Global Food Processing Machinery Market Size, Share, Trends, & Growth Forecast Report - Segmented By Type (Thermal, Cutting & Peeling, Extraction, Mixer, Blender & Homogenizer), Mode Of Operation (Semi-Automatic, Fully Automatic), Application (Bakery & Confectionery, Meat, Poultry & Seafood, Dairy, Beverages, And Others), And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis From 2025 To 2033

Global Food Processing Machinery Market Size

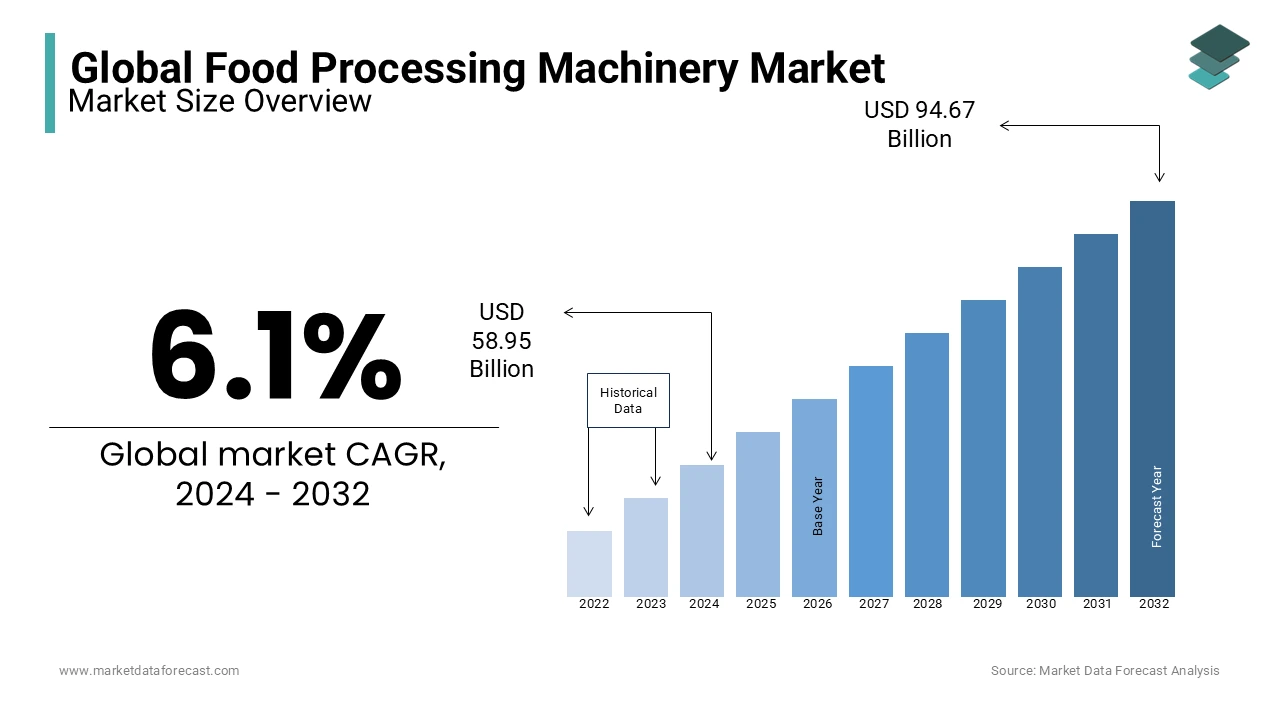

The global food processing machinery market size was valued at USD 58.95 billion in 2024 and is expected to be USD 62.55 billion in 2025, and it is estimated to reach a valuation of USD 100.45 billion by the end of 2033, expanding at a CAGR of 6.1% during the forecast period. The urge for processed foods is a notable aspect that is presumed to promote the development of the food processing machinery business.

A food processing machine is a tool that facilitates the commercial production and packaging of various kinds of food, such as meat, baked goods, seafood, poultry, dairy products, drinks, etc. These products are popular worldwide because they are rich in nutrients, stable at room temperature, and with low risk of contamination. These exist in a variety of designs, sizes, and configurations and can be conveniently operated. Previous traditional tools were designed to perform a single task, but now advanced equipment has been developed that includes multiple processing lines to accommodate continuous and automated tasks. Food manufacturers use food processing equipment to process food using techniques such as mixing, homogenization, pasteurization, and filling. Food processing helps remove and preserve toxins. Compared to typical foods, there are many advantages like better taste, low risk of contamination, long shelf life and high portability.

MARKET DRIVERS

The rise in food production abilities and the boom of the food processing sector in developing nations are propelling the food and beverage processing machinery market growth.

Increased people's perception of the increase in processed food and disposable income are further contributing to the growth of the global market for food processing machinery. It is supposed to lead the market as the F&B sector expands rapidly worldwide. Elements like rising disposable income, rapid globalization, and the adoption of automation technologies are beginning to grow this market. As the demand for processed and packaged foods increases as the population grows, the pressure on the processing industry will increase, contributing to the expansion of the market. Changes in health and diet awareness in developing countries, as well as in developing countries, are assumed to spur market growth in the coming years. Additionally, several government agencies are encouraging food processing equipment manufacturers to strengthen their R&D capabilities, which can promote market growth.

Automatic equipment has been in higher demand in recent years than semi-automatic machines. The latest trends, like Industry 4.0 and the green revolution in production units, allow automation in the food processing sector. It is also supporting market growth. Food safety and standards are vital objectives for value chain participants, and they must follow strict government regulations and standards. Ready-to-eat meals and snacks are two basic categories of processed foods that increase the demand for processing and packaging equipment. As the popularity of functional beverages increased, the need for equipment used in the production of non-alcoholic and dairy drinks increased.

Food packaging machines are growing consumer preference for hygienic, healthy, and safe food by providing durable and aesthetic packaging solutions that can withstand rigorous processing and transportation, and the demand for integrated packaging solutions is increasing. Perform multi-functional tasks like packing, filling, packing, cartooning, capping, labeling, decorating, palletizing, transporting, sealing, etc., on a single platform. The market has also increased the popularity of sterile packaging equipment as demand for solid food has skyrocketed, and it has been successful in machine manufacturing. Categories like morphology, filling and sealing machines, bottle caps, and tray formation have also witnessed significant growth.

MARKET RESTRAINTS

The global food processing machinery market is likely to be hampered by restrictions from various governments, such as the Food Safety Modernization Act (FSMA)

High cost, along with other government regulatory constraints, is an essential factor that can inhibit growth in target markets to some degree. The main limiting factors in the food and beverage processing equipment market are increased energy and labor costs and increased production costs due to increased demand for organic and fresh food. Equipment such as homogenizers, heaters, and ovens used in the food and beverage processing industry consumes much more energy and power. Automatic machine is considered advanced but require an uninterruptible power supply to operate efficiently, increasing energy costs. In developed nations like the United States, Germany, the United Kingdom, and France, new demand for food among consumers, changes in eating habits, and food safety risks are affecting the food processing industry. Due to the aging population in developed countries, health problems are growing, and they prefer fresh, organic food without synthetic ingredients. These factors are suspected of limiting long-term market growth.

MARKET OPPORTUNITIES

The growing popularity of meat products across the globe will eventually create growth opportunities for the food processing machinery market. The demand for processed food products, especially meat ingredients, is surging in undeveloped countries where companies are likely to expand their portfolio with different strategies that are prompting the growth rate of the food processing machinery market. The rapid adoption of the latest technologies in packaging processed food products that extend the life span also adds fuel to the growth rate of the market. Processed food needs to be packaged properly to avoid any hazards to the environment. Also, the launch of different packaging styles of food products with important information can promote the growth rate of the food processing machinery market. The launch of highly convenience food products with the growing demand from consumers for healthy snack items and ready-to-eat food products is additionally to leverage the market’s growth rate. The quick adoption of the latest technologies in the food and beverage industry, like automation that can eventually increase the production rate with high efficiency of the products and less utilization of people’s workforce shall promote the market’s growth rate in the coming years.

MARKET CHALLENGES

However, the production rate of food products depends completely on the availability of raw materials. A slight disruption in the supply chain may negatively impact the availability of raw materials, which is a common challenging factor for key market players. In a few countries, the lack of proper infrastructure may negatively impact the growth rate of the market due to difficulty in the installation of the machinery. On the other hand, the lack of proper facilities for storing the raw materials from the farm to the processing units is inclined to degrade the growth rate of the market. More than 30% of the raw materials produced in farms are lost before it goes to the supply chain.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.1% |

|

Segments Covered |

By Type, Mode of Operation, Application, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Anko Food Machine, Atlas Pacific Engineering Co. Inc, Bean (John) Technologies Corp., Bühler AG, Tetra Laval, GEA, Tomra Systems, Krones, SPX Corp, and Berkshire Hathaway Inc |

SEGMENTAL ANALYSIS

Global Food Processing Machinery Market Analysis By Type

The thermal segment holds the largest share of the food processing machinery market. The thermal food processing machinery’s primary objective is to make various food products and increase their shelf life. Analyzing the thermal characteristics of the raw materials before processing can positively influence the efficiency of the overall food production rate, which is anticipated to fuel the growth rate of the market. The cutting and peeling segment accounts for holding the prominent growth rate for the past few years and will continue the workflow in the coming years. Cutting and peeling have an important role in the food processing industry. The food to be processed in the machinery needs to be first best suitable, and the vegetable or the meat should be cut into pieces for proper texture and fine quality of the final products.

Global Food Processing Machinery Market Analysis By Mode of Operation

The semi-automatic segment is leading with the largest share of the market, whereas the fully automatic segment is likely to hold the highest CAGR by the end of 2029. The rising popularity of convenient food products is raising the demand to raise the production rate of the food products. The automatic mode of operation, whether it is semi- or fully-automatic machinery, will have prominent growth opportunities in the coming future. Semi-automatic machinery is greatly used, especially in small and medium-scale industries, and is ascribed to prompting the market’s growth rate.

Global Food Processing Machinery Market Analysis By Application

The dairy segment is gaining huge traction over the share of the food processing machinery market. The growing popularity of dairy products like milk and others, along with the eventually increasing population all across the world, is projected to accelerate the growth rate of the food processing machinery market. The poultry & seafood segment is to have the fastest growth rate during the forecast period. People’s awareness of the consumption of high protein-based products has substantially elevated the growth rate of the market. The launch of innovative flavors that fit the customer’s preferences with different flavors is also an additional way to surge the market’s growth rate.

REGIONAL ANALYSIS

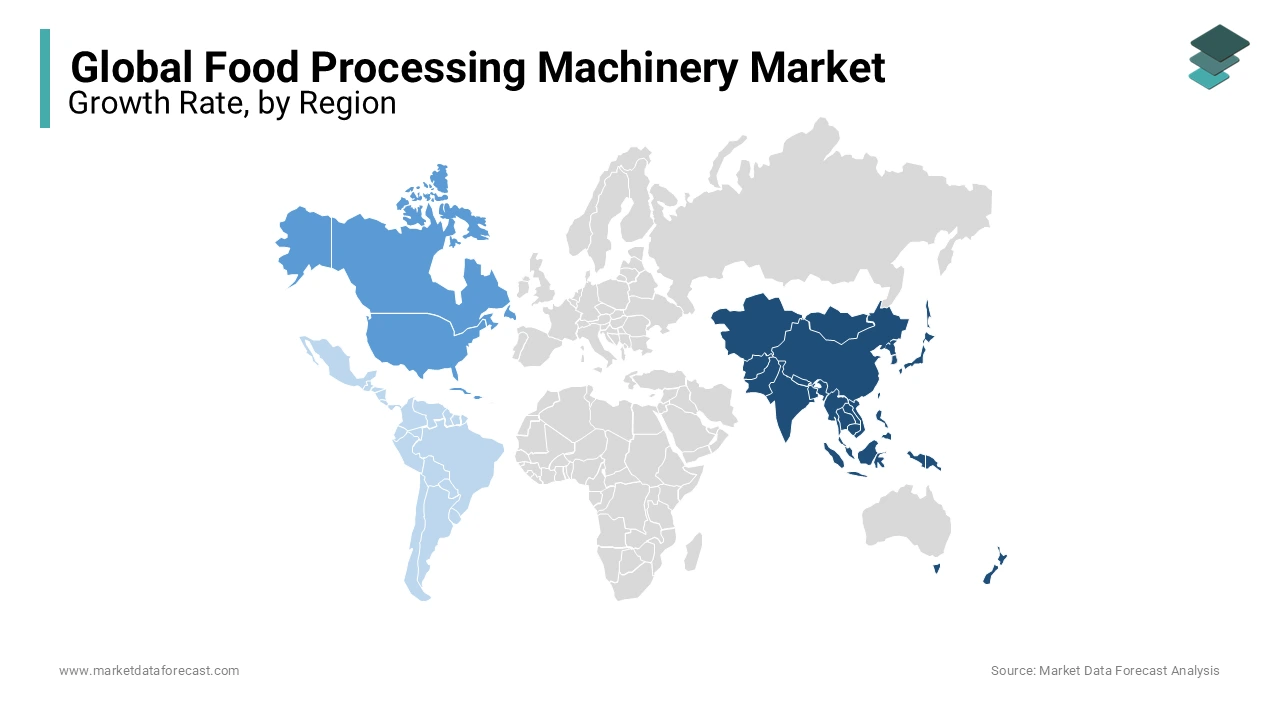

Asia Pacific holds the dominant share of the food processing machinery market, with the increasing need to raise the production rate of processed foods to fulfill the demands of the growing population. The rising number of working people in emerging countries like India and China is attributed to the growth rate of the food processing machinery market in the Asia Pacific region. In China, the female workforce is gradually increasing every year. According to the World Bank Gender Data Portal survey, 60.5% of the female population participated in work duties. The opportunities for female lead roles in the workplace are growing, which is inclined to elevate the need to depend on the healthy and nutritional foods that are readily available. Due to a lack of time to prepare freshly cooked meals, many people depend on eating ready-to-eat meals, which is boosting the scope of launching new and high-quality food products using various techniques.

North America is next to Asia Pacific, holding the largest share of the food processing machinery market. Rising disposable income in developed countries like the US and Canada is solely to promote growth opportunities for the market. According to the US Department of Agriculture, consumers, businesses, and government bodies spent more than USD 2.6 trillion on food and beverages. 11.2% of the personal disposable income was spent on food by the consumers in US in 2023. These statistics show that people are spending more on processed food products, which are likely to show huge opportunities for the food processing machinery market in the coming years.

Europe's food processing machinery market is likely to hit the highest CAGR by the end of 2029. Europe is the world's largest exporter of processed food products. EU trade policies lead companies to manufacture high-quality food with social/environmental responsibility that helps contribute to high-quality food products with various techniques.

Latin America and the Middle East & Africa are esteemed to have significant growth opportunities in the coming years. Increasing awareness of the availability of various healthy and nutritional food products is amplifying the growth rate of the market to an extent.

KEY PLAYERS IN THE GLOBAL FOOD PROCESSING MACHINERY MARKET

Major Key Players in the Global Food Processing Machinery Market are Anko Food Machine, Atlas Pacific Engineering Co. Inc, Bean (John) Technologies Corp., Bühler AG, Tetra Laval, GEA, Tomra Systems, Krones, SPX Corp, and Berkshire Hathaway Inc

RECENT HAPPENINGS IN THE MARKET

- In 2024, GEA exhibited the latest innovation at the International Production and Processing Expo (IPPE). The company’s latest innovation is the new continuous line for bacon, which will be highlighted at the expo. The machinery for slicing, packaging, freezing, cooking, and others are sustainable in delivering consistent and premium quality food products.

- In 2024, JBT Corporation, one of the leading companies in providing high-value food and beverage products, announced that the agreement had been finalized with Marel Shares. The merger between these companies is accounted for in bringing out new and innovative equipment in the food industry.

DETAILED SEGMENTATION OF GLOBAL FOOD PROCESSING MACHINERY MARKET INCLUDED IN THIS REPORT

This research report on the global food processing machinery market has been segmented and sub-segmented based on type, mode of operation, application, & region.

By Type

- Thermal

- Cutting & Peeling

- Extraction

- Mixer

- Blender

- Homogenizer

By Mode of Operation

- Semi-Automatic

- Fully Automatic

By Application

- Bakery & Confectioner

- Meat

- Poultry & Seafood

- Dairy

- Beverages

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What are the key drivers of growth in the food processing machinery market?

Factors driving growth include increasing demand for processed and convenience foods, technological advancements leading to more efficient machinery, stringent food safety regulations requiring advanced processing equipment, and expanding food production industries globally.

2. What are the major challenges faced by the food processing machinery industry?

Challenges include high initial investment costs for advanced machinery, maintenance and operational costs, adapting to changing consumer preferences and regulatory requirements, and competition from domestic and international manufacturers.

3. What are some trends shaping the food processing machinery market?

Trends include the adoption of Internet of Things (IoT) technology for remote monitoring and control of machinery, increased focus on sustainability and eco-friendly practices, development of intelligent and connected machines, and customization options to meet specific customer needs.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]