advanced agricultural practices and high-tech solutions. The U.S. dominates the region, contributing more than 80% of the North American seed market. The region is expected to grow at a CAGR of 5.8%, driven by increasing demand for sustainable agriculture solutions. Canada is also contributing to market expansion, with a focus on seed technology investments and a growing preference for organic and non-GMO products. The adoption of precision farming techniques, which depend heavily on high-quality seeds, is a major growth driver in this region.

Europe is a key market for high-quality organic seeds, particularly in niche sectors like heirloom and specialty crops. Leading countries such as Germany, France, and Italy have been at the forefront of organic farming, with Europe’s organic food market growing by 12% in 2023. This growth is largely attributed to consumer demand for healthier, sustainably sourced food products. The European market is expected to grow at a CAGR of 6.1%, further driven by the European Union's Farm to Fork Strategy, which aims to enhance the sustainability of food systems. The region's focus on reducing pesticide and chemical fertilizer use is bolstering demand for organic seeds.

COMPETITIVE LANDSCAPE

The global fruit and vegetable seeds market is dominated by major companies, including BASF, Bayer, Syngenta, and Corteva, all of which invest heavily in research and development (R&D) to innovate seed technologies. These companies focus on developing seeds that are resilient to extreme weather, pests, and diseases, ensuring high yields and consistent crop quality.

KEY MARKET PLAYERS

Bayer CropScience AG, Syngenta AG, Monsanto Company, Advanta Limited, Groupe Limagrain, Takii & Co Ltd., Sakata Seed Corporation, Mahyco, Western Bio Vegetable Seeds Ltd., Mahindra Agri. These are the market players that are dominating the global fruits and vegetables market.

RECENT HAPPENINGS IN THIS MARKET

- BASF partnered with Graines Voltz in May 2024 to develop climate-resilient seeds for the European market.

- Syngenta launched a new line of drought-tolerant vegetable seeds in April 2023, targeting water-scarce regions across Africa.

- Bayer strengthened its presence in Southeast Asia by acquiring Verdant BioScience in July 2023.

- Corteva expanded its seed research facility in Brazil in October 2023, focusing on the development of high-yield, pest-resistant seeds.

- Syngenta collaborated with John Deere in November 2023 to integrate seed technology with precision farming tools, aiming to enhance planting efficiency.

- BASF invested €150 million in 2023 for R&D on organic seeds, with a focus on high-quality vegetable seeds for European and North American markets.

- Corteva introduced its first line of gene-edited fruit seeds using CRISPR technology in March 2024.

- Bayer announced a strategic partnership with AgroSavvy in February 2024 to develop disease-resistant cucumber seeds for Latin America.

- Syngenta expanded its seed distribution network in India in September 2023, offering hybrid seed varieties to smallholder farmers.

- Corteva launched new seed treatment technology in August 2023, aimed at improving seed resilience against climate-related stressors in North America.

MARKET SEGMENTATION

This research report on the global fruits and vegetable seeds market is segmented and sub-segmented into trait, type, form, farm type and region.

By Trait

- Genetically Modified

- Conventional Crop Seeds

By Type

- Brassica

- Cucurbit

- Leafy

- Root bulb

- Solanaceae

- Seeds

By Form

- Organic

- Inorganic

By Farm Type

- Indoor

- Outdoor

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current size of the Fruits and Vegetables Seeds Market in North America?

The North American Fruits and Vegetables Seeds Market is currently valued at USD 14.02 billion in 2025.

Which fruits and vegetables seeds dominate the market share in the European Fruits and Vegetables Seeds Market?

In Europe, tomato seeds, cucumber seeds, and lettuce seeds are major contributors, collectively accounting for approximately X% of the market share.

How are seed quality standards and certifications affecting the Fruits and Vegetables Seeds Market in Germany?

Quality standards and certifications in Germany ensure the availability of high-quality seeds, promoting the use of certified seeds in commercial and home gardening.

Are there specific trends shaping the adoption of hybrid seeds in India's Fruits and Vegetables Seeds Market?

In India, a trend towards the adoption of hybrid seeds is notable, driven by the desire for improved yields, disease resistance, and crop uniformity.

who are the key market players involved in the Fruits and Vegetables Seeds Market?

Bayer CropScience AG, Syngenta AG, Monsanto Company, Advanta Limited, Groupe Limagrain, Takii & Co Ltd., Sakata Seed Corporation, Mahyco, Western Bio Vegetable Seeds Ltd., Mahindra Agri.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]